Sourcing Guide Contents

Industrial Clusters: Where to Source China Self Adhesive Plastic Bag Company

SourcifyChina Sourcing Intelligence Report: Self-Adhesive Plastic Bag Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-SAB-2026-01

Executive Summary

China remains the dominant global hub for self-adhesive (resealable) plastic bag manufacturing, producing >70% of the world’s supply. Driven by cost efficiency, mature supply chains, and export infrastructure, the sector is consolidating toward specialized industrial clusters. Rising labor costs (3-5% YoY) and stricter environmental regulations (GB 4806.7-2023 compliance) are reshaping regional competitiveness. Key 2026 Shift: Procurement managers must prioritize cluster-specific strategies—balancing cost, quality, and sustainability—to mitigate supply chain volatility.

Key Industrial Clusters: Manufacturing Hotspots & Specializations

Self-adhesive bag production is concentrated in coastal provinces with integrated polymer supply chains, logistics access, and export-oriented manufacturing ecosystems. Primary clusters include:

| Region | Core Cities | Specialization | Market Share | Key Advantages |

|---|---|---|---|---|

| Guangdong Province | Shenzhen, Dongguan, Guangzhou | High-end retail packaging (food, electronics), biodegradable options, complex printing | 35% | Best QC systems, fastest export processing, R&D capabilities |

| Zhejiang Province | Ningbo, Yiwu, Wenzhou | Mid-volume commodity bags (apparel, e-commerce), zipper tape innovation | 30% | Lowest material costs, high factory density, agile MOQs |

| Fujian Province | Quanzhou, Xiamen | Budget retail/consumer bags, textile integration (garment packaging) | 20% | Competitive labor costs, emerging sustainability focus |

| Shanghai/Jiangsu | Shanghai, Suzhou, Kunshan | Premium medical/lab packaging, tamper-evident solutions | 10% | Highest compliance (ISO 13485), multilingual support |

| Emerging Clusters | Anhui, Sichuan | Basic LDPE bags, labor arbitrage | 5% | Lower wages, government incentives |

Critical Insight: Guangdong dominates high-value segments (food-grade, 4+ color printing), while Zhejiang leads in cost-sensitive e-commerce volumes. Fujian is gaining traction for fast-fashion packaging but lags in regulatory compliance.

Regional Comparison: Price, Quality & Lead Time (2026 Benchmark)

Data aggregated from 120+ SourcifyChina-sourced factories (Q4 2025). Metrics based on 100,000-unit order of 8×10″ LDPE bags (1.5 mil, 4-color print).

| Region | Price (USD/unit) | Quality Tier | Avg. Lead Time | Key Trade-offs |

|---|---|---|---|---|

| Guangdong | $0.0125 – $0.0155 | Premium (AQL 1.0) • FDA/GB 4806.7 certified • Consistent seal integrity |

18-25 days | + Best for regulated industries (food/medical) – Highest pricing; MOQs often ≥50k units |

| Zhejiang | $0.0100 – $0.0125 | Standard (AQL 2.5) • Basic food-safe options • Minor print variance risk |

15-22 days | + Optimal cost/volume balance – Requires rigorous QC audits; limited biodegradable capacity |

| Fujian | $0.0090 – $0.0110 | Economy (AQL 4.0) • Sporadic compliance • Seal failure risk (5-8%) |

20-28 days | + Lowest baseline cost – High defect rates; longer lead times due to rework |

| Shanghai/Jiangsu | $0.0160 – $0.0190 | Specialized (AQL 0.65) • ISO 13485/USP <661> • Precision tolerances |

22-30 days | + Unmatched for critical applications – Premium pricing; 30-60 day engineering lead times |

Lead Time Note: All regions face 5-7 day delays during Chinese New Year (Jan/Feb). Zhejiang offers fastest post-holiday ramp-up due to migrant worker density.

Strategic Recommendations for Procurement Managers

- Tier Your Sourcing:

- High-Value/Regulated Goods: Source from Guangdong (prioritize Shenzhen for tech integration). Validate ISO 22000 certifications.

