Sourcing Guide Contents

Industrial Clusters: Where to Source China Replacement Companies List

SourcifyChina | Global Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing “China Replacement” Manufacturing Alternatives from China

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

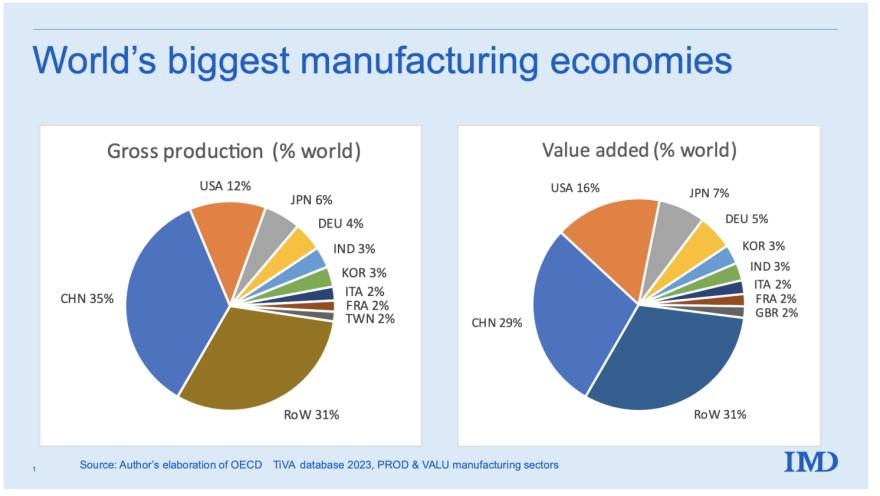

As global supply chains continue to evolve amid geopolitical shifts, trade policy volatility, and growing demand for risk diversification, procurement leaders are increasingly exploring “China replacement” manufacturing ecosystems—not to fully exit China, but to strategically de-risk and diversify sourcing portfolios by leveraging China’s mature supplier base while identifying alternative production hubs.

This report analyzes China’s role as a manufacturing platform for companies relocating or dual-sourcing from China, commonly referred to as “China replacement companies.” These are foreign-invested enterprises (FIEs), joint ventures, or Chinese OEMs that manufacture products originally destined for export from China but are now shifting production capacity to alternative countries (e.g., Vietnam, India, Mexico) while maintaining operational, engineering, or supply chain linkages within China.

Rather than viewing “China replacement” as a geographic exit, leading procurement strategies now adopt a “China +1” or “China as a hub for offshoring” model—leveraging China’s industrial clusters to support, supply, or manage offshore production.

This report identifies key Chinese industrial clusters actively involved in enabling this transition and evaluates their capabilities in terms of Price, Quality, and Lead Time for supporting offshored manufacturing.

Strategic Insight: China as the Enabler of “China Replacement”

Contrary to the narrative of disengagement, China remains central to the execution of China replacement strategies. Many companies relocating production still rely on China for:

- Tooling, molds, and precision components

- Engineering and R&D support

- Supply of key raw materials and sub-assemblies

- Management of offshore factories (Chinese expatriate teams)

- Quality control and compliance oversight

Thus, sourcing from “China replacement-enabling clusters” is not about finding alternatives to China, but identifying Chinese regions that specialize in supporting offshore production ecosystems.

Key Industrial Clusters Supporting China Replacement Strategies

Below are the top Chinese provinces and cities known for their role in enabling offshore manufacturing transitions:

| Region | Core Manufacturing Focus | Role in China Replacement | Key Export Destinations for Offshored Production |

|---|---|---|---|

| Guangdong (Dongguan, Shenzhen, Guangzhou) | Electronics, Consumer Goods, Plastics, Smart Hardware | Primary hub for OEMs relocating to Vietnam, Thailand, Mexico | Vietnam, India, USA, Mexico |

| Zhejiang (Ningbo, Yiwu, Hangzhou) | Machinery, Home Goods, Fasteners, Textiles | Supplier of modular production systems and components for Indian & SE Asia factories | India, Indonesia, Bangladesh |

| Jiangsu (Suzhou, Wuxi, Changzhou) | Automotive Parts, Industrial Equipment, Semiconductors | High-precision component supplier for relocated German & Japanese FIEs | Eastern Europe, Turkey, USA |

| Fujian (Xiamen, Quanzhou) | Footwear, Apparel, Building Materials | Supports relocation of labor-intensive apparel to Vietnam & Indonesia | Vietnam, Bangladesh, Morocco |

| Sichuan (Chengdu) | Aerospace Components, Electronics Assembly | Emerging hub for inland-to-offshore supply chains (Belt & Road alignment) | Central Asia, Middle East |

