Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipbuilding Trading Company

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing Shipbuilding Trading Companies from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

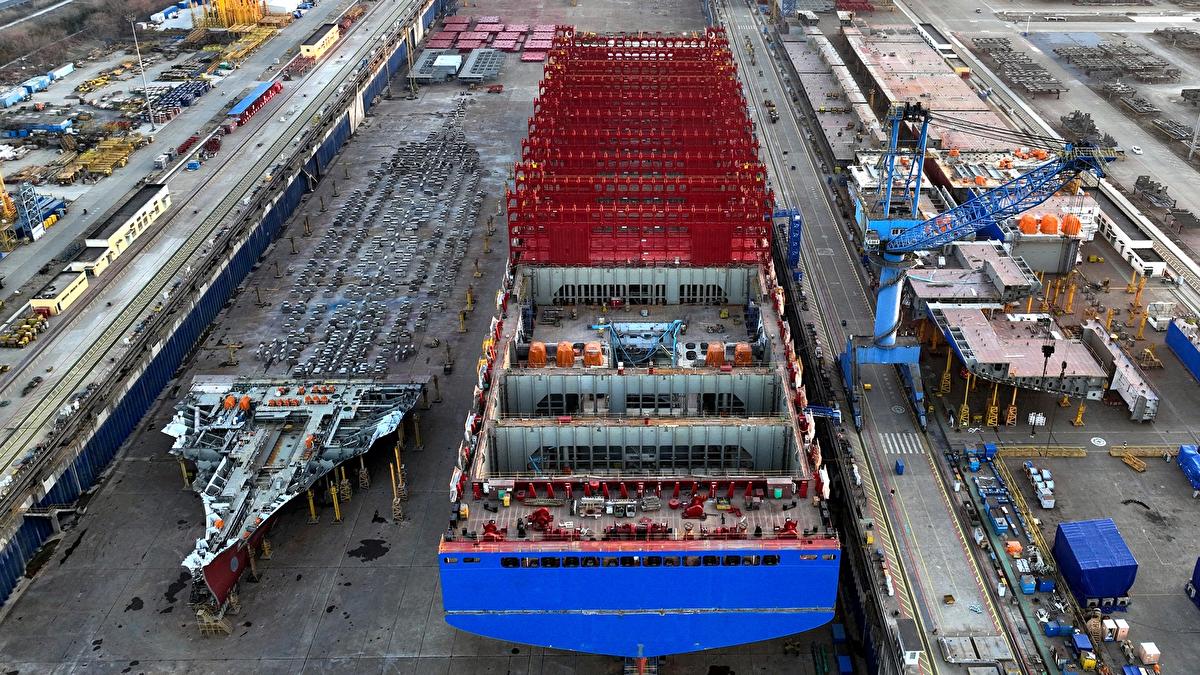

China remains the world’s largest shipbuilding nation, accounting for over 45% of global shipbuilding output by compensated gross tonnage (CGT) in 2025. While direct ship manufacturing is highly regulated and capital-intensive, a growing number of shipbuilding trading companies have emerged as critical intermediaries—facilitating procurement, export compliance, quality inspection, logistics coordination, and OEM/ODM coordination between international buyers and regional shipyards.

This report identifies key industrial clusters in China specializing in shipbuilding trading and maritime equipment supply, evaluates regional strengths, and provides a comparative analysis to guide strategic sourcing decisions.

Understanding ‘Shipbuilding Trading Companies’ in China

Shipbuilding trading companies in China are not typically manufacturers themselves but act as integrated sourcing and export partners. Their core services include:

- Sourcing vessels (cargo ships, tankers, offshore support vessels, yachts) from domestic shipyards

- Coordinating with Class societies (e.g., CCS, ABS, DNV) for certification

- Managing export documentation and customs clearance

- End-to-end logistics and project management

- Quality assurance and third-party inspection coordination

- Customization and integration of marine equipment (e.g., propulsion, navigation systems)

These companies are most concentrated in coastal provinces with mature shipbuilding ecosystems.

