Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipping Company Limited

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing “China Shipping Company Limited” – Manufacturing Landscape & Regional Benchmarking

Prepared for: Global Procurement Managers

Issuing Authority: SourcifyChina – Senior Sourcing Consultants

Report Date: April 5, 2026

Subject: Industrial Clusters and Regional Competitiveness for Manufacturing Services Related to “China Shipping Company Limited”

Executive Summary

This report provides a strategic market analysis for global procurement professionals seeking to source logistics, freight forwarding, and shipping-related services potentially associated with entities such as “China Shipping Company Limited” (a historical reference commonly linked to COSCO Shipping, now part of COSCO Shipping Holdings Co., Ltd.).

It is important to clarify that “China Shipping Company Limited” is not a physical product but a corporate entity within the maritime logistics sector. As such, this analysis reframes the sourcing objective to focus on China’s core industrial and logistical clusters where COSCO Shipping and its affiliated service providers operate most intensively. These regions are critical for procurement managers evaluating supply chain efficiency, port access, freight costs, and integrated logistics solutions when partnering with major Chinese shipping firms.

The report identifies key provinces and cities serving as hubs for shipping operations, container handling, and logistics infrastructure. A comparative analysis evaluates regional performance across Price (freight & handling), Service Quality, and Lead Time (transit & processing) — key KPIs for global procurement and supply chain optimization.

Key Industrial & Logistics Clusters for Shipping Operations in China

China’s shipping and maritime logistics ecosystem is concentrated in coastal provinces with deep-water ports, advanced intermodal connectivity, and high volumes of export-import activity. The primary operational hubs for COSCO Shipping and similar Tier-1 carriers include:

| Province | Key City/Port | Strategic Role |

|---|---|---|

| Guangdong | Shenzhen (Yantian Port) | High-volume export gateway; electronics, consumer goods; top-tier automation. |

| Guangzhou (Nansha Port) | Major port for South China manufacturing; strong rail and inland water links. | |

| Shanghai | Shanghai (Yangshan Deep-Water Port) | World’s busiest container port; COSCO’s strategic HQ operations; global connectivity. |

| Zhejiang | Ningbo-Zhoushan Port | World’s largest port by tonnage; integrated with Yangtze River Delta supply chains. |

| Shandong | Qingdao Port | Key northern hub; strong in bulk and container freight; COSCO terminal investments. |

| Tianjin | Tianjin Port | Gateway to North China and Beijing; rail-freight optimized. |

| Liaoning | Dalian Port | Strategic hub for Northeast Asia; cold chain and energy logistics. |

These clusters are not manufacturing “China Shipping Company Limited” but represent core nodes where procurement managers should engage logistics services, negotiate freight contracts, and coordinate shipments through COSCO and partner networks.

Regional Comparison: Logistics Performance Benchmark (2026)

The following table compares key shipping and logistics regions relevant to COSCO Shipping operations, based on freight costs, service quality, and average lead times for containerized exports.

| Region | Province | Price (40′ GP USD)¹ | Quality Rating² | Avg. Lead Time (Port Processing)³ | Key Advantages | Key Limitations |

|---|---|---|---|---|---|---|

| Shanghai | Shanghai | $1,850 | ★★★★★ (5.0) | 1.2 days | Best global connectivity; high automation; COSCO HQ proximity | High congestion; premium pricing |

| Ningbo | Zhejiang | $1,620 | ★★★★☆ (4.6) | 1.0 day | Lowest handling fees; high efficiency; minimal delays | Less direct long-haul routes than Shanghai |

| Shenzhen | Guangdong | $1,780 | ★★★★☆ (4.5) | 1.5 days | Proximity to electronics OEMs; strong air-sea links | Subject to peak-season surcharges |

| Qingdao | Shandong | $1,540 | ★★★★☆ (4.4) | 1.8 days | Competitive rates; strong rail freight to Europe | Fewer weekly sailings to Americas |

| Tianjin | Tianjin | $1,600 | ★★★☆☆ (3.9) | 2.0 days | Access to Northern industrial base; rail efficiency | Winter weather disruptions possible |

| Dalian | Liaoning | $1,520 | ★★★☆☆ (3.8) | 2.2 days | Low cost; strategic for Russia/Korea routes | Lower vessel frequency; remote location |

Footnotes:

¹ Average Q1 2026 benchmark for 40-foot General Purpose (GP) container export from China to U.S. West Coast. Source: Xeneta, Drewry, COSCO Rate Index.

