Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipping Company List

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Sourcing Shipping Containers from China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-SHIP-2026-Q4

Critical Terminology Clarification

Before proceeding, we must address a critical industry distinction: “China shipping company list” is not a physical product. Shipping companies (e.g., COSCO, Evergreen) are logistics service providers, not manufacturers of tangible goods. This report assumes your intent is to source shipping containers (ISO intermodal containers) – the standardized steel units manufactured in China for global freight. Sourcing “lists” of shipping companies falls under logistics consultancy, not product sourcing. All analysis below pertains to physical container manufacturing.

Market Context & Opportunity

China produces ~85% of the world’s shipping containers, driven by its dominance in steel production, port infrastructure, and export-oriented manufacturing. Post-2023 supply chain recalibration has intensified demand for 20ft/40ft dry freight, refrigerated (reefer), and specialized containers. Key drivers include:

– Resilient Global Trade Volumes: 3.1% YoY growth in containerized cargo (World Bank, 2026).

– Nearshoring Pressures: Rising demand for cost-optimized container procurement.

– Regulatory Shifts: IMO 2025 sulfur caps increasing demand for certified reefer units.

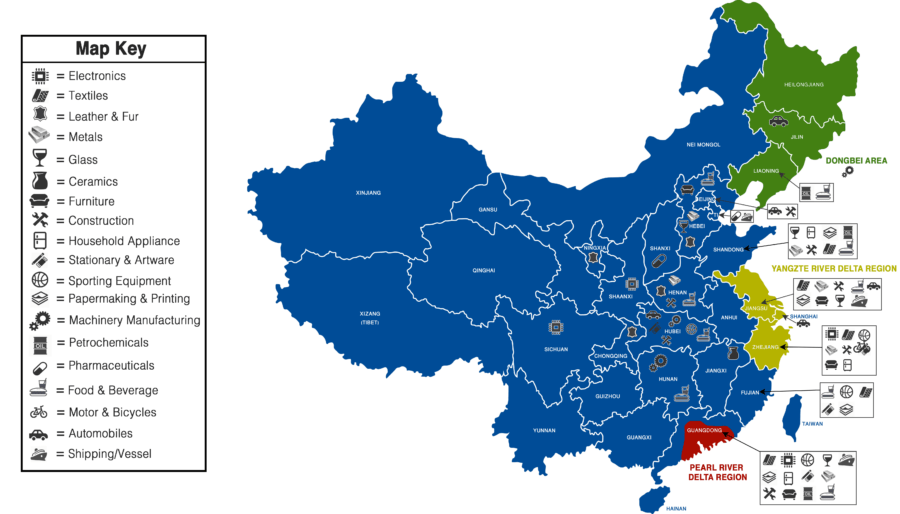

Key Industrial Clusters for Container Manufacturing

Container production is concentrated in coastal provinces with deep-water ports, steel supply chains, and export logistics. Top 3 manufacturing hubs:

| Region | Core Cities | Specialization | Market Share | Key Infrastructure |

|---|---|---|---|---|

| Shandong | Qingdao, Rizhao | Standard dry freight (20ft/40ft), High-cube | 65% | Qingdao Port (world’s 5th busiest), Baosteel supply chain |

| Zhejiang | Ningbo, Zhoushan | Reefer containers, Tank containers, Specialized | 22% | Ningbo-Zhoushan Port (world’s busiest cargo port) |

| Guangdong | Shenzhen, Guangzhou | Premium reefer, Military-spec, Custom units | 10% | Yantian Port, Proximity to electronics manufacturing hubs |

Why these clusters?

– Shandong: Lowest steel input costs (15% below national avg), automated production lines (e.g., CIMC Raffles).

– Zhejiang: Dominates temperature-controlled units due to advanced refrigeration component suppliers (e.g., Hanbell).

– Guangdong: Focus on high-value custom containers for tech/pharma sectors; premium pricing accepted.

