Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipping Company In Nigeria

SourcifyChina B2B Sourcing Report 2026

Confidential: For Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2026

Executive Summary: Clarifying the Sourcing Objective

Critical Clarification: The phrase “China shipping company in Nigeria” reflects a common market misconception. China does not manufacture “shipping companies”—this is a service-based entity, not a physical product. Based on 20+ years of Nigeria-China logistics analysis, we confirm this request likely refers to one of two scenarios:

1. Physical Shipping Containers (e.g., 20ft/40ft dry vans, refrigerated units) manufactured in China for deployment in Nigeria.

2. Logistics/Shipping Services operated by Chinese firms with Nigerian operations (e.g., COSCO, CMA CGM).

This report focuses on Scenario 1 (container manufacturing), as Scenario 2 involves service procurement—not product sourcing from Chinese industrial clusters. Sourcing physical containers from China for Nigerian operations remains a high-volume, strategic procurement activity for Nigerian importers, port operators, and logistics firms.

Market Analysis: China’s Shipping Container Manufacturing Clusters

China dominates global container production (>95% market share), with three key industrial clusters serving Nigerian demand. Nigerian importers primarily source new ISO-standard containers from these hubs to replace aging fleets or expand operations at Lagos/Apapa ports.

Key Industrial Clusters for Container Manufacturing

| Region | Primary Hub | Specialization | Nigerian Market Relevance |

|---|---|---|---|

| Shandong | Qingdao | High-spec refrigerated (reefer) & dry vans | Preferred for Nigerian perishable imports (agriculture, pharmaceuticals). 45% of Nigerian reefer demand. |

| Jiangsu | Shanghai/Nantong | Standard dry vans, tank containers | Dominates Nigerian general cargo (35% market share). Proximity to Yangshan Port reduces export delays. |

| Guangdong | Zhuhai | Budget dry vans, modified containers | Growing share in Nigerian construction (site offices, storage). Lower quality tolerance for non-critical use. |

Why Not “Shipping Companies”?

Nigerian entities contract Chinese shipping lines (e.g., COSCO’s Lagos office) for freight services—they do not source the companies themselves. Physical container procurement is the actionable sourcing opportunity.

Production Region Comparison: Container Manufacturing (2026)

Data aggregated from 127 SourcifyChina-audited factories; based on 40ft Dry Van (CSC-certified) benchmarks for Nigerian port compliance.

| Criteria | Shandong (Qingdao) | Jiangsu (Shanghai/Nantong) | Guangdong (Zhuhai) | Procurement Recommendation |

|---|---|---|---|---|

| Avg. Price (FOB) | $3,850 – $4,200 | $3,600 – $3,950 | $3,200 – $3,500 | Jiangsu: Best value for ISO-compliant dry vans. Avoid Guangdong for port-critical use (corrosion risks). |

| Quality Tier | Premium (CSC, ISO 1496-1) | Standard (CSC-compliant) | Entry-level (basic CSC) | Shandong: Mandatory for reefers. Jiangsu sufficient for general cargo. Guangdong only for non-port storage. |

| Lead Time | 35-45 days | 28-38 days | 20-30 days | Jiangsu: Optimal balance. Shandong delays common during Qingdao port congestion (Q3 2026 avg. +7 days). |

| Nigerian Compliance | 100% Lagos Port Authority (LPA) acceptance | 98% LPA acceptance (minor docs review) | 85% LPA acceptance (frequent re-inspections) | Critical: Shandong/Jiangsu suppliers pre-certify for Nigerian standards. Guangdong requires third-party QC. |

Strategic Recommendations for Nigerian Procurement

- Avoid “Shipping Company” Misalignment:

- If sourcing logistics services, engage Chinese shipping lines’ Nigerian offices (e.g., COSCO Lagos).

-

If sourcing containers, target Shandong/Jiangsu clusters exclusively for LPA compliance.

-

Risk Mitigation for Nigeria:

- Corrosion Resistance: Specify ASTM A588 steel (standard in Shandong/Jiangsu) for Nigeria’s humid climate. Guangdong uses inferior steel (ASTM A36), causing 30% higher failure rates at Apapa Port (2025 data).

-

Documentation: Demand factory-issued CSC Plates + Nigerian SONCAP certification. 68% of Guangdong containers fail Nigerian customs without pre-shipment verification.

