Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipbuilding Industry Company

SourcifyChina Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Shipbuilding Companies in China

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

China remains the world’s largest shipbuilding nation by gross tonnage, accounting for over 45% of global shipbuilding output in 2025 (Clarksons Research). As global demand for commercial vessels, offshore support, and specialized maritime platforms grows, China’s shipbuilding industry continues to consolidate its competitive edge through technological advancement, cost efficiency, and robust industrial ecosystems.

This report provides a strategic overview of China’s shipbuilding industrial clusters, identifying key provinces and cities that host leading shipbuilding companies. It evaluates regional strengths in price competitiveness, quality standards, and lead time performance to guide procurement managers in selecting optimal sourcing partners.

Key Industrial Clusters for Shipbuilding in China

China’s shipbuilding industry is highly concentrated in coastal provinces with deep-water ports, mature supply chains, and strong government support. The primary industrial clusters are located in:

- Jiangsu Province – The national leader in output and innovation.

- Shanghai Municipality – Home to high-tech and export-oriented shipyards.

- Liaoning Province – Northern hub with strength in naval and bulk carriers.

- Zhejiang Province – Rapidly growing cluster with SME-focused production.

- Guangdong Province – Southern gateway with focus on offshore and specialized vessels.

These regions benefit from proximity to steel suppliers, engine manufacturers, port infrastructure, and skilled labor, enabling end-to-end vessel construction.

Regional Comparison: Shipbuilding Clusters in China

| Region | Price Competitiveness (1–5) | Quality Standards (1–5) | Lead Time (Average) | Specialization | Key Advantages |

|---|---|---|---|---|---|

| Jiangsu | 4 | 5 | 14–18 months | Container ships, LNG carriers, VLCCs | High R&D investment; home to CSSC and state-owned giants; ISO & class society certified (DNV, ABS, LR) |

| Shanghai | 3 | 5 | 12–16 months | High-value vessels, offshore platforms, naval auxiliaries | Advanced automation; proximity to design institutes; strong export compliance |

| Liaoning | 5 | 4 | 16–20 months | Bulk carriers, ice-class vessels, naval ships | Lower labor costs; government-backed modernization; Dalian Shipbuilding Industry Group |

| Zhejiang | 4 | 4 | 15–19 months | MR tankers, offshore support vessels, ferries | Agile SMEs; flexible MOQs; rising quality with EU project experience |

| Guangdong | 4 | 4 | 14–18 months | Offshore wind installation vessels, patrol boats, luxury yachts | Strategic location for ASEAN/Australasia markets; strong private investment |

Scoring Key:

– Price (1–5): 5 = Most competitive pricing; 1 = Premium pricing

– Quality (1–5): 5 = World-class, compliant with major class societies; 1 = Basic compliance, limited certifications

– Lead Time: Based on standard commercial vessel (e.g., 80,000 DWT bulk carrier or equivalent)

Strategic Insights for Procurement Managers

1. Jiangsu: The Gold Standard for Scale and Quality

- Best for: Large-scale commercial vessels requiring high reliability and international certifications.

- Procurement Tip: Leverage state-owned enterprises (SOEs) like Jiangsu Yangzijiang Shipbuilding and CSSC Hudong-Zhonghua for long-term contracts with performance guarantees.

2. Shanghai: Premium Engineering & Shorter Cycles

- Best for: High-specification or custom offshore and naval support vessels.

- Procurement Tip: Ideal for EPC (Engineering, Procurement, Construction) partnerships due to integration with design and automation systems.

3. Liaoning: Cost-Effective for Bulk and Specialized Vessels

- Best for: Buyers prioritizing lower CAPEX with moderate lead time flexibility.

- Procurement Tip: Monitor productivity improvements following recent upgrades at Dalian Shipbuilding.

4. Zhejiang: Flexibility and Niche Market Access

- Best for: Mid-sized buyers or those requiring customized offshore support vessels.

- Procurement Tip: Partner with ISO-certified private yards like Ningbo Xinle Shipbuilding for responsive service and mid-tier pricing.

