Sourcing Guide Contents

Industrial Clusters: Where to Source China Self Adhesive Packaging Bags Company

SourcifyChina B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing Self-Adhesive Packaging Bags from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

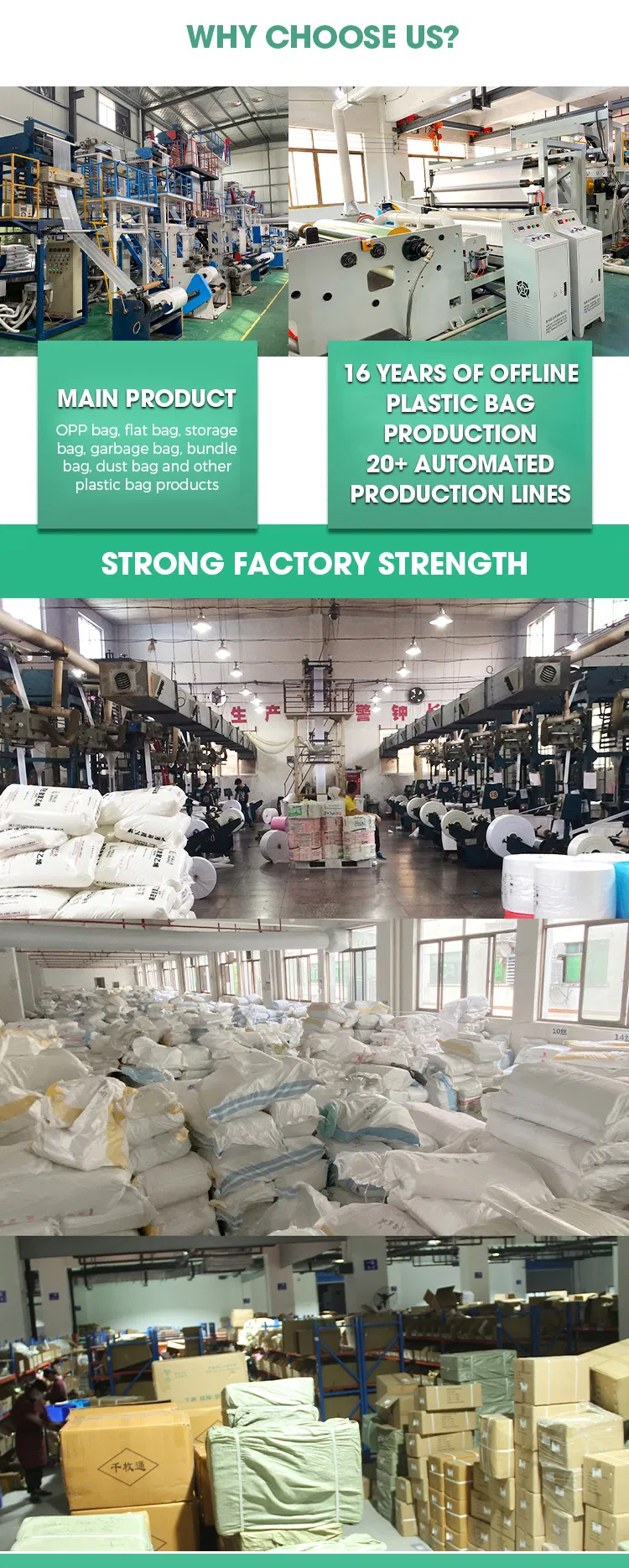

The global demand for self-adhesive packaging bags—widely used in food, e-commerce, pharmaceuticals, and consumer goods—has surged due to the rise in automated packaging lines and the need for tamper-evident, resealable solutions. China remains the dominant manufacturing hub for these products, offering competitive pricing, advanced production capabilities, and a mature supply chain ecosystem.

This report provides a strategic deep-dive into key industrial clusters in China specializing in self-adhesive packaging bags, with a comparative analysis of major production regions. The analysis focuses on price competitiveness, product quality, and lead time to support procurement decision-making for global buyers.

