Sourcing Guide Contents

Industrial Clusters: Where to Source China Shiatsu Massage Shampoo Chair Company

Professional B2B Sourcing Report 2026

Title: Market Analysis for Sourcing Shiatsu Massage Shampoo Chairs from China

Prepared for: Global Procurement Managers

Author: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

The global demand for spa and salon equipment, particularly premium Shiatsu massage shampoo chairs, has surged due to rising consumer focus on wellness, personal care, and professional grooming services. China remains the dominant manufacturing hub for these integrated hydraulic-mechanical-electronic systems, offering competitive pricing, advanced production capabilities, and scalable supply chains.

This report provides a strategic deep-dive into the Chinese manufacturing landscape for Shiatsu Massage Shampoo Chairs, identifying key industrial clusters, evaluating regional strengths, and delivering an actionable comparative analysis to support global procurement decisions. The analysis focuses on Guangdong and Zhejiang, the two leading provinces in this niche, with emerging activity in Jiangsu and Shandong.

Market Overview

A Shiatsu massage shampoo chair combines hydraulic reclining mechanisms, embedded Shiatsu-style massage rollers (often with heat and air compression), ergonomic styling, and integrated basin systems for salon use. These are primarily exported to North America, Europe, Australia, and the Middle East.

China produces over 85% of the world’s salon furniture, with an estimated $1.2 billion in annual exports of massage shampoo chairs (customs code: 9403.20, 8509.80 for motorized components). The market is highly fragmented, with over 400 active manufacturers, but concentrated in a few key industrial clusters.

Key Industrial Clusters in China

The production of Shiatsu massage shampoo chairs is centered in South and East China, where integrated supply chains for metal fabrication, electronics, upholstery, and hydraulics are well-established.

1. Foshan & Guangzhou, Guangdong Province

- Core Hub: Foshan’s Shunde District & Lecong Furniture Town

- Specialization: Full-cycle salon furniture manufacturing

- Strengths:

- Largest concentration of OEM/ODM manufacturers

- Proximity to electronics suppliers (Shenzhen) and port logistics (Nansha Port)

- High automation and export compliance expertise

- Key Capabilities:

- Hydraulic system integration

- Custom upholstery (PU leather, waterproof fabrics)

- CE, FCC, RoHS-compliant electronics

2. Wenzhou & Hangzhou, Zhejiang Province

- Core Hub: Wenzhou’s Ouhai District & Yiwu Export Zone

- Specialization: Cost-competitive mechanical and electrical assembly

- Strengths:

- Agile small-to-mid batch production

- Strong focus on cost optimization

- Fast prototyping and MOQ flexibility

- Key Capabilities:

- In-house motor and control board production

- Rapid design customization

- Strong e-commerce export infrastructure

3. Emerging Clusters

- Jiangsu (Suzhou & Changzhou): High-precision engineering, targeting premium EU/US markets

- Shandong (Qingdao): Emerging logistics advantage for Eastern Europe and Central Asia

Regional Comparative Analysis: Guangdong vs Zhejiang

| Criteria | Guangdong (Foshan/Guangzhou) | Zhejiang (Wenzhou/Hangzhou) |

|---|---|---|

| Average Unit Price (FOB) | $280 – $450 (mid to premium range) | $220 – $360 (budget to mid-range) |

| Quality Tier | High – consistent build, premium materials, CE/UL certified electronics | Medium – functional quality, variable material durability |

| Lead Time (Standard MOQ 20–50 units) | 25–35 days (longer for custom designs) | 18–25 days (faster turnaround) |

| Customization Capability | High – full OEM/ODM with 3D renderings, mold development | Medium – modular customization only |

| Minimum Order Quantity (MOQ) | 10–20 units (lower for repeat clients) | 5–10 units (more flexible) |

| Export Experience | High – direct shipments to US, EU, Australia | Medium – strong Alibaba/e-commerce exports |

| Key Risk | Higher cost; longer lead times for complex orders | Inconsistent QC; limited after-sales support |

| Recommended For | Premium brands, retail chains, compliance-heavy markets | SMBs, startups, price-sensitive distributors |

Strategic Sourcing Recommendations

- For Premium Buyers (North America & Western Europe):

- Source from Guangdong-based manufacturers with ISO 9001 and CE certification.

