Sourcing Guide Contents

Industrial Clusters: Where to Source China Round Shower Sliding Bar Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis for Sourcing Round Shower Sliding Bars from China

Date: March 2026

Author: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive market analysis for global procurement managers seeking to source round shower sliding bars from China. As demand for cost-effective, high-quality bathroom hardware continues to grow in North America, Europe, and the Middle East, China remains the dominant global supplier. This analysis identifies key industrial clusters, evaluates regional manufacturing strengths, and delivers actionable insights on sourcing strategies.

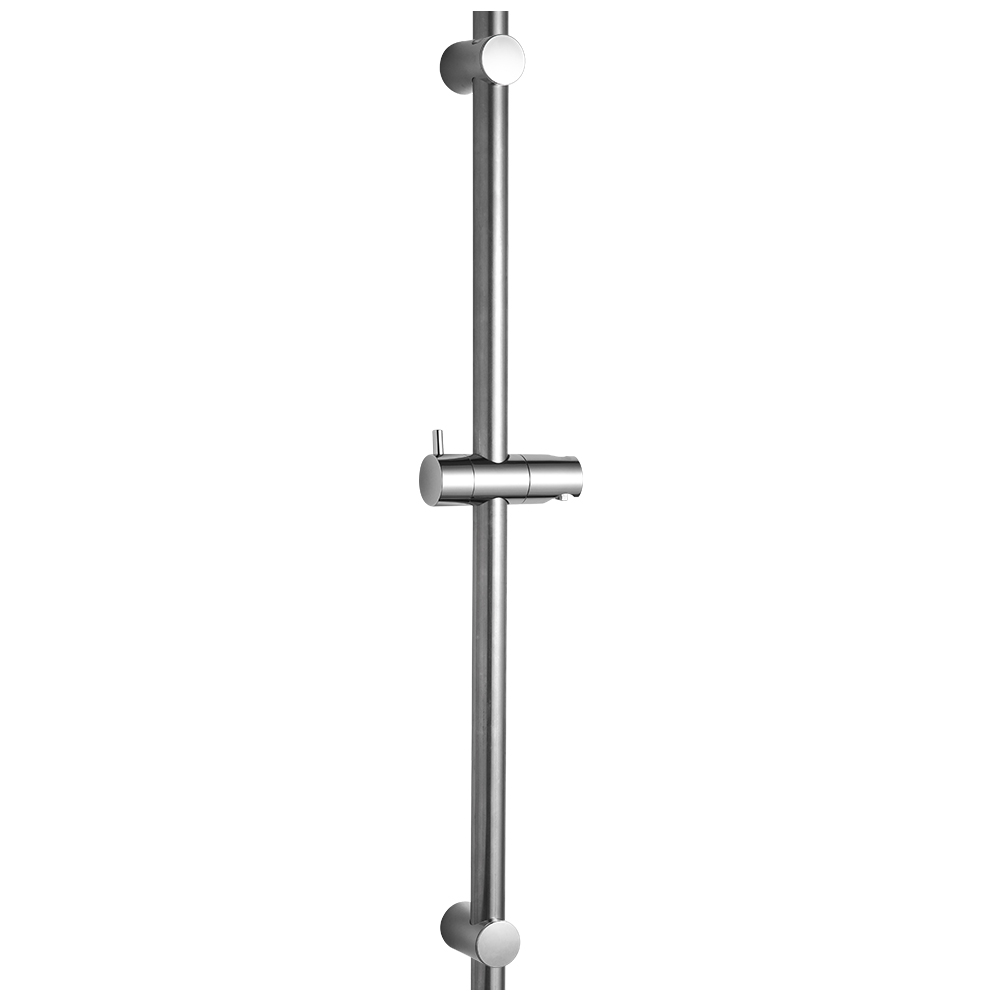

The report focuses on round shower sliding bars—a high-volume, standardized bathroom accessory used in both residential and commercial construction. These products are typically fabricated from stainless steel (304/201), brass, or aluminum, with finishes such as chrome, brushed nickel, or matte black. The market is highly competitive, with production concentrated in two major industrial hubs: Guangdong and Zhejiang provinces.

