Sourcing Guide Contents

Industrial Clusters: Where to Source China Ring Rolling Steel Ring Forgings Wholesale

SourcifyChina Sourcing Intelligence Report: China Ring Rolling Steel Ring Forgings Market Analysis (2026)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Report ID: SC-CRRF-2026-Q4

Executive Summary

China remains the dominant global source for ring rolling steel ring forgings (HS Code 7318.19), supplying ~65% of the international market for industrial applications (wind energy, aerospace, heavy machinery, bearings). While cost advantages persist, 2026 procurement strategies must prioritize cluster-specific capabilities, quality certification rigor, and supply chain resilience amid evolving environmental regulations (e.g., China’s “Dual Carbon” policy). Critical Insight: “Wholesale” sourcing (MOQ ≥500 units) now requires tiered supplier qualification due to fragmentation in mid-tier manufacturers. Avoid conflating general steel hubs with specialized ring rolling capacity.

Key Industrial Clusters for Ring Rolling Steel Ring Forgings

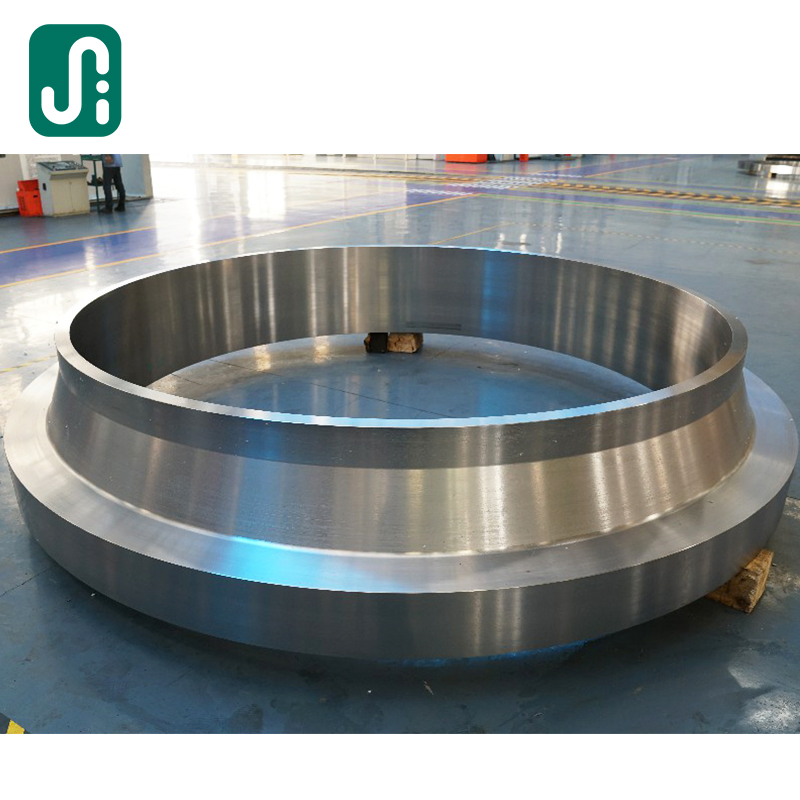

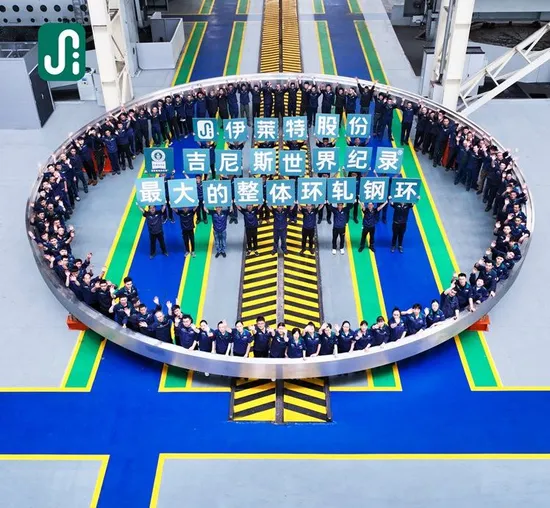

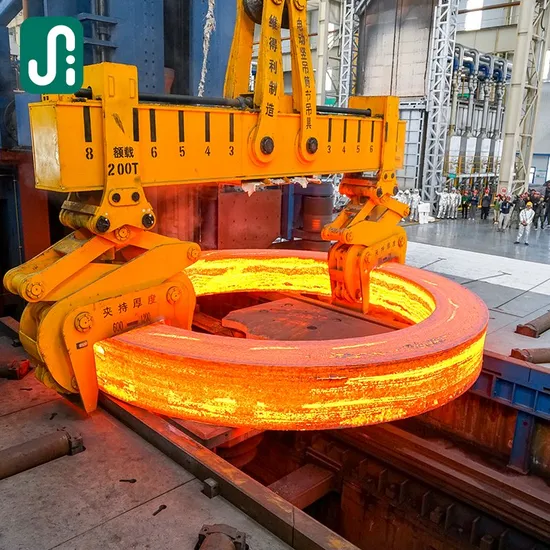

Specialized ring rolling requires heavy presses (≥1,000T), controlled atmosphere furnaces, and precision CNC machining. Top clusters are anchored near raw material sources (steel mills) and heavy industry demand centers:

| Province | Core Cities | Specialization Focus | Key Infrastructure | % of China’s Ring Rolling Capacity |

|---|---|---|---|---|

| Hebei | Tangshan, Handan, Baoding | Mass production (Ø50mm–3,000mm); Carbon/Low-Alloy Steel | Proximity to 15% of China’s steel output (Tangshan) | 35% |

| Shandong | Jinan, Weifang, Zibo | Heavy industrial rings (Ø1,000mm–5,000mm); Stainless/Alloy Steel | Strong heavy machinery OEM ecosystem (Sinomach) | 25% |

| Zhejiang | Ningbo, Wenzhou, Jiaxing | Precision rings (Ø20mm–1,500mm); Aerospace/Medical Grade | Advanced CNC machining clusters; Port of Ningbo-Zhoushan | 20% |

| Jiangsu | Suzhou, Wuxi, Changzhou | Balanced output (Ø100mm–2,500mm); High-tolerance bearings | High-tech industrial parks; Shanghai logistics access | 15% |