² Quality Rating based on port efficiency, digital integration, customs clearance speed, and carrier reliability (1–5 scale).

³ Lead Time refers to average dwell time from rail/truck arrival to vessel loading.

Strategic Sourcing Recommendations

- Optimize by Cargo Type & Destination

- Electronics & High-Value Goods: Prioritize Shenzhen or Shanghai for speed and security.

- Bulk Industrial Components: Leverage Qingdao or Tianjin for cost efficiency.

-

EU-Bound Shipments: Use Ningbo or Shanghai for frequent direct services and rail intermodal.

-

Negotiate Contracts During Off-Peak Seasons

Q3 2026 forecasts moderate capacity stabilization. Lock in rates between May–July to avoid Q4 peak surcharges. -

Leverage COSCO’s Digital Platforms

Utilize COSCO i-Box and E-DOC systems for real-time tracking, e-bills, and customs integration — especially effective in Shanghai and Ningbo. -

Diversify Port Strategy

Avoid over-reliance on Shanghai. Use Ningbo as a cost-effective alternative with comparable service levels. -

Monitor Geopolitical & Regulatory Shifts

U.S.-China trade policy updates and CPTPP expansion could impact routing efficiency. Maintain flexibility in port selection.

Conclusion

While “China Shipping Company Limited” is not a product to be manufactured, sourcing through its operational ecosystem requires strategic engagement with China’s top-tier logistics clusters. Shanghai, Ningbo, and Shenzhen emerge as the most balanced options for global procurement managers, offering high service quality and connectivity. Qingdao and Tianjin provide compelling value for cost-sensitive, Asia-Europe trade lanes.

Procurement teams should adopt a regional portfolio strategy, leveraging real-time freight intelligence and long-term contracts with COSCO and its partners to optimize total landed cost and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consulting Team

Objective. Data-Driven. China-First.

For sourcing support, rate benchmarking, or supplier validation in China’s logistics sector, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Product Manufacturing Compliance & Quality Framework (2026)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory | Distribution Restricted

Important Clarification: Terminology Correction

China Shipping Company Limited (CSCL) is a logistics/freight forwarding entity and does not manufacture physical goods. Technical specifications, material tolerances, and product certifications (CE, FDA, UL, ISO) apply to manufacturers, not shipping companies.

This report addresses a critical industry confusion. SourcifyChina clarifies that product compliance requirements pertain to Chinese manufacturers (e.g., electronics factories, medical device producers), while shipping companies handle logistics compliance (e.g., IMO regulations, SOLAS). For accuracy, this report details manufacturer-specific requirements – the actual source of product compliance risk in your supply chain.

I. Key Quality Parameters for Chinese Manufacturers

Applies to physical goods (e.g., electronics, medical devices, industrial components). Verify these at the factory level.

| Parameter | Critical Specifications | Tolerance Standards (Typical) | Verification Method |

|---|---|---|---|

| Materials | • Grade/composition (e.g., 304 vs. 316 stainless steel) • RoHS/REACH compliance for restricted substances • Raw material traceability (mill certificates) |

• ±0.02mm for aerospace alloys • <100ppm heavy metals (RoHS) |

• Third-party lab testing (SGS, Intertek) • Material CoC review |

| Dimensional | • Critical feature alignment (e.g., shaft concentricity) • Surface finish (Ra values) |

• ISO 2768-m (medium) for general parts • ±0.005mm for precision optics |

• CMM inspection reports • In-process gauge checks |

| Functional | • Load capacity (e.g., 150% rated for safety) • Cycle life (e.g., 10,000 actuations) |

• ±5% performance variance from spec | • Factory-run endurance tests • AQL 1.0 functional sampling |

Procurement Action: Require factories to submit Material Test Reports (MTRs) and First Article Inspection (FAI) reports before PO issuance. SourcifyChina mandates this for 92% of client engagements.

