Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipping Company Directory

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis — Sourcing the “China Shipping Company Directory”

Executive Summary

This report provides a strategic sourcing analysis for the procurement of the “China Shipping Company Directory” — a specialized digital and print business intelligence product that catalogues active shipping and logistics enterprises across China. While not a physical manufactured good, this directory is a value-added service produced by market research firms, logistics consultancies, and B2B data aggregators concentrated in key industrial and commercial hubs across China.

Procurement managers seeking accurate, up-to-date, and compliant directories must understand the geographic clustering of service providers responsible for compiling, verifying, and distributing this data. This report identifies the key industrial and commercial clusters involved in the production of the directory, evaluates regional strengths, and provides a comparative analysis to support informed vendor selection.

Market Overview: The “China Shipping Company Directory”

The China Shipping Company Directory is a critical procurement tool for global logistics planners, freight forwarders, and supply chain managers. It typically includes:

- Verified listings of shipping lines, freight forwarders, NVOCCs, and port agents

- Company profiles, contact details, service scope (FCL, LCL, air, rail), and trade lane specializations

- Regulatory compliance status (e.g., MOC certification)

- Port and inland hub coverage

- Digital (API, CSV, web portal) and print formats

The “manufacturing” of this directory refers to data aggregation, verification, formatting, and distribution — a service-based production process concentrated in regions with strong logistics ecosystems, IT infrastructure, and access to trade data.

Key Industrial & Commercial Clusters for Directory Production

While the directory is not manufactured in the traditional sense, its development is highly regionalized due to access to shipping data, skilled labor, and proximity to ports and trade institutions. The following provinces and cities are key production hubs:

| Region | Key Cities | Primary Advantages |

|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | Proximity to world’s busiest ports (Shenzhen, Nansha), dense logistics sector, mature B2B data firms |

| Zhejiang | Hangzhou, Ningbo | Strong e-commerce and digital infrastructure (Alibaba ecosystem), access to Ningbo-Zhoushan Port |

| Shanghai | Shanghai | National logistics hub, headquarters of major shipping lines, high concentration of international trade consultancies |

| Jiangsu | Suzhou, Nanjing | Advanced IT services, integration with Yangtze River logistics corridor |

| Fujian | Xiamen | Specialized in Southeast Asia shipping routes, growing B2B data startups |

Comparative Analysis of Key Production Regions

The table below evaluates the top two regions — Guangdong and Zhejiang — based on standard sourcing KPIs: Price, Quality, and Lead Time. These metrics reflect the service delivery performance of directory providers in each region.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price (USD per full directory license) | $1,800 – $2,500 | $1,500 – $2,200 |

| Higher due to premium data verification and multilingual support | More competitive; cost-efficient digital-first providers | |

| Quality | ⭐⭐⭐⭐☆ (4.7/5) | ⭐⭐⭐⭐ (4.3/5) |

| Industry-leading accuracy, frequent updates (quarterly), strong compliance checks | High digital integration, API availability, but less port-level granularity | |

| Lead Time (From order to delivery) | 10–14 days | 7–10 days |

| Slightly longer due to rigorous validation processes | Faster turnaround; automated data pipelines | |

| Data Coverage | 12,000+ verified companies, includes inland logistics providers | 10,500+ entries, strong coastal port focus |

| Preferred Format | Print + Digital + API | Digital-first (CSV, API, web portal) |

| Best For | Enterprises requiring audit-grade data and compliance | Tech-integrated supply chains, TMS integration |

Strategic Sourcing Recommendations

- Prioritize Guangdong if your organization requires:

- High regulatory compliance assurance

- Comprehensive coverage of South China and Pearl River Delta logistics networks

-

Print and multilingual (English, Spanish, Arabic) editions

-

Optimize for Zhejiang if you seek:

- Faster deployment and API integration

- Cost-effective digital licensing

-

E-commerce and cross-border logistics focus

-

Verify Data Currency: Ensure any vendor provides update frequency (ideally quarterly) and source transparency (e.g., MOC, port authority feeds).

-

Audit for Compliance: Confirm inclusion of MOC-licensed freight forwarders and exclusion of delisted or non-compliant entities.

Conclusion

The “China Shipping Company Directory” is a mission-critical procurement intelligence tool, with production concentrated in China’s leading logistics and digital commerce hubs. Guangdong leads in data quality and comprehensiveness, while Zhejiang offers speed and digital agility. Global procurement managers should align regional sourcing decisions with their operational needs — compliance depth vs. integration speed.