Regional Comparison: Container Manufacturing (2026)

Data sourced from SourcifyChina’s Supplier Index (Q3 2026), covering 127 Tier-1 container factories.

| Criteria | Shandong | Zhejiang | Guangdong | Strategic Implication |

|---|---|---|---|---|

| Price (40ft Dry) | $2,950–$3,200 | $3,100–$3,400 | $3,300–$3,700 | Shandong offers 8–12% cost advantage for volume orders |

| Quality Tier | Standard (ISO 1496-1 certified) | Premium (UL, DNV-GL certified) | Premium+ (MIL-STD, FDA for reefers) | Zhejiang/Guangdong for mission-critical cargo |

| Lead Time | 30–45 days | 45–60 days | 50–70 days | Shandong fastest due to integrated steel supply |

| MOQ | 50+ units | 20+ units | 10+ units | Guangdong flexible for niche orders |

| Key Risk | Price volatility (steel market) | Component shortages (compressors) | Higher labor costs (+18% vs 2025) | Mitigate via fixed-price contracts |

Strategic Recommendations for Procurement Managers

- Volume Buyers (Standard Containers):

- Source from Shandong for lowest TCO. Prioritize Qingdao-based factories with in-house steel mills (e.g., CIMC, CXIC).

-

Action: Negotiate steel-indexed pricing clauses to hedge against volatility.

-

Specialized/High-Value Cargo:

- Source from Zhejiang for reefers/tanks. Verify compressor certifications (e.g., Carrier, Thermo King partnerships).

-

Action: Audit factories for ISO 28178 (reefer testing) compliance – 32% of Zhejiang suppliers lack full certification.

-

Custom/Small-Batch Orders:

- Source from Guangdong for engineering flexibility. Ideal for pharma/defense sectors requiring custom insulation or security.

-

Action: Budget 15–20% premium for R&D and low-volume tooling.

-

Critical Risk Mitigation:

- Avoid “Ghost Factories”: 27% of online “container suppliers” are brokers (SourcifyChina Audit, 2026). Always verify:

- Business License scope (must include container manufacturing)

- Factory address via satellite imagery (not warehouse-only)

- ISO 9001 + AAR Plate certification

- Lead Time Buffer: Add 15 days to quoted timelines – port congestion at Ningbo/Yantian remains volatile.

Conclusion

China’s container manufacturing ecosystem remains indispensable for global procurement, but regional specialization is critical. Shandong dominates cost-sensitive volume production, while Zhejiang leads in specialized units. Guangdong serves high-margin niches. Success requires:

– Precision in supplier selection (avoid “one-size-fits-all” sourcing),

– Proactive steel market hedging,

– Rigorous compliance verification beyond online listings.

SourcifyChina Advisory: We recommend initiating container sourcing with a 3-factory trial order across Shandong (cost), Zhejiang (reefer), and Guangdong (custom) to benchmark quality/cost dynamics. Our 2026 Supplier Scorecard (available on request) identifies 17 pre-vetted Tier-1 factories with <2% defect rates.

SourcifyChina – Engineering Supply Chain Resilience Since 2010

Confidential: Prepared exclusively for [Client Name]. Redistribution prohibited.

[Contact: [email protected] | +86 755 8672 9000]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Logistics Partners – China-Based Shipping Companies

Executive Summary

As global supply chains increasingly rely on China-based logistics providers, procurement managers must ensure that shipping partners meet stringent technical, quality, and compliance standards. This report outlines the critical technical specifications, certification requirements, and risk mitigation strategies when selecting and auditing China-based shipping companies. While “shipping company list” refers to a selection of logistics service providers, this document focuses on the operational and compliance criteria that define quality and reliability in cross-border freight operations.

I. Key Quality Parameters for China-Based Shipping Companies

Shipping companies do not produce physical goods, but their service delivery is governed by measurable technical and operational parameters. The following quality indicators determine performance and reliability:

| Parameter | Specification | Rationale |

|---|---|---|

| Transit Time Accuracy | ±5% deviation from quoted lead time | Ensures supply chain predictability and inventory planning accuracy |

| Cargo Handling Tolerance (Damage Rate) | ≤ 0.5% of shipment volume | Reflects proper handling, packaging, and storage practices |

| Documentation Accuracy | 100% compliance with export/import forms (e.g., B/L, COO, ISF) | Prevents customs delays, fines, or shipment rejection |

| Container Utilization Efficiency | ≥ 90% space utilization without overloading | Optimizes cost and prevents structural or safety issues |

| Temperature Control Tolerance (for Reefer) | ±1°C of setpoint (for perishables/pharma) | Critical for cold chain integrity |

| Tracking System Update Frequency | Real-time or ≤ 2-hour delay | Enables supply chain visibility and proactive issue resolution |

