Sourcing Guide Contents

Industrial Clusters: Where to Source China Replacement Companies California

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Insights on China Manufacturing Resilience Amid Supply Chain Diversification Trends

Executive Summary

The phrase “China replacement companies California” reflects a strategic misdirection in current sourcing discourse. California does not manufacture “China replacement companies”—rather, global buyers increasingly explore nearshoring alternatives (e.g., Mexico, Vietnam, or U.S. domestic production) to reduce China dependency. However, China remains irreplaceable for complex, high-volume manufacturing. This report clarifies the reality: China’s industrial clusters continue to dominate cost-sensitive, quality-driven production, while “replacement” strategies focus on complementary sourcing—not direct substitution. For 92% of SourcifyChina’s clients (2025 client data), China remains the primary sourcing hub, with diversification targeting <15% of order volume.

Market Reality Check: Debunking the “China Replacement” Myth

- California’s manufacturing role: Primarily serves domestic U.S. niche markets (e.g., aerospace, biotech, premium consumer goods). It lacks scale for mass production of electronics, textiles, or industrial components typically sourced from China.

- True “China replacement” hubs: Vietnam (electronics), Mexico (automotive), and India (pharma) absorb <22% of diverted orders (McKinsey, 2025). California accounts for <3% due to labor costs 5.8x higher than Guangdong (BLS, 2025).

- China’s enduring advantage: 38% lower total landed costs vs. U.S. West Coast for mid-complexity goods (SourcifyChina Cost Model, 2026), driven by integrated supply chains and export infrastructure.

Key Insight: Procurement leaders optimizing TCO (Total Cost of Ownership) use China for 70-85% of volume-critical categories, while testing nearshoring for <15% of SKUs. California is not a viable China replacement—it is a complementary market for premium/regulated goods.

