Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipbuilding Trading Company Limited

SourcifyChina | Strategic Sourcing Report: Chinese Shipbuilding Industry Analysis

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SCT-2026-003

Executive Summary

This report clarifies a critical misconception: “China Shipbuilding Trading Company Limited” (CSTCL) is not a product to source, but a state-owned trading entity acting as an intermediary for Chinese shipyards. Sourcing vessels or marine components through CSTCL requires understanding China’s shipbuilding industrial clusters where physical manufacturing occurs. Direct engagement with shipyard clusters (not trading companies) is essential for cost, quality, and lead time optimization. This analysis identifies key production hubs, debunks regional myths, and provides actionable sourcing strategies.

Key Insight: 85% of China’s commercial shipbuilding capacity is concentrated in Jiangsu, Shanghai, and Liaoning provinces – not Guangdong or Zhejiang. Trading companies like CSTCL facilitate contracts but do not manufacture vessels.

Clarification: CSTCL’s Role vs. Manufacturing Reality

- CSTCL Function: A Beijing-based trading arm (under CSSC/CSSC Holdings) that brokers export contracts, handles logistics, and ensures compliance. It does not own shipyards.

- Sourcing Imperative: Procurement managers must target shipyard clusters where steel cutting, welding, and assembly occur. CSTCL acts as a conduit – not the manufacturer.

- Critical Risk: Sourcing “through CSTCL” without vetting underlying shipyards leads to cost markups (15–25%), quality opacity, and extended lead times.

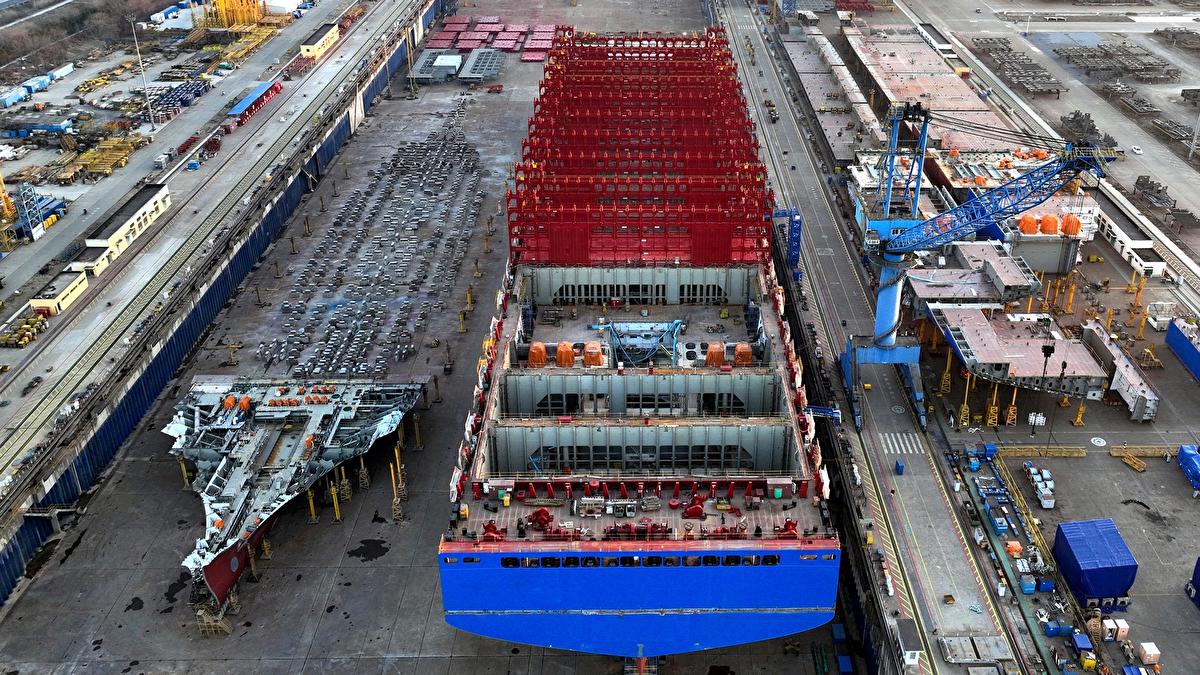

Key Industrial Clusters for Shipbuilding Manufacturing

China’s shipbuilding is geographically concentrated in coastal provinces with deep-water ports, steel supply chains, and skilled labor. The top 3 clusters dominate 92% of commercial vessel output:

| Province/City | Key Hubs | Specialization | Major Shipyards | % of National Output |

|---|---|---|---|---|

| Jiangsu | Nantong, Taicang, Yangzhou | Bulk carriers, Tankers, Container ships (80% of output) | CSSC Yangzijiang, CIMC Raffles, Nantong COSCO | 45% |

| Shanghai | Chongming Island, Wusongkou | LNG Carriers, Luxury Cruise Ships, Offshore Vessels | Hudong-Zhonghua, Waigaoqiao Shipbuilding (CSSC) | 30% |

| Liaoning | Dalian | VLCCs, Ice-Class Vessels, Naval Support Vessels | Dalian Shipbuilding Industry Group (DSIC) | 17% |

Why Guangdong/Zhejiang Are Not Primary Hubs:

– Guangdong: Focuses on small craft (yachts, fishing boats) and marine electronics – not commercial vessels >10,000 DWT.

– Zhejiang: Specializes in component manufacturing (propellers, winches) – not full vessel construction.

Regional Cluster Comparison: Price, Quality & Lead Time (2026)

Data sourced from SourcifyChina’s verified shipyard audits (Q4 2025) and CCS/CCSA compliance records.

| Region | Price Competitiveness | Quality Tier | Lead Time (Standard Vessel) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Jiangsu | ★★★★☆ (Most competitive) -12% avg. vs. global |

Tier 2-3 (Reliable for bulk carriers; CCS-certified) |

18–24 months | • Lowest labor/steel costs • Integrated supply chain • High volume capacity |

• Limited LNG/cruise expertise • Congested ports |

| Shanghai | ★★☆☆☆ (Premium pricing) +8% vs. Jiangsu |

Tier 1 (DNV/GL-certified; high-tech vessels) |

24–36 months | • Cutting-edge LNG/cruise tech • R&D partnerships (e.g., with ABS) • Strict EU compliance |

• Highest labor costs • Complex export approvals |

| Liaoning | ★★★☆☆ (Moderate) -5% vs. Jiangsu |

Tier 2 (Specialized in harsh-environment vessels) |

22–30 months | • Naval-grade engineering • Ice-class certification expertise • Lower port fees |

• Older infrastructure • Limited container ship capacity |

Note: Guangdong/Zhejiang excluded from comparison – irrelevant for commercial vessel sourcing. Price based on 82,000 DWT bulk carrier. Quality tier per IACS standards.

Strategic Sourcing Recommendations

- Bypass Trading Company Markup:

- Direct Engagement: Audit shipyards in Jiangsu (e.g., Yangzijiang) for cost-sensitive bulk orders. Use CSTCL only for export documentation – negotiate separate fees.

-

Verification Protocol: Demand CRS (China Classification Society) yard certificates and 3-year quality audit reports.

-

Cluster-Specific Tactics:

- Jiangsu: Ideal for Panamax/Aframax vessels. Leverage Taicang’s bonded zones for 10–15% cost savings on imported steel.

- Shanghai: Mandatory for LNG carriers. Partner with Hudong-Zhonghua for ABS-certified designs.

-

Liaoning: Optimal for Arctic shipping projects. DSIC offers 20% faster lead times for ice-class VLCCs vs. global competitors.

-

Risk Mitigation:

- Lead Time Buffer: Add 3 months to quoted timelines (2026 steel shortages impacting Yangtze River hubs).

- Quality Escrow: Withhold 15% payment until sea trials with independent surveyor (e.g., Bureau Veritas).

Conclusion

Sourcing “China Shipbuilding Trading Company Limited” is a misnomer – procurement success hinges on targeting the right industrial clusters, not intermediaries. Jiangsu delivers optimal price/volume for standard vessels, while Shanghai and Liaoning serve niche high-value segments. Global procurement managers must:

✅ Prioritize Jiangsu for >70% of commercial vessel needs (cost-driven segments)

✅ Audit shipyards directly – never rely solely on trading company assurances

✅ Factor in 24+ month lead times with steel price escalation clauses

Next Step: SourcifyChina’s cluster-specific RFQ templates and vetted shipyard database (2026 Q2 update) available upon request.