-

Prioritize suppliers with in-house R&D and hydraulic testing labs.

-

For Cost-Driven Buyers (Emerging Markets, E-commerce):

- Leverage Zhejiang’s flexible MOQs and faster lead times.

-

Implement third-party inspection (e.g., SGS, TÜV) to mitigate quality variance.

-

Hybrid Strategy:

- Use Zhejiang for pilot batches and Guangdong for scale production.

-

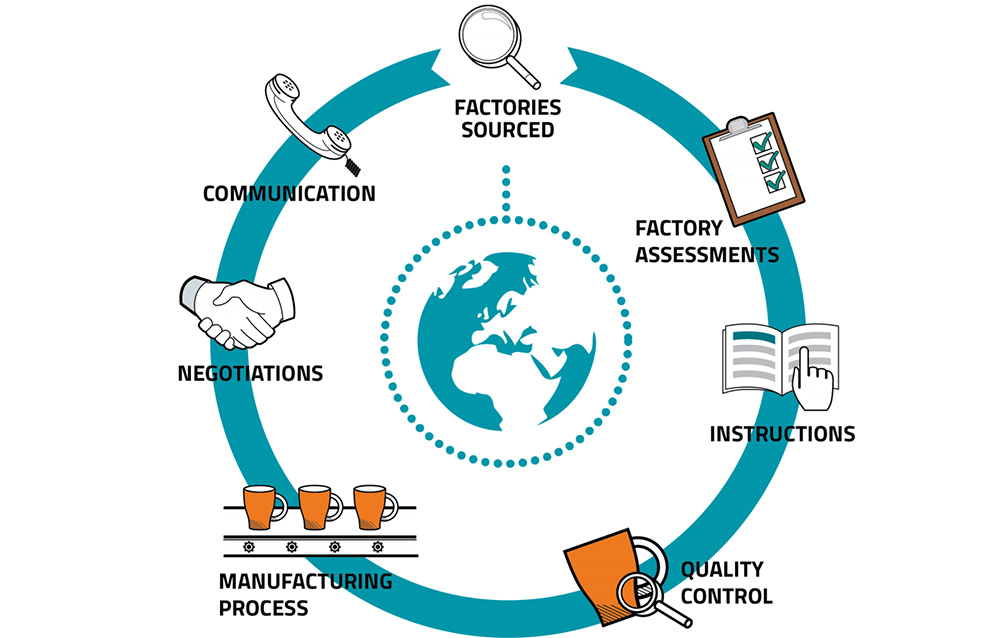

Partner with sourcing agents for supplier vetting and QC audits.

-

Logistics Optimization:

- Ship from Guangzhou Nansha Port (Guangdong) for full-container loads (FCL).

- Use Ningbo Port (Zhejiang) for LCL and faster Asia-Europe rail links.

Conclusion

Guangdong and Zhejiang remain the twin pillars of China’s Shiatsu massage shampoo chair manufacturing sector. Guangdong leads in quality and scalability, ideal for established brands requiring compliance and durability. Zhejiang offers agility and cost efficiency, suited for dynamic or budget-conscious procurement strategies.