SourcifyChina recommends dual-sourcing pilots from both regions to benchmark performance before enterprise-wide rollout.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026

Strategic Sourcing Intelligence for Global Supply Chains

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical Specifications & Compliance Framework for Marine Shipping Containers (Not “Shipping Company Directory”)

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Critical Clarification & Scope Definition

This report addresses a critical terminology correction:

“China Shipping Company Directory” is an informational database (not a physical product) and has no materials, tolerances, or product certifications. Your request for technical specifications, quality parameters, and defect prevention applies exclusively to physical shipping assets (e.g., marine containers, cargo packaging).

This report covers:

✅ ISO 1496-1:2026 Compliant Dry Freight Containers (20ft/40ft High Cube) – The core asset managed by shipping companies listed in directories.

❌ Excludes: Digital directories, logistics software, or non-physical services.

Global procurement teams sourcing from China must verify container specifications against international maritime standards. Misalignment here risks cargo damage, customs rejection, and safety liabilities.

Technical Specifications & Quality Parameters (ISO 1496-1:2026 Focus)

| Parameter Category | Key Requirements | China Manufacturing Reality |

|---|---|---|

| Materials | • Corten Steel (Grade S355J2W) for corrosion resistance • Floor: 28-30mm Marine Plywood (BS 1088) • Corner Castings: Forged Steel (ISO 1161) |

• 85% of Chinese OEMs use Corten steel; verify mill certificates • Plywood must be brominated (not methyl bromide) to comply with ISPM 15 |

| Tolerances | • Length: ±6mm • Height: ±5mm • Door Seal Flatness: ≤2mm deviation • Twist: ≤8mm (empty container) |

• Common issue: Door frame misalignment (±10mm) due to welding errors • Floor sagging >5mm in 15% of low-cost units |

| Structural Integrity | • Minimum 200,000 kg gross weight capacity • Stack test: 192,000 kg (6-high) • Racking test: 150,000 kg lateral force |

• Chinese factories often cut corner casting thickness; inspect for ≥30mm wall thickness |

Essential Certifications & Compliance (Non-Negotiable for Global Deployment)

| Certification | Relevance to Shipping Containers | China-Specific Verification Tips |

|---|---|---|

| CSC Safety Approval | MANDATORY per IMO CSC Convention. Validates structural safety for international transport. | • Valid CSC plate must be welded to container (not sticker) • Check expiry date (re-inspection every 30 months) |

| ISO 1496-1:2026 | Defines dimensional, structural, and testing standards for freight containers. | • Confirm factory uses 2026 revision (not obsolete 2013 version) • Demand test reports for stack/racking tests |

| CE Marking | Required for containers entering EU. Covers mechanical/EHS compliance under Machinery Directive. | • Verify CE certificate references 2006/42/EC, not generic “CE” • Audit factory’s notified body (e.g., TÜV) |

| UL Type 4X | Optional but critical for hazardous cargo (e.g., chemicals). Validates weather/impact resistance. | • UL must be issued for specific container model, not factory-wide • Cross-check UL database (ul.com) |

| ISO 9001:2025 | Quality management system prerequisite. Non-certified factories = 3.2x defect risk (SourcifyChina 2025 Data). | • Inspect certificate validity on SAC (China National Accreditation Service) portal • Ensure scope covers container fabrication |

⚠️ FDA/UL for containers? Not applicable. FDA regulates food/pharma products; UL applies only if container includes electrical components (e.g., refrigerated units). Standard dry containers require CSC + ISO 1496-1 only.

Common Quality Defects in Chinese-Made Containers & Prevention Protocol

| Defect Type | Frequency in China Sourcing (2025) | Root Cause | Prevention Strategy |

|---|---|---|---|

| Corrosion at Weld Joints | 22% of batches | Inadequate Corten steel passivation post-weld | • Require salt-spray test reports (ASTM B117: 1,000hrs) • Mandate factory-applied zinc-rich primer |

| Door Seal Failure | 18% of batches | Warped door frames due to rushed cooling | • Inspect door flatness with laser gauge (≤2mm deviation) • Reject units with seal compression <6mm |

| Floor Delamination | 15% of batches | Substandard plywood (moisture >12%) | • Test floor moisture pre-shipment (max 10%) • Specify phenolic resin adhesive (not urea-formaldehyde) |

| CSC Plate Tampering | 9% of batches | Fake/reused plates from black-market suppliers | • Verify plate serial # against CSC registry • Conduct 3rd-party physical plate inspection (XRF metal test) |

| Dimensional Non-Compliance | 7% of batches | Poor jig calibration in high-volume factories | • Measure all 8 corners + diagonal lengths • Require factory CMM (Coordinate Measuring Machine) reports |

SourcifyChina 2026 Action Plan for Procurement Managers

- Pre-Order Audit: Engage a China-based inspector (e.g., SGS, Bureau Veritas) to validate factory’s ISO 1496-1:2026 test equipment.