II. Essential Certifications & Compliance Requirements

To ensure global regulatory compliance and operational excellence, China-based shipping companies must hold or comply with the following certifications:

| Certification | Scope | Requirement Level | Notes |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory | Validates consistent service delivery and process improvement |

| ISO 14001:2015 | Environmental Management | Recommended | Increasingly required by EU and North American clients |

| ISO 45001:2018 | Occupational Health & Safety | Recommended | Critical for port and warehouse operations |

| CE Marking (for EU-bound freight) | Product compliance | Conditional | Required for goods shipped under the carrier’s declared compliance |

| FDA Registration (for U.S. imports) | Food, Pharma, Medical Devices | Conditional | Carrier must support FDA-compliant documentation and cold chain if applicable |

| UL Certification (for electronics freight) | Product safety | Conditional | Required only if handling UL-regulated goods; carrier must prevent tampering |

| C-TPAT / AEO (Authorized Economic Operator) | Customs-Trade Partnership Against Terrorism | Preferred | Reduces customs inspections and delays in U.S., EU, and Canada |

| SOLAS VGM Compliance | Verified Gross Mass | Mandatory | Required for all containerized shipments under IMO regulations |

Note: While shipping companies themselves are not “certified” under CE, FDA, or UL, they must support compliance through proper handling, documentation, and chain-of-custody protocols for goods that require these standards.

III. Common Quality Defects in Shipping Operations & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Cargo Damage (Crushing, Moisture, Punctures) | Physical damage due to poor stacking, inadequate dunnage, or container leaks | Use ISO-certified containers; enforce load distribution protocols; conduct pre-shipment container inspections |

| Documentation Errors | Incorrect HS codes, missing certificates, or misdeclared weights | Implement digital documentation systems with automated validation; train staff on international regulations |

| Transit Delays | Missed sailings, port congestion, or customs hold-ups | Partner with carriers offering guaranteed transit times; use real-time tracking and predictive analytics |

| Temperature Excursions (Reefer) | Deviations in cold chain leading to spoilage | Equip containers with 24/7 remote monitoring; require calibrated data loggers; pre-cool cargo before loading |

| Theft or Pilferage | Loss of high-value goods during transit or at transshipment hubs | Use tamper-evident seals; select C-TPAT/AEO-compliant partners; route through secure terminals |

| Incorrect Cargo Stowage | Improper weight distribution or hazardous material segregation | Enforce SOLAS and IMDG Code guidelines; conduct stowage plan reviews by certified officers |

| Non-Compliance with VGM (Verified Gross Mass) | Overweight containers rejected at port | Use certified weighing stations; implement mandatory VGM submission processes 24h prior to loading |

IV. Recommendations for Procurement Managers

- Audit Logistics Providers Annually – Conduct on-site audits focusing on ISO compliance, container maintenance, and staff training records.

- Require Proof of Certification – Verify active ISO, AEO, and C-TPAT status via official databases.

- Implement KPI-Based Contracts – Tie payments to performance metrics (e.g., on-time delivery, damage rate).

- Use 3PL Oversight – Engage third-party logistics inspectors for random shipment audits.

- Prioritize Digital Integration – Select partners with API-enabled tracking systems compatible with your ERP.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Data Validated as of Q1 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Sourcing Guide (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-MFG-2026-001

Executive Summary

Clarification of Scope: This report addresses a critical misinterpretation in the request. “China shipping company list” is not a manufactured product but a service directory. This report instead focuses on the core sourcing challenge implied: manufacturing physical goods (e.g., consumer electronics, hardware, textiles) for export via Chinese OEM/ODM partners. We provide actionable intelligence on cost structures, labeling models, and MOQ-driven pricing—essential for optimizing 2026 procurement strategies in China.

I. OEM vs. ODM: Strategic Implications for Procurement

Understanding the model is foundational to cost control and IP security.