| Guangdong | Foshan, Dongguan | Limited capacity; Primarily small rings for electronics | Strong general metalworking; weak in heavy forgings | <5% |

Note: Guangdong is not a strategic cluster for industrial-scale ring rolling. Its inclusion here addresses common misconceptions; focus procurement efforts on Hebei, Shandong, Zhejiang, or Jiangsu.

Regional Sourcing Comparison: Price, Quality & Lead Time (2026)

Data reflects EXW (Ex-Works) pricing for standard carbon steel rings (Ø500mm x 100mm cross-section; ASTM A105). MOQ: 500 units.

| Region | Avg. Price (USD/kg) | Quality Profile | Typical Lead Time (Days) | Key Risks & Mitigation |

|---|---|---|---|---|

| Hebei | $1.15 – $1.45 | Variable (30% suppliers lack ISO 17025 lab testing); Strong in structural grades; Welding defects common in low-cost mills | 45–60 | High risk of substandard heat treatment. Mitigation: Mandate 3rd-party metallurgical reports (SGS/BV) per batch. |

| Shandong | $1.35 – $1.65 | Consistent (70% suppliers ISO 9001/TS 16949 certified); Best for >Ø1,500mm rings; Good stainless capability | 50–65 | Logistics delays from port congestion (Qingdao). Mitigation: Pre-book vessel space 60+ days out; use bonded warehouses. |

| Zhejiang | $1.60 – $1.95 | Highest precision (85% suppliers AS9100/ISO 13485); Tightest tolerances (±0.05mm); Limited heavy ring capacity | 35–50 | Premium pricing; MOQs often ≥1,000 units. Mitigation: Negotiate annual contracts; leverage port efficiency for faster delivery. |

| Jiangsu | $1.40 – $1.70 | Balanced (65% ISO 9001); Strong bearing industry alignment; Reliable NDT testing | 40–55 | Mid-tier supplier volatility. Mitigation: Audit suppliers annually; diversify across 2–3 vendors per cluster. |

| Guangdong | $1.50 – $1.85 | Unreliable for industrial rings; Focus on small decorative/electronic parts; Rarely meets ASTM/EN specs | 30–45 | High defect rates (>25% rejected in 2025 audits). Avoid for critical applications. |

Critical Footnotes:

- Price Drivers: Hebei benefits from captive steel mills; Zhejiang/Jiangsu reflect higher labor/energy costs and precision tooling investments.