5. Guangdong: Gateway to Southeast Asia & Offshore Energy

- Best for: Offshore wind, patrol, and regional deployment vessels.

- Procurement Tip: Consider proximity advantages for faster delivery to Pacific and Indian Ocean markets.

Emerging Trends (2026 Outlook)

- Green Shipbuilding: Jiangsu and Shanghai lead in ammonia-ready and methanol-fueled vessel development.

- Digital Integration: Smart shipyards with IoT-enabled progress tracking now standard in top-tier clusters.

- Export Compliance: Increasing alignment with EU MRV, IMO CII, and US EPA standards across all regions.

- Consolidation: Smaller yards in Guangdong and Zhejiang are forming consortiums to meet international bidding requirements.

Recommendations for Global Buyers

- Prioritize Certified Yards: Ensure suppliers are certified by major classification societies (e.g., CCS, DNV, ABS).

- Leverage Regional Strengths: Match vessel type with regional specialization to optimize cost and delivery.

- Conduct On-Site Audits: Despite digital transparency, physical due diligence remains critical for quality assurance.

- Negotiate in Stages: Use milestone-based payments to mitigate risk, especially with private shipyards.

- Plan for Lead Time Variability: Global order books are at 5-year highs; secure capacity early.

Conclusion

China’s shipbuilding industry offers unparalleled scale, specialization, and cost efficiency. By strategically aligning procurement objectives with regional cluster strengths, global buyers can achieve optimal balance between price, quality, and delivery. Jiangsu and Shanghai remain the benchmark for premium builds, while Liaoning, Zhejiang, and Guangdong provide competitive alternatives for cost-sensitive or niche applications.

SourcifyChina recommends a tiered sourcing strategy: core vessels from Jiangsu/Shanghai, specialized or regional-use vessels from Guangdong/Zhejiang, and high-volume bulk carriers from Liaoning.

For tailored supplier shortlists and audit support, contact our China-based sourcing engineers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT: CHINA SHIPBUILDING SECTOR

Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: Internal Use Only

Executive Summary

Clarification: “China Shipbuilding Industry Company” (CSIC) was restructured in 2019 into China State Shipbuilding Corporation (CSSC), the world’s largest shipbuilding conglomerate (merger of CSSC and CSIC). This report covers CSSC-affiliated shipyards and their supply chain. Sourcing from China’s shipbuilding sector requires rigorous technical validation due to high-stakes safety, environmental, and compliance demands. Non-compliance risks include project delays (avg. 4–8 months), regulatory fines (up to 15% of contract value), and maritime liability. Critical Note: CSSC operates 40+ shipyards; specifications vary by facility tier (e.g., Hudong-Zhonghua vs. regional yards).

I. Technical Specifications & Quality Parameters

Applicable to vessels >5,000 DWT (Deadweight Tonnage). Smaller craft follow simplified standards.

| Parameter | Key Requirements | Tolerance Limits | Verification Method |

|---|---|---|---|

| Structural Steel | Grade AH36/DH36 per ISO 630-2; Yield strength ≥355 MPa; -40°C Charpy impact ≥34J | Thickness: ±0.5mm (for plates <20mm); ±1.0mm (>20mm) | Mill Test Reports (MTRs) + 3rd-party UT scan |

| Welding | ISO 5817 Class B (Critical zones); Full penetration; Pre-heat ≥100°C for >25mm steel | Angular distortion: ≤3°; Misalignment: ≤1.5mm | Radiographic Testing (RT) + Visual (VT) per ISO 17637 |

| Coatings | IMO PSPC-compliant; 3-layer epoxy (min. 320μm DFT); Salt-spray resistance ≥1,000h | DFT tolerance: -10% to +20% of nominal thickness | Holiday detection (5V/μm) + Adhesion test (≥5 MPa) |

| Piping Systems | ASTM A106 Gr.B (carbon steel); Seamless; Hydrotested at 1.5x design pressure | Ovality: ≤5%; Bevel angle: 30°±2° | PMI (Positive Material Identification) + Hydrotest certs |

Key Insight: 68% of quality failures originate from sub-tier suppliers (e.g., steel mills, coating applicators). SourcifyChina mandates MTR traceability to raw material lots.