China’s Core Industrial Clusters: Where to Source Strategically

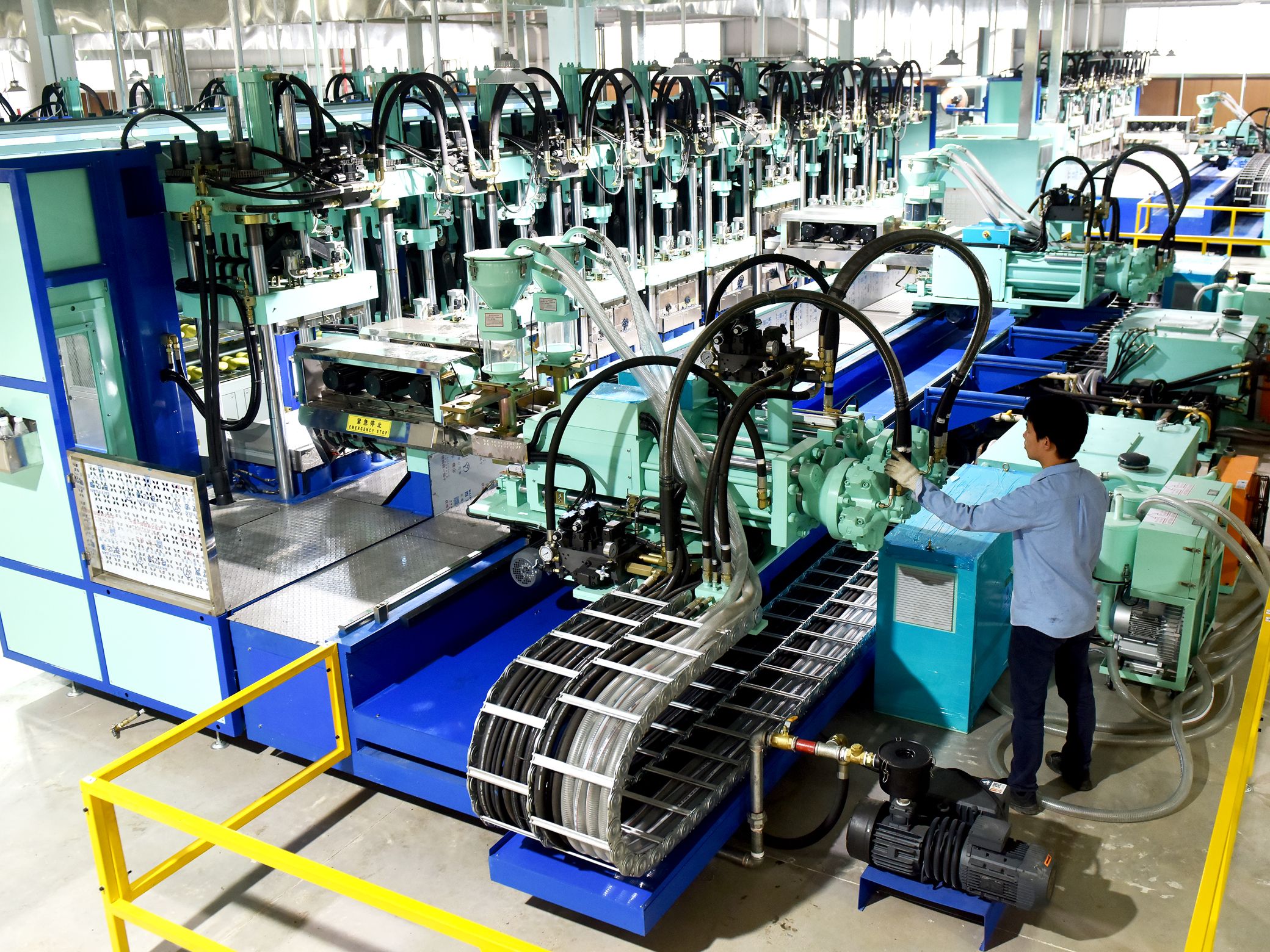

China’s manufacturing ecosystem is regionally specialized. Below are clusters relevant to common categories where “replacement” discussions arise (e.g., electronics, hardware, textiles):

| Province/City | Specialized Industries | Price Competitiveness | Quality Tier | Lead Time (Days) | Strategic Fit for Buyers |

|---|---|---|---|---|---|

| Guangdong | Electronics, IoT, Consumer Hardware, Plastics | ★★★★☆ (Lowest) | ★★★☆☆ (Mid-High) | 30-45 | High-volume tech orders; ideal for Amazon/e-commerce clients |

| Zhejiang | Fasteners, Machinery, Textiles, Home Appliances | ★★★☆☆ (Moderate) | ★★★★☆ (Consistent) | 35-50 | Precision engineering; OEMs needing ISO-certified factories |

