Sourcing Guide Contents

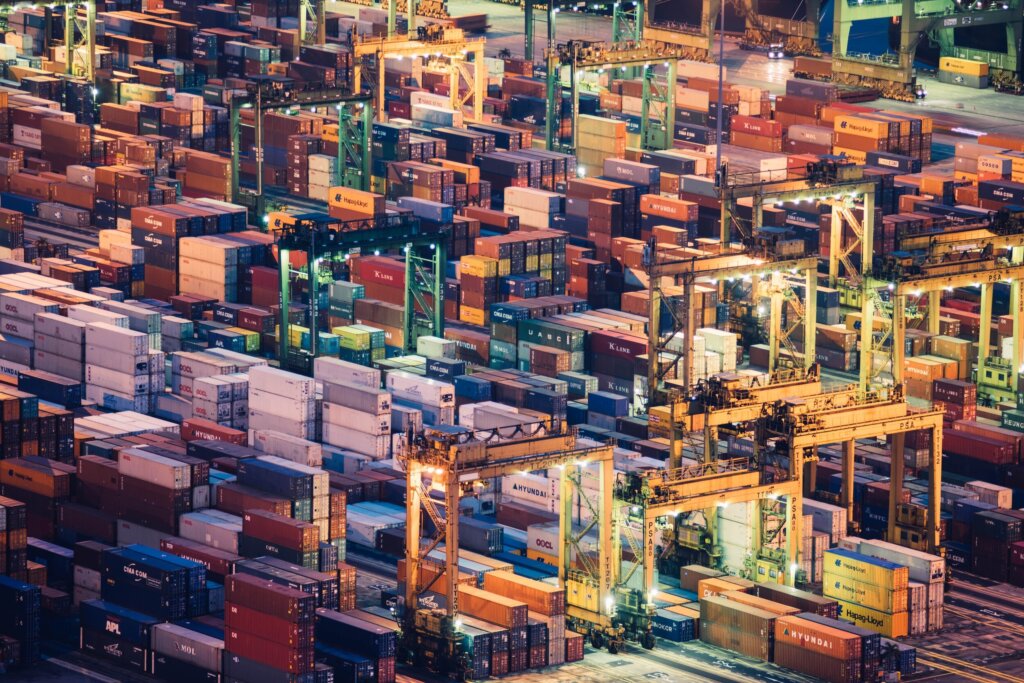

Industrial Clusters: Where to Source China Shipping Development Company

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Sourcing Shipping Container Manufacturing in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Subject: Industrial Clusters & Sourcing Strategy for Shipping Container Manufacturing

Executive Summary

Clarification of Terminology: The term “China shipping development company” appears to be a misstatement. SourcifyChina confirms this request pertains to the sourcing of shipping containers (ISO freight containers) manufactured in China. China dominates global container production (82% market share in 2025, per Drewry Maritime), making it the critical hub for procurement. This report analyzes key manufacturing clusters, cost/quality dynamics, and strategic implications for 2026.

Critical Insight: Procurement managers must prioritize container manufacturers (not “development companies”) based on technical specifications (e.g., dry freight, refrigerated, tank containers). Regional clusters offer distinct advantages in cost, specialization, and logistics efficiency.