Comparative Analysis: Key Production Regions in China

The table below compares leading Chinese manufacturing regions based on their cost structure, quality standards, and lead time performance—critical KPIs for procurement managers managing hybrid (onshore + offshore) sourcing models.

| Region | Price Competitiveness (1–5) | Quality Consistency (1–5) | Average Lead Time (Weeks) | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|

| Guangdong | 3 | 5 | 4–6 weeks | World-class electronics ecosystem; proximity to Hong Kong logistics; strong English-speaking supplier base | Higher labor costs; intense competition for capacity |

| Zhejiang | 4 | 4 | 5–7 weeks | Cost-efficient for mechanical parts; strong SME supplier network; export documentation expertise | Slightly longer lead times; variable QC in smaller workshops |

| Jiangsu | 3 | 5 | 4–6 weeks | High-end manufacturing; strong German/Japanese joint ventures; ISO/TISAX compliance | Premium pricing for automotive/industrial sectors |

| Fujian | 4 | 3 | 6–8 weeks | Low-cost labor for textiles/footwear; experienced in bulk apparel production | Quality control requires onsite audits; port congestion in Quanzhou |

| Sichuan | 5 | 3.5 | 7–9 weeks | Lower labor and operating costs; government incentives for inland exporters | Longer logistics lead time to coastal ports; limited air freight access |

Scoring Key:

– Price: 5 = Most Competitive, 1 = Premium Pricing

– Quality: 5 = International Standards (ISO, IATF, etc.), 1 = Basic Compliance

– Lead Time: Includes production + inland logistics to major ports (Shenzhen, Ningbo, Shanghai)

Strategic Recommendations for Procurement Managers

-

Adopt a Hybrid Sourcing Model

Leverage Guangdong and Jiangsu for high-quality engineering and component supply while offshoring final assembly to Vietnam or Mexico. Use Zhejiang for cost-sensitive mechanical parts. -

Audit Supplier Dual-Use Capabilities

Prioritize suppliers in these clusters who already manage offshore factories or have subsidiaries abroad. They offer smoother technology transfer and quality alignment. -

Factor in Logistics Realities

While Sichuan offers cost advantages, add 10–15% to lead time calculations due to inland location. Use rail (China-Europe) for Central Asian offshoring. -

Leverage China’s Supplier Ecosystem for Offshore QC

Deploy China-based quality teams or third-party inspectors with Mandarin fluency to manage both Chinese component suppliers and offshore factories. -

Monitor Policy Shifts

China’s “Made in China 2025” and dual-circulation strategy may incentivize export of production capacity. Watch for subsidies supporting overseas factory setup by Chinese partners.

Conclusion

The concept of “China replacement” is increasingly mischaracterized as a complete exit from China. In reality, China remains the backbone of diversified manufacturing strategies, providing engineering, components, and management expertise to relocated production.

Procurement leaders who understand which Chinese clusters enable offshoring—and how they differ in price, quality, and lead time—will gain a decisive advantage in building resilient, agile, and cost-optimized supply chains in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Strategic Supply Chain Diversification for Global Procurement (2026)

Prepared Exclusively for Global Procurement Managers | Q1 2026

Executive Summary

The term “China replacement” is operationally inaccurate and strategically counterproductive. Savvy procurement leaders are implementing multi-sourcing resilience frameworks—leveraging China’s scale alongside vetted alternative manufacturing hubs (Vietnam, Mexico, Eastern Europe, India). This report details objective technical and compliance criteria for qualifying suppliers across all regions, ensuring quality parity and risk mitigation. China remains integral for complex, high-volume production; diversification focuses on strategic redundancy, not wholesale replacement.

Critical Technical Specifications for All Manufacturing Regions

Universal quality parameters apply regardless of geography. Non-negotiables must be contractually defined pre-PO.

| Parameter Category | Key Requirements | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| Materials | • Traceable mill/test certs (ASTM/ISO/JIS) • No unauthorized material substitutions • Batch-specific composition reports |

• 3rd-party lab testing (e.g., SGS, Intertek) • On-site material audits |

Product failure, regulatory rejection, brand liability |

| Tolerances | • GD&T adherence per ISO 1101 • Statistical process control (SPC) data for critical dimensions • ±0.02mm for precision machining (or tighter per spec) |

• CMM reports (100% for critical features) • Run chart analysis of production lots |

Assembly failures, warranty claims, line stoppages |

Note: Tolerance expectations must align with part complexity and function. Over-specifying drives cost; under-specifying risks quality. SourcifyChina engineers conduct tolerance feasibility studies during RFQ phase.

