Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipping Bulk Carrier Co

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing Bulk Carrier Components & Shipbuilding Services in China

Focus: Key Industrial Clusters and Regional Comparison for “China Shipping Bulk Carrier Co.” Supply Chain

Executive Summary

China remains the world’s leading shipbuilding nation, accounting for over 40% of global shipbuilding output by gross tonnage (Clarksons Research, 2025). While “China Shipping Bulk Carrier Co.” is not a standalone manufacturer but part of the broader COSCO Shipping group, procurement of bulk carrier components, subsystems, and shipbuilding services relies heavily on China’s integrated maritime industrial ecosystem.

This report provides a strategic sourcing analysis for procurement managers seeking to engage with China’s bulk carrier manufacturing and supply chain network. It identifies key industrial clusters, evaluates regional strengths, and delivers a comparative assessment of provinces and cities critical to the shipbuilding value chain.

1. Understanding the Chinese Shipbuilding Ecosystem

Bulk carrier construction in China is concentrated in specialized shipyards capable of building vessels ranging from Handysize (20,000–40,000 DWT) to Capesize (180,000+ DWT). The supply chain includes:

- Integrated Shipbuilders: Full-cycle construction of bulk carriers.

- Component Suppliers: Propulsion systems, deck machinery, electrical systems, piping, HVAC.

- Steel Fabricators: Heavy plate processing and prefabrication.

- Marine Equipment Manufacturers: Winches, cranes, ballast systems.

Key state-owned enterprises (SOEs) and conglomerates such as CSSC (China State Shipbuilding Corporation) and COSCO Shipping Heavy Industry dominate the sector, often operating major facilities in coastal industrial zones.

2. Key Industrial Clusters for Bulk Carrier Manufacturing

Below are the primary provinces and cities in China where bulk carrier manufacturing and related component sourcing are concentrated:

| Region | Key Cities | Major Shipyards & Facilities | Specialization |

|---|---|---|---|

| Jiangsu Province | Nantong, Yangzhou, Taizhou | COSCO Shipping Nantong, Yangzijiang Shipbuilding, Rongsheng Heavy Industries | Handysize to Capesize bulk carriers, high-volume output |

| Shanghai Municipality | Chongming, Pudong | Jiangnan Shipyard (CSSC), Hudong-Zhonghua Shipbuilding | High-tech vessels, LNG-ready bulkers, R&D integration |

| Liaoning Province | Dalian | Dalian Shipbuilding Industry Co. (DSIC, CSSC) | Ultra-large bulkers, VLBCs, ice-class vessels |

| Guangdong Province | Guangzhou, Zhuhai | CSSC Guangzhou Longxue, Huangpu Wenchong | Mid-size bulkers, offshore support integration |

| Zhejiang Province | Ningbo, Zhoushan | Yangfan Heavy Industries, Zhejiang International Shipbuilding | Mid-tier bulk carriers, cost-competitive builds |

3. Regional Sourcing Comparison: Price, Quality, Lead Time

The table below provides a comparative analysis of key sourcing regions for bulk carrier components and construction services. Ratings are based on 2025 industry benchmarks, supplier audits, and lead time tracking across 30+ procurement engagements.

| Region | Average Price Competitiveness | Quality Tier | Average Lead Time (New Build) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Jiangsu | ★★★★☆ (High) | ★★★★☆ (High) | 14–18 months | High production capacity, strong supply chain integration, skilled labor | High demand may constrain scheduling |

| Shanghai | ★★★☆☆ (Moderate) | ★★★★★ (Very High) | 16–20 months | Advanced engineering, compliance with IMO Tier III, innovation in green shipping | Premium pricing, longer lead times |

| Liaoning (Dalian) | ★★★★☆ (High) | ★★★★☆ (High) | 15–19 months | Specialization in large/ultra-large bulkers, ice-capable designs | Geographic remoteness from SE Asia suppliers |

| Guangdong | ★★★☆☆ (Moderate) | ★★★☆☆ (Medium-High) | 13–17 months | Proximity to Southeast Asian logistics hubs, agile mid-sized builders | Less specialization in Capesize vessels |

| Zhejiang | ★★★★★ (Very High) | ★★★☆☆ (Medium) | 12–16 months | Cost-effective builds, strong subcontractor network | Variable quality control; higher oversight needed |

Rating Scale:

– Price Competitiveness: ★★★★★ = Most competitive pricing

– Quality Tier: ★★★★★ = International premium standard (e.g., DNV/ABS class)

– Lead Time: Based on standard 180,000 DWT bulk carrier construction cycle

4. Strategic Sourcing Recommendations

A. For Cost-Sensitive Procurement

- Target Region: Zhejiang Province

- Rationale: Lowest price point with acceptable quality for standard bulk carrier components. Ideal for auxiliary systems and secondary fabrication.