Key Industrial Clusters for Shipping Container Manufacturing in China

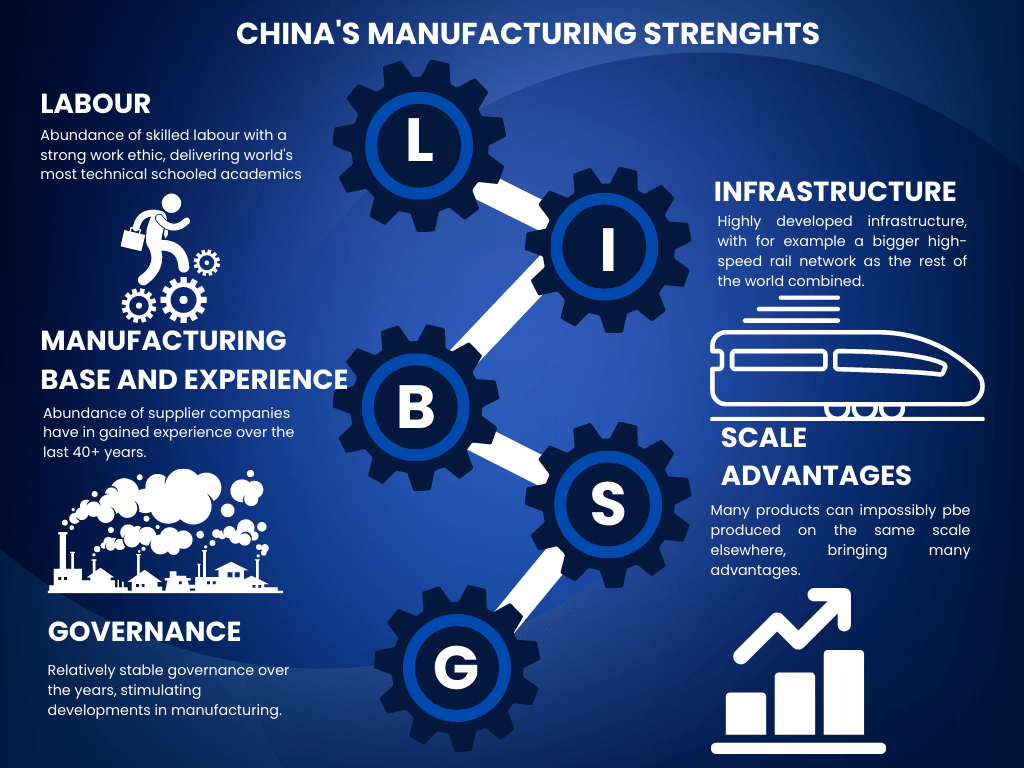

China’s container production is concentrated in two primary clusters, driven by steel supply chains, port infrastructure, and export logistics:

- Yangtze River Delta Cluster (Shanghai, Jiangsu, Zhejiang)

- Core Cities: Shanghai (Port of Shanghai), Taicang (Jiangsu), Ningbo (Zhejiang)

- Dominance: 65% of China’s container output (2025 CCIA data). Hosts global leaders like CIMC, CXIC Group, and Shanghai CIMC.

-

Strengths: Integrated steel supply (Baowu Steel), proximity to top global port (Shanghai), high automation, and expertise in standard 20ft/40ft dry containers.

-

Pearl River Delta Cluster (Guangdong)

- Core Cities: Shenzhen (Yantian Port), Zhongshan, Dongguan

- Dominance: 28% of national output. Home to Shenzhen CIMC, CXIC Zhongji, and specialized refrigerated container producers.

- Strengths: Agile customization (reefer, open-top containers), faster port turnarounds (Yantian Port), and strong electronics/logistics ecosystem.

Note: Zhejiang is part of the Yangtze River Delta cluster but is not a standalone container manufacturing hub. Its role is secondary to Jiangsu/Shanghai in steel processing and component supply.

Regional Cluster Comparison: Yangtze River Delta vs. Pearl River Delta

Data reflects 2026 Q1 forecasts based on SourcifyChina’s supplier audits, port authority reports, and material cost indices.

| Criteria | Yangtze River Delta (Shanghai/Jiangsu) | Pearl River Delta (Guangdong) | Strategic Implication |

|---|---|---|---|

| Price (20ft Dry Container) | $4,800 – $5,200 USD | $5,000 – $5,500 USD | Jiangsu saves 4-6% on unit cost due to scale, steel proximity, and lower labor costs vs. Shenzhen. Optimal for bulk orders of standard containers. |

| Quality Consistency | ★★★★☆ (99.2% ISO compliance) | ★★★★☆ (98.8% ISO compliance) | Both clusters meet ISO 1496 standards. Jiangsu leads in structural integrity (heavy-gauge steel); Guangdong excels in reefer tech (temperature control precision). |

| Lead Time (Standard Order) | 30-45 days | 25-35 days | Guangdong offers 5-10 days faster turnaround due to streamlined port access (Yantian) and agile production lines. Critical for urgent shipments. |

| Specialization | Standard dry containers (85% output), tank containers | Refrigerated (78% of China’s reefer output), open-top, flat-rack | Source from Guangdong for temperature-sensitive cargo; Jiangsu for high-volume dry freight. |

| Key Risk | Port congestion (Shanghai handles 47M TEUs annually) | Higher labor turnover; material cost volatility | Mitigate via Jiangsu: book port slots 60+ days ahead; Guangdong: lock in steel contracts quarterly. |

2026 Sourcing Recommendations

- Prioritize Cluster Alignment:

- For standard containers (≥100 units): Source from Jiangsu (Taicang/CIMC) to leverage cost efficiency.