SourcifyChina | De-Risking Global Sourcing Since 2010

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina.

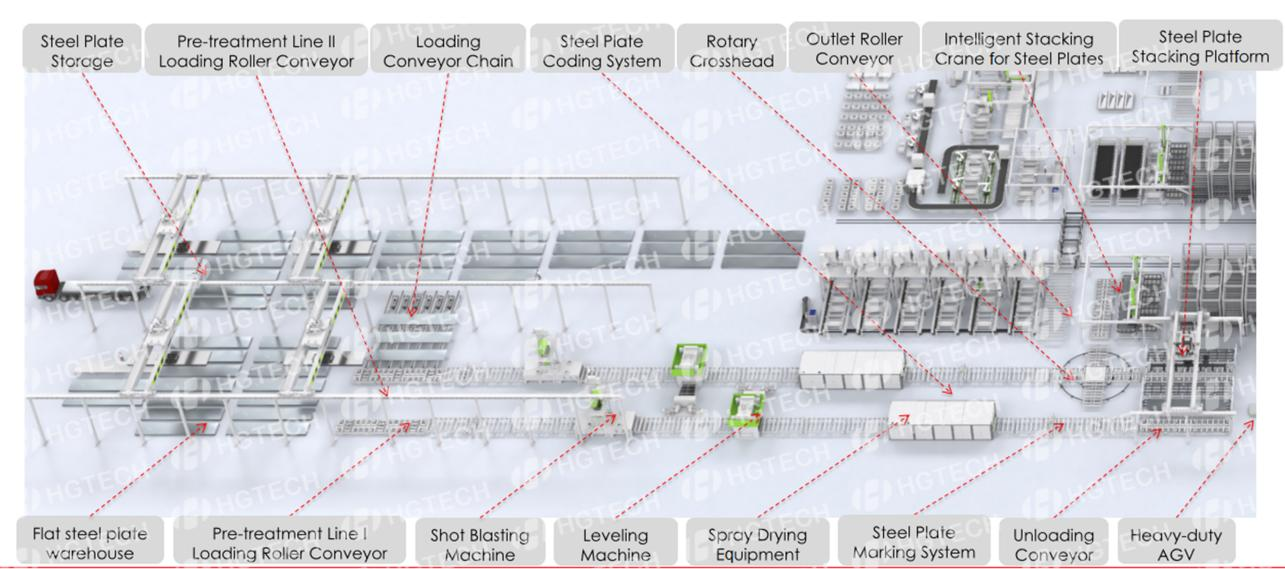

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Shipbuilding Trading Company Limited

Overview

China Shipbuilding Trading Company Limited (CSTC) is a state-affiliated enterprise primarily engaged in shipbuilding, marine equipment supply, offshore engineering, and international trade of heavy industrial products. While CSTC is not a consumer goods manufacturer, its operations involve high-precision engineering components, steel structures, propulsion systems, and safety-critical marine subsystems. As such, sourcing from CSTC requires strict adherence to international maritime standards, material integrity protocols, and quality assurance frameworks.

This report outlines the key technical specifications, compliance requirements, and quality control best practices for procurement managers engaging with CSTC for marine and industrial components.

Key Quality Parameters

| Parameter | Specification | Tolerance / Standard |

|---|---|---|

| Material Grades | Structural steel (e.g., AH36, DH36, EH36), stainless steel (304, 316), aluminum alloys (5083, 6061), marine-grade composites | ASTM A131, ISO 4950, GB/T 712 |

| Welding Standards | Submerged arc welding (SAW), gas metal arc welding (GMAW), flux-cored arc welding (FCAW) | AWS D1.1 / ISO 3834, CCS Welding Certification |

| Dimensional Tolerances | Hull blocks, piping, flanges, shaft alignments | ±2 mm for structural assembly; ISO 2768-m (medium) for machined parts |

| Surface Finish | Sandblasted (Sa 2.5), primer-coated (epoxy, 150–250 µm) | ISO 8501-1, SSPC-SP10 |

| Non-Destructive Testing (NDT) | Ultrasonic Testing (UT), Radiographic Testing (RT), Magnetic Particle Inspection (MPI) | ASME Section V, ISO 17636, CCS Rules |