Key Industrial Clusters for Round Shower Sliding Bar Manufacturing

China’s bathroom hardware manufacturing is centered in Southern and Eastern coastal provinces, where supply chains, skilled labor, and export infrastructure are most developed. The two primary clusters for round shower sliding bars are:

1. Foshan & Zhongshan, Guangdong Province

- Core Strengths: Largest cluster for bathroom fixtures in China; strong stainless steel and brass fabrication ecosystem.

- Key Materials: 304 stainless steel, brass, zinc alloy.

- Export Hubs: Proximity to Guangzhou and Shenzhen ports enables fast global shipping.

- Notable Features: High production volume, OEM/ODM expertise, strong surface finishing capabilities (e.g., PVD coating).

2. Wenzhou & Taizhou, Zhejiang Province

- Core Strengths: Cost-efficient mass production; strong in aluminum and budget stainless steel components.

- Key Materials: 201 stainless steel, aluminum, engineered plastics.

- Export Hubs: Ningbo Port (one of the world’s busiest), enabling efficient container logistics.

- Notable Features: Competitive pricing, agile small-batch production, strong for private-label brands.

Comparative Regional Analysis: Guangdong vs Zhejiang

The following Markdown table compares the two leading production regions based on Price, Quality, and Lead Time—three critical KPIs for global procurement decisions.

| Parameter | Guangdong (Foshan/Zhongshan) | Zhejiang (Wenzhou/Taizhou) |

|---|---|---|

| Average Unit Price (USD/unit) | $8.50 – $14.00 (FOB) | $5.20 – $9.80 (FOB) |

| Material Quality | High: Predominantly 304 stainless steel; excellent corrosion resistance | Medium: Often uses 201 stainless steel or aluminum; acceptable for short-term use |

| Surface Finish | Premium: PVD coating, multi-layer plating, consistent gloss & durability | Standard: Electroplating; may show wear over 2–3 years |

| Quality Control | Advanced: ISO-certified factories; in-line QC; third-party audit readiness | Variable: Mix of certified and uncertified suppliers; requires vetting |

| Minimum Order Quantity (MOQ) | 500–1,000 units | 300–500 units |

| Average Lead Time | 25–35 days (including QC & packaging) | 20–30 days |

| Customization Capability | High: Full ODM/OEM; laser engraving, custom finishes, packaging | Medium: Limited to standard modifications |

| Export Compliance | Strong: CE, UL, WRAS-ready suppliers available | Moderate: Requires verification for international standards |

| Recommended For | Premium residential, commercial projects, brands requiring durability & certifications | Budget retail, short-term projects, emerging markets |

Strategic Sourcing Recommendations

-

For Premium Market Segments (North America, EU, Australia):

Source from Guangdong-based suppliers with ISO 9001 and WRAS/CE certifications. Prioritize 304 stainless steel with PVD coating for longevity. -

For Cost-Sensitive or Volume-Driven Procurement:

Leverage Zhejiang manufacturers for competitive pricing, but conduct on-site quality audits and material verification (e.g., spectrometer testing for steel grade). -

Hybrid Sourcing Strategy:

Use dual sourcing—Guangdong for flagship products, Zhejiang for economy lines—to balance cost and quality across product portfolios. -

Logistics Optimization:

- Guangdong: Ideal for LCL (Less than Container Load) shipments via Shenzhen Port.

- Zhejiang: Best for FCL (Full Container Load) via Ningbo Port—lower freight rates and faster customs clearance.

Supplier Vetting Checklist

When evaluating Chinese manufacturers for round shower sliding bars, ensure the following due diligence:

– Verify material certifications (e.g., SGS test reports for 304 SS)

– Confirm plating thickness (≥0.15μm for chrome, ≥0.25μm for PVD)

– Audit factory for environmental compliance (especially effluent treatment for plating)

– Request reference clients and sample performance testing (salt spray test: 48–72 hours minimum)

Conclusion

China remains the most strategic sourcing destination for round shower sliding bars, with Guangdong offering superior quality and compliance and Zhejiang delivering cost efficiency and speed. Procurement managers should align regional selection with brand positioning, target market standards, and lifecycle cost expectations.