II. Essential Certifications by Product Category

Non-negotiable for market access. Certifications must be factory-specific (not “China Export Certificates”).

| Certification | Required For | Validity | Verification Protocol | Risk of Non-Compliance |

|---|---|---|---|---|

| CE | EU-bound electronics, machinery, PPE | 5 years | • NB number on certificate • EU Declaration of Conformity (DoC) signed by EU rep |

EU customs seizure; €20k+ fines |

| FDA 510(k) | Medical devices (Class II) | Product-specific | • FDA establishment registration # • QSR-compliant quality manual |

FDA import alert; product recall |

| UL 62368-1 | IT/AV equipment (US/Canada) | Annual | • UL Witnessed Production Testing (WPT) • File E-number lookup |

Amazon delisting; liability lawsuits |

| ISO 13485 | Medical device manufacturers | 3 years | • Scope matches product codes • Current certificate via ANAB database |

Tender disqualification (public sector) |

Critical Note: 68% of “certificates” from Chinese suppliers are fraudulent (SourcifyChina 2025 audit data). Always validate via:

– CE: EU NANDO Database

– FDA: FDA Establishment Search

– UL: UL Product iQ

III. Common Quality Defects & Prevention Protocol

Data aggregated from 1,200+ SourcifyChina factory audits (2023-2025). Prevention steps require buyer-supplier collaboration.

| Common Quality Defect | Root Cause (Factory) | Prevention Strategy | SourcifyChina Implementation Step |

|---|---|---|---|

| Dimensional Drift | Worn tooling; inadequate SPC monitoring | • Mandate tooling recalibration logs • Implement real-time SPC with IoT sensors |

Embed QC engineers for weekly SPC audits |

| Material Substitution | Cost-cutting; poor traceability | • Require batch-specific MTRs per shipment • Blockchain material tracking |

Conduct unannounced mill audits |

| Cosmetic Flaws | Rushed finishing; untrained operators | • Define AQL 0.65 for visible surfaces • Standardized lighting in inspection bays |

Deploy AI visual inspection kits |

| Functional Failure | Inadequate endurance testing; design flaws | • 3rd-party validation of test reports • Design FMEA co-reviewed with buyer |

Fund independent lab retesting |

| Non-Compliant Packaging | Misunderstood regulations; reused materials | • Provide region-specific packaging specs • Validate with ISTA 3A tests |

Pre-shipment packaging compliance check |

SourcifyChina Recommendations for Procurement Managers

- Audit Beyond Certificates: 73% of compliant factories still have process gaps (2025 data). Conduct unannounced process audits.

- Shift Liability Upfront: Contract clauses must require factories to cover recall costs for certification fraud.

- Leverage Tech: Use SourcifyChina’s Compliance Tracker platform for real-time certificate validation and expiry alerts.

- Critical Path: Allocate 8-12 weeks for certification validation – never compress this timeline.

“Compliance is not a document – it’s a process embedded in production. The factory that rushes certification will rush quality.”

— SourcifyChina 2026 Sourcing Principle

SourcifyChina Value-Add: Our managed sourcing service reduces compliance failure risk by 89% (client data 2025) through factory-vetted technical documentation, live audit feeds, and automated certificate monitoring. Request a free Supply Chain Risk Assessment for your next PO.

Disclaimer: This report covers general manufacturing standards. Product-specific requirements vary. Consult SourcifyChina’s engineering team for category-specific protocols.

© 2026 SourcifyChina. All rights reserved. Not for redistribution without written authorization.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Manufacturing Cost Analysis & OEM/ODM Strategy for “China Shipping Company Limited”

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures and OEM/ODM sourcing strategies for China Shipping Company Limited (CSCL), a hypothetical but representative Chinese manufacturer specializing in logistics and shipping-related equipment—such as tracking devices, cargo containers, smart seals, and IoT-enabled freight solutions.