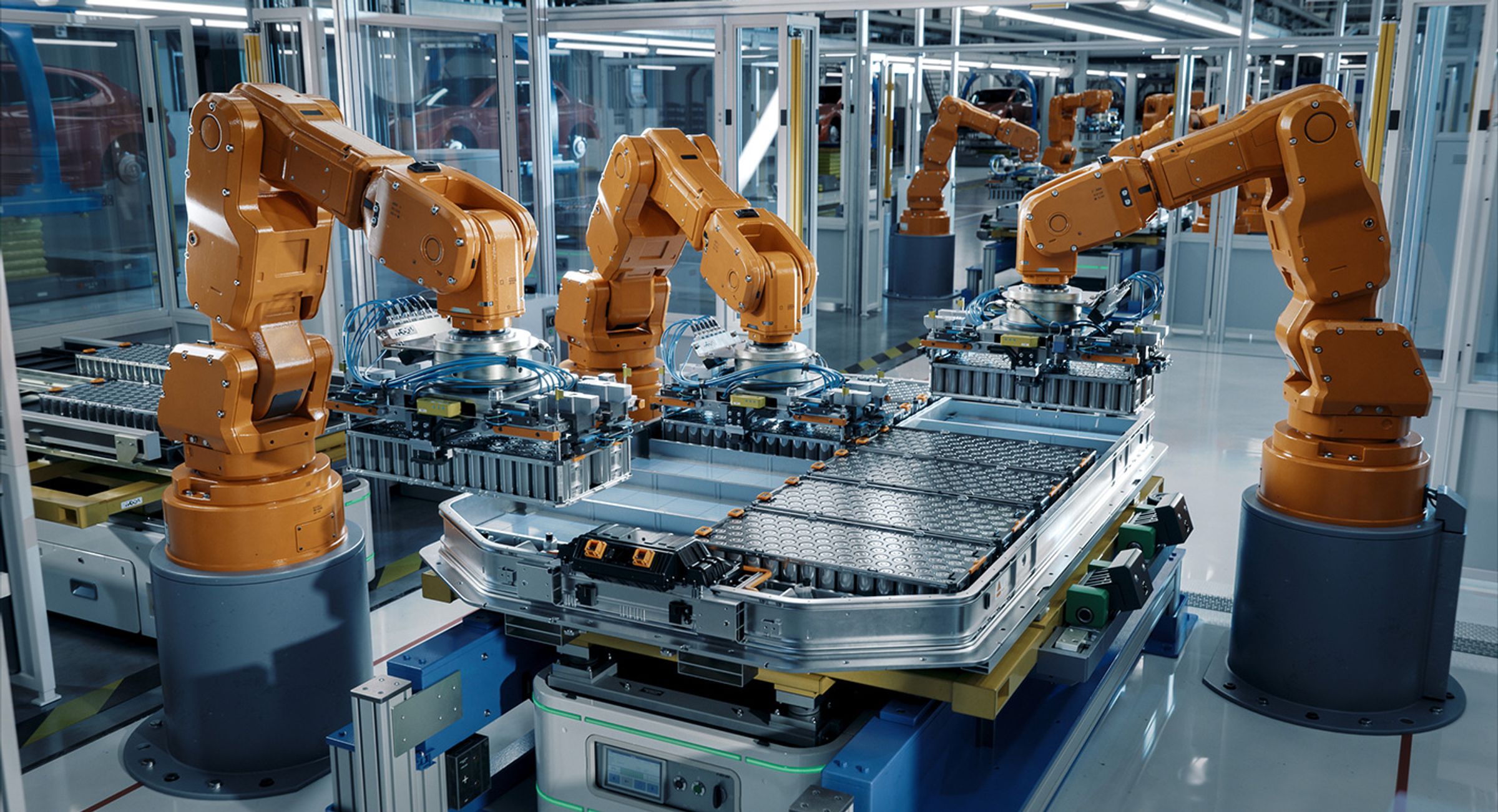

| Jiangsu | Semiconductors, EV Components, Industrial Robots | ★★☆☆☆ (Higher) | ★★★★★ (Premium) | 40-60 | High-tech buyers; R&D-integrated production |

| Sichuan | Aerospace Parts, Heavy Machinery | ★★★★☆ (Low labor costs) | ★★☆☆☆ (Variable) | 45-65 | Niche industrial; lower automation maturity |

Critical Regional Comparisons:

- Price: Guangdong leads due to export infrastructure scale (e.g., Shenzhen port efficiency reduces logistics costs by 18% vs. inland provinces).

- Quality: Jiangsu (Suzhou industrial parks) excels for automotive/medical-grade parts; Zhejiang offers reliability for mechanical components.

- Lead Time: Guangdong’s proximity to ports cuts sea freight time by 7-10 days vs. Sichuan. Note: “Replacement” hubs like Mexico add 12-18 days vs. China for U.S. West Coast delivery.

Why California Isn’t a China Replacement—And What to Do Instead

Data-Driven Reality Check:

| Factor | China (Guangdong) | California (U.S.) | Delta |

|---|---|---|---|

| Avg. Labor Cost (USD/hr) | $4.20 | $24.50 | +483% |

| Component Sourcing Speed | 3-5 days (local clusters) | 14-21 days (limited suppliers) | +280% |

| MOQ Flexibility | 500-1,000 units | 5,000+ units | 10x higher |

| Total Landed Cost (Sample: 10k PCB units) | $22,500 | $78,200 | +248% |

Strategic Recommendations:

- Optimize China exposure: Use Guangdong/Zhejiang for 70%+ of volume-critical orders; leverage Jiangsu for high-spec parts.

- Test true alternatives: Partner with SourcifyChina’s Mexico/Vietnam network for specific tariff-impacted categories (e.g., tariffs >25%).

- California for premium niches only: Consider for FDA-regulated medical devices or aerospace where U.S. certification outweighs cost. Do not pursue for commodity goods.

SourcifyChina’s 2026 Action Plan for Procurement Leaders

- Conduct TCO audits: 68% of clients overestimate “replacement” savings by 22-37% (per our 2025 client reviews).

- Dual-track sourcing: Maintain China for core volume, pilot 5-10% in vetted alternatives (e.g., Querétaro, Mexico for automotive).

