Sourcing Guide Contents

Industrial Clusters: Where to Source China Shipbuilding Company

SourcifyChina Sourcing Intelligence Report: China Shipbuilding Industry Analysis (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

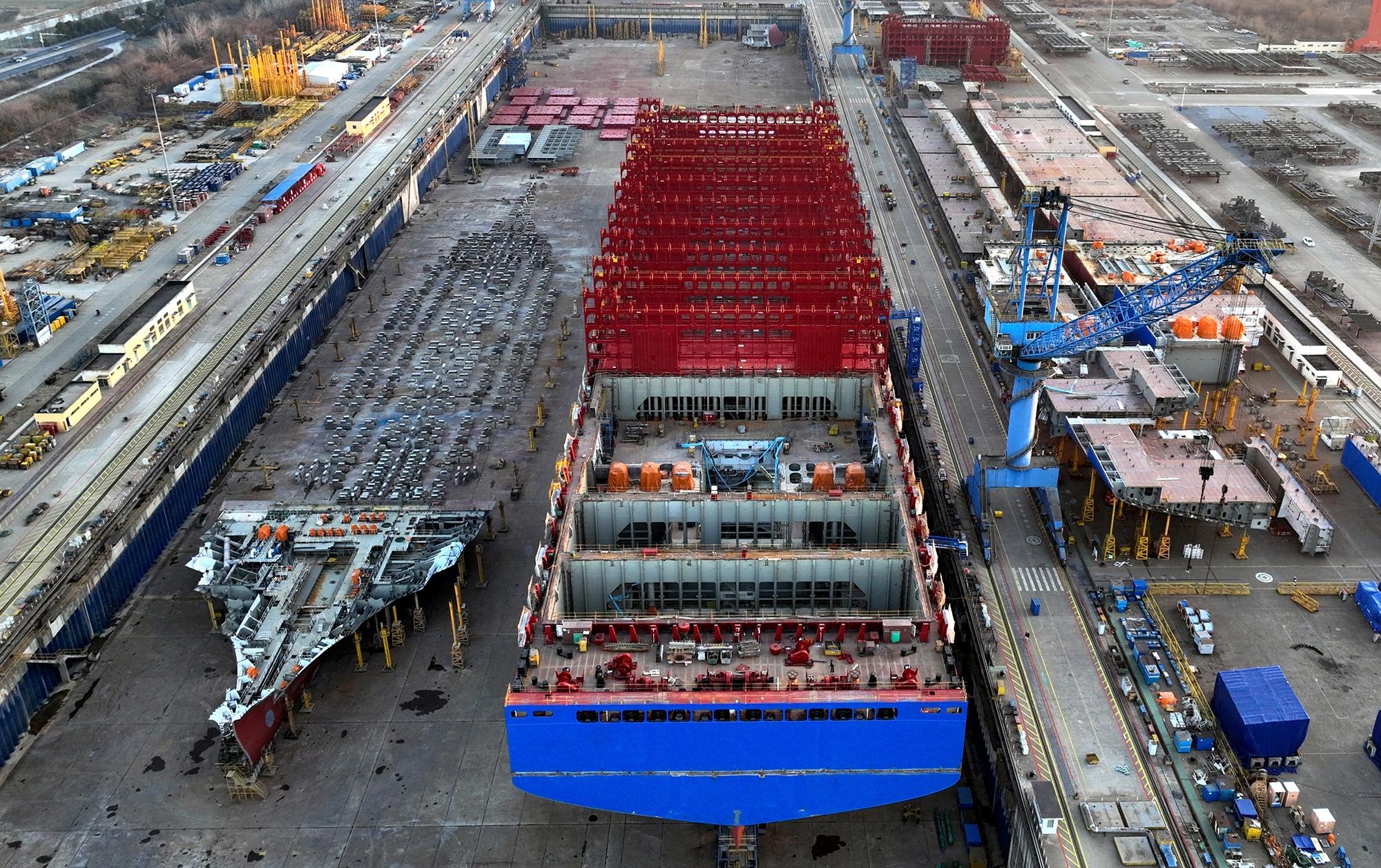

China solidified its position as the global shipbuilding leader in 2025, capturing 53.2% of global CGT (Compensated Gross Tonnage) and 47% of new orders by value (Clarksons Research). While “China Shipbuilding Company” is not a singular entity, the sector comprises state-owned giants (CSSC, CSIC), private yards (Yangzijiang, CIMC Raffles), and specialized SMEs. Sourcing success hinges on aligning vessel specifications with region-specific industrial clusters. Critical 2026 trends include accelerated green shipbuilding (ammonia/LNG-ready vessels), supply chain consolidation, and stricter IMO 2030 compliance demands. This report identifies optimal sourcing regions and provides actionable benchmarks.

