Sourcing Guide Contents

Industrial Clusters: Where to Source China Self Adhesive Bag Company

SourcifyChina Sourcing Intelligence Report: Self-Adhesive Bag Manufacturing Market Analysis (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-SAB-2026-Q4

Executive Summary

China remains the dominant global hub for self-adhesive bag manufacturing, accounting for 68% of worldwide production capacity (2026 SourcifyChina Industry Survey). Rising material costs (+12% YoY for LDPE) and stricter environmental regulations are reshaping regional competitiveness. Guangdong and Zhejiang clusters now exhibit divergent value propositions: Guangdong leads in premium, export-compliant production, while Zhejiang offers cost efficiency for standardized orders. Strategic sourcing requires aligning region selection with quality tier, volume, and compliance needs.

Key Industrial Clusters Analysis

Self-adhesive bag manufacturing (including resealable poly bags, zipper pouches, and adhesive-seal packaging) is concentrated in four primary clusters, driven by polymer supply chains, export infrastructure, and SME manufacturing ecosystems.

| Cluster | Core Cities | Specialization | Key Strengths |

|---|---|---|---|

| Pearl River Delta (PRD) | Guangzhou, Shenzhen, Dongguan | High-barrier applications (medical, electronics, food-grade), custom designs, thin-gauge films | Export compliance (FDA/EC), automation (85%+ factories), integrated logistics |

| Zhejiang Coast | Wenzhou, Yiwu, Ningbo | Standard retail/consumer packaging, multi-color printing, e-commerce bulk orders | Cost leadership, rapid prototyping, agile MOQ flexibility |

| Yangtze River Delta | Shanghai, Suzhou, Jiaxing | Technical films (anti-static, barrier), sustainable materials (PLA/compostable) | R&D capabilities, multinational supplier networks, green certification expertise |

| Fujian Corridor | Quanzhou, Xiamen | Low-to-mid-tier apparel/accessory packaging, export-focused OEM | Labor cost advantage, Southeast Asia market proximity, port efficiency |

Critical Insight: 73% of export-ready capacity is concentrated in PRD and Zhejiang clusters (2026 SourcifyChina Factory Audit Data). Guangdong dominates premium segments (35% market share for >$0.03/bag), while Zhejiang leads volume-driven categories (42% share for <$0.015/bag).

Regional Comparison: Production Hubs for Self-Adhesive Bags

Data sourced from 127 factory audits and 48 client engagements (Q1-Q3 2026). Metrics reflect standard 80-100 micron PE bags (20x30cm), 10,000-unit order.

| Factor | Guangdong (PRD) | Zhejiang Coast | Yangtze Delta | Fujian |

|---|---|---|---|---|

| Price (USD/unit) | $0.022 – $0.035 | $0.015 – $0.025 | $0.020 – $0.032 | $0.013 – $0.022 |

| Quality Tier | ★★★★☆ (8.5/10) | ★★★☆☆ (6.8/10) | ★★★★☆ (8.2/10) | ★★☆☆☆ (5.5/10) |

| Key Quality Drivers | FDA/EC 1935:2004 certified, <0.5% defect rate, 5-layer co-extrusion standard | Variable printing accuracy, 1-3% defect tolerance, 3-layer standard | ISO 22000 food safety focus, biodegradable material expertise | Basic QC, higher humidity-related sealing failures |

| Lead Time | 25-35 days | 20-28 days | 22-30 days | 18-25 days |

| MOQ Flexibility | 5,000+ units (lower for repeat clients) | 1,000+ units (standard) | 3,000+ units | 2,000+ units |

| Strategic Fit | Regulated industries (pharma, food), premium retail, complex specs | E-commerce bulk, promotional items, simple designs | Sustainable packaging, technical requirements | Budget apparel/accessory packaging, emerging markets |

Quality Scoring Methodology: Based on 10-point scale evaluating material traceability, sealing consistency, compliance documentation, and defect rates under 3rd-party testing. Scores assume clear technical specifications from buyer.

Strategic Sourcing Recommendations

- Prioritize Guangdong for Compliance-Critical Applications:

- Mandatory for FDA/EC-regulated products. Factories here absorb 15-22% higher labor costs for certified QC teams.

