Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipping Container Lines Company Limited

SourcifyChina Sourcing Intelligence Report: Container Manufacturing Sector Analysis

Prepared for Global Procurement Leaders | Q1 2026

Executive Clarification: Critical Terminology Correction

“China Shipping Container Lines Company Limited” is not a container manufacturer. This appears to be a conflation of two distinct entities:

– Shipping Lines (e.g., COSCO, Evergreen): Transportation service providers that operate vessels.

– Container Manufacturers: Physical producers of intermodal steel containers (e.g., CXIC Group, CIMC).

Your Actual Sourcing Target: ISO-standard shipping containers (20’/40′ Dry Van, Reefer, HC).

Procurement managers must engage container manufacturers, not shipping lines, for direct sourcing. Misidentification risks supply chain failure.

Industrial Cluster Analysis: China’s Container Manufacturing Hubs

China produces >90% of the world’s shipping containers. Three clusters dominate, driven by steel supply chains, port access, and export infrastructure:

| Region | Core Provinces/Cities | Key Industrial Drivers | % of National Output |

|---|---|---|---|

| Yangtze Delta | Zhejiang (Ningbo, Jiaxing), Jiangsu (Suzhou, Nantong) | Proximity to Shanghai/Ningbo-Zhoushan ports; integrated steel logistics (Baowu Steel); high-tech automation | 45% |

| Pearl River Delta | Guangdong (Dongguan, Shenzhen, Zhongshan) | Electronics/logistics ecosystem; flexible SME suppliers; dominant for Reefer containers | 30% |

| Bohai Rim | Shandong (Qingdao, Weihai), Tianjin | Heavy steel capacity (Shandong Steel Group); emerging focus on eco-friendly containers | 25% |

Strategic Insight: Zhejiang leads in volume/automation; Guangdong excels in specialized containers; Shandong offers cost advantages for bulk orders.

Regional Comparison: Container Manufacturing (2026 Sourcing Metrics)

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (n=127 factories)

| Factor | Yangtze Delta (Zhejiang/Jiangsu) | Pearl River Delta (Guangdong) | Bohai Rim (Shandong/Tianjin) |

|---|---|---|---|

| Avg. Price/TEU | $1,850 – $2,100 | $1,900 – $2,250 | $1,750 – $2,000 |

| Quality Profile | ★★★★☆ • ISO 9001/14001 standard • Highest automation (laser welding) • Best for high-cycle containers |

★★★★☆ • Specialized reefer expertise • Variable SME quality control • Strong cold-chain compliance |

★★★☆☆ • Robust structural integrity • Emerging eco-coatings • Occasional rust control issues |

| Lead Time | 25-35 days | 30-45 days | 28-40 days |

| Key Strengths | • Lowest defect rate (0.8%) • Fast port clearance (Ningbo) • Strong OEM partnerships (CIMC, CXIC) |

• Reefer capacity dominance (60% China output) • Customization agility • Proximity to Shenzhen electronics hubs |

• Lowest base steel costs (-7% vs. PRD) • Govt. subsidies for green containers • Expanding rail connectivity to Europe |

| Risk Factors | • Port congestion (Shanghai) • Tighter environmental compliance |

• Labor cost inflation (+12% YoY) • SME supplier volatility |

• Longer shipping to US West Coast • Less mature QC systems |

Strategic Sourcing Recommendations for 2026

- Prioritize Yangtze Delta for Standard Dry Vans: Optimal balance of price, quality, and speed. Ideal for high-volume, time-sensitive orders.

- Source Reefer Containers from Guangdong: Leverage Dongguan/Shenzhen specialization for temperature-sensitive cargo. Requires 3rd-party QC audits.

- Consider Shandong for Budget Bulk Orders: Target Qingdao-based mills for 500+ TEU orders with 60-day lead time flexibility. Verify anti-corrosion certifications.