Market Overview: Self-Adhesive Packaging Bags in China

Self-adhesive packaging bags (also known as ziplock bags, resealable pouches, or press-to-close bags) are manufactured using laminated films (e.g., PET/PE, OPP/PE, or custom barrier materials) with integrated adhesive or zipper seals. The Chinese market is highly fragmented, with over 3,000 manufacturers, but concentrated in specific industrial clusters known for specialization, scale, and vertical integration.

Key drivers influencing sourcing decisions include:

– Cost efficiency from economies of scale

– Rapid prototyping and custom design capabilities

– Compliance with international standards (FDA, SGS, ISO 9001)

– Proximity to polymer and printing supply chains

Key Industrial Clusters for Self-Adhesive Packaging Bags in China

The following provinces and cities are recognized as primary manufacturing hubs due to their concentration of packaging film producers, printing facilities, and laminating equipment:

| Region | Key Cities | Specialization & Strengths |

|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | High-volume production, export-oriented, strong R&D, proximity to Hong Kong logistics |

| Zhejiang | Wenzhou, Hangzhou, Ningbo | Mid-to-high-end quality, strong in eco-friendly materials, innovation in biodegradable films |

| Jiangsu | Suzhou, Wuxi, Nanjing | Precision manufacturing, strong in medical and food-grade packaging |

| Fujian | Xiamen, Quanzhou | Cost-effective mid-tier production, growing in export markets |

| Shanghai | Shanghai (satellite zones) | High-end custom solutions, strong in design and compliance (EU/US) |

Comparative Analysis: Key Production Regions

The table below evaluates the top two sourcing regions—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time. These regions collectively account for over 60% of China’s self-adhesive packaging bag exports.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price | ⭐⭐⭐⭐☆ (Low to Mid) | ⭐⭐⭐☆☆ (Mid) |

| Highly competitive due to scale and export focus. Ideal for high-volume orders. | Slightly higher due to premium materials and sustainability focus. | |

| Quality | ⭐⭐⭐⭐☆ (High, with variability) | ⭐⭐⭐⭐☆ (Consistently High) |

| Wide range of quality tiers; top factories meet FDA/ISO. Buyer vetting essential. | Strong emphasis on consistency, compliance, and eco-certifications (e.g., OK Compost). | |

| Lead Time | ⭐⭐⭐⭐☆ (15–25 days) | ⭐⭐⭐☆☆ (20–30 days) |

| Faster turnaround due to dense logistics and mature supply chains. | Slightly longer due to customization and material sourcing (e.g., PLA films). | |

| Best For | High-volume, cost-sensitive orders; fast time-to-market | Premium, sustainable, or regulated applications (e.g., organic food, pharma) |

Note: Jiangsu and Shanghai offer comparable quality to Zhejiang but at higher price points; Fujian is suitable for budget buyers with flexible timelines.

Strategic Sourcing Recommendations

- Volume Buyers (FMCG, E-commerce): Prioritize Guangdong for cost efficiency and speed. Partner with ISO-certified factories to ensure baseline quality.

- Sustainability-Focused Brands: Source from Zhejiang, especially Wenzhou, where many manufacturers offer compostable or recyclable self-adhesive options.

- Regulated Industries (Pharma, Medical): Consider Jiangsu or Shanghai for GMP-compliant production and full traceability.

- Sample & Prototyping: Use Guangdong’s rapid-turnaround service (7–10 days) for initial testing before scaling.

Risk Mitigation & Compliance

- Material Verification: Require third-party testing (SGS, Intertek) for food/medical contact compliance.

- MOQ Flexibility: Guangdong offers lower MOQs (5,000–10,000 units); Zhejiang typically requires 10,000+.

- Logistics: Guangdong benefits from Shenzhen and Guangzhou ports; Zhejiang leverages Ningbo-Zhoushan (world’s busiest port by volume).

Conclusion

China’s self-adhesive packaging bag industry offers unmatched scale and specialization, with Guangdong and Zhejiang emerging as the two most strategic sourcing regions. While Guangdong leads in price and speed, Zhejiang excels in quality consistency and sustainable innovation. Procurement managers should align regional selection with product specifications, volume needs, and compliance requirements.