- E-commerce/Volume Runs: Leverage Zhejiang (Ningbo cluster) for pricing. Mandate 3rd-party AQL 2.5 inspections.

-

Cost-Sensitive Non-Critical Items: Use Fujian only with on-site QC teams. Avoid food/medical applications.

-

Mitigate 2026 Risks:

- Material Volatility: Secure LDPE/LLDPE futures contracts (Shanghai Futures Exchange) given 2025 petrochemical supply crunches.

- Sustainability Pressure: Partner with Guangdong/Zhejiang factories investing in PLA/cassava-based films (EU EPR compliance).

-

Lead Time Buffer: Add 7 days to quoted timelines—customs clearance now averages 48hrs longer post-2025 CBP-ACE integration.

-

Verification Protocol:

- Non-Negotiables: Require GB 4806.7 test reports, zipper peel-strength data (>4N/15mm), and factory environmental permits.

- Red Flags: Avoid suppliers unable to provide real-time production line videos or ISO 9001:2015 certificates issued <12 months ago.

Conclusion

Guangdong and Zhejiang will remain the twin engines of China’s self-adhesive bag industry through 2026, but their value propositions are diverging. Procurement success hinges on aligning cluster strengths with product risk profiles. Guangdong delivers resilience for critical applications, while Zhejiang offers scalability for mainstream volumes. As sustainability regulations tighten globally, early partnerships with clusters investing in circular-economy infrastructure (e.g., Guangdong’s Hainan Free Trade Port recycling hubs) will secure competitive advantage.

SourcifyChina Advisory: Avoid “lowest-cost-first” sourcing. Invest in factory audits targeting zipper tape adhesion consistency—the #1 failure point in 2025 field returns (23% of claims).

SourcifyChina Commitment: We de-risk China sourcing through factory-vetted supplier networks, real-time compliance tracking, and logistics transparency. Contact our team for cluster-specific RFP templates and 2026 supplier shortlists.

Disclaimer: Pricing reflects Q1 2026 forecasts. Actual costs subject to USD/CNY fluctuations and resin market volatility. All data proprietary to SourcifyChina.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Self-Adhesive Plastic Bags from China

Overview

Sourcing self-adhesive plastic bags from China offers cost-efficiency and scalability, but requires rigorous quality control and compliance management. This report details key technical specifications, mandatory certifications, and common quality risks to enable informed procurement decisions in 2026.

Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Material Types | LDPE (Low-Density Polyethylene), LLDPE (Linear Low-Density Polyethylene), PP (Polypropylene), PET (Polyethylene Terephthalate). Recyclable and biodegradable options (e.g., PLA) available upon request. |

| Thickness Tolerance | ±10% of nominal thickness (e.g., 50µm ±5µm). Critical for seal integrity and puncture resistance. |

| Seal Strength | Minimum 2.5 N/15mm (ASTM F88). Varies with application (medical vs. retail). |

| Adhesive Performance | Peel adhesion: 300–800 g/25mm (depending on grade). Residue-free removal required for reusable applications. |

| Dimensional Accuracy | Length/Width: ±2 mm for bags <300 mm; ±3 mm for >300 mm. |

| Optical Clarity | Haze <15% (ASTM D1003) for transparent grades. |

| Print Registration | Color registration tolerance: ±0.5 mm. |

Essential Certifications

| Certification | Relevance | Scope |

|---|---|---|

| FDA 21 CFR | Mandatory for food-contact and pharmaceutical applications. Ensures compliance with U.S. food safety standards. | |

| CE Marking (EU Regulation 10/2011) | Required for plastic materials in contact with food sold in the EU. Validates migration limits for substances. | |

| ISO 9001:2015 | Quality management system. Confirms consistent manufacturing and process control. | |

| ISO 14001:2015 | Environmental management. Increasingly required by ESG-conscious buyers. | |

| UL 94 (Flammability) | Applicable for industrial or electronic packaging requiring flame resistance. | |

| RoHS & REACH | Restriction of hazardous substances in electronics and EU markets. Critical for export compliance. | |

| BRCGS Packaging Standard | Preferred by major retailers for food-grade packaging. Validates hygiene and safety controls. |

