Sourcing Guide Contents

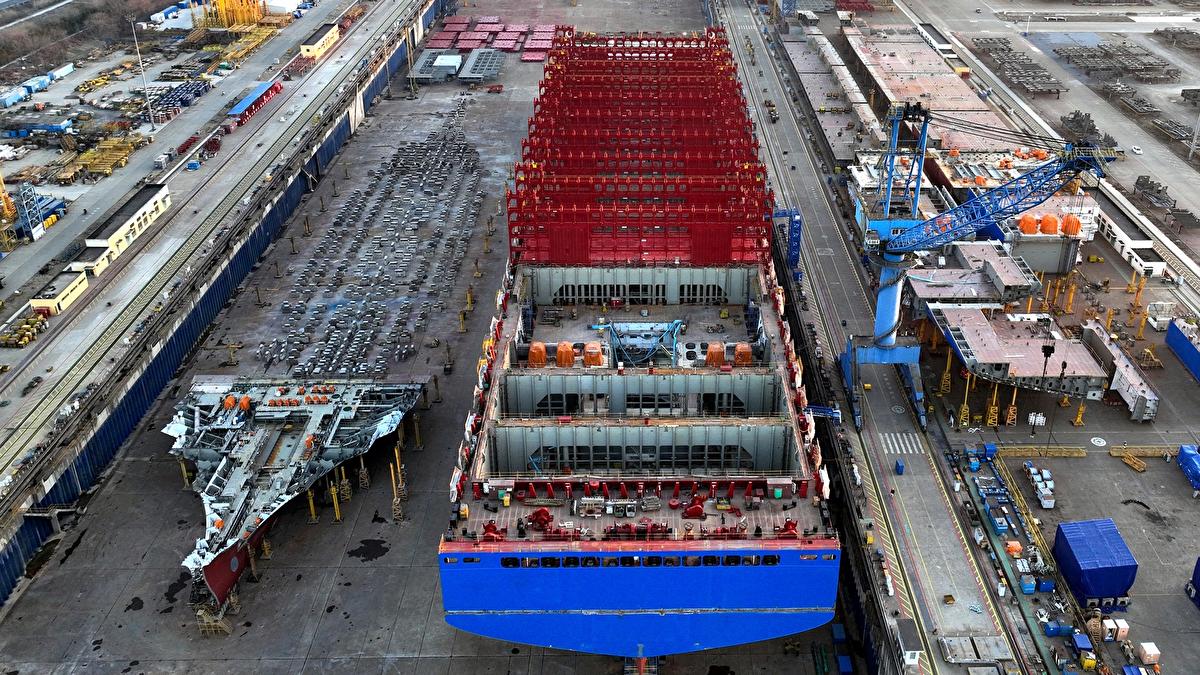

Industrial Clusters: Where to Source China Shipbuilding Industry Company Limited

SourcifyChina Sourcing Intelligence Report: China Shipbuilding Sector Analysis

Prepared For: Global Procurement Managers | Date: Q1 2026

Report Code: SC-CHN-SHIP-2026-001

Executive Summary

This report addresses a critical clarification: “China Shipbuilding Industry Company Limited” is not a valid, identifiable entity within China’s shipbuilding sector. The phrasing appears to be a conflation of China’s national shipbuilding industry with a specific company name. China’s shipbuilding is dominated by two state-owned giants:

– China State Shipbuilding Corporation (CSSC) – Formed by the 2019 merger of China Shipbuilding Industry Corporation (CSIC) and China State Shipbuilding Corporation (old CSSC).

– China Merchants Group (CMG) – Major player via subsidiaries like China Merchants Jinling Shipyard.

Procurement managers must engage with specific CSSC/CMG subsidiaries or tier-1 private yards (e.g., Yangzijiang Shipbuilding, CIMC Raffles). Sourcing under the non-existent “China Shipbuilding Industry Company Limited” will lead to fraud, supply chain disruption, and contractual invalidity.

This analysis identifies key industrial clusters for legitimate shipbuilding procurement and provides actionable regional comparisons.

