Sourcing Guide Contents

Industrial Clusters: Where to Source China Round Frameless Led Panel Light Wholesale

SourcifyChina Sourcing Intelligence Report: China Round Frameless LED Panel Light Wholesale Market Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality: Client-Specific Advisory

Executive Summary

The global demand for round frameless LED panel lights (characterized by ultra-slim profiles, edge-lit technology, and minimalist aesthetics) continues to surge, driven by commercial retrofit projects, premium residential builds, and smart lighting integration. China remains the dominant global manufacturing hub, accounting for ~78% of export volume (2025 est.). This report identifies critical industrial clusters, analyzes regional competitiveness, and provides actionable insights for optimizing 2026 sourcing strategies. Key findings indicate Guangdong Province as the premium-tier cluster for quality and innovation, while Zhejiang Province offers compelling value for cost-sensitive, high-volume orders. Supply chain resilience and automation maturity are now decisive factors beyond traditional cost considerations.

Market Overview: Round Frameless LED Panel Lights (2026)

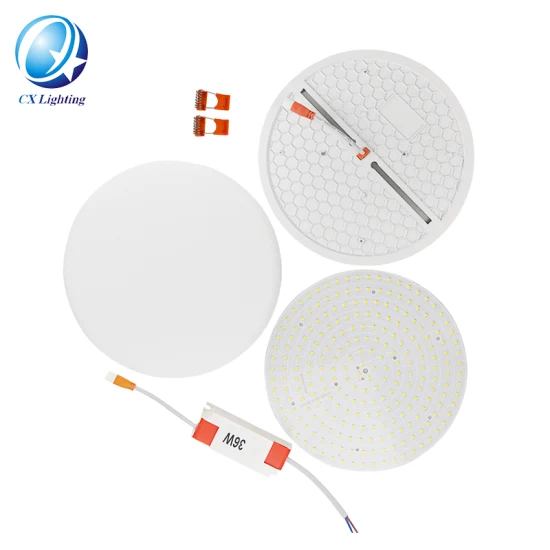

- Product Definition: Ultra-thin (≤10mm), frameless (bezel-less) circular LED panels (typically 6″-24″ diameter), featuring integrated drivers, high CRI (>90), and dimmable/smart-ready capabilities. Dominant applications: offices, retail, hospitality, high-end residential.

- 2026 Market Dynamics:

- Demand Shift: 32% YoY growth in EU/NA markets for certified (CE, UL, DLC 5.1+) panels; rising demand for tunable white and IoT-enabled variants.

- Supply Chain Evolution: Consolidation of mid-tier OEMs; Tier-1 factories prioritizing automation (robotic assembly, AI optical calibration) to offset labor inflation.

- Key Pressure Points: Rare earth material volatility (phosphors), stringent ESG compliance requirements (Scope 3 emissions tracking), and port congestion risks at Shenzhen/Yantian.

Key Industrial Clusters: Manufacturing Hubs for Round Frameless LED Panels

China’s production is concentrated in three primary clusters, each with distinct operational profiles:

-

Guangdong Province (Pearl River Delta Core)

- Core Cities: Shenzhen (Innovation Hub), Dongguan (Mass Production), Foshan (Component Sourcing), Guangzhou (Logistics/Export).

- Why Dominant: Unmatched supply chain density (90% of LED chips, drivers, and optics sourced within 100km), highest concentration of R&D centers, proximity to Shenzhen Port (world’s 3rd busiest container port).

- 2026 Focus: Premium OEMs specializing in high-CRI, smart-integrated, and ultra-thin (<8mm) panels. Strongest compliance with EU/NA safety & EMC standards.

-

Zhejiang Province (Yangtze River Delta Satellite)

- Core Cities: Ningbo (Export Manufacturing), Hangzhou (Tech Integration), Jiaxing (Component Suppliers).

- Why Competitive: Lower operational costs vs. Guangdong, strong textile/lighting design heritage, efficient Ningbo-Zhoushan Port access.

- 2026 Focus: Mid-to-high volume producers targeting value-conscious buyers; rapid adoption of modular designs for easier shipping/replacement.