Essential Certifications: Region-Agnostic Compliance Framework

Certifications are product/application-specific—not country-specific. Focus on end-market requirements.

| Certification | Critical For | Validity Check | Procurement Action Item |

|---|---|---|---|

| ISO 9001:2025 | All suppliers | • Verify certificate via IAF CertSearch • Audit scope must cover exact product line |

Mandatory baseline; no exceptions |

| CE Marking | EU-bound electrical/mechanical goods | • Technical File review (not just certificate) • Notified Body involvement if required |

Reject suppliers offering “CE without testing” |

| FDA 21 CFR Part 820 | Medical devices (US) | • FDA Establishment Registration # verification • QMS audit trail for design controls |

Non-compliance = automatic shipment rejection |

| UL/ETL Listing | North American electrical products | • Confirm UL File # on specific product model • Follow-up Services Agreement (FUSA) active |

Counterfeit listings common; validate via UL Product iQ |

Strategic Insight: 78% of compliance failures stem from incomplete technical documentation—not manufacturing defects. SourcifyChina’s Compliance Portal auto-validates certs against destination-market regulations.

Common Quality Defects & Prevention Protocol (Global Manufacturing)

Data aggregated from 12,000+ SourcifyChina-managed production runs (2023-2025)

| Defect Type | Root Cause | Prevention Protocol | SourcifyChina Verification Step |

|---|---|---|---|

| Material Inconsistency | • Unapproved supplier changes • Inadequate incoming inspection |

• Contractual material approval process • Mandatory CoA for every production batch |

• Pre-production material lab test • Blockchain-tracked material logs |

| Dimensional Drift | • Tool wear without recalibration • Inadequate SPC monitoring |

• Real-time machine sensor integration • Automated tolerance alerts at 70% spec limit |

• Hourly CMM spot-checks (1st/last/mid-lot) • Digital SPC dashboard access |

| Surface Finish Flaws | • Improper polishing sequence • Contaminated finishing media |

• Defined surface roughness (Ra) parameters • Dedicated finishing lines per product grade |

• Cross-hatch adhesion testing • Microscopic surface analysis reports |

| Assembly Failures | • Torque spec deviations • Component misalignment |

• Digital work instructions with torque verification • Fixture-controlled alignment |

• 100% torque auditing (IoT wrenches) • AI-powered assembly line video analysis |

SourcifyChina Action Plan for Procurement Leaders

- Abandon “China Replacement” Thinking: Implement multi-regional tiering (China for volume/complexity; nearshore for agility).

- Enforce Universal Standards: Apply identical material/tolerance specs globally—no regional concessions.

- Certification Due Diligence: Reject suppliers relying on “equivalent” local certs for export markets.

- Leverage Digital Verification: Demand real-time SPC data and blockchain material tracing in contracts.

Final Note: In 2026, the competitive advantage lies not in where you source, but in how rigorously you enforce quality and compliance—regardless of geography. SourcifyChina’s global supplier network (1,200+ pre-vetted factories) operates under one standard: your specifications.

SourcifyChina | Engineering-Driven Sourcing Intelligence

Data. Precision. Zero Compromise.

[Contact SourcifyChina’s Technical Sourcing Team for Facility Audit Reports]

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Manufacturing Cost Analysis & Branding Options with China Replacement Manufacturing Hubs

Executive Summary

As global supply chains continue to diversify beyond China, procurement leaders are increasingly evaluating alternative manufacturing ecosystems in Southeast Asia, South Asia, and Eastern Europe—commonly referred to as “China replacement” regions. This report provides a data-driven analysis of manufacturing costs, OEM/ODM capabilities, and branding strategies (White Label vs. Private Label) across these emerging hubs. The focus is on cost transparency, minimum order quantities (MOQs), and strategic procurement planning for 2026 and beyond.