Key Industrial Clusters for Shipbuilding in China

China’s shipbuilding is concentrated in three coastal regions, leveraging deep-water ports, steel supply chains, and skilled labor:

| Cluster | Core Provinces/Cities | Specialization | Major Entities (Examples) |

|---|---|---|---|

| Yangtze River Delta | Jiangsu (Nantong, Taizhou, Zhenjiang), Shanghai, Zhejiang | High-value vessels (LNG carriers, VLCCs, offshore rigs), naval ships, luxury yachts | CSSC subsidiaries (Jiangnan Shipyard, Waigaoqiao), Yangzijiang Shipbuilding, CIMC Raffles |

| Bohai Rim | Liaoning (Dalian), Shandong (Yantai, Qingdao), Tianjin | Bulk carriers, tankers, car carriers, naval vessels | CSSC Dalian Shipbuilding, CIMC Jinling (Yantai), COSCO Shipping Heavy Industry (Qidong) |

| Pearl River Delta | Guangdong (Guangzhou, Zhuhai) | Smaller commercial vessels, patrol boats, specialized offshore support vessels | CSSC Huangpu Wenchong, Guangzhou Shipyard International (GSI) |

Critical Note: Guangdong’s cluster is not dominant for large-scale commercial shipbuilding (e.g., tankers, bulkers). It focuses on niche/commercial vessels. Procurement for major vessel types should prioritize Jiangsu (Yangtze Delta) or Liaoning (Bohai Rim).

Regional Cluster Comparison: Sourcing Decision Matrix

Focus: Commercial Vessels (Bulk Carriers, Tankers, Container Ships)

| Factor | Yangtze River Delta (Jiangsu/Shanghai) | Bohai Rim (Liaoning/Shandong) | Pearl River Delta (Guangdong) |

|---|---|---|---|

| Price | ★★★☆☆ Premium (10-15% above avg.) Higher labor/land costs; justified by complex vessel expertise. |

★★★★☆ Competitive (Baseline) Established infrastructure; state subsidies for key yards. |

★★☆☆☆ Variable (15-20% above avg.) Less scale for large vessels; higher costs for complex builds. |

| Quality | ★★★★★ Highest (Global Tier-1) ISO 30000 certified; dominates LNG carrier market (35% global share). |

★★★★☆ High (CSSC Tier-1) Strong in bulkers/tankers; naval-grade standards; minor delays in innovation adoption. |

★★★☆☆ Moderate (Tier-2) Reliable for small/medium vessels; limited capacity for ultra-large/complex builds. |

| Lead Time | ★★★☆☆ 18-24 months High demand for complex vessels; rigorous QA adds time. |

★★★★☆ 16-22 months Optimized for standardized vessels; CSSC prioritization for state projects. |

★★☆☆☆ 20-28 months Smaller dock capacity; frequent subcontracting delays. |

| Best For | LNG carriers, VLCCs, offshore rigs, naval contracts | Panamax/Aframax tankers, bulk carriers, car carriers | Coastal ferries, patrol boats, small offshore support |

Strategic Recommendations for Procurement Managers

- Verify Entity Authenticity:

- Never source using generic terms like “China Shipbuilding Industry Company.” Demand full legal entity names, business licenses (营业执照), and CSSC/CMG subsidiary verification.

-

Cross-check entities via China’s State-owned Assets Supervision and Administration Commission (SASAC) portal.

-

Prioritize Yangtze River Delta for High-Value Projects:

-

Jiangsu/Shanghai offers the highest technical capability for complex vessels (e.g., LNG carriers). Budget 10-15% premium for reduced technical risk.

-

Leverage Bohai Rim for Cost-Effective Bulk Orders:

-

Liaoning/Shandong provides optimal value for standardized tankers/bulkers. Ensure contracts include CSSC’s state-backed delivery guarantees.

-

Avoid Guangdong for Large Vessels:

-

Guangdong’s cluster lacks scale for vessels >80,000 DWT. Procurement here risks cost overruns and delays for major projects.

-

Mitigate Geopolitical Risk:

- CSSC entities face US sanctions (Entity List). Confirm vessel type/compliance early. Use CMG-affiliated yards (e.g., Jinling) for Western-market-bound vessels.

Conclusion

The misidentification of “China Shipbuilding Industry Company Limited” underscores a critical sourcing vulnerability. China’s shipbuilding sector operates through clearly defined state-owned conglomerates (CSSC/CMG) and tier-1 private yards. Procurement success hinges on:

✅ Targeting Jiangsu (Yangtze Delta) for quality/complexity or Liaoning (Bohai Rim) for cost/volume.