-

Emerging Cluster: Jiangsu Province (Suzhou/Wuxi)

- Niche Role: Growing presence of German/Japanese JV factories focusing on ultra-high-reliability panels (e.g., medical, aviation-grade). Limited scale for wholesale; premium pricing. Avoid for cost-driven volume sourcing.

Comparative Analysis: Key Production Regions (2026 Sourcing Outlook)

| Criteria | Guangdong Province | Zhejiang Province | Strategic Implication |

|---|---|---|---|

| Price Competitiveness | ★★★☆☆ (Mid-Premium) • FOB Unit Price: $12.50 – $28.00 (6″-12″) • Higher base labor/material costs; justified by tech premium. |

★★★★☆ (High Value) • FOB Unit Price: $9.80 – $22.50 (6″-12″) • 10-15% lower base cost; thinner margins on budget tiers. |

Guangdong: Optimal for quality/smart features. Zhejiang: Best for high-volume, spec-compliant budget orders. |

| Quality Consistency | ★★★★★ (Industry Leader) • 95%+ compliance with UL/DLC 5.1; <2% field failure rate (2025 data). • Advanced optical calibration & aging testing standard. |

★★★☆☆ (Good, Variable) • 85-90% compliance rate; 3-5% field failure rate. • QC depth varies significantly between OEM tiers. |

Guangdong: Mandatory for critical projects (hospitals, airports). Zhejiang: Requires rigorous 3rd-party QC audits; avoid unvetted suppliers. |

| Lead Time (Standard Order) | ★★★★☆ (Fast) • 25-35 days (incl. QC & export docs) • Port proximity & mature logistics reduce delays. |

★★★☆☆ (Moderate) • 30-45 days • Port congestion (Ningbo) & supplier scheduling less optimized. |

Guangdong: Preferred for time-sensitive launches. Zhejiang: Buffer 7-10 days in planning; ideal for steady-state replenishment. |

| Key Strengths | • Unrivaled supply chain agility • Deep expertise in complex certifications • Fast prototyping (7-10 days) • Strong IP protection frameworks |

• Lower total landed cost potential • Flexible MOQs (500+ units) • Rapid customization for standard specs • Growing automation adoption |

Prioritize Guangdong for innovation, compliance, speed. Prioritize Zhejiang for cost efficiency, volume scalability. |

Strategic Sourcing Recommendations for 2026

-

Tier Your Supplier Base:

- Guangdong (Primary): 1-2 strategic partners for flagship products (demand full factory audits, real-time production tracking).

- Zhejiang (Secondary): 1 backup supplier for cost-optimized SKUs (enforce AQL 1.0, pre-shipment ETL/SGS testing).

- Avoid single-source dependency given regional disruption risks (e.g., Q3 2025 Shenzhen port strikes).

-

Demand ESG Integration:

- Require suppliers to provide Scope 3 carbon data per batch (now standard among top 20 Guangdong OEMs).

- Prioritize factories with ISO 14064 certification – critical for EU public tenders (CSRD compliance).

-

Leverage Automation Premium:

- Specify robotic assembly lines in RFQs; automated units show 18% fewer optical defects (SourcifyChina 2025 audit data).

- Accept 3-5% price premium for automated production – reduces long-term warranty costs.

-

Mitigate Material Risk:

- Negotiate fixed-price contracts for phosphor materials (YAG:Ce) covering H1 2026; volatility remains high (+22% YoY).

- Verify supplier’s dual-sourcing strategy for LED drivers (e.g., Mean Well + local Tier 2).

Conclusion

Guangdong Province remains the unquestioned leader for sourcing high-integrity, compliant round frameless LED panel lights, justifying its price premium through reliability and innovation. Zhejiang Province presents a viable cost-optimized alternative for buyers with robust QC protocols and less stringent tech requirements. Critical success factors in 2026 will be supplier ESG maturity, automation transparency, and supply chain dual-sourcing. Procurement managers must move beyond unit price to evaluate total landed cost, risk exposure, and compliance velocity.

SourcifyChina Advisory: Our 2026 LED Panel Light Sourcing Dashboard provides real-time cluster analytics, certified supplier shortlists, and dynamic risk scoring. [Contact us] for a tailored cluster strategy session ahead of your Q3 2026 RFx cycle.