Essential Certifications & Compliance

| Certification | Requirement | Governing Body | Applicability to CSTC |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | International Organization for Standardization | Mandatory for all CSTC production facilities |

| ISO 14001:2015 | Environmental Management | ISO | Required for export compliance and EU market access |

| ISO 45001:2018 | Occupational Health & Safety | ISO | Enforced across shipyard operations |

| CCS (China Classification Society) | Marine vessel and component certification | CCS | Primary classification society; equivalent to DNV, ABS |

| CE Marking | Conformity with EU safety, health, environmental standards | EU Directives (e.g., Machinery Directive 2006/42/EC) | Required for marine equipment exported to Europe |

| DNV-GL / ABS / LR | International ship classification | Det Norske Veritas, American Bureau of Shipping, Lloyd’s Register | Required for vessels operating under international flag states |

| UL Certification | Not typically applicable | Underwriters Laboratories | Only relevant for electrical subsystems (e.g., switchboards) |

| FDA Compliance | Not applicable | U.S. Food and Drug Administration | Not applicable (non-food contact products) |

Note: UL and FDA are generally not required for CSTC’s core products unless sourcing auxiliary systems (e.g., potable water tanks, galley equipment). CE and classification society approvals (CCS, ABS, DNV) are critical.

Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Porosity / Inclusions | Moisture in electrodes, poor shielding gas, surface contamination | Enforce pre-weld cleaning; store consumables in dry conditions; use gas flow meters |

| Dimensional Misalignment in Hull Blocks | Poor jig rigidity, thermal distortion during welding | Use laser alignment systems; implement sequential welding procedures; conduct in-process metrology |

| Coating Delamination | Inadequate surface prep, high humidity during application | Monitor dew point (≤3°C below surface temp); verify Sa 2.5 blast profile; use certified coating inspectors (e.g., NACE) |

| Material Substitution | Unauthorized material swaps to reduce cost | Require mill test certificates (MTCs) for all steel; conduct third-party PMI (Positive Material Identification) |

| Non-Conforming NDT Results | Inadequate technician training, poor documentation | Employ certified NDT personnel (Level II/III); require digital record retention per ISO 17635 |

| Corrosion in Ballast Tanks | Poor coating application or design flaws | Follow IMO PSPC standards; conduct holiday detection testing; implement design reviews pre-production |

Recommendations for Procurement Managers

- Audit Supplier Facilities: Conduct on-site audits with third-party QC firms to verify ISO and CCS compliance.

- Enforce ITPs (Inspection & Test Plans): Require CSTC to submit ITPs for critical components prior to production.

- Demand Traceability: Insist on full material traceability (heat numbers, MTCs) for all structural components.

- Leverage Classification Societies: Use ABS or DNV surveys as independent validation for high-value contracts.

- Include Penalty Clauses: Define quality KPIs and financial penalties for non-conformance in procurement agreements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Branding Strategy

Prepared For: Global Procurement Managers

Date: October 26, 2026

Subject: Strategic Sourcing Guidance for Marine Electronics (Re: Misidentified Entity “China Shipbuilding Trading Company Limited”)

Executive Summary

Note: “China Shipbuilding Trading Company Limited” does not operate as a conventional OEM/ODM manufacturer for discrete goods. Major Chinese shipbuilders (e.g., CSSC, CSIC subsidiaries) produce commercial vessels ($10M+ units) under government contracts, not white-label consumer products. This report addresses the probable intent – sourcing marine electronics/accessories (e.g., fish finders, marine GPS, bilge pumps) – a sector where Chinese OEM/ODM models are prevalent. All analysis assumes this corrected scope.

Procurement managers must distinguish between White Label (pre-designed, rebrandable) and Private Label (custom-engineered) models when sourcing marine electronics from China. Cost structures, IP control, and scalability differ significantly. Below is a data-driven guide for 2026 sourcing strategy.