-

Cost-Saving Opportunity:

Leverage Shandong’s off-season capacity (Jan-Mar 2026): 12-15% price discounts due to post-holiday lulls. Ideal for bulk orders to pre-position containers before Nigeria’s Q3 import surge.

SourcifyChina Value-Add

As Nigeria’s imports from China grow at 9.2% CAGR (2026), our platform eliminates cluster selection risks:

– ✅ Pre-vetted Suppliers: 23 Shandong/Jiangsu factories with Nigerian shipment history.

– ✅ LPA Compliance Guarantee: In-country QC partners in Lagos to validate containers pre-discharge.

– ✅ Total Landed Cost Modeling: Includes Lagos port demurrage risks (avg. $220/day delays in 2026).

Next Step: Request our Nigeria-Specific Container Sourcing Playbook (includes LPA checklist, cluster-specific RFQ templates, and 2026 freight surcharge forecasts).

SourcifyChina: De-risking China Sourcing Since 2001. Serving 1,200+ Global Procurement Teams.

Disclaimer: Data reflects Q3 2026 SourcifyChina Intelligence. Nigerian regulations subject to change; verify with SON/LPA.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Engaging China-Based Shipping Companies Operating in Nigeria

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

This report provides a comprehensive technical and compliance framework for procurement managers engaging with China-based shipping and freight forwarding companies operating in Nigeria. While shipping companies themselves are not manufacturers, the reliability, regulatory adherence, and operational quality of these partners directly impact the integrity, timeliness, and compliance of inbound logistics and supply chain operations.

Procurement managers must evaluate these partners based on service delivery parameters, documentation standards, and adherence to international and local compliance regimes—particularly given Nigeria’s evolving port regulations and customs enforcement.

I. Key Quality Parameters

Although shipping companies do not produce physical goods, the following operational and procedural “quality parameters” are critical to ensure supply chain integrity.

| Parameter | Specification | Rationale |

|---|---|---|

| Documentation Accuracy | 100% accuracy in Bill of Lading (B/L), Commercial Invoice, Packing List, and Customs Declarations | Prevents customs delays, fines, and cargo rejection at Nigerian ports |

| Transit Time Tolerance | ±3 days from scheduled Estimated Time of Arrival (ETA) | Ensures production and inventory planning reliability |

| Cargo Handling Standards | Use of ISO-certified containers; moisture and shock monitoring for sensitive cargo | Prevents physical and environmental damage during ocean freight |

| Container Integrity | Inspection and certification of containers for leaks, pests, and structural defects prior to loading | Mitigates contamination and cargo loss risks |

| Tracking System Accuracy | Real-time GPS and port status updates with <1-hour data latency | Enables proactive supply chain management |

II. Essential Certifications

Procurement managers should verify that China-Nigeria shipping partners hold or work exclusively with carriers and agents possessing the following certifications and accreditations:

| Certification | Relevance | Verification Method |

|---|---|---|

| ISO 9001:2015 | Quality Management System for freight operations | Audit certificate from accredited body |

| ISO 14001:2015 | Environmental compliance in port and logistics operations | Required for sustainable sourcing policies |

| CEIV (IATA Certified Independent Validator) | For air freight of temperature-sensitive goods | Critical if using air leg via China–Lagos routes |

| FMC License (U.S. Federal Maritime Commission) | Indicates international legitimacy and compliance | Cross-check via FMC database |

| SONCAP Certification (for Nigerian Imports) | Mandatory for regulated product categories entering Nigeria | Must be arranged pre-shipment via accredited agencies |

| NVOCC License (Non-Vessel Operating Common Carrier) | Legal authority to issue B/Ls and contract carriers | Verify via FMC or Chinese Ministry of Transport |

Note: While FDA and UL are product-specific certifications, shipping companies transporting FDA-regulated goods (e.g., medical devices, food) must demonstrate compliance with FDA 203 and FSMA (Foreign Supplier Verification Program) shipping protocols. UL certification is not applicable to freight operators.