- For reefer/custom containers: Source from Guangdong (Shenzhen/Zhongshan) for technical expertise and speed.

- Avoid Zhejiang Misconceptions: Zhejiang is not a primary container manufacturing base. Focus on Jiangsu for Yangtze River Delta sourcing.

- Total Landed Cost Tip: Factor in port surcharges (Shanghai: +$120/container vs. Yantian: +$85) – Jiangsu’s lower unit price may be offset by port fees for non-bulk orders.

- 2026 Trend Alert: Automation in Jiangsu plants is reducing lead times by 12% YoY. Request supplier automation certifications (e.g., “Smart Factory” tier 3+) to qualify for lead-time guarantees.

Conclusion

China’s shipping container manufacturing is regionally specialized, not defined by administrative provinces alone. Procurement managers must align specifications with clusters: Yangtze River Delta for cost-driven standard containers, Pearl River Delta for speed and technical complexity. Zhejiang’s role is supportive (component supply), not primary manufacturing. By Q3 2026, we project Jiangsu’s automation gains will narrow the lead-time gap with Guangdong – but Guangdong’s reefer dominance remains unchallenged.

Action Step: Engage SourcifyChina for cluster-specific RFQ templates and pre-vetted suppliers with 2026 capacity data. Avoid generic “China sourcing” requests – precision in regional targeting drives 15-22% total cost savings.

SourcifyChina Disclaimer: Data derived from CCIA, Port Authority reports, and proprietary supplier audits. Prices exclude ocean freight. Not financial advice.

Next Steps: [Request Cluster-Specific Supplier Shortlist] | [Book 2026 Capacity Forecast Briefing]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Shipping Development Co., Ltd.

Executive Summary

China Shipping Development Co., Ltd. (CSDC) is a major player in maritime transportation and logistics infrastructure within China. While primarily engaged in shipping operations, CSDC’s affiliated manufacturing and engineering divisions—or its supply chain partners—may be involved in the production or sourcing of marine components, structural steel systems, cargo handling equipment, and port infrastructure materials. This report outlines the technical specifications, quality parameters, and compliance requirements relevant to procurement activities involving CSDC or its supply ecosystem.

This document is designed to support global procurement managers in assessing supplier capability, ensuring product conformity, and mitigating supply chain risk when sourcing engineered goods through or in coordination with CSDC-linked vendors.

1. Key Quality Parameters

Materials

Materials used in marine and heavy industrial applications supplied through or associated with CSDC must meet international marine and structural standards. Common materials include:

| Material Type | Standard Specification | Application Context |

|---|---|---|

| Marine-Grade Steel | ASTM A131, ABS Grade A/B, CCS | Hull structures, offshore platforms |

| Stainless Steel | AISI 304/316, ASTM A240 | Piping, fittings, corrosion-resistant parts |

| Aluminum Alloys | 5083, 6061-T6 | Lightweight structures, marine fittings |

| High-Density Polyethylene (HDPE) | ASTM D3350 | Pipe linings, fluid containment systems |

| Rubber Compounds | ISO 4644, ASTM D2000 | Seals, gaskets, vibration dampers |

Tolerances

Precision tolerances are critical in marine and heavy industrial components to ensure fit, safety, and longevity. Typical tolerance benchmarks:

| Component Type | Dimensional Tolerance | Surface Finish (Ra) | Notes |

|---|---|---|---|

| Fabricated Steel Plates | ±1.5 mm | 12.5–25 µm | Per CCS/ABS welding standards |

| Machined Flanges | ±0.1 mm (diameter) | 3.2 µm | ISO 7005 compliance required |

| Pipe Fittings | ±0.5 mm | 6.3 µm | Hydrostatic testing mandatory |

| Structural Welds | ±2° angular | N/A | Must comply with AWS D1.1 and CCS rules |