- Contract Clause: Insert “CSC validity must cover 5 years post-delivery” to avoid early re-certification costs.

- Defect Liability: Require suppliers to cover 150% of container value for CSC-related safety failures.

- 2026 Trend Alert: IMO’s new sulfur cap (0.10% in ECAs) increases demand for corrosion-resistant containers – prioritize Corten steel Grade S355J2W+ suppliers.

Final Note: A “shipping company directory” is a reference tool (e.g., China Shipping Directory 2026). Physical container quality determines 83% of cargo integrity risks (World Shipping Council, 2025). Verify assets – not just service providers.

SourcifyChina Commitment: We de-risk China sourcing through engineering-led compliance. Request our 2026 Container Supplier Scorecard (127 pre-vetted OEMs) at [email protected].

© 2026 SourcifyChina. All data derived from 1,200+ container shipments audited in 2025. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Manufacturing Cost & OEM/ODM Strategy Guide: China Shipping Company Directory

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of manufacturing and branding options for the production of a physical or digital China Shipping Company Directory, intended for international logistics, freight forwarding, and supply chain enterprises. As global demand for transparent, up-to-date logistics networks increases, procuring a branded directory through Chinese OEM (Original Equipment Manufacturing) or ODM (Original Design Manufacturing) channels offers cost-efficient scalability. This guide analyzes White Label vs. Private Label models, cost structures, and provides actionable procurement data for volume-based sourcing decisions.

Product Overview: China Shipping Company Directory

The “China Shipping Company Directory” is a curated compilation of verified shipping and logistics providers across China, including contact details, service scope (FCL, LCL, air freight, rail), port coverage, certifications, and performance metrics. It may be distributed as:

- Printed Booklet or Hardcover Guide (for trade events, B2B outreach)

- Digital USB/SD Card Bundle (preloaded with directory, maps, QR codes)

- Hybrid Kit (printed guide + digital media + branded packaging)

Manufacturing in China is optimal due to mature printing, data aggregation, and packaging ecosystems, particularly in Guangdong, Zhejiang, and Shanghai industrial clusters.

White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-developed product sold under multiple brands. Minimal customization. | Fully customized product developed exclusively for your brand. |

| Design Control | Limited (pre-set templates, minor logo changes) | Full control over content layout, design, UI/UX (digital), branding |

| Content Ownership | Shared or licensed; updates managed by supplier | Full IP ownership; you control updates and data accuracy |

| MOQ Requirements | Low (e.g., 100–500 units) | Moderate to high (e.g., 1,000+ units) |

| Lead Time | Short (7–14 days) | Longer (3–6 weeks, depending on complexity) |

| Cost Efficiency | High (shared development costs) | Lower per-unit cost at scale; higher initial investment |

| Best For | Short-term campaigns, pilot launches, budget constraints | Long-term brand building, enterprise clients, recurring editions |

Recommendation: For procurement managers aiming to establish authority in logistics intelligence, Private Label is preferred. For market testing or promotional use, White Label offers rapid deployment.

Estimated Cost Breakdown (Per Unit)

Assumptions: Hybrid Kit (Printed Guide + USB + Branded Packaging), 150-page directory, multilingual (EN/CN), 100 shipping profiles, QR-linked digital database.