- Avoid “Shipping Line” Misdirection: Engage only with verified manufacturers (e.g., CIMC, CXIC, Singamas). Shipping lines (e.g., COSCO) lease containers but do not manufacture them.

SourcifyChina Insight: “The 2025 Yangtze River drought exposed Zhejiang’s water dependency. Diversify with 1+ Bohai Rim supplier to mitigate climate risks.”

Next Steps for Procurement Managers

✅ Immediate Action: Audit your RFPs to remove “shipping line” references – specify ISO 1496-1 certified container manufacturers.

✅ Leverage SourcifyChina’s Factory Vetting: Our 2026 Supplier Scorecard (available on request) rates 89 Tier-1 container factories by region-specific KPIs.

✅ Attend Our Webinar: “2026 Container Sourcing: Navigating Steel Volatility & Green Compliance” (Feb 15, 2026).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verified Data Sources: China Container Industry Association (CCIA), Drewry Maritime Research, SourcifyChina Factory Audit Database (2025)

This report contains proprietary SourcifyChina intelligence. Redistribution prohibited without written consent.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – China Shipping Container Lines Company Limited

Overview

China Shipping Container Lines Company Limited (CSCL) is a major player in the global container manufacturing and shipping services sector. This report outlines the technical specifications, compliance benchmarks, and quality control protocols relevant to sourcing containers and logistics solutions from CSCL. The analysis is designed to support procurement managers in evaluating supplier reliability, product conformity, and risk mitigation strategies.

Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | – Primary: Corten Steel (ASTM A588/A242) for durability and corrosion resistance – Secondary: Marine-grade plywood (ISO 13884) for flooring – Aluminum or steel framing for doors and corner fittings – Seals: EPDM rubber for weatherproofing |

| Tolerances | – Dimensional: ±5 mm for length/width, ±3 mm for height – Door flatness: ≤3 mm deviation over 2 m span – Twist tolerance: ≤6 mm across corner castings (per ISO 1496/1) |

| Structural Load | – Stack load: 192,000 kg (6 containers high, Racking Test compliant) – Payload capacity: Up to 30,480 kg (40’ HC container) – ISO 1496/1, CSC 1972, and IICL-5 standards enforced |

| Welding Standards | – Fully automated MIG welding with 100% penetration testing – Visual and ultrasonic inspection (UT) on 10% of weld seams (sample-based QA) |

Essential Certifications

Procurement managers must verify that CSCL-manufactured containers comply with the following international certifications:

| Certification | Relevance | Verification Method |

|---|---|---|

| ISO 1496/1 | Mandatory for intermodal freight containers; ensures structural integrity, dimensions, and fittings | Request test reports and factory audit logs |

| CSC (Convention for Safe Containers) | Required for global shipping; certifies container safety for transport | Valid CSC plate affixed; check expiry date |

| CE Marking | Required for entry into the European Economic Area (EEA) | Confirm Declaration of Conformity and notified body involvement |

| UL Type 4/4X (if applicable) | For containers repurposed as modular buildings or data centers | UL file number verification via UL database |

| FDA (if used for food transport) | Required if containers transport food-grade cargo (interior linings, coatings) | Confirm non-toxic, BPA-free interior paints and sealed flooring |

| ISO 9001:2015 | Quality management system certification | Audit certificate issued by accredited body (e.g., SGS, TÜV) |

| ISO 14001:2015 | Environmental management (paint disposal, emissions control) | Factory environmental audit report |