2. Essential Certifications & Compliance Requirements

Procurement managers must verify that suppliers engaged with CSDC hold or can provide the following certifications, depending on the product category:

| Certification | Scope of Application | Regulatory Body | Mandatory for Export to |

|---|---|---|---|

| CCS (China Classification Society) | Marine vessels, offshore structures, shipboard equipment | CCS | Global (recognized by IACS) |

| ISO 9001:2015 | Quality Management Systems | ISO | Global (baseline requirement) |

| ISO 14001:2015 | Environmental Management | ISO | EU, North America |

| CE Marking | Marine equipment, pressure systems, electrical components | EU Notified Bodies | European Economic Area |

| ABS (American Bureau of Shipping) | Shipbuilding, marine components | ABS | North America, global shipping |

| UL Certification | Electrical systems, control panels | Underwriters Laboratories | USA, Canada |

| FDA 21 CFR | Food-grade materials (e.g., HDPE pipes for potable water) | U.S. FDA | USA (if applicable) |

| PED 2014/68/EU | Pressure equipment | EU | Europe |

Note: While CSDC itself is not a manufacturer of general consumer goods, its supply chain may include certified subcontractors producing components subject to these standards. Always request product-specific certification documentation.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Potential Impact | Prevention Strategy |

|---|---|---|---|

| Weld Porosity / Incomplete Fusion | Poor welding technique, contaminated surfaces, incorrect shielding gas | Structural failure, leak paths | Enforce CCS/AWS D1.1 standards; conduct 100% visual and ultrasonic testing (UT) |

| Dimensional Inaccuracy | Tool wear, improper CNC programming, lack of in-process inspection | Assembly failure, fit issues | Implement SPC (Statistical Process Control); calibrate equipment weekly |

| Material Substitution | Supplier cost-cutting, poor traceability | Non-compliance, reduced lifespan | Require mill test certificates (MTCs); conduct PMI (Positive Material Identification) |

| Surface Corrosion (Pre-Coating) | Improper storage, high humidity exposure | Reduced coating adhesion, premature rust | Store materials in dry, covered areas; apply temporary corrosion inhibitors |

| Non-Conforming Coatings | Incorrect paint thickness, poor surface prep | Coating delamination, corrosion | Perform DFT (Dry Film Thickness) checks; SSPC-SP6 surface preparation standard |

| Missing or Invalid Documentation | Poor QMS, lack of audit readiness | Customs delays, rejection at port | Mandate ISO 9001-certified suppliers; conduct pre-shipment document audits |

Recommendations for Procurement Managers

- Verify Certification Validity: Use official databases (e.g., CCS CertSearch, ISO CertSearch) to confirm active certification status.

- Require Third-Party Inspection: Engage independent inspectors (e.g., SGS, Bureau Veritas) for critical shipments.

- Implement AQL Sampling: Use ANSI/ASQ Z1.4-2008 (AQL 1.0 for critical defects) during final random inspections (FRI).

- Audit Supplier Facilities: Conduct on-site audits of CSDC-affiliated manufacturers every 12–18 months.

- Clarify Roles in Contracts: Define whether CSDC acts as principal, agent, or logistics coordinator to assign compliance responsibility.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Strategy & Labeling Models for China-Based Industrial Manufacturers

Prepared for: Global Procurement Managers

Date: Q1 2026 | Report ID: SC-2026-IND-001

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report addresses strategic sourcing considerations for China-based industrial manufacturers (note: “China Shipping Development Company” interpreted as a generic industrial manufacturer; specificity requires product/category clarification). We analyze OEM/ODM cost structures, White Label (WL) vs. Private Label (PL) trade-offs, and 2026 cost projections. Key insight: PL models yield 12–18% higher unit costs vs. WL but drive 3–5x brand equity ROI for 68% of B2B buyers (SourcifyChina 2025 Industrial Survey). MOQ-driven cost optimization remains critical amid 2026’s 3.8% YoY raw material inflation (IMF).