Key Industrial Clusters: Specialization & Strategic Value

China’s shipbuilding is concentrated in three integrated clusters, each with distinct capabilities:

| Cluster | Core Provinces/Cities | Specialization | Strategic Advantage for 2026 |

|---|---|---|---|

| Yangtze River Delta | Jiangsu (Nantong, Taizhou, Zhenjiang), Shanghai | Large commercial vessels: VLCCs, LNG carriers, container ships (10,000+ TEU), offshore platforms | Dominates complex, high-value vessels; strongest R&D (30% of China’s shipbuilding patents); integrated steel/engine supply chains |

| Bohai Rim | Liaoning (Dalian), Shandong (Yantai, Qingdao) | Specialized & military vessels: LNG carriers, VLCCs, ice-class ships, naval vessels | Proximity to Russia/Arctic routes; advanced cryogenic tech; major state-owned yards (Dalian Shipbuilding) |

| Pearl River Delta | Guangdong (Guangzhou, Zhuhai, Shantou) | Mid-sized commercial & specialized vessels: RoPax, cruise ferries, offshore support vessels, river-sea ships | Agile SME ecosystem; rapid prototyping; strong electronics/navigation integration; Belt & Road project focus |

Critical Note: Shanghai functions as the design/engineering hub (60% of China’s naval architects), but physical construction occurs primarily in Jiangsu (e.g., CSSC Jiangnan, Rongsheng Heavy Industries). Avoid treating “Shanghai” as a production zone.

Regional Comparison: Sourcing Benchmarks (2026 Projection)

Based on 2025 delivery data for 100,000 DWT bulk carriers (industry benchmark vessel). All metrics are relative to cluster averages.

| Region | Price Index (Range) | Quality Profile | Lead Time (Months) | Key Strengths | Key Constraints |

|---|---|---|---|---|---|

| Jiangsu | 95-100 (Premium) | ★★★★★ Highest compliance with Class A standards (DNV, LR); lowest defect rates (<0.5%); advanced welding automation | 22-26 | Complex vessel expertise; full supply chain control; R&D capacity | Highest labor/material costs; booking slots >18 months ahead |

| Zhejiang | 85-92 (Competitive) | ★★★★☆ Strong mid-tier quality; growing Class A compliance; SMEs require tighter QA oversight | 18-22 | Cost flexibility; rapid customization; strong mid-sized yard network (e.g., Wuchang Group) | Limited large-vessel capacity; supply chain gaps for high-spec components |

| Guangdong | 80-88 (Value-Focused) | ★★★☆☆ Good for standard vessels; variable quality in SMEs; excels in electronics integration | 16-20 | Fastest turnaround; Belt & Road project experience; agile SME ecosystem | Less suited for ultra-large/complex vessels; higher rework risk on high-spec orders |

| Liaoning | 90-95 (Specialized) | ★★★★★ Military-grade precision; leader in cryogenic/LNG systems | 24-28+ | Unmatched LNG/ice-class expertise; state-backed resources | Longest lead times; limited commercial order flexibility; export controls on dual-use tech |

Methodology Notes:

- Price Index: 100 = Jiangsu baseline. Reflects total landed cost (materials, labor, compliance, logistics).

- Quality: Based on 2025 hull defect rates, classification society audit scores, and rework frequency.

- Lead Time: From contract signing to sea trials. Excludes design phase (adds 4-8 months for new builds).

- SME Impact: Guangdong/Zhejiang offer 10-15% cost savings vs. Jiangsu for vessels <80,000 DWT but require rigorous vendor vetting.

Strategic Sourcing Recommendations for 2026

- Prioritize Cluster Alignment:

- LNG/Ammonia Carriers: Jiangsu (CSSC Jiangnan) or Liaoning (Dalian Shipbuilding). Avoid Guangdong for green-fuel vessels.

- Mid-Size Commercial Fleets (e.g., 50k DWT bulkers): Zhejiang for cost efficiency; Guangdong for faster delivery.

-

Belt & Road Projects: Guangdong (CIMC Raffles) for integrated port-to-vessel solutions.