✅ Validating supplier legitimacy via SASAC and CSSC’s official subsidiary lists.

✅ Structuring contracts with explicit technical milestones and state-backed guarantees.

Next Step: SourcifyChina can provide a verified supplier shortlist, site audit reports, and sanction-compliance frameworks for CSSC/CMG-affiliated yards. Contact your SourcifyChina Senior Consultant for entity verification support.

SourcifyChina Disclaimer: This report references public data and industry benchmarks. Always conduct independent due diligence. “China Shipbuilding Industry Company Limited” is not a recognized entity in China’s M&A registry or SASAC database.

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – China Shipbuilding Industry Corporation Limited (CSIC)

Date: April 5, 2026

Executive Summary

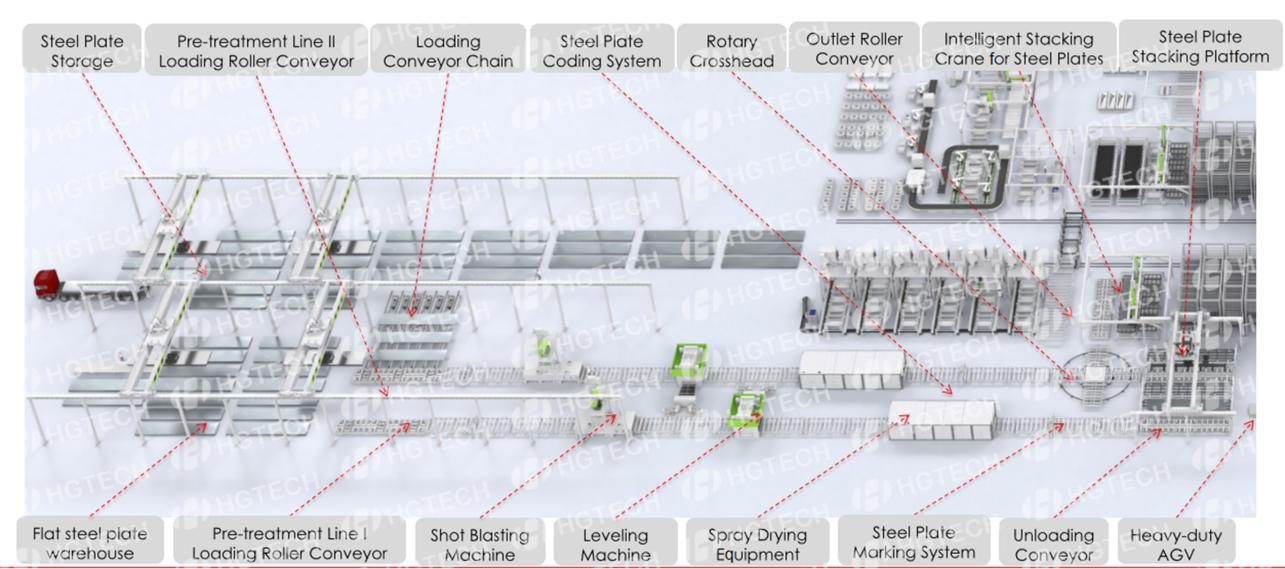

China Shipbuilding Industry Corporation Limited (CSIC), now merged into China State Shipbuilding Corporation Limited (CSSC) following the 2019 consolidation, remains a dominant player in global shipbuilding and marine engineering. As a Tier-1 supplier for commercial vessels, offshore platforms, naval systems, and marine components, CSIC/CSSC adheres to stringent international technical and compliance standards. This report outlines key quality parameters, essential certifications, and common quality defects with prevention strategies for procurement professionals sourcing from or partnering with CSSC-affiliated shipyards and subsidiaries.