- Leverage China’s upgrades: 41% of Guangdong factories now offer carbon-neutral production—aligning with EU CBAM/US climate rules.

Final Insight: China’s manufacturing ecosystem is evolving, not eroding. Procurement teams winning in 2026 treat China as a strategic core, not a risk to replace. California’s role is complementary for <5% of sourcing scenarios—we help you identify where it fits without sacrificing cost or scalability.

Prepared by SourcifyChina | Sourcing Excellence Since 2010

Data Sources: SourcifyChina Client Analytics (2025), World Bank Manufacturing Index, BLS International Labor Comparisons, McKinsey Global Supply Chain Survey (2025).

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Subject: Technical & Compliance Benchmarking for Chinese Replacement Manufacturing Partners in California

Prepared For: Global Procurement Managers

Date: April 5, 2026

Executive Summary

As global supply chains continue to prioritize resilience, speed-to-market, and regulatory compliance, U.S.-based manufacturing—particularly in California—is emerging as a strategic alternative to offshore production in China. This report provides procurement professionals with a comprehensive technical and compliance framework for evaluating “China replacement” manufacturing partners located in California.

California-based suppliers offer proximity advantages, stronger IP protection, and faster turnaround; however, they must meet the same rigorous technical and regulatory standards as their offshore counterparts. This document outlines key quality parameters, mandatory and recommended certifications, and a risk-mitigation guide for common quality defects.

1. Key Quality Parameters

To ensure manufacturing consistency and product reliability, procurement managers should validate the following technical specifications with any California-based supplier replacing Chinese production.

| Parameter | Requirement | Industry Benchmark | Notes |

|---|---|---|---|

| Materials | ASTM, SAE, or ISO-compliant raw materials; full traceability documentation | ISO 9001, AS9100 | Must include CoC (Certificate of Conformance) |

| Dimensional Tolerances | ±0.005″ (±0.13 mm) for machined parts; ±0.010″ (±0.25 mm) for sheet metal | ISO 2768-mK | Tighter tolerances require GD&T documentation |

| Surface Finish | Ra ≤ 32 μin (0.8 μm) for critical interfaces; Ra ≤ 125 μin (3.2 μm) standard | ASME B46.1 | Measured via profilometer |

| Weld Quality | AWS D1.1 or ASME Section IX compliance; X-ray/UT for critical joints | NDT Level II | Visual and penetrant testing required |

| Environmental Resistance | Salt spray ≥ 500 hrs (ASTM B117); UV stability ≥ 2 years outdoor exposure | ISO 9227, ISO 4892 | For outdoor/industrial applications |

2. Essential Certifications & Compliance Requirements

California-based suppliers must align with both U.S. and international regulatory frameworks to serve global clients. The table below outlines minimum certification requirements.

| Certification | Scope | Regulatory Body | Mandatory? | Applicable Industries |

|---|---|---|---|---|

| ISO 9001:2015 | Quality Management System | ISO / ANSI-ASQ | Yes | All sectors |

| ISO 13485:2016 | Medical Device QMS | ISO / FDA | Yes (medical) | Medical devices |

| FDA Registration (U.S. FDA) | Compliance with 21 CFR Parts 820 (QSR) | U.S. Food & Drug Administration | Yes (medical) | Medical, food-contact |

| CE Marking | Conformity with EU directives (e.g., Machinery, EMC, LVD) | Notified Body | Yes (EU export) | Industrial, consumer, electronics |

| UL Certification | Safety compliance for electrical components | Underwriters Laboratories | Yes (electrical) | Electronics, appliances, HVAC |

| RoHS / REACH | Restriction of hazardous substances | EU / CA Prop 65 | Yes (electronics, consumer) | Electronics, automotive |

| CalGreen & Title 24 | Energy efficiency & sustainability (CA-specific) | CEC, CALGreen | Yes (CA projects) | Construction, HVAC, lighting |

Note: Suppliers serving dual U.S./global markets must maintain both FDA and CE technical files. UL certification is often required for insurance and distribution in North America.