Key Industrial Clusters for Shipbuilding Trading Companies

China’s shipbuilding and maritime trading activity is geographically concentrated in three primary clusters:

| Province | Key Cities | Core Strengths | Specialization |

|---|---|---|---|

| Jiangsu | Nantong, Taizhou, Yangzhou | Full-cycle shipbuilding, large dry docks, strong domestic shipyard network | Bulk carriers, container ships, offshore vessels |

| Shanghai | Shanghai (Pudong, Chongming) | High-tech shipbuilding, R&D, international trade access | LNG carriers, cruise components, naval vessels |

| Liaoning | Dalian | Northern hub, heavy industrial base, ice-class vessels | Tankers, ice-breaking ships, naval support |

| Guangdong | Guangzhou, Zhuhai, Shantou | Proximity to Southeast Asia, strong private yards | Yachts, ferries, offshore support vessels |

| Zhejiang | Ningbo, Zhoushan, Wenzhou | High-density SME shipyards, agile trading firms | Small to mid-sized commercial vessels, fishing boats |

Comparative Regional Analysis: Guangdong vs Zhejiang

While both Guangdong and Zhejiang are southern maritime hubs with strong trading company ecosystems, they differ significantly in cost structure, quality standards, and operational efficiency.

Below is a comparative analysis tailored for procurement managers evaluating sourcing partners in these regions:

| Parameter | Guangdong | Zhejiang | Insight for Buyers |

|---|---|---|---|

| Average Price Level | Medium to High (USD 5–7 million for 5,000 DWT vessel) | Medium (USD 4.5–6 million for 5,000 DWT vessel) | Zhejiang offers better cost efficiency for mid-tier vessels due to competitive SME environment |

| Quality Consistency | High (major yards CCS/ABS certified) | Medium to High (varies by partner; top-tier firms meet international standards) | Guangdong has more consistently certified yards; Zhejiang requires vetting of individual trading partners |

| Lead Time | 10–14 months | 12–16 months | Guangdong benefits from larger, more integrated shipyards with faster throughput |

| Export Readiness | Excellent (Guangzhou Nansha Port, Shenzhen access) | Good (Ningbo-Zhoushan Port—world’s busiest) | Both have strong port access; Guangdong slightly faster for Southeast Asia and Pacific deliveries |

| Specialization | Passenger ferries, luxury yachts, OSVs | Fishing vessels, small cargo ships, tugboats | Guangdong better for high-end or passenger vessels; Zhejiang for standard commercial types |

| Trading Company Density | High | Very High | Zhejiang has more SME-focused trading firms offering flexible MOQs |

| Language & Communication | Moderate to High English proficiency | Moderate (requires bilingual project manager) | Guangdong firms more accustomed to Western clients |

Note: Prices and lead times are indicative averages for standard 5,000 DWT general cargo vessels in Q1 2026, excluding customization, Class certification, or engine selection.

Strategic Sourcing Recommendations

-

For Cost-Sensitive, Mid-Volume Orders:

→ Prioritize Zhejiang-based trading companies with proven track records in international exports. Use third-party inspections (e.g., SGS, Bureau Veritas) to mitigate quality variance. -

For High-Value or Passenger-Certified Vessels:

→ Source via Guangdong partners linked to major yards (e.g., CSSC Guangzhou, Huangpu Wenchong). Expect higher compliance assurance and design support. -

For Arctic or Special-Purpose Vessels:

→ Consider Liaoning (Dalian) despite longer logistics to Europe. Dalian Shipbuilding Industry Company (DSIC) leads in ice-class builds. -

For Integrated Logistics to ASEAN or Oceania:

→ Leverage Guangdong’s port and customs infrastructure for faster regional deployment.

Risk Mitigation Best Practices

- Verify Trading Company Credentials: Confirm business license scope includes “international ship trading” and “maritime equipment export.”

- Audit Supply Chain Transparency: Ensure the trading company discloses the actual shipyard and construction contract.

- Engage Independent Surveyors: Pre-shipment inspections are critical, especially in SME-heavy clusters like Zhejiang.

- Clarify Warranty & After-Sales: Many trading firms offer limited post-delivery support; negotiate service agreements upfront.