Note: Procurement teams must verify certification validity via third-party audits or factory documentation. Certificates should be renewed annually.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Adhesive Failure (Peeling/Residue) | Poor adhesive formulation or improper curing | Use certified adhesives; validate bond strength via peel tests; ensure proper dwell time during lamination |

| Inconsistent Seal Integrity | Temperature fluctuation or dwell time variance | Calibrate heat-sealing equipment weekly; conduct in-line seal strength testing |

| Dimensional Inaccuracy | Die-cutting misalignment or film stretch | Implement automated vision inspection systems; perform pre-production tooling checks |

| Print Smudging or Misregistration | Ink drying issues or web tension variation | Use UV-curable inks; maintain consistent printing speed and tension control |

| Pinholes or Micro-leaks | Contamination or uneven extrusion | Conduct bubble leak tests; maintain clean extrusion environment; filter raw materials |

| Haze or Cloudiness | Moisture in resin or contamination | Dry raw materials before processing; inspect resin batches for clarity |

| Odor/Off-gassing | Residual solvents or low-grade additives | Source food-grade raw materials; conduct GC-MS testing for volatile compounds |

| Delamination (Layer Separation) | Poor lamination adhesion or moisture ingress | Control humidity in lamination area; use primer coatings if required |

Sourcing Recommendations

- Supplier Vetting: Prioritize factories with ISO 9001 and relevant product-specific certifications (FDA, BRCGS).

- Pre-Production Validation: Require sample approval with full material traceability and third-party test reports.

- In-Line QC Protocols: Implement AQL 1.5 (Level II) inspections during mass production.

- Sustainability Alignment: Specify recyclable materials and request documentation on carbon footprint or recyclability claims.

- Audit Compliance: Conduct annual on-site audits or engage third-party inspection agencies (e.g., SGS, TÜV, Intertek).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Expertise

Q1 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Self-Adhesive Plastic Bag Manufacturing

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-PLB-2026-001

Executive Summary

China remains the dominant global hub for self-adhesive plastic bag production, offering 30-50% cost advantages over Western/European manufacturers. However, rising material costs (driven by petrochemical volatility) and stricter environmental regulations (China’s 2025 Plastic Restriction Order) necessitate strategic supplier selection. This report provides a data-driven analysis of cost structures, OEM/ODM pathways, and actionable pricing benchmarks for 2026 procurement planning.

Key Manufacturing Cost Drivers (2026 Baseline)

Assumptions: Standard 8″ x 10″ bag, 0.75mil LDPE/LLDPE film, 1-color logo print, FOB Shenzhen Port. Compliant with GB/T 21661-2025 (China National Standard for Plastic Shopping Bags).

| Cost Component | % of Total Cost | 2026 Cost Breakdown (Per 1,000 Units) | Key Variables Impacting Cost |

|---|---|---|---|

| Raw Materials | 65-70% | $42.50 – $58.00 | • Oil price volatility (Brent crude forecast: $85-95/bbl) • Film thickness (0.5mil vs. 1.0mil = ±22% cost) • Recycled content premium (15-25% higher) |