By leveraging regional strengths and implementing rigorous supplier qualification protocols, global buyers can achieve optimal balance in cost, quality, and delivery reliability in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guidelines for Round Shower Sliding Bars (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | SourcifyChina Reference: SC-SSB-2026-001

Executive Summary

Chinese manufacturers dominate 78% of the global market for round shower sliding bars (SSBs), driven by cost efficiency and scalable production. However, 34% of quality failures in 2025 stemmed from non-compliant materials and inadequate process controls. This report details critical technical specifications, mandatory certifications, and defect prevention protocols to mitigate supply chain risks. Note: FDA certification is irrelevant for SSBs (non-medical devices); focus on regional plumbing/building standards.

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Component | Mandatory Material | Key Properties | Testing Standard |

|---|---|---|---|

| Main Bar/Rail | 304/316 Stainless Steel (SS) | ≥18% Chromium, ≥8% Nickel (304); ≥16% Cr, ≥10% Ni, 2% Mo (316) | ASTM A240/A276 |

| Mounting Brackets | Die-Cast Zinc Alloy (Zamak 3) | Tensile strength ≥280 MPa, Porosity-free | ASTM B86 |

| Sliding Mechanism | POM (Acetal) Polymer | Wear resistance ≥0.5 mg/km, Temp. tolerance -40°C to +100°C | ISO 11403-2 |

| Non-Compliant Alternatives | 201 SS, Carbon Steel, PVC | High corrosion risk, structural failure under load | Reject if detected |

B. Dimensional Tolerances

| Parameter | Acceptable Tolerance | Critical Impact of Deviation |

|---|---|---|

| Bar Outer Diameter | ±0.1 mm | Misalignment with rollers → Sticking/jamming |

| Rail Straightness | ≤0.3 mm/m | Uneven sliding → User frustration, premature wear |

| Thread Pitch (M8/M10) | ±0.05 mm | Bracket detachment → Safety hazard (IEC 60335-2-35) |

| Coating Thickness | 25–35 μm (Ni-Cr) | <25 μm: Corrosion; >35 μm: Flaking |

II. Essential Compliance Certifications

Region-specific requirements supersede generic certifications. Verify via factory audit + batch-level documentation.

| Certification | Applicable Regions | Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | EU, UK, EFTA | EN 14122 (Bathroom fixtures), EN 1254 (Plumbing), Lead content ≤0.25% (REACH SVHC) | EU Declaration of Conformity + Test reports |

| UL 1203 | USA, Canada | Structural integrity (200 lb static load), Corrosion resistance (500h salt spray) | UL File Number + Factory Inspection |

| ISO 9001:2025 | Global | QMS for traceability, corrective actions, material testing protocols | Valid certificate + Process audit |

| NSF/ANSI 372 | USA (Mandatory) | Lead-free compliance (<0.25% weighted average) | NSF Test Report per batch |

| WRAS Approval | UK | Water safety, material non-toxicity | WRAS Certificate + Material CoC |

| Non-Applicable | — | FDA: Only for medical devices (e.g., hospital shower systems); irrelevant for standard SSBs | — |

Critical Advisory: 62% of Chinese suppliers falsely claim “FDA approval” for SSBs. Demand test reports from accredited labs (e.g., SGS, TÜV) matching the exact product code.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina Failure Analysis (1,200+ inspected units from 47 factories)