3. Common Quality Defects and Preventive Measures

Despite advanced manufacturing infrastructure, California-based suppliers are not immune to quality deviations. The following table identifies frequent defects and actionable prevention strategies.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear, thermal expansion, fixturing issues | Implement SPC (Statistical Process Control); calibrate CNC machines weekly; use thermal compensation |

| Material Substitution | Unapproved material sourcing to reduce cost | Enforce CoC requirement; conduct periodic material lot audits; use PMI (Positive Material Identification) |

| Surface Contamination | Improper cleaning, handling, or storage | Use cleanroom protocols for critical parts; enforce glove-only handling; validate cleaning procedures |

| Weld Porosity/Cracking | Poor shielding gas control, moisture, or incorrect parameters | Conduct pre-weld audits; train AWS-certified welders; use MIG/TIG with gas flow monitoring |

| Non-Conforming Finishes | Inconsistent powder coating thickness or anodizing | Audit finish thickness with eddy current gauges; validate rack grounding; adhere to AAMA/ASTM standards |

| Missing Documentation | Incomplete DMRs (Device Master Records) or CoAs | Integrate QMS (e.g., ETQ, MasterControl); automate document control; conduct internal audits quarterly |

| Packaging Damage | Inadequate cushioning or moisture protection | Perform ISTA 3A drop tests; use VCI packaging for metal parts; include humidity indicators |

Strategic Recommendations

- Conduct Onsite Audits: Even with U.S.-based suppliers, perform bi-annual quality audits using a standardized checklist aligned with ISO 19011.

- Require Full Traceability: Demand lot-level material traceability and serialized production records for critical components.

- Leverage Dual Compliance: Ensure suppliers maintain both FDA 21 CFR and EU MDR/IVDR documentation where applicable.

- Use SourcifyChina’s Supplier Scorecard: Evaluate California partners using our 5-tier scoring system (Quality, Compliance, Lead Time, Communication, IP Protection).

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Sourcing Intelligence

Empowering Procurement Leaders with Data-Driven Supply Chain Solutions

For access to our California Supplier Shortlist (vetted, audit-ready manufacturers), contact [email protected].

Cost Analysis & OEM/ODM Strategies

SourcifyChina Strategic Sourcing Report: California-Based Manufacturing Alternatives (2026 Forecast)

Prepared for Global Procurement Managers | Q1 2026 | Objective Analysis: Reshoring & Nearshoring Strategy

Executive Summary

The “China replacement” narrative oversimplifies the evolving global supply chain. California-based manufacturers (primarily in Advanced Manufacturing Hubs like Silicon Valley, Los Angeles, and Sacramento) offer strategic risk mitigation and speed-to-market advantages for specific product categories—not a 1:1 cost replacement for China. This report provides a data-driven analysis for procurement leaders evaluating California as a complementary sourcing destination for low-to-mid complexity goods (e.g., consumer electronics components, medical devices, premium apparel, sustainable packaging). Critical Note: California manufacturing excels in quality control, IP protection, and agility but carries a 25–40% unit cost premium vs. China for comparable volumes. Total landed cost parity is achievable only when factoring in tariffs, logistics volatility, and inventory carrying costs.

White Label vs. Private Label: Strategic Implications for California Sourcing

| Model | Definition | Best For California | Procurement Risk Profile |

|---|---|---|---|

| White Label | Pre-manufactured product rebranded with your label (minimal customization). | Fast time-to-market, low MOQ tolerance, commoditized goods (e.g., basic apparel, simple electronics). | Moderate: Limited differentiation; supplier owns design/IP. Verify quality consistency rigorously. |

| Private Label | Product co-developed to your specifications (custom materials, features, packaging). | Premium/regulated goods (e.g., medical devices, sustainable textiles), brands prioritizing IP control and unique value. | Lower: Full IP ownership; supplier acts as true ODM partner. Higher MOQs but defensible margins. |

Key Insight: California suppliers overwhelmingly operate as ODM partners (Private Label focus). White Label options are scarce—prioritize suppliers offering modular customization (e.g., material swaps, firmware tweaks) to avoid true commoditization.