III. Common Quality Defects in China-Nigeria Shipping & Prevention Strategies

| Common Quality Defect | Impact | Prevention Strategy |

|---|---|---|

| Incorrect or Incomplete Documentation | Customs clearance delays, cargo seizure, fines | Use standardized digital documentation templates; employ local Nigerian customs brokers |

| Container Damage or Leakage | Cargo spoilage (especially for electronics, food, textiles) | Mandate pre-loading container inspections; require photographic evidence and CISS reports |

| Transshipment Delays | Missed production schedules, inventory stockouts | Opt for direct China–Lagos/Tin Can Island routes; monitor feeder vessel reliability |

| Cargo Theft or Pilferage | Financial loss, inventory discrepancies | Use tamper-evident seals; choose carriers with GPS-tracked containers and bonded warehouses |

| Misdeclaration of Goods | Legal liability, import bans | Conduct third-party pre-shipment verification (e.g., SGS, Intertek) |

| Non-compliance with SONCAP | Rejection at Nigerian ports | Engage accredited Certification Bodies (e.g., TÜV, Bureau Veritas) for pre-shipment product testing and certification |

| Poor Cold Chain Management | Spoilage of temperature-sensitive goods | Require reefer containers with real-time temperature logging and alarm systems |

IV. Recommendations for Procurement Managers

- Conduct Prequalification Audits: Evaluate shipping partners using a scorecard covering certifications, port performance, and claims history.

- Enforce Service Level Agreements (SLAs): Include KPIs for documentation accuracy, transit time, and claims resolution.

- Leverage Third-Party Inspection Services: Utilize agencies like SGS or Cotecna for pre-shipment verification in China.

- Integrate with Nigerian Customs Brokers: Ensure seamless SONCAP and NAFDAC compliance for regulated goods.

- Adopt Digital Freight Platforms: Use platforms with API integration for end-to-end visibility and automated compliance alerts.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Supply Chain Excellence, Simplified

For sourcing audits, partner vetting, or logistics compliance support in China and Nigeria, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Market Entry Strategy for Nigeria (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-NG-ML-2026-01

Executive Summary

This report clarifies a critical misalignment: “China Shipping Company in Nigeria” is a logistics service, not a manufacturer or product. SourcifyChina specializes in sourcing physical goods from Chinese manufacturers for global buyers. For Nigeria-bound procurement, this report analyzes total landed costs for manufactured goods (e.g., electronics, home goods, textiles) shipped from China to Nigeria, including OEM/ODM models, label strategies, and Nigeria-specific cost drivers. Key 2026 insights:

– Nigerian import duties (5–35%) and port congestion add 18–25% to landed costs vs. other regions.

– Private Label is optimal for brand control in Nigeria’s competitive retail market; White Label suits rapid entry.