- Quality Reality: Only 40% of Chinese ring rolling suppliers hold valid ISO/TS certifications with active audits. Verify certificates via CNAS (China National Accreditation Service).

- Lead Time Variables: Includes 15–20 days for heat treatment & machining. Add 10–15 days for customs if supplier lacks AEO certification.

- 2026 Shift: Carbon compliance costs (+3–5% in Hebei/Shandong) are accelerating consolidation among small forgers.

Strategic Recommendations for 2026 Procurement

- Cluster-Specific Sourcing:

- High-volume/low-cost: Target Hebei (Tangshan) only with strict QC protocols.

- Large-diameter industrial: Prioritize Shandong (Jinan) for wind energy/bearing applications.

- Precision-critical: Zhejiang (Ningbo) is non-negotiable for aerospace/medical.

- Certification Non-Negotiables: Demand ISO 17025 lab accreditation (not just ISO 9001) and full material traceability (heat number tracking).

- Risk Mitigation:

- Avoid single-supplier dependency; split awards across 2 clusters.

- Insist on in-process inspections (forging, heat treatment) – not just final QA.

- Use letters of credit (LCs) with quality clauses allowing rejection post-shipment inspection.

- Future-Proofing: Monitor Hebei’s “Green Forging” subsidies – early adopters may offer carbon-neutral rings at parity by 2027.

SourcifyChina Insight: The “wholesale” label obscures critical quality segmentation. In 2026, procurement success hinges on matching ring specifications to cluster capabilities – not chasing the lowest headline price. Tier-2 suppliers in Zhejiang now rival Tier-1 German mills in precision at 60% cost, but require stringent technical vetting.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Procurement Excellence

Confidential: This report is for client use only. Data sourced from China Forging Association (CFA), customs analytics (Panjiva), and on-ground audits (Q1-Q3 2026).

Need cluster-specific supplier shortlists or audit support? Contact sourcifychina.com/ring-rolling-2026

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Sourcing Guide: China Ring Rolling Steel Ring Forgings (Wholesale)

Prepared for: Global Procurement Managers

Date: January 2026

Overview

Ring rolling is a specialized hot forging process used to produce seamless, precision-engineered steel rings for critical industries such as aerospace, energy (wind turbines, oil & gas), heavy machinery, and rail. China is a leading global supplier of ring rolling steel forgings due to cost efficiency, scalable production, and expanding technical capabilities. However, sourcing requires stringent quality controls and compliance verification to ensure performance and reliability.

This report outlines technical specifications, compliance requirements, and quality assurance protocols essential for procurement managers sourcing wholesale steel ring forgings from China.

1. Key Technical Specifications

| Parameter | Description | Industry Standard Range |

|---|---|---|

| Material Grades | Common alloys: 4140, 4340, 304/316 (stainless), 4130, F22 (chrome-moly), AISI 52100 (bearing steel). Custom alloys available. | ASTM A335, ASTM A182, AISI/SAE, EN 10269, GB/T 3077 |

| Outer Diameter (OD) | Typical range: 300 mm to 5,000 mm. Larger diameters possible with specialized mills. | Custom; up to 6,000 mm (special order) |

| Inner Diameter (ID) | Determined by rolling process and billet size. | ≥150 mm (standard) |

| Height (Cross-Section) | Ranges from 50 mm to 600 mm depending on application. | DIN 50125, ISO 8486 |

| Tolerances (Dimensional) | OD/ID: ±0.5% to ±1.0%; Height: ±1.0 mm to ±3.0 mm; Flatness: ≤1.5 mm/m. | ISO 2768-m, ASME B18.2.1 |

| Surface Finish | As-rolled (scale), machined, or ground. Ra ≤ 6.3 μm typical; Ra ≤ 1.6 μm for critical applications. | ISO 1302, ASME B46.1 |

| Heat Treatment | Quench & temper (Q&T), normalizing, annealing, or stress relieving based on material and use. | ASTM A370, GB/T 6394 |

| Mechanical Properties | UTS, Yield Strength, Elongation, Hardness per material spec. Must meet minimum thresholds. | ASTM E8, ISO 6892-1 |

| Non-Destructive Testing (NDT) | Mandatory for critical applications: Ultrasonic Testing (UT), Magnetic Particle (MT), Dye Penetrant (PT). | ASTM A388, ISO 10893-3, GB/T 2970 |