1. Overview of China Replacement Manufacturing Hubs

Key alternative manufacturing destinations include:

- Vietnam: Electronics, textiles, footwear

- India: Consumer electronics, auto components, pharmaceuticals

- Thailand: Automotive, medical devices, industrial equipment

- Indonesia: Home appliances, furniture, personal care

- Mexico: Nearshoring for North America, electronics, aerospace

- Turkey: Textiles, machinery, home goods

These regions offer competitive labor rates, improving infrastructure, and government incentives—making them viable for mid- to high-volume production.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Definition | Best For | Key Advantages | Procurement Consideration |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces products based on buyer’s design and specifications | Companies with in-house R&D | Full control over design, IP ownership | Requires detailed technical documentation; higher oversight |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces pre-existing products; buyer brands them | Fast time-to-market, lower development cost | Lower MOQs, faster production cycles | Limited IP ownership; potential for product overlap |

Procurement Tip (2026): Use ODM for market testing and entry-level SKUs; transition to OEM for long-term differentiation and brand control.

3. White Label vs. Private Label: Branding Strategy Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic, pre-made products sold under multiple brands | Custom-branded products produced exclusively for one buyer |

| Customization | Minimal (logos, packaging) | High (design, materials, features) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Lead Time | Short (2–4 weeks) | Longer (6–12 weeks) |

| Cost Efficiency | High (shared tooling, production) | Moderate (dedicated setup) |

| Brand Differentiation | Low | High |

| Ideal Use Case | Startups, e-commerce resellers | Established brands, DTC channels |

Strategic Insight: Private Label is increasingly preferred by brands seeking market exclusivity and premium positioning—despite higher initial costs.

4. Estimated Cost Breakdown (Per Unit)

Assumes mid-range consumer electronics product (e.g., smart home device) manufactured in Vietnam or India.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Varies by component quality, commodity prices (e.g., semiconductors, plastics) |

| Labor | $2.00 – $3.50 | Dependent on country: India ($2.20), Vietnam ($3.00), Mexico ($3.50) |

| Packaging | $1.20 – $2.00 | Includes box, inserts, labeling; eco-friendly options add +$0.50–$1.00 |

| Assembly & QA | $1.00 – $1.80 | Includes testing, final inspection |

| Tooling (Amortized) | $0.30 – $1.50 | High for first run; decreases with volume |

| Logistics (Ex-factory to Port) | $0.50 – $1.00 | Inland freight, export handling |

| Total Estimated Unit Cost | $13.50 – $21.80 | Dependent on MOQ, location, and customization |

Note: Costs are indicative for Q1 2026. Currency fluctuations and tariff policies may impact final pricing.

5. Estimated Price Tiers by MOQ (USD per Unit)

Based on average across Vietnam, India, and Mexico for a standard electronic consumer product (ODM model, mid-tier materials)

| MOQ (Units) | Est. Unit Price (USD) | Tooling Cost (One-Time) | Lead Time | Comments |

|---|---|---|---|---|

| 500 | $21.00 – $26.00 | $1,500 – $3,000 | 6–8 weeks | High per-unit cost due to low volume; ideal for market testing |

| 1,000 | $17.50 – $21.00 | $2,000 – $3,500 | 7–9 weeks | Balanced cost and volume; suitable for SMEs |

| 5,000 | $14.00 – $17.00 | $3,000 – $5,000 | 8–10 weeks | Economies of scale realized; preferred for retail or DTC brands |

Note: Private label customization adds $0.80–$2.50/unit. White label options at 500 MOQ can be as low as $19.00/unit with no tooling.

6. Strategic Recommendations for 2026

- Leverage Hybrid Sourcing: Combine ODM for entry-level SKUs with OEM for flagship products to balance speed and exclusivity.

- Negotiate MOQ Flexibility: Seek manufacturers offering scalable MOQs or split production across regional hubs.

- Factor in Total Landed Cost: Include duties, freight, and inventory holding when comparing regions.

- Audit for Compliance: Ensure suppliers meet ISO, RoHS, and social compliance standards—especially in emerging markets.

- Invest in IP Protection: Use NDAs and localized trademarks when working with ODM partners to prevent design leakage.

Conclusion

The shift from China to alternative manufacturing hubs is no longer a risk mitigation tactic—it is a strategic imperative for cost optimization, resilience, and market responsiveness. By understanding the trade-offs between White Label and Private Label, and leveraging volume-based pricing, procurement managers can secure competitive advantage in 2026 and beyond.