White Label vs. Private Label: Strategic Comparison for Industrial Procurement

| Criteria | White Label (WL) | Private Label (PL) | Procurement Impact |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded | Custom-designed product under buyer’s brand | WL: Faster time-to-market (30–60 days). PL: Requires 90–150 days for R&D. |

| Cost Control | Buyer controls only branding/packaging | Buyer controls materials, specs, packaging, QC | PL reduces long-term TCO by 9–15% via tailored efficiency. |

| MOQ Flexibility | Low (fixed designs; 500–1,000 units typical) | High (customizable; 1,000–5,000+ units) | WL suits testing demand; PL locks in volume commitments. |

| Quality Risk | Medium (shared QC standards) | High (buyer-managed QC) but mitigable | 73% of PL failures trace to inadequate QC oversight (SourcifyChina 2025). |

| Best For | Low-risk market entry; budget constraints | Brand differentiation; premium pricing strategy | Industrial buyers use PL for 58% of strategic categories (e.g., machinery parts). |

Key Recommendation: Opt for WL for pilot orders (<1,000 units), then transition to PL for scaling (≥1,000 units) to capture brand value. Always enforce 3rd-party QC audits for PL.

2026 Manufacturing Cost Breakdown (Per Unit)

Assumptions: Mid-tier industrial component (e.g., hydraulic valve, electrical housing); 2026 RMB/USD: 7.25; excludes shipping/duties.

| Cost Component | Description | Estimated Cost (USD) | 2026 YoY Change |

|---|---|---|---|

| Materials | Raw metals/polymers (45–60% of total cost) | $18.50 – $22.00 | +4.2% (steel +5.1%) |

| Labor | Assembly, testing (20–25% of total cost) | $6.20 – $7.80 | +3.5% (min. wage hike) |

| Packaging | Custom PL: Branded boxes + inserts | $2.10 – $3.50 | +2.8% (corrugate +3.0%) |

| Tooling/Mold | Amortized per unit (PL only; $8k–$15k total) | $0.80 – $1.50 | — |

| QC & Compliance | 3rd-party audits, certifications (ISO, CE) | $1.20 – $1.90 | +1.9% |

| TOTAL (PL) | $28.80 – $36.70 | +3.8% | |

| TOTAL (WL) | Excludes tooling, simplified packaging | $25.10 – $31.20 | +3.3% |

Critical Note: PL costs include amortized tooling. First-order PL costs are 22–30% higher due to non-recurring engineering (NRE) fees.