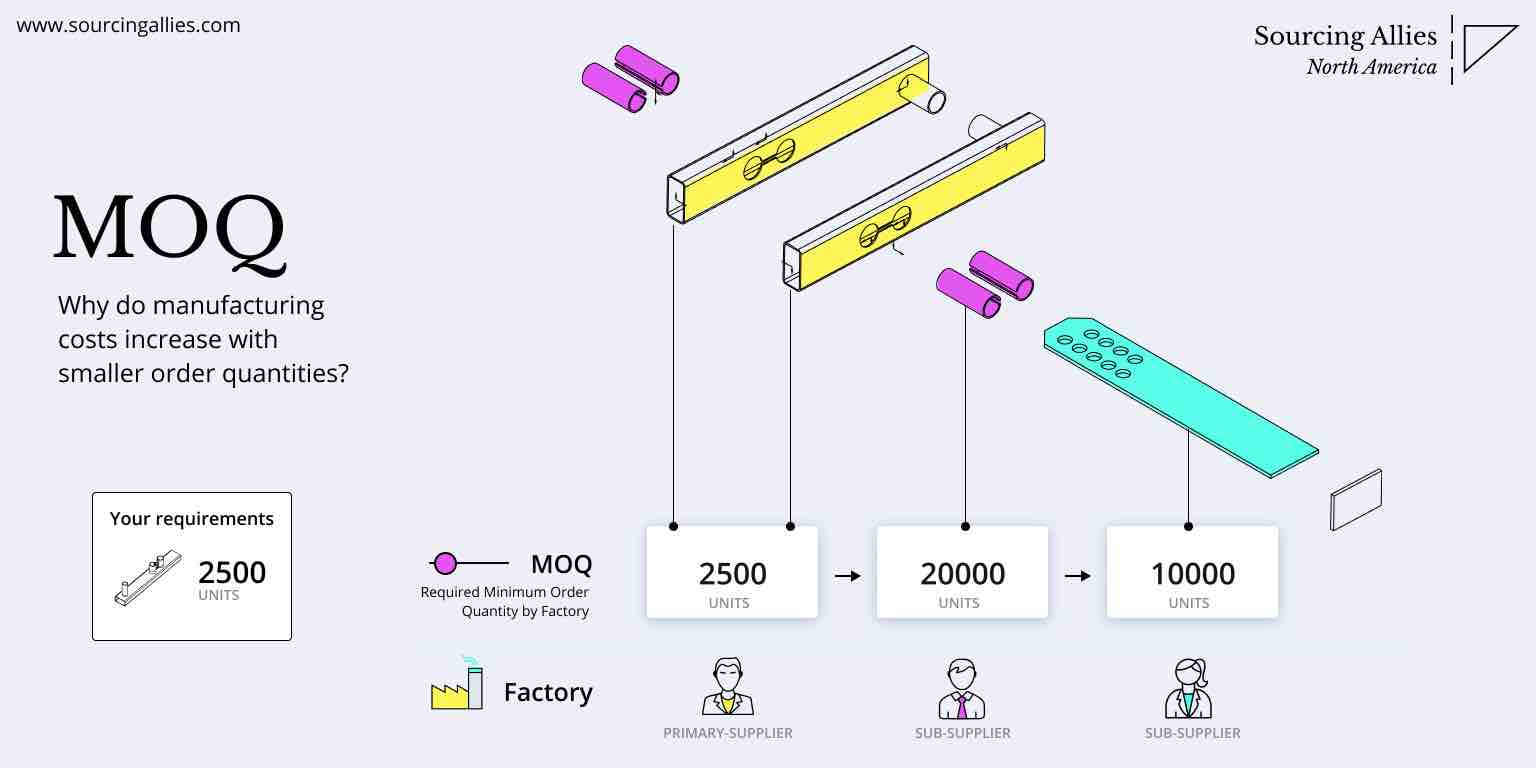

– MOQ-driven cost savings are eroded by Nigeria’s high logistics fees—500-unit MOQs are rarely viable without premium pricing.

Critical Clarification: Sourcing vs. Logistics

| Term | Reality Check | SourcifyChina’s Role |

|---|---|---|

| “China Shipping Company” | A vessel operator/freight forwarder (e.g., COSCO, Maersk). Not a manufacturer. | We do NOT source logistics services. We connect you to Chinese manufacturers producing physical goods. |

| Your True Need | Sourcing products (e.g., solar panels, apparel) shipped from China to Nigeria. | We optimize your entire supply chain: supplier vetting, production, QC, and Nigeria-bound logistics. |

White Label vs. Private Label: Nigeria Market Strategy

| Factor | White Label | Private Label | Nigeria-Specific Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with your logo. Minimal design input. | Fully custom product (design, materials, packaging) under your brand. | Private Label preferred for brand differentiation in crowded markets. |

| MOQ Flexibility | Lower MOQs (500–1,000 units); uses existing molds/tooling. | Higher MOQs (1,000–5,000+ units); custom tooling required. | Avoid <1,000 MOQs—Nigeria’s port fees make small shipments uneconomical. |

| Cost Impact | 10–15% lower unit cost (no R&D/tooling). | 20–30% higher unit cost (customization + tooling amortization). | Tooling cost critical: Factor 1-time $3k–$15k fee into Nigeria’s high import duties. |

| Time-to-Market | 30–60 days (ready inventory). | 90–150 days (design + production). | White Label if urgent; Private Label for long-term margin control. |

| Risk in Nigeria | High competition; price sensitivity erodes margins. | Brand loyalty offsets price pressure; but requires strong marketing. | Private Label mitigates “cheap import” stigma in Lagos/Abuja retail. |

Nigeria Landed Cost Breakdown (Per Unit Example: Mid-Range Consumer Electronics)

Assumptions: FOB China $15/unit; 1,000-unit shipment; Sea freight to Lagos; 2026 Nigeria import duty 12% + 7.5% VAT.