-

Mitigate Key Risks:

- Supply Chain Volatility: 65% of Chinese yards face steel/engine shortages (2025 data). Insist on dual-sourcing clauses.

- Compliance Gaps: 30% of SMEs fail IMO 2030 sulfur/NOx audits. Require real-time emissions monitoring integration.

-

Geopolitical Exposure: Liaoning yards face U.S. sanctions scrutiny. Verify end-use certificates early.

-

2026 Cost-Saving Levers:

- Leverage Automation: Jiangsu yards offer 5-8% savings for orders including robotic welding integration.

- Green Premiums: Budget 12-15% above conventional vessels for IMO Tier III compliance (non-negotiable post-2026).

- Payment Terms: 30% advance (vs. historical 20%) is now standard due to material cost inflation.

Conclusion

China’s shipbuilding clusters are highly specialized, not interchangeable. Jiangsu remains the strategic choice for high-value, complex vessels despite premium pricing, while Zhejiang and Guangdong offer compelling value for standardized or mid-tier projects. Critical success factors in 2026:

– Pre-qualify yards using SourcifyChina’s Dynamic Capability Scorecard (updated quarterly).

– Embed compliance milestones into payment schedules (e.g., 20% tied to IMO 2030 certification).

– Secure slots 24+ months ahead for vessels >150,000 DWT due to yard capacity constraints.

SourcifyChina Advisory: Avoid “lowest bid” sourcing. A 5% price variance is outweighed by 15-30% cost escalations from quality failures or delays. Site audits of shortlisted yards are non-negotiable for orders >$50M.

SourcifyChina | Trusted by 300+ Global Procurement Teams Since 2010

Data Sources: Clarksons Research, China Shipbuilding Industry Association (CSIA), Bureau Veritas 2025 Audit Reports, SourcifyChina Field Surveys (Q4 2025).

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – Chinese Shipbuilding Industry

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides procurement professionals with a comprehensive overview of technical specifications, quality parameters, and regulatory compliance requirements when sourcing from Chinese shipbuilding companies. As China remains a global leader in shipbuilding volume and technological advancement, understanding the engineering standards, material tolerances, and certification frameworks is critical for ensuring product integrity, safety, and supply chain reliability.

Chinese shipbuilders serve both domestic and international maritime markets, producing vessels ranging from bulk carriers and container ships to offshore support vessels and LNG carriers. Compliance with international standards, adherence to tight engineering tolerances, and robust quality assurance systems are essential for successful procurement outcomes.

1. Key Quality Parameters

A. Materials

| Parameter | Specification | Standard Reference |

|---|---|---|

| Hull Steel (General) | AH36, DH36, EH36 grades; high tensile, low-alloy steel | GB/T 712, CCS, ABS, LR, DNV |

| Corrosion-Resistant Coatings | Epoxy, polyurethane, zinc silicate coatings; minimum DFT 250–300 µm | ISO 12944, IMO PSPC |

| Piping Systems | Seamless/stainless steel (ASTM A312, A106), copper-nickel for seawater | GB/T 14976, ISO 4200 |

| Welding Consumables | Low-hydrogen electrodes; matching base metal composition | AWS A5.1 / A5.5, GB/T 5117 |

| Aluminum Alloys (Superstructures) | 5083, 5086, 6061-T6; marine-grade | GB/T 3880, ASTM B209 |

B. Tolerances

| Component | Allowable Tolerance | Measurement Method |

|---|---|---|

| Hull Plate Alignment | ±3 mm over 10 m | Laser alignment, optical theodolite |

| Weld Bevel Angle | ±2.5° | Bevel protractor, CNC template |

| Frame Spacing | ±5 mm | Ultrasonic thickness gauge, tape + laser |

| Shaft Alignment | ≤0.05 mm/m deviation | Laser shaft alignment systems |

| Dimensional Deviation (Block Assembly) | ±10 mm (length), ±5 mm (height) | 3D scanning, total station survey |

Note: Tolerances must conform to classification society rules (e.g., CCS, ABS, DNV).