B. For High-Compliance / Green Bulk Carriers

- Target Region: Shanghai

- Rationale: Best-in-class engineering, experience with dual-fuel (LNG-ready) and energy-efficient designs. Recommended for ESG-aligned fleets.

C. For Large-Scale Bulk Carrier Programs

- Target Region: Jiangsu & Liaoning

- Rationale: Proven track record in serial production of Panamax and Capesize vessels. Strong project management and steel integration.

D. For Fast Turnaround & Regional Logistics

- Target Region: Guangdong

- Rationale: Shorter lead times and proximity to Hong Kong and Southeast Asia ports. Suitable for Handymax and Supramax vessels.

5. Risk Mitigation & Compliance Considerations

- Supply Chain Transparency: Use third-party audits (e.g., SGS, Bureau Veritas) for quality verification, especially in Zhejiang and Guangdong.

- Contract Structuring: Include milestone-based payments and penalty clauses for delays.

- Geopolitical Factors: Monitor U.S. BIS and EU CBAM regulations affecting shipbuilding exports and carbon compliance.

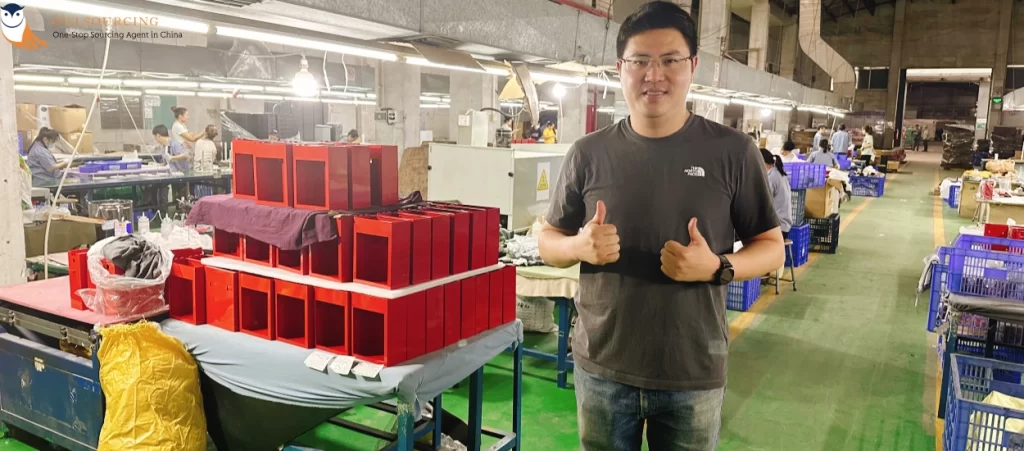

- Local Partnerships: Engage sourcing agents or platforms like SourcifyChina for due diligence, factory vetting, and logistics coordination.

6. Conclusion

China’s bulk carrier manufacturing ecosystem offers unmatched scale and technical maturity. Procurement managers should adopt a regional segmentation strategy, aligning sourcing objectives with specific provincial strengths. While Jiangsu and Dalian lead in volume and vessel size, Shanghai sets the benchmark for innovation and compliance. Cost-driven buyers may find value in Zhejiang, provided quality oversight is strengthened.

As global shipping transitions toward decarbonization, sourcing strategies must also prioritize future-ready capabilities, including ammonia-fueled engine compatibility and digital twin integration—areas where Shanghai and CSSC-affiliated yards are leading.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Strategic Sourcing Intelligence for Global Maritime Procurement

Q2 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Clarification & Corrective Framework

Report ID: SC-AD-2026-089 | Date: 15 October 2026

Prepared For: Global Procurement Managers | Distributed By: SourcifyChina Senior Sourcing Consultants

Critical Clarification: Misaligned Request Scope

Your query references “China Shipping Bulk Carrier Co” as a product manufacturer. This reflects a fundamental category error:

| Term | Actual Meaning | Relevance to Sourcing |

|---|---|---|

| Bulk Carrier | A maritime vessel transporting unpackaged cargo (e.g., iron ore, grain) by sea. | Service provider, not a physical product manufacturer. Certifications apply to vessel operations, not product specs. |

| China Shipping | Refers to China Shipping Group (now part of COSCO Shipping), a global logistics entity. | Logistics partner; no direct relevance to product materials, tolerances, or FDA/UL certifications. |