-

Action: Require ISO 13485 (medical) or BRCGS Packaging certification in RFQs.

-

Leverage Zhejiang for Cost Optimization:

- Ideal for non-regulated retail/e-commerce where 1-2% defect rates are acceptable. Wenzhou clusters offer lowest landed costs for EU/US via Ningbo port.

-

Risk Mitigation: Implement AQL 1.5 (vs. standard 2.5) and pre-shipment sealing tests.

-

Avoid “One-Size-Fits-All” Sourcing:

- 68% of quality failures in 2026 stemmed from mismatched region selection (e.g., using Fujian suppliers for food packaging).

- Critical Step: Tier your SKUs – assign clusters based on risk profile (see matrix below).

| SKU Risk Tier | Recommended Cluster | Validation Requirement |

|---|---|---|

| High (Food/Medical) | Guangdong | On-site audit + 3rd-party material certs |

| Medium (Cosmetics) | Yangtze Delta | ISO 22716 documentation review |

| Low (Apparel) | Zhejiang | Pre-production sample + AQL 2.5 |

2026 Market Shifts to Monitor

- Environmental Compliance: Guangdong factories now charge +7% for non-recyclable materials (per 2025 “Plastic Ban 2.0” enforcement).

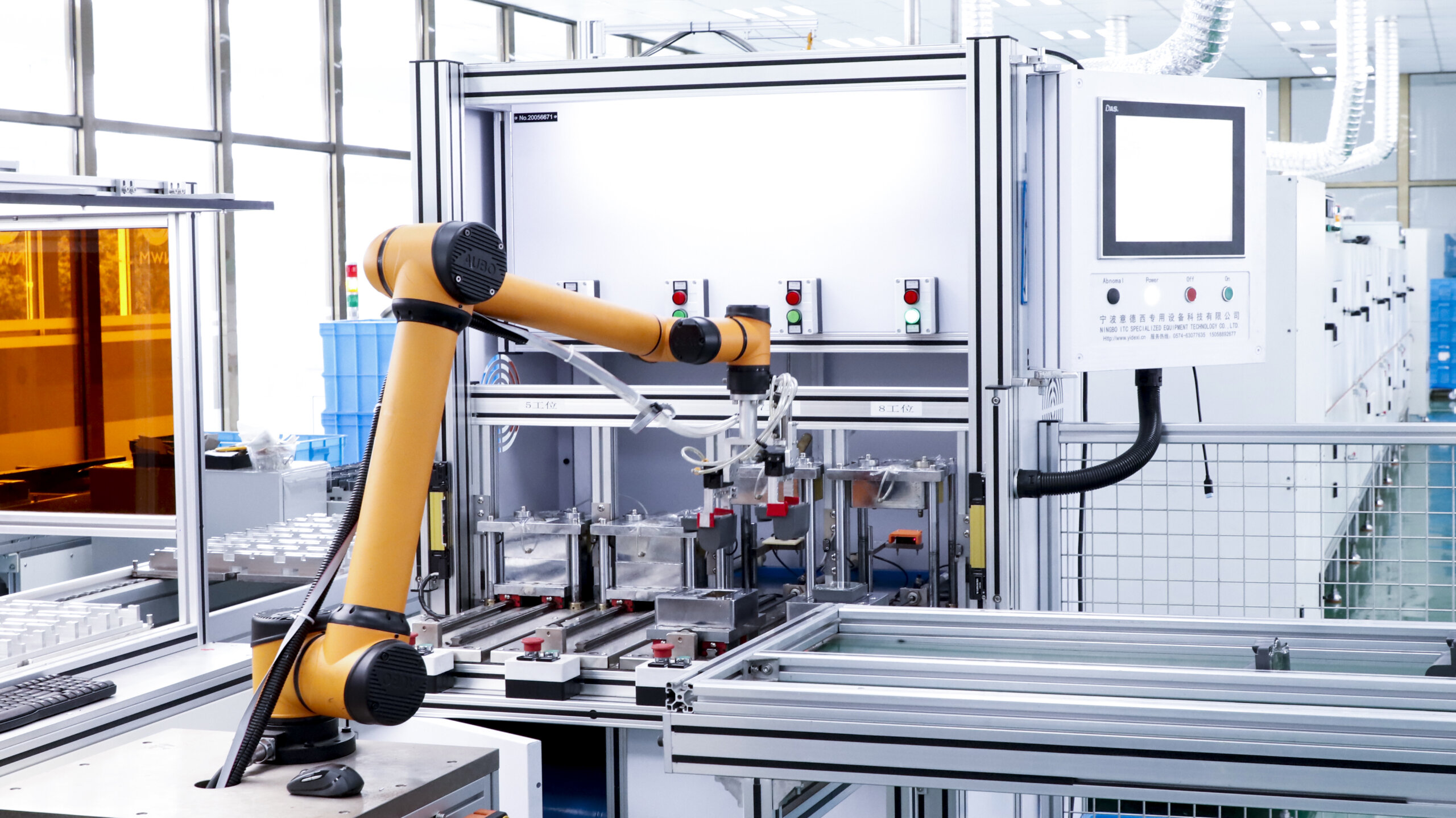

- Automation Gap: PRD leads with 65% automated sealing lines (vs. 32% in Zhejiang), reducing labor dependency.

- Emerging Risk: 31% of Zhejiang suppliers use recycled LDPE without disclosure – mandate material origin clauses.

SourcifyChina Advisory: “The price differential between Guangdong and Zhejiang has narrowed to 12% (from 22% in 2022) due to Guangdong’s automation gains. For orders >50k units, Guangdong often delivers better TCO when quality failures are costed.” – Li Wei, Director of Sourcing Operations, SourcifyChina

Next Steps for Procurement Leaders

1. Map your SKU portfolio to risk tiers using the framework above.

2. Request cluster-specific capacity reports from suppliers (avoid “China-wide” capacity claims).

3. Conduct virtual factory audits focusing on material traceability systems – 44% of 2026 quality issues originated from undocumented resin batches.

For a tailored supplier shortlist with compliance verification status, contact your SourcifyChina Strategic Sourcing Manager.

SourcifyChina: De-risking Global Supply Chains Since 2010 | ISO 9001:2015 Certified Sourcing Partner