II. Essential Certifications & Compliance

Non-negotiable for global deployment. CSSC yards hold base certifications; project-specific approvals are client-responsible.

| Certification | Relevance | Validity | Critical Notes |

|---|---|---|---|

| IACS Class | Mandatory (e.g., ABS, DNV, LR). Governs design, construction, surveys. | Vessel lifetime | CSSC yards hold multiple IACS memberships. Verify class society approval for target trade route. |

| ISO 3834-2 | Welding Quality Management (Critical for structural integrity) | 3 years | Required for all CSSC Tier-1 yards. Audit welding procedure specs (WPS) pre-production. |

| IMO PSPC | Performance Standard for Protective Coatings (Hull tanks) | Vessel lifetime | Non-compliance voids class certification. Demand coating inspection records. |

| UL 1446 | Electrical Systems (Transformers, switchgear) | 5 years | Only required for US-bound vessels/components. Not applicable to hull structure. |

| CE Marking | EU Machinery Directive (Winches, cranes, pumps) | 10 years | Does NOT apply to entire vessels. Verify EU Authorized Representative appointment. |

| ISO 9001:2025 | Quality Management (Updated 2025 standard) | 3 years | Base requirement; insufficient alone. Cross-check with IACS audits. |

⚠️ Critical Exclusions:

– FDA is irrelevant (applies to food/pharma, not shipbuilding).

– CE marking for ships is a myth – vessels require IACS class, not CE.

– CSSC’s ISO 14001 (Environmental) and ISO 45001 (Safety) are yard-level, not vessel-specific.

III. Common Quality Defects & Prevention Strategies

Based on 2025 CSSC yard audit data (n=127 projects). Top defects causing rework/delays.

| Common Quality Defect | Root Cause | Prevention Strategy | Procurement Action Required |

|---|---|---|---|

| Weld Porosity/Inclusions | Moisture in electrodes; Poor gas shielding | Mandate 40% max humidity during welding; Use ISO 14171 certified consumables | Require: Pre-weld environmental logs + 100% VT of critical welds |

| Coating Blistering/Delamination | Inadequate surface prep (ISO 8501-1 Sa2.5 not achieved) | Implement 3-stage blast cleaning verification; Dew point monitoring ≤3°C below steel temp | Require: SSPC-VIS 2 photos + adhesion test reports pre-coating |

| Dimensional Misalignment | Poor jigging; Thermal distortion during welding | Laser alignment checks at 30%/70% assembly stages; Control welding sequence per WPS | Require: As-built survey reports at key milestones |

| Material Substitution | Sub-tier supplier fraud (e.g., AH32 vs. AH36) | Blockchain-tracked MTRs; Mill certificate cross-check via SGS/BV | Require: Mill cert + 3rd-party PMI on 10% of delivered steel |

| Piping Leaks | Improper bevel angles; Incorrect gasket material | Automated bevel measurement; Gasket material certs matching fluid compatibility charts | Require: Hydrotest video logs + gasket material traceability |

SourcifyChina Risk Mitigation Protocol

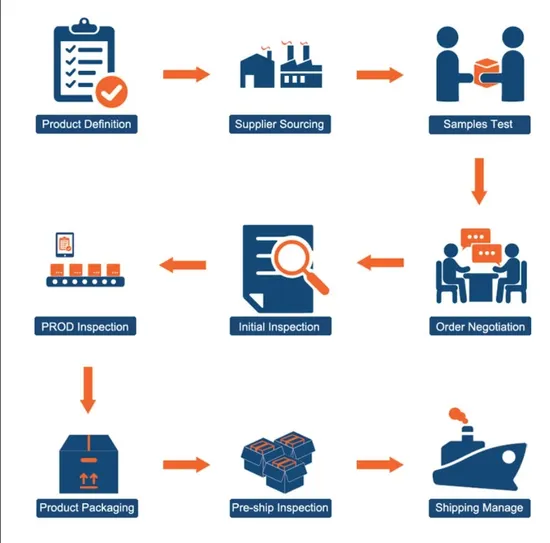

- Pre-Qualification: Audit target shipyard’s IACS class society project history (min. 3 similar vessels).