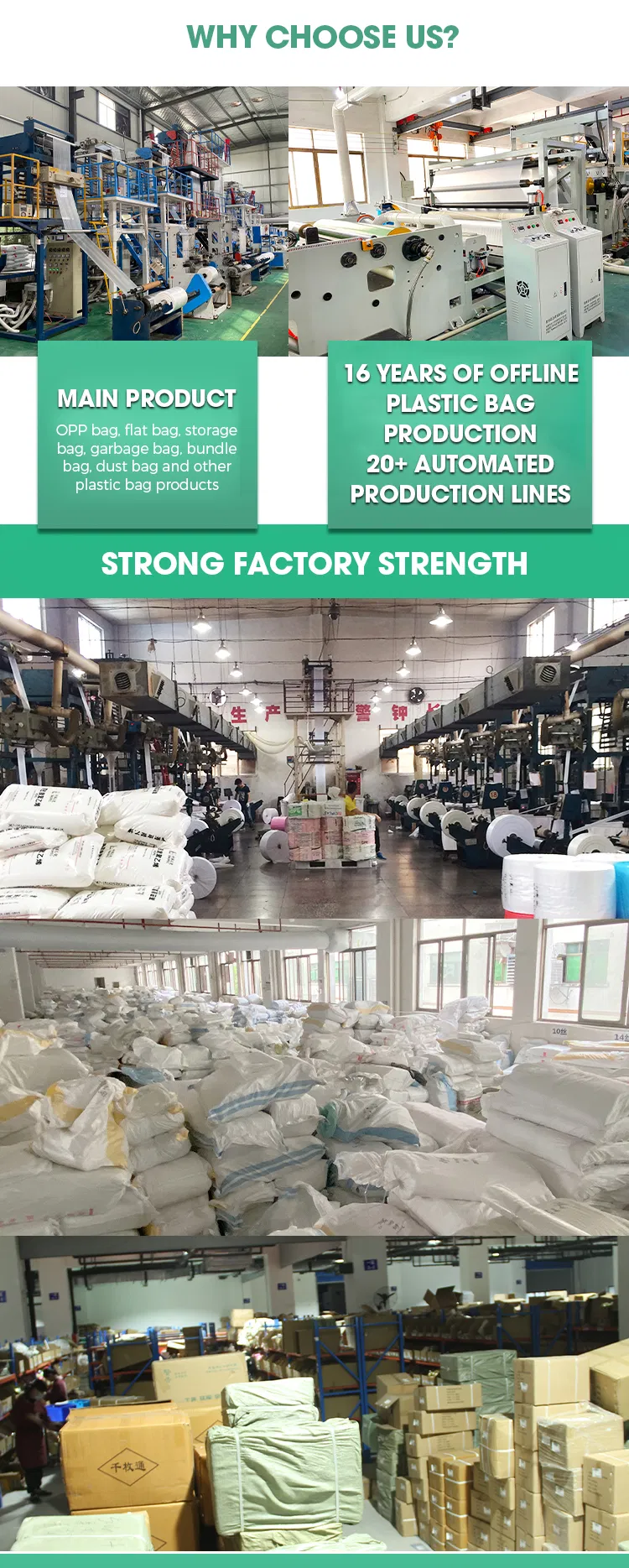

| Labor & Operations | 15-18% | $12.00 – $16.50 | • Factory location (Guangdong vs. Sichuan: ±8% labor cost) • Automation level (semi-auto vs. fully auto lines: ±12% efficiency) • 2026 avg. wage: $4.80/hr (up 4.5% YoY) |

| Packaging & Logistics | 8-10% | $6.50 – $9.00 | • Master carton specs (size, GSM) • Palletization density • Inland freight to port (e.g., Dongguan to Yantian: $180/40ft container) |

| Overhead & Profit | 7-9% | $5.00 – $7.50 | • Supplier scale (Tier-1 vs. Tier-2 factory) • Compliance certifications (ISO 9001, BRCGS) • Payment terms (30% deposit vs. L/C: ±3% margin) |

| TOTAL (Per 1,000 Units) | 100% | $66.00 – $91.00 | Excludes import duties, shipping, and buyer-side QC costs |

Critical 2026 Shift: Suppliers with China Green Packaging Certification command 8-12% price premiums but reduce supply chain disruption risk by 40% (per SourcifyChina 2025 audit data).