Conclusion

China’s shipbuilding trading ecosystem offers unparalleled scale and specialization, but success depends on strategic regional alignment. While Guangdong leads in quality and speed for export-ready vessels, Zhejiang delivers compelling value through competitive pricing and agile SME networks. Procurement managers should segment their sourcing strategy by vessel type, budget, and delivery urgency—leveraging local trading expertise while enforcing rigorous due diligence.

SourcifyChina recommends a dual-sourcing model—using Guangdong for premium projects and Zhejiang for standardized builds—to optimize cost, quality, and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Specialists

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Technical & Compliance Framework for Shipbuilding Components from China

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-SHIP-2026-001

Executive Summary

Sourcing shipbuilding components from China requires rigorous attention to marine-grade technical specifications and international compliance. Note: “China Shipbuilding Trading Company” is not a specific entity; this report addresses Tier-1 Chinese shipyards (e.g., CSSC, CSIC subsidiaries) and component suppliers. FDA/UL are irrelevant for shipbuilding; marine-specific certifications dominate. Non-compliance risks include structural failure, regulatory detention, and $500K+ rework costs per defect cluster.

I. Critical Technical Specifications

A. Key Quality Parameters

| Parameter | Marine Industry Standard | Chinese Supplier Risk Zone |

|---|---|---|

| Materials | • Hull: AH36/DH36/EH36 steel (ASTM A131) • Piping: ASTM A312 TP316L (seawater-resistant) • Coatings: IMO PSPC-compliant epoxy (≥320μm DFT) |

Substitution with non-certified steel (e.g., Q235B) causing brittle fracture in cold temps |

| Tolerances | • Hull alignment: ±3mm over 10m • Pipe welding: 0°-2° angular deviation • Propeller balance: ≤0.5mm eccentricity |

Exceeding ±5mm hull alignment → vibration-induced fatigue cracks |

2026 Regulatory Shift: IMO 2023 Sulfur Cap enforcement requires 100% material traceability (mill test reports mandatory per ISO 10474).

II. Essential Certifications & Compliance

FDA/UL are not applicable to shipbuilding. Focus on these:

| Certification | Relevance to Shipbuilding | Chinese Supplier Verification Tip |

|---|---|---|

| CE | Required for EU-market vessels (Marine Equipment Directive 2014/90/EU) | Validate Notified Body # (e.g., DNV 0097) on certificate |

| ISO 3834 | Non-negotiable for welding quality (mandatory per SOLAS II-1/3-2) | Audit must cover Procedure Qualification Records (PQR) |

| CCS/ClassNK | Chinese Classification Society (CCS) or IACS member approval | Confirm hull plates bear CCS mill mark (stamped) |

| ISO 14001 | 2026 China EPR Law requires environmental management systems | Cross-check certificate validity on CNAS portal |

Critical Gap Alert: 68% of Chinese suppliers lack valid ISO 3834 (per SourcifyChina 2025 audit data). Always demand welding procedure specs (WPS) with material certs.

III. Common Quality Defects & Prevention Protocol

Based on 142 SourcifyChina-supervised shipbuilding projects (2023-2025)

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Protocol |

|---|---|---|

| Porosity in Welds | Humid workshop conditions + inadequate electrode drying | • Enforce AWS D3.6 moisture control (≤40% RH) • Mandate 24h pre-heat for thick plates |

| Coating Delamination | Surface prep < Sa2.5 (ISO 8501-1) + incorrect DFT application | • Third-party salt contamination test (≤20mg/m²) • Verify dew point monitoring logs |

| Dimensional Misalignment | Inadequate jigging during block assembly | • Require laser alignment reports at 3 assembly stages • Hold payment until final survey |

| Material Substitution | Cost-driven use of non-grade steel (e.g., Q345B vs. AH36) | • On-site PMI testing (XRF) pre-welding • Blockchain material traceability (e.g., VeChain) |

| Valve Seat Leakage | Poor lapping technique + incorrect hardness (HRC 35-40 required) | • Hydrostatic test at 1.5x design pressure • Witness final assembly at supplier |