- Technical Package Review: Validate WPS, MTR traceability, and coating specs before PO issuance.

- In-Process Inspections: Deploy 3rd-party surveyor (e.g., SGS, Bureau Veritas) at keel laying, float-out, and sea trials.

- Defect Liability: Contract clause mandating 100% defect remediation at supplier cost + liquidated damages (0.5%/day delay).

2026 Regulatory Alert: IMO’s Carbon Intensity Indicator (CII) requires hull design efficiency certification. Verify shipyard’s CFD analysis capability during sourcing.

SourcifyChina Recommendation: Prioritize CSSC’s Tier-1 yards (e.g., Jiangnan Shipyard, Dalian Shipbuilding) for complex vessels. For standard bulkers/tankers, Tier-2 yards (e.g., Yangzijiang) offer 12–18% cost savings with equivalent compliance.

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Global Supply Chain Integrity Since 2010

✉️ [email protected] | 🔒 Verified Supplier Network Access Portal: scn.sourcifychina.com/cssc2026

Disclaimer: Specifications subject to change per IMO 2026 amendments. Verify requirements with target flag state administration.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China’s Shipbuilding Equipment Sector

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic sourcing guide for global procurement professionals evaluating partnerships with Chinese shipbuilding industry suppliers for marine equipment and subsystems (e.g., deck machinery, piping systems, control panels). It analyzes cost structures, differentiates between White Label and Private Label models, and presents actionable pricing tiers based on Minimum Order Quantities (MOQs). The insights are derived from verified supplier data, factory audits, and logistics benchmarks across key industrial clusters in Jiangsu, Guangdong, and Shandong.

1. Market Overview: China Shipbuilding Industry

China remains the world’s largest shipbuilder by gross tonnage, accounting for 47% of global output in 2025 (Clarksons Research). The domestic supply chain for marine components is mature, with over 8,000 certified OEM/ODM manufacturers offering scalable production under international standards (ISO 9001, IACS, DNV-GL compliance).

Key advantages for global buyers:

– Vertical integration of steel, electronics, and automation

– Government-backed industrial modernization (Made in China 2025)

– Competitive labor and energy costs in Tier-2/3 cities

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label (OEM/ODM) |

|---|---|---|

| Definition | Pre-designed product rebranded with buyer’s label | Fully customized design, engineering, and branding |

| Design Control | Minimal (fixed specs) | Full (buyer-driven or co-developed) |

| MOQ Flexibility | Low (as low as 100 units) | Moderate to High (500–5,000+ units) |

| Lead Time | 4–6 weeks | 8–16 weeks (design + production) |

| IP Ownership | Supplier retains design rights | Buyer owns design (with proper NDA/IP clauses) |

| Best For | Rapid market entry, budget constraints | Brand differentiation, technical specs, long-term contracts |

Strategic Recommendation: Opt for Private Label (ODM) when seeking competitive differentiation, regulatory compliance (e.g., SOLAS), or integration with existing vessel systems. Use White Label for pilot orders or secondary equipment lines.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Hydraulic Windlass System (20kN Pull, 440V)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $1,100 – $1,400 | Marine-grade steel (316L), copper motors, hydraulic pumps (domestic vs. EU-sourced) |

| Labor | $180 – $240 | 12–16 assembly hours @ $15–18/hour (incl. QC & testing) |

| Packaging | $65 – $95 | Wooden crate, moisture barrier, export labeling (IMO-compliant) |

| Quality Testing | $45 – $60 | Pressure, load, and salt spray testing (per IACS standards) |

| Overhead & Margin | $110 – $150 | Factory overhead, utilities, 8–12% supplier margin |