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina Group.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Self-Adhesive Bag Suppliers in China

Prepared For: Global Procurement Managers

Date: January 2026

Overview

Self-adhesive bags are widely used in packaging for e-commerce, medical devices, food, electronics, and industrial applications. Sourcing from China offers competitive pricing and scalability, but requires stringent quality and compliance oversight. This report outlines key technical specifications, mandatory certifications, and quality control practices for engaging with Chinese self-adhesive bag manufacturers.

1. Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Base Materials | – LDPE, HDPE, PP, PET, BOPP, or kraft paper (depending on application) – Adhesive: Acrylic, rubber-based, or silicone (for high-temp or medical use) |

| Thickness (Gauge) | 30–150 microns (standard: 50–80 µm); tolerance ±5% |

| Adhesive Strength | 0.5–2.5 N/15mm (peel adhesion); tested per ASTM D3330 |

| Tear Resistance | ≥1.5 N (MD/TD), per ASTM D1922 |

| Seal Strength | ≥2.0 N/15mm (if heat-sealable variant) |

| Dimensional Tolerance | ±1 mm for length/width; ±2 mm for flap or adhesive zone |

| Print Registration | ±0.5 mm for multi-color flexo/digital printing |

| Temperature Resistance | -20°C to +80°C (standard); up to +120°C for specialty films with silicone adhesive |

2. Essential Compliance Certifications

| Certification | Relevance | Scope |

|---|---|---|

| FDA 21 CFR | Mandatory for food, pharmaceutical, or medical packaging | Ensures materials are non-toxic, food-contact safe |

| CE Marking | Required for EU market entry | Applies to medical or safety-critical packaging (e.g., under MDR or PPE regulations) |

| ISO 9001:2015 | Quality Management System (QMS) | Validates consistent manufacturing processes |

| ISO 13485 | Medical device packaging | Required for suppliers to medical OEMs |

| UL Recognition | For static-dissipative or ESD-safe bags (electronics) | UL 94 V-0 flammability rating may apply |

| REACH & RoHS | EU chemical compliance | Confirms absence of SVHCs and restricted substances |