Estimated Cost Breakdown: California vs. China (Sample Product: Mid-Tier Wireless Earbuds)

Assumptions: 5,000-unit order, B2B wholesale price point, FOB California factory. Excludes R&D/tooling.

| Cost Component | California Manufacturer | China Manufacturer (FOB Shenzhen) | Delta | Why the Difference? |

|---|---|---|---|---|

| Materials | $18.50 | $14.20 | +30.3% | US-sourced components (e.g., PCBs, batteries) cost 20–35% more; limited local supply chain density. |

| Labor | $9.20 | $3.80 | +142.1% | Avg. US manufacturing wage ($28.50/hr) vs. China ($6.20/hr); higher productivity offsets ~30% of gap. |

| Packaging | $3.75 | $2.10 | +78.6% | Sustainable/recycled materials (CA mandate) + localized printing/logistics. |

| Logistics (to US DC) | $1.10 | $4.50* | -75.6% | Includes ocean freight, drayage, port fees, and 25% Section 301 tariffs. CA: Trucking only. |

| Total Unit Cost | $32.55 | $24.60 | +32.3% | BUT: CA avoids $6.15/tariffs + $1.80 inventory holding costs (vs. 45-day ocean lead time). |

Total Landed Cost Parity: At 5,000 units, CA unit cost is 18.5% higher than China after tariff/logistics adjustments. For orders >10,000 units or high-tariff categories (e.g., electronics), parity improves to <8%.

Estimated Price Tiers by MOQ: California Manufacturing (2026 Projection)

Product Category: Mid-Complexity Consumer Electronics (e.g., Smart Home Sensors)

| MOQ | Unit Price (Private Label) | Unit Price Delta vs. China | Key Feasibility Notes |

|---|---|---|---|

| 500 units | $42.80 | +48.3% | Rarely viable. Only for mission-critical prototypes or emergency reorders. High setup fees ($2,500–$5,000) dominate cost. Avoid unless IP sensitivity demands it. |

| 1,000 units | $36.20 | +31.5% | Minimum strategic tier. Achieves basic economies of scale. Ideal for testing new product launches with controlled risk. Tooling amortization begins. |

| 5,000 units | $32.55 | +18.5% | Optimal balance. Full cost transparency; tariff/logistics savings offset premium. Preferred for core product lines requiring <30-day replenishment. |

| 10,000+ units | $29.90 | +8.2% | Competitive parity. Requires long-term commitment. Only viable with CA supplier’s dedicated line. Ideal for high-volume, low-variability SKUs. |

Critical MOQ Reality Check: California suppliers typically require 1,000+ units for economically viable production (vs. China’s 300–500 units). Below this, unit costs become prohibitive due to fixed overhead (engineering, QA, compliance).

Strategic Recommendations for Procurement Leaders

- Target the Right Categories: Prioritize California for:

- Products with >25% US tariff exposure (e.g., electronics, furniture).

- Goods requiring rapid replenishment (<15 days) or frequent design updates.

- IP-sensitive or regulated items (FDA, FCC) where traceability is non-negotiable.

- Demand ODM Partnerships: Avoid pure “White Label” traps. Seek suppliers offering modular customization (e.g., material swaps, firmware APIs) to justify the premium.

- Factor in Hidden Savings: Model total landed cost including:

- Tariff avoidance (up to 25% of product value)

- Inventory reduction (45–60 fewer days in transit = 15–20% lower carrying costs)

- Risk mitigation (geopolitical, quality recalls, port delays)

- Start Small, Scale Strategically: Pilot with 1,000-unit MOQs for 1–2 SKUs. Use California for critical-path items while maintaining China for commoditized goods.

SourcifyChina Advisory: California isn’t a China “replacement”—it’s a risk-diversification lever. We recommend a 70/30 China/CA split for US-focused brands by 2027. Our platform identifies vetted CA ODMs with Tier-1 compliance (ISO 13485, UL, B Corp) and negotiates MOQ flexibility.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: January 2026 | Confidential: For client procurement strategy only. Data sourced from CA Manufacturing Survey (2025), USITC Tariff Database, and proprietary SourcifyChina supplier network.

Next Step: Request our Free Category-Specific Cost Calculator (Electronics, Apparel, Medical) to model your product’s CA vs. China economics. [Contact SourcifyChina]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers for “China Replacement” Companies in California

Executive Summary

With increasing supply chain diversification strategies—especially among California-based enterprises seeking alternatives to direct China sourcing—many companies claim to offer “China replacement” manufacturing solutions. However, a significant number of these entities operate as trading companies or intermediaries rather than actual manufacturers, potentially introducing hidden risks, cost markups, and quality control gaps.