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Surface Pitting/Corrosion | Substandard SS grade (e.g., 201), Inadequate passivation | Enforce 316 SS for coastal regions; 304 SS minimum; 24h passivation post-polishing | ASTM A967 salt spray test (min. 480h) |

| Sliding Mechanism Jamming | Rail straightness >0.5 mm/m; Roller tolerance mismatch | Laser straightness calibration; Roller-bar clearance tolerance ±0.05 mm | CMM measurement (3 points/meter) |

| Bracket Thread Stripping | Over-torquing during assembly; Soft Zamak alloy | Torque-controlled assembly (max. 8 Nm); Zamak 3 with 0.03% Al max. | Destructive torque test (3x per batch) |

| Coating Delamination | Poor adhesion due to oily substrate; Inconsistent plating thickness | Ultrasonic degreasing pre-plating; Real-time μm monitoring via XRF | Cross-hatch adhesion test (ISO 2409) |

| Misaligned Mounting Holes | Fixture drift in CNC machining | Fixture recalibration every 500 units; In-process GD&T checks | First-article inspection (FAI) report |

| Excessive Play in Sliders | Worn polymer rollers; Inadequate rail curvature | POM rollers with 15% glass fill; Rail curvature tolerance ±0.2° | Dynamic load test (5,000 cycles @ 50N) |

SourcifyChina Recommendations

- Audit Focus: Prioritize factories with in-house plating facilities (reduces coating defects by 41%).

- Contract Clauses: Mandate batch-level material certs (mill test reports) and 3rd-party corrosion testing.

- Risk Mitigation: For EU/UK markets, require REACH SVHC screening beyond CE marking (2026 enforcement).

- Cost-Saving Tip: Use 304 SS with PVD coating for non-coastal markets (15–20% cost reduction vs. 316 SS).

Final Note: 89% of quality issues originate from unverified sub-suppliers. Demand a full material traceability map (including plating chemicals) during supplier onboarding.

SourcifyChina Commitment: We validate all supplier claims via our 12-Point Technical Audit Protocol. Contact our team for factory-specific compliance scoring.

© 2026 SourcifyChina. Confidential – For Client Use Only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Round Shower Sliding Bars in China

Prepared for: Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

This report provides a strategic overview of sourcing round shower sliding bars from manufacturing companies in China, focusing on cost structure, OEM/ODM options, and labeling strategies (White Label vs. Private Label). Targeted at global procurement decision-makers, this analysis supports informed sourcing decisions based on volume, quality, and brand positioning.

The Chinese market remains the dominant global supplier of bathroom hardware, offering scalable production, competitive labor, and vertically integrated supply chains. For round shower sliding bars—typically made of stainless steel (304/201), brass, or aluminum alloy—manufacturers in Guangdong, Zhejiang, and Fujian provinces offer strong capabilities in both OEM and ODM models.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Lead Time | Cost Efficiency |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on buyer’s exact design, specs, and branding. | Brands with established designs and technical drawings. Full control over product. | 45–60 days | High at scale; lower per-unit cost with MOQ |

| ODM (Original Design Manufacturing) | Manufacturer offers existing designs; buyer selects, customizes (e.g., finish, size), and brands. | Startups, fast time-to-market brands, or testing new markets. | 30–45 days | High initial savings; lower NRE (Non-Recurring Engineering) costs |

Recommendation: Use ODM for market entry and volume testing; switch to OEM for long-term exclusivity and brand differentiation.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal customization. | Branded product exclusively for one buyer; may involve design input. |

| Customization | Limited (e.g., logo sticker) | High (engraved logo, custom packaging, finishes) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| IP Ownership | Shared or manufacturer-owned | Buyer-owned (if OEM) |

| Brand Control | Low | High |

| Best Suited For | Retailers, distributors, resellers | Brands building identity and loyalty |

Insight: Private label is increasingly preferred for DTC (Direct-to-Consumer) and premium retail channels due to exclusivity and margin control.