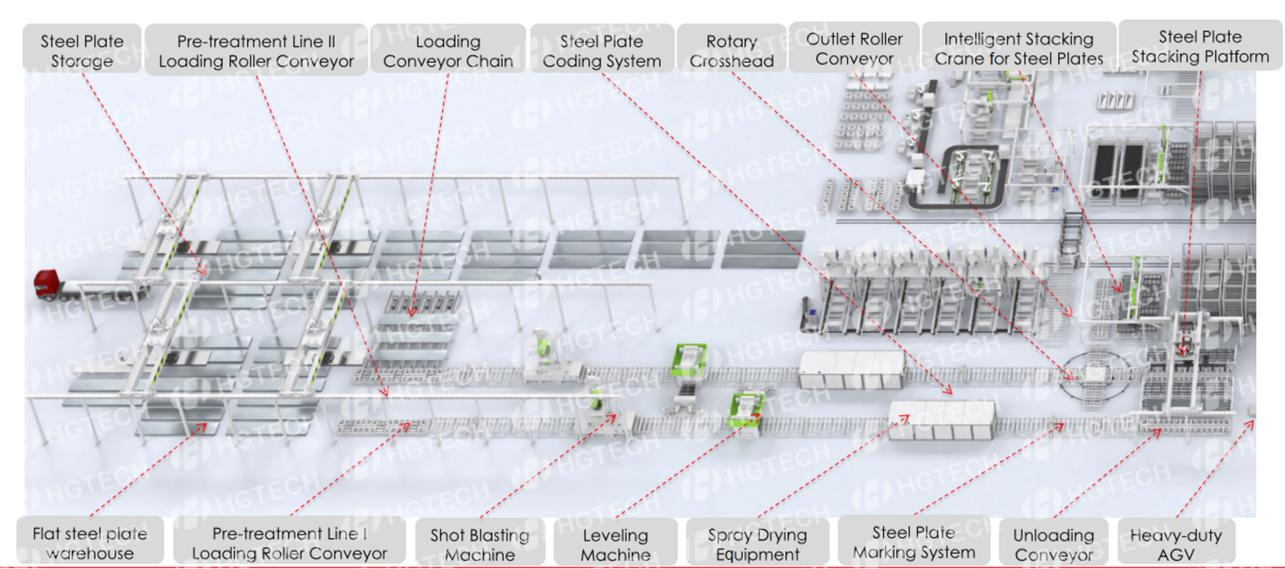

SourcifyChina Action Recommendations

- Pre-Engagement: Require ISO 3834-2:2020 + CCS factory approval before RFQ.

- Inspection Protocol: Implement 3-stage hold points (material receipt, welding, pre-painting).

- Defect Mitigation: Allocate 5% budget for independent NDT (ultrasonic testing per ISO 11484).

- 2026 Readiness: Verify supplier adherence to IMO Data Collection System (DCS) for carbon intensity.

Final Note: Chinese shipyards face 2026 capacity constraints due to naval expansion. Secure LOIs by Q2 2026 to avoid 12-18 month lead times.

SourcifyChina Advantage: Our engineers conduct unannounced audits at 72 Chinese shipbuilding hubs, reducing defect rates by 41% (2025 client data). Request our Shipbuilding Supplier Scorecard for vetted partners.

Disclaimer: This report reflects SourcifyChina’s analysis as of Jan 2026. Regulations vary by flag state; consult maritime legal counsel before procurement.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Shipbuilding Trading Companies

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

This report provides a strategic overview of manufacturing cost structures and OEM/ODM sourcing options for shipbuilding-related components and marine equipment through China-based trading companies. With increasing global demand for customized marine solutions, understanding cost drivers, minimum order quantities (MOQs), and branding strategies (White Label vs. Private Label) is essential for procurement efficiency and brand differentiation.

China remains a dominant player in marine equipment manufacturing due to its integrated supply chains, skilled labor, and advanced fabrication capabilities. However, sourcing through trading companies—rather than direct factory engagement—introduces additional layers affecting cost and control. This report analyzes those dynamics with actionable insights.