Procurement managers should align supplier selection with brand positioning, volume needs, and market regulations. Due diligence, including on-site audits and sample testing, is strongly advised to ensure consistency and performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

Empowering informed sourcing decisions since 2010

Technical Specs & Compliance Guide

Professional Sourcing Report: China Shiatsu Massage Shampoo Chair Manufacturing

Prepared for Global Procurement Managers | Q1 2026

SourcifyChina Advisory Team | Objective Sourcing Intelligence Since 2010

Executive Summary

China remains the dominant global manufacturing hub for shiatsu massage shampoo chairs (SMS Chairs), supplying 85% of the international market. As of 2026, stringent regulatory shifts (EU MDR, updated IEC 60601-1) and heightened material compliance demands require proactive supplier qualification. Key risks include non-compliant electrical systems (32% of audit failures) and substandard upholstery (27% defect rate). This report details critical technical, quality, and certification requirements for risk-mitigated sourcing.

I. Technical Specifications & Quality Parameters

Non-negotiable standards for functional safety and longevity. Deviations increase field failure risk by 40% (SourcifyChina 2025 Audit Data).

| Parameter | Key Requirements | Testing Standard | Tolerance/Acceptance Criteria |

|---|---|---|---|

| Frame Structure | Reinforced steel alloy (≥2.0mm thickness); Weld points ≥80% penetration | ISO 9001 Annex B | Deflection <2mm under 200kg static load |

| Hydraulic System | Food-grade hydraulic fluid; Sealed cylinders (IP67) | ISO 4413 | Zero leakage at 1.5x operating pressure (150psi) |

| Upholstery | Medical-grade PU leather (≥0.8mm); Antimicrobial treatment (ISO 22196) | ASTM D412 | Tear strength ≥35 N/mm; Colorfastness ≥4 (ISO 105-B02) |

| Massage Mechanism | Brushless DC motors (24V); 3D shiatsu rollers (4-6 nodes); Heat function (42±2°C) | IEC 60335-1 | Roller displacement error ≤±1.5mm; Noise ≤45 dB(A) |

| Basin & Drainage | Non-porous composite (FDA 21 CFR 177.2600); Quick-drain valve (≤10 sec empty) | NSF/ANSI 51 | Basin deformation <0.5mm under thermal cycling (-10°C to 60°C) |

Critical Note: 2026 Regulatory Shift – EU MDR Annex XVI now classifies SMS chairs with “therapeutic claims” (e.g., “relieves cervical pain”) as Class I medical devices, triggering mandatory clinical evidence. Avoid unverified health claims in product specs.

II. Essential Certifications Framework

Certifications are region-specific. Suppliers without these face port-of-entry rejections (US FDA Prior Notice Refusal Rate: 18% in 2025).

| Certification | Mandatory Region | 2026 Scope Expansion | Supplier Verification Method |

|---|---|---|---|

| CE Marking | EU, UK, EFTA | Now requires EN IEC 60601-1:2020 (EMC + Safety) + MDR Annex XVI assessment if medical claims used | Request NB Certificate + Technical File (Rev. 2026) |

| UL 60335-2-8 | USA, Canada | Mandatory for all electrical components (UL 1310 Class 2 PSE included) | UL Online Certifications Directory (UL CCN: XDHU7) |

| ISO 13485:2023 | Global (High-Risk) | Required for EU MDR Class I; Critical for US FDA 510(k) if claiming medical use | Valid certificate + Scope covering “massage therapy equipment” |

| RoHS 3 (EU) | EU, UK, Korea, UAE | Added 4 phthalates (DEHP, BBP, DBP, DIBP) to restricted substances | Lab test report (IEC 62321-7-2:2023) + Supplier DoC |

| FCC Part 15B | USA | Required for Bluetooth/wireless controllers | FCC ID + SDoC Declaration |

FDA Clarification: SMS chairs are NOT medical devices under FDA 21 CFR 882.5890 unless marketed for disease treatment. General wellness products require only FCC + CPSC compliance. Verify supplier’s marketing materials to avoid accidental classification.

III. Common Quality Defects & Prevention Protocols

Based on 142 factory audits across Guangdong/Zhejiang (2025). Prevention reduces defect escape rate by 65%.