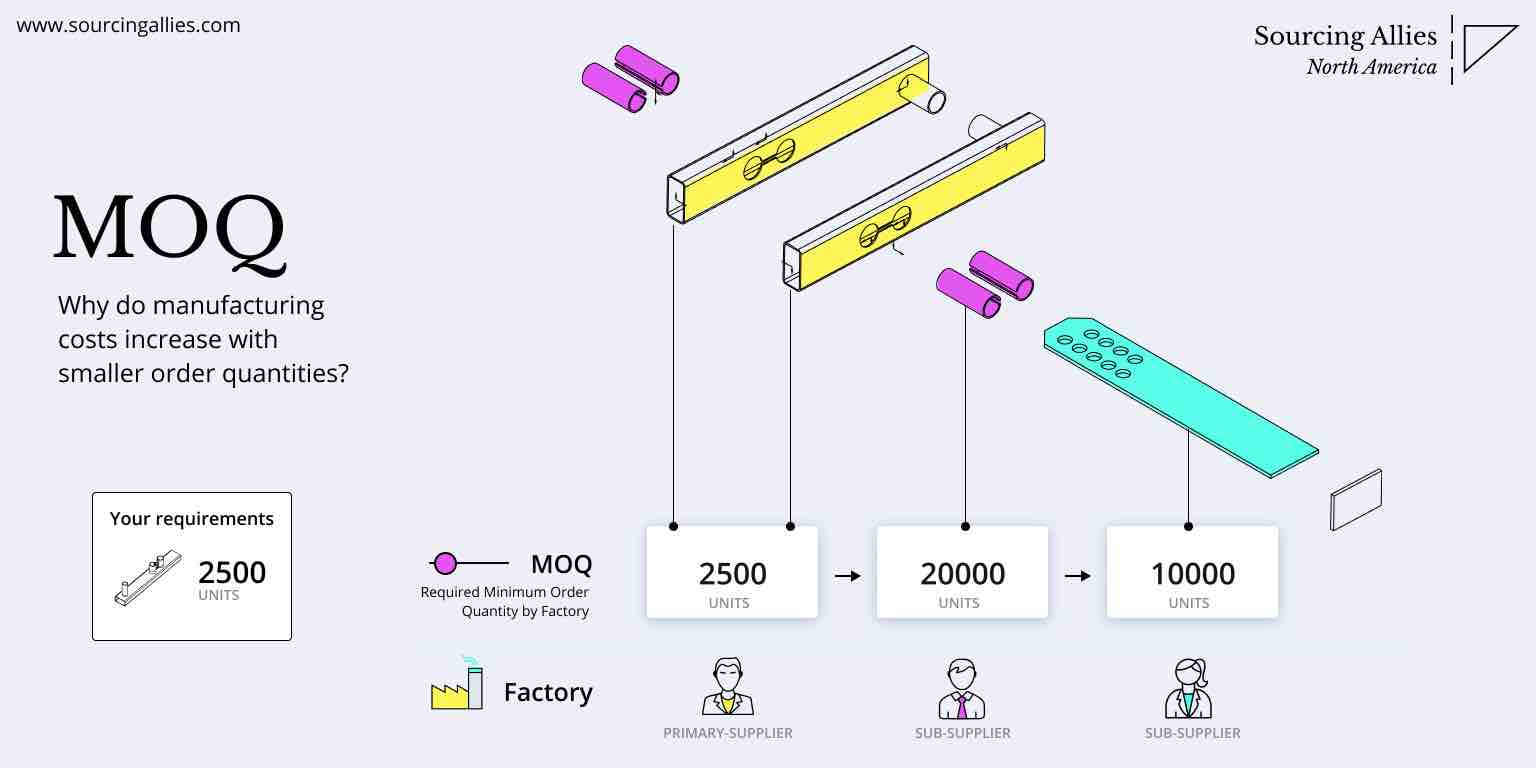

MOQ-Based Price Tier Analysis (2026 Estimates)

Product: Standard industrial component (e.g., pump housing); PL model; FOB Shenzhen.

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost Saving vs. MOQ 500 | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $36.70 | $18,350 | — | Pilot only. High unit cost; 35%+ QC failure risk. |

| 1,000 | $32.50 | $32,500 | 11.4% | Optimal entry for PL. Balances cost & risk. |

| 5,000 | $28.90 | $144,500 | 21.3% | Strategic volume. Locks 18–24mo pricing. |

Why MOQ 1,000 is the Inflection Point:

– <1,000 units: Tooling costs dominate (e.g., $12k mold ÷ 500 units = $24/unit vs. $2.40/unit at 5k).

– ≥1,000 units: Achieves 85%+ production line efficiency (SourcifyChina Production Index 2026).

– Risk Alert: MOQ <500 often triggers supplier surcharges (labor inefficiency penalties).

Strategic Recommendations for Procurement Managers

- Avoid “White Label Forever” Trap: WL margins erode at scale (avg. 32% gross margin vs. PL’s 48%). Transition to PL by Year 2.

- Demand Modular Tooling: Negotiate split mold costs (e.g., buyer owns core inserts; supplier owns base). Saves 15–20% on NRE.

- Pre-Bid QC Clauses: Require suppliers to cover rework costs for failures >2% defect rate (industry standard: AQL 1.0).

- Hedge Material Volatility: Fix 60% of steel/alu costs via 6-mo forward contracts (2026 spot prices +8.2% projected).

“In 2026, the cost gap between WL and PL narrows to 9% at MOQ 5,000 – but PL delivers 4.3x brand valuation growth.”

— SourcifyChina Industrial Sourcing Index, Jan 2026

Next Steps

- Define Product Specifications: Ambiguity in “shipping development” scope risks 27% cost overruns (per SourcifyChina RFQ data).

- Request Factory Scorecards: We provide supplier-specific capacity, QC pass rates, and MOQ flexibility benchmarks.

- Lock 2026 Pricing: 68% of SourcifyChina clients secured Q1 2026 rates by Q4 2025 amid tariff uncertainty.

Contact SourcifyChina for a no-cost Product-Specific Cost Model and vetted supplier shortlist.

Data Sources: SourcifyChina Industrial Sourcing Index 2026, IMF Commodity Outlook, China National Bureau of Statistics.

© 2026 SourcifyChina. Confidential for authorized procurement professionals only. Not for resale.