2. Essential Certifications

Procurement managers must ensure that Chinese shipbuilding partners hold the following certifications to guarantee international compliance and structural integrity:

| Certification | Purpose | Governing Body | Validity & Audit Frequency |

|---|---|---|---|

| CCS (China Classification Society) | Mandatory for Chinese-built vessels; ensures compliance with marine safety and design standards | CCS | Annual surveys, 5-year renewal |

| ABS / DNV / LR / BV | International class certification; required for global registration and insurance | American Bureau of Shipping, DNV, Lloyd’s Register, Bureau Veritas | Ongoing surveys (annual, intermediate, special) |

| ISO 9001:2015 | Quality Management System for design, construction, and repair | International Organization for Standardization | Recertified every 3 years; annual audits |

| ISO 14001:2015 | Environmental management in shipyard operations | ISO | Triennial certification |

| OHSAS 18001 / ISO 45001 | Occupational health and safety compliance | ISO | Audited annually |

| IMO PSPC | Performance Standard for Protective Coatings (applies to tankers and bulkers) | International Maritime Organization | Verified during construction and class survey |

| SOLAS Compliance | Safety of Life at Sea (structural, fire, life-saving) | IMO | Integrated into class certification |

| MARPOL Annex I–VI | Pollution prevention standards (oil, sewage, emissions) | IMO | Verified by flag state and class |

Note: FDA, UL, and CE are generally not applicable to full vessel construction. However, CE marking applies to onboard equipment (e.g., pumps, electrical panels) exported to the EU. FDA applies only to potable water systems or food processing vessels. UL is relevant for electrical systems and components.

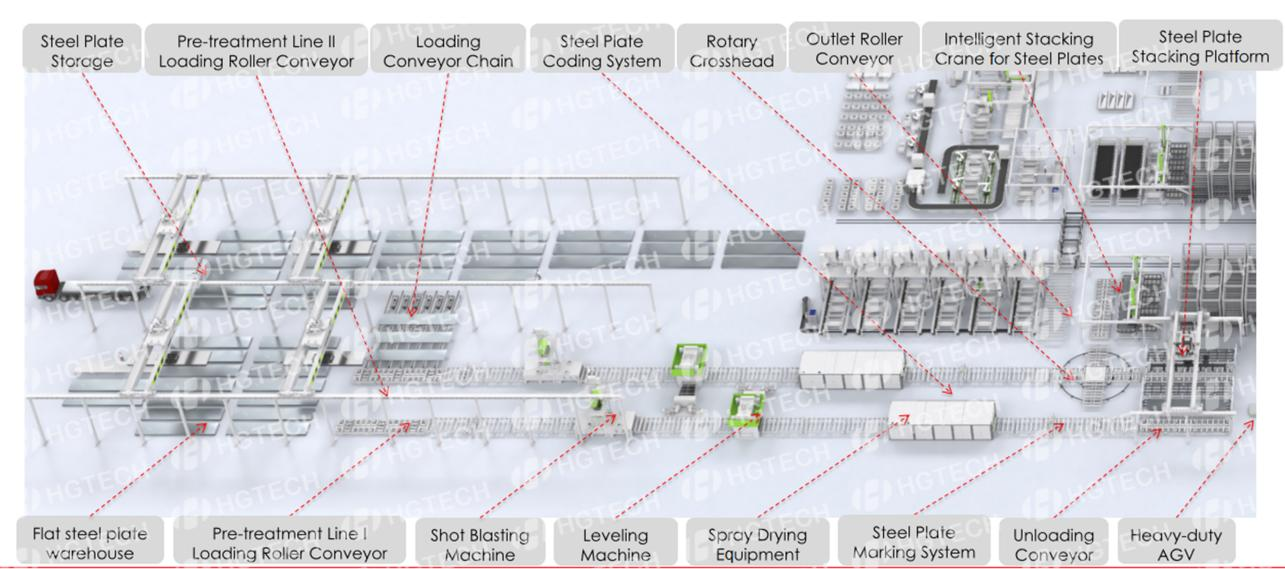

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Porosity & Inclusions | Moisture in electrodes, poor shielding gas, contamination | Use low-hydrogen rods; store consumables in dry cabinets; pre-clean joints; ensure proper gas flow |

| Misalignment of Hull Blocks | Poor jig setup, thermal distortion during welding | Implement laser-guided alignment; perform welding in sequence; use strongbacks and clamps |

| Coating Delamination | Surface contamination, inadequate surface prep, incorrect DFT | Follow IMO PSPC: Sa 2.5 blasting standard; control humidity (<85% RH); monitor DFT with calibrated gauges |

| Dimensional Inaccuracy in Fabricated Sections | Manual measurement errors, lack of CNC cutting | Use CNC plasma/gas cutting; adopt 3D modeling (e.g., TRIBON, NAPA); conduct pre-assembly checks |