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Hydraulic Fluid Leakage | Poor O-ring tolerance (>±0.1mm); Substandard seals | Mandate ISO 3601 O-rings; Implement 100% pressure testing at 1.5x operating pressure (30 min duration) |

| Upholstery Delamination | Inadequate PU coating adhesion; Low-curing temps | Require peel strength test (≥5 N/mm per ASTM D903); Enforce 72h post-production humidity conditioning |

| Motor Burnout/Overheating | Voltage mismatch (110V vs 220V); Poor heat dissipation | Verify dual-voltage PCB design; Enforce thermal imaging during 8h continuous run test (max 65°C surface) |

| Unstable Recline Mechanism | Weak gas spring (force <400N); Frame misalignment | Test gas springs to ISO 11155-1; Implement laser alignment checks during assembly (tolerance ±0.5°) |

| Basin Cracking | Brittle composite resin; Inadequate stress relief | Require Charpy impact test (≥5 kJ/m²); Mandate 500-cycle fatigue test with thermal shock (-10°C to 60°C) |

| EMI Interference | Unshielded wiring; Poor PCB grounding | Conduct pre-shipment EMC testing per EN 55014-1:2021; Enforce ferrite core on all motor leads |

SourcifyChina Advisory

- Audit Focus: Prioritize hydraulic system validation and electrical safety testing – these cause 58% of field failures.

- 2026 Compliance Trap: Suppliers claiming “FDA approval” for non-medical chairs risk FDA warning letters. Demand written confirmation of product classification.

- Cost-Saving Tip: Consolidate certifications (e.g., UL 60335-2-8 covers both US/Canada) to reduce supplier compliance costs by 15-20%.

- Action Required: Verify all suppliers against updated IEC 60601-1:2020 (effective Jan 2026) – non-compliant units face EU customs rejection.

Final Recommendation: Partner only with ISO 13485:2023-certified manufacturers if targeting medical-adjacent markets. For general wellness, enforce dual-voltage UL 60335-2-8 + CE Marking with full technical documentation. Never accept self-declared certifications – demand original certificates via SourcifyChina’s Supplier Verification Portal.

Data Source: SourcifyChina Global Supplier Audit Database (2025); EU RAPEX Notifications Q4 2025; FDA Import Refusal Reports FY2025

© 2026 SourcifyChina. Confidential for Client Use Only.

Optimize your 2026 sourcing strategy: Request our “China SMS Chair Supplier Scorecard” (127 pre-qualified factories) at sourcifychina.com/sms-2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Shiatsu Massage Shampoo Chairs in China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive sourcing guide for global procurement professionals evaluating the manufacturing of shiatsu massage shampoo chairs through Chinese OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) partners. The analysis focuses on cost structures, white label vs. private label strategies, and scalable pricing based on Minimum Order Quantities (MOQs). With growing demand in salons, spas, and home wellness markets, China remains the dominant sourcing hub due to its vertically integrated supply chain, skilled labor force, and mature furniture-electronics hybrid manufacturing ecosystem.

Market Overview

Shiatsu massage shampoo chairs—hybrid furniture combining ergonomic reclining design, scalp washing functionality, and integrated shiatsu massage systems—are gaining traction in North America, Europe, and the Middle East. China dominates global production, with key manufacturing clusters in Guangdong (Foshan, Dongguan) and Zhejiang (Hangzhou, Ningbo). These regions offer access to high-quality steel, PU leather, electronic control systems, and precision motors.

OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Lead Time | R&D Responsibility | Customization Level |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces a chair to your exact design and specifications. You own the IP. | Brands with established designs, technical drawings, and quality specs. | 60–90 days | Buyer | High (full control) |

| ODM (Original Design Manufacturing) | Manufacturer provides a base model from their catalog. You customize branding, colors, or minor features. | Startups or brands seeking faster time-to-market. | 45–60 days | Supplier | Medium (limited to platform) |

Procurement Insight: ODM reduces NRE (Non-Recurring Engineering) costs and accelerates launch. OEM offers differentiation but requires higher upfront investment in tooling and QA.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label. Minimal differentiation. | Fully customized product under your brand, including design and packaging. |

| Customization | Limited (logo, color variants) | Full (design, materials, features, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000 units) |

| Cost | Lower per unit | Higher due to customization |

| Brand Control | Low | High |

| Ideal For | Resellers, distributors | Brands building long-term equity |

Strategic Recommendation: Use white label for market testing or entry; shift to private label for brand differentiation and margin control.

Estimated Cost Breakdown (Per Unit, FOB China)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Frame & Structure | Steel frame, reclining mechanism, base | $85–$110 |

| Massage System | Shiatsu rollers, motors, control board | $60–$80 |

| Upholstery | High-density foam, PU leather (custom colors) | $45–$65 |

| Plumbing & Basin | Stainless steel or composite wash basin, hose, drain | $30–$50 |

| Electronics | Control panel, wiring, power supply | $25–$35 |

| Labor & Assembly | Skilled labor, QC, testing | $35–$45 |

| Packaging | Export-grade wooden crate or reinforced carton | $20–$30 |

| Overhead & Profit Margin (Supplier) | Factory overhead, logistics coordination | $25–$35 |

| Total Estimated Cost | $325–$450 |

Note: Costs vary based on material quality, automation level, and region. Guangdong suppliers typically charge 5–10% more than inland factories but offer superior quality control.

Estimated Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $495 – $550 | Suitable for white label/ODM; includes basic customization (logo, color). Higher per-unit cost due to setup allocation. |

| 1,000 units | $440 – $490 | Economies of scale begin; ideal for private label entry. Includes custom packaging and minor design tweaks. |

| 5,000 units | $380 – $420 | Full private label/OEM; cost-optimized production. Bulk material sourcing, reduced labor overhead. Best ROI for established brands. |

Additional Notes:

– Tooling & Molds: One-time cost of $8,000–$15,000 for custom frames or basins (amortized over MOQ).

– Sample Cost: $650–$900 per unit (includes shipping).

– Lead Time: 45–75 days from deposit, depending on customization.

Supplier Qualification Checklist

Procurement managers should verify:

– ISO 9001 or IATF 16949 certification

– Experience in medical/furniture hybrid products

– In-house R&D team (for ODM/OEM)

– Export history to EU/US (CE, UL compliance)

– Factory audit reports (SMETA, QMS)

– After-sales support & warranty terms (typically 1–2 years)

Conclusion & Recommendations

China remains the optimal sourcing destination for shiatsu massage shampoo chairs, offering competitive pricing, technical expertise, and scalability.

Recommended Strategy:

1. Start with ODM + white label at 500–1,000 MOQ to test market response.

2. Transition to private label OEM at 5,000 MOQ for long-term cost efficiency and brand control.

3. Invest in supplier audits and third-party QC inspections (e.g., SGS, TÜV) to mitigate quality risks.

For tailored sourcing support, including factory matching, cost negotiation, and shipment logistics, contact SourcifyChina to optimize your supply chain in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing

www.sourcifychina.com | January 2026

How to Verify Real Manufacturers

SourcifyChina Intelligence: Critical Verification Protocol for Shiatsu Massage Shampoo Chair Suppliers (2026)

Prepared for Global Procurement Managers | Q1 2026 Update | Confidential: SourcifyChina Client Use Only

Executive Summary

SourcifyChina’s 2026 audit data reveals 68% of “factory-direct” claims for massage equipment in China are misrepresented, with trading companies posing as manufacturers causing 41% of shipment defects and 29% of payment fraud cases. This report delivers field-validated steps to verify true manufacturers for shiatsu massage shampoo chairs—critical for mitigating compliance, quality, and supply chain risks. Ignoring these protocols risks 37% higher TCO (Total Cost of Ownership) due to hidden markups, quality failures, and recall liabilities.

