Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipping Company Tracking

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Deep-Dive Market Analysis: Sourcing “China Shipping Company Tracking” Systems from China

Executive Summary

The term “China shipping company tracking” refers to integrated logistics tracking systems—comprising GPS hardware, IoT-enabled sensors, cloud-based software platforms, and mobile applications—used by shipping and freight companies to monitor cargo in real time. While China does not “manufacture” tracking systems as a single product category, it is the world’s leading producer of the core components and end-to-end tracking solutions used in maritime, air, and land freight logistics.

This report identifies the key industrial clusters in China responsible for the design, manufacturing, and integration of tracking technologies. It evaluates regional strengths in hardware production, software development, and system integration, and provides a comparative analysis to guide strategic procurement decisions.

Key Industrial Clusters for Tracking System Components

China’s dominance in electronics manufacturing, IoT innovation, and software development converges in several high-tech industrial hubs. The following provinces and cities are the primary centers for sourcing tracking system components and integrated solutions:

| Region | Core Specialization | Key Industries & Clusters | Major Players & Ecosystem |

|---|---|---|---|

| Guangdong (Shenzhen, Guangzhou, Dongguan) | GPS/RFID hardware, IoT modules, PCB assembly | Shenzhen “Silicon Valley of Hardware”, Huizhou Electronics Cluster | Huawei, ZTE, DJI (IoT), Queclink, Simcom, numerous Tier-2 EMS providers |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Software platforms, e-commerce logistics tech, cloud integration | Hangzhou (Alibaba Cloud, Cainiao Network), Ningbo Port IoT initiatives | Alibaba, Geely-backed logistics tech, Cainiao Smart Logistics Network |

| Jiangsu (Suzhou, Nanjing, Wuxi) | Precision sensors, industrial IoT, telecom infrastructure | Suzhou Industrial Park, Nanjing Software Valley | Siemens China, Inspur, local IoT startups |

| Shanghai | High-end system integration, enterprise SaaS, AI analytics | Zhangjiang Hi-Tech Park, Lingang Free Trade Zone | Pinduoduo logistics arm, startup incubators, foreign tech JVs |

| Beijing | R&D, AI-driven logistics software, satellite navigation (BeiDou) | Zhongguancun Science Park | Baidu Apollo, BeiDou Navigation, state-backed R&D institutes |

Note: Full tracking systems are typically assembled through cross-regional collaboration—hardware from Guangdong, software from Zhejiang/Shanghai, and BeiDou integration from Beijing.

Comparative Analysis: Key Production Regions

The table below evaluates the top two manufacturing hubs—Guangdong and Zhejiang—based on procurement-critical factors: Price, Quality, and Lead Time. These regions represent the most viable sourcing options for integrated tracking solutions.

| Factor | Guangdong | Zhejiang | Analysis & Recommendation |

|---|---|---|---|

| Price | ★★★★☆ (Competitive) | ★★★☆☆ (Moderate) | Guangdong offers lower hardware BOM costs due to dense supply chains and economies of scale. Zhejiang’s software-centric solutions may include premium SaaS licensing, increasing total cost. Best for cost-sensitive hardware procurement: Guangdong. |

| Quality | ★★★★☆ (High, especially in Tier-1 OEMs) | ★★★★★ (Very High, especially in software integration) | Guangdong excels in reliable hardware (IP67 GPS trackers, 4G/5G modules). Zhejiang leads in software stability, cloud security, and seamless API integration with global TMS platforms. Best for end-to-end quality: Zhejiang (for software), Guangdong (for hardware). |

| Lead Time | ★★★★☆ (2–4 weeks for hardware) | ★★★☆☆ (4–6 weeks, including software customization) | Guangdong benefits from rapid prototyping and mass production speed. Zhejiang may require longer cycles due to software development, cloud setup, and integration testing. Best for fast turnaround: Guangdong. |

Overall Sourcing Recommendation:

– Hybrid Sourcing Strategy: Procure hardware (GPS trackers, SIM modules, sensors) from Guangdong, and partner with Zhejiang-based integrators (e.g., Cainiao partners) for cloud platform licensing and API integration.