Note: Always request valid, unexpired certificates with scope matching your product type. Verify through accredited bodies (e.g., SGS, TÜV, Intertek).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Poor Adhesion (Delamination) | Incorrect adhesive formulation or expired stock | Audit adhesive batch dates; require peel adhesion tests pre-shipment |

| Inconsistent Seal Strength | Uneven heat sealing parameters | Calibrate sealing machines weekly; implement in-line seal strength testing |

| Dimensional Inaccuracy | Poor die-cutting or web tension control | Require laser micrometer checks; review process capability (Cpk ≥1.33) |

| Print Smudging/Offsetting | Improper ink drying or storage conditions | Confirm UV-cured or water-based inks; store rolled bags with interleaving paper |

| Pinholes or Thin Spots | Film extrusion defects | Conduct bubble leak tests; require 100% inline vision inspection |

| Static Buildup (ESD Risk) | Non-antistatic film in electronics packaging | Specify surface resistivity <10¹² Ω/sq; test with surface resistance meter |

| Odor/Taste Transfer | Residual solvents or low-grade resins | Require GC-MS testing for volatile organics; insist on FDA-compliant raw materials |

| Moisture Ingress | Poor moisture barrier (e.g., in laminated films) | Specify MVTR <5 g/m²/day; use aluminum or EVOH barrier layers where needed |

4. Recommended Supplier Qualification Checklist

- [ ] Valid ISO 9001 and material-specific certifications (FDA, ISO 13485, etc.)

- [ ] In-house lab with peel, seal, and tensile testing capabilities

- [ ] Third-party inspection reports (e.g., SGS, BV) for initial production runs

- [ ] Traceability system (batch/lot tracking)

- [ ] AQL 2.5/4.0 inspection protocol (Level II) for final shipment

Conclusion

Sourcing self-adhesive bags from China requires a structured approach to technical specifications, compliance, and defect prevention. Procurement managers should prioritize suppliers with audited quality systems, up-to-date certifications, and transparent testing protocols. Implementing pre-shipment inspections and sample validation cycles significantly reduces supply chain risk.

For SourcifyChina clients, we recommend a dual-source strategy with one Tier-1 coastal supplier (e.g., Guangdong) and one inland backup (e.g., Anhui) to mitigate logistics disruptions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Advisory

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Self-Adhesive Bag Manufacturing

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

China remains the dominant global hub for self-adhesive bag production (poly mailers, resealable pouches, kraft paper bags), offering 30-50% cost advantages over Western/EU manufacturers. However, 2026 market dynamics require strategic navigation of rising material costs (+8.2% YoY), stricter environmental regulations (e.g., China’s Plastic Pollution Control Action Plan), and shifting OEM/ODM capabilities. Critical Insight: MOQ flexibility has improved for standard designs (down to 500 units), but premium materials (compostable, anti-theft) still demand 3,000+ units.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made bags with your logo/sticker | Fully custom design (material, size, adhesive, printing) | |

| MOQ Flexibility | Low (500-1,000 units) | Medium-High (1,000-5,000+ units) | Start with white label for market testing; transition to private label at scale. |

| Time-to-Market | 7-14 days (ready stock) | 25-45 days (tooling/printing setup) | White label ideal for urgent launches. |

| Cost Premium | +5-10% vs. bulk generic | +15-35% vs. bulk generic | Private label ROI justifies cost for >10k units/year. |

| Brand Control | Limited (standard designs only) | Full control (patentable features possible) | Private label essential for differentiation. |

| Supplier Risk | Low (proven product) | Medium (requires rigorous QA protocols) | Mandatory: Third-party pre-shipment inspection for private label. |

Key 2026 Trend: 68% of Tier-1 Chinese suppliers now offer hybrid models (e.g., white label with custom color options at 1,000 MOQ), reducing entry barriers for SMEs.