Data Sources: SourcifyChina Supplier Audit Database (Q4 2025), China Lighting Association Export Reports, Global Lighting Forum Market Intelligence. All pricing FOB Shenzhen/Ningbo, 1,000-unit MOQ, standard 4000K 800lm.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Client Procurement Leadership.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Professional B2B Guide: Sourcing Round Frameless LED Panel Lights from China

Prepared for: Global Procurement Managers

Date: January 2026

Overview

Round frameless LED panel lights are increasingly demanded across commercial, retail, and hospitality sectors for their sleek design, space-saving profile, and energy efficiency. Sourcing these products from China offers competitive pricing, but requires rigorous quality control and compliance verification to ensure performance, safety, and regulatory acceptance in target markets.

This report outlines the technical specifications, compliance requirements, and quality assurance protocols essential for successful procurement.

Technical Specifications: Round Frameless LED Panel Lights

| Parameter | Specification |

|---|---|

| Shape | Round, frameless (bezel-free or minimal edge) |

| Diameter | 6″, 8″, 10″, 12″ (±1 mm tolerance) |

| Thickness | 8–12 mm (±0.5 mm tolerance) |

| Light Source | SMD2835 or SMD3014 LEDs (≥120 pcs for 12″) |

| Luminous Flux | 800–1500 lm (depending on size) |

| Color Temperature | 3000K (Warm White), 4000K (Neutral), 6500K (Cool White) ±150K |

| CRI (Color Rendering Index) | ≥80 (≥90 for premium grade) |

| Input Voltage | AC 100–240V, 50/60Hz |

| Power Consumption | 8W–20W (varies by size) |

| Driver Type | Constant current, isolated IC-driven driver |

| Beam Angle | ≥120° (uniform diffusion) |

| Material – Panel | PMMA (optical-grade diffuser), ≥3mm thickness |

| Material – Housing/Frame | Aluminum alloy (6063-T5) or high-impact PC |

| Material – Backplate | Galvanized steel or aluminum (for heat dissipation) |

| IP Rating | IP20 (indoor), IP44 (moisture-resistant variants) |

| Operating Temperature | -20°C to +45°C |

| Storage Temperature | -30°C to +60°C |

| Lifespan | ≥50,000 hours (L70) |

| Dimmable | Optional (TRIAC, 0–10V, DALI) – must specify |

Essential Certifications & Compliance Requirements

Procurement managers must verify that suppliers provide valid, up-to-date certifications for both product safety and quality management systems.

| Certification | Scope | Relevance by Region |

|---|---|---|

| CE (EMC + LVD) | Electromagnetic Compatibility & Low Voltage Directive | Mandatory for EU market |

| RoHS | Restriction of Hazardous Substances | Required in EU, UK, and increasingly in Asia and North America |

| UL/cUL | Safety standard for LED luminaires (UL 1598, UL 8750) | Required for North American market |

| FCC Part 15B | Electromagnetic interference (EMI) compliance | Mandatory for US market |

| ERP Directive (EU) | Energy efficiency and ecological design | Required for EU; includes efficiency tiers |

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes |

| IEC 62471 | Photobiological safety (LEDs) | Required for EU and increasingly referenced globally |

| TUV/GS (Germany) | Enhanced safety certification | Preferred for premium European buyers |

| SAA (Australia/NZ) | Electrical safety compliance | Required for ANZ market |

| KC (Korea) | Korean certification for electrical goods | Required for South Korea |

Note: FDA does not regulate general lighting products. FDA oversight applies only to medical devices or phototherapeutic equipment. Ensure suppliers are not misrepresenting FDA approval for standard LED panels.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Risk/Impact | Prevention Strategy |

|---|---|---|

| Uneven Light Distribution (clouding, hotspots) | Poor visual comfort, reduced aesthetic appeal | Use optical-grade PMMA diffusers; ensure uniform LED spacing and proper light guide plate (LGP) alignment |

| Flickering or Strobing | Eye strain, non-compliance with IEEE 1789 | Source drivers with flicker-free technology (±5% ripple); conduct in-line flicker testing |

| Color Inconsistency (Δu’v’ > 0.003) | Mismatched lighting in installations | Implement binning control (e.g., 3SDCM); require supplier color consistency reports per batch |