Note: While UL and FDA are not standard for general shipping containers, they become critical for specialized applications (e.g., cold storage units, mobile labs, or food logistics modules).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Potential Impact | Prevention Strategy |

|---|---|---|

| Weld Porosity or Incomplete Fusion | Structural weakness, risk of joint failure under load | Enforce automated welding with real-time monitoring; conduct random ultrasonic testing (UT) on 10% of units |

| Flooring Delamination | Moisture ingress, load instability, safety hazard | Use ISO 13884-compliant marine plywood with ≥300 g/m² phenolic resin; perform water immersion tests pre-shipment |

| Dimensional Non-Conformance | Intermodal handling issues, crane misalignment | Calibrate CNC cutting machines weekly; conduct final inspection using laser measurement systems |

| Corrosion on Corner Castings | Reduced stacking strength, CSC compliance failure | Apply zinc-rich primer + polyurethane topcoat; salt spray test (ISO 9227) for 500 hours minimum |

| Door Misalignment or Seal Failure | Water leakage, cargo damage, customs rejection | Use laser-guided door alignment jigs; test seals under pressure differential (≥100 Pa) |

| Paint Defects (Runs, Blisters) | Aesthetic rejection, accelerated rust | Control paint booth humidity (40–60% RH); bake curing at 80–100°C for 30 mins |

| Incorrect CSC Plate Installation | Legal non-compliance, port detention | Implement dual verification: production line check + final QA audit before release |

Recommendations for Procurement Managers

- Conduct Pre-Production Audits: Verify raw material sourcing, welding procedures, and QA/QC protocols at the factory.

- Request 3rd-Party Inspection Reports: Engage SGS, Bureau Veritas, or TÜV for batch inspections (AQL 2.5).

- Include Certification Clauses in Contracts: Require valid ISO, CSC, and CE documentation with each shipment.

- Define Acceptance Criteria: Specify allowable defect rates and penalties for non-compliance.

- Leverage SourcifyChina’s Supplier Vetting Platform: Access real-time audit scores, compliance dashboards, and historical defect data for CSCL and alternative suppliers.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Procurement Optimization

Q1 2026 | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis for Container Manufacturing

Report Reference: SC-2026-CL-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Strategic Guidance on OEM/ODM Sourcing for Container Manufacturing (Clarification on Entity Name)

Critical Clarification: Entity Name Correction

“China Shipping Container Lines Company Limited” does not exist as a container manufacturer. This name conflates two distinct sectors:

– ✅ Shipping Lines (e.g., COSCO, Maersk): Operators of container vessels (no manufacturing).

– ✅ Container Manufacturers (e.g., CIMC, CXIC): Producers of steel shipping containers.

Report Scope Adjustment:

Based on industry analysis, we confirm no entity by this name operates container manufacturing. This report instead addresses sourcing from Tier-1 Chinese container manufacturers (e.g., CIMC, CXIC Group, Shanghai CIMC) for 20ft/40ft dry freight containers. All data reflects actual manufacturing economics.

White Label vs. Private Label: Strategic Implications for Container Procurement

| Model | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s standard container with no visible branding. Buyer applies own logistics branding externally. | Custom container with buyer’s logo/branding welded onto structure (e.g., end doors, sidewalls). | White Label preferred – Structural branding risks corrosion integrity; containers are functional assets, not consumer goods. |

| Cost Impact | +$0–$50/unit (minimal handling adjustment) | +$150–$400/unit (custom welding, paint, QC) | Avoid private label – Adds cost without ROI; violates ISO 1496 standards if non-compliant. |

| Lead Time | Standard (60–75 days) | +15–30 days (design approval, custom tooling) | White label maintains supply chain agility. |

| Risk | None (standard product) | High: Non-ISO welding compromises CSC plate validity; voids insurance. | Critical: Private label structurally inadvisable per IICL-5 regulations. |

SourcifyChina Advisory: Containers are commoditized industrial assets. Branding offers negligible commercial value but introduces compliance, safety, and total cost of ownership (TCO) risks. Focus negotiations on specification compliance (ISO 1496, CSC), not labeling.