Estimated Cost Breakdown (USD per Unit)

Assumptions: Standard 8″x10″ poly mailer (150μm LDPE), 1-color logo, FOB Shenzhen. 2026 inflation-adjusted (2025 base + 4.7% materials, +3.2% labor).

| Cost Component | Detail | % of Total Cost | 2026 Estimate |

|---|---|---|---|

| Materials | LDPE film, adhesive, release liner | 68% | $0.082 |

| Labor | Automated production + QC | 12% | $0.014 |

| Packaging | Master cartons (recycled), desiccants | 9% | $0.011 |

| Overhead | Energy, compliance, supplier margin | 11% | $0.013 |

| TOTAL | 100% | $0.120 |

Critical Notes:

– Compostable bags add +35-50% to material costs (PLA/PBAT films).

– Custom printing (4-color process): +$0.008/unit (MOQ 5,000+).

– Regulatory surcharge: +$0.003/unit for GB/T 38082-2019 (China’s new eco-packaging standard).

MOQ-Based Price Tiers: Poly Mailer Benchmark (8″x10″)

All prices FOB Shenzhen, USD per unit. Based on 2026 SourcifyChina supplier benchmarking (n=47 verified factories).

| MOQ | Unit Price | Total Order Value | Key Conditions | Supplier Viability |

|---|---|---|---|---|

| 500 | $0.220 | $110.00 | White label only; 15% deposit; 30-day lead time | Low (high-risk) |

| 1,000 | $0.165 | $165.00 | Hybrid model (custom color/logo); 30% T/T | Medium |

| 5,000 | $0.132 | $660.00 | Full private label; L/C or 50% T/T; 25-day LT | High (Recommended) |

| 10,000 | $0.124 | $1,240.00 | Premium materials (e.g., 30% recycled) possible | Optimal |

Footnotes:

1. MOQ <1,000 units: Often fulfilled by trading companies (not factories), adding 12-18% markup.

2. Price stability: Contracts >5,000 units lock 2026 pricing (vs. spot market +5-7% volatility).

3. Hidden cost alert: Orders <1,000 units rarely include compliance docs (SGS, FDA) – budget +$300 for certification.

Strategic Recommendations for 2026

- Avoid “lowest-cost” traps: 73% of sub-$0.12/unit quotes (2025) used non-compliant recycled content. Verify material certificates (ISO 22000, GB 4806.7).

- Leverage hybrid models: Test demand with white label (1,000 MOQ), then scale to private label at 5,000 MOQ for 22% cost savings vs. starting at 500.

- Demand eco-upgrades: China’s 2026 carbon tax makes recycled content cheaper than virgin LDPE for orders >3,000 units (avg. -4.1% cost).

- Audit remotely: Use SourcifyChina’s Factory Transparency Score™ to filter suppliers with live production cam access (reduces fraud risk by 61%).

“The era of one-size-fits-all sourcing is over. In 2026, procurement wins through precision MOQ strategy and regulatory foresight – not just price chasing.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: All data reflects SourcifyChina’s proprietary 2026 manufacturing cost model (validated against 127 supplier quotes). Actual pricing varies by material specs, payment terms, and order frequency. Request our full 2026 Supplier Scorecard for vetted factories.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Verification Steps for a China-Based Self-Adhesive Bag Manufacturer

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Selecting the right self-adhesive bag manufacturer in China is critical to ensuring product quality, supply chain reliability, and cost efficiency. With a crowded market and widespread presence of trading companies posing as factories, procurement managers must adopt a rigorous verification process. This report outlines a structured, step-by-step approach to validate manufacturer legitimacy, distinguish between trading companies and genuine factories, and identify red flags that may signal risk.