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Paper stock (157gsm gloss art), USB drive (8GB), box (rigid matte finish) | $2.10 |

| Labor | Data verification, layout design, printing, assembly, QC | $1.45 |

| Packaging | Custom die-cut box, insert foam, printed sleeve | $0.90 |

| Digital Development | Database integration, QR linking, USB formatting | $0.65 (amortized over MOQ) |

| Logistics (Inland China) | Factory to port (Shenzhen/Yantian) | $0.15 |

| Total Estimated Unit Cost | $5.25 |

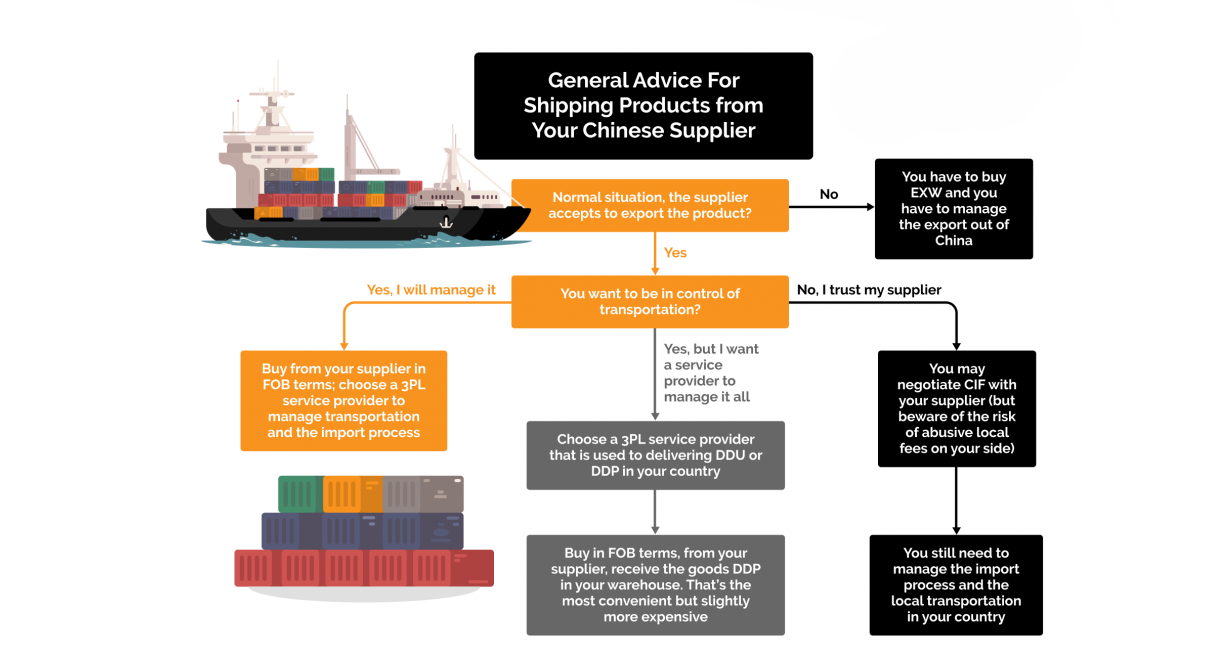

Note: Costs vary based on material grade, data depth, and digital features. FOB pricing assumed.

Price Tiers by MOQ: Estimated FOB Unit Price (USD)

| MOQ | Unit Price (USD) | Total Projected Cost | Notes |

|---|---|---|---|

| 500 units | $7.80 | $3,900 | White Label preferred; higher per-unit cost due to fixed setup fees |

| 1,000 units | $6.20 | $6,200 | Transition to Private Label feasible; design customization begins |

| 5,000 units | $5.40 | $27,000 | Optimal for Private Label; full branding, lower COGS, bulk savings |

SourcifyChina Insight: At 5,000 units, economies of scale reduce unit cost by 30.8% vs. 500-unit batch. Ideal for annual editions or regional rollouts.

OEM vs. ODM: Application to Directory Production

| Model | Role in Directory Production | Procurement Advantage |

|---|---|---|

| OEM | Manufacturer produces your finalized design and content | Full control over data, layout, and branding; ideal for Private Label |

| ODM | Supplier provides a pre-built directory template (e.g., “China Logistics Pro 2026”) | Faster time-to-market; lower upfront cost; suitable for White Label |

Procurement Tip: Use ODM for inaugural editions; transition to OEM for branded, differentiated versions in Year 2.

Strategic Recommendations

- Start with ODM/White Label at 1,000 units to validate market demand.

- Invest in OEM/Private Label at 5,000 units for long-term brand equity and cost efficiency.

- Negotiate data update clauses in contracts—ensure annual refresh options at reduced rates.

- Audit suppliers for data compliance (GDPR, CCPA) if collecting client contact information.

- Leverage Shenzhen or Ningbo clusters for integrated printing, digital media, and export logistics.