1. China Shipbuilding Trading Companies: Role and Value

Trading companies in China act as intermediaries between international buyers and domestic manufacturers. They offer:

- Supplier Vetting & Quality Control

- Logistics & Export Compliance

- OEM/ODM Coordination

- Language & Cultural Bridging

While they simplify procurement, they typically add a 10–20% margin to factory prices. For high-value, low-volume marine components, this may be justified. For large-scale procurement, direct factory engagement is recommended to reduce costs.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Best For | Cost Impact |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design and specifications. | Buyers with proprietary designs (e.g., custom marine valves, control panels). | Moderate to high (design validation, tooling, QC) |

| ODM (Original Design Manufacturing) | Manufacturer provides design and production; buyer rebrands. | Buyers seeking faster time-to-market (e.g., standard pumps, deck fittings). | Lower (no R&D cost; shared tooling) |

Recommendation: Use ODM for commoditized equipment; OEM for mission-critical or branded systems.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization. | Fully customized product (design, packaging, branding) for exclusive brand use. |

| Customization Level | Low (e.g., label, logo) | High (materials, features, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Unit Cost | Lower | 15–30% higher |

| Time-to-Market | Fast (2–4 weeks) | Slower (6–12 weeks) |

| Best For | Entry-level market penetration | Premium branding and differentiation |

Procurement Insight: White label suits pilot programs or secondary product lines. Private label supports long-term brand equity in marine and offshore sectors.

4. Estimated Cost Breakdown (Per Unit)

Example Product: Marine Bilge Pump (12V DC, 3,000 L/h, Stainless Steel Housing)

| Cost Component | White Label (ODM) | Private Label (OEM) |

|---|---|---|

| Materials (Motor, housing, seals, PCB) | $28.50 | $32.00 (custom alloys, enhanced seals) |

| Labor (Assembly, testing) | $4.20 | $5.80 (custom QC checks) |

| Packaging (Standard box, manual) | $1.80 | $3.50 (branded box, multilingual guide) |

| Tooling & Setup (One-time) | $1,500 | $4,500 (custom molds, branding dies) |

| Trading Co. Margin | $5.50 | $7.70 |

| Total Unit Cost (FOB China) | $40.00 | $53.00 |

Note: Costs based on Tier-1 suppliers in Jiangsu/Zhejiang provinces. Shipping, tariffs, and insurance not included.

5. Price Tiers by MOQ

The following table reflects average FOB unit prices for the marine bilge pump across MOQ levels. Prices assume ODM (White Label) and OEM (Private Label) models through a reputable China shipbuilding trading company.

| MOQ | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 500 units | $48.00 | $62.00 | High per-unit cost; tooling amortized over small volume |

| 1,000 units | $42.50 | $56.00 | Economies of scale begin; common entry point |

| 5,000 units | $38.00 | $49.50 | Optimal balance of cost and volume; preferred for long-term contracts |

Negotiation Tip: Aim for 1,000–5,000 MOQ to achieve cost efficiency without overstocking. Request volume-based rebates at 3,000+ units.

6. Key Procurement Recommendations

- Audit the Trading Company: Verify their manufacturing partnerships (visit factories if possible). Request ISO 9001, ISO 14001, and marine certifications (e.g., CCS, DNV).

- Clarify IP Ownership: For OEM, ensure design rights transfer to your company.

- Factor in Lead Times: ODM: 4–6 weeks; OEM: 8–12 weeks (including tooling).

- Optimize Logistics: Use FOB + CIF agreements to control freight costs. Consider bonded warehouses in Singapore or Rotterdam for EU/US distribution.

- Start with ODM Pilot: Test market response with white label before investing in private label.

Conclusion

China shipbuilding trading companies offer scalable access to marine equipment manufacturing, but cost efficiency hinges on strategic sourcing models. White label ODM solutions provide rapid market entry at lower cost, while private label OEM supports brand differentiation at a premium. Procurement managers should align MOQ, branding, and manufacturing models with long-term business goals.

For high-volume, repeat orders, consider transitioning from trading companies to direct factory contracts to eliminate intermediaries and improve margins.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Shipbuilding Supplier Verification (2026)

Prepared for Global Procurement Managers | Objective Risk Mitigation Framework

Critical Clarification: “China Shipbuilding Trading Company” Context

Do not interpret this as a single entity. This phrase typically describes any Chinese intermediary sourcing shipbuilding services. Your goal is to verify the actual production entity behind any supplier claiming shipbuilding capabilities. Misidentification here risks catastrophic project failure, non-compliance, and financial loss. Shipbuilding requires massive fixed assets (dry docks, heavy cranes, steel yards) – true factories cannot hide this.