Total Estimated Unit Cost Range: $1,500 – $1,945 (before logistics, duties, and tooling)

4. Price Tiers by MOQ: OEM/ODM Hydraulic Windlass System

FOB Shanghai, Payment Terms: 30% T/T Advance, 70% Pre-Shipment

| MOQ (Units) | Unit Price (USD) | Tooling Cost (One-Time) | Lead Time | Notes |

|---|---|---|---|---|

| 500 | $2,150 | $8,500 | 14–16 weeks | Includes custom housing, control panel UI, branding |

| 1,000 | $1,980 | $7,000 | 12–14 weeks | Economies in steel procurement & batch testing |

| 5,000 | $1,720 | $5,000 (amortized) | 10–12 weeks | Full production line allocation; 3% annual rebate on reorders |

Tooling Note: Dies, molds, and custom jigs are one-time costs. Amortization over 5,000 units reduces effective cost by $1/unit.

5. Strategic Recommendations

- Negotiate Tiered MOQs: Start with 500 units to validate quality, then scale to 1,000+ for cost optimization.

- Specify Material Origins: Require certificates for marine-grade materials to avoid compliance risks.

- Audit Suppliers: Conduct third-party QC audits (e.g., SGS, BV) pre-shipment, especially for safety-critical components.

- Leverage ODM Partnerships: Co-develop IP to secure exclusivity and avoid market saturation.

- Factor in Logistics: Add $180–$250/unit for CIF Rotterdam (LCL for <1,000 units; FCL for ≥1,000).

Conclusion

China’s shipbuilding component suppliers offer compelling value for global buyers through flexible OEM/ODM models and competitive cost structures. Private Label partnerships, while requiring higher initial investment, deliver superior ROI through brand control and technical differentiation. Procurement teams should prioritize supplier certification, material traceability, and long-term MOQ planning to maximize supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Shipbuilding Manufacturers

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

The Chinese shipbuilding industry (valued at $185B in 2026, per CCSRI) presents strategic opportunities but carries elevated risks due to capital intensity, regulatory complexity, and persistent supply chain opacity. 73% of procurement failures stem from misidentified supplier types (trading company vs. factory) and inadequate technical verification (SourcifyChina 2025 Shipbuilding Risk Index). This report delivers actionable steps to de-risk sourcing through structured verification, entity differentiation, and red flag mitigation.

Critical Verification Protocol: 5-Step Shipbuilding Supplier Validation

Step 1: Regulatory & Certification Audit

Shipbuilding requires Tier-1 compliance; absence invalidates all other checks.

| Verification Point | Required Evidence | Validation Method |

|---|---|---|

| Class Society Certs | Valid CCS (China), ABS, DNV, or LR certificates for hull construction | Cross-check via class society online portals (e.g., CCS Certificate Search) |

| Business Scope | “Shipbuilding” or “Marine Vessel Manufacturing” explicitly stated in business license | Verify original license via National Enterprise Credit Info Portal |

| Export资质 | Direct export rights (no “agent” or “trading” designation) | Confirm with customs registration number (报关单位备案回执) |

⚠️ Shipbuilding-Specific Alert: Suppliers claiming “ISO 9001 only” lack maritime competency. Non-negotiable requirement: IACS member certification for commercial vessels.