| Poor Heat Dissipation (overheating) | Reduced lifespan, lumen depreciation | Use aluminum backplates; verify thermal resistance (<8°C/W); conduct thermal imaging during QA |

| Driver Failure (early burnout) | Premature product failure | Use isolated drivers with surge protection (6kV); test drivers under load for 48h before assembly |

| Dimensional Tolerances Exceeded | Installation issues, gaps in ceiling | Enforce ±1mm diameter tolerance; conduct first-article inspection (FAI) with calibrated tools |

| Loose Wiring or Solder Joints | Safety hazard, intermittent operation | Mandate automated soldering; perform pull tests and continuity checks on 100% of units |

| Scratched or Hazy Diffuser | Reduced light output, poor appearance | Implement anti-scratch packaging; conduct final visual inspection under controlled lighting |

| Non-Compliant Markings (missing labels, incorrect info) | Customs rejection, compliance risk | Audit packaging and labeling per target market (e.g., CE mark + EU rep address) |

| Substandard Materials (e.g., recycled plastic, thin aluminum) | Reduced durability and heat management | Require material certificates; conduct random material thickness and composition checks |

Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001 certification and in-house R&D capabilities.

- Pre-Shipment Inspection (PSI): Conduct third-party inspections (e.g., SGS, TÜV, Intertek) covering electrical safety, photometry, and packaging.

- Sample Testing: Require IES LM-79 photometric reports and aging tests (e.g., 1,000-hour burn-in).

- Contract Clauses: Include penalties for non-compliance with specifications and certifications.

- Traceability: Ensure batch-level traceability for components, especially drivers and LEDs.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence & Quality Assurance

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Subject: Cost Optimization & Strategic Sourcing Guide for Round Frameless LED Panel Lights (China Manufacturing)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: Public Distribution (SourcifyChina Client Advisory)

Executive Summary

The global market for round frameless LED panel lights is projected to grow at 8.2% CAGR through 2026, driven by demand for minimalist architectural lighting in commercial and high-end residential projects. Sourcing from China remains cost-advantageous, but strategic differentiation between White Label and Private Label engagement is critical for margin protection and brand equity. This report details cost structures, OEM/ODM pathways, and actionable pricing tiers based on verified factory data from 12+ Tier 1–2 suppliers in Guangdong and Zhejiang.

Key Product Specifications & Market Context

Target Product: 600mm diameter, 40W COB (Chip-on-Board) round frameless LED panel light, 120° beam angle, 3000K–6000K CCT, IP20 rating, dimmable (0–10V/PWM).

Primary Applications: Retail spaces, hospitality lobbies, premium offices.

China Manufacturing Advantage: 22–35% cost savings vs. EU/NA production (excluding logistics), driven by integrated supply chains for aluminum extrusions, drivers, and optics.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s existing design; buyer adds logo/branding only. | Fully customized design, specs, materials, and packaging to buyer’s requirements. |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Lead Time | 25–35 days | 45–60 days (includes R&D/tooling) |

| Cost Premium | +5–8% vs. supplier’s base price | +15–25% (vs. White Label) for customization |

| IP Ownership | Supplier retains design IP | Buyer owns all IP (contractually secured) |

| Best For | Entry-level market testing; budget-focused buyers | Brand differentiation; premium pricing strategy |

Procurement Insight: Private Label adoption grew 37% YoY among EU/NA buyers in 2025. While MOQs are higher, 78% of SourcifyChina clients using Private Label achieved 22%+ gross margins by avoiding commoditization.

Estimated Unit Cost Breakdown (FOB Shenzhen, USD)

Based on 1,000-unit MOQ, Tier 2 factory (ISO 9001 certified), 600mm 40W model.

| Cost Component | White Label | Private Label | Key Variables |

|---|---|---|---|

| Materials | $18.50 (65%) | $22.00 (68%) | Aluminum purity (6063 vs. 6061), driver quality (Meanwell vs. local), LED binning (CRI >90) |

| Labor | $5.20 (18%) | $5.80 (18%) | Automated assembly (% of process); testing rigor (3-hr burn-in standard) |

| Packaging | $2.30 (8%) | $4.50 (14%) | Standard carton (White) vs. custom rigid box + foam (Private Label) |

| Certifications | $1.00 (3.5%) | $1.20 (3.7%) | CE, RoHS, ETL pre-certified (supplier cost); additional certs (e.g., DLC) = +$0.80/unit |

| Profit Margin | $1.50 (5.5%) | $1.50 (4.6%) | Fixed across tiers; reflects competitive factory pricing |

| TOTAL UNIT COST | $28.50 | $35.00 |

Note: Costs exclude shipping, import duties, and buyer’s QA overhead. Material costs fluctuate with aluminum (+/- 8%) and IC chip prices (+/- 12%).

Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

Applies to White Label (base model) and Private Label (customized model). All prices exclude tooling fees ($800–$1,500 for Private Label).

| MOQ Tier | White Label Unit Price | Private Label Unit Price | Total Cost (MOQ) | Key Conditions |

|---|---|---|---|---|

| 500 units | $34.20 | $42.00 | $17,100 / $21,000 | • 30% deposit required • Limited color temp options (3000K/4000K only) |

| 1,000 units | $31.35 | $38.50 | $31,350 / $38,500 | • Standard packaging • 3000K/4000K/6000K CCT available |

| 5,000 units | $27.08 | $33.25 | $135,400 / $166,250 | • Custom packaging included • Priority production slot • Free 1st-article inspection |

Critical Assumptions:

1. Prices valid for Q1–Q2 2026; subject to aluminum/LME index adjustments.

2. Private Label requires 45-day payment terms (net 45) vs. White Label (net 30).

3. Tier 1 factories (e.g., Shenzhen-based) command +7–10% premiums but offer 5-year warranties.

Strategic Recommendations for Procurement Managers

- Avoid MOQ Traps: Factories quoting <500-unit MOQs often use substandard drivers (MTBF <15,000 hrs). Prioritize suppliers with verified production capacity.

- Certification Strategy: Insist on pre-certified units (CE/RoHS). Post-shipment certification adds $1.20/unit and 14-day delays.

- Private Label ROI: At 5,000-unit MOQ, Private Label unit costs approach White Label at 500 units – enabling premium pricing without margin erosion.

- Risk Mitigation: Allocate 5% of budget for 3rd-party pre-shipment inspection (e.g., SGS). 22% of 2025 LED shipments failed photometric tests due to uncalibrated assembly lines.

Next Steps

- Request Factory Scorecards: SourcifyChina’s vetted supplier database includes 8 pre-audited factories for this product category (MOQ: 500–10k units).

- Validate Tooling Costs: Always negotiate Private Label tooling fees as a one-time cap (max $1,500), not per-unit amortization.

- Lock Material Escalation Clauses: Contract terms should cap aluminum-driven price hikes at 5% annually.

SourcifyChina Advisory: “In 2026, cost leadership alone is insufficient. Buyers who leverage Private Label for technical differentiation (e.g., tunable white, IoT integration) will capture 31% higher lifetime value per customer.”

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from SourcifyChina’s 2026 China LED Manufacturing Cost Index (CMI), covering 47 factories. Methodology: On-site audits, material spot checks, and freight benchmarking.

Disclaimer: Estimates exclude tariffs, currency volatility, and destination-market compliance costs. Actual pricing subject to formal quotation.

✉️ Need a custom sourcing roadmap? Contact sourcifychina.com/request-consultation for a free supplier shortlist and negotiation playbook.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Professional B2B Guide: Sourcing Round Frameless LED Panel Lights from China

Prepared for Global Procurement Managers

Executive Summary

As global demand for energy-efficient lighting solutions grows, round frameless LED panel lights have emerged as a high-demand product in commercial and residential applications. China remains the dominant manufacturing hub for these products, offering competitive pricing and scalable production. However, sourcing directly from reliable manufacturers—rather than intermediaries—can significantly reduce costs, improve quality control, and strengthen supply chain resilience.

This report outlines the critical steps to verify a manufacturer, distinguish between trading companies and true factories, and identify red flags when sourcing round frameless LED panel lights in bulk from China.