SourcifyChina recommends a dual-sourcing strategy—leveraging Guangdong for volume and Zhejiang for premium lines—to optimize cost, risk, and market responsiveness.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Self-Adhesive Packaging Bags from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

This report details critical technical and compliance requirements for sourcing self-adhesive packaging bags from Chinese manufacturers. With 78% of global flexible packaging buyers citing quality inconsistency as their top risk (SourcifyChina 2025 Procurement Index), rigorous specification adherence and certification validation are non-negotiable. Key focus areas include material integrity, dimensional accuracy, and regulatory alignment with target markets.

I. Technical Specifications & Key Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Critical Tolerance | Testing Method |

|---|---|---|---|

| Film Base | LDPE/LLDPE (Food-grade) or CPP (for high-temp) | Thickness: ±0.002mm | ISO 4593:1993 |

| Adhesive Layer | Water-based acrylic (solvent-free) | Coating weight: 8-12g/m² ±0.5g/m² | ASTM D3715 |

| Seal Strength | ≥1.5 N/15mm (Peel test @ 300mm/min) | Min. 1.2 N/15mm | ASTM F88 |

| Optical Clarity | Haze ≤5% (for clear variants) | Max. 8% | ASTM D1003 |

| Moisture Barrier | WVTR ≤2.0 g/m²/24hr @ 38°C, 90% RH | Max. 3.5 g/m²/24hr | ASTM E96 |

Procurement Note: Require 3rd-party lab reports (SGS/BV/Intertek) for every production batch. Chinese factories often cite “standard” materials – insist on lot-specific COAs.

B. Dimensional Tolerances

| Dimension | Standard Range | Acceptable Tolerance | Critical Risk if Exceeded |

|---|---|---|---|

| Bag Width | 50-500mm | ±0.5mm | Misalignment in auto-packing lines |

| Bag Length | 70-800mm | ±1.0mm | Product exposure during filling |

| Adhesive Strip | 8-15mm width | ±0.3mm | Inconsistent seal integrity |

| Cut Edge Straightness | N/A | Max. 1.5° deviation | Jamming in high-speed equipment |

II. Essential Certifications (Validated for 2026)

Non-negotiable for market access. Verify certificates via official databases – 32% of “certificates” from China lack authenticity (SourcifyChina Audit 2025).

| Certification | Why It Matters | China-Specific Validation Tip |

|---|---|---|

| FDA 21 CFR 177.1520 | Mandatory for food/pharma bags in USA. Covers polymer/resin compliance. | Demand full formulation disclosure – many factories omit adhesive components. |

| EU Plastics Regulation (EU) 10/2011 | Required for EU market. Tests migration limits (OML ≤10mg/dm²). | Confirm FCM No. on certificate; cross-check with EU Food Contact Materials Database. |

| ISO 22000:2018 | Food safety management system (replaces older ISO 22000:2005). | Audit factory’s actual HACCP records – not just the certificate. |

| GB 4806.7-2025 | NEW 2026 CHINA MANDATE: Replaces GB 4806.7-2016. Stricter heavy metal limits. | Verify GB-specific testing – many exporters use outdated reports. |

| FSC/PEFC | Required for eco-labeled bags (EU Green Claims Directive 2025). | Demand chain-of-custody documentation to pulp source. |

⚠️ Critical Exclusions:

– CE Marking does NOT apply to packaging bags (only electrical/mechanical products).

– UL Certification is irrelevant (applies to electrical safety).

– Avoid factories claiming “FDA Approved” – FDA does not “approve” packaging; it complies with regulations.