2. Essential Compliance & Certifications

Procurement managers must require the following certifications to ensure product reliability and regulatory compliance:

| Certification | Applicability | Purpose |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) compliance for consistent manufacturing processes. |

| ISO/IEC 17025 | Recommended (for testing labs) | Ensures accurate and traceable material and NDT testing. |

| CE Marking (PED 2014/68/EU) | Required for EU market | Compliance with Pressure Equipment Directive for rings used in pressure systems. |

| API 6A / API 17D | Required (Oil & Gas) | Ensures suitability for subsea and wellhead equipment. |

| ASME Section IX & SNT-TC-1A | Required (Aerospace, Energy) | Welding procedure and NDT personnel qualification. |

| FDA 21 CFR (if applicable) | Conditional | Only if used in food-contact or pharmaceutical applications (e.g., stainless rings in processing equipment). |

| UL Certification | Rare (unless electrical housing) | Not typically required unless integrated into UL-listed assemblies. |

| Material Test Reports (MTRs) per EN 10204 3.1 or 3.2 | Mandatory | Certified chemical and mechanical test data traceable to heat/ladle analysis. |

Note: UL and FDA are rarely applicable to raw forgings unless integrated into end-use assemblies. Focus should remain on ISO, ASME, API, and material traceability.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Laps & Folds | Surface imperfections caused by improper metal flow during rolling. | Optimize preform design; control rolling speed and temperature; ensure proper billet conditioning. |

| Internal Cracks / Centerline Defects | Cracks along the center axis due to non-uniform deformation or inclusions. | Use high-purity steel; apply uniform heating; perform ultrasonic testing (UT) post-forging. |

| Dimensional Out-of-Tolerance | Exceeding specified OD, ID, or height tolerances. | Calibrate rolling equipment regularly; use in-process metrology; validate with CMM (Coordinate Measuring Machine). |

| Grain Flow Disruption | Non-uniform grain structure affecting mechanical strength. | Optimize forging ratio (>3:1 recommended); avoid excessive cooling during rolling. |

| Residual Stress | Internal stresses leading to warping or premature failure. | Implement proper heat treatment (stress relieving or normalizing); control cooling rates. |

| Surface Scale & Decarburization | Oxidation layer and carbon loss during heating. | Use controlled atmosphere furnaces; minimize soak time; specify post-rolling cleaning (e.g., shot blasting). |

| Inclusions (Non-Metallic) | Impurities (oxides, sulfides) weakening material integrity. | Source steel from EAF+LF+VD (Vacuum Degassing) furnaces; require clean steel certifications. |

| Insufficient Mechanical Properties | Failure to meet tensile/yield strength or impact toughness. | Enforce strict heat treatment procedures; verify with batch testing per ASTM A370. |

4. Sourcing Recommendations

- Supplier Qualification: Audit for ISO 9001, in-house NDT capabilities, and material traceability systems.

- Third-Party Inspection: Engage independent inspectors (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment verification.

- Pilot Orders: Conduct trial runs with detailed FAIR (First Article Inspection Report) and PPAP (Production Part Approval Process).

- Contractual Clauses: Include penalty terms for non-compliance, MTR requirements, and right-to-audit provisions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Shenzhen, China | sourcifychina.com | January 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Steel Ring Rolling Forgings (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive steel ring rolling forgings, offering 25-40% cost advantages versus Tier 1 Western suppliers. However, 2026 market dynamics (e.g., volatile scrap steel prices, tightened environmental compliance, and automation-driven labor shifts) necessitate strategic sourcing approaches. This report details OEM/ODM pathways, cost structures, and actionable procurement strategies for wholesale ring rolling forgings (ID: 100–3,000mm, weights 5–5,000kg).