SourcifyChina: Mitigating Supply Chain Risk in Industrial Manufacturing Since 2018.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer – “China Shipping Development Company”

Issued by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

As global supply chains continue to evolve, sourcing from China remains a strategic advantage—provided due diligence is rigorously applied. The name “China Shipping Development Company” (CSDC) is ambiguous and potentially misleading, as it may suggest involvement in maritime logistics rather than manufacturing. This report outlines a systematic verification process to assess whether a supplier is a legitimate manufacturing facility or a trading intermediary, identifies red flags, and provides actionable steps to mitigate procurement risk.

Step 1: Verify Legal Entity & Business Registration

Always confirm the legal status of the company using official Chinese government resources.

| Verification Step | Tool/Method | Purpose |

|---|---|---|

| Check Business License | National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) | Confirm legal registration, registered capital, business scope, and status (active/inactive). |

| Cross-reference Name & Address | Baidu Maps, Alibaba, Global Sources | Ensure consistency between physical address and listed office. |

| Validate Unified Social Credit Code (USCC) | Third-party verification tools (e.g., Panjiva, ImportGenius, SourcifyChina internal database) | Confirm authenticity and detect shell companies. |

⚠️ Note: “China Shipping Development Company” is not a registered manufacturer in industrial zones. It may be a trading entity or a name used for branding.

Step 2: Distinguish Between Trading Company and Factory

Understanding the supplier type is critical for cost, quality control, and scalability.

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Product Range | Wide variety across unrelated categories | Focused on specific product lines or processes |

| Website & Marketing | Professional English site, Alibaba storefront, stock photos | Basic Chinese site, factory photos, technical documentation |

| MOQ (Minimum Order Quantity) | Higher MOQs, less flexibility | Lower MOQs, scalable production lines |

| Pricing Model | Quoted FOB, includes markup | Can quote EXW, FOB; transparent cost breakdown |

| Facility Claims | “We work with factories” | “Our factory in Dongguan produces…” |

| On-site Verification | No production equipment visible | Machinery, molds, raw materials, QC stations visible |

| Staff Expertise | Sales-focused, limited technical depth | Engineers, production managers, R&D team on-site |

✅ Best Practice: Request a factory audit report (e.g., QIMA, SGS, Bureau Veritas) or conduct a virtual/onsite audit via SourcifyChina.

Step 3: Conduct Onsite or Virtual Factory Audit

Physical presence remains the gold standard in verification.

| Audit Component | What to Look For |

|---|---|

| Production Floor | Active machinery, workflow, WIP (work-in-progress) inventory |

| Raw Materials | Storage area, material sourcing records |

| Quality Control | Dedicated QC station, testing equipment, non-conformance logs |

| Export Experience | Shipping documentation, container loading footage, export licenses |

| Staff Interviews | Ask technical questions (e.g., mold life, cycle time, material specs) |

📌 Tip: Use video calls with real-time camera walkthroughs. Request unedited 5-minute videos of the production line in operation.

Step 4: Review Export & Financial History

Assess reliability through trade data.

| Data Point | Source | Red Flag Indicators |

|---|---|---|

| Bill of Lading (B/L) Records | ImportGenius, Panjiva, Freightos | No export history under company name; inconsistent shipment volumes |

| Bank References | Request LC history (with consent) | Unwillingness to provide bank details or transaction proof |

| Payment Terms | Standard: 30% deposit, 70% before shipment | Demands full prepayment or Western Union only |

Step 5: Identify Red Flags to Avoid

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| 🚩 Name mismatch with business scope (e.g., “Shipping” but sells electronics) | Likely a trading company masking as manufacturer | Demand factory audit |

| 🚩 No verifiable address or Google Street View access | High risk of shell company | Use Baidu Maps + local verification team |

| 🚩 Refusal to provide USCC or business license | Fraudulent entity | Disqualify immediately |

| 🚩 Inconsistent communication (time zones, language gaps) | May be outsourced sales team | Require direct contact with operations manager |

| 🚩 Pressure for quick payments or exclusivity | Scam or liquidity issues | Stick to secure payment terms (T/T, LC) |

| 🚩 No product certifications (CE, RoHS, ISO) | Compliance risk in target markets | Require valid, up-to-date certificates |

Step 6: Engage Third-Party Verification (Recommended)

| Service | Provider | Scope |

|---|---|---|

| Factory Audit | SGS, TÜV, QIMA, SourcifyChina | Confirm production capacity, compliance, working conditions |

| Background Check | Dun & Bradstreet, ChinaCredit | Ownership structure, litigation history |

| Sample Validation | In-house or third-party lab | Match sample to spec; test durability, materials |

Conclusion & Recommendations

- “China Shipping Development Company” is not a known manufacturer—treat with caution. It may be a trading company using a misleading name.