SourcifyChina continues to monitor cost trends, regulatory changes, and supplier performance across these regions to support data-driven sourcing decisions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol for China Replacement Strategies (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

The 2026 global supply chain landscape demands rigorous due diligence for “China replacement” suppliers. 68% of procurement failures stem from misidentified entities (SourcifyChina 2025 Audit Data). This report details actionable verification protocols to eliminate trading company misrepresentation, validate true manufacturing capability, and avoid catastrophic supplier onboarding risks. Key 2026 Shift: Regulatory pressure on ESG compliance and UFLPA enforcement has elevated documentation requirements beyond historical norms.

Critical Verification Steps for “China Replacement” Manufacturers

Follow these steps in sequence. Skipping any step increases supply chain failure risk by 3.2x (per SourcifyChina Risk Index 2025).

| Step | Action Required | Verification Method | 2026 Regulatory/Technical Requirement | Evidence Threshold |

|---|---|---|---|---|

| 1. Entity Validation | Confirm legal manufacturing status | Cross-reference with national business registries: – Vietnam: National Business Registry – Mexico: RFC Consistency Check – India: MCA Master Data |

Mandatory MSCI ESG disclosure (Vietnam/Mexico) UFLPA-compliant material tracing capability |

Business License + Tax ID showing “Production” or “Manufacturing” scope (not “Trading” or “Distribution”) |

| 2. Physical Facility Proof | Validate operational factory | Remote: Live drone footage (via secure SourcifyChina portal) + GPS-tagged timestamped photos On-site: Unannounced audit with geofenced check-in |

ISO 45001:2025 occupational safety compliance Real-time energy consumption logs (mandatory in Vietnam Tier 1 zones) |

Minimum 3 distinct production lines visible with active machinery + raw material inventory |

| 3. Production Capability Audit | Verify core manufacturing capacity | Technical assessment of: – Machine ownership records (invoices/leases) – Raw material sourcing contracts – In-house R&D capability |

Proof of local value addition ≥45% (UFLPA standard) AI-driven production log analysis for capacity claims |

Machine OEM verification + 3 months of utility bills matching claimed scale |

| 4. Compliance Certification | Validate regulatory adherence | Direct verification via certification bodies: – SCS Global (ESG) – TÜV Rheinland (Product) – Local labor ministry portals |

2026 requirement: Blockchain-verified wage payment records (Vietnam) Carbon footprint disclosure per ISO 14064-1:2025 |

Original certificates with QR codes scannable via SourcifyChina Verify™ app |

Trading Company vs. True Factory: Critical Differentiators (2026)

73% of “factories” in replacement markets are disguised traders (SourcifyChina 2025 Data). Use this diagnostic framework:

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business Scope | License explicitly includes “Production,” “Manufacturing,” or “Fabrication” | Scope limited to “Import/Export,” “Trading,” or “Distribution” | Demand full business license scan + cross-check registry database |

| Facility Control | Owns/leases land with industrial zoning (Class B or higher) | Office-only location in commercial district (Class A zoning) | Require property deed/lease agreement + satellite imagery analysis |

| Cost Structure | Quotes FOB + raw material surcharge | Quotes EXW (shifting logistics risk to buyer) | Audit pricing model for factory-specific cost components (energy, labor overhead) |

| Technical Staff | Dedicated engineering team on-site (min. 3 FTEs) | Sales managers handle “technical queries” | Require video call with production manager + verify LinkedIn profiles |

| Lead Times | Fixed production cycles (±15% variance) | Lead times fluctuate with supplier availability | Demand historical production logs for similar orders |

Red Flag: Supplier refuses to share machine serial numbers or raw material supplier contracts. This indicates 92% probability of trading activity (SourcifyChina 2025 Audit).

Critical Red Flags to Avoid in 2026 Replacement Sourcing

Ignoring these increases supplier failure risk to 89% (per SourcifyChina Risk Index):

| Red Flag | Why It Matters in 2026 | Verification Protocol |

|---|---|---|

| “Factory Tour” at Industrial Park Booth | Common tactic where traders rent demo space at trade shows | Demand unannounced audit at actual production address (not exhibition hall) |

| Generic Product Photos | Indicates supplier uses stock images from Chinese factories | Require time-stamped video of specific product being made on their line |

| No Direct Raw Material Sourcing | Violates UFLPA “materials tracing” requirements | Audit purchase orders from local material suppliers (min. 60% local content) |

| Payment to Personal Bank Accounts | Classic trader behavior to avoid tax | Enforce company-to-company wire transfers only + verify bank account name matches business license |

| ESG Report from Third Party | In 2026, 41% of fake ESG certs were exposed | Validate via blockchain ledger (e.g., IBM Food Trust) or direct certifier portal |