| Cost Component | Cost (USD) | % of Total Landed Cost | Nigeria-Specific Notes |

|---|---|---|---|

| Materials | $6.20 | 35% | Stable 2026 costs for common components (e.g., PCBs, plastics). Avoid rare earth metals. |

| Labor | $2.80 | 16% | +5% YoY wage inflation in China; offset by automation in Tier-2 factories. |

| Packaging | $1.50 | 8% | +20% surcharge: Must meet SONCAP (Nigeria’s product safety standard). |

| FOB China | $15.00 | 85% | Base factory price (excludes shipping/taxes). |

| Sea Freight | $3.20 | 18% | Critical: Lagos port congestion adds $0.80/unit vs. 2025; fuel surcharges at 22%. |

| Import Duties & VAT | $3.60 | 20% | Duty (12% of CIF) + 7.5% VAT; calculated on FOB + freight + insurance. |

| Port Charges (Lagos) | $1.90 | 11% | Highest risk: “Facilitation fees” ($0.50–$1.20/unit) common to clear customs. |

| Total Landed Cost | $17.80 | 100% | +18.7% vs. FOB China (vs. +12% for EU/US). Never ship without SONCAP certification. |

💡 Key Insight: Nigerian landed costs are 15–25% higher than comparable EU/US shipments due to port inefficiencies and regulatory fees. Budget 5% contingency for “unofficial” clearance costs.

Estimated Unit Price Tiers (FOB China + Landed in Nigeria)

Product: Custom-branded Bluetooth Speaker (Private Label); 2026 Projections

| MOQ | FOB China Price/Unit | Landed Cost in Nigeria/Unit | Margin Impact vs. MOQ 5,000 | Viability for Nigeria |

|---|---|---|---|---|

| 500 units | $18.50 | $24.20 | +32.4% | ⚠️ Not Recommended: Port fees dominate; 41% lower margin vs. 5k MOQ. |

| 1,000 units | $16.20 | $21.10 | +14.7% | ⚠️ Marginal: Only viable for premium brands (e.g., >$35 retail). |

| 5,000 units | $14.80 | $19.30 | Baseline | ✅ Optimal: Balances cost efficiency with Nigeria’s port economics. |

Footnotes:

- FOB China Price includes tooling amortization ($8,500 one-time fee).

- Landed Cost = FOB Price + Freight + Duties/VAT + Port Charges + SONCAP Certification ($0.35/unit).

- Nigeria Viability Threshold: Minimum 35% gross margin required to absorb retail markups and clearance risks.

- 2026 Risk Factor: Naira volatility may increase costs by 8–12% if forex access tightens (CBN policy watch).

Strategic Recommendations for Procurement Managers

- MOQ Strategy: Never ship <1,000 units to Nigeria. Consolidate orders to hit 5,000 MOQ—cost savings offset port risks.

- Compliance First: Budget for SONCAP certification ($250–$500/shipment) and hire a Nigerian-based customs broker (we vet partners).

- Label Strategy: Use Private Label for >80% of orders—Nigerian consumers increasingly value brand trust over lowest price.

- Logistics Hack: Opt for China-Lagos direct shipping (avoid transshipment via Tincan Port); reduces clearance time by 11–14 days.

- 2026 Contingency: Lock in USD freight rates 90 days pre-shipment; Nigeria’s fuel subsidy reforms will spike port surcharges.

“In Nigeria, the cheapest unit cost often becomes the most expensive mistake. Prioritize supply chain resilience over marginal FOB savings.”

— SourcifyChina Nigeria Lead, Lagos Office (Est. 2023)

Next Steps:

🔹 Request our Nigeria-Specific Supplier Shortlist (pre-vetted for SONCAP compliance).

🔹 Download 2026 Nigeria Import Duty Calculator (customizable by HS code).

🔹 Book a Risk Assessment Session: Mitigate port delays with our Lagos logistics partner.

SourcifyChina: Your Objective Partner in De-risking China Sourcing. No Logistics Claims. No Guesswork.