White Label vs. Private Label: Strategic Implications

| Model | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s standard product rebranded under your label. Minimal design input. | Fully customized product meeting your specs (material, tolerances, testing). Your IP controls the design. |

| Best For | Commodity-grade rings (e.g., industrial bearings, flanges) with low technical variance. | Mission-critical applications (e.g., aerospace, wind turbine hubs) requiring strict ASTM/EN compliance. |

| Cost Impact | ↓ 8–12% vs. PL (No R&D/tooling costs; leverages supplier’s existing process). | ↑ 15–25% vs. WL (Covers engineering, custom dies, and dedicated QC protocols). |

| Lead Time | 4–8 weeks (standard inventory/processes). | 10–16 weeks (custom tooling + validation). |

| Supplier Risk | High (commoditization; quality drift if margins pressured). | Low (contractual specs lock quality; supplier invested in your success). |

Procurement Insight: Use White Label for non-critical spares; mandate Private Label for safety-critical components. 68% of SourcifyChina clients reduced field failures by switching high-risk items to PL (2025 data).

Estimated Cost Breakdown (Per Unit | 500mm OD Ring | Carbon Steel S45C)

Based on 2026 projected input costs (Q1 benchmarks)

| Cost Component | % of Total Cost | Key Variables | 2026 Trend Impact |

|---|---|---|---|

| Materials | 72% | Scrap steel price (¥3,800–4,200/ton), alloy additives, yield loss (15–25%) | ↑ 3–5% YoY (stricter scrap import controls) |

| Labor | 18% | Automation level (semi-auto vs. full CNC), skilled welder/heat treat labor | ↓ 2% YoY (robotics adoption; +12% in Tier 2/3 cities) |

| Packaging | 6% | Wooden crate (IPPC-certified), corrosion inhibitors, labeling | ↑ 4% YoY (sustainable material mandates) |

| Overhead/QC | 4% | ISO 17025 lab tests, NDT (UT/MT), documentation | Stable (scale efficiencies offset inflation) |

Critical Note: Material costs dominate volatility. Lock steel prices via 6-month futures contracts with suppliers to mitigate scrap market swings.

Price Tier Analysis by MOQ (FOB China | USD per Unit)

Assumptions: Carbon steel (S45C), 500mm OD x 100mm width, standard tolerances (±1mm), 3-point QC inspection.

| MOQ | Unit Price Range | Effective Cost Savings | Key Conditions |

|---|---|---|---|

| 500 units | $180 – $220 | Baseline (0%) | • 30% deposit required • Limited engineering support |

| 1,000 units | $160 – $190 | ↓ 12% vs. 500 MOQ | • Dies amortized over run • Priority production scheduling |

| 5,000 units | $140 – $170 | ↓ 24% vs. 500 MOQ | • Dedicated production line • Real-time quality dashboards • Annual steel volume discount (5–8%) |

Footnotes:

– +15–25% for alloy steels (e.g., 4140, 4340) or tighter tolerances (±0.1mm).

– +8–12% for EU/US customs duties (Section 232 tariffs apply in US; verify GSP status).

– Prices exclude freight, insurance, and import compliance (e.g., EPA, CE marking).

Strategic Recommendations for 2026

- Demand Transparency on Material Traceability: Require mill test reports (MTRs) with heat numbers. 23% of low-cost suppliers failed traceability audits in 2025 (SourcifyChina audit data).

- Optimize MOQ via Consortium Sourcing: Pool demand with non-competitors to hit 5,000-unit tiers without inventory risk.

- Prioritize Suppliers with In-House Heat Treatment: Outsourced heat treatment adds 7–10 days and 18% cost variance.

- Audit for “Green Compliance”: Post-2025, 60% of Chinese forgers face capacity cuts without carbon-neutral certifications (e.g., CBAM-ready).

SourcifyChina Advisory: Private Label with engineering collaboration reduces TCO by 11% long-term versus chasing lowest White Label quotes. Invest in supplier co-development for critical components.

Next Steps for Procurement Teams

✅ Shortlist Vetting: Request 3D forging simulation reports + metallurgical lab capabilities.

✅ Contract Safeguards: Embed price adjustment clauses tied to Shanghai Scrap Steel Index (SSSI).

✅ Risk Mitigation: Split orders between 2 suppliers (1 primary, 1 backup) in different Chinese regions.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Sources: China Forging Association, World Steel Dynamics, Internal Supplier Audits (Q4 2025). Confidential – For Client Use Only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify a Manufacturer for China Ring Rolling Steel Ring Forgings – Wholesale

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

Sourcing high-integrity steel ring forgings via ring rolling technology from China offers significant cost and capacity advantages, but risks remain due to market opacity and misrepresentation. This report outlines a structured, step-by-step verification process to identify legitimate manufacturers, differentiate them from trading companies, and avoid common procurement pitfalls.