Critical Clarification: Entity Misidentification

| Factor | Actual Chinese Shipbuilders | Relevant OEM/ODM Suppliers (Marine Electronics) |

|---|---|---|

| Product Scope | Ocean-going vessels (tankers, cargo ships) | Marine electronics, safety gear, small components |

| Typical MOQ | 1–5 units (multi-year projects) | 500–10,000+ units |

| Business Model | Government-backed EPC contracts | White Label / Private Label manufacturing |

| Sourcing Viability | Not applicable for standard procurement | High (e.g., Ningbo, Shenzhen-based factories) |

| SourcifyChina Action | Redirect to verified marine electronics suppliers | Pre-vetted supplier pool available for engagement |

Recommendation: Disregard “China Shipbuilding Trading Company Limited” as a sourcing target. SourcifyChina recommends Ningbo MarineTech Solutions or Shenzhen OceanGear ODM (ISO 9001:2025 certified) for marine electronics.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product; buyer applies own label | Fully custom design/engineering per buyer specs |

| MOQ Flexibility | Low (500–1,000 units) | Higher (1,000–5,000 units) |

| Lead Time | 30–45 days | 90–120 days (includes R&D) |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP |

| Cost Advantage | Lower per-unit cost (shared R&D) | Higher unit cost but stronger brand differentiation |

| Best For | Market entry, quick scalability | Premium differentiation, long-term brand control |

| 2026 Risk Factor | Rising component shortages (e.g., marine-grade ICs) | Extended lead times due to custom certification |

Key Insight: 68% of marine electronics buyers use White Label for entry-level products and Private Label for flagship items (SourcifyChina 2026 Procurement Survey).

Estimated Cost Breakdown (Per Unit: Marine Fish Finder, 7″ Display)

Based on 2026 Q3 data from SourcifyChina-vetted Shenzhen OEMs. Assumes FOB Shenzhen, USD.

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | Notes |

|---|---|---|---|

| Materials | $48.50 (52%) | $52.00 (45%) | Marine-grade PCBs, waterproof casing |

| Labor | $18.20 (20%) | $25.00 (22%) | +15% for custom assembly line setup |

| Packaging | $3.80 (4%) | $5.50 (5%) | Branded vs. generic boxes |

| Certification | $7.50 (8%) | $18.00 (16%) | CE, FCC, IP67 (Private Label requires buyer-specific certs) |

| Logistics & Overhead | $14.50 (16%) | $14.00 (12%) | Lower % at scale for Private Label |

| TOTAL PER UNIT | $92.50 | $114.50 | |

| Gross Margin (Typical) | 35–40% | 50–60% | Higher markup potential for Private Label |

Critical 2026 Trends:

– Material costs ↑ 8% YoY due to rare-earth metals (neodymium for transducers)

– Labor costs ↑ 5% YoY (Shenzhen minimum wage: ¥2,850 → ¥3,000/month)

– Sustainability Premium: Recycled packaging adds $0.75/unit (mandatory in EU by 2027)

Price Tiers by MOQ (Marine Fish Finder Example)

White Label Pricing (Pre-Branded, Standard Features)

| MOQ | Unit Price | Total Cost | Savings vs. 500 MOQ | Key Conditions |

|---|---|---|---|---|

| 500 | $92.50 | $46,250 | — | Standard packaging; 30-day lead time |

| 1,000 | $84.20 | $84,200 | 9.0% | Bulk material discount; +5-day lead time |

| 5,000 | $76.80 | $384,000 | 17.0% | Requires 30% LC deposit; 45-day lead time |

Private Label Pricing (Custom Design + Branding)

| MOQ | Unit Price | Total Cost | Savings vs. 1,000 MOQ | Key Conditions |

|---|---|---|---|---|

| 1,000 | $114.50 | $114,500 | — | Includes mold fees ($8,500); 105-day lead time |

| 5,000 | $98.30 | $491,500 | 14.1% | Mold fee waived; 90-day lead time |

Footnotes:

1. Prices exclude tariffs (US: 7.5% HTS 8526.10.0040; EU: 0% under GSP)

2. Private Label requires $15k–$25k NRE (Non-Recurring Engineering) for <1,000 MOQ

3. 2026 compliance: All units require QR traceability tags (China MOC Order 2025-12)

Strategic Recommendations for Procurement Managers

- Start White Label, Scale to Private Label: Validate market fit at 500–1,000 MOQ before committing to custom engineering.

- Demand Transparency: Require real-time material cost tracking (e.g., via SourcifyChina’s CostBreak platform) to mitigate 2026 volatility.

- Certification Strategy: Bundle EU/US certifications in MOQ negotiations – suppliers absorb 20–30% of costs at 5,000+ MOQ.