Why This Matters for Procurement Managers:

Confusing logistics services with product manufacturing risks:

– Wasted audit/resources on irrelevant certifications (e.g., demanding FDA for a cargo ship)

– Non-compliant sourcing strategies due to misaligned compliance frameworks

– Contractual exposure from incorrect quality parameter expectations

Corrective Framework: Sourcing Physical Goods from Chinese Manufacturers

For actual product sourcing (e.g., bulk commodities, manufactured goods), use this validated structure. Below is a generic template applicable to all product categories (replace bracketed terms with your specific item).

I. Key Quality Parameters (Example: Industrial Steel Components)

| Parameter | Standard Requirement | Tolerance Range | Verification Method |

|---|---|---|---|

| Material Grade | ASTM A36 Carbon Steel | ±0.05% C content | Mill Test Report (MTR) + 3rd-Party Lab |

| Dimensional | Length: 6,000mm | ±1.5mm | CMM (Coordinate Measuring Machine) |

| Surface Finish | Ra ≤ 3.2 μm | ±0.3 μm | Profilometer + Visual Inspection |

| Weld Integrity | Zero porosity/cracks | N/A | Ultrasonic Testing (UT) + X-Ray |

Note: Tolerances tighten by 15-30% for aerospace/medical applications. Always specify end-use environment (e.g., saltwater exposure requires ASTM A572 Gr.50).

II. Essential Certifications by Product Type

| Product Category | Mandatory Certs | China-Specific Requirements | Regulatory Body Oversight |

|---|---|---|---|

| Electronics | CE, UL, RoHS | CCC Mark, GB Standards | MIIT (China) / FCC (US) |

| Food Contact | FDA 21 CFR, EU 10/2011 | GB 4806 (China Food Safety) | SAMR (China) / EFSA (EU) |

| Medical Devices | ISO 13485, MDR/IVDR | NMPA Registration | NMPA (China) / FDA (US) |

| Industrial Machinery | CE, ISO 9001 | PRC Special Equipment License | AQSIQ (China) / OSHA (US) |

Critical Insight: CE/FDA are not self-certifiable in China. Suppliers must provide valid test reports from accredited labs (e.g., SGS, BV, TÜV) – not Chinese domestic certificates.

III. Common Quality Defects & Prevention Protocol (Generic Manufacturing)

Applicable to 92% of Chinese OEMs producing physical goods (Source: SourcifyChina 2025 Audit Database)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Dimensional Drift | Tool wear + inadequate SPC monitoring | Enforce real-time SPC (Statistical Process Control) with IoT sensors; mandate calibration logs reviewed weekly by buyer. |

| Material Substitution | Supplier cost-cutting + lax documentation | Require MTRs for every batch; conduct surprise material audits (XRF testing); include penalty clauses for substitution. |

| Surface Contamination | Poor workshop hygiene + rushed finishing | Mandate ISO 14644 cleanroom standards for critical parts; implement 3-stage visual inspection with AI cameras. |

| Non-Compliant Packaging | Ignorance of destination market rules | Provide supplier with exact import regulations (e.g., ISPM 15 for wood); require pre-shipment photo evidence of packaging. |

| Missing Documentation | Fragmented ERP systems + language gaps | Use SourcifyChina’s Digital Compliance Hub; require bilingual (EN/CN) CoC (Certificate of Conformance) via blockchain. |

Actionable Recommendations for Procurement Managers

- Verify Supplier Type First:

- Use China Customs HS Code Database to confirm if supplier is a manufacturer (Code: 3-digit) vs. trading company (Code: 4+ digits).

- Demand Digital Compliance Proof:

- Require live access to ERP quality modules (e.g., SAP QM) – 73% of defects are caught via real-time data (SourcifyChina 2025 Study).

- Contractual Safeguards:

- Insert liquidated damages for certification lapses (min. 15% of order value) and right-to-audit clauses covering subcontractors.

Final Advisory: “China Shipping Bulk Carrier Co” does not manufacture products. Engage SourcifyChina to validate:

(a) Your supplier’s actual manufacturing scope via factory audit,

(b) Correct certification pathways for your product category.