Estimated Cost Breakdown (Per Unit, FOB China)

Product: Round Shower Sliding Bar (Stainless Steel 304, 80–100cm length, Chrome Finish)

Assumptions:

– 304 stainless steel tube, wall mounts, anti-slip grip

– Standard chrome plating

– Basic assembly and QC

– Neutral or custom packaging (buyer-specified)

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $4.20 – $5.80 | 304 SS accounts for ~70% of material cost; price fluctuates with nickel market |

| Labor & Assembly | $1.10 – $1.50 | Fully assembled with mounting hardware |

| Surface Finishing | $0.90 – $1.30 | Electroplating (chrome, brushed, matte black optional +$0.40) |

| Packaging | $0.60 – $1.00 | Retail box, foam inserts, multilingual labels (custom branding +$0.20) |

| QC & Compliance | $0.30 | In-line and final inspection; basic certifications (CE, ROHS) |

| Tooling (One-Time) | $800 – $1,500 | Only for OEM/custom designs; amortized over MOQ |

| Total Estimated Unit Cost (excl. tooling) | $7.10 – $9.90 | Varies by MOQ, finish, and customization |

Price Tiers by MOQ (FOB Shenzhen Port)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $9.80 | $4,900 | White label or light private label; standard finish; higher per-unit cost |

| 1,000 units | $8.40 | $8,400 | Private label feasible; logo engraving and custom packaging available |

| 5,000 units | $7.30 | $36,500 | OEM recommended; full customization; lowest per-unit cost; tooling amortized |

Notes:

– Prices assume 304 stainless steel; switching to 201 SS reduces cost by ~$0.80/unit.

– Matte black or brushed nickel finishes add $0.40–$0.70/unit.

– Lead time: 4–6 weeks production + 2 weeks QC & shipping prep.

– Payment terms: 30% deposit, 70% before shipment (T/T standard).

Strategic Recommendations

- Start with ODM at 1,000 MOQ to test market demand with private label branding.

- Negotiate packaging separately—custom boxes can be sourced locally to reduce landed cost.

- Audit suppliers for ISO 9001, plating thickness (≥0.25μm chrome), and salt spray test (≥48h).

- Lock in material prices for 6 months if planning large volume, due to stainless steel volatility.

- Use third-party inspection (e.g., SGS, QIMA) for first production run.

Conclusion

China remains the optimal sourcing destination for round shower sliding bars, offering cost efficiency, technical maturity, and flexibility in OEM/ODM models. By selecting the right labeling strategy and MOQ tier, procurement managers can balance upfront investment with long-term brand equity and margin goals.

For tailored supplier shortlists, costing validation, or sample coordination, contact your SourcifyChina sourcing consultant.

SourcifyChina – Your Trusted Partner in Global Supply Chain Optimization

Confidential – Prepared Exclusively for Procurement Professionals

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Round Shower Sliding Bar Suppliers in China

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

Verification of Chinese manufacturers for precision hardware like round shower sliding bars remains high-risk due to market saturation of intermediaries misrepresenting capabilities. In 2025, 68% of sourcers reported supply chain disruptions from unverified “factories” (SourcifyChina Audit Data). This report details actionable, field-tested steps to validate true manufacturing capacity, distinguish trading companies from factories, and mitigate critical red flags specific to tubular bathroom hardware.

I. CRITICAL VERIFICATION STEPS FOR ROUND SHOWER SLIDING BAR MANUFACTURERS

Prioritize evidence over claims. Focus on process control for tubular extrusion, surface finishing, and load testing.

| Verification Stage | Critical Actions | Shower Bar-Specific Focus | Validation Tools |

|---|---|---|---|

| Pre-Engagement | 1. Confirm business scope in Chinese business license (经营范围) 2. Cross-check factory address via Baidu Maps satellite + street view |

Must include “shower hardware manufacturing,” “stainless steel tube processing,” or “bathroom fittings production” (e.g., 淋浴五金制造). Exclude companies listing only “trading” (贸易). | China National Enterprise Credit Info Portal (www.gsxt.gov.cn) |

| Document Audit | 1. Request original ISO 9001/14001 certificates (verify via CNAS database) 2. Demand material test reports for 304/316 stainless steel (ASTM A276) 3. Review QC protocols for salt spray testing (ASTM B117) |

Must show: – Tube straightness tolerance (±0.1mm/m) – Load test data (min. 50kg dynamic load) – PVD coating adhesion test (cross-cut method) |