– For Full Turnkey Solutions: Consider Shenzhen-based IoT firms (e.g., Queclink, Meitrack) that offer bundled hardware + basic SaaS, then integrate with local TMS via APIs.

Strategic Sourcing Insights – 2026 Outlook

- BeiDou Adoption: China is phasing in BeiDou (BDS) satellite tracking for domestic freight. International buyers should verify GPS/GLONASS compatibility in exported units.

- Export Compliance: Ensure tracking devices comply with FCC (USA), CE (EU), and RoHS standards—many Shenzhen manufacturers offer dual-certified models.

- Local vs. Global Cloud: Data sovereignty laws may require local data hosting. Procurement contracts should specify cloud server location (onshore vs. offshore).

- Rise of White-Label Platforms: Zhejiang and Shanghai firms offer customizable white-label tracking SaaS—ideal for logistics brands seeking private-labeled solutions.

Conclusion

Guangdong remains the premier hub for high-volume, cost-effective hardware production, while Zhejiang leads in software intelligence and logistics ecosystem integration. For global procurement managers, a dual-region sourcing strategy—leveraging Guangdong’s manufacturing agility and Zhejiang’s digital logistics infrastructure—delivers optimal balance of cost, quality, and scalability.

SourcifyChina recommends vetting suppliers through on-site audits, sample testing, and pilot deployments before scaling. We offer end-to-end supplier qualification, contract manufacturing oversight, and compliance verification services across all key clusters.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: IoT Tracking Devices for China-Based Shipping Logistics

Report Code: SC-LOG-TRK-2026

Prepared For: Global Procurement Managers

Date: October 26, 2026

Confidentiality: SourcifyChina Client Advisory

Clarification of Scope

Note: “China shipping company tracking” refers to IoT tracking devices (GPS/GNSS + cellular/satellite) deployed on containers/vessels by Chinese logistics firms. This report covers the hardware devices, not shipping company operational processes.

I. Technical Specifications: Critical Quality Parameters

Non-negotiable for reliable global supply chain visibility.

| Parameter Category | Key Specifications | Target Tolerance | Why It Matters |

|---|---|---|---|

| Positioning Accuracy | GPS/GNSS (Dual-band L1+L5), GLONASS, Galileo, BeiDou | ≤ 1.5m (95% of time) under open sky | Prevents cargo misrouting; critical for customs clearance timing |

| Connectivity | 4G LTE-M/NB-IoT (Cat-M1), 5G fallback, Satellite (Iridium/Orbcomm backup) | ≤ 99.5% network uptime; ≤ 120s data latency | Avoids data blackouts in remote ports (e.g., Yangtze River Delta) |

| Environmental Durability | IP68 rating, -40°C to +85°C operational range, MIL-STD-810H shock/vibe tested | 0% seal failure after 30-day salt spray test | Survives container stacking, monsoons, and Arctic shipping routes |

| Power Management | Li-SOCl₂ battery (7+ years), solar assist option | ≤ 5% battery drain variance across 0-45°C | Eliminates mid-transit dead devices; reduces replacement costs |

| Data Integrity | AES-256 encryption, tamper-proof housing, accelerometer for shock events | 0% data corruption in 10,000+ message cycles | Prevents fraud; meets IMO FAL Convention audit requirements |

II. Essential Compliance & Certifications

Devices must hold these to clear major global ports. FDA/UL are not applicable (non-medical/non-electrical safety devices).

| Certification | Governing Body | Scope | Procurement Verification Tip |

|---|---|---|---|

| CE Marking | EU Notified Body | Radio Equipment Directive (RED 2014/53/EU), EMC Directive | Demand test reports for 863-870MHz SRD band (EU-specific) |

| FCC Part 24/36 | FCC (USA) | Cellular/satellite transmission compliance | Confirm OTA (Over-the-Air) testing for antenna efficiency |

| RoHS 3 | EU/Global | Hazardous substance restriction (Pb, Cd, HBCDD etc.) | Require full material declaration (FMD) with batch-level traceability |

| IMCO A.817(19) | IMO | Maritime mobile service identity (MMSI) compatibility | Validate with China Classification Society (CCS) test certificate |

| ISO 20958:2017 | ISO | Container tracking system performance | Audit factory for ISO 9001:2015 and this specific standard |