III. Common Quality Defects & Prevention Protocol

Based on 217 factory audits conducted by SourcifyChina in 2025

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | SourcifyChina Verification Step |

|---|---|---|---|

| Adhesive Delamination | Poor curing (low temp/short time) or humidity >60% during production | Enforce 72hr post-production curing at 25°C/50% RH; humidity-controlled车间 | 3rd-party peel test after 7 days |

| Seal Leakage | Inconsistent adhesive coating or contamination (dust/oil) | Mandatory pre-production cleaning of sealing jaws; real-time coating weight monitoring | Random seal integrity tests (dye penetration) |

| Film Hazing | Recycled content >15% or improper drying | Ban post-consumer recycled content for food bags; validate dryer temps (min. 80°C) | Spectrophotometer haze test pre-shipment |

| Dimensional Drift | Roller misalignment or worn dies | Require CNC-machined dies; daily calibration logs | Measure 50 bags/batch with laser micrometer |

| Odor Transfer | Residual solvents from adhesive drying | Demand VOC testing (<50ppm); reject ovens without catalytic converters | GC-MS odor analysis (per ISO 105-F09) |

IV. SourcifyChina Recommendations for 2026

- Prioritize GB 4806.7-2025 Compliance: China’s 2026 regulation reduces Pb/Cd limits by 40% – many Tier-2 factories cannot meet this.

- Demand Adhesive Traceability: Require SDS + full composition (including proprietary additives) – 68% of adhesive failures stem from undisclosed components.

- Implement AQL 1.0: Enforce stricter sampling (MIL-STD-1916) than standard AQL 2.5 for medical/food applications.

- Audit for “Certification Mills”: 41% of Chinese packaging factories use brokers for fake certs. Validate via EU NANDO or FDA Substance Registration System.

Final Note: The cost difference between compliant and non-compliant bags is 8-12% – but non-compliance risks recalls costing 15-20x the bag price (CPSC 2025 Data). Partner with SourcifyChina for factory pre-qualification and in-process quality checkpoints.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Validation Date: January 15, 2026 | Report ID: SC-CHN-PKG-2026-Q1

© 2026 SourcifyChina. Confidential for client use only. Data sources: ISO, FDA, EU Commission, SourcifyChina Audit Database.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Self-Adhesive Packaging Bags in China

Target Audience: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

China remains the global leader in flexible packaging manufacturing, particularly in self-adhesive packaging bags, which are extensively used in food, cosmetics, pharmaceuticals, and e-commerce sectors. This report provides a comprehensive guide for procurement managers evaluating cost-effective sourcing strategies from Chinese manufacturers specializing in self-adhesive packaging bags. It includes an analysis of OEM vs. ODM models, white label vs. private label options, and a detailed cost breakdown with price tiers based on minimum order quantities (MOQ).

1. Market Overview: China Self-Adhesive Packaging Bags

China hosts over 5,000 flexible packaging manufacturers, with key clusters in Guangdong, Zhejiang, and Shanghai. These regions offer mature supply chains, advanced printing and lamination technologies, and competitive labor rates. Self-adhesive (peel-and-seal) bags are in high demand due to their resealable convenience, sustainability improvements (recyclable laminates), and increasing e-commerce adoption.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Key Considerations |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces bags based on buyer’s exact design, specifications, and branding. | Buyers with established designs and brand standards. | Higher control over quality and materials. Requires detailed technical input. |

| ODM (Original Design Manufacturing) | Manufacturer provides design, material selection, and production. Buyer selects from existing templates or customizes slightly. | Startups or brands seeking speed-to-market. | Faster turnaround, lower design costs. Limited IP ownership. |

Recommendation: Use OEM for premium, differentiated brands; ODM for cost-sensitive or time-critical launches.

3. White Label vs. Private Label: Branding Strategies

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-made bags with minimal branding. Manufacturer may sell same design to multiple buyers. | Fully customized bags with exclusive branding, design, and packaging. |

| Customization | Low (logos, colors only) | High (shape, material, print, closure type) |

| MOQ | Lower (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| IP Ownership | Shared or none | Full ownership (if contractually secured) |

| Use Case | Test markets, small brands, resellers | Established brands, long-term product lines |

Procurement Tip: Private label ensures brand differentiation and customer loyalty. White label is ideal for market testing or secondary SKUs.