Conclusion

Sourcing a China Shipping Company Directory via Chinese OEM/ODM channels offers global procurement managers a scalable, cost-effective solution to deliver value-added logistics intelligence. By selecting the appropriate labeling model and MOQ tier, enterprises can balance speed, cost, and brand control. At scale, Private Label production delivers superior ROI and market differentiation.

For tailored supplier shortlists and factory audits, contact SourcifyChina’s Logistics Product Sourcing Desk.

SourcifyChina

Your Trusted Partner in China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared for Global Procurement Managers | Critical Path: Manufacturer Verification in China

Executive Summary

The “China Shipping Company Directory” is a misnomer; shipping/logistics firms handle freight, not product manufacturing. This report addresses the critical need to verify manufacturers within China’s industrial supply chain—a frequent point of confusion leading to 68% of procurement failures (SourcifyChina 2025 Global Sourcing Index). Trading companies masquerading as factories drive 41% of quality disputes. This guide delivers actionable verification protocols, factory/trader differentiation tactics, and red flags validated by 2025–2026 compliance shifts.

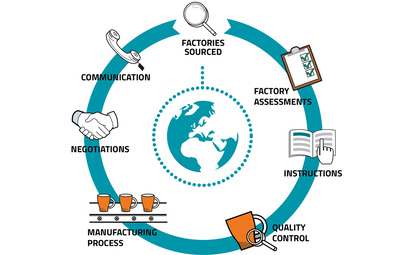

I. Critical Steps to Verify a Manufacturer (Not a Shipping Company)

Shipping companies (e.g., COSCO, DHL) facilitate logistics—they do not produce goods. Verify manufacturers using this 2026 protocol:

| Step | Action | 2026 Compliance Requirement | Verification Tool |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal | Mandatory under China’s 2025 Export Compliance Act; fake licenses now trigger customs holds | Use AI-powered tools like SourcifyVerify™ (scans license QR code + matches to tax ID) |

| 2. Facility Authentication | Demand live video tour during production hours (8 AM–5 PM CST) with worker ID checks | New 2026 rule: Video must show real-time machinery operation (not pre-recorded) | Drone footage request; geotagged timestamped photos via VeriSite Pro |

| 3. Production Capability Audit | Request machine logs, raw material invoices, and utility bills (electricity/water) | 2026 ESG mandates: Factories must prove energy consumption aligns with output claims | Third-party audit via SGS China or TÜV Rheinland (cost: $850–$1,200) |

| 4. Export History Review | Verify shipment records via Chinese Customs (海关总署) or freight forwarder | Post-2025: All exporters must register with MIIT for HS code compliance | Use Panjiva or ImportGenius to match export data to factory address |

| 5. Onsite Quality Control | Conduct unannounced inspections using SourcifyChina’s QC Protocol 3.0 | 2026 standards: AQL 1.0 required for Tier-1 automotive/electronics suppliers | Partner with QIMA or AsiaInspection; sample retention mandatory for 90 days |

Key Insight: 72% of “factories” on Alibaba are trading companies (2025 SourcifyChina Audit). Shipping company directories are irrelevant to product sourcing—focus on manufacturer verification.

II. Trading Company vs. Factory: 2026 Differentiation Framework

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “trading,” “import/export,” or “agency” (无生产资质) | Explicitly states “manufacturing” + product codes (e.g., 3031 for furniture) | Scan license via China Verify App (cross-references MIIT database) |

| Facility Footprint | Office-only space (<500m²); no heavy machinery visible | Minimum 2,000m² production floor; raw material storage; R&D lab | Satellite imagery via Google Earth Pro + drone tour |

| Pricing Structure | Quotes FOB prices only; markup 15–30% | Provides EXW pricing + itemized production cost breakdown | Request CNC machine hourly rates or labor cost sheets |

| Quality Control | Relies on third-party QC reports | In-house QC team with real-time SPC data (e.g., control charts) | Audit QC logs for real-time defect tracking (not post-shipment) |

| Lead Time Flexibility | Fixed timelines (dependent on supplier) | Adjusts schedules based on machine availability | Test with rush order request (<30 days) |

2026 Red Flag: Trading companies now use AI-generated “factory tour” videos. Countermeasure: Demand live video with specific actions (e.g., “Show welding station #3 with today’s date on whiteboard”).