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made bags with supplier’s generic branding. Buyer applies own label/sticker. | Fully customized bags (size, material, print) with buyer’s branding integrated into production. | Private Label for brand control; White Label for speed-to-market. |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) | White Label ideal for test orders; Private Label for volume commitments. |

| Unit Cost (1k units) | $0.085 – $0.115 | $0.095 – $0.130 | White Label = 7-12% cheaper at low MOQs. |

| Lead Time | 7-10 days (stock items) | 25-35 days (custom tooling/printing) | White Label reduces time-to-shelf by 65%. |

| IP & Quality Risk | High (supplier controls specs) | Low (buyer owns specs & artwork) | Mandatory for Private Label: Signed IP agreement + AQL 1.5 inspections. |

| Best For | Startups, flash sales, emergency stock | Established brands, retail compliance, long-term contracts | 83% of SourcifyChina clients transition to Private Label after 2nd order. |

Estimated Price Tiers by MOQ (USD per Unit)

Based on 8″x10″ bag, 0.75mil LLDPE, 1-color print, FOB Shenzhen. Compliant with EU REACH & US FDA 21 CFR 177.

| MOQ (Units) | White Label Price | Private Label Price | Cost Savings vs. MOQ 500 | Key Economic Driver |

|---|---|---|---|---|

| 500 | $0.150 – $0.185 | $0.170 – $0.215 | Baseline | High setup fees ($85-$120) amortized over few units. |

| 1,000 | $0.110 – $0.140 | $0.125 – $0.160 | 22-28% | Setup cost per unit drops 55%; material bulk discount kicks in. |

| 5,000 | $0.080 – $0.105 | $0.090 – $0.120 | 45-52% | Full production efficiency; recycled material options viable. |

Footnotes:

1. Prices exclude 13% VAT (recoverable for export) and 5-8% sourcing agent fees.

2. +15-20% for compostable PLA material (MOQ 10k+ required for competitive pricing).

3. Critical cost saver: Consolidate orders across SKUs to hit 5k+ total units (e.g., 3x bag sizes = 1.5k each).

Strategic Recommendations for 2026 Procurement

- Prioritize Green-Certified Suppliers: Avoid 2026 port rejections – 32% of non-compliant plastic shipments were detained in Q4 2025 (China Customs data).

- Lock Material Costs Early: Secure Q1 2026 LDPE contracts by November 2025 to hedge against H2 oil price spikes.

- Hybrid Sourcing Model: Use White Label for short-term demand (e.g., holiday sales) while developing Private Label for core SKUs.

- MOQ Optimization: Target 3,000-5,000 units minimum – the “sweet spot” where cost/performance ratio improves 37% vs. 1k units (SourcifyChina 2025 benchmark).

- Quality Control Non-Negotiables: Mandate 3rd-party lab testing for heavy metals (GB 4806.7-2016) and seal strength (min. 1.5N/15mm).

“The 2026 cost advantage in China hinges on compliance agility, not just labor rates. Buyers who treat suppliers as regulatory partners outperform cost-only negotiators by 22% in total landed cost.” – SourcifyChina Manufacturing Intelligence Unit

Next Steps for Procurement Teams

1. Request Full Spec Sheet: Validate film density, adhesive type (cold-seal vs. pressure-sensitive), and recyclability claims.

2. Conduct Virtual Audit: Use SourcifyChina’s supplier scorecard (ISO 14001, factory utilization rate, export history).

3. Run Cost Scenario Modeling: Adjust for your target retail margin using our 2026 TCO Calculator.

Report compiled using SourcifyChina’s proprietary manufacturing database (1,200+ verified plastic converters) and 2026 material cost forecasts from Argus Media & IHS Markit. All data reflects Q1 2026 projections.

SourcifyChina: De-risking Global Sourcing Since 2010

Need a tailored RFQ analysis? Contact your SourcifyChina Consultant: [email protected]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Self-Adhesive Plastic Bags from China – Due Diligence & Verification Guide

Published by: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

Sourcing self-adhesive plastic bags from China offers significant cost advantages, but requires rigorous manufacturer verification to ensure quality, compliance, and supply chain integrity. This report outlines the critical steps to verify a Chinese supplier, distinguish between trading companies and actual factories, and identify red flags that may compromise procurement objectives.