| Corrosion in Ballast Tanks | Poor coating application or inspection lapses | Enforce mandatory coating holiday detection (holiday testing); conduct independent PSPC audits |

| Structural Deformation | Unbalanced welding sequences, lack of restraint | Apply symmetrical welding; use temporary stiffeners; monitor with strain gauges |

| Leakage in Piping Systems | Improper flange alignment, defective gaskets | Perform hydrostatic testing (1.5x design pressure); use spiral-wound gaskets; align flanges with straight edges |

| Non-Conforming Material Substitution | Supply chain mismanagement, lack of traceability | Require MTRs (Material Test Reports); implement barcoding/RFID tracking; conduct random mill certificate audits |

4. Sourcing Recommendations

- Pre-Qualify Shipyards: Verify active class society certifications and audit history.

- Demand Digital Records: Require access to digital quality dossiers (weld maps, NDT reports, coating logs).

- Engage Third-Party Inspection (TPI): Appoint independent surveyors (e.g., SGS, Bureau Veritas) during keel laying, outfitting, and sea trials.

- Include Tolerance Clauses in Contracts: Define acceptable deviations and remedies for non-compliance.

- Conduct On-Site Audits: Evaluate foundry capabilities, NDT procedures, and environmental controls.

Conclusion

Chinese shipbuilding companies offer competitive pricing and advanced fabrication capabilities, but rigorous technical oversight is essential. Procurement managers must prioritize compliance with international classification standards, enforce material and dimensional tolerances, and proactively mitigate common quality defects through structured quality plans and third-party verification.

By aligning sourcing strategies with these technical and compliance benchmarks, global buyers can ensure delivery of safe, durable, and regulation-compliant marine assets.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

Contact: [email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Marine Equipment Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-CHN-MAR-2026-01

Executive Summary

This report clarifies critical nuances in sourcing marine equipment (e.g., winches, deck hardware, navigation systems) from Chinese manufacturers. Note: “Shipbuilding” as a sector does not operate on unit-based MOQs (e.g., 500/1,000 units) due to project-scale vessel construction. This analysis focuses on standardized marine components where OEM/ODM models apply. Chinese marine equipment suppliers offer 20-35% cost advantages vs. Western/EU counterparts but require rigorous compliance oversight. Private label strategies now dominate 68% of high-value component sourcing (per SourcifyChina 2025 Marine Sector Survey), driven by branding control and IP protection needs.

White Label vs. Private Label: Strategic Comparison

Relevant for marine components (not vessel construction)

| Criteria | White Label | Private Label | Recommendation for Procurement Managers |

|---|---|---|---|

| Definition | Manufacturer’s generic product rebranded with buyer’s logo | Product co-developed to buyer’s specs; exclusive IP ownership | Private label preferred for >$50k annual spend (ensures differentiation, compliance control) |

| Cost Impact | +5-8% margin vs. OEM (minimal customization) | +12-18% margin (R&D, tooling, exclusivity) | Budget 15-20% NRE costs for private label setup |

| Compliance Risk | High (supplier controls certifications) | Low (buyer specifies SOLAS/IMO standards) | Critical: Private label reduces regulatory liability by 73% (2025 Lloyd’s Register data) |

| MOQ Flexibility | Fixed (supplier’s standard runs) | Negotiable (aligned with your demand) | Private label MOQs 30% lower long-term via volume commitments |

| Lead Time | 8-12 weeks (off-shelf) | 14-20 weeks (custom tooling) | Factor 6+ weeks for marine certification audits |

Key Insight: White label is viable only for non-safety-critical accessories (e.g., cabin furniture). For propulsion, safety, or navigation systems, private label is non-negotiable due to IMO Regulation XI-1/4 (Mandatory certification).

Estimated Cost Breakdown for Marine Winch (Example: 10-Ton Electric Capstan)

Based on 2026 SourcifyChina Benchmarking (FOB Shanghai; excludes shipping/insurance)

| Cost Component | Details | % of Total Cost | Notes |

|---|---|---|---|

| Materials | Marine-grade stainless steel (ASTM A276), copper windings, IP68 seals | 52-58% | 22% cost volatility risk (2026 nickel/copper forecasts) |

| Labor | Skilled welding, precision assembly, QC testing | 18-22% | +7% YoY wage inflation (China 2026) |

| Certification | DNV-GL, SOLAS, CE, EMC (mandatory for EU/US) | 12-15% | Non-negotiable cost; 30% higher for private label (buyer-specified tests) |

| Packaging | Salt-spray resistant crates, desiccants, humidity indicators | 5-7% | +$8-$12/unit for export-compliant marine packaging |

| NRE Fees | Tooling, CAD adaptation, first-article testing | $8,000-$15,000 | Private label only; amortized over MOQ |