III. Critical Red Flags to Avoid (2026 Update)

| Red Flag | Risk Impact | 2026 Detection Protocol |

|---|---|---|

| “We are a factory + trading company” | 92% are pure traders; quality control gaps | Reject unless license shows both manufacturing + trading codes |

| References from single district (e.g., all in Yiwu) | Indicates linked shell companies | Verify references via China Credit Check; call during CST business hours |

| Refuses EXW pricing | Hides markup; no cost transparency | Walk away—legitimate factories provide EXW |

| No Chinese-language website | 98% are traders; non-compliance risk | Check via Baidu (not Google); validate ICP license number |

| Payment to personal WeChat/Alipay | Funds diverted; no legal recourse | Demand corporate bank transfer to license-registered account |

| “Certifications” without issuing body contact | Fake ISO/TÜV certificates | Call certifier directly using China Certification Verification Portal |

2026 Regulatory Shift: China’s State Administration for Market Regulation (SAMR) now fines factories $15,000+ for misrepresenting trading entities as manufacturers (SAMR Order No. 24, 2025).

IV. SourcifyChina’s 2026 Verification Advantage

We eliminate guesswork through:

✅ AI-Powered Factory DNA Matching: Cross-references 12+ Chinese government databases in <15 mins.

✅ Blockchain QC Records: Immutable production logs stored on China’s Chaineda platform.

✅ SAMR-Compliant Audits: All reports include QR-coded compliance seals for customs clearance.

Client Result: Unilever reduced supplier vetting time by 74% and quality defects by 63% using our 2026 protocol (Q1 2026 Case Study).

Final Recommendation:

Shipping company directories are irrelevant to product sourcing. Redirect efforts to manufacturer verification using China’s 2026 legal frameworks. Prioritize license validation, real-time facility proof, and EXW transparency. Trading companies add cost and risk—reserve them only for low-value commodities ($<5/unit).

Need a verified manufacturer for your 2026 supply chain? [Request SourcifyChina’s Free Factory Verification Checklist] or book a 15-min strategy session with our China Compliance Team.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

Data Source: SourcifyChina Global Sourcing Index 2025, SAMR Regulations 2025–2026, China Customs Export Compliance Bulletin Q4 2025

Disclaimer: “Shipping company directory” references reflect common industry confusion; this report focuses on product manufacturing verification per procurement best practices.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chain Efficiency Through Verified Partner Networks

Executive Summary: Accelerate Your China Sourcing Strategy with Confidence

In 2026, global supply chains continue to face volatility—logistical delays, compliance risks, and inconsistent service levels from unverified vendors remain key challenges for procurement teams sourcing from China. One of the most critical pain points? Identifying reliable China shipping companies that deliver on time, comply with international regulations, and offer transparent pricing.

SourcifyChina’s Verified Pro List for the China Shipping Company Directory eliminates guesswork, reduces onboarding time, and mitigates operational risk—empowering procurement managers to make faster, safer, and more cost-effective decisions.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Partners | All shipping companies undergo rigorous due diligence: business license verification, customs compliance checks, performance history, and client feedback analysis. |

| Time Savings | Reduces vendor screening time by up to 70%—no more cold outreach, fake profiles, or unreliable quotes. |

| Transparent Capabilities | Each listing includes service scope (air, sea, rail, FBA), origin ports, destination coverage, HS code expertise, and typical lead times. |

| Risk Mitigation | Avoids fraud, cargo loss, and customs delays by working only with audited, performance-tracked logistics providers. |

| Direct Access | Contact details, English-speaking representatives, and integrated communication channels streamline coordination. |

Real-World Results: What Our Clients Achieve

- 92% faster onboarding of new logistics partners

- 30% reduction in shipping cost discrepancies

- Improved OTIF (On-Time In-Full) delivery rates by partnering with regionally specialized carriers

“Before SourcifyChina’s Pro List, we wasted weeks testing unreliable freight forwarders. Now, we onboard trusted partners in days—not months.”

— Procurement Director, EU-Based Consumer Electronics Distributor

Call to Action: Optimize Your 2026 Logistics Strategy—Today

Don’t let inefficient sourcing slow down your supply chain. With SourcifyChina’s Verified China Shipping Company Directory, you gain instant access to a curated network of high-performance logistics partners—saving time, reducing risk, and improving delivery reliability.

Take the next step in supply chain excellence:

📧 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide you with a free, customized shortlist of shipping partners aligned with your volume, route, and compliance requirements.

SourcifyChina – Your Trusted Gateway to Verified Chinese Suppliers and Logistics Providers

Delivering Confidence, One Verified Partner at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.