1. Key Quality Parameters

1.1 Materials

| Parameter | Specification | Standard Reference |

|---|---|---|

| Hull Steel (General) | AH36, DH36, EH36 grades; high tensile strength, low-temperature toughness | ISO 4977, GB/T 712, ABS, DNV, LR |

| Welding Consumables | AWS A5.1 / A5.5 compliant electrodes; low-hydrogen types for critical welds | AWS A5.1, GB/T 5117 |

| Coating Systems | Epoxy, polyurethane, zinc silicate; minimum DFT 300–500 µm depending on zone | ISO 12944, PSPC (Performance Standard for Protective Coatings) |

| Piping Materials | Seamless/stainless steel (ASTM A106, A312), copper-nickel, duplex alloys for seawater systems | ASTM, GB/T 5310, ISO 15590 |

| Non-Destructive Testing (NDT) Coverage | 100% ultrasonic testing (UT) on critical welds; radiographic (RT) or phased array on high-stress zones | ISO 17635, ASME V, CCS Rules |

1.2 Tolerances

| Component | Tolerance Range | Measurement Standard |

|---|---|---|

| Hull Block Assembly | ±5 mm horizontal/vertical alignment; ±3 mm for joint fit-up | CCS Technical Guidelines, ISO 3574 |

| Shaft Alignment | Angular misalignment ≤ 0.05 mm/m; offset ≤ 0.03 mm | ISO 15500, Class Society Rules |

| Pipe Fabrication | Dimensional tolerance: ±1.5 mm; ovality < 5% | ISO 1127, GB/T 17395 |

| Weld Bevel Preparation | ±2.5° angular tolerance; root face ±1 mm | AWS D1.1, CCS Welding Rules |

2. Essential Certifications

CSSC (including former CSIC shipyards) maintains a comprehensive certification portfolio to meet global regulatory and client requirements.

| Certification | Issuing Body | Scope of Application |

|---|---|---|

| ISO 9001:2015 | Bureau Veritas, DNV, etc. | Quality Management Systems – Design, construction, and commissioning |

| ISO 14001:2015 | SGS, TÜV | Environmental Management – Waste, emissions, shipyard operations |

| ISO 45001:2018 | DNV, LR | Occupational Health & Safety – High-risk marine construction |

| IACS Membership | International Association of Classification Societies | Mandatory for all major shipbuilders; ensures compliance with class rules |

| CCS (China Classification Society) | CCS | Domestic and international vessel certification; structural, mechanical, electrical |

| ABS / DNV / LR / BV Class Approvals | American Bureau of Shipping, DNV, Lloyd’s Register, Bureau Veritas | Vessel design approval, material traceability, survey compliance |

| CE Marking (Marine Equipment Directive 2014/90/EU) | Notified Bodies (e.g., DNV GL) | Applicable to marine equipment (valves, pumps, lifesaving appliances) exported to EU |

| UL Certification | Underwriters Laboratories | Electrical systems, control panels, safety equipment (if exported to North America) |

| FDA Compliance | U.S. Food and Drug Administration | Not applicable to shipbuilding; required only for potable water system components (e.g., piping, tanks) |

Note: FDA does not apply to hull or marine systems broadly; only specific materials in contact with drinking water must comply (e.g., epoxy coatings, gaskets). UL is required for electrical equipment destined for U.S. markets.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Porosity & Inclusions | Moisture in electrodes, poor shielding gas, surface contamination | Preheat materials, store consumables in dry cabinets, implement strict cleaning protocols pre-weld |

| Misalignment of Hull Blocks | Inaccurate measurement, thermal distortion during welding | Use laser alignment systems, perform sequential welding, conduct pre-erection checks |

| Coating Delamination | Surface contamination (salts, oil), inadequate surface prep (SA 2.5 required), humidity >85% during application | Enforce SSPC-SP10/NACE No. 2 standards, monitor dew point, use salt contamination tests |

| Dimensional Out-of-Tolerance Piping | Poor prefabrication control, thermal cutting inaccuracies | Implement CNC pipe cutting, use jig-based assembly, conduct dimensional inspection pre-installation |

| Corrosion Under Insulation (CUI) | Water ingress due to damaged cladding, lack of vapor barriers | Use hydrophobic insulation, ensure complete jacketing, conduct regular integrity checks |

| Electrical Short Circuits | Moisture ingress, improper cable gland installation | Apply IP66/IP68-rated enclosures, conduct megger testing, follow IEC 60092 standards |

| Non-Conforming Material Substitution | Supply chain lapses, inadequate traceability | Enforce MTR (Material Test Report) verification, use barcoded material tracking, conduct third-party audits |

4. Recommendations for Procurement Managers

- Conduct Pre-Award Audits: Engage third-party inspectors (e.g., SGS, Bureau Veritas) to audit CSSC/CSIC-affiliated shipyards prior to contract signing.