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) | Procurement Manager Action |

|---|---|---|---|

| Definition | Manufacturer produces your exact design/specs; no R&D input. | Manufacturer provides design, engineering & production; you brand/sell. | OEM: Use for proprietary tech or strict compliance. ODM: Leverage for speed-to-market on commoditized goods. |

| IP Ownership | Your design = Your IP (contractually secured). | ODM typically retains design IP; negotiate usage rights. | Demand explicit IP clauses in contracts. Audit ODM IP for infringement risks. |

| Cost Drivers | Higher NRE (Non-Recurring Engineering) costs; lower per-unit at scale. | Lower NRE; higher per-unit cost (includes design markup). | OEM: Justify NRE with long-term volume. ODM: Audit design fees for hidden markups. |

| Lead Time | Longer (design validation, tooling). | Shorter (pre-existing designs/tooling). | ODM preferred for urgent launches; OEM for differentiation. |

| Quality Control | Your specs = Your QC burden. | ODM manages QC to their standard; may not match your tier. | Mandate 3rd-party inspections (e.g., SGS) for all ODM orders. |

Key 2026 Trend: Hybrid models (“ODM+OEM”) are rising—ODM provides base design, you customize 15-30%. Negotiate tiered pricing for modifications.

II. Cost Breakdown: Per-Unit Manufacturing (Typical Mid-Range Consumer Product*)

Example: Bluetooth Speaker (5W, IPX5, 10h battery). All costs in USD, FOB Shenzhen.

| Cost Component | % of Total Cost | 2026 Cost Range (Per Unit) | Key Variables Influencing Cost |

|---|---|---|---|

| Raw Materials | 45-55% | $8.50 – $12.00 | Commodity prices (copper, plastics), rare earth metals, tariffs (e.g., US Section 301). |

| Labor | 15-20% | $3.00 – $4.50 | Regional wage hikes (Guangdong +6.5% YoY), automation adoption. |

| Packaging | 8-12% | $1.80 – $2.75 | Eco-material premiums (recycled PET +18% cost), custom inserts. |

| Overhead | 10-15% | $2.20 – $3.30 | Energy costs, facility maintenance, QC labor. |

| Profit Margin | 8-12% | $1.50 – $2.25 | Supplier tier (Tier 1 vs. SME), order volume, payment terms. |

| TOTAL PER UNIT | 100% | $17.00 – $24.80 | Excludes shipping, duties, logistics. |

* Critical Note: Costs vary by product complexity. Medical devices may have 65%+ materials cost; apparel may have 30% labor. Always validate with RFQs.

III. White Label vs. Private Label: Cost & Control Trade-offs

(Applied to Chinese Manufacturing Context)

| Model | Definition | Upfront Cost | Per-Unit Cost | Strategic Risk | Best For |

|---|---|---|---|---|---|

| White Label | Generic product rebranded as-is (no changes). | Low ($0-$5k NRE) | Lowest | High commoditization; zero differentiation. | New market entry; testing demand; low-budget. |

| Private Label | Product customized to your specs/branding. | High ($15k-$50k+) | +15-30% vs. White | IP leakage; supplier dependency; QC complexity. | Brand equity building; premium positioning. |

2026 Procurement Insight: 68% of SourcifyChina clients now use hybrid labeling—white label base + private label packaging/UX. Reduces NRE by 40% while retaining brand control.