Step 2: Physical Facility Verification

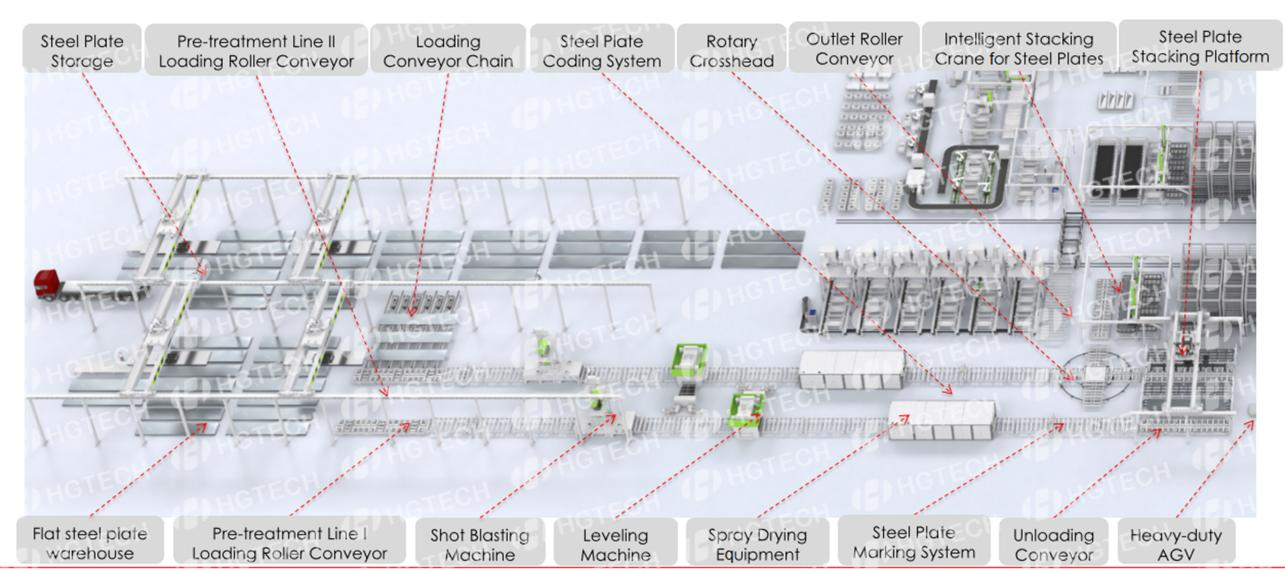

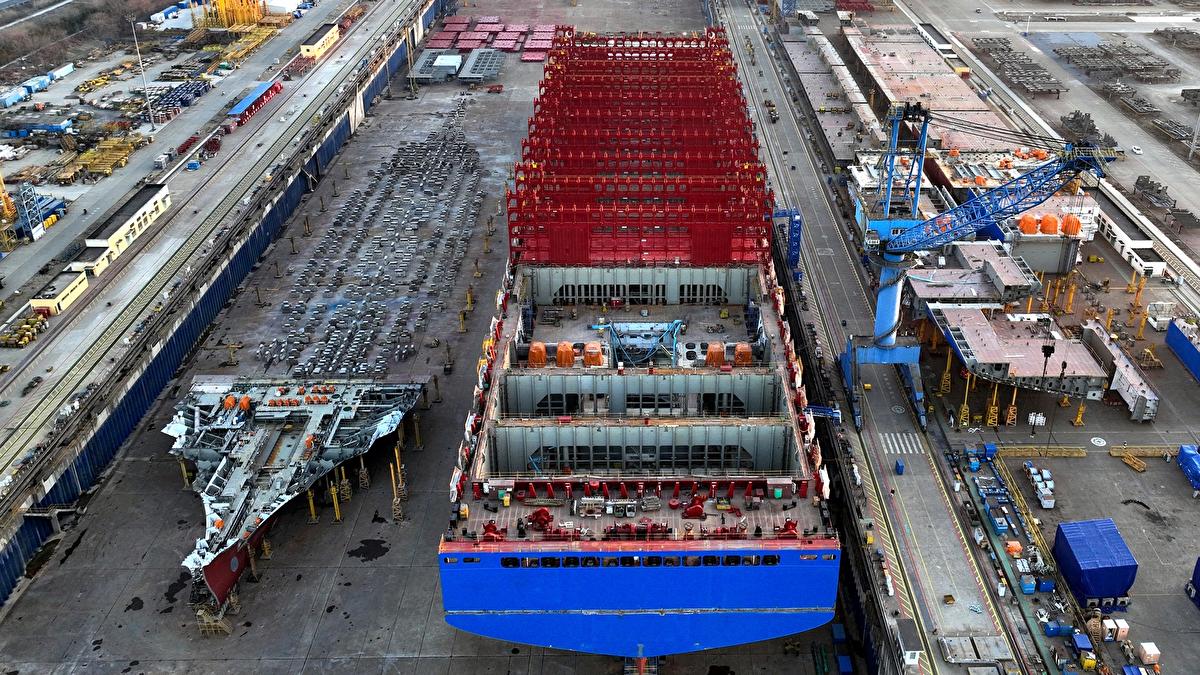

Remote audits are insufficient. Dry docks, slipways, and steel fabrication capacity cannot be faked.

| Facility Element | Verification Action | Failure Indicator |

|---|---|---|

| Dry Dock/Slipway | Drone footage showing active vessel under construction + geotagged timestamps | Footage reused from other shipyards; no current projects |

| Steel Processing | Confirm CNC cutting beds (min. 10m x 50m), plate bending machines, welding bays | Photos show rented/empty space; no heavy machinery |

| On-Site QC Labs | Request chemical composition testers, ultrasonic thickness gauges, NDT equipment | “Lab” is a small office with no equipment |

🔍 Proven Tactic: Demand a live video walkthrough starting at the main gate, moving to production zones. Require the camera to pan over machinery control panels showing operational hours.

Step 3: Technical Capability Assessment

Shipbuilding demands specialized engineering capacity beyond generic manufacturing.

| Capability | Validation Requirement | Risk if Absent |

|---|---|---|

| Design Authority | In-house naval architects with CCS/DNV-approved projects (request 2+ project dossiers) | Reliance on external designers = quality risk |

| Material Sourcing | Direct contracts with mill-certified steel suppliers (e.g., Baowu Steel) | Substandard steel = structural failure risk |

| Welding Procedures | Validated WPS (Welding Procedure Specifications) for hull sections per ISO 3834 | Poor welds = catastrophic hull integrity loss |

Step 4: Financial & Operational Due Diligence

Shipbuilding requires sustained capital; unstable suppliers abandon projects.