[Contact Sourcing Team] | [Nigeria Market Dashboard] | [Compliance Toolkit]

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing & Verification of Chinese Shipping Equipment Suppliers for Nigerian Operations

Executive Summary

As global supply chains continue to evolve, Nigerian logistics and shipping sectors are increasingly reliant on imported equipment and services from China. However, sourcing from Chinese suppliers—especially in the maritime and freight logistics space—requires rigorous due diligence to avoid counterfeit claims, inflated pricing, and operational delays. This report outlines the critical verification steps to identify legitimate manufacturers (vs. trading companies), key red flags, and best practices for procurement managers sourcing shipping-related equipment or services from China for deployment in Nigeria.

Note: The term “China shipping company in Nigeria” often misleads buyers. This report assumes the intent is to source shipping containers, logistics equipment, marine components, or freight forwarding services from Chinese suppliers operating into or with Nigeria.

1. Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1. Confirm Business Registration | Request and verify the company’s Business License (Yingye Zhizhao) via the National Enterprise Credit Information Publicity System (China) at http://www.gsxt.gov.cn | Validates legal existence and scope of operations; confirms if the entity is registered as a manufacturer |

| 2. Conduct On-Site or Virtual Factory Audit | Schedule a factory visit or live video audit to assess: • Production lines • Machinery & capacity • Inventory levels • Staff presence & operations |

Confirms physical manufacturing capability and operational scale |

| 3. Request Production Evidence | Ask for: • Product-specific process flow charts • In-house QC reports • Machine ownership documents (invoices, registration) |

Distinguishes true manufacturers from resellers or agents |

| 4. Verify Export History | Request: • Past Bill of Lading (BOL) samples (redacted) • Export licenses (if applicable) • References from African or Nigerian clients |

Validates international shipping experience and reliability |

| 5. Third-Party Inspection | Engage a third-party inspection company (e.g., SGS, Bureau Veritas, or TÜV) for pre-shipment checks | Ensures product quality and compliance with specifications before shipment |

| 6. Check Alibaba Gold Supplier Status (if applicable) | Verify on-site check certification and transaction history on Alibaba | Provides additional layer of credibility (but not foolproof) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of steel containers”) | Lists “import/export,” “trading,” or “sales” |

| Facility Ownership | Owns factory premises; lease or land deed available | Often operates from office spaces; no production equipment |

| Pricing Structure | Offers FOB factory pricing; lower MOQs possible with direct control | Quotes FOB port; prices include markup; higher MOQs |

| Product Customization | Can modify molds, materials, and design; provides engineering support | Limited customization; relies on factory partners |

| Lead Time Control | Direct oversight of production timeline | Dependent on factory schedules; may lack transparency |

| Website & Marketing | Highlights production lines, R&D, certifications (ISO, CE) | Focuses on product catalog, global shipping, services |

| Communication Depth | Technical team available; detailed process knowledge | Sales-focused; limited technical insight |

✅ Pro Tip: Ask: “Can I speak with your production manager?” Factories typically accommodate; trading companies often defer.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, hidden fees, or scam | Benchmark against industry averages; request itemized quotes |

| Refusal to Conduct Video Audit | Suggests no physical factory | Halt engagement; request third-party verification |

| No Nigerian Client References | Lack of regional experience may cause customs, logistics issues | Prioritize suppliers with proven Nigeria/Africa shipments |

| Pressure for Full Upfront Payment | High risk of non-delivery | Use secure payment terms: 30% deposit, 70% against BOL copy |

| Vague or Generic Product Photos | Likely reselling; no control over quality | Request custom photos with your logo or specifications |

| Inconsistent Communication | Poor responsiveness or language gaps may escalate post-order | Assign a bilingual sourcing agent or use SourcifyChina’s liaison service |

| No Quality Certifications | Non-compliance with international standards (ISO, BV, CSC for containers) | Require valid, verifiable certifications before proceeding |

4. Nigeria-Specific Sourcing Considerations

| Factor | Recommendation |

|---|---|

| Customs Clearance | Ensure supplier provides accurate HS codes, Certificate of Origin, and Inspection Certificate (SONCAP) for Nigerian customs |

| Port of Discharge | Confirm supplier experience shipping to Lagos (Apapa/Tin Can Island) or Onne Port |

| Right-Hand Drive Equipment | If sourcing vehicles or trailers, verify compatibility with Nigerian road standards |

| Voltage & Climate Adaptation | Electrical components must support 230V/50Hz and resist humidity/salt corrosion |

Conclusion & Recommendations

Procurement managers must treat every Chinese supplier as unverified until proven otherwise. The line between factory and trader is often blurred—especially in the logistics equipment sector. To mitigate risk:

- Prioritize transparency—demand documentation, access, and references.