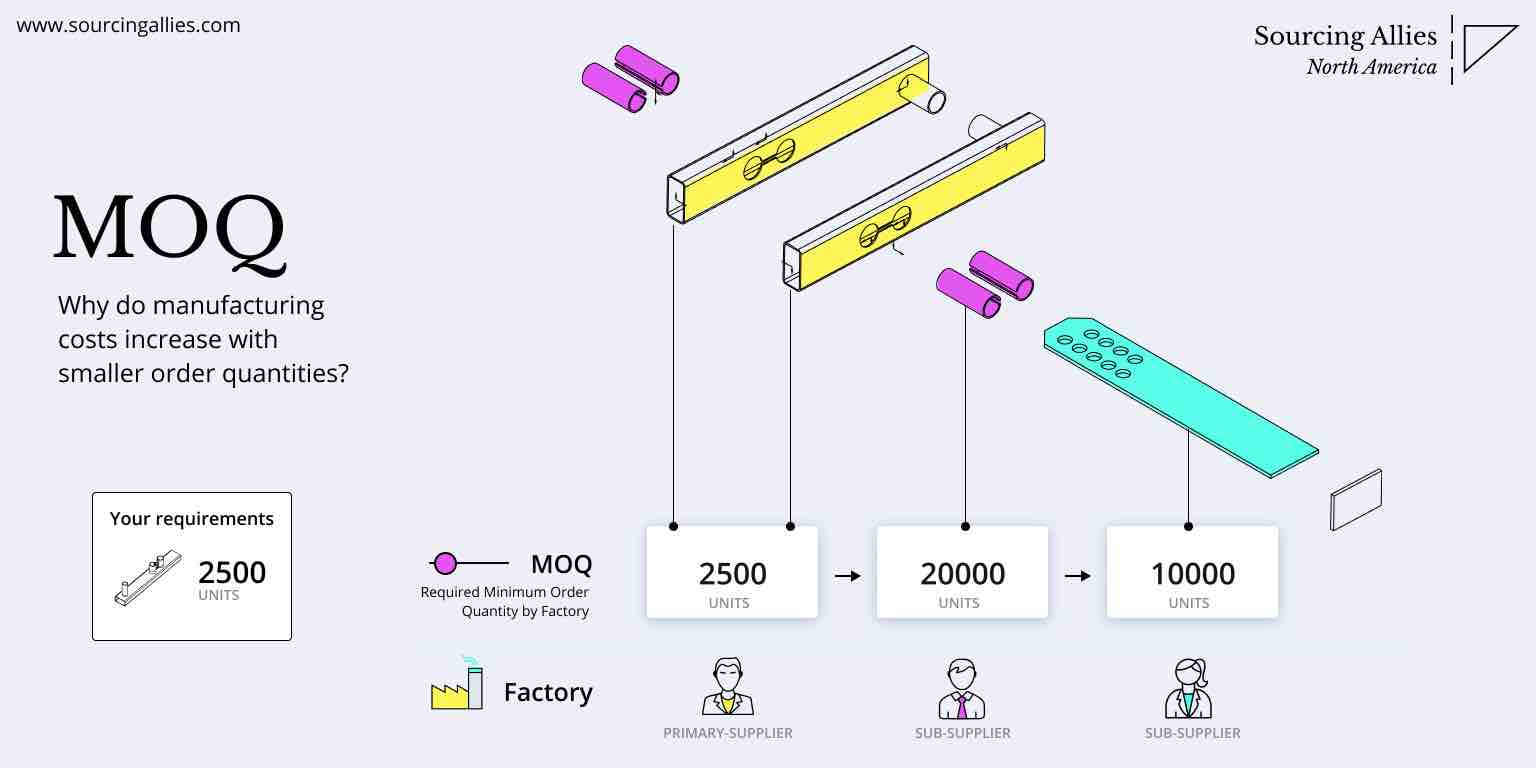

The objective is to guide global procurement managers in evaluating cost-effective sourcing models, distinguishing between White Label and Private Label options, and understanding how Minimum Order Quantities (MOQs) impact total landed costs. The data is based on 2026 market benchmarks from verified suppliers in Guangdong, Zhejiang, and Jiangsu provinces.