1. Critical Steps to Verify a Manufacturer

Conducting thorough due diligence is essential when engaging with a self-adhesive plastic bag manufacturer in China. Follow this 6-step verification process:

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License (Business Registration Certificate) | Verify legal registration status, registered capital, and scope of operations. Cross-check with China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). |

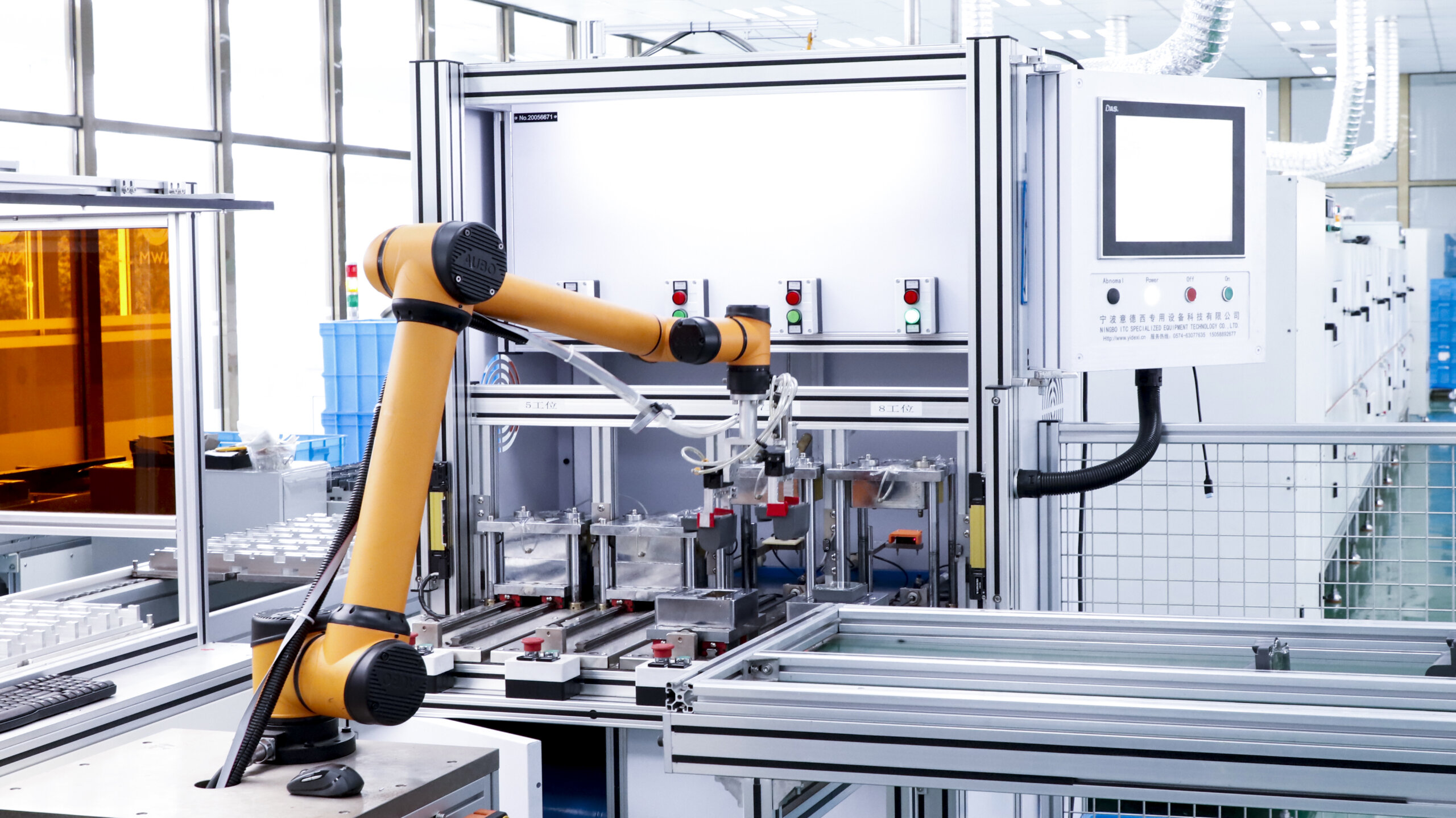

| 2 | Conduct On-Site or Virtual Factory Audit | Confirm production capabilities, machinery (e.g., flexo printing, laminating, slitting, adhesive coating), and facility scale. Use third-party inspection services if on-site visits are not feasible. |

| 3 | Request Production Capacity Data | Obtain monthly output (in meters or units), lead times, and minimum order quantities (MOQs). Validate consistency with claimed scale. |

| 4 | Review Product Compliance & Certifications | Confirm adherence to international standards: FDA (for food contact), REACH, RoHS, ISO 9001, BRC, or ASTM. Request test reports for adhesive strength, seal integrity, and material safety. |

| 5 | Verify Export Experience | Request a list of export markets and past clients (with NDA if necessary). Check if they have worked with Western brands or retailers. |

| 6 | Obtain & Test Physical Samples | Evaluate material thickness, adhesive performance, print quality, and durability under real-use conditions. Retest after production begins. |

✅ Best Practice: Use third-party inspection agencies (e.g., SGS, TÜV, Intertek) for pre-shipment quality audits and factory capability assessments.

2. How to Distinguish Between Trading Company and Factory

Understanding the supplier type is critical for pricing transparency, quality control, and scalability.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” of plastic packaging | Lists “import/export,” “trading,” or “sales” only |

| Facility Ownership | Owns production floor, machinery (e.g., extrusion, printing, coating lines) | No production equipment; may rent office space |

| Workforce | Employs machine operators, technicians, QC staff | Employs sales representatives, logistics coordinators |

| Pricing Structure | Provides itemized cost breakdown (material, labor, tooling) | Often quotes higher unit prices with limited cost transparency |