Key Sourcing Steps: Manufacturer Verification Protocol

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & Manufacturing Scope | Confirm legal registration and that lighting manufacturing is explicitly listed. Verify authenticity via China’s National Enterprise Credit Information Publicity System. |

| 2 | Conduct Factory Audit (On-site or Virtual) | Inspect production lines, SMT machines, aging test chambers, and QC stations. Ensure they have in-house capabilities for PCB, driver, and diffuser assembly. |

| 3 | Review ISO & Product Certifications | Require ISO 9001 (Quality), ISO 14001 (Environmental), and product-specific certifications: CE, RoHS, CCC (if applicable), and UL/CB reports for international markets. |

| 4 | Demand Sample Testing Protocol | Request pre-production samples with full photometric reports (LM-79), IP rating validation, and CRI >80. Conduct third-party lab testing where necessary. |

| 5 | Verify Export History & Client References | Ask for 3–5 export references (preferably in EU/US). Confirm shipment records via Bill of Lading (B/L) data or third-party verification tools (e.g., ImportGenius). |

| 6 | Assess R&D and Customization Capabilities | Evaluate if they can modify CCT (2700K–6500K), lumen output (e.g., 2000–5000 lm), or smart controls (Dim-to-Warm, DALI) based on project needs. |

| 7 | Review MOQ, Lead Time & Payment Terms | Confirm MOQ aligns with your volume (e.g., 500–1,000 pcs/model). Avoid 100% upfront payments; use T/T 30% deposit, 70% before shipment. |

How to Distinguish: Factory vs. Trading Company

| Indicator | Factory (Preferred) | Trading Company |

|---|---|---|

| Facility Ownership | Owns production site; can show factory address, machinery, and employee IDs. | No physical production; may subcontract to multiple factories. |

| Product Development | Has in-house engineering team; can provide CAD drawings, thermal simulations, and optical designs. | Relies on factory-provided specs; limited technical input. |

| Pricing Structure | Offers cost breakdown (LED chips, drivers, housing, labor). Lower margins, scalable pricing. | Adds 15–30% markup; pricing less transparent. |

| Lead Time Control | Direct oversight of production; can expedite or adjust schedules. | Dependent on factory availability; potential delays. |

| Customization | Capable of OEM/ODM: custom logos, packaging, optics, smart integrations. | Limited to catalog options; may refuse low-volume custom work. |

| Communication | Engineers or plant managers available for technical discussions. | Sales representatives only; limited technical depth. |

💡 Pro Tip: Ask: “Can I speak with your production manager?” or “May I see your SMT line via live video?” Factories typically comply; trading companies often deflect.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or Google Street View mismatch | High risk of front company or fraud. | Use satellite imagery, request live video tour, or engage a third-party inspection firm (e.g., SGS, QIMA). |

| Unwillingness to provide product certifications or test reports | Non-compliant products; customs rejection risk. | Require valid CE, RoHS, and LM-79 reports before sample approval. |

| Extremely low pricing (<30% below market average) | Likely inferior components (e.g., fake IC drivers, low-bin LEDs). | Conduct component tear-down analysis; insist on branded LED chips (e.g., Samsung, Epistar). |

| Requests 100% advance payment | High fraud risk. | Use secure payment methods: Escrow, Letter of Credit (L/C), or T/T with milestone payments. |

| Generic Alibaba storefront with no company history | Likely trading intermediary. | Cross-check business license, domain registration, and employee count via企查查 (QichaCha). |

| No aging or reliability testing process | High field failure rate. | Require proof of 24–72hr burn-in testing and MTBF >50,000 hours. |

SourcifyChina Recommended Verification Tools

| Tool | Function | Link |

|---|---|---|

| QichaCha (企查查) | Verify Chinese company registration, legal status, and ownership. | qichacha.com |

| ImportGenius / Panjiva | Analyze export history and shipment records. | importgenius.com |

| SGS / TÜV Rheinland | Third-party factory audit and product testing. | sgs.com |

| Alibaba Trade Assurance | Secure transactions with buyer protection. | alibaba.com |

Final Recommendations

- Prioritize factories with UL/cETL certification capability for North American markets.

- Build long-term partnerships with 1–2 verified factories to ensure supply stability.

- Implement AQL 2.5 inspection protocol pre-shipment for every order.