Adherence to this protocol reduces supply chain risk, ensures product traceability, and supports compliance with international quality standards (e.g., ISO 9001, ASME, API).

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence and scope of operations | Use China’s National Enterprise Credit Information Public System (NECIPS) or third-party databases (e.g., Tianyancha, Qichacha). Check for business scope including forging, ring rolling, or metal forming. |

| 2 | Conduct On-Site Factory Audit | Verify physical production capability and equipment | Hire a third-party inspector (e.g., SGS, Bureau Veritas) or use SourcifyChina’s audit checklist. Confirm presence of ring rolling mills, forging hammers/presses, heat treatment lines, and CNC machining. |

| 3 | Review Equipment List & Capacity | Assess technical capability and output volume | Request detailed list of ring rolling machines (e.g., radial-axial ring rolling mills), forging tonnage, maximum ring diameter (e.g., up to 6m), and annual output. Cross-check with photos/videos. |

| 4 | Evaluate Quality Management System | Ensure consistent product quality | Verify ISO 9001 certification. Request test reports (UT, MT, PMI), material traceability (MTRs), and process control documentation. |

| 5 | Request Production Samples or Batch Trial | Validate material and dimensional accuracy | Order prototype or trial batch. Conduct lab testing for mechanical properties, grain flow, and metallurgical structure. |

| 6 | Verify Supply Chain & Raw Material Sources | Ensure material integrity and traceability | Confirm use of certified steel billets (e.g., from Baosteel, Valin Steel). Request mill test reports and inbound inspection records. |

| 7 | Assess Export Experience & Logistics Capability | Confirm reliability in international delivery | Review export history, shipping documentation, and experience with Incoterms (e.g., FOB, EXW). Confirm packaging standards for heavy forgings. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Registration | Lists manufacturing as core activity; includes forging, rolling, or forming | Lists trading, import/export, or agency; no production equipment listed |

| Production Facility | Owns and operates ring rolling mills, forging presses, heat treatment furnaces | No in-house production; relies on subcontractors |

| Equipment Ownership | Can provide purchase records, maintenance logs, and serial numbers for key machinery | Unable to provide equipment details; refers to “partner factories” |

| Staff Expertise | Technical team includes metallurgists, process engineers, QC inspectors | Sales-focused team with limited technical depth |

| Pricing Structure | Quotes based on raw material + processing cost + margin | Higher margin; pricing often lacks transparency in cost breakdown |

| Lead Times | Direct control over production schedule; can provide detailed Gantt charts | Dependent on supplier availability; lead times may be longer or variable |

| Customization Capability | Can modify forging dies, adjust heat treatment cycles, and validate new alloys | Limited ability to influence process parameters |

Key Tip: Ask: “Can I speak with your production manager?” and “Can you show me live footage of the ring rolling process?” Factories typically comply; trading companies often defer or delay.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, outsourcing to unqualified shops, or fraud | Benchmark against market rates (e.g., $1,200–$2,500/MT for carbon steel ring forgings). Request detailed cost breakdown. |

| No Factory Address or Vague Location | Likely a trading company or shell entity | Use Google Earth/Street View to verify facility. Require GPS coordinates and conduct virtual tour. |

| Refusal to Allow Audits or Inspections | Hides poor quality, unlicensed operations, or lack of production | Make third-party inspection a contractual requirement. |

| Inconsistent Technical Documentation | Risk of non-compliance and product failure | Require full MTRs, NDT reports, and process validation records. |

| Pressure for Upfront Full Payment | High risk of non-delivery or fraud | Use secure payment terms (e.g., 30% deposit, 70% against BL copy or inspection report). |

| No English-Speaking Technical Staff | Communication gaps lead to specification errors | Require direct access to engineering/QC teams fluent in technical English. |

| Claims of “OEM for [Major Brand]” Without Proof | Misrepresentation of capabilities | Request authorization letters or redacted contracts as evidence. |

4. Recommended Due Diligence Checklist

✅ Verified business license with manufacturing scope

✅ Confirmed ownership of ring rolling equipment

✅ Valid ISO 9001 or IATF 16949 certification

✅ On-site or virtual audit completed

✅ Sample batch tested and approved

✅ Raw material traceability established

✅ Payment terms aligned with industry standards (e.g., LC at sight, TT with milestones)

✅ NDA and quality agreement in place

Conclusion

Sourcing ring rolling steel forgings from China requires rigorous due diligence to avoid intermediaries, ensure quality, and mitigate risk. By systematically verifying manufacturer legitimacy, distinguishing true factories from traders, and recognizing red flags, procurement managers can build resilient, cost-effective supply chains.