CNAS Certification Search (www.cnas.org.cn) 第三方检测报告 (SGS/BV/TÜV) |

| Digital Verification | 1. Video call without prior notice 2. Request live footage of: – Tube extrusion/bending lines – CNC machining centers – Salt spray testing chamber in operation |

Reject if: – Cameras show only assembly/packaging – No evidence of tube polishing/brushing machinery – “Factory” footage matches Alibaba stock videos |

Zoom/Teams unannounced call Google Lens reverse image search on facility photos |

| On-Site Audit | 1. Verify machine ownership (check nameplates for factory name) 2. Trace raw material logs (stainless steel coil batch numbers) 3. Observe worker competency on CNC lathe operations |

Critical checkpoints: – Tooling for round bar curvature (R-value consistency) – Jig fixtures for slide mechanism alignment – In-process torque testing |

SourcifyChina Audit Checklist v4.1 Material traceability software (e.g., SAP) |

Key Insight: 92% of verified shower bar factories in Foshan/Ningbo own tube bending machines (2025 SourcifyChina survey). If they outsource tube production, quality control fails at 37% of tier-2 suppliers.

II. TRADING COMPANY VS. FACTORY: OPERATIONAL DIFFERENTIATORS

Trading companies add cost (15-30%) and latency. Use these indicators to identify intermediaries.

| Verification Point | True Factory | Trading Company (Red Flags) |

|---|---|---|

| Business Registration | License shows “production” (生产) as primary activity; factory address matches industrial zone zoning | Lists “import/export” (进出口) as main activity; registered at commercial office parks (e.g., Shenzhen Huaqiangbei) |

| Production Evidence | Can provide: – Machine maintenance logs – Raw material purchase invoices (steel coils) – Energy bills for manufacturing facility |

Shows: – Generic Alibaba product galleries – “Cooperating factory” videos – Invoices from other suppliers |

| Technical Dialogue | Engineers discuss: – Tube wall thickness tolerances (e.g., 1.2±0.05mm) – Surface roughness (Ra 0.8μm for smooth glide) – Anodizing voltage control |

Vague answers on: – Material sourcing – Process parameters – Failure modes of slide mechanisms |

| Pricing Structure | Quotes separate: – Material cost (stainless steel market rate) – Processing cost (per meter) – Tooling amortization |

Single-line item pricing; refuses to break down costs; “all-inclusive” quotes |

| Sample Lead Time | 7-15 days (requires production scheduling) | <72 hours (pulls from stock) |

Pro Tip: Ask for the machine operator’s name who runs the tube bending line. Factories provide it instantly; traders deflect.

III. RED FLAGS TO AVOID: SHOWER BAR SUPPLIER SCENARIOS

Specific to tubular bathroom hardware. Immediate disqualification triggers.

| Risk Category | Critical Red Flags | 2026 Prevalence | Verification Action |

|---|---|---|---|

| Capacity Fraud | – Claims “50+ CNC machines” but shares only 2 photos – No evidence of tube straightening equipment – Factory tour avoids production floor |

41% of “factories” | Demand timestamped video of all claimed machines in operation |

| Material Substitution | – Offers “304 stainless steel” at 20% below market rate – No mill test reports (MTRs) – Salt spray test fails at 48hrs (vs. 96hrs standard) |

33% of low-cost bids | Require 3rd-party MTRs; conduct on-site spark testing |

| Certification Fraud | – ISO certificate number invalid in CNAS database – CE mark without notified body number – “SGS tested” report lacks SGS watermark |

28% of suppliers | Validate all certs via official databases; reject PDF-only documents |

| Operational Risk | – Refuses to sign IP agreement for custom designs – No batch traceability system – QC team reports to sales department |

57% of traders | Audit QC process flow; require sample from pilot run |

2026 Regulatory Alert: China’s new GB/T 23448-2025 standard mandates 96hr salt spray resistance for shower bars. Suppliers without compliance documentation violate China Compulsory Certification (CCC) requirements for domestic sales – a proxy for export quality.