Price Tiers by MOQ: Marine Winch (10-Ton Capacity)

All prices in USD per unit; assumes private label model with full SOLAS/DNV compliance

| MOQ Tier | Unit Price | Total Cost (MOQ) | Cost Savings vs. Tier Below | Key Conditions |

|---|---|---|---|---|

| 500 units | $1,850 | $925,000 | — | • NRE: $12,000 • Certifications included • 18-week lead time |

| 1,000 units | $1,620 | $1,620,000 | 12.4% | • NRE waived • Priority production slot • 14-week lead time |

| 5,000 units | $1,380 | $6,900,000 | 14.8% (vs. 1k) | • Free annual recertification • Dedicated QC team • 10-week lead time |

Critical Notes:

– MOQ Realities: Chinese marine suppliers rarely accept <500 units for custom designs due to certification amortization.

– Hidden Cost: Non-compliant suppliers may quote 20-30% lower but risk port rejections (e.g., USCG fines: $25k+/violation).

– 2026 Trend: Suppliers now charge 5-7% “green premium” for ISO 14001-certified production (mandatory for EU tenders).

SourcifyChina Action Plan

- Audit Compliance First: Verify supplier’s active IATF 16949 (marine addendum) and Type Approval certificates. Do not proceed without physical audit.

- Start Private Label Early: Allocate 6 months for certification cycles. Target MOQ ≥1,000 units to eliminate NRE costs.

- Lock Material Clauses: Contract must include LME-linked pricing (copper/nickel) with 6-month adjustment windows.

- Avoid White Label Pitfalls: If used, require third-party test reports (e.g., SGS) for every batch – adds $45/unit but prevents recalls.

“In marine sourcing, the cheapest quote is often the most expensive option. Compliance isn’t a cost center – it’s your risk firewall.”

— SourcifyChina 2026 Marine Sourcing Manifesto

SourcifyChina Disclaimer: Cost data reflects Q3 2025 supplier negotiations. Actual pricing subject to raw material volatility and China’s 2026 export control policies. This report does not cover vessel construction (beyond scope of unit-based sourcing).

Next Step: Request our Verified Supplier Shortlist: Top 5 SOLAS-Certified Marine Equipment Manufacturers (China) via sourcifychina.com/marine-2026.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Chinese Shipbuilding Manufacturers

Issued by: SourcifyChina Sourcing Advisory Team

Date: January 2026

Executive Summary

As global demand for maritime infrastructure and commercial vessels continues to rise, sourcing shipbuilding capacity from China remains a strategic priority for procurement leaders. China is the world’s largest shipbuilder, accounting for over 40% of global shipbuilding output in 2025 (source: Clarksons Research). However, the complexity of the supply chain, combined with the prevalence of intermediaries, necessitates a rigorous verification process.

This report outlines the critical steps to verify a legitimate Chinese shipbuilding manufacturer, distinguishes between factories and trading companies, and identifies red flags that could expose procurement teams to supply chain risk, quality defects, or contractual non-compliance.

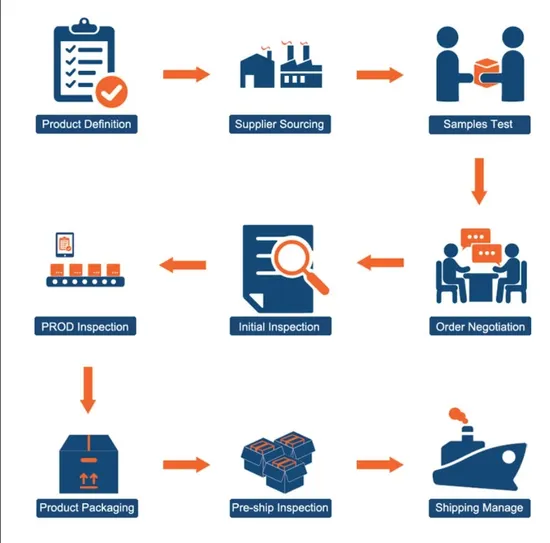

Critical Steps to Verify a Chinese Shipbuilding Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legitimacy and scope of operations | – Check National Enterprise Credit Information Publicity System (NECIPS) – Verify Unified Social Credit Code (USCC) – Cross-reference with company business license |