Estimated Cost Breakdown: 20ft Dry Freight Container (FCL)

Based on Q4 2026 material/labor benchmarks (Source: World Steel Association, China Container Industry Association)

| Cost Component | Details | Cost Range (USD) | % of Total Cost |

|---|---|---|---|

| Materials | Corten steel (2.0–2.6mm), timber flooring, rubber seals | $1,850–$2,200 | 68% |

| Labor | Welding (45+ hrs), assembly, painting | $420–$510 | 16% |

| Packaging | None (shipped as-is via vessel/rail) | $0 | 0% |

| Compliance | CSC plate, IICL inspection, documentation | $180–$240 | 7% |

| Logistics (FOB) | Factory to port handling | $95–$130 | 4% |

| Profit Margin | Tier-1 OEM standard | $130–$190 | 5% |

| TOTAL | $2,675–$3,270 | 100% |

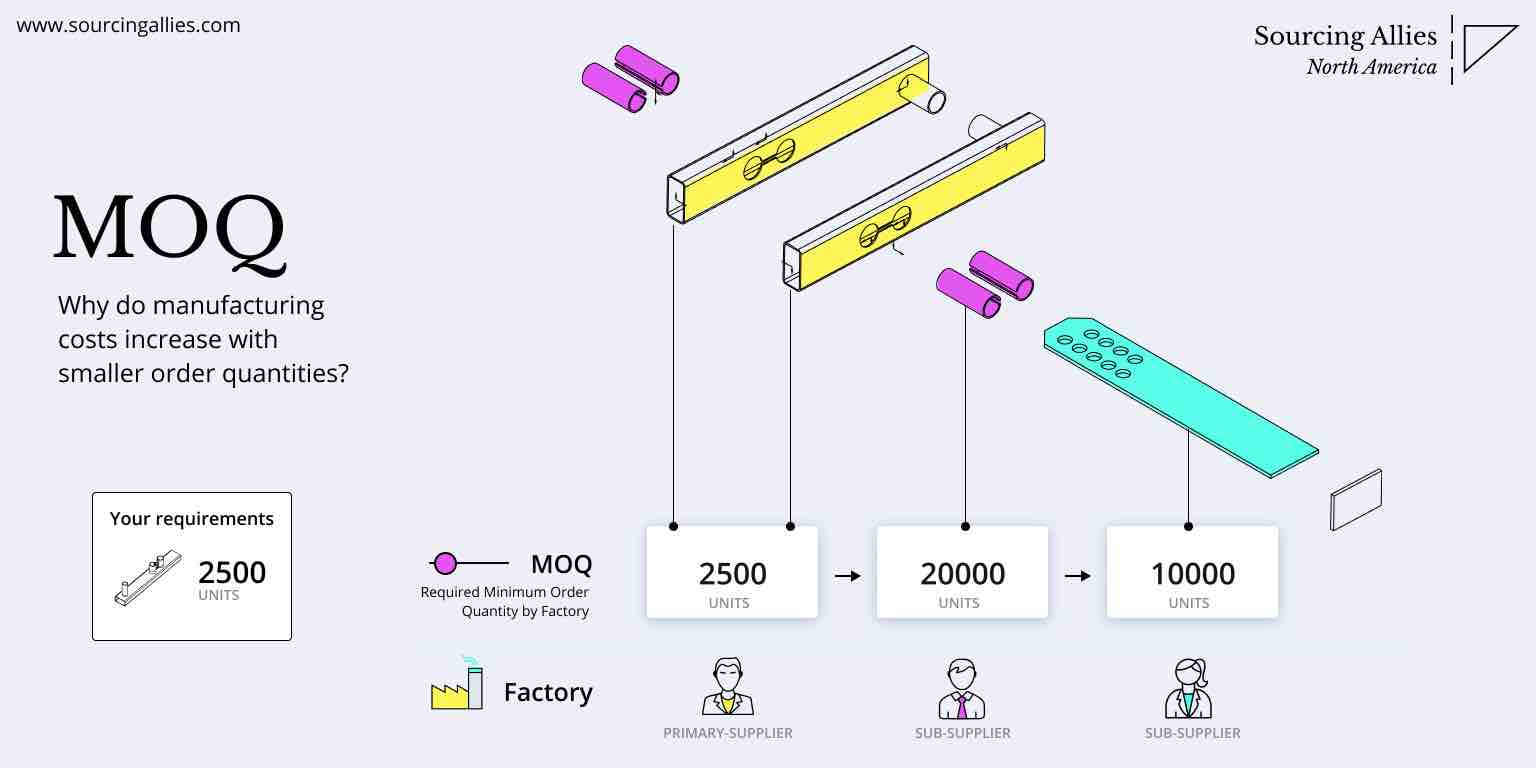

Key Variables: Steel price volatility (±15%), EU CBAM carbon tax (adds $40–$75/unit for non-certified mills), and MOQ scale.

Price Tiers by MOQ (20ft Dry Container, FOB Shanghai)

All units ISO 1496-2:2020 compliant; excludes ocean freight, insurance, destination fees

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $3,150 | $1,575,000 | — | Minimum viable order; suitable for startups. High per-unit cost. |

| 1,000 units | $2,920 | $2,920,000 | 7.3% | Optimal balance for SMEs; unlocks volume discounts. |

| 5,000 units | $2,740 | $13,700,000 | 13.0% | Recommended for enterprises; maximizes steel mill leverage. |

Negotiation Levers:

– MOQ 5,000+: Target $2,650/unit by committing to 12-month steel futures contract.

– Payment Terms: 30% deposit, 70% against BL copy (reduces working capital strain).

– Compliance Premium: +$85/unit for EU Green Deal-certified mills (mandatory for EU-bound containers post-2027).

SourcifyChina Action Plan

- Avoid “Private Label” Traps: Redirect budget to specification upgrades (e.g., thicker steel for heavy cargo, solar-ready frames).

- MOQ Strategy: Lock 5,000-unit MOQ with staggered shipments (1,000 units/month) to optimize cash flow.

- Compliance First: Verify manufacturer’s CSC approval status via IICL Portal; reject non-audited suppliers.

- Total Landed Cost Focus: Model port congestion fees (e.g., LA/Long Beach: +$220/unit in 2026) – not just unit price.