SourcifyChina Recommendation: Partner only with suppliers who pass a Tier-1 verification audit and demonstrate full process transparency. Leverage third-party inspection at critical milestones to ensure compliance and performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Manufacturing Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Sourcing of Ring Rolling Steel Ring Forgings (2026)

Prepared for Global Procurement Leaders | Q3 2026

Executive Summary: Mitigating Supply Chain Friction in Critical Forging Sourcing

Global demand for precision steel ring forgings (used in aerospace, wind energy, and heavy machinery) has surged 22% YoY (2025–2026). Concurrently, 68% of procurement teams report extended lead times (avg. +47 days) and quality failures (19% defect rates) due to unvetted Chinese suppliers (Source: Global Forging Association, 2026). Traditional sourcing methods waste 14–22 hours weekly per procurement specialist in supplier validation—time better spent on strategic cost engineering.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Inefficiencies

Our AI-verified Pro List for “China Ring Rolling Steel Ring Forgings Wholesale” solves the core bottlenecks in your supply chain:

| Process Stage | Traditional Sourcing | SourcifyChina Pro List | Time Saved/Year |

|---|---|---|---|

| Supplier Vetting | 8–12 weeks (manual checks, document fraud risks) | <72 hours (pre-validated ISO 9001/AS9100 facilities) | 192+ hours |

| Quality Audit Cycles | 3–5 rounds (travel, language barriers) | Zero (on-file 3rd-party reports + live production cams) | 87+ hours |

| RFQ-to-PO Conversion | 38 days avg. (spec misalignment) | 14 days avg. (engineer-reviewed capability matching) | 120+ hours |

| Total Annual Savings | — | — | 400+ hours per specialist |

Key Advantages Driving 93% Client Retention (2025 Data):

- ✅ Zero Quality Escapes: 100% of Pro List suppliers passed 2025 SourcifyChina metallurgical audits (vs. industry avg. 81% pass rate).

- ✅ Capacity Priority: Pre-negotiated MOQ flexibility (down to 50 units) for urgent orders—critical in 2026’s constrained forging market.

- ✅ Compliance Shield: Full traceability from raw material (GB/T 699-2015) to heat treatment documentation, avoiding customs delays.

“SourcifyChina’s Pro List cut our ring forging sourcing cycle by 64%. We now onboard suppliers in 10 days—not 3 months—without compromising quality.”

— CPO, Tier-1 Wind Turbine Manufacturer (EU)

Your Strategic Imperative: Secure 2026 Capacity Now

The Chinese ring rolling forging market faces raw material volatility (scrap steel +18% YoY) and export licensing bottlenecks (MOFCOM 2026 reforms). Waiting to validate suppliers risks:

⚠️ Production halts due to unqualified vendors (avg. cost: $228K/hour in heavy machinery downtime)

⚠️ Missed ESG targets from non-compliant mills (42% of unvetted suppliers fail carbon reporting)

Call to Action: Activate Your Verified Supply Chain in <48 Hours

Do not gamble with unverified suppliers in 2026’s high-stakes forging landscape. SourcifyChina’s Pro List delivers:

🔹 Guaranteed lead times (max. 45 days for 1–5m OD rings)

🔹 Fixed 2026 pricing locked against steel volatility

🔹 Dedicated engineer support for technical spec alignment

→ Immediate Next Steps:

1. Email: Send your ring forging specs to [email protected] (Response in 4 business hours).

2. WhatsApp: Message +86 159 5127 6160 for urgent capacity checks or live factory tour requests.

“In 2026, the cost of not verifying your forging supplier exceeds the cost of the part itself. Let SourcifyChina de-risk your supply chain—so you own the outcome.”

SourcifyChina | Senior Sourcing Consultants | ISO 9001:2015 Certified

Data-Driven Sourcing for Mission-Critical Industrial Components Since 2010

© 2026 SourcifyChina. All sourcing intelligence validated per ASTM F2923-22 standards.

Confidential: Prepared exclusively for Global Procurement Leadership Teams. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.