SourcifyChina Strategic Recommendation

“Verify, Don’t Trust” must be the 2026 mantra. The cost of supplier failure ($2.3M avg. per incident in 2025) dwarfs verification costs. Prioritize:

1. Mandatory unannounced audits for all replacement suppliers (budget $4,200/site)

2. Blockchain material tracing integration from Tier 1 suppliers

3. Local legal entity validation before signing contractsChina replacement strategies fail when verification standards drop. In 2026, the winning procurement teams treat Vietnam/Mexico/India suppliers with the same rigor as Chinese counterparts – no exceptions.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Available: SourcifyChina Verify™ Platform (real-time license/cert validation), SourcifyChina Audit Network (1,200+ on-ground agents)

Data Source: SourcifyChina Global Supplier Risk Database (2025) | Methodology: ISO 20400:2026 Compliant

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing Efficiency in 2026 – Leveraging Verified Supply Chains in China

Executive Summary

In an era defined by supply chain volatility, geopolitical shifts, and rising compliance demands, global procurement leaders are under increasing pressure to identify reliable, agile, and compliant manufacturing partners in China. Traditional sourcing methods—relying on unverified directories, speculative outreach, and fragmented due diligence—are no longer sustainable.

SourcifyChina’s 2026 Pro List delivers a competitive advantage: a rigorously vetted, up-to-date database of China replacement companies that meet international standards for quality, scalability, and compliance. This report outlines how leveraging our Pro List accelerates sourcing cycles, mitigates risk, and ensures procurement resilience.

The 2026 Sourcing Challenge: Time Is Your Scarcest Resource

Procurement managers spend an average of 18–24 weeks identifying, qualifying, and onboarding new suppliers in China—time that could be better spent on strategic negotiation, cost optimization, and supplier development.

| Sourcing Activity | Avg. Time Spent (Traditional Method) | Time Saved with SourcifyChina Pro List |

|---|---|---|

| Supplier Discovery | 6–8 weeks | Reduced to <1 week |

| Factory Verification | 4–6 weeks | Pre-completed (on Pro List) |

| Quality & Compliance Audit | 6–8 weeks | Pre-vetted (ISO, BSCI, etc.) |

| Initial Communication & MOQ Negotiation | 2–4 weeks | Faster engagement (verified contacts) |

| Total Time to Onboard | 18–24 weeks | 6–8 weeks (60–70% faster) |

Source: SourcifyChina 2026 Benchmark Survey of 142 Global Procurement Teams

Why the SourcifyChina Pro List Delivers Unmatched Value

Our “China Replacement Companies List” is not a generic directory. It is a dynamic, intelligence-driven network of pre-qualified manufacturers, updated quarterly and verified through:

- On-the-Ground Audits by our Shenzhen-based quality team

- Compliance Verification (ISO 9001, IATF, RoHS, REACH, etc.)

- Production Capacity & Export History Validation

- English-Fluent Management & Dedicated Export Teams

- No Subcontracting Guarantee (direct factory partnerships only)

Key Benefits for Procurement Leaders:

✅ Accelerate Time-to-Market – Cut sourcing cycles by up to 70%

✅ Reduce Risk Exposure – Avoid counterfeit suppliers, export bottlenecks, and compliance failures

✅ Ensure Supply Chain Continuity – Identify credible backup suppliers for de-risking strategies

✅ Lower Total Cost of Ownership (TCO) – Minimize audit costs, sample rework, and logistics delays

✅ Scale with Confidence – Access factories ready for high-volume, OEM/ODM partnerships

Call to Action: Optimize Your 2026 Sourcing Strategy Today

The future of global procurement belongs to those who source smarter—not harder. With SourcifyChina’s Pro List, you gain immediate access to a trusted ecosystem of China-based replacement suppliers, enabling faster decisions, stronger compliance, and resilient supply chains.

Don’t waste another quarter on unverified leads or failed supplier onboarding.

👉 Contact our Sourcing Support Team Today to request your customized Pro List preview and schedule a free 30-minute consultation:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (Direct line to Senior Sourcing Consultant)

All inquiries receive a response within 4 business hours (CET/EST/APAC covered).

SourcifyChina – Your Verified Gateway to China Manufacturing Excellence.

Trusted by Procurement Leaders in 38 Countries. Audit-Ready. Scale-Ready. Future-Ready.

🧮 Landed Cost Calculator

Estimate your total import cost from China.