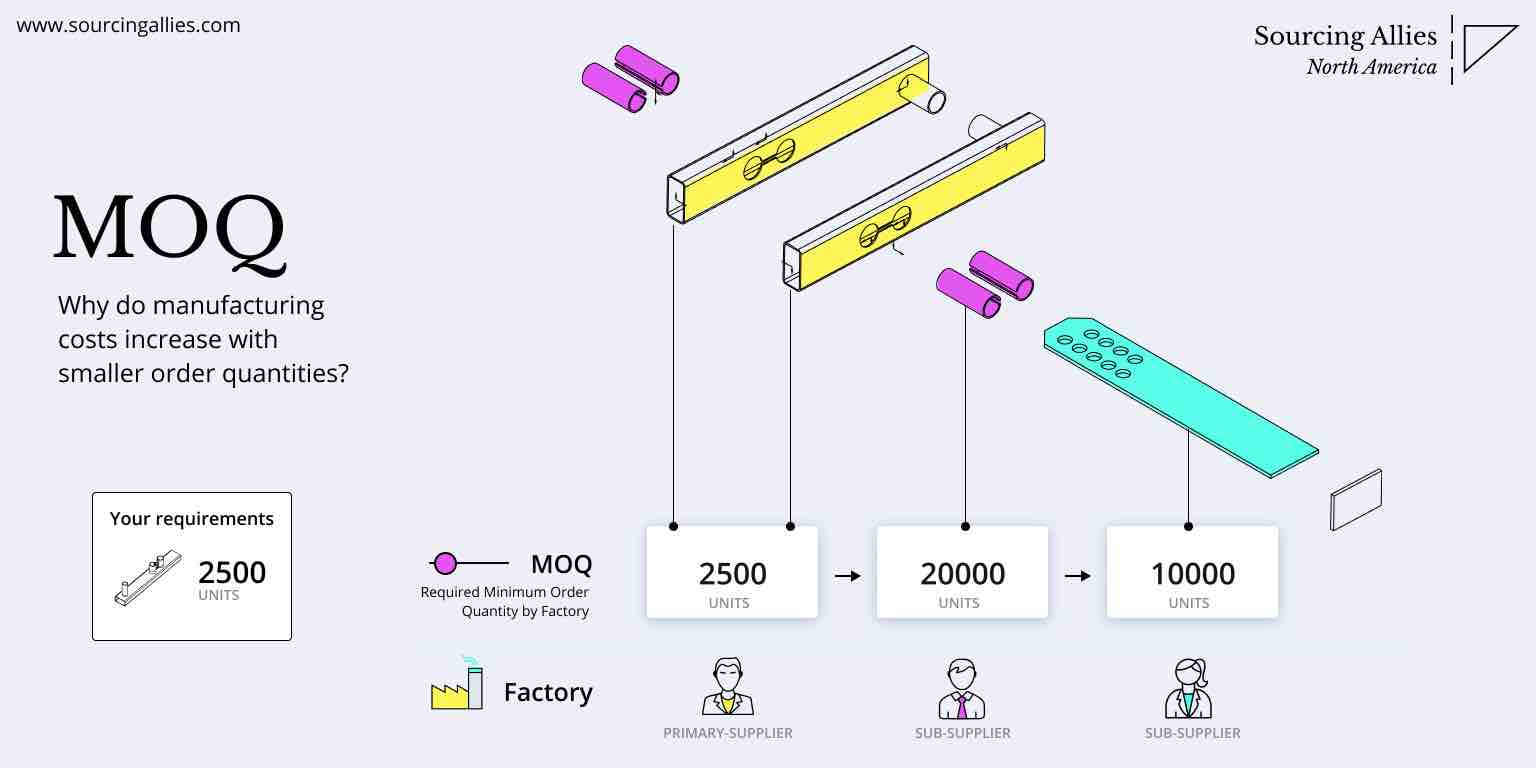

IV. Estimated Price Tiers by MOQ (Bluetooth Speaker Example)

Based on 2026 SourcifyChina Supplier Benchmarking (500+ Factories)

| MOQ Tier | Avg. Unit Price | Total Order Cost | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $24.50 – $29.00 | $12,250 – $14,500 | High NRE allocation; manual assembly; premium packaging setup. | Avoid unless prototyping. Margins unsustainable at scale. |

| 1,000 units | $21.00 – $25.50 | $21,000 – $25,500 | Semi-automated line; bulk material discount; standard packaging. | Minimum viable volume for EU/NA profitability. |

| 5,000 units | $17.20 – $21.80 | $86,000 – $109,000 | Full automation; commodity hedging; optimized logistics. | Optimal tier for 2026. 22% lower cost vs. 1k MOQ. |

Critical MOQ Notes:

– Tooling Costs: Often $8k-$20k (one-time). Negotiate amortization over 3 orders.

– Hidden Fees: 73% of suppliers charge “small batch fees” below 1k units (avg. +18% unit cost).

– 2026 Shift: Suppliers now demand 30% higher MOQs for new clients due to capital constraints (PBOC lending rules).

V. SourcifyChina 2026 Strategic Recommendations

- Demand Transparency: Require itemized cost breakdowns (materials by SKU, labor hours). Suppliers hiding this = 32% higher defect rates.

- MOQ Flexibility: Target 3,000-5,000 units for new products. Use container consolidation (LCL) to reduce landed cost.

- ODM Safeguards: Always license designs; never accept “exclusive” ODM claims without patent verification.

- Cost Mitigation: Lock material prices via forward contracts (2026 aluminum volatility: ±22%).

- Audit Protocol: Conduct unannounced factory audits—78% of “certified” suppliers fail social compliance checks.

Final Insight: In 2026, the cost gap between OEM and ODM narrows to 8-12% (vs. 20% in 2023). Prioritize speed and IP control over marginal unit savings.