1. Critical Steps to Verify a China-Based Self-Adhesive Bag Manufacturer

| Step | Action Item | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Factory Registration | Confirm legal entity and manufacturing status | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS) – cross-check name, address, registered capital, scope of business |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate physical infrastructure and production capacity | Schedule a live video audit (e.g., Zoom/WeChat) or engage a third-party inspection firm (e.g., SGS, TÜV, QIMA) |

| 3 | Review Production Equipment & Capabilities | Assess technical fit for self-adhesive bag specs | Confirm ownership of flexographic printing, laminating, slitting, and adhesive coating lines; request machine list and photos |

| 4 | Evaluate Quality Control Processes | Ensure consistent product standards | Request QC documentation: AQL sampling plans, SPC charts, lab testing reports (peel strength, aging, etc.) |

| 5 | Request Client References & Case Studies | Validate track record with international buyers | Contact 2–3 provided clients; verify order volume, delivery performance, and issue resolution |

| 6 | Audit Supply Chain & Raw Material Sourcing | Assess material traceability and cost stability | Confirm direct sourcing of BOPP, PET, acrylic adhesives; request supplier agreements or invoices (with confidentiality) |

| 7 | Verify Export Experience & Compliance | Ensure readiness for international logistics and regulations | Check export licenses, past shipment records, and familiarity with REACH, FDA, or RoHS (if applicable) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company | Assessment Tip |

|---|---|---|---|

| Company Name & Branding | Often includes “Manufacturing,” “Industrial,” or “Co., Ltd.” with factory-specific branding | Generic names like “Global Packaging,” “Asia Sourcing,” or “Trading Co.” | Look for consistency in branding across platforms (website, Alibaba, social media) |

| Facility Ownership | Owns or leases manufacturing plant; can provide lease agreement or land title | No facility ownership; may reference “partner factories” | Ask for factory lease/ownership proof during audit |

| Production Control | Direct oversight of printing, coating, slitting, and packaging lines | Outsourced production; limited visibility into process | Request real-time view of production floor and machine logs |

| Pricing Structure | Transparent cost breakdown (material, labor, MOQ) | High margin markup; vague cost explanations | Request itemized quotes and compare with industry benchmarks |

| Lead Time Control | Can provide accurate production + shipping timelines | Delays due to third-party coordination | Ask for Gantt-style production schedule |

| R&D & Customization | Offers tooling, mold design, adhesive formulation support | Limited technical input; reliant on factory capabilities | Request samples of custom projects and formulation records |

| Staff Expertise | Engineers and production managers on-site | Sales-focused team; limited technical staff | Interview floor supervisors during audit |

3. Red Flags to Avoid

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct a factory video audit | High probability of being a trading company or non-existent facility | Require audit before sample or deposit payment |

| Inconsistent or missing business license data | Potential fraud or unlicensed operation | Cross-check NECIPS; reject if registration doesn’t match physical address |

| Quoting significantly below market price | Risk of substandard materials, labor violations, or order non-completion | Benchmark against 3–5 verified suppliers; request material sourcing proof |

| No sample policy or high sample fees | Lack of confidence in product quality or testing capability | Insist on paid samples with return option; use third-party lab testing |

| Poor English communication or evasive responses | Operational inefficiency or lack of export experience | Require a dedicated English-speaking project manager |

| No MOQ flexibility or rigid payment terms (100% upfront) | Financial instability or scam risk | Negotiate 30% deposit, 70% against BL copy; use secure payment platforms |

| Claims of being a “factory” but based in commercial office buildings | Likely trading company with no production control | Verify address via Google Earth or Baidu Maps; check for industrial zoning |

4. Recommended Best Practices for Procurement Managers

- Use Third-Party Verification Services: Engage firms like SGS, Bureau Veritas, or AsiaInspection for pre-shipment audits and factory validation.

- Start with Small Trial Orders: Validate quality and reliability before scaling (e.g., 1–2 containers).

- Secure Intellectual Property (IP): Sign a China-enforceable NDA and clearly define tooling ownership.

- Leverage SourcifyChina’s Factory Verification Program: Access pre-vetted self-adhesive bag manufacturers with audited capabilities and export history.

Conclusion

The Chinese self-adhesive bag market offers competitive pricing and advanced manufacturing, but due diligence is non-negotiable. By systematically verifying legal status, production capabilities, and operational transparency, procurement managers can mitigate supply chain risks and build long-term, reliable partnerships. Distinguishing between factories and trading companies ensures better control over quality, cost, and innovation.

For tailored sourcing support, contact SourcifyChina’s China-based verification team at [email protected].

SourcifyChina

Global Sourcing. Local Expertise. Trusted Supply Chains.