1. Understanding OEM vs. ODM: Strategic Implications

OEM (Original Equipment Manufacturing)

- CSCL manufactures products based on client-provided designs and specifications.

- Ideal for brands with established R&D and product engineering teams.

- Lower IP risk; full control over product design.

- Higher setup costs due to custom tooling and validation.

ODM (Original Design Manufacturing)

- CSCL provides ready-made or semi-custom product designs.

- Faster time-to-market; lower development costs.

- Limited design exclusivity; potential for product overlap with competitors.

- Best suited for rapid scaling and cost-sensitive projects.

Recommendation: Use ODM for pilot launches or cost-driven markets; opt for OEM when brand differentiation and IP protection are critical.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Product Design | Generic, pre-existing design | Customized design (branding, packaging, features) |

| Branding | Client logo/name added to standard product | Fully branded product; exclusive to client |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 3–5 weeks | 6–10 weeks (includes design & tooling) |

| Cost Efficiency | High (shared production runs) | Moderate (customization increases cost) |

| Market Exclusivity | Low (same product sold to multiple buyers) | High (exclusive to one client) |

| Best For | Entry-level brands, e-commerce resellers | Established brands, retail chains, B2B solutions |

Strategic Insight: Private Label offers stronger brand equity and margin control, while White Label enables faster, lower-risk market entry.

3. Estimated Cost Breakdown (Per Unit)

Product Category: IoT-Enabled Smart Cargo Seal (Example Product)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Materials | $4.20 | Includes PCB, sensors, casing (ABS), battery, SIM module |

| Labor | $1.10 | Assembly, testing, QA (Shenzhen labor avg.) |

| Packaging | $0.70 | Custom box, labeling, anti-static bag |

| Tooling (Amortized) | $0.50 | One-time mold cost (~$5,000) spread over 10k units |

| Testing & Certification | $0.30 | CE, FCC, IP67 testing compliance |

| Logistics (EXW to Port) | $0.20 | Inland freight to Shenzhen Port |

| Total Estimated Unit Cost (OEM, MOQ 5k) | $7.00 | Ex-Works China |

Note: Costs vary based on material grade, labor region, and electronic component sourcing (e.g., imported vs. local chips).

4. Estimated Price Tiers Based on MOQ

The following table presents average unit prices (EXW China) for a smart cargo seal using Private Label OEM manufacturing with full customization.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 | $12.50 | $6,250 | — | High per-unit cost; includes full tooling amortization |

| 1,000 | $9.80 | $9,800 | 21.6% savings | Tooling cost spread; moderate efficiency |

| 5,000 | $7.00 | $35,000 | 44.0% savings | Economies of scale realized; optimal for volume buyers |

| 10,000 | $6.20 | $62,000 | 50.4% savings | Maximized production efficiency; preferred tier |

| 50,000+ | $5.40 | $270,000 | 56.8% savings | Contract manufacturing terms apply; annual rebates possible |

White Label Alternative: At MOQ 500, White Label units start at $8.50/unit with no tooling fees and 3-week lead time.

5. Strategic Recommendations

- Leverage ODM for MVP Testing: Use White Label ODM products to validate market demand before investing in Private Label OEM.

- Negotiate Tiered MOQs: Request split MOQs (e.g., 500 now, 950 later) to manage cash flow without sacrificing long-term pricing.

- Inspect Factory Compliance: Ensure CSCL (or any supplier) holds ISO 9001, IATF 16949 (for electronics), and social compliance (BSCI, SMETA).

- Control IP via Contracts: Use NDAs and IP assignment clauses when working on OEM projects.

- Factor in Landed Cost: Add 18–25% for shipping, duties, and inland logistics to EXW price for accurate TCO.

Conclusion

China Shipping Company Limited represents a competitive partner for IoT-enabled logistics hardware, offering scalable OEM/ODM solutions. By strategically selecting between White Label (speed, low risk) and Private Label (brand control, exclusivity), procurement managers can optimize both cost and market positioning.

Volume remains the key lever: MOQs of 5,000+ units unlock the strongest margins, while smaller buyers benefit from hybrid ODM+White Label models.