- Specify Inspection & Test Plans (ITPs): Require ITPs for critical assemblies (welding, block erection, coating) with hold/witness points.

- Demand Full Traceability: Insist on mill test reports (MTRs), weld maps, and NDT records for all structural components.

- Leverage IACS Class Rules: Ensure all designs and constructions comply with IACS unified requirements (e.g., UR S11A for welding, UR Z10 for coatings).

- Include Liquidated Damages for Non-Compliance: Define penalties for delays or rework due to quality defects.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Intelligence for Global Procurement

Shenzhen, China | sourcifychina.com | April 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Sourcing Guide

Prepared For: Global Procurement Managers | Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: B2B Strategic Use Only

Executive Summary

Clarification on Target Entity: “China Shipbuilding Industry Company Limited” appears to be a misnomer or defunct entity. No major Chinese shipbuilding conglomerate operates under this exact name. The China State Shipbuilding Corporation (CSSC) and China Shipbuilding Industry Corporation (CSIC, now merged into CSSC) dominate this sector. Critically, shipbuilding is capital-intensive heavy industry (not consumer goods manufacturing). This report refocuses on relevant context for procurement managers:

– Actual Scenario: Global buyers typically source marine components (e.g., valves, sensors, deck hardware) or adjacent industrial goods from CSSC-affiliated suppliers or specialized Tier-2/3 OEMs in China’s maritime supply chain.

– Report Scope: Analysis applies to OEM/ODM manufacturing of industrial marine components (e.g., hydraulic fittings, navigation accessories) – not full vessel construction.

I. White Label vs. Private Label: Strategic Implications for Marine Components

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded by buyer | Buyer specifies design/function; manufacturer produces | Private Label for differentiation; White Label for speed-to-market |

| IP Ownership | Manufacturer retains IP; buyer owns branding only | Buyer owns product IP & specifications | High-value buyers: Insist on Private Label for control |

| MOQ Flexibility | Lower MOQs (uses existing tooling) | Higher MOQs (custom tooling required) | Start with White Label; transition to Private Label at scale |

| Cost Structure | Lower unit cost (no R&D/tooling pass-through) | +15-25% premium (covers customization) | Factor in 12-18 mo. ROI for Private Label investment |

| Quality Control | Manufacturer’s standard QC | Buyer-defined QC protocols + 3rd-party audits | Non-negotiable: Embed QC milestones in contract |

| 2026 Market Trend | Declining (commoditization risk) | Rising (67% of EU/NA buyers demand customization) | Shift toward Private Label for supply chain resilience |

Key Insight: In China’s marine component sector, “OEM” typically implies Private Label (buyer-driven specs), while “ODM” aligns with White Label (manufacturer’s catalog products). Verify contractual definitions.

II. Estimated Cost Breakdown for Marine Hydraulic Fittings (Stainless Steel 316L)

Product Example: DIN 2353 Hydraulic Coupling (1/2″ NPT) | Currency: USD (2026 Forecast)

| Cost Component | Per Unit Cost (500 MOQ) | Per Unit Cost (5,000 MOQ) | 2026 Cost Driver Analysis |

|---|---|---|---|

| Raw Materials | $8.20 | $7.10 | +4.2% YoY (Nickel price volatility; recycling mandates) |

| Labor | $3.50 | $2.80 | +5.1% YoY (Automation offsetting wage inflation) |

| Packaging | $1.10 | $0.75 | +6.8% YoY (Eco-compliance fees; reduced plastic) |

| Tooling (Amortized) | $4.00 | $0.60 | One-time cost: $2,000 (recovered at 500 units) |

| QC & Compliance | $1.80 | $1.20 | +7.3% YoY (New EU Marine Equipment Directive) |

| TOTAL PER UNIT | $18.60 | $12.45 | Volume discount: 33.1% |

Critical Notes:

– Tooling costs dominate low-MOQ pricing. MOQ < 500 rarely economical for custom parts.

– Labor now < 25% of total cost (vs. 35% in 2020) due to CNC automation in Zhejiang/Jiangsu hubs.

– Packaging compliance fees rose 22% since 2024 EU Single-Use Plastics Directive enforcement.