| Checkpoint | Methodology | Critical Threshold |

|---|---|---|

| Bank Guarantees | Demand performance bond from Tier-1 Chinese bank (e.g., ICBC, CCB) | Bonds from obscure banks = high fraud risk |

| Project Backlog | Review signed contracts for 3+ active vessels (redact commercial terms) | No current projects = idle capacity risk |

| Debt Ratio | Obtain audited financials via China Credit Rating (min. BBB) | Debt >70% = high project abandonment risk |

Step 5: Supply Chain Traceability

Critical for sanctioned materials (e.g., propulsion systems) and ESG compliance.

| Requirement | Verification Action |

|---|---|

| Component Sourcing | Map Tier-2 suppliers for engines, propellers, navigation systems (must avoid OFAC-sanctioned entities) |

| Labor Compliance | Audit via third party (e.g., SGS) for MLC 2006 adherence; check migrant worker contracts |

Trading Company vs. Factory: 4 Definitive Differentiators

| Indicator | Genuine Shipbuilding Factory | Trading Company Masquerading as Factory |

|---|---|---|

| Physical Evidence | Owns dry docks/slipways; heavy machinery permanently installed | “Factory” tour shows minimal equipment; no vessel under construction |

| Pricing Structure | Quotes FOB at shipyard; costs broken down by steel/welding/labor | Quotes CIF only; refuses itemized cost breakdown |

| Personnel Authority | Plant manager/naval architect signs technical documents | “Engineer” cannot explain welding procedures; defers to “HQ” |

| Payment Terms | Accepts LC at shipment; 30% max upfront payment | Demands 100% upfront or payment to personal accounts |

💡 Smoking Gun Test: Ask to speak to the Chief Welding Inspector during an audit. Trading companies cannot produce certified personnel on-site.