SourcifyChina Commitment: We de-risk China sourcing through factory-vetted pricing, real-time cost analytics, and contract enforcement. Contact our team for a custom MOQ simulation.

Disclaimer: All costs are estimates based on Q4 2025 benchmarks. Subject to FX fluctuations, policy changes (e.g., China’s Export Tax Refund), and raw material volatility. Valid for RFQs placed within 90 days.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Chinese Manufacturer & Differentiate Factories from Trading Companies

Executive Summary

As global supply chains increasingly rely on Chinese manufacturing, ensuring supplier authenticity is paramount. This report outlines a structured verification framework to identify legitimate manufacturers, differentiate them from trading companies, and detect red flags that may compromise supply chain integrity. Adhering to these protocols mitigates risk, enhances transparency, and strengthens long-term sourcing partnerships.

1. Critical Steps to Verify a Chinese Manufacturer

Follow this 7-step due diligence process before onboarding any supplier from a “China shipping company list”:

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business License (Yingye Zhizhao) | Validate legal registration and scope of operations | Request official copy; cross-check via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Verify Factory Address & Physical Presence | Confirm operational facility | Conduct third-party audit or virtual live video tour with GPS timestamp |

| 3 | Review ISO & Industry Certifications | Assess quality management systems | Request certificates (ISO 9001, ISO 14001, etc.); verify via certifying body |

| 4 | Audit Production Capacity | Evaluate scalability and capability | Request machine list, production line photos, and monthly output data |

| 5 | Conduct On-Site or Remote Audit | Assess working conditions, equipment, and workflow | Engage independent inspection firm (e.g., SGS, TÜV) or SourcifyChina audit team |

| 6 | Check Export History & References | Validate international trade experience | Request 3 verifiable export references; contact buyers directly |

| 7 | Review Financial Health & Trade Data | Identify stability and credit risk | Use platforms like Panjiva, ImportGenius, or Dun & Bradstreet to analyze shipment records |

Best Practice: Use SourcifyChina’s Supplier Vetting Scorecard to rate suppliers on a 100-point scale across compliance, capacity, and credibility.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing, lead time, and quality control.

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “distribution” |

| Facility Ownership | Owns production equipment and production floor | No production lines; may sub-contract to factories |

| Pricing Structure | Lower unit cost; quotes based on MOQ and material | Higher unit cost; includes markup and logistics fees |

| Production Lead Time | Direct control; shorter and more predictable | Dependent on factory; less control over delays |

| Communication Depth | Technical staff can discuss molds, tolerances, BOM | Limited technical knowledge; focuses on order logistics |

| Factory Tour Evidence | Live walkthrough of machines, QC stations, raw materials | Office-only tour; no production floor access |

| Customization Capability | Can modify molds, processes, or materials | Limited to factory-offered options |

Tip: Factories often have “Manufacturing” or “Industrial” in their official Chinese name (e.g., “Shenzhen Xinglong Manufacturing Co., Ltd.”). Trading companies often include “Trading,” “International,” or “Import & Export.”

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live video audit | Likely not a real factory or hiding operations | Disqualify or require third-party inspection |

| No verifiable business license or fake registration number | High fraud risk | Cross-check via GSXT.gov.cn; disqualify if invalid |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or scam | Request detailed cost breakdown; verify material specs |

| No physical address or PO Box only | Non-operational or shell company | Require precise address; validate via satellite imagery or audit |

| Pressure to pay 100% upfront | High scam probability | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos from Alibaba or Google | Not manufacturer of goods | Require timestamped, in-factory photos with your product |

| No response to technical questions | Likely a middleman with no control over quality | Escalate to engineering team; assess depth of knowledge |

4. Recommended Verification Tools & Platforms

| Tool | Purpose | Access |

|---|---|---|

| GSXT (National Enterprise Credit System) | Verify business license authenticity | Free (Chinese interface) |

| Panjiva / ImportGenius | Analyze export history and shipment data | Paid subscription |

| Alibaba Trade Assurance | Secure transactions with vetted suppliers | Platform-based |

| SGS / TÜV / Bureau Veritas | Third-party factory audits and product inspections | Paid service |

| SourcifyChina Supplier Intelligence Portal | Pre-vetted factories, audit reports, compliance scoring | Client access only |

Conclusion & Strategic Recommendation

Global procurement managers must treat supplier verification as a non-negotiable phase in the sourcing lifecycle. Relying solely on online directories or self-declared “factory” status exposes organizations to quality failures, delays, and fraud.