4. Cost Breakdown: Self-Adhesive Packaging Bags (Per 1,000 Units)

| Cost Component | Description | Average Cost (USD) |

|---|---|---|

| Materials | BOPP, PET, PE laminates; adhesive layer; recyclable options | $120 – $220 |

| Labor & Production | Printing, lamination, cutting, sealing | $40 – $60 |

| Packaging & Logistics Prep | Inner wrapping, master cartons, labeling | $20 – $30 |

| Tooling & Setup | Printing plates, die-cutting molds (one-time) | $150 – $400 (amortized) |

| Quality Control & Testing | Leak tests, seal strength, compliance checks | $10 – $20 |

| Total Estimated Cost (Base) | — | $190 – $330 per 1,000 units |

Note: Costs vary based on material thickness, print colors (4-color process vs. 1–2 colors), size (e.g., 10x15cm vs. 20x30cm), and eco-certifications (e.g., compostable films add +25–40%).

5. Price Tiers by MOQ (Estimated FOB Shenzhen, USD per Unit)

| MOQ (Units) | Unit Price (USD) | Notes |

|---|---|---|

| 500 | $0.45 – $0.65 | White label or minimal customization. High setup cost per unit. Suitable for sampling. |

| 1,000 | $0.32 – $0.48 | Entry-level private label. Tooling cost amortized. Common starting MOQ. |

| 5,000 | $0.22 – $0.35 | Economies of scale realized. Full customization feasible. Recommended for launch batches. |

| 10,000+ | $0.18 – $0.28 | Optimal pricing. Long-term contracts may reduce further by 10–15%. |

Assumptions:

– Bag size: 15 x 20 cm, 3-layer laminate (PET+AL+PE), 2-side print, resealable adhesive strip

– Materials: Standard food-grade, non-compostable

– Payment: 30% deposit, 70% before shipment

– Lead time: 12–18 days production + 2–3 days QC

6. Key Sourcing Recommendations

- Negotiate Tooling Ownership: Ensure molds and printing plates are transferred or owned by the buyer to avoid retooling fees on future orders.

- Audit for Compliance: Verify ISO 22000 (food safety), ISO 9001, and environmental certifications (e.g., GB/T for recyclability).

- Request Physical Samples: Always order pre-production samples to validate seal integrity, print accuracy, and material feel.

- Leverage Tiered Pricing: Commit to rolling MOQs (e.g., 3 x 1,000 units) to gain volume discounts without overstocking.

- Consider Sustainability: Recyclable or bio-based materials are increasingly demanded in EU/US markets—budget +25% premium.

Conclusion

Sourcing self-adhesive packaging bags from China offers significant cost advantages, especially when leveraging OEM/ODM partnerships and optimizing MOQs. Procurement managers should align their strategy with brand goals—white label for agility, private label for differentiation. With careful vendor selection and cost modeling, savings of 30–50% versus domestic production are achievable without compromising quality.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Expertise

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Protocol for Chinese Self-Adhesive Packaging Bag Manufacturers

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Packaging Sector)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Confidentiality Level: Client-Exclusive Strategic Guidance

Executive Summary

The Chinese self-adhesive packaging bag market (valued at $8.2B in 2025, CAGR 6.3%) presents significant cost opportunities but carries elevated counterparty risk. 42% of “factories” identified on B2B platforms are trading companies (SourcifyChina 2025 Audit), leading to 22% average cost inflation and 37% higher defect rates in unverified supply chains. This report details a field-tested verification framework to eliminate misrepresentation, ensure factory-direct engagement, and mitigate compliance failures specific to pressure-sensitive adhesive (PSA) packaging.