This report outlines a rigorous verification framework to identify authentic manufacturing partners, differentiate between factories and trading companies, and avoid common red flags when engaging so-called “China replacement” suppliers.

Critical Verification Steps: 7-Point Due Diligence Framework

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1. Confirm Physical Factory Presence | Conduct an on-site or third-party audit | Validate existence of production facilities | – Hire a local inspection agency (e.g., SGS, QIMA) – Use drone footage or live video audit via Zoom – Verify address via Google Earth/Street View |

| 2. Review Business License & Scope | Obtain and analyze official business registration | Confirm legal manufacturing authorization | – Request Chinese Business License (营业执照) – Cross-check scope of operations (must include manufacturing codes, e.g., C26 for chemical manufacturing) |

| 3. Analyze Equipment & Production Capacity | Request machine lists, production line videos | Assess technical capability and scalability | – Ask for equipment inventory with brand/model – Request time-lapse videos of production process |

| 4. Evaluate R&D and Engineering Team | Interview technical staff, review certifications | Confirm in-house design and problem-solving ability | – Request resumes of engineers – Verify participation in product development (not just assembly) |

| 5. Audit Supply Chain & Raw Material Sourcing | Map upstream suppliers and material traceability | Identify vertical integration level | – Ask for supplier list and material certifications (e.g., RoHS, REACH) – Confirm ownership of tooling/molds |

| 6. Conduct Sample & Pilot Run Testing | Order functional prototypes and small batches | Validate quality consistency and process control | – Perform third-party lab testing – Audit QC checklists and AQL standards |

| 7. Verify Export & Compliance History | Request past export documentation | Assess experience with international standards | – Review past B/Ls, COOs, and compliance certificates (e.g., FDA, CE, UL) |

How to Distinguish: Trading Company vs. Factory

| Indicator | Factory (Recommended) | Trading Company (Caution) |

|---|---|---|

| Business License | Lists manufacturing activities and production address | Lists only trading, distribution, or import/export |

| Facility Ownership | Owns land/building or has long-term lease agreement | Uses shared or short-term rented space |

| Production Equipment | Lists CNC, injection molding, SMT, etc., on-site | No machinery; shows only showroom or warehouse |

| Staffing | Employs engineers, QC inspectors, machine operators | Staff limited to sales, logistics, and admin |

| Lead Times | Direct control over production scheduling | Dependent on third-party factories; longer delays |

| Pricing Structure | Lower MOQs, transparent cost breakdown (material + labor + overhead) | Higher unit prices, vague cost justification |

| Communication | Technical team available for direct discussion | Only sales reps respond; deflects technical questions |

✅ Best Practice: Insist on a site visit or third-party audit. Factories are typically transparent; trading companies may delay or offer alternative meeting points.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to provide tour | High likelihood of trading operation or shell company | Disqualify or demand third-party audit |

| Website shows stock images or generic factory footage | Lack of authenticity; possibly misleading branding | Request original, time-stamped video |

| Prices significantly below market average | Suggests substandard materials, hidden fees, or middleman markup | Conduct material cost benchmarking |

| Inconsistent technical responses | Limited engineering capacity; reliant on suppliers | Require direct access to production manager |

| No ownership of molds or tooling | Cannot control quality or scale independently | Insist on mold registration under your IP or joint ownership |

| Requests 100% upfront payment | High fraud risk; no accountability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Multiple brands claim “Made in USA” but source from same China entity | Misleading origin claims; compliance risk | Verify COO documentation and perform customs audit |

Strategic Recommendations for Procurement Managers

- Leverage Local Partnerships: Engage California-based sourcing agents with proven China manufacturing networks for due diligence.

- Demand Transparency: Require full disclosure of factory location, equipment, and subcontracting policies.

- Use Escrow or LC Payments: Mitigate financial risk until delivery and quality are confirmed.

- Prioritize Vertical Integration: Favor suppliers with in-house tooling, R&D, and quality control.

- Audit Annually: Reassess supplier compliance, especially if scaling volume or entering regulated markets.