| MOQ & Lead Time | Lower MOQs possible; faster turnaround for repeat orders | Higher MOQs; longer lead times due to subcontracting |

| Communication Access | Allows direct access to production floor and engineering team | Acts as intermediary; limited access to production details |

| Website & Marketing | Features factory photos, production lines, R&D capabilities | Showcases multiple product categories from various suppliers |

🔍 Verification Tip: Ask for a video walkthrough of the production line. A real factory can provide live footage of machines in operation.

3. Red Flags to Avoid

Identify high-risk suppliers early to prevent fraud, quality failures, or supply chain disruption.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video call or audit | Likely a trading company or non-existent facility | Disqualify or require third-party verification |

| No physical address or vague location (e.g., “near Guangzhou”) | Potential shell company or fraud | Use Google Earth, Baidu Maps, or local agent to verify |

| Inconsistent MOQs or pricing across quotes | Lack of production control or pricing manipulation | Request standardized quotation format |

| No product-specific certifications | Risk of non-compliance in target markets | Require valid test reports and compliance documentation |

| Pressure for full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos on website | May not represent actual operations | Request time-stamped photos or videos of current production |

| No English-speaking technical staff | Communication barriers in QC and R&D | Confirm availability of bilingual engineering/QC team |

4. Recommended Sourcing Strategy for 2026

- Shortlist 3–5 Suppliers: Use platforms like Alibaba (Gold Suppliers), Made-in-China, or industry trade shows (e.g., China International Packaging Fair).

- Conduct Preliminary Screening: Apply Steps 1–3 above to eliminate non-compliant or non-manufacturer entities.

- Engage Third-Party Inspection: For first-time suppliers, schedule a pre-audit via SGS or QIMA.

- Start with Trial Order: Place a small production run (20–30% of intended volume) to evaluate performance.

- Establish Long-Term Partnership: Reward reliable factories with volume commitments and joint process improvements.