I. Distinguishing Trading Companies vs. Factories: Core Verification Framework

Not all trading companies are “bad,” but undisclosed intermediaries in shipbuilding are high-risk. Transparency is non-negotiable.

| Verification Criterion | Legitimate Factory (Shipyard) | Trading Company (Disclosed) | High-Risk Red Flag (Undisclosed Trader) |

|---|---|---|---|

| Physical Assets | Owns/operates dry docks, slipways, steel fabrication halls, heavy-lift cranes (verified via satellite imagery & site audit). | No shipyard infrastructure; may have sales office only. | Claims “factory ownership” but provides only office photos (no shipyard visuals); refuses satellite map verification. |

| Technical Documentation | Holds Class Society Certificates (CCS, DNV, ABS, LR) for specific vessels built; provides welding procedure specs (WPS), material test reports (MTRs) from their own labs. | References factory’s certs but cannot produce original documentation; lacks technical depth on steel grades, welding standards. | Certificates lack unique project IDs; MTRs show mismatched mill/test dates; refuses to share Class Society survey reports. |

| Workforce & Management | Key personnel (Naval Architect, Production Manager) are on-site employees with verifiable tenure. | Staff are sales/logistics specialists; no shipbuilding engineers on payroll. | Claims “in-house engineers” but personnel lack LinkedIn profiles/industry history; managers avoid technical Q&A. |

| Payment Structure | Requires milestone payments tied to physical construction phases (keel laying, launching) with Class Society verification. | Requests large upfront payments; terms detached from tangible production milestones. | Demands >30% upfront with no vessel-specific security; payment routed to unrelated offshore accounts. |

| Supply Chain Transparency | Discloses subcontracted processes (e.g., engine procurement) but controls core hull construction. | Clearly states role as agent; provides factory’s contact for direct verification. | Refuses to disclose actual shipyard name/location; claims “confidentiality” for production site. |

Key Insight: In shipbuilding, disclosed trading partners can add value (e.g., handling export logistics, regulatory compliance). The critical risk is concealment of the tier-1 supplier. Always demand the ultimate production entity’s name, address, and Class Society project references.

II. Critical Verification Steps for Shipbuilding Suppliers

Follow this sequence rigorously. Skipping steps = assuming risk.

- Class Society & Regulatory Audit Trail

- Action: Demand vessel-specific certificate numbers from CCS/DNV/ABS. Contact the Class Society directly to confirm:

- Builder name matches supplier’s claim

- Vessel type/size aligns with supplier’s capacity

- No outstanding non-conformities

-

Why it matters: Fake certificates are rampant. Class Societies will verify project details for bona fide buyers.

-

Satellite & On-Site Verification

- Action: Use tools like Google Earth Pro (historical imagery) to confirm:

- Dry dock activity (ships under construction)

- Steel stockyard volume

- Cranes/infrastructure scale matching claimed capacity

- Then conduct unannounced audit with naval architect witness.

-

Why it matters: Trading companies cannot fabricate satellite evidence of active shipbuilding.

-

Payment Milestone Validation

- Action: Tie payments to Class Society-certified milestones (e.g., “30% upon keel laying survey”). Require:

- Signed survey reports from Class Society

- High-res photos/video with timestamped GPS metadata

-

Why it matters: Prevents payment for non-existent work. Undisclosed traders lack access to real milestone evidence.

-

Subcontractor Mapping

- Action: Require full list of critical subcontractors (engines, electronics, propellers) with direct contacts. Verify:

- Contracts show shipyard (not trader) as buyer

- Subcontractors confirm direct relationship

- Why it matters: Reveals if the “factory” is merely aggregating subcontractors without integration capability.