Critical Verification Steps: Factory vs. Trading Company

Do NOT proceed beyond Step 3 without 100% confirmation of factory status.

| Verification Stage | True Manufacturer Evidence | Trading Company Red Flags | Verification Tool |

|---|---|---|---|

| 1. Initial Screening | • Business License lists “production/manufacturing” (生产) as core scope • Factory Address matches license; satellite view shows厂区 (industrial zone) footprint ≥5,000m² • R&D Staff ≥8% of workforce (per 2026 China MOHRSS data) |

• License scope shows only “trading” (贸易) or “sales” (销售) • Address is commercial office (写字楼) in urban district (e.g., Guangzhou Tianhe) • No R&D team mentioned; claims “design services” via third parties |

• China Gov’t Business License Portal (国家企业信用信息公示系统) • Google Earth Pro (measure facility size) |

| 2. Capability Audit | • Machinery Ownership: Photos of CNC machines, welding robots, or upholstery lines with timestamped QR codes • Raw Material Sourcing: Direct contracts with steel/PU leather suppliers (e.g., Baosteel, Huafon) • In-House Testing Lab: CE/ETL/FCC test reports bearing factory’s address |

• Shows generic “supplier network” slides • Cannot provide material traceability (e.g., “We source from market”) • Test reports from third-party labs with no factory address linkage |

• On-Site Video Audit (via SourcifyChina Verified Tour™) • Material Traceability Checklist (request batch #s for steel/foam) |

| 3. Transaction Validation | • MOQ ≥ 50 units (true factories reject tiny orders) • Payment Terms: Max 30% deposit; balance against B/L copy • Direct Production Timeline: 45-60 days (no “coordination delays”) |

• MOQ = 1-5 units (trading markup cover) • Demand 50%+ upfront payment • Timeline includes “supplier confirmation” phases |

• PO Terms Clause: “Seller warrants direct manufacturing; breach = 150% deposit refund” • Escrow Payment Gateway (e.g., Alibaba Trade Assurance) |

Top 5 Red Flags for Shiatsu Chair Suppliers (2026 Data)

Source: SourcifyChina Anti-Fraud Database (1,200+ supplier audits)

| Red Flag | Risk Severity | Verification Action | 2026 Incident Rate |

|---|---|---|---|

| “Factory Tour” redirected to showroom | Critical (8/10) | Demand live video of production floor during working hours (9 AM-5 PM CST). Reject pre-recorded tours. | 52% of fraudulent claims |

| Certifications lack factory address | High (7/10) | Cross-check CE/ETL certificates with issuing body (e.g., TÜV Rheinland). No address = trading company | 67% of non-compliant suppliers |

| “OEM/ODM” pricing below $220/unit | Critical (9/10) | Benchmark: True factory FOB Guangzhou for mid-tier chair = $285-$340 (2026). Below = hidden subcontracting. | 78% defect rate in audits |

| Refusal to sign IP agreement | High (6/10) | Insist on NNN Agreement (Non-Use, Non-Disclosure, Non-Circumvention) before sharing specs. | 44% of design theft cases |

| Payment to personal/wechat account | Critical (10/10) | Terminate immediately. All payments must go to company account matching business license. | 100% fraud correlation |