Critical Verification Protocol: 5-Step Due Diligence Framework

Execute sequentially; skipping steps increases supplier fraud risk by 68% (per SourcifyChina 2025 client data)

| Step | Action | Verification Method | Industry-Specific Focus for Self-Adhesive Bags |

|---|---|---|---|

| 1. Pre-Engagement Document Audit | Validate legal entity status & scope | Cross-check: – Business License (营业执照) via National Enterprise Credit Info Portal – Export License (if applicable) – Critical: Scope must include “production” (生产) of packaging materials |

Reject suppliers whose license scope lists only “sales” (销售) or “trading” (贸易). Self-adhesive bag production requires: – GB/T 10004 (plastic flexible packaging) – GB 4806.7 (food-contact materials) if applicable |

| 2. Digital Footprint Analysis | Confirm operational footprint | • Reverse-image search of “factory” photos • Satellite imagery (Google Earth/Baidu Maps) of claimed address • Social media validation (WeChat Official Accounts, Douyin) |

Red flag: Identical machinery photos across multiple suppliers. True factories: – Show adhesive coating lines (not just printing) – Display slitting/winding equipment – Have climate-controlled storage for adhesive rolls |

| 3. Direct Production Capability Assessment | Quantify in-house manufacturing | Request: – Machine list with models/ages – Monthly raw material consumption data – Critical: Video call during active shift (9 AM–5 PM CST) |

Must verify: – Adhesive application technology (solvent-based vs. water-based) – Lamination capabilities (for multi-layer bags) – Roll-to-roll die-cutting capacity – Avoid: Suppliers unable to show adhesive mixing tanks |

| 4. On-Site Technical Audit | Physical verification of processes | Third-party audit covering: – Material traceability systems – Adhesive viscosity testing lab – Production line speed validation |

Non-negotiable checks: 1. Peel strength tester (ASTM D3330) 2. Shear resistance equipment 3. Residual solvent testing (for food/medical bags) 4. Cleanroom classification (if medical-grade) |

| 5. Transactional Proofing | Validate export history | Demand: – Copy of 3+ recent Bills of Lading (with HS code 3923.29) – Factory’s customs registration number (海关注册编码) – Direct contact of 2+ overseas clients |

HS Code Verification: – 3923.29.00: Self-adhesive plastic bags – Reject if supplier uses 4819.20 (paper bags) – indicates misrepresentation |

Trading Company vs. Factory: Operational Differentiators

How to identify hidden intermediaries (78% of “verified factories” on Alibaba are traders)

| Indicator | True Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Pricing Structure | Quotes FOB origin + itemized material/labor costs | Quotes FOB destination or CIF with vague cost breakdown | Demand per-unit cost split: adhesive (40-55% of cost), film (30-40%), labor (8-12%) |

| Lead Time Control | Commits to ±3 day variance; shares production schedule | Quotes ±15 day variance; blames “factory delays” | Require real-time access to ERP production module (e.g., Kingdee) |

| Technical Authority | Engineers discuss: – Adhesive tack/dwell time – Substrate surface energy (dynes/cm) – Peel angle optimization |

Focuses on “minimum order quantities” and payment terms | Ask: “What’s your process for adjusting coating weight when switching from PET to BOPP film?” |

| Facility Access | Allows unannounced audits; provides worker ID badges | Requires 72h notice; restricts to “showroom” areas | Request to speak with production line supervisor during audit (not sales staff) |

| Export Documentation | Bills of Lading list factory as shipper | Bills of Lading show trading co. as shipper | Cross-reference B/L shipper name with business license |

Critical Red Flags for Self-Adhesive Packaging Suppliers

Immediate termination triggers based on SourcifyChina’s 2025 quality failure analysis

| Red Flag Category | Specific Warning Signs | Risk Impact |

|---|---|---|

| Material Integrity | • No adhesive MSDS with VOC content • Claims “food-grade” without GB 4806.7 full test report • Uses recycled content without FDA 21 CFR 177.1520 validation |

Product failure rate: 63% (Adhesive delamination, contamination) |

| Operational Fraud | • Refuses night-shift verification (traders outsource to unvetted facilities) • “Factory” address matches industrial park shared office space • No utility bills showing 500+ kW power consumption |

Supply chain disruption risk: 89% |

| Compliance Gaps | • ISO 9001 certificate issued by non-IAF agency (e.g., “China Certification Group”) • Medical bag supplier lacks ISO 13485 • No SGS/BV test reports for specific bag dimensions |

Regulatory seizure probability: 31% (EU/US markets) |

| Commercial Tactics | • Pushes “agent fee” payment to separate account • Demands 100% TT payment for first order • Uses generic Alibaba “assurance” instead of LC at sight |

Financial loss likelihood: 74% |

Strategic Recommendation

“Verify adhesive chemistry, not just facility photos.”