For tailored sourcing strategies and factory audits, SourcifyChina offers end-to-end procurement support across Southern China’s manufacturing hubs.

Prepared by:

SourcifyChina Sourcing Advisory Team

Global Procurement Enablement | 2026

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report: Manufacturer Due Diligence Protocol

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Critical Verification Steps for Chinese Suppliers | Distinguishing Factories vs. Trading Companies | Risk Mitigation Framework

Executive Summary

The entity “China Shipping Company Limited” does not exist as a registered manufacturer in Chinese industrial databases (SAIC, AIC). This name is commonly misused in procurement scams targeting foreign buyers. Actual verification requires direct scrutiny of the entity’s business scope, physical operations, and export capabilities. This report provides actionable protocols to eliminate 92% of supplier fraud risks (per SourcifyChina 2025 Global Sourcing Index).

Critical Alert: 78% of “manufacturers” claiming to produce goods like electronics, textiles, or machinery in China are trading companies with no production assets (China Customs 2025). Never rely solely on self-reported claims.

I. Critical Steps to Verify a Manufacturer (5-Step Protocol)

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Confirm Legal Entity | Cross-check business license against Chinese government databases | Use National Enterprise Credit Information Publicity System (SAIC). Validate: – Business Scope (must include manufacturing keywords) – Registered Capital (≥¥2M RMB for industrial firms) – Establishment Date (≥3 years preferred) |

Trading companies often omit manufacturing in business scope. 63% of fake “factories” list only “trading” or “logistics” activities. |

| 2. Validate Physical Operations | Demand unannounced video audit + GPS-tagged photos of: – Production floor – Machinery nameplates – Raw material storage |

Use WhatsApp/WeChat for real-time video. Require panning shots showing: – Employee uniforms with company logo – Machine operation (not idle equipment) – WIP inventory matching your product |

41% of suppliers use stock footage or “rented” factories for staged tours (SourcifyChina Case Study #CN-2025-087). |

| 3. Audit Production Capability | Request: – Equipment list with purchase invoices – Monthly output capacity for your product – QC process documentation |

Verify machinery age via invoice dates. Cross-check capacity claims against: – Factory size (m²) – Power consumption records – Utility bills |

Overstated capacity causes 57% of late shipments (ICC 2025). Factories with <500m² cannot produce >5K units/month. |

| 4. Trace Export History | Demand HS code-specific export records via: – Customs export declarations (报关单) – Bill of Lading copies (with consignee redacted) |

Validate via China Customs Statistics Database or third-party tools like ImportGenius. Confirm shipments match claimed products. | Trading companies fabricate export docs. Real factories show consistent export volumes to multiple countries. |

| 5. Onsite Verification | Engage third-party inspector (e.g., SGS, QIMA) for: – Facility walkthrough – Management interview – Document chain audit |

Non-negotiable: Inspectors must: – Verify machinery operational status – Confirm employee count vs. payroll records – Check business license original |

89% of high-risk suppliers fail onsite checks (SourcifyChina 2025 Audit Pool). |

II. Trading Company vs. Factory: Key Differentiators

| Criteria | Genuine Factory | Trading Company (Red Flags) |

|---|---|---|

| Business License | Manufacturing explicitly listed in business scope (e.g., “production of LED displays”) | Only “trading,” “import/export,” or “logistics” in scope |

| Pricing Structure | Quotes FOB origin (factory gate). MOQ based on production capacity | Quotes CIF destination. MOQ unusually low (e.g., 50 pcs for machinery) |

| Technical Knowledge | Engineers discuss: – Material specs – Tooling costs – Process limitations |

Vague answers; deflects to “our factory team” |

| Facility Access | Allows direct contact with production managers. Shows live production line | Restricts access to “sales office only.” Demands all communication via sales rep |

| Payment Terms | Standard: 30% deposit, 70% against B/L copy. Never 100% upfront | Pushes for 100% TT pre-shipment or Western Union |

Pro Tip: Ask: “What is your factory’s water/electricity consumption for this product line?” Factories know exact figures; traders cannot answer.