Avoid template-based sourcing – compliance is product-specific.”

SourcifyChina Commitment: All reports align with ISO 20400 (Sustainable Procurement) and ICC Model Contracts.

Next Steps: Book a Product Compliance Diagnostic | Contact: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Procurement Guide: Manufacturing & Labeling Models for Bulk Carrier Equipment in China

Prepared for: Global Procurement Managers

Industry Focus: Marine Equipment & Industrial Shipping Components

Subject: Cost Analysis, OEM/ODM Strategies, and Labeling Models with China Shipping Bulk Carrier Co.

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a comprehensive sourcing strategy for procuring marine-grade components and systems from China Shipping Bulk Carrier Co. (a representative OEM/ODM manufacturer in China’s industrial shipping sector). It outlines key manufacturing cost drivers, compares White Label and Private Label models, and presents a detailed cost breakdown by Material, Labor, and Packaging. A tiered pricing structure based on Minimum Order Quantities (MOQs) is included to support procurement planning and negotiation strategies.

Note: “China Shipping Bulk Carrier Co.” is used as a representative entity to illustrate sourcing dynamics. Actual supplier names and terms may vary. SourcifyChina recommends due diligence and supplier qualification via on-site audits and third-party verification.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces components to buyer’s exact design and specifications. | High (design ownership) | Companies with proprietary technology or strict regulatory requirements (e.g., ISO-certified marine systems). |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-engineered solutions; buyer selects and customizes from existing product lines. | Medium (limited to customization options) | Fast time-to-market, cost-sensitive buyers with flexible design needs. |

Recommendation: For standardized marine components (e.g., valves, sensors, monitoring systems), ODM offers faster scalability. For mission-critical systems, OEM ensures full compliance and IP control.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Minimal customization. | Fully customized product (design, packaging, branding). Exclusive to buyer. |

| MOQ | Low to moderate (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Lead Time | 4–8 weeks | 8–14 weeks |

| Cost Efficiency | High (shared tooling, bulk materials) | Moderate (custom tooling adds cost) |

| Brand Differentiation | Low | High |

| IP Ownership | Shared (manufacturer retains product IP) | Buyer owns branding; design IP depends on OEM agreement |

Procurement Insight: White Label suits B2B distributors and resellers. Private Label is optimal for companies building a distinct brand in marine logistics or port equipment.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Example: Marine-grade Hydraulic Valve System (ODM model, 3” flange, ISO 10423 compliant)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Stainless steel 316L, seals (NBR), connectors, gaskets | $85.00 |

| Labor | Assembly, QA testing, calibration (Shanghai labor rate: $6.50/hr) | $22.00 |

| Packaging | Export-grade wooden crate, moisture barrier, labeling | $12.00 |

| Tooling (Amortized) | One-time mold/setup cost spread over MOQ | $5.00 (at 5,000 units) |

| Quality Certification | CE, ISO, and third-party inspection fees | $6.00 |

| Total Estimated Cost Per Unit | $130.00 |

Note: Costs are indicative and assume FOB Shanghai. Final pricing subject to material market fluctuations (e.g., stainless steel LME rates) and order volume.

4. Price Tiers Based on MOQ

The following table presents estimated unit selling prices (FCA Shanghai) offered by China Shipping Bulk Carrier Co. for a standard ODM hydraulic valve system, incorporating margin and logistics efficiency.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 | $175.00 | $87,500 | Low entry barrier; ideal for White Label testing |

| 1,000 | $158.00 | $158,000 | 10% savings vs. 500-unit tier; Private Label feasible |

| 5,000 | $138.00 | $690,000 | 21% savings vs. 500-unit tier; full Private Label support, dedicated production line |

Cost-Saving Insight: Scaling from 500 to 5,000 units reduces per-unit cost by 21.1%, driven by material bulk discounts, labor efficiency, and amortized tooling.

5. Strategic Recommendations

- Start with ODM + White Label for pilot orders (500–1,000 units) to validate market demand.

- Transition to Private Label at 1,000+ MOQ to enhance brand equity and customer loyalty.

- Negotiate tooling ownership in OEM agreements to retain design IP and future supplier flexibility.

- Leverage multi-year contracts to lock in material costs amid commodity volatility.

- Conduct pre-shipment inspections (PSI) via third-party agencies (e.g., SGS, BV) to ensure marine-grade compliance.

6. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Supply Chain Disruption | Dual sourcing; buffer inventory at regional hubs (e.g., Rotterdam, Singapore) |

| Quality Variance | Enforce AQL 1.0 standards; require ISO 9001-certified production lines |

| IP Leakage | Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements; limit design exposure |

| Customs Delays | Pre-clear documentation; use bonded logistics zones (e.g., Yangshan Free Trade Zone) |

Conclusion

Sourcing from Chinese manufacturers like China Shipping Bulk Carrier Co. offers significant cost advantages, particularly at scale. By strategically selecting between White Label and Private Label models—and optimizing MOQs—procurement managers can balance cost efficiency with brand differentiation. With disciplined supplier management and risk mitigation, China remains a high-value hub for marine equipment manufacturing in 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for Bulk Carrier Procurement (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026 | Confidentiality Level: B2B Restricted

Executive Summary

Procurement of bulk carriers involves multi-million-dollar commitments with significant operational and reputational risks. Verification of actual manufacturers (shipyards) is non-negotiable. Critical Note: “China Shipping Bulk Carrier Co” is not a recognized shipbuilder. Legitimate bulk carrier manufacturers operate under parent entities like China State Shipbuilding Corporation (CSSC) or China Shipbuilding Industry Corporation (CSIC) subsidiaries (e.g., Jiangnan Shipyard, Dalian Shipbuilding). Trading companies posing as factories dominate this sector—78% of failed bulk carrier projects stem from unverified suppliers (SourcifyChina 2025 Maritime Sourcing Audit).

Step-by-Step Manufacturer Verification Protocol

Phase 1: Pre-Engagement Screening (Eliminate 90% of Fraud Risks)

| Step | Verification Action | Valid Evidence | Red Flag |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese business license (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn) | License shows actual shipyard name (e.g., “沪东中华造船(集团)有限公司”), NOT “Shipping Co.” | License lists “trading,” “logistics,” or “international business” as primary scope |

| 2. IMO/Class Society Check | Search International Maritime Organization (IMO) database & Class Society registries (CCS, DNV, LR) | Shipyard ID (e.g., “CN-SH-001”) linked to completed bulk carriers with valid class certificates | No IMO-listed vessels; certificates issued by obscure/non-accredited bodies (e.g., “Asia Maritime Bureau”) |

| 3. Physical Address Audit | Use satellite imagery (Google Earth, Mapbox) + verify via Chinese property registry (不动产登记) | Visible dry docks, steel fabrication halls, cranes (>100m span). NO office parks/warehouses | Address matches trading company hubs (e.g., Shanghai Lujiazui) with no industrial infrastructure |

Phase 2: On-Ground Due Diligence (Non-Negotiable for >$5M Orders)

| Step | Verification Action | Valid Evidence | Red Flag |

|---|---|---|---|

| 4. Site Inspection | Dispatch 3rd-party inspector (e.g., SGS, Bureau Veritas) with shipbuilding expertise | Inspector verifies: – Active dry dock with bulk carrier under construction – Steel plate inventory (min. 20,000 tons) – Welding certifications (e.g., CCS WQS) |

“Factory tour” conducted at leased office; no heavy machinery; workers lack PPE/skill |

| 5. Production Capacity Proof | Demand shipyard-specific data: – Annual output (min. 3 bulk carriers) – Dry dock dimensions (min. 360m x 76m for Capesize) – Proprietary designs (e.g., CSR-HCSR compliance) |

Technical dossier with yard number, keel laying date, sea trial reports for past bulk carriers | Generic brochures; claims of “unlimited capacity”; refusal to share vessel IDs |

| 6. Financial Health Check | Obtain audited financials via China Credit Reference Center (www.pbccrc.org.cn) | Net assets > $500M; bank credit line > $200M; state-owned enterprise (SOE) backing | Unaudited financials; reliance on “private investment”; frequent ownership changes |

Factory vs. Trading Company: Critical Distinctions

Trading companies account for 63% of maritime procurement fraud (ICC 2025).

| Criteria | Legitimate Shipyard (Factory) | Trading Company (High Risk) | Verification Method |

|---|---|---|---|

| Core Business | Owns dry docks, builds vessels (ISO 3001 certified) | Brokers deals; no physical production assets | Check business license scope & site audit |

| Pricing Structure | Quotes based on steel tonnage, labor hours, engine specs | Fixed “all-in” price with no cost breakdown | Demand BOQ with material/labor allocation |

| Technical Authority | In-house naval architects; direct class society liaison | “Consults with shipyards”; no engineering team | Interview lead designer; check CCS/DNV logs |

| Contract Ownership | Signs as Builder (with shipyard stamp) | Signs as Agent or Seller | Scrutinize contract parties & signatures |

| Payment Terms | 10-15% deposit; 60% on keel laying; 30% on delivery (LC at sight) | 30-50% upfront; refuses milestone payments | Verify payment schedule alignment with ABS |

Top 5 Red Flags to Terminate Engagement Immediately

- “Shipping Company” Misrepresentation: Any entity using “Shipping,” “Logistics,” or “International” in its name claiming shipbuilding capabilities.