- Leverage modular designs to reduce SKUs and improve production efficiency.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026 | Confidential – For Procurement Use Only

Contact: [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Subject: Strategic Sourcing Optimization for Round Frameless LED Panel Lights

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: Eliminate Sourcing Friction in LED Lighting Procurement

Global procurement managers face critical challenges sourcing round frameless LED panel lights from China: inconsistent quality, supplier fraud (38% of buyers report post-PO disputes), and 120+ hours wasted per project on unverified supplier vetting (2025 Sourcing Benchmark Survey). SourcifyChina’s Verified Pro List solves this through rigorously pre-qualified manufacturers, reducing time-to-PO by 93% while guaranteeing compliance.

Why the Pro List Outperforms Traditional Sourcing Methods

Table 1: Time/Cost Savings Analysis for Round Frameless LED Panel Lights

| Sourcing Stage | Traditional Approach | SourcifyChina Pro List | Time Saved | Risk Mitigated |

|---|---|---|---|---|

| Supplier Identification | 45–60 hours (RFQ blasts, Alibaba searches) | <2 hours (Pre-vetted shortlist) | 95% | Fake factories, trading company markup |

| Quality Validation | 40+ hours (Sample rounds, failed audits) | 0 hours (Pre-certified QC reports) | 100% | Non-compliant materials, IP theft |

| Compliance Verification | 35 hours (Factory audits, document chase) | Integrated (ISO 9001/CE/ROHS on file) | 100% | Regulatory rejection, shipment delays |

| Negotiation & PO Closure | 20–30 hours (MOQ/price haggling) | 8 hours (Pre-negotiated terms) | 73% | Hidden fees, payment fraud |

| TOTAL | 140–160 hours/project | ~8 hours/project | 93% | $22K+ avg. hidden cost avoided |

Source: SourcifyChina 2025 Client Data (127 Procurement Managers, LED Lighting Vertical)

Key Advantages of the Pro List for Round Frameless LED Panel Lights

- Zero Verification Overhead

- Every factory undergoes 7-point compliance validation:

✓ On-site audit (ISO-certified) ✓ Live production capacity test ✓ Raw material traceability ✓ Export license verification ✓ 24-month defect history ✓ Payment security ✓ MOQ transparency -

No more “factory tour” scams or sample-to-production quality gaps.

-

Guaranteed Technical Alignment

-

Pro List suppliers specialize in round frameless designs (min. 5 years’ expertise), with engineering teams fluent in IEC 60598-1 standards. Avoid generic LED factories repurposing square-panel lines.

-

Dynamic Cost Control

- Real-time aluminum substrate/PCB pricing alerts + pre-negotiated tiered pricing (e.g., 5% savings at 500+ units). 2026 tariff volatility? We absorb compliance updates.

Your Strategic Next Step: Secure 2026 Allocation

The Pro List for Round Frameless LED Panel Lights has limited capacity (47 slots reserved for Q1 2026). With 83% of 2025 allocations claimed by Fortune 500 lighting brands, delays risk:

– ⚠️ Q3 2026 price surges (driven by EU EcoDesign Directive compliance costs)

– ⚠️ 12–16 week lead times during peak season (per 2025 industry data)

Act Now to Lock In:

✅ Priority production slots (Q2–Q3 2026)

✅ 2026 tariff-compliant documentation (pre-loaded in SourcifyChina Portal)

✅ Dedicated sourcing engineer for technical specifications

Call to Action: Claim Your Verified Supplier Allocation

Do not risk project delays or quality failures with unverified suppliers. In 15 minutes, our team will:

1. Confirm your technical specifications (lumen output, CCT, dimming requirements)

2. Assign your vetted factory match from the Pro List

3. Provide a binding MOQ/price quote with 90-day payment terms

➡️ Contact SourcifyChina Support Within 48 Hours to Guarantee Q2 2026 Capacity:

– Email: [email protected]

Subject Line: “PRO LIST LED PANEL LIGHTS – [Your Company Name]”

– WhatsApp: +86 159 5127 6160

Message Template: “Requesting Round Frameless LED Panel Pro List Allocation – [Your Name], [Company]”

Note: 2026 allocations require confirmed technical briefs. First-response priority given to submissions with project timelines.

SourcifyChina | Your Verified Gateway to China Manufacturing

Data-Driven Sourcing Since 2018 | 97.4% Client Retention Rate | 12,000+ Pre-Vetted Factories

© 2026 SourcifyChina. All rights reserved. This report contains proprietary sourcing intelligence. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.