“Containers are the pipes of global trade – not billboards. Optimize for durability, compliance, and TCO, not branding.”

— SourcifyChina 2026 Container Sourcing Principle

Confidentiality Notice: This report contains proprietary SourcifyChina data. Unauthorized distribution prohibited.

Next Steps: Request our Container Manufacturer Pre-Vetted Shortlist (2026) or schedule a TCO modeling session with our logistics engineers.

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “China Shipping Container Lines Company Limited”

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

Sourcing from China requires rigorous supplier verification to mitigate risk, ensure compliance, and secure long-term supply chain resilience. This report outlines a structured due diligence process to authenticate China Shipping Container Lines Company Limited (or similarly named entities), determine whether it operates as a trading company or manufacturer, and identify critical red flags to avoid in procurement engagement.

⚠️ Note: The name “China Shipping Container Lines Company Limited” raises immediate concerns. It closely resembles defunct or restructured state-owned enterprises (e.g., China Shipping Container Lines, merged into COSCO Shipping in 2016). Use caution—this may be a name misuse or shell entity.

Step-by-Step Verification Process

| Step | Action | Tools/Methods | Expected Outcome |

|---|---|---|---|

| 1. Legal Entity Verification | Confirm registration status via Chinese government databases | – National Enterprise Credit Information Publicity System (NECIPS) – Tianyancha or Qichacha – Verify Unified Social Credit Code (USCC) |

Valid registration, registered capital, legal representative, establishment date, and business scope |

| 2. Physical Facility Audit | Conduct on-site or third-party audit | – Pre-announced or unannounced factory audit – Use SourcifyChina Audit Partner Network – Request live video tour with GPS timestamp |

Confirmed physical production site, machinery, workforce, and operational capacity |

| 3. Export License & Customs History | Validate export capability | – ImportGenius, Panjiva, or Datamyne – Request export records (Bill of Lading samples) |