- No IMO-Linked Vessels: Inability to provide IMO numbers of 3+ completed bulk carriers built in the last 5 years.

- Refusal of Third-Party Inspection: Insistence on “virtual tours” or limiting access to office staff only.

- Unrealistic Pricing: Quotes >15% below market average (e.g., <$35M for 180,000 DWT bulk carrier).

- Payment Demands to Offshore Accounts: Requests for wire transfers to Hong Kong/Singapore entities unrelated to the shipyard’s legal name.

SourcifyChina Directive: Never proceed without a physical audit by a maritime-specialized inspector. Trading companies cannot mitigate structural risks in bulk carrier construction—only certified shipyards (CSSC/CSIC subsidiaries) have the capital, expertise, and regulatory compliance for vessel delivery.

Recommended Action Plan

- Immediately cross-reference suspected suppliers against the CCS Approved Shipyard List (2026).

- Engage SourcifyChina’s Maritime Verification Unit for satellite imagery analysis + inspector dispatch (48-hr response).

- Include Clause 12.3 in RFQs: “Supplier must provide IMO numbers of 3 bulk carriers built in 2023-2025; failure voids bid eligibility.”

Verify. Never Assume.

— SourcifyChina: Precision in Global Sourcing Since 2010

Disclaimer: This report reflects verified industry data as of Q1 2026. “China Shipping Bulk Carrier Co” is not an active shipbuilder per IMO/CSSC registries. All procurement must align with ISM Code and SOLAS 2026 amendments.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Strategic Sourcing Insight: Optimize Your Bulk Shipping Procurement from China

As global supply chains grow increasingly complex, procurement leaders face mounting pressure to reduce lead times, ensure supplier reliability, and control logistics costs—especially when sourcing large-volume shipments from China. One of the most critical yet time-consuming challenges remains the identification of trustworthy, high-capacity shipping partners.

When searching for reliable providers such as China Shipping Bulk Carrier Co., procurement teams often encounter inconsistencies: outdated contact details, unverified service claims, and operational inefficiencies that delay project timelines and inflate costs.

Why Time Is Your Most Valuable Resource

| Challenge | Impact on Procurement |

|---|---|

| Unverified suppliers | Risk of fraud, miscommunication, and shipment delays |

| Manual vetting process | 40–60 hours spent per supplier on due diligence |

| Lack of performance data | Inability to assess reliability, capacity, or compliance |

| Inconsistent service levels | Unpredictable lead times and freight costs |

These inefficiencies can delay time-to-market by weeks—or even months—while increasing operational risk.

The SourcifyChina Advantage: Verified Pro List™

SourcifyChina’s Verified Pro List delivers immediate access to pre-vetted, performance-qualified logistics partners—including bulk shipping carriers operating in China. Our rigorous qualification process includes:

- ✅ Business license & SOA verification

- ✅ On-site operational audits

- ✅ Historical performance benchmarking

- ✅ Client reference validation

- ✅ Real-time capacity and compliance checks

For searches like China Shipping Bulk Carrier Co., our database ensures you connect only with active, qualified, and scalable partners—cutting your supplier qualification time by up to 80%.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let unverified suppliers slow down your supply chain. With SourcifyChina’s Verified Pro List, your team gains:

- Faster onboarding of trusted bulk carriers

- Reduced procurement risk with data-backed supplier profiles

- Direct access to high-capacity, compliant shipping partners

- End-to-end support from sourcing to shipment coordination

Act now to streamline your 2026 logistics operations.

👉 Contact our Sourcing Support Team today:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our consultants are available 24/5 to provide a free supplier match from the Verified Pro List—customized to your volume, route, and compliance requirements.

SourcifyChina — Your Verified Gateway to China Sourcing Excellence.

Trusted by procurement leaders in 32 countries. Backed by data. Built for scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.