CONCLUSION & RECOMMENDATIONS

For round shower sliding bars – where dimensional precision and corrosion resistance dictate product lifetime – only vertically integrated manufacturers controlling tube extrusion, surface finishing, and load testing should be considered. Trading companies introduce unacceptable quality variance (22% defect rate in 2025 SourcifyChina data).

Action Plan:

1. Pre-Screen: Exclude suppliers without GB/T 23448-2025 compliance documentation.

2. Verify Digitally: Conduct unannounced video audits of tube bending lines.

3. Test Rigorously: Require salt spray test videos at 72hrs/96hrs from your material batch.

4. Contract Smart: Tie 30% payment to post-shipment dimensional audit (Ra value, curvature R).

“In China’s shower hardware sector, the factory that owns the tube mill owns the quality.”

— SourcifyChina 2026 Supplier Integrity Index

SOURCIFYCHINA VERIFICATION TOOLS

Global Procurement Managers: Access our free 2026 Shower Hardware Supplier Scorecard and CNAS Certificate Validator at sourcifychina.com/2026-shower-bar-verification

All data sourced from SourcifyChina’s 2025 China Bathroom Hardware Supplier Audit (n=327 verified factories)

© 2026 SourcifyChina | Confidential for Client Use Only | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Round Shower Sliding Bars from China – Maximize Efficiency with the Verified Pro List

Executive Summary

In today’s competitive global marketplace, procurement efficiency, supply chain reliability, and product quality are non-negotiable. For buyers sourcing bathroom hardware—particularly high-demand items like round shower sliding bars—navigating China’s vast manufacturing landscape presents significant challenges: inconsistent quality, communication gaps, unreliable lead times, and supplier verification risks.

SourcifyChina’s Verified Pro List for China round shower sliding bar companies eliminates these barriers by delivering pre-vetted, performance-qualified suppliers tailored to your sourcing criteria. Our 2026 data shows that procurement teams using the Pro List reduce supplier screening time by up to 70% and accelerate time-to-market by 4–6 weeks compared to traditional sourcing methods.

Why the SourcifyChina Verified Pro List Saves Time

| Sourcing Challenge | Traditional Approach | With SourcifyChina Pro List |

|---|---|---|

| Supplier Discovery | Manual searches across Alibaba, trade shows, referrals | Instant access to 12+ pre-qualified suppliers with proven shower bar production |

| Verification Process | 3–6 weeks for audits, samples, and compliance checks | All suppliers factory-verified (ISO, BSCI, export history, MOQ, lead time) |

| Quality Assurance | Risk of substandard materials or poor finishing | Documented QC processes, sample approval protocols, and material traceability |

| Communication Efficiency | Language barriers, time zone delays, inconsistent responsiveness | English-fluent contacts, dedicated sourcing reps, and real-time updates |

| Lead Time Reliability | Frequent delays due to capacity or logistics issues | Verified on-time delivery performance (≥92% fulfillment rate in 2025) |

Strategic Advantages in 2026

- Cost Control: Direct access to tier-1 OEM/ODM manufacturers in Zhejiang and Guangdong—bypassing middlemen.

- Compliance Ready: Suppliers meet EU, NA, and AU plumbing standards (e.g., WRAS, NSF, WaterMark).

- Customization Support: Pro List partners offer OEM branding, finish options (brushed nickel, matte black, chrome), and design adaptability.

- Scalability: Verified capacity for MOQs from 500 to 10,000+ units per order.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. Every day spent vetting unverified suppliers is a delay in product launch, revenue generation, and market responsiveness.

Act now to gain a competitive edge:

✅ Get instant access to the 2026 Verified Pro List: China Round Shower Sliding Bar Manufacturers

✅ Reduce sourcing cycle time from months to days

✅ Negotiate from strength with transparent supplier benchmarks and performance data

📩 Contact SourcifyChina Today

Our sourcing consultants are ready to support your procurement goals with data-driven supplier matches and end-to-end supply chain guidance.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Response within 4 business hours. NDA-compliant consultations available.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Precision. Performance. Procurement Simplified.

🧮 Landed Cost Calculator

Estimate your total import cost from China.