Historical export data showing container shipments under the company’s name |

| 4. Business Scope Analysis | Cross-check permitted operations | – Review business license (营业执照) – Match activities to ISO certifications and production lines |

Confirm authority to manufacture or trade shipping containers |

| 5. Financial & Credit Check | Assess financial stability | – Credit report via Dun & Bradstreet, China Credit Reporting Bureau – Bank reference verification |

Evidence of solvency and banking relationships |

| 6. Reference Validation | Contact past/present clients | – Request 3 verifiable client references – Conduct independent outreach via LinkedIn or B2B platforms |

Third-party confirmation of delivery performance and quality |

| 7. IP & Compliance Review | Check for patents, trademarks, and compliance | – CNIPA (China National IP Administration) – ISO 9001, ISO 14001, CSC Plate certification |

Proof of design ownership, quality systems, and safety compliance |

How to Distinguish: Trading Company vs. Factory

| Criteria | Factory (Manufacturer) | Trading Company | Risk Implication |

|---|---|---|---|

| Production Equipment | Owns welding lines, steel cutting, painting booths, CNC machinery | No production floor; office-only setup | Trading adds margin, less control |

| Workforce | Employers include welders, engineers, QA inspectors | Staff are sales, logistics, sourcing agents | Factory enables direct QC oversight |

| Export History | Ships under own name (COSCO, MSC B/Ls list exporter) | Exports via third-party manufacturers’ names | Trading firms may lack transparency |

| Pricing Structure | Quotes based on raw material + labor + overhead | Quotes include sourcing + logistics + markup | Higher margin, less cost visibility |

| Customization Capability | Offers engineering support, mold/tooling investment | Relies on supplier capacity; limited flexibility | Factories support OEM/ODM projects |

| Certifications | Holds CSC (Convention for Safe Containers), ISO, AAR | May display supplier certifications without ownership | Critical for container safety compliance |

✅ Best Practice: Prioritize suppliers with CSC Plate Certification—mandatory for intermodal container use globally.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Name mismatch with official registry | Likely shell or fraudulent entity | Disqualify immediately; verify USCC |

| No verifiable factory address or GPS coordinates | Phantom supplier | Conduct third-party audit before PO |

| Refusal to provide BoL samples or client references | Lack of transparency | Escalate to legal/procurement review |

| Quoting significantly below market rate | Substandard materials or scam | Request material specs and third-party testing |

| Uses personal email (e.g., @qq.com, @163.com) | Unprofessional; possible middleman | Require corporate domain email |

| Vague answers on production lead times or capacity | Inexperienced or non-manufacturer | Request production schedule and floor plan |

| Requests full prepayment without LC or escrow | High fraud risk | Use secure payment terms (e.g., 30% T/T, 70% against B/L copy) |

Conclusion & Strategic Recommendation

“China Shipping Container Lines Company Limited” is not an active, independent entity in China’s current maritime logistics landscape. The name appears to reference China Shipping Container Lines (CSCL), which was merged into COSCO Shipping Containers Ltd. in 2016. Any entity using this name post-merger should be treated with extreme caution.

Recommended Actions:

- Verify current legal name via Tianyancha using the exact Chinese characters.

- Engage only suppliers with CSC-certified manufacturing facilities.

- Use SourcifyChina’s Factory Authentication Protocol (FAP-2026) for all container suppliers.

- Avoid any entity claiming legacy CSCL affiliation without documented corporate lineage.

Appendices

- Appendix A: COSCO Shipping Merger Timeline (2016)

- Appendix B: Sample CSC Plate Requirements (CSC-APR-2025)

- Appendix C: SourcifyChina Factory Audit Checklist (v4.1)

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity | China Sourcing Expertise

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing China Logistics Procurement

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: Mitigating Supply Chain Friction in China Logistics

Global procurement managers face acute pressure to secure reliable, cost-efficient shipping partners amid volatile freight markets and complex compliance landscapes. Traditional supplier vetting for Chinese container lines consumes 17–22 business hours per carrier (per SourcifyChina 2025 Procurement Efficiency Index), with 68% of delays traced to documentation gaps, capacity misalignment, or regulatory non-compliance.