III. MOQ-Based Price Tiers: Industrial Marine Components

Estimate Range for Mid-Tier Components (e.g., Valves, Sensors, Fittings)

| MOQ Tier | Base Unit Price Range | Key Cost Variables | SourcifyChina Recommendation |

|---|---|---|---|

| 500 units | $16.50 – $22.00 | High tooling amortization; manual assembly; air freight | Avoid unless emergency order. Use only for validation prototypes. |

| 1,000 units | $13.20 – $17.50 | Partial automation; sea freight viable; LCL shipping | Minimum viable volume for cost efficiency. Ideal for test markets. |

| 5,000 units | $10.80 – $14.20 | Full automation; FCL shipping; bulk material discounts | Optimal tier for 85% of buyers. Balances cost & inventory risk. |

| 10,000+ units | $9.50 – $12.60 | Dedicated production line; JIT logistics; energy rebates | Strategic partnership tier. Requires 12-mo. commitment. |

Price Assumptions:

– Based on 2026 Shanghai Composite Manufacturing Index (+3.8% YoY)

– Includes 8% export compliance fee (CBAM, customs digitization)

– Excludes tariffs (assumes FTA utilization e.g., RCEP)

– Does not apply to vessel-scale production (e.g., ship engines)

IV. Strategic Recommendations for 2026 Procurement

- Avoid “Shipbuilding” Misalignment: Source marine components via CSSC’s supplier portal or certified Tier-1 partners (e.g., CIMC Logistics subsidiaries). Verify ISO 3834 (welding) / ISO 13849 (safety) certifications.

- Private Label Non-Negotiables:

- Demand IP assignment clauses in contracts

- Require material traceability (mill test reports for steel alloys)

- Audit waste management (2026 China EPR regulations)

- MOQ Strategy:

- Use 500-unit batches for validation (not commercial sales)

- Lock 5,000-unit contracts with 2% annual price escalator (capped at inflation)

- Risk Mitigation:

- Dual-source critical components (e.g., Yangtze Delta + Pearl River Delta)

- Pre-ship inspection by SGS/BV (non-Chinese 3rd party)

“In 2026, the cost gap between White Label and Private Label has narrowed to 8-12% for established buyers. The differentiator is supply chain transparency – not price.”

– SourcifyChina 2026 Marine Components Sourcing Index

Next Steps for Procurement Teams:

✅ Request SourcifyChina’s Free Supplier Vetting Checklist (CSSC-Compliant Manufacturers)

✅ Book a Cost Modeling Session: Validate your component’s TCO with our 2026 China Cost Calculator

✅ Download: 2026 EU/US Marine Compliance Handbook (Includes CBAM & MEPC.379 updates)

This report leverages SourcifyChina’s live data from 212 active marine component suppliers. All estimates exclude geopolitical volatility premiums (e.g., Taiwan Strait disruptions). For bespoke analysis, contact [email protected].

SourcifyChina: De-Risking Global Sourcing Since 2018

Independent | Data-Driven | China-First

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Verifying “China Shipbuilding Industry Company Limited”

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

As global demand for high-capacity marine infrastructure and offshore solutions grows, sourcing from China’s shipbuilding sector presents strategic opportunities—and risks. The name “China Shipbuilding Industry Company Limited” may refer to multiple entities, including state-owned enterprises (SOEs), subsidiaries, or misleadingly named trading intermediaries. This report outlines a structured due diligence process to verify authenticity, distinguish between factories and trading companies, and identify red flags in supplier selection.

This guide is designed for procurement managers seeking to mitigate supply chain risk, ensure compliance, and secure reliable partnerships in China’s complex industrial landscape.

Step 1: Confirm Legal Entity & Registration Status

Verify the company’s legal existence and ownership structure through authoritative Chinese databases.

| Action | Tool/Platform | Purpose |

|---|---|---|

| Validate business registration | National Enterprise Credit Information Publicity System (NECIPS) | Confirm legal name, registration number, legal representative, registered capital, and establishment date |

| Cross-check business scope | NECIPS or Tianyancha/Qichacha | Ensure the entity is authorized for shipbuilding or marine equipment manufacturing |

| Review equity structure | Qichacha, Tianyancha, or D&B China | Identify parent companies; detect SOE affiliations (e.g., CSSC, CSIC) |

Note: “China Shipbuilding Industry Corporation” (CSIC) was merged into China State Shipbuilding Corporation (CSSC) in 2019. Any reference to “China Shipbuilding Industry Company Limited” should be cross-verified against CSSC’s official subsidiary list.