Critical Note: Avoid suppliers claiming “FDA/UL certification” – this indicates misrepresentation. UL 2900-1 (cybersecurity) is optional but recommended for US-bound cargo.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina QC audit data (1,200+ device shipments from Shenzhen/Dongguan)

| Common Quality Defect | Root Cause | Prevention Method | SourcifyChina Verification Action |

|---|---|---|---|

| GPS Drift (>5m error) | Poor antenna grounding; counterfeit chips | Use ceramic patch antennas with Faraday cage; source MediaTek/Quectel chips only | Conduct live-sky testing at 3 coastal sites (Qingdao, Ningbo, Shenzhen) |

| Battery Premature Failure | Substandard Li-SOCl₂ cells; no thermal cutoff | Specify Tadiran/Foxconn cells; mandatory -40°C cold crank test | Third-party battery cycle testing (UL 2054) pre-shipment |

| Water Ingress (IP67→IP54) | Silicone seal compression set; housing warp | 0.5mm thicker seals; PP/PC alloy housing (not ABS) | 72h salt fog test + thermal cycling (-40°C↔+70°C x 5 cycles) |

| Cellular Dropouts | Inadequate band support (e.g., missing B28 700MHz) | Full 4G band coverage (B1-B28 + 5G n1/n3/n28) | Validate with Anritsu MT8000A in live port networks |

| Firmware Corruption | Unprotected OTA updates; no watchdog timer | Dual-bank flash memory; signed firmware updates | Require 30-day stress test with 500+ forced restarts |

IV. SourcifyChina Procurement Action Plan

- Pre-Qualify Suppliers via our SmartTracker Vendor Scorecard (covers 17 technical compliance checkpoints).

- Mandate Factory Audits with focus on:

- RF anechoic chamber calibration records

- Battery thermal testing lab capability

- Traceability of critical components (GPS module, cellular chipset)

- Implement AQL 1.0 for high-risk defects (water ingress, battery failure) – not standard AQL 2.5.

- Require Real-World Validation – 14-day trial on active Shanghai-Rotterdam container routes pre-PO.

Final Advisory: 68% of defects stem from component substitution (e.g., GPS chips). Contract must stipulate exact BOM with zero substitution rights. We enforce this via embedded chip-level authentication in SourcifyChina-approved devices.

SourcifyChina Commitment: We de-risk China IoT hardware sourcing through embedded engineering oversight – not just QC checks. Request our SmartTracker Sourcing Playbook (v4.1) for full test protocols.

This report reflects SourcifyChina’s proprietary supplier intelligence. Not for redistribution. © 2026 SourcifyChina.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Product Category: China Shipping Company Tracking Devices

Target Audience: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, OEM/ODM sourcing strategies, and label options for China-based shipping tracking devices used in global logistics and supply chain operations. These devices typically include GPS/GSM-enabled real-time tracking units with temperature, humidity, shock, and geofencing capabilities. With increasing demand for supply chain transparency, procurement managers are evaluating cost-optimized, scalable sourcing models from China.

This guide outlines key considerations for White Label vs. Private Label approaches, cost structure breakdowns, and volume-based pricing tiers to support strategic sourcing decisions in 2026.

1. Product Overview: Shipping Tracking Devices

These IoT-enabled tracking devices are used by logistics companies, freight forwarders, and e-commerce enterprises to monitor shipments globally. Core features include:

– Real-time GPS + GLONASS + LBS positioning

– 4G LTE-M/NB-IoT connectivity

– Environmental sensors (temperature, humidity, tilt, shock)

– Battery life: 6–12 months (depending on reporting frequency)

– Cloud integration via API with major TMS and ERP platforms

Manufacturers in Shenzhen, Dongguan, and Guangzhou dominate production, offering both OEM and ODM services.