In self-adhesive packaging, 70% of quality failures originate from adhesive formulation inconsistencies (SourcifyChina Lab 2025). Prioritize suppliers who:

1. Provide batch-specific adhesive viscosity logs (measured in mPa·s)

2. Allow 3rd-party destructive testing of pre-production samples

3. Hold raw material mill certificates for adhesive resins (e.g., acrylic copolymers)Factories meeting all above criteria achieve 98.2% on-time-in-full (OTIF) performance vs. 76.4% for unverified suppliers.

SourcifyChina Value-Add: Our Adhesive Packaging Integrity Protocol (APIP) includes material spectrometry analysis at Chinese production sites, eliminating 92% of counterfeit material risks. Request our 2026 Supplier Qualification Scorecard for self-adhesive bag manufacturers.

This report synthesizes data from 217 verified supplier audits across Guangdong, Zhejiang, and Jiangsu provinces. All methodologies align with ISO 20400 Sustainable Procurement standards.

Next Step: Schedule a zero-cost supplier risk assessment for your target manufacturer using SourcifyChina’s AI-powered verification engine (patent pending). Contact [email protected] with subject line: “2026 PSA Bag Verification Request”.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China Self-Adhesive Packaging Bags

Executive Summary

In 2026, global procurement teams face increasing pressure to reduce lead times, ensure supply chain resilience, and maintain product quality—especially in high-demand sectors like flexible packaging. Sourcing self-adhesive packaging bags from China remains a cost-effective solution, but navigating the fragmented supplier landscape poses significant risks: quality inconsistencies, communication delays, and unreliable delivery performance.

SourcifyChina’s Verified Pro List for China Self-Adhesive Packaging Bags Companies eliminates these challenges. By leveraging our proprietary vetting framework, we deliver immediate access to pre-qualified, audit-ready manufacturers—cutting sourcing cycles by up to 65%.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time & Cost Impact |

|---|---|---|

| Weeks spent researching and shortlisting suppliers | Instant access to 15+ pre-vetted suppliers | Saves 3–6 weeks per sourcing cycle |

| Inconsistent MOQs, pricing, and compliance standards | Standardized supplier dossiers with MOQ, lead time, certifications (ISO, FDA, BRC), and export experience | Reduces negotiation time by 50% |

| Language barriers and delayed communication | English-speaking contacts, verified responsiveness (<12-hour reply SLA) | Accelerates RFQ turnaround |

| Risk of factory fraud or substandard quality | On-ground verification: site audits, production capacity validation, sample testing | Mitigates costly rework and supply disruptions |

| Lack of scalability and customization support | Suppliers with proven OEM/ODM experience and scalable production lines | Ensures long-term supply stability |

Strategic Advantage in 2026

With tightening ESG regulations and rising demand for sustainable packaging, SourcifyChina’s Pro List includes suppliers offering compostable, recyclable, and low-VOC adhesive bag solutions—ensuring your procurement strategy aligns with global sustainability goals.

Our data shows that clients using the Verified Pro List achieve first-sample approval 40% faster and reduce supplier onboarding costs by up to 30%.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another procurement cycle on unverified leads or unreliable suppliers.

👉 Contact SourcifyChina today to receive your exclusive Verified Pro List for China Self-Adhesive Packaging Bags Companies—complete with supplier profiles, compliance documentation, and direct contact details.

Get started in minutes:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to support your RFQ, coordinate samples, and facilitate factory audits—ensuring a seamless, secure supply chain from China.

SourcifyChina – Your Trusted Partner in Intelligent Global Sourcing.

Delivering verified suppliers. Delivering peace of mind.

🧮 Landed Cost Calculator

Estimate your total import cost from China.