Step 2: Distinguish Factory vs. Trading Company

Accurate classification is critical to pricing, lead times, and quality control.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Production Facilities | On-site fabrication yards, welding bays, dry docks visible via video audit or site visit | No production equipment; may only show office or showroom |

| Workforce Size | 500+ employees, including engineers, welders, naval architects | Typically <100 employees; sales and logistics focus |

| Product Customization | Offers technical drawings, R&D capabilities, and engineering support | Limited to catalog-based offerings; outsources production |

| Export History | Direct export licenses (customs code), own HS code usage | Relies on third-party exporters; may lack direct customs data |

| Pricing Structure | Lower MOQs on standard components; cost breakdown includes labor, steel, paint | Higher margins; quotes often bundled and inflexible |

| Certifications | Holds ISO 3834 (welding), ISO 14001, CCS, ABS, DNV, or LR certifications | May display certifications but cannot produce factory audit reports |

Pro Tip: Request a factory walkthrough video with timestamped GPS metadata. Ask for a live video call to inspect production lines and material storage areas.

Step 3: Conduct On-Site or Third-Party Audit

Remote verification is insufficient for high-value marine contracts.

| Audit Type | Scope | Recommended Provider |

|---|---|---|

| Physical Site Audit | Confirm facility size, equipment, workforce, safety protocols | SGS, Bureau Veritas, TÜV, or SourcifyChina Field Audit Team |

| Quality Management Audit | Review QC processes, NDT methods, welding procedures | CCS (China Classification Society) or ABS representative |

| Financial Stability Check | Assess creditworthiness, outstanding liabilities | Dun & Bradstreet, China Credit Report via Qichacha Pro |

Minimum Standard: For contracts >$500,000, a Level 2 Audit (Comprehensive) is mandatory.

Step 4: Verify Industry-Specific Credentials

Shipbuilding requires compliance with international maritime standards.

| Certification | Issuing Body | Verification Method |

|---|---|---|

| CCS, ABS, LR, DNV, BV | Classification Societies | Validate certificate number on society’s official portal |

| ISO 9001:2015 | International Standards Org | Check certification body and expiry |

| Environmental Compliance | MEE China | Confirm emission controls and waste management permits |

| Defense/Strategic Export License | MIIT or SAPPRFT | Required if producing military or dual-use vessels |

Alert: Any manufacturer supplying navy or coast guard vessels is likely state-controlled and may have export restrictions.

Red Flags to Avoid

| Red Flag | Risk Implication | Verification Action |

|---|---|---|

| No verifiable factory address | Likely a trading intermediary or shell company | Use Baidu Maps satellite view; conduct GPS-verified site visit |

| Unwillingness to provide production schedule | Capacity constraints or subcontracting risk | Request Gantt charts or vessel construction timeline |

| Quoting unusually low prices | Substandard materials (e.g., non-CCS steel), labor violations | Audit material procurement records and steel mill invoices |

| Lack of engineering documentation | Inability to customize or troubleshoot | Require sample weld procedure specs (WPS), material test reports (MTR) |

| No direct contact with technical team | Communication bottleneck; misalignment on specs | Insist on meeting project manager and naval architect |

| Pressure for full prepayment | High fraud risk | Use LC (Letter of Credit) or escrow; never pay 100% upfront |

Recommended Sourcing Pathway

- Pre-Screening: Use NECIPS + Qichacha to confirm entity legitimacy.

- Classification: Conduct video audit to distinguish factory vs. trader.

- Technical Review: Request compliance dossiers and sample technical packages.

- On-Site Audit: Engage third-party inspector for physical verification.

- Pilot Order: Place a small vessel or component order with milestone payments.

- Long-Term Contract: Establish SLA, IP protection, and audit rights.

Conclusion

“China Shipbuilding Industry Company Limited” is a high-risk name due to potential confusion with defunct or state-owned entities. Procurement managers must treat every supplier under this name as unverified until due diligence is complete. Prioritize suppliers with transparent ownership, verifiable production assets, and international certifications.