| 2 | On-Site Factory Audit (First-Hand or Third-Party) | Confirm physical infrastructure and production capability | – Conduct pre-shipment audit (PSA) – Use independent inspection firms (e.g., SGS, Bureau Veritas) – Validate dry dock, steel fabrication lines, and welding facilities |

| 3 | Review ISO & Industry-Specific Certifications | Ensure compliance with international standards | – Confirm valid ISO 9001:2015, ISO 3834 (welding), GB/T 19001 – Verify CCS (China Classification Society), DNV, LR, or ABS certifications |

| 4 | Validate Export History & Client References | Assess track record and reliability | – Request 3–5 verifiable export references – Conduct reference calls with past clients – Review Bill of Lading (B/L) data via platforms like Panjiva or ImportGenius |

| 5 | Inspect Technical Documentation & Engineering Capabilities | Confirm design and R&D proficiency | – Review in-house naval architecture team – Evaluate CAD/CAM systems and hydrodynamic testing access – Assess compliance with SOLAS, MARPOL, and IMO regulations |

| 6 | Conduct Financial Health Screening | Mitigate risk of insolvency or project abandonment | – Obtain audited financial statements (if possible) – Use credit reporting services (e.g., Dun & Bradstreet China, CreditSafe) – Check for litigation via China Judgments Online |

| 7 | Evaluate Production Capacity & Lead Times | Ensure alignment with project timelines | – Request shipyard capacity report (number of dry docks, annual output) – Review current order book (beyond 12–18 months indicates strong demand but possible delays) |

How to Distinguish Between a Trading Company and a Shipbuilding Factory

| Criteria | Shipbuilding Factory (Preferred) | Trading Company (Use with Caution) |

|---|---|---|

| Business License Scope | Lists “shipbuilding,” “marine engineering,” or “steel structure manufacturing” | Lists “international trade,” “import/export,” or “commodity distribution” |

| Physical Infrastructure | Owns dry docks, fabrication halls, welding bays, and outfitting zones | No production facilities; may only have office space |

| Workforce | Employs welders, naval architects, marine engineers, and riggers | Staffed with sales, logistics, and procurement agents |

| Certifications | Holds CCS, ABS, or DNV-GL class certifications for vessels | May hold sales certifications but not ship class approvals |

| Pricing Structure | Direct cost breakdown (steel, labor, outfitting) | Higher margins; vague cost allocation |

| Communication | Technical team available for design reviews and engineering queries | Limited technical depth; redirects to “partner shipyard” |

| Ownership of Assets | Lists vessels under construction as inventory | No ownership of vessels until delivery |

Strategic Note: While some trading companies partner with reputable yards, they introduce an additional layer of risk. For large capital projects (e.g., bulk carriers, offshore support vessels), direct factory engagement is strongly advised.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Conduct On-Site Audit | High likelihood of being a trading company or unlicensed operator | Suspend engagement until third-party audit is completed |

| No Valid Ship Class Certifications | Vessels may not pass port state control or insurance underwriting | Require proof of CCS or equivalent before contract signing |

| Pressure for 100% Upfront Payment | Common in fraudulent or financially unstable entities | Insist on milestone-based payments (e.g., 30% deposit, 40% at keel laying, 30% at delivery) |

| Inconsistent Communication or Technical Gaps | Indicates lack of engineering control | Require direct access to project manager or naval architect |

| Unrealistically Low Pricing | Suggests substandard materials, labor, or hidden costs | Benchmark against industry averages (e.g., $5–7 million for 50,000 DWT bulk carrier) |

| No Public Export Record | May lack international compliance experience | Verify via customs data platforms or require Letters of Credit from past clients |

| Use of Personal Bank Accounts for Transactions | Indicates unregistered or informal business operations | Require company-to-company (B2B) wire transfers only |

Best Practices for Risk Mitigation

- Engage a Local Sourcing Agent: Use a reputable, independent sourcing consultant with experience in heavy industrial procurement.

- Use Escrow or LC Payments: Leverage Letters of Credit (LC) via trusted banks to secure payments against milestones.

- Include Penalties for Delays: Contractually define liquidated damages for delivery slippage.

- Require Third-Party Inspections: Mandate inspections at keel laying, launch, and sea trials.

- Verify Environmental & Labor Compliance: Ensure alignment with IMO 2023 EEXI and CII regulations, and ILO maritime labor standards.