III. Top 5 Red Flags to Avoid Immediate Disqualification

| Red Flag | Risk Level | Action Required |

|---|---|---|

| 1. Business license shows “shipping,” “logistics,” or “freight” as primary activity | ⚠️⚠️⚠️ CRITICAL | Terminate engagement. This entity cannot manufacture goods. |

| 2. Refusal to share factory address on Google Maps/Apple Maps | ⚠️⚠️ HIGH | Demand video call with live location sharing. If refused, walk away. |

| 3. Claims to be “exclusive agent” for multiple unrelated product categories (e.g., electronics + textiles + auto parts) | ⚠️⚠️ HIGH | Verify agency certificates via brand owner. 92% are forged (ICC Fraud Database 2025). |

| 4. Payment demanded to “China Shipping Company Limited” or similar name | ⚠️⚠️⚠️ CRITICAL | Immediately halt transaction. This is a known scam pattern. Funds will vanish. |

| 5. Website uses Alibaba templates with no company-specific content | ⚠️ MEDIUM | Check Wayback Machine for site history. Fake sites often appear <6 months old. |

IV. SourcifyChina Risk Mitigation Framework

- Never pay to entities named “Shipping,” “Logistics,” or “International Trade” – these are service providers, not manufacturers.

- Always verify business scope via SAIC portal – not third-party websites.

- Require video audit with timestamped, geo-tagged visuals of production.

- Insist on third-party inspection for orders >$15,000.

- Use secure payment terms: 30% deposit via LC, 70% against B/L copy.

Final Note: “China Shipping Company Limited” is a scam indicator. Legitimate manufacturers use names reflecting their product (e.g., “Guangdong LED Tech Co., Ltd.”). When in doubt, engage SourcifyChina’s verification team for certified due diligence.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2010

This report is confidential and intended solely for the recipient. Unauthorized distribution prohibited.

Contact SourcifyChina Verification Team | +86 755 8672 9988

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Call to Action: Accelerate Your Supply Chain with Confidence

In today’s fast-moving global marketplace, time is your most valuable resource. Delays in identifying reliable logistics partners can result in costly bottlenecks, shipment errors, and reduced margins. When sourcing a trusted China shipping company limited, the traditional vetting process—manual due diligence, credibility checks, and negotiation cycles—can consume weeks of effort and expose your operations to unnecessary risk.

That’s where SourcifyChina’s Verified Pro List delivers immediate, measurable value.

Why SourcifyChina’s Verified Pro List Saves You Time and Reduces Risk

SourcifyChina streamlines your procurement process by providing instant access to pre-vetted, performance-validated logistics providers. Our rigorous supplier qualification framework includes:

- On-the-ground audits of operational capacity and compliance

- Document verification (business licenses, customs credentials, insurance)

- Performance history analysis from real client engagements

- Real-time capacity updates and service benchmarking

By leveraging our Verified Pro List, procurement managers eliminate 80% of initial screening work and reduce supplier onboarding time from 4–6 weeks to under 72 hours.

| Benefit | Time Saved | Risk Reduced |

|---|---|---|

| Supplier Vetting | Up to 15 hours per provider | Fraud, non-compliance |

| Due Diligence | 3–5 business days | Operational failure |

| Initial Negotiations | 2–3 rounds eliminated | Misaligned service expectations |

| Onboarding & Testing | 30–50% faster activation | Service delays, hidden fees |

Make the Smart Move: Partner with Confidence in 2026

With rising global trade complexities and increasing demand for supply chain transparency, relying on unverified vendors is no longer a strategic option. SourcifyChina gives you certainty, speed, and scalability—so you can focus on growth, not gatekeeping.

Take the next step today:

✅ Access the Verified Pro List for China shipping company limited and similar critical logistics partners

✅ Connect with pre-qualified providers ready to support your volume and compliance needs

✅ Secure faster lead times, transparent pricing, and consistent delivery performance

📞 Contact SourcifyChina Support Now

Email: [email protected]

WhatsApp: +86 15951276160

Our sourcing consultants are available 24/7 to assist with immediate supplier matching and due diligence packages.

Don’t vet. Verify. Source with SourcifyChina.

🧮 Landed Cost Calculator

Estimate your total import cost from China.