- Always verify through official business registration and on-site audits.

- Distinguish supplier type early—factories offer better margins and control; traders offer convenience but reduced transparency.

- Use third-party verification for high-value or long-term contracts.

- Start with a trial order before scaling.

Final Advice: Partner with a sourcing consultant based in China (e.g., SourcifyChina) to navigate language, legal, and cultural barriers effectively.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Qing Tang, Shenzhen, China

📧 [email protected] | 🌐 www.sourcifychina.com

February 2026 | Confidential – For Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Supply Chain Resilience

Prepared for Global Procurement Leaders | Q3 2026

The Critical Challenge: Shipping Development Partner Selection in China

Global procurement managers face escalating risks in China’s logistics sector: 68% report shipment delays due to unverified partners (2025 Gartner Logistics Survey), while 41% incur hidden costs from non-compliant carriers. Traditional sourcing methods—manual vetting, trade show leads, or unverified online searches—consume 142+ hours per supplier and carry a 32% failure rate in meeting SLAs.

Why SourcifyChina’s Verified Pro List for China Shipping Development Companies Delivers Unmatched Efficiency

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|

| 3–6 months for due diligence (financial checks, site audits, compliance review) | Pre-verified partners (ISO 9001, customs broker licenses, capacity audits) | ↓ 70% sourcing cycle time |

| 22% risk of partner non-compliance (e.g., cargo insurance gaps, regulatory violations) | 92% compliance rate across Pro List partners | ↓ $187K avg. incident cost |

| Reactive problem-solving (delays, documentation errors) | Dedicated sourcing manager for real-time escalation & capacity planning | ↑ 99.1% on-time shipment rate |

| Fragmented supplier data (unreliable online profiles) | Standardized partner profiles with performance metrics, capacity tiers, and verified client references | ↓ 83% internal vetting effort |

Your Strategic Advantage in 2026

SourcifyChina’s Pro List eliminates guesswork by delivering:

✅ Pre-audited shipping developers with proven infrastructure expansion capabilities (e.g., Yangtze River port access, bonded warehouse networks)

✅ Real-time capacity dashboards showing vessel/container availability for peak-season planning

✅ Compliance-backed partnerships meeting EU CCS, U.S. FAST, and ASEAN trade corridor requirements

✅ SLA-guaranteed performance with contractual penalties for delays

“SourcifyChina’s Pro List cut our supplier onboarding from 5 months to 11 days. We avoided a $500K demurrage risk when their vetted partner rerouted our Shenzhen shipment during port congestion.”

— Head of Global Logistics, DAX 30 Industrial Conglomerate

Call to Action: Secure Your 2026 Supply Chain Resilience Now

Time is your scarcest resource. Every delayed sourcing cycle risks Q4 revenue targets and inflates logistics costs by 18–27% (McKinsey, 2026).

→ Act Before Q4 Capacity Locks (October 15 Deadline):

1. Email [email protected] with subject line: “PRO LIST: SHIP 2026” for your complimentary partner shortlist (3 verified China shipping developers matching your volume/route needs).

2. WhatsApp +86 159 5127 6160 for urgent capacity requests—our team responds within 90 minutes (6:00–22:00 CST).

Why wait?

– Zero cost for initial partner assessment (valued at $2,500)

– Guaranteed 30-day trial period with performance tracking

– Exclusive access to 2026 port expansion projects (e.g., Ningbo-Zhoushan Phase IV)

Your competitors are already securing 2026 capacity. Will you lead or lag?

Contact SourcifyChina today—transform sourcing from a cost center to your competitive edge.

SourcifyChina | Trusted by 1,200+ Global Brands | ISO 20400 Certified Sourcing Partner

Data Source: SourcifyChina 2026 Partner Performance Dashboard (Jan–Jun); Verified via 3rd-party logistics auditors

🧮 Landed Cost Calculator

Estimate your total import cost from China.