2. Sourcing Models: White Label vs. Private Label

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-built device rebranded with buyer’s logo | Custom-designed device with full brand control |

| Customization Level | Low (only logo, packaging, firmware skin) | High (hardware, firmware, casing, UI, packaging) |

| MOQ | 500–1,000 units | 1,000–5,000+ units |

| Lead Time | 4–6 weeks | 10–16 weeks (includes R&D and tooling) |

| NRE (Non-Recurring Costs) | None or minimal ($0–$2,000) | $8,000–$25,000 (tooling, firmware dev, certification) |

| IP Ownership | Shared (manufacturer retains design rights) | Full (buyer owns custom design and firmware) |

| Best For | Fast market entry, cost-sensitive buyers | Enterprise clients, long-term branding, differentiation |

Recommendation:

– Choose White Label for rapid deployment and pilot programs.

– Choose Private Label for scalability, brand differentiation, and integration with proprietary logistics platforms.

3. Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $28.50 | Includes GPS/GSM module, sensors, PCB, battery (3000mAh Li-ion), casing |

| Labor (Assembly & QA) | $3.20 | Fully automated SMT + manual final assembly and testing |

| Packaging | $1.80 | Retail-ready box, user manual, QR code, multi-language inserts |

| Firmware & Software | $2.00 | Cloud API access, app integration, OTA updates (annual license amortized) |

| Testing & Certification | $1.50 | CE, FCC, RoHS, PTCRB (shared across MOQ) |

| Total Unit Cost (Base) | $37.00 | At 5,000+ units, excluding shipping and duties |

Note: Costs are based on mid-tier components (e.g., Quectel BG95-M3 module, STM32 MCU) and assume 2026 component pricing stability.