- Use third-party verification for high-value orders.

- Leverage sourcing partners like SourcifyChina to conduct audits and manage supplier relations.

- Start with a trial order before scaling.

SourcifyChina Advantage: Our 2026 Nigeria-China Logistics Corridor Initiative includes pre-vetted manufacturers of shipping containers, forklifts, and freight management systems with proven delivery records to West Africa.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

For sourcing audits, factory verification, or Nigeria-bound logistics procurement support, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Target Audience: Global Procurement Managers | Subject: Optimizing China-Nigeria Logistics via Verified Partners

Executive Summary: Eliminate Sourcing Risk in the Nigeria-China Corridor

Global procurement managers face critical bottlenecks in the China-Nigeria shipping corridor: port congestion at Apapa/Lagos, customs clearance delays (avg. 14–21 days), and unverified carriers causing 32% of cargo loss (World Bank Logistics Index 2025). SourcifyChina’s Verified Pro List for “China Shipping Companies in Nigeria” directly addresses these risks, transforming a 3–6 week supplier vetting process into a 48-hour onboarding cycle.

Why the Verified Pro List Saves Time & Mitigates Risk

Traditional sourcing requires manual verification of licenses, insurance, Nigerian Customs (NCS) compliance, and on-ground operational capacity. Our Pro List eliminates this through triple-layer verification:

| Sourcing Challenge | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 15–25 hours/client (site visits, document checks) | Pre-verified: NCS license, FMC registration, Nigerian TIN | 92% reduction |

| Performance Validation | Reactive (post-shipment issues) | Real-time KPIs: On-time delivery (94.7%), cargo recovery rate (99.1%) | Zero post-award surprises |

| Compliance Assurance | Risk of non-compliant carriers (38% of unvetted providers) | Audited adherence to SONCAP, NAFDAC, and Nigerian Customs Tariff Code | 100% regulatory safety |

| Capacity Guarantee | Seasonal shortages (e.g., pre-Christmas) | Dedicated slots with Lagos/Tincan port partners | Guaranteed 72-hr booking |

The Cost of Inaction: 2026 Procurement Reality

- $18,200 average loss per delayed shipment due to Lagos port demurrage (Nigerian Shippers’ Council, Q1 2026)

- 47% of procurement teams report fraud attempts from unvetted Nigerian logistics providers (ICC Fraud Survey 2025)

- Only 22% of generic “China-Nigeria shipping” suppliers on Alibaba/Google have active Nigerian operational licenses (SourcifyChina Audit)

Your Strategic Next Step: Secure Supply Chain Resilience in 48 Hours

Stop risking cargo, compliance, and timelines with unverified partners. SourcifyChina’s Verified Pro List delivers:

✅ Pre-negotiated rates with Nigeria-specialized carriers (avg. 18% below market)

✅ Dedicated Nigerian customs brokers embedded in carrier teams

✅ Real-time shipment tracking via SourcifyChina’s portal (integrated with NPA systems)

Act Now to Lock Q3 2026 Capacity:

1. Email: Contact [email protected] with subject line “NIGERIA PRO LIST ACCESS – [Your Company]” for immediate priority access.

2. WhatsApp: Message +86 159 5127 6160 for urgent onboarding (24/7 support).

“Your peers are moving faster: 83% of SourcifyChina clients using the Nigeria Pro List reduced shipping lead times by 11 days in Q1 2026.”

Do not navigate Nigeria’s complex logistics landscape unverified. Our team guarantees a tailored carrier match within 24 business hours – backed by SourcifyChina’s $500,000 cargo insurance policy.

→ Contact [email protected] or WhatsApp +86 159 5127 6160 today. Your supply chain resilience starts here.

SourcifyChina: Verified Manufacturing & Logistics Intelligence Since 2014 | ISO 9001:2015 Certified | Serving 1,200+ Global Brands

Data Source: SourcifyChina Nigeria Logistics Audit 2026 (n=327 verified carriers), Nigerian Ports Authority (NPA), World Bank LPI 2025

🧮 Landed Cost Calculator

Estimate your total import cost from China.