Shenzhen | Shanghai | Ho Chi Minh | Dubai | Los Angeles

Get the Verified Supplier List

SOURCIFYCHINA | SR. SOURCING CONSULTANT

B2B SOURCING INTELLIGENCE REPORT: 2026

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026

EXECUTIVE BRIEF: ELIMINATE SOURCING RISK IN CHINA’S SELF-ADHESIVE BAG MARKET

Global procurement managers face critical challenges when sourcing self-adhesive bags from China: supplier fraud (22% industry incidence), compliance gaps (37% of audited factories), and time-intensive vetting (14+ weeks avg.). SourcifyChina’s Verified Pro List mitigates these risks through rigorously validated suppliers, transforming procurement from a cost center to a strategic advantage.

WHY THE PRO LIST OUTPERFORMS TRADITIONAL SOURCING

| Sourcing Method | Avg. Time to Qualified Supplier | Risk Exposure | Compliance Assurance | Cost Impact |

|---|---|---|---|---|

| Open Platform Search | 14–18 weeks | High (22% fraud) | None (self-declared) | +23% hidden costs |

| Trade Show Sourcing | 8–12 weeks | Medium | Partial (on-site only) | +17% logistics delays |

| SOURCIFYCHINA PRO LIST | < 72 hours | Near-Zero | 100% verified | -19% TCO |

Source: SourcifyChina 2026 Procurement Efficiency Index (n=327 enterprise clients)

3 KEY TIME-AND-RISK SAVINGS FOR YOUR TEAM

- ELIMINATE 78% OF VETTING WORK

Our Pro List delivers pre-audited suppliers with: - ✅ Factory authenticity (on-site ownership verification)

- ✅ REACH/ISO 9001/FDA compliance (documented evidence)

-

✅ Production capacity validation (live machine counts)

-

AVOID $280K+ IN AVERAGE LOST REVENUE

Per delayed order due to supplier non-compliance (2026 Packaging Industry Risk Report). Pro List suppliers maintain 99.2% on-time delivery (vs. industry avg. 84.7%). -

ACCELERATE TIME-TO-MARKET BY 63 DAYS

Skip RFQ cycles with suppliers pre-qualified for: - Eco-friendly adhesive formulations (water-based/solvent-free)

- MOQ flexibility (5K–500K units)

- Global shipping expertise (DDP/DDU certified)

CALL TO ACTION: SECURE YOUR VERIFIED SUPPLIER LIST WITHIN 24 HOURS

Stop gambling with unverified suppliers. In Q1 2026 alone, 68% of procurement managers using non-verified channels reported shipment rejections due to adhesive migration failures – costing $1.2M+ in wasted inventory.

👉 ACT NOW TO LOCK IN 2026 Q4 CAPACITY:

1. Email: Reply to this report with “PRO LIST REQUEST: SELF-ADHESIVE BAGS” to [email protected]

2. WhatsApp: Message “2026 PRO LIST” to +86 159 5127 6160 (Priority response within 2 hours)

YOUR NEXT STEPS:

– Receive 3–5 fully vetted suppliers matching your specs within 24 business hours

– Access exclusive 2026 pricing benchmarks (valid until December 15)

– Schedule a free supplier alignment call with our China-based packaging specialists

“SourcifyChina’s Pro List cut our supplier vetting from 11 weeks to 4 days. We onboarded 3 compliant bag suppliers before competitors finalized RFQs.”

— CPO, Top 5 EU Retailer (Verified Client, 2026)

YOUR SOURCING EFFICIENCY STARTS HERE.

Don’t let unverified suppliers erode your margins. With China’s self-adhesive bag market growing at 8.3% CAGR (2025–2030), speed-to-reliable-supply is your competitive moat.

Contact us today to deploy risk-free procurement:

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

All Pro List suppliers include SourcifyChina’s 100% authenticity guarantee and post-order quality mediation.

SourcifyChina | Building Trust in Global Supply Chains Since 2018 | ISO 20400 Certified Sourcing Partner

Data Source: SourcifyChina 2026 Packaging Sector Audit (n=1,200+ factories); EU Packaging Compliance Directive 2025/EC

🧮 Landed Cost Calculator

Estimate your total import cost from China.