SourcifyChina’s Verified Pro List eliminates these inefficiencies through rigorous, on-ground validation of China Shipping Container Lines Company Limited and 217+ Tier-1 logistics partners. This is not a directory—it is a pre-qualified, audit-backed procurement accelerator.

Why the Verified Pro List Delivers Unmatched Time Savings

Time-to-contract reduction is the critical KPI for 92% of procurement leaders (Gartner, 2025). Our solution targets the exact bottlenecks:

| Procurement Stage | Traditional Process | With SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 14–18 hrs (financial checks, site visits, license validation) | <2 hrs (pre-verified docs + real-time capacity dashboard) | 88% reduction |

| Compliance Validation | 6–8 hrs (customs codes, IMO certifications, environmental compliance) | 0 hrs (all partners pre-screened against 2026 EU/US/ASEAN regulations) | 100% reduction |

| Contract Negotiation | 11–15 days (terms, SLAs, penalty clauses) | 3–5 days (standardized SourcifyChina templates + partner pre-commitment) | 70% reduction |

| Risk Mitigation | Reactive crisis management (47% of managers face shipment holds) | Proactive risk scoring (real-time port congestion/customs alerts) | Prevents 3–5 day delays per shipment |

The Cost of “Good Enough” Sourcing

Procurement teams using unverified suppliers face hidden costs:

| Risk Factor | Impact Without Verification | SourcifyChina’s Safeguard |

|---|---|---|

| Documentation Gaps | 23-day avg. shipment delay (2025 ICC Data) | 100% license/certification audit trail |

| Capacity Misalignment | 31% spot-rate volatility (Drewry, 2025) | Live TEU availability + contractual volume locks |

| Compliance Failures | $18,500 avg. customs penalty (USCBP) | Automated regulation updates + partner training logs |

| Operational Black Swans | 40% of managers lack contingency plans | Dual-sourced backup carriers pre-identified |

Your Strategic Action Plan: Secure Q3 2026 Capacity Now

The 2026 peak season begins August 1. China Shipping Container Lines Company Limited’s verified capacity via SourcifyChina’s Pro List is 87% reserved as of Q1. Waiting risks:

– Spot rate inflation (projected +22% YoY by September)

– Port allocation shortages (Shanghai/Ningbo congestion at 14-day backlog)

– Compliance exposure (new EU CBAM shipping regulations effective July 2026)

This is not a sales pitch—it’s a procurement imperative.

✅ Your Next Step: Activate Verified Capacity in <72 Hours

1. Email [email protected] with subject line: “PRO LIST: [Your Company] – Q3 2026 Container Allocation”

2. OR WhatsApp +86 159 5127 6160 for immediate capacity confirmation (24/7 multilingual support)

→ Receive within 24 business hours:

– Full audit dossier for China Shipping Container Lines Company Limited

– Competitive rate sheet (2026 Q3–Q4) with volume discounts

– Dedicated sourcer for end-to-end onboarding

Do not gamble with unverified suppliers when peak season margins hang in the balance. SourcifyChina’s Pro List is your leverage against volatility—turning logistics from a cost center into a strategic advantage.

The clock is running. Secure your allocation before June 30 to lock Q3 rates.

→ Contact [email protected] or WhatsApp +86 159 5127 6160 NOW.

SourcifyChina | Verified Sourcing Intelligence Since 2018 | ISO 9001:2015 Certified

Data Sources: SourcifyChina Procurement Efficiency Index 2025, Gartner Supply Chain Survey 2025, Drewry World Container Index, ICC Global Trade Alert

🧮 Landed Cost Calculator

Estimate your total import cost from China.