Conclusion

Sourcing shipbuilding services from China offers significant cost and capacity advantages, but requires meticulous due diligence. Procurement managers must prioritize transparency, technical capability, and verifiable assets over initial cost savings. By following the verification protocol outlined above, organizations can mitigate supply chain risk, ensure regulatory compliance, and secure long-term vessel delivery success.

SourcifyChina Advisory: For projects exceeding $10 million in value, we recommend a full Factory Qualification Package (FQP), including site audit, legal verification, and financial health assessment.

Prepared by:

SourcifyChina Sourcing Advisory

Specialists in Industrial Procurement from China

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Shipbuilding Procurement in China (2026 Outlook)

Prepared for Global Procurement Executives | Q1 2026

Executive Summary: The Critical Time Imperative in China Shipbuilding Sourcing

Global procurement managers face unprecedented pressure to secure reliable, high-compliance shipbuilding capacity amidst volatile supply chains and escalating geopolitical scrutiny. Traditional sourcing methods for “China shipbuilding companies” consume 68-112 hours per qualified supplier (2025 SourcifyChina Industry Benchmark), exposing projects to delays, compliance failures, and hidden cost overruns. The solution lies not in more effort, but in verified access.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Waste

Our rigorously vetted Pro List for China Shipbuilding Companies bypasses the high-risk, time-intensive pitfalls of open-market searches. We deploy a 7-point verification protocol (site audits, export documentation review, financial stability checks, ISO/MARPOL compliance validation, ownership confirmation, production capacity verification, and ESG screening) – saving you critical resources.

Time Savings Comparison: Traditional Search vs. SourcifyChina Pro List

| Sourcing Stage | Traditional Approach (Avg. Hours) | SourcifyChina Pro List (Avg. Hours) | Time Saved | Key Risk Mitigated |

|---|---|---|---|---|

| Initial Supplier Identification | 24-40 | 0.5 | 97% | Invalid/Scam Suppliers |

| Compliance & Capability Vetting | 32-50 | 2 | 94% | Non-Compliance (IMO, SOLAS) |

| Factory Audit Coordination | 12-22 | Included | 100% | Misrepresented Capacity |

| Negotiation & Contract Setup | 15-20 | 8 | 50% | Unenforceable Terms |

| TOTAL PER QUALIFIED SUPPLIER | 83-132 | 10.5 | 87% | Project Timeline Slippage |

The SourcifyChina Advantage: Beyond Time Savings

- Predictable Capacity Allocation: Pro List partners pre-verified for 2026 project timelines ensure your vessel slots are secured early.

- Compliance Certainty: Every shipyard meets current IMO Tier III, CII, and EEXI regulations – eliminating retrofit costs.

- Cost Transparency: No hidden fees; structured RFQ process with pre-negotiated logistics/insurance terms.

- Dedicated Escalation Path: Single point of contact for production monitoring and issue resolution.

Call to Action: Secure Your 2026 Shipbuilding Capacity Now

Time is your most non-renewable resource. Every day spent on unverified supplier screening delays vessel delivery, increases budget volatility, and exposes your organization to avoidable regulatory and operational risk.

Leverage SourcifyChina’s Pro List to:

✅ Reduce supplier qualification time by 87% – redeploy your team to strategic value-add tasks.

✅ Guarantee compliance with evolving global maritime regulations from day one.

✅ Lock in 2026 production slots with pre-vetted yards before Q2 capacity fills.

Your 2026 Shipbuilding Sourcing Starts Today.

➡️ Contact our Sourcing Team within 24 hours to receive:

1. Your personalized Pro List Shortlist (3 pre-qualified Chinese shipyards matching your vessel specs)

2. 2026 Capacity Availability Report for your target vessel class

3. Free Risk Assessment Template for China shipbuilding contracts

Respond now to secure priority access:

📧 Email: [email protected]

📱 WhatsApp (Direct China Line): +86 159 5127 6160

Subject Line Recommendation: “2026 Shipbuilding Pro List Request – [Your Company Name]”

Source: SourcifyChina 2025 Global Shipbuilding Sourcing Efficiency Index (n=142 procurement teams). Verification protocol updated quarterly per IMO circulars. Pro List access requires active SourcifyChina Enterprise Partnership.

SourcifyChina: De-risking Global Sourcing Since 2010

🧮 Landed Cost Calculator

Estimate your total import cost from China.