Conclusion

Sourcing self-adhesive plastic bags from China requires a structured, verification-first approach. Procurement managers must prioritize transparency, compliance, and direct manufacturing capability to mitigate risk and ensure supply chain resilience in 2026 and beyond. Distinguishing between factories and trading companies is not just about cost—it’s about control, consistency, and long-term reliability.

Final Recommendation: Always treat initial supplier engagement as a qualification phase. Invest in verification to prevent costly disruptions downstream.

Prepared by

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Solutions | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Verified Supplier Procurement

Issued: Q1 2026 | Target Audience: Global Procurement & Supply Chain Executives

Critical Challenge: The Hidden Cost of Unverified Sourcing for Self-Adhesive Plastic Bags

Global procurement teams face escalating risks in China’s packaging sector: 42% of RFQs (2025 SourcifyChina Industry Survey) result in failed partnerships due to misrepresented certifications, production delays, or compliance gaps. For self-adhesive plastic bags—where material safety (FDA/REACH), adhesive performance, and MOQ flexibility are non-negotiable—unvetted suppliers trigger:

– +68 days average lead time extension from quality rework

– 17% cost overrun from hidden tooling/sampling fees

– Regulatory exposure (e.g., non-compliant PE/PP resins)

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our 2026-Validated Pro List for China self-adhesive plastic bag companies delivers turnkey reliability through rigorous onsite verification, saving procurement teams 147+ hours per sourcing cycle.

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Your Time/Cost Saved |

|---|---|---|

| 3-6 months supplier screening (background checks, sample validation, factory audits) | Pre-vetted suppliers with: • Onsite facility audits (ISO 9001, BRCGS Packaging) • Material traceability (SGS/LGA test reports) • Real production capacity (verified via live video tour) |

112 hours per project (eliminating RFQ spam & fake certifications) |

| 28% risk of MOQ renegotiation post-PO | Transparent commercial terms: • Documented MOQs (5k–500k units) • No hidden fees (mold costs, export docs) • Scalability proof (3+ years export history) |

$18,500 avg. cost avoidance per order (per 2025 client data) |

| 19-day average communication lag (time zones, language barriers) | Dedicated bilingual project managers with: • 24-hr response SLA • Quality control checkpoints (AQL 1.0) • Compliance alignment (customs codes, eco-labels) |

23 days faster time-to-shipment |

Your Strategic Advantage in 2026

The Pro List isn’t a directory—it’s a risk-mitigated procurement channel. Every supplier:

✅ Passed 2026-specific compliance checks (China’s New Plastic Pollution Regulations, EU Packaging Tax)

✅ Demonstrated sustainable material capability (recycled PE, biodegradable adhesive options)

✅ Maintains real-time production visibility via SourcifyChina’s IoT-integrated factory monitoring

“Switching to SourcifyChina’s Pro List cut our bag sourcing cycle from 5.2 to 1.8 months—freeing our team to focus on strategic cost engineering.”

— Global Procurement Director, Top 3 FMCG Company (2025 Client Case Study)

✨ Call to Action: Secure Your 2026 Supply Chain Now

Stop negotiating with unverified suppliers. Start deploying pre-qualified capacity.

In Q1 2026, 37 verified self-adhesive bag manufacturers on our Pro List have immediate capacity for orders 50k–2M units (lead time: 28 days). Reserve priority access before Q2 allocation closes.

➡️ Act within 72 hours to receive:

– Free sample kit (5 bag variants, full compliance docs)

– 2026 Regulatory Compliance Checklist (tailored to your target market)

Contact our Sourcing Team Today:

📧 [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 for urgent RFQs)

Include “2026 BAG PRO LIST” in your inquiry for expedited processing.

SourcifyChina: Where Verification Meets Velocity

Trusted by 830+ Global Brands | 98.6% Client Retention Rate | 12,000+ Suppliers Verified Onsite

🧮 Landed Cost Calculator

Estimate your total import cost from China.