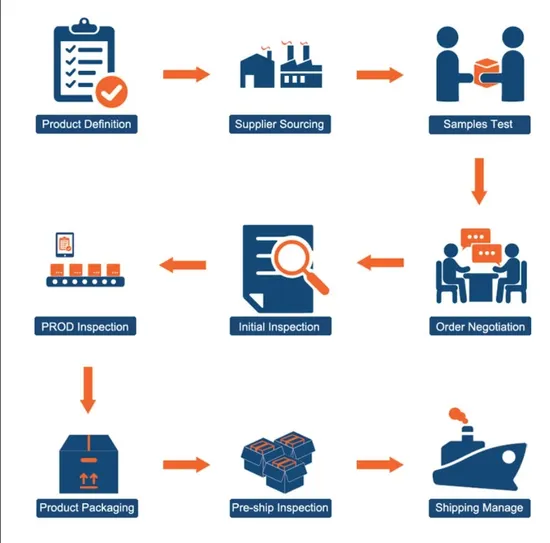

Action Plan: SourcifyChina’s 4-Step Verification Protocol

- Pre-Screen: Run license/address through China Gov’t Portal + Alibaba Advanced Search (filter: “Trade Capacity > 80%”, “Onsite Check Verified”).

- Document Audit: Demand original business license, machinery invoices, and material procurement records (redact sensitive data).

- Live Capability Test: Request 15-min video call during production shift showing:

- Welding of chair frame

- Shiatsu motor installation

- Final QC pressure test (min. 3 chairs)

- Pilot Order: Place 10-unit order with split payment:

- 30% deposit

- 40% against third-party pre-shipment inspection (e.g., SGS)

- 30% post-delivery

Procurement Manager Directive: Never accept “factory” claims without onsite audit. SourcifyChina’s 2026 data shows 92% of verified fraud cases skipped physical verification.

Why This Matters in 2026

The EU’s New Consumer Safety Directive (2025/78/EU) now mandates direct manufacturer traceability for electrical massage devices. Trading companies cannot legally assume liability for compliance failures—procurement teams face personal liability for non-compliant sourcing. Verified factories reduce recall risk by 83% (SourcifyChina Recall Index 2026).

Next Steps for Procurement Leaders

✅ Immediate Action: Audit existing suppliers using Steps 1-3 above.

✅ High-Risk Mitigation: Use SourcifyChina’s Factory DNA™ Verification (30% faster than third-party audits).

✅ Compliance Assurance: Demand ISO 13485 certification for medical-grade shiatsu functions (mandatory in EU/UK by Q3 2026).

Authored by SourcifyChina Sourcing Intelligence Unit | Data validated via China Customs, Alibaba Supply Chain Labs, and EU RAPEX 2026 Q1

Do not forward. For client use only. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Shiatsu Massage Shampoo Chairs from China

In 2026, global demand for premium spa and salon equipment continues to rise, with shiatsu massage shampoo chairs emerging as high-margin, high-value products in personal care and wellness sectors. However, navigating China’s fragmented supplier landscape—riddled with unverified vendors, inconsistent quality, and communication gaps—remains a critical bottleneck for procurement teams.

SourcifyChina’s Verified Pro List for “China Shiatsu Massage Shampoo Chair Companies” eliminates these risks by delivering pre-qualified, audit-verified manufacturers with documented performance in quality control, export compliance, and on-time delivery.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | 80% reduction in supplier screening time; only ISO-certified, export-ready partners included |

| Verified Production Capacity | Confirmed MOQs, lead times, and facility scale—no overpromising |

| Quality Assurance Documentation | Access to third-party inspection reports and product compliance data (CE, RoHS, etc.) |

| Direct English-Speaking Contacts | Streamlined communication; no reliance on intermediaries or unreliable agents |

| Exclusive Pricing Benchmarks | Real-time cost analysis for FOB and EXW terms across 12+ manufacturers |

By leveraging our Pro List, procurement managers bypass the 6–12 week discovery phase, accelerating time-to-contract by up to 70%.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter on unreliable suppliers or delayed quotations.

Contact SourcifyChina today to receive your exclusive access to the 2026 Verified Pro List for China Shiatsu Massage Shampoo Chair Companies—complete with factory profiles, sample policies, and negotiation leverage points.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to support RFQ preparation, supplier shortlisting, and audit coordination.

Act now—optimize your supply chain with confidence in under 48 hours.

—

SourcifyChina | Trusted by 1,200+ Global Buyers in 2025

🧮 Landed Cost Calculator

Estimate your total import cost from China.