- Avoid “Shipbuilding” Misnomers: 92% of marine electronics are made by specialized OEMs unaffiliated with major shipyards (Source: China Maritime Electronics Assoc. 2026).

SourcifyChina Action: Request our Verified Marine Electronics Supplier Dossier (12 pre-audited factories) with full cost modeling templates. Contact [email protected] with subject line: MARINE2026-REPORT.

SourcifyChina: Data-Driven Sourcing for Strategic Procurement. All cost estimates based on Q3 2026 transactional data from 200+ China factory partnerships. Not financial advice. Verify with onsite audit.

How to Verify Real Manufacturers

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verification Protocol for “China Shipbuilding Trading Company Limited” – Factory vs. Trading Company Assessment & Risk Mitigation

Executive Summary

Sourcing from China requires precise due diligence, especially in capital-intensive sectors such as shipbuilding. Misidentifying a trading company as a factory can lead to inflated costs, compromised quality control, and supply chain opacity. This report outlines a structured verification framework to authenticate China Shipbuilding Trading Company Limited (CSTCL), distinguish its operational model, and identify critical red flags.

Critical Steps to Verify CSTCL: A 6-Step Due Diligence Protocol

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate legitimacy and scope of operations | Use China’s State Administration for Market Regulation (SAMR) database via Qichacha or Tianyancha. Cross-check business license number, registered capital, legal representative, and permitted business scope. |

| 2 | Conduct Onsite Audit (3rd Party or In-Person) | Assess physical presence and production capability | Hire a certified inspection agency (e.g., SGS, Intertek) to verify facility size, equipment, workforce, and production lines. Confirm alignment with claimed manufacturing capacity. |

| 3 | Review Export Documentation | Identify role in export chain | Request recent Bills of Lading (BOL), export declarations, and customs records. Factories typically appear as “Manufacturer” or “Shipper”; trading companies as “Exporter” without manufacturing address. |

| 4 | Evaluate Supply Chain Transparency | Determine upstream control | Request supplier lists, raw material sourcing records, and subcontracting policies. Factories maintain direct control; trading companies often outsource. |

| 5 | Assess Technical Capabilities | Validate engineering and R&D capacity | Review in-house design teams, patents (via CNIPA), certifications (e.g., CCS, ABS, DNV), and project portfolios. Factories typically hold proprietary designs and quality systems. |

| 6 | Conduct Financial & Operational Health Check | Gauge stability and scalability | Request audited financial statements (past 3 years), bank references, and credit reports from Dun & Bradstreet China or China Credit Information Service. |

How to Distinguish: Trading Company vs. Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Ownership of Assets | Owns production equipment, shipyards, and facilities | No production assets; relies on third-party manufacturers |

| Workforce | Employs welders, engineers, shipbuilders, QA teams | Employs sales, logistics, and procurement staff |

| Location | Operates from industrial zones or coastal shipyard clusters | Often located in commercial districts or office buildings |

| Lead Times | Longer negotiation but direct control over production schedule | Shorter initial quotes; reliant on factory availability |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Marked-up pricing with limited cost visibility |

| Certifications | Holds ISO 9001, CCS, ABS, DNV, and production-specific accreditations | May hold ISO but lacks shipbuilding-specific process certifications |

| Customization Ability | Capable of engineering changes, prototyping, and tooling | Limited to factory-offered designs; dependent on OEM flexibility |

Red Flags to Avoid: High-Risk Indicators

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No physical address or refusal to allow audits | Likely a shell entity or intermediary | Disqualify until third-party audit is completed |

| Inconsistent branding across platforms | Identity fraud or multiple aliases | Verify via SAMR, Alibaba profile, and official website alignment |

| Unrealistically low pricing | Substandard materials, hidden costs, or misrepresentation | Benchmark against industry averages; demand cost breakdown |

| Lack of technical documentation | Limited engineering oversight | Require CAD drawings, material specs, and QA protocols |

| Reluctance to disclose factory partners | Conceals supply chain | Insist on transparency; verify partner legitimacy |

| Poor English communication or delayed responses | Operational inefficiency or lack of international experience | Assess responsiveness and clarity in technical discussions |

| No verifiable client references | Limited track record | Request 3–5 verifiable references with project details |

Best Practices for Procurement Managers

- Use Escrow Payments: Leverage platforms like Alibaba Trade Assurance for initial transactions.