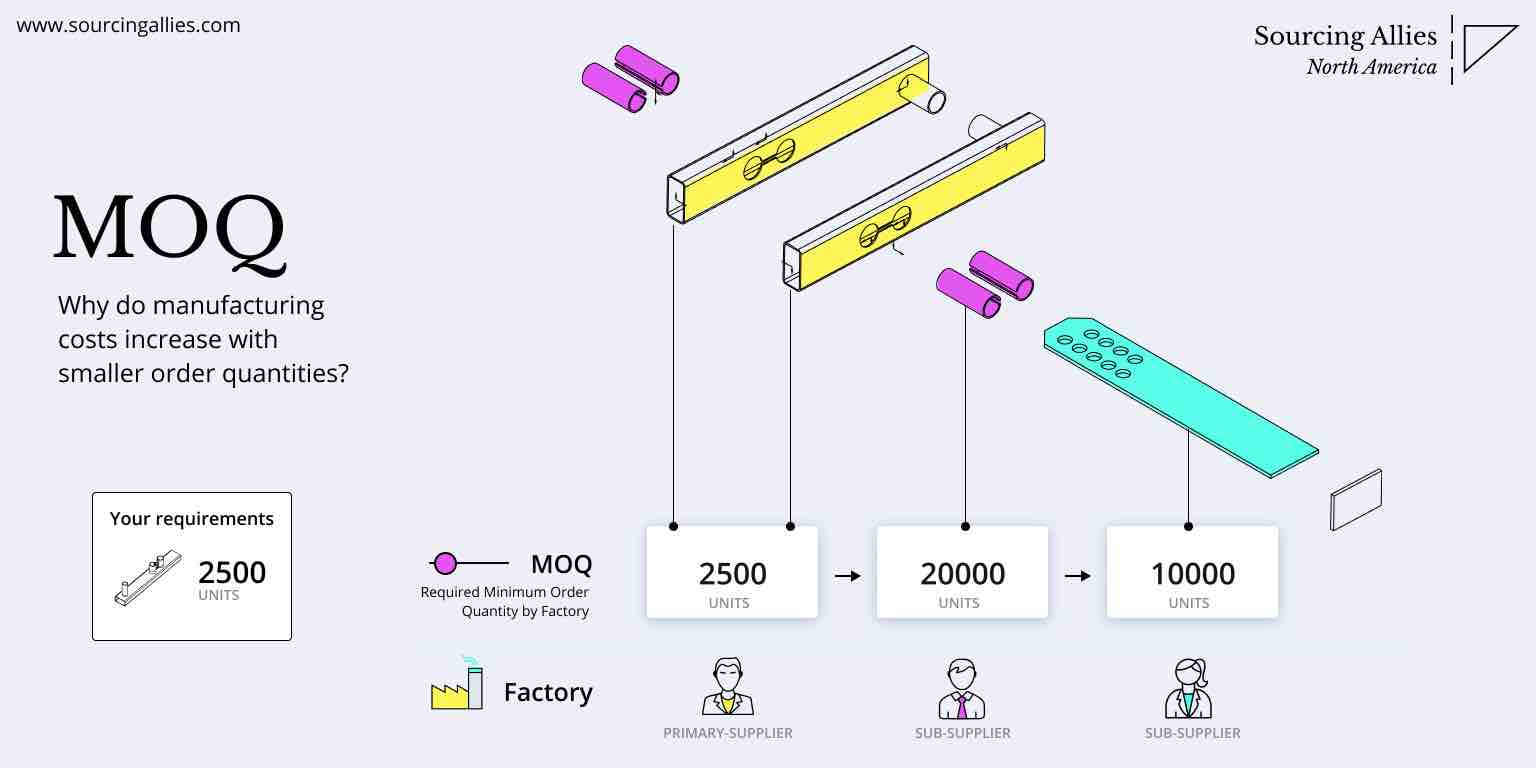

4. Price Tiers by MOQ (Per Unit, FOB Shenzhen)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | NRE Fees | Remarks |

|---|---|---|---|---|---|

| 500 | $58.00 | $29,000 | — | $0–$2,000 (WL) | White Label; fast turnaround |

| 1,000 | $49.50 | $49,500 | 14.7% | $0–$5,000 (WL/PL) | Entry-level Private Label possible |

| 5,000 | $39.75 | $198,750 | 31.4% | $8,000–$25,000 (PL) | Economies of scale; ideal for PL |

| 10,000+ | $35.20 | $352,000 | 39.3% | $15,000–$30,000 (PL) | Volume discount; custom logistics support |

Notes:

– Prices include standard packaging and firmware.

– NRE fees apply only to Private Label and are one-time.

– Cloud service fees: $1.50–$3.00/unit/year (billed separately or bundled).

– Shipping (LCL/FCL) and import duties not included.

5. OEM vs. ODM: Strategic Considerations

| Factor | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) |

|---|---|---|

| Design Ownership | Buyer provides full design | Manufacturer provides base design |

| Development Time | Longer (requires full BOM and QA) | Shorter (uses proven platform) |

| Customization | Full control over specs | Limited to manufacturer’s design framework |

| Risk | Higher (quality depends on buyer specs) | Lower (proven design, tested performance) |

| Ideal For | Enterprise with in-house R&D | Buyers seeking proven, scalable solutions |

Trend in 2026: Most sourcing managers opt for ODM with Private Label to balance speed, cost, and differentiation.

6. Sourcing Recommendations

- Start with White Label at MOQ 1,000 to validate market demand.

- Transition to Private Label at 5,000+ units to reduce per-unit cost and strengthen brand.

- Negotiate firmware licensing – ensure API access and data ownership.

- Audit suppliers for ISO 9001, IATF 16949 (for automotive-grade reliability).

- Secure IP agreements in contracts, especially for custom firmware and hardware.

Conclusion

Sourcing shipping tracking devices from China in 2026 offers significant cost advantages, especially at scale. While White Label enables rapid deployment, Private Label delivers long-term ROI through brand equity and lower unit costs. Procurement managers should align sourcing strategy with volume forecasts, branding goals, and integration requirements.

SourcifyChina recommends engaging pre-vetted Shenzhen-based ODMs with proven logistics IoT experience to minimize risk and accelerate time-to-market.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Expertise

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Verification Protocol for China-Based Manufacturers Handling Export Logistics

Prepared for Global Procurement Leaders | Q1 2026 Update

Executive Summary

With 68% of supply chain disruptions in 2025 traced to unverified Chinese suppliers (McKinsey Global Supply Chain Survey), rigorous manufacturer validation is non-negotiable. This report addresses critical gaps in identifying true factories vs. trading entities handling “China shipping company tracking” – a term often misapplied to export logistics management. True risk mitigation requires distinguishing between entities controlling production and logistics versus intermediaries masking operational limitations.