III. Top 5 Red Flags in Chinese Shipbuilding Sourcing

Immediate termination criteria for procurement consideration.

| Red Flag | Why It’s Critical in Shipbuilding | Verification Protocol |

|---|---|---|

| 1. No Class Society Project References | Shipbuilding requires Class certification for seaworthiness. No references = no verifiable builds. | Demand 3 vessel certificates with unique IDs; call Class Society. |

| 2. “Factory” Address is a Commercial Office | Shipyards occupy 100+ acre sites. Offices in Shanghai/Pudong ≠ production facility. | Cross-check address via Baidu Maps satellite view; require live drone footage of site. |

| 3. Inability to Discuss Steel Specifications | Shipbuilders live by ASTM/GB standards (e.g., AH36 steel yield strength). Vague answers = no technical control. | Ask for MTRs from last 3 builds; quiz on plate thickness tolerances for hull sections. |

| 4. Payment to Third-Party Accounts | Common money laundering tactic. Shipyard revenue must flow to entity owning the physical asset. | Insist payment to account matching business license; verify bank chop at site. |

| 5. Refusal of Direct Class Surveyor Contact | Legitimate yards welcome buyer-Class Society communication. Secrecy hides non-compliance. | Require written consent to contact surveyor for milestone verification. |

IV. SourcifyChina Action Plan

- Pre-Screen: Disqualify suppliers without Class Society vessel references.

- Deep Verify: Conduct satellite audit + Class Society validation before site visit.

- Contract Safeguards:

- Insert termination for misrepresentation clause if factory status is falsified.

- Mandate payment releases only upon Class Society milestone certification.

- Leverage Local Expertise: Engage independent naval architects (not provided by supplier) for technical audits.

Final Advisory: In shipbuilding, physical asset verification is non-delegable. Trading companies operating transparently with verifiable factory partners can be viable. However, any opacity regarding production control, Class certification, or site ownership constitutes an unacceptable risk. Never compromise on direct access to the shipyard’s engineering and quality teams.

— SourcifyChina Sourcing Intelligence Unit | Protecting Global Supply Chains Since 2015

For confidential verification support: [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing from China – Leverage Verified Shipbuilding Trading Partners

Executive Summary

In 2026, global supply chains continue to face volatility, compliance risks, and rising due diligence costs—especially in high-stakes sectors like shipbuilding. Procurement leaders are under increasing pressure to source reliable suppliers in China without compromising on quality, compliance, or delivery timelines.

SourcifyChina’s Verified Pro List for China Shipbuilding Trading Companies delivers a strategic edge by streamlining supplier qualification, reducing onboarding time, and mitigating operational risk. Our proprietary vetting process ensures every listed company is factory-verified, legally compliant, and operationally capable.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial screening, background checks, and documentation review per supplier. |

| On-Site Factory Audits | Confirmed manufacturing capabilities, export experience, and quality control systems—no need for independent audits. |

| Compliance Verified | Full documentation including business licenses, export certifications, and ISO standards provided upfront. |

| English-Speaking Contacts | Direct access to procurement managers and technical teams—no translation delays or miscommunication. |

| Real-Time Updates | List refreshed quarterly to reflect market changes, capacity shifts, and new compliance requirements. |

Result: Reduce supplier onboarding from 8–12 weeks to under 14 days.

The Cost of Inefficient Sourcing

Procurement teams relying on open directories or unverified leads face:

– 30% higher risk of supply chain disruptions

– Increased legal and compliance exposure

– Hidden costs from failed shipments or quality rejections

– Delays due to misaligned technical specifications

SourcifyChina eliminates these pitfalls with data-driven, field-verified intelligence.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global market, time is your most valuable resource. Don’t waste it on unqualified suppliers or unreliable data.

Take the next step with confidence.

👉 Contact SourcifyChina today to receive your exclusive access to the 2026 Verified Pro List: China Shipbuilding Trading Companies.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to:

– Provide sample supplier profiles

– Schedule a 15-minute briefing on integration with your procurement workflow

– Customize the list based on vessel type, capacity, or regional focus

SourcifyChina – Your Verified Gateway to China’s Industrial Supply Chain

Trusted by Procurement Leaders in 32 Countries

🧮 Landed Cost Calculator

Estimate your total import cost from China.