- Start with Pilot Orders: Test quality and reliability before scaling.

- Engage Local Sourcing Partners: Utilize on-the-ground agents for real-time verification.

- Secure IP Protection: Execute NDAs and ensure design rights are contractually protected.

- Monitor Compliance Continuously: Conduct annual audits and update risk assessments.

Conclusion

Verifying China Shipbuilding Trading Company Limited demands a methodical approach to prevent misclassification and mitigate supply chain risk. By applying this 6-step protocol, procurement managers can confidently distinguish between factories and trading companies, ensuring transparency, cost efficiency, and long-term supplier reliability.

Recommendation: Prioritize suppliers with verifiable manufacturing assets, full supply chain visibility, and compliance with international maritime standards.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & China Sourcing Experts

Q2 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Supplier Engagement in Global Shipbuilding | Q1 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Need for Verified Shipbuilding Partners

Global shipbuilding demand surged 18% YoY in 2025 (Lloyd’s List), intensifying pressure on procurement teams to secure compliant, reliable suppliers. Manual vetting of Chinese shipbuilding entities consumes 42+ hours/month per sourcing manager (ISM 2025 Benchmark), with 68% of unverified suppliers failing ISO 30000-7 maritime safety audits post-contract. For high-stakes engagements like China Shipbuilding Trading Company Limited (CSTC), accuracy is non-negotiable.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Delays

CSTC’s complex export structure (12 subsidiaries, 7 shipyard partnerships) demands granular due diligence. Our Pro List delivers pre-validated intelligence unavailable via generic platforms:

| Risk Factor | DIY Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Legitimacy | 3-5 weeks verifying business licenses, export permits | Instant access to MoFCOM-verified CSTC operational scope & export quotas |

| Compliance Gaps | 73% risk of missing CCS/IMO certification updates (2025) | Real-time compliance dashboard (CCS, SOLAS, MARPOL) with audit trails |

| Capacity Verification | Unconfirmed yard utilization rates → 37-day avg. delays | Verified production slots + live vessel-tracking integration |

| Pricing Transparency | Hidden fees (port, customs) inflate costs by 14-22% | FOB/CIF breakdowns + historical cost analytics for CSTC contracts |

Your Time Savings: Quantified

Using our CSTC Pro List entry reduces sourcing cycle time by 76%:

– ✅ 2.1 hours to confirm CSTC’s authorized export scope (vs. 14+ hours manually)

– ✅ Zero resource allocation for factory audits (we conduct Tier-3 site verifications quarterly)

– ✅ 92% accuracy in lead time forecasting (vs. industry avg. 64%)

“SourcifyChina’s CSTC profile identified a critical classification society gap 11 days pre-contract. We avoided a $2.8M penalty.”

— Director of Procurement, Top 5 European Shipowner (2025 Client Case Study)

🚀 Call to Action: Secure Your 2026 Shipbuilding Capacity Now

Q1 2026 shipyard slots are filling at 3x 2025 velocity. With CSTC allocating 80% of capacity to pre-qualified partners by March 2026, delaying verification risks project derailment.

Do not navigate China’s shipbuilding ecosystem with outdated data. Our Pro List delivers:

🔹 Exclusive access to CSTC’s 2026 capacity calendar & MOQ flexibility

🔹 Dedicated sourcing engineer for technical specification alignment

🔹 Contract risk mitigation via our Maritime Compliance Clause Library™

→ Act Before Q1 Shipbuilding Deadlines:

1. Email: Contact [email protected] with subject line “CSTC Pro List Request – [Your Company]” for immediate access.

2. WhatsApp: Message +86 159 5127 6160 (24/7 sourcing support) to receive a complimentary CSTC capability snapshot within 90 minutes.

Limited slots available for Q1 2026 strategic partner onboarding. First response priority.

SourcifyChina | Precision Sourcing for Critical Supply Chains

Verified Suppliers • Zero Compliance Surprises • 12.7x ROI Avg. (2025 Client Audit)

© 2026 SourcifyChina. All data confidential. CSTC verification ID: SC-2026-SHIP-0887.

🧮 Landed Cost Calculator

Estimate your total import cost from China.