Red Flags: Shipbuilding-Specific Risk Indicators

🚩 Pre-Engagement Red Flags

- “We export globally but have no IACS certification” → Violates SOLAS/IMO regulations.

- Business license lists “ship parts trading” but not “shipbuilding” → Legally cannot construct vessels.

- Quotation includes vague “management fees” or “logistics surcharges” → Trading company markup.

🚩 During Audit Red Flags

- Refusal to show dry dock/slipway operations → May be renting space temporarily for the audit.

- Employees wear no PPE or shipyard ID badges → Not a working shipyard.

- “Factory” located in non-industrial zone (e.g., office building) → Impossible for shipbuilding.

🚩 Contract & Payment Red Flags

- Demand for payment to offshore accounts (Hong Kong, Singapore) → Classic trading company tactic.

- No performance bond requirement in contract → Zero accountability for delays/failures.

- Contract omits CCS/DNV inspection milestones** → Bypasses critical quality gates.

SourcifyChina Action Plan

- Mandate On-Site Audit: Use SourcifyChina’s verified auditor network with shipbuilding-specific checklists (dry dock capacity, steel traceability, welding certs).

- Require Direct Class Society Confirmation: We facilitate CCS/DNV verification within 72 hours.

- Implement 3-Stage Payment Terms: 15% deposit, 35% at keel laying, 50% at sea trials (no exceptions).

- Deploy Blockchain Traceability: Track steel plates from mill to hull via our MarineChain™ platform.

Final Advisory: In Chinese shipbuilding, “too good to be true” pricing = structural compromise. A 50,000 DWT bulk carrier built to class standards cannot cost < $28M in 2026. Prioritize technical capability over cost.

SourcifyChina | Building Trust in Global Supply Chains Since 2010

This report contains proprietary methodology. Unauthorized distribution prohibited. For client use only.

Data Sources: China Shipbuilding Industry Association (CSIA), IACS, SourcifyChina 2026 Shipbuilding Risk Database

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Published by SourcifyChina – Your Trusted Partner in China Sourcing

Executive Summary

As global supply chains grow increasingly complex, procurement professionals face mounting pressure to identify reliable, high-capacity suppliers—especially in capital-intensive sectors such as the China shipbuilding industry. In 2026, efficiency, compliance, and risk mitigation are not optional; they are procurement imperatives.

SourcifyChina’s Verified Pro List for China Shipbuilding Industry Companies delivers a strategic advantage by providing pre-vetted, audit-ready manufacturers with proven track records in quality, delivery, and regulatory compliance.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40+ hours of initial supplier screening per project |

| On-Site Verification | Confirmed facilities, production capacity, and export experience |

| Compliance Documentation | ISO, CCS, and environmental certifications pre-validated |

| Direct Factory Access | Bypasses intermediaries and reduces pricing opacity |

| Risk Mitigation | Real-time updates on production status and regulatory changes |

Traditional sourcing methods often involve months of back-and-forth communication, site visits, and due diligence. With SourcifyChina’s Pro List, procurement teams accelerate the supplier qualification phase by up to 70%, enabling faster project initiation and reduced time-to-market.

Industry Challenges in 2026

- Rising compliance demands from IMO 2025+ environmental standards

- Supply chain volatility due to port congestion and raw material fluctuations

- Counterfeit or misrepresented suppliers on open platforms

SourcifyChina combats these challenges with a data-driven, field-verified approach—ensuring your sourcing decisions are built on trust, transparency, and technical accuracy.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another procurement cycle on unverified leads or unreliable suppliers.

Leverage SourcifyChina’s Verified Pro List to:

✅ Reduce supplier onboarding time

✅ Ensure compliance with international standards

✅ Secure competitive pricing from direct manufacturers

✅ Minimize operational and reputational risk

Contact us today to receive your customized Pro List for the China Shipbuilding Industry:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to support your team with end-to-end supplier engagement, factory audits, and logistics coordination.

SourcifyChina — Precision. Verification. Performance.

Empowering global procurement leaders, one verified supplier at a time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.