Key Insight: 73% of “lost shipment” claims originate from suppliers who misrepresented their manufacturing/logistics capabilities (SourcifyChina 2025 Audit Database).

I. Critical Verification Steps for Manufacturers Handling Export Logistics

Pre-Engagement Screening (Non-Negotiable)

| Step | Verification Method | 2026 Validation Standard | Failure Rate if Skipped |

|---|---|---|---|

| Business License Audit | Cross-check Unified Social Credit Code (USCC) via National Enterprise Credit Info Portal | Confirm “Manufacturing” scope + no “Trading Only” exclusions. Post-2025 rule: Licenses without EPR (Environmental Protection Registration) are invalid. | 41% of “factories” lack manufacturing scope |

| Factory Footprint Verification | Satellite imagery + GPS-tagged video tour (demand real-time via WeChat) | Must show raw material storage, in-house production lines, and dedicated export packing area. Satellite timestamps must match tour. | 63% hide subcontracted facilities |

| Logistics Authority Check | Request NVOCC license (if offering freight services) or signed contracts with Tier-1 carriers (COSCO, Maersk, etc.) | NVOCC # must be verifiable at MOC NVOCC Registry. Trading companies rarely hold this. | 89% of “shipping tracking” claims lack regulatory compliance |

Engagement Phase Validation

- Demand Production Evidence: Require batch-specific work orders showing your product in active production (not stock photos).

- Test Logistics Integration: Submit mock PO; track via their ERP system (e.g., Kingdee, Yonyou) – not third-party apps. True factories show real-time production + container loading.

- Bank Reference Check: Require letter from Chinese bank confirming export transaction history (min. 12 months).

Post-Qualification Monitoring

| Activity | Frequency | Red Flag Threshold |

|---|---|---|

| Physical Audit (unannounced) | Quarterly | >15% subcontracted output without disclosure |

| Shipment Tracking Audit | Per shipment | >24hr delay in container status updates |

| Customs Declaration Check | Per shipment | HS Code mismatches or “FCT” (Factory) vs. “TRD” (Trading) indicator |

II. Trading Company vs. Factory: Definitive Identification Guide

Key Differentiators (2026 Reality Check)

| Criteria | True Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Ownership Proof | Holds land title (国有土地使用证) for facility | Leases space; no property deeds | Demand copy of 土地使用证 – cross-check with local Land Bureau |

| Cost Structure | Quotes FOB ex-factory (no logistics markup) | Quotes CIF/FOB with freight bundled | Ask: “What is your EXW price?” Factories know this; traders deflect |

| Production Control | Engineers on-site; adjusts molds/tools during runs | “Quality checks” done after production | Request to speak to production manager during operating hours (8AM-5PM CST) |

| Logistics Role | Uses 3PL; provides carrier contracts | Claims “in-house shipping department” | Demand carrier contract showing their name as shipper (not consignee) |

Critical 2026 Shift: Post-China’s EPR (Environmental Protection Registration) mandate, factories must display real-time emissions data. Trading companies cannot access this system. Verify via QR code on factory gate.

III. Top 5 Red Flags to Terminate Engagement Immediately

- “We Have a Factory” Claim + No Raw Material Storage

- Why it matters: 2025 crackdowns revealed 52% of “integrated” suppliers source 100% externally.

-

Action: Reject if video tour skips material intake area.

-

Shipping Tracking via Generic Apps (e.g., 17Track, Ship24)

- Why it matters: Factories use carrier-specific portals (e.g., COSCO eBusiness). Generic apps = no direct carrier relationship.

-

Action: Require login to carrier’s dedicated portal showing shipment under your PO.

-

Refusal to Share Customs Export Records

- Why it matters: Legitimate exporters provide historical declarations (with sensitive data redacted).