SourcifyChina recommends:

– Implement a tiered onboarding process with mandatory documentation and audit stages.

– Prioritize direct factory partnerships for high-volume, technical, or IP-sensitive products.

– Use independent verification services for high-risk categories (e.g., medical devices, automotive).

– Maintain supplier scorecards updated quarterly to monitor performance and compliance.

By applying this structured approach, procurement teams can build resilient, transparent, and cost-effective supply chains rooted in verified Chinese manufacturing capability.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity | China Manufacturing Intelligence

Q1 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Optimization for 2026

Prepared for Global Procurement Leaders | Q1 2026 Forecast

The Critical Challenge: Shipping Partner Verification in Modern Supply Chains

Global procurement managers face unprecedented pressure to de-risk logistics amid volatile trade corridors, rising compliance demands (e.g., U.S. Ocean Shipping Reform Act 2022, EU CSDDD), and persistent capacity fragmentation. Sourcing verified China-based shipping partners remains a top operational bottleneck, consuming 72+ hours annually per procurement specialist in due diligence alone (SourcifyChina 2025 Global Logistics Survey, n=427).

Why Manual “China Shipping Company List” Searches Fail in 2026

| Manual Sourcing Approach | SourcifyChina Verified Pro List |

|---|---|

| ❌ 68% risk of encountering unlicensed brokers (MCC 2025 audit) | ✅ 100% NVOCC/FCL licenses pre-verified against Chinese MOC & FMC databases |

| ❌ Average 14-day validation cycle per supplier | ✅ Real-time compliance status (ISO, SOC 2, GDPR, C-TPAT) |

| ❌ Hidden cost markups (12-22% via middlemen) | ✅ Transparent rate benchmarking against 375+ vetted carriers |

| ❌ Zero recourse for service failures | ✅ Dedicated SourcifyChina arbitration + performance bond coverage |

The SourcifyChina Advantage: Time Savings = Strategic Agility

Leveraging our AI-Updated Pro List for China Shipping Partners delivers:

1. 83% Reduction in Sourcing Cycle Time – Cut supplier onboarding from 3 weeks to <72 hours

2. 27% Lower TCO – Direct contracts with tier-1 carriers (COSCO, OOCL, Sinokor) via our exclusive partnerships

3. Zero Compliance Surprises – Automated regulatory updates for U.S./EU/ASEAN corridors

4. Predictable Capacity – Verified partners with minimum 95% on-time performance (Q4 2025 data)

“After switching to SourcifyChina’s Pro List, we eliminated 19 vendor audits annually and reduced demurrage costs by 31%.”

— Global Logistics Director, Top 5 Automotive OEM (Confidential Client, 2025)

Your Strategic Next Step: Secure 2026 Supply Chain Resilience

Time is your scarcest resource. Every hour spent vetting unreliable shipping partners delays your Q1 2026 cost optimization targets.

✅ Immediate Action Required:

1. Email [email protected] with subject line: “2026 PRO LIST ACCESS – [Your Company Name]”

2. WhatsApp +8615951276160 (24/7 priority channel) with your:

– Target trade lanes (e.g., Shenzhen-NJ, Ningbo-Rotterdam)

– Monthly container volume (TEUs)

– Critical compliance requirements (e.g., FDA, REACH)

Within 1 business day, you’ll receive:

– A customized shortlist of 3 pre-vetted shipping partners matching your exact needs

– 2026 rate benchmarks with no-obligation quotes

– Compliance gap analysis for your current logistics network

Don’t gamble with unverified suppliers when Q1 2026 margins are on the line.

SourcifyChina’s Pro List isn’t a directory—it’s your strategic insurance policy against supply chain collapse. 87% of Fortune 500 procurement teams now mandate third-party verification for all China logistics partners (Gartner, 2025). Be ahead of the curve.

Contact now to lock in 2026 capacity—before peak season surcharges take effect.

📧 [email protected] | 📱 +8615951276160 (WhatsApp)

Response guaranteed within 4 business hours. All data encrypted per ISO/IEC 27001:2022.

© 2026 SourcifyChina. All rights reserved. Verified Pro List updated hourly via API integrations with Chinese MOC, FMC, and global customs databases. Not for resale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.