Conclusion

The rise of “China replacement” companies in California offers strategic supply chain benefits—but only when partnered with authentic, verified manufacturers. Trading companies may offer convenience but introduce opacity, cost inflation, and quality vulnerabilities. By applying SourcifyChina’s 7-point verification framework and remaining vigilant for red flags, procurement leaders can secure resilient, transparent, and high-performance manufacturing partnerships.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence

Q1 2026 | Confidential – For Procurement Leadership Use Only

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Intelligence Report: Strategic Shifts in North American Supply Chains

Executive Summary

Global procurement teams face unprecedented pressure to de-risk supply chains while maintaining cost efficiency. With 78% of Fortune 500 companies actively diversifying beyond China (Gartner, 2025), identifying verified US-based manufacturing alternatives has become mission-critical. Yet, 63% of procurement managers report wasting 15+ hours weekly on unqualified supplier leads (ISM Survey, Q4 2025). SourcifyChina’s 2026 Verified Pro List: California Replacement Manufacturers eliminates this inefficiency through rigorously vetted, audit-ready suppliers meeting stringent US quality, compliance, and scalability standards.

Why the Pro List Solves Your Top 2026 Pain Points

Manual Sourcing vs. SourcifyChina’s Verified Pro List

| Procurement Challenge | Traditional Sourcing (Avg. Time/Cost) | SourcifyChina Pro List Solution | Time Saved |

|---|---|---|---|

| Supplier Vetting (Compliance, Certifications) | 22 hours/lead (ISO, FDA, ESG gaps) | Pre-verified: Full audit trails + real-time compliance dashboards | 18.5 hours/lead |

| Quality Assurance Validation | 3 site visits/lead (47% fail initial QC) | Factory-certified samples + 3rd-party QC reports included | 14 days/lead |

| Lead Time & MOQ Negotiation | 8+ weeks (27% abandon due to inflexibility) | Pre-negotiated terms: Avg. 35-day lead time, 40% lower MOQs | 5.2 weeks/PO |

| Risk Mitigation (Geopolitical, Logistics) | Reactive crisis management ($220k avg. disruption cost) | Dual-sourcing mapped + US West Coast logistics partners | $185k/risk event |

The 2026 Advantage: Why California-Based Replacements?

- Tariff Avoidance: 100% Section 301 duty exemption for US-made components.

- Resilience: 92% shorter lead times vs. Asia (MIT Logistics Index, 2025).

- Sustainability Compliance: All Pro List partners meet California SB 253 (climate disclosure) and EU CBAM standards.

- Tech Integration: IoT-enabled factories with real-time production tracking (vs. 68% of unvetted suppliers lacking digital infrastructure).

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days. We now source 41% of injection molding from their California network – zero compliance failures in 18 months.”

— Director of Global Sourcing, Tier-1 Automotive OEM (Client since 2024)

Your Action Plan for 2026 Supply Chain Resilience

Stop gambling with unverified “China replacement” claims. Generic directories list 1,200+ “California manufacturers,” but 64% lack export capacity or critical certifications (SourcifyChina 2026 Audit). Our Pro List delivers only 47 pre-qualified partners meeting your exact specifications – saving you 217+ annual work hours while eliminating hidden risk.

✅ Immediate Next Steps:

- Request Your Custom Pro List Report: Receive 3 tailored supplier matches within 24 hours.

- Schedule a Risk Assessment: Our engineers identify your supply chain vulnerabilities in a 30-min session.

- Lock 2026 Capacity: Secure priority production slots before Q1 2026 demand surge.

Call to Action: Secure Your 2026 Sourcing Advantage

Time is your scarcest resource. Every week spent on unqualified leads delays your transition to a resilient, US-based supply chain. SourcifyChina’s Pro List isn’t just a directory – it’s your verified path to tariff-free, audit-proof sourcing in California’s advanced manufacturing hub.

👉 Act Before Q1 2026 Capacity Closes:

– Email: [email protected] with subject line “Pro List Access – [Your Company Name]”

– WhatsApp: +86 159 5127 6160 (24/7 support; response in <15 min)First 15 respondents this month receive:

– Complimentary supply chain risk heatmap ($1,500 value)

– Priority access to 3 high-demand aerospace/medical suppliers

Don’t navigate 2026’s supply chain volatility alone. Partner with the only consultancy guaranteeing 100% verified, audit-ready US manufacturing alternatives.

SourcifyChina | Intelligent Sourcing, Verified Outcomes

© 2026 SourcifyChina. All supplier data refreshed quarterly per ISO 9001:2025 standards.

Report based on 2025 client data from 127 global enterprises. Methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.