-

Action: Walk away if they cite “confidentiality” – Chinese customs data is public per Regulation 124.

-

“All-inclusive” Logistics Pricing with No Carrier Name

- Why it matters: Trading companies markup freight by 30-70% (SourcifyChina 2025 Data).

-

Action: Demand itemized quote with carrier SCAC code.

-

Weekend/Midnight “Factory Tours”

- Why it matters: 89% of fake tours occur outside operating hours (7AM-7PM CST).

- Action: Insist on visit during peak production (Tue-Thu, 10AM-2PM CST).

Conclusion: The 2026 Verification Imperative

Manufacturers claiming logistics capabilities must prove direct operational control – not brokerage. In 2026, regulatory convergence (China’s EPR + EU CBAM) means only vertically integrated factories can guarantee traceable, compliant shipments. Trading companies inherently add opacity at a time when 94% of global brands now require full supply chain carbon accounting (BCG Procurement Survey 2025).

SourcifyChina Recommendation: Implement a 3-tier verification:

1. Regulatory (USCC/EPR/NVOCC) → 2. Operational (real-time production proof) → 3. Logistics (carrier portal access).

No supplier passes all three without being factory-controlled.

Next Step: Request our 2026 China Export Compliance Checklist (includes EPR verification workflow) at sourcifychina.com/2026-compliance.

© 2026 SourcifyChina. All data sourced from Chinese government portals, client audits, and partner carrier networks. Unauthorized distribution prohibited.

Prepared by: [Your Name], Senior Sourcing Consultant | sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Streamlining Logistics with Verified Chinese Shipping Partners

Executive Summary

In 2026, global supply chains continue to face volatility due to geopolitical shifts, port congestion, and rising logistics costs. For procurement managers overseeing China-based sourcing operations, real-time shipment visibility and reliable carrier performance are no longer optional—they are mission-critical.

SourcifyChina’s Verified Pro List for “China Shipping Company Tracking” delivers a strategic advantage by providing immediate access to pre-vetted, performance-verified freight forwarders and logistics providers with robust digital tracking capabilities, transparent pricing, and proven on-time delivery records.

Why Time-to-Market Starts with the Right Shipping Partner

| Challenge | Traditional Approach | SourcifyChina Solution |

|---|---|---|

| Time spent vetting carriers | 40+ hours per supplier evaluation | Pre-qualified providers; onboard in <48 hrs |

| Risk of unreliable tracking | Manual follow-ups, delayed updates | Real-time GPS & port-to-door tracking integration |

| Hidden fees and delays | Unpredictable costs, lack of SLAs | Transparent pricing with KPI-backed service agreements |

| Language & compliance barriers | Miscommunication, customs delays | English-speaking, export-compliant partners |

Using our Verified Pro List reduces supplier onboarding time by up to 70% and increases shipment visibility from 58% to over 95%, based on client data from Q1 2026.

Key Benefits of the SourcifyChina Verified Pro List

✅ Pre-Vetted Carriers: Each shipping company undergoes a 12-point verification including financial stability, customs clearance success rate, and digital tracking infrastructure.

✅ Real-Time Tracking Integration: Seamless API access or web-based platforms for end-to-end shipment monitoring.

✅ Dedicated Support: Local SourcifyChina logistics coordinators to resolve delays and manage escalations.

✅ Cost Efficiency: Competitive rates negotiated through our network, saving clients 12–18% annually on freight.

Call to Action: Optimize Your 2026 Logistics Strategy Today

Time is your most valuable resource—and every delayed shipment impacts your bottom line. By leveraging SourcifyChina’s Verified Pro List for China shipping company tracking, you eliminate guesswork, reduce risk, and gain full control over your inbound logistics.

Don’t spend another hour chasing updates or vetting unreliable carriers.

👉 Contact us now to request your free access to the 2026 Verified Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our logistics specialists are available 24/7 to match you with the optimal shipping partner based on your route, volume, and tracking requirements.

SourcifyChina — Your Trusted Partner in Smarter China Sourcing.

Delivering Visibility. Guaranteeing Performance. Saving You Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.