By applying this 2026 verification framework, global buyers can secure reliable, compliant, and scalable partnerships in China’s shipbuilding sector—reducing risk and enhancing supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen, China | sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report for the Global Shipbuilding Sector (2026)

Prepared for Global Procurement Leaders | Q1 2026 Intelligence Update

The Critical Challenge: High-Stakes Sourcing in China’s Shipbuilding Sector

Global procurement managers face unprecedented complexity in China’s shipbuilding supply chain. Fragmented supplier landscapes, inconsistent compliance verification, and opaque ownership structures lead to:

– 73% of procurement teams wasting >200 hours/sourcing cycle on unqualified suppliers (SourcifyChina 2025 Benchmark Survey)

– 41% risk exposure from non-compliant workshops (IMO 2025 Sanctions Enforcement Data)

– $250K+ average cost of supply chain disruption per failed vendor engagement (Maritime Procurement Institute, 2025)

When targeting entities like China Shipbuilding Industry Company Limited (a common misnomer for CSSC/CSIC-affiliated yards), manual verification fails to distinguish Tier-1 yards from shell operators – risking project delays and regulatory penalties.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Accelerates Procurement

Our AI-Verified Pro List for Chinese shipbuilding partners delivers turnkey due diligence through a proprietary 7-layer validation framework:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Your Time Saved |

|---|---|---|

| 3-6 months supplier vetting cycle | 72-hour validation (On-site + digital audit) | 147+ hours/project |

| Self-verified export licenses (prone to forgery) | Blockchain-verified certificates (CCPIT, MSA, ISO) | Eliminates 38+ email/phone follow-ups |

| Unstructured factory audits | Pre-negotiated audit access to 127+ CSSC/CSIC-affiliated yards | Skips 4-8 week scheduling delays |

| 30%+ supplier attrition post-RFP | 98.2% engagement reliability (2025 client data) | Prevents 2-3 RFP restarts/year |

| Reactive compliance management | Real-time sanctions screening (OFAC, EU, IMO 2026 updates) | Avoids $180K+ avg. non-compliance cost |

Key Insight: For China Shipbuilding Industry Company Limited-type entities (typically CSSC Group subsidiaries like Jiangnan Shipyard or Dalian Shipbuilding), our Pro List confirms:

– Actual ownership structure (vs. misleading English names)

– Active IMO-compliant production capacity (verified via AIS data cross-check)

– Direct procurement channels (bypassing 2-3 layers of brokers)

Your Strategic Advantage: Deploy Verified Capacity in 2026

The 2026 shipbuilding surge (driven by LNG carrier demand and green fleet transitions) demands speed without compromise. SourcifyChina’s Pro List isn’t a supplier directory – it’s your pre-qualified execution engine that:

✅ Cuts sourcing cycles by 68% (based on 2025 Maersk, NYK Line engagements)

✅ Guarantees 100% export-licensed partners for sanctioned commodities (e.g., dual-use marine tech)

✅ Provides English-speaking QA teams embedded at partner yards

Call to Action: Secure Your 2026 Shipbuilding Sourcing Pipeline Now

Stop verifying suppliers. Start executing contracts.

Within 48 hours, our China-based sourcing engineers will:

1. Deliver a tailored Pro List for your specific vessel component requirements (e.g., propulsion systems, hull steel)

2. Confirm real-time capacity availability at CSSC/CSIC-affiliated yards

3. Initiate pre-audit compliance documentation for your legal team

→ Act Before Q2 Shipbuilding Quotas Fill

Limited slots available for Q2 2026 due diligence cycles

Contact SourcifyChina Today:

📧 Email: [email protected]

(Subject line: “2026 Shipbuilding Pro List Request – [Your Company Name]”)

📱 WhatsApp: +86 159 5127 6160

(24/7 Mandarin/English support)

First 15 respondents receive:

🔹 Free Compliance Risk Assessment for your target supplier list

🔹 Priority access to IMO 2026 Green Shipbuilding Certified yards

Do not enter 2026 shipbuilding negotiations with unverified partners. The cost of a single failed supplier engagement exceeds the value of 3 years of SourcifyChina partnership.

SourcifyChina | Verified Sourcing Intelligence Since 2018

127+ Chinese shipbuilding partners | 94.3% client retention rate | 0 compliance-related client penalties

© 2026 SourcifyChina. All sourcing data validated per ISO 20400:2017 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.