Sourcing Guide Contents

Industrial Clusters: Where to Source China Rendering Company

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Rendering Services from China

Executive Summary

As global demand for high-fidelity 3D visualization, architectural rendering, product visualization, and VFX continues to grow, China has emerged as a competitive hub for rendering services. While traditionally known for manufacturing, China’s digital infrastructure and skilled technical workforce have positioned it as a strategic sourcing destination for rendering services—particularly for cost-effective, high-throughput production.

This report provides a comprehensive market analysis of China’s rendering service industry, identifying key industrial clusters, evaluating regional strengths, and offering a comparative assessment to guide procurement decisions.

Market Overview: China’s Rendering Services Sector

The term “rendering company” in China refers to specialized studios or tech firms offering 3D rendering, animation, and visualization services across industries including architecture, real estate, e-commerce, automotive design, and entertainment.

China’s rendering ecosystem is supported by:

– High concentration of skilled 3D artists and software engineers

– Government-backed digital economy initiatives

– Competitive pricing due to lower labor and operational costs

– Advanced cloud rendering infrastructure (e.g., Alibaba Cloud, Tencent Cloud)

Although not a traditional “manufacturing” sector, rendering services are increasingly treated as a digital production process—making China a compelling offshore outsourcing destination.

Key Industrial Clusters for Rendering Services in China

China’s rendering services are concentrated in major technology and creative hubs, where digital talent, infrastructure, and client ecosystems converge.

| Province/City | Key Cities | Industry Focus | Notable Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | Architectural, Product, Real Estate Visualization | Proximity to manufacturing clients; strong export orientation; high-tech infrastructure |

| Zhejiang | Hangzhou, Ningbo | E-commerce, Consumer Product Rendering | Home to Alibaba; strong digital commerce ecosystem; agile project turnaround |

| Jiangsu | Suzhou, Nanjing | Industrial Design, Automotive, VR/AR | Advanced R&D facilities; integration with engineering firms |

| Beijing | Beijing | High-end VFX, Film, Government Projects | Top-tier talent; premium service providers; strong IP protection awareness |

| Shanghai | Shanghai | Luxury Branding, Architecture, International Clients | Bilingual teams; global standards compliance; premium quality output |

Regional Comparison: Rendering Service Providers (2026 Benchmark)

The table below compares key sourcing regions based on critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness (1–5) | Quality Level (1–5) | Average Lead Time (Standard Project) | Best For |

|---|---|---|---|---|

| Guangdong | 5 ⭐⭐⭐⭐⭐ | 4 ⭐⭐⭐⭐☆ | 7–14 days | High-volume architectural & product rendering; cost-sensitive buyers |

| Zhejiang | 4.5 ⭐⭐⭐⭐☆ | 4 ⭐⭐⭐⭐☆ | 5–10 days | E-commerce visuals; fast turnaround; Alibaba-integrated workflows |

| Jiangsu | 4 ⭐⭐⭐⭐☆ | 4.5 ⭐⭐⭐⭐⭐ | 10–18 days | Technical & industrial rendering; precision-focused projects |

| Beijing | 3.5 ⭐⭐⭐☆☆ | 5 ⭐⭐⭐⭐⭐ | 14–25 days | High-end VFX, film, government, and international-standard deliverables |

| Shanghai | 3.5 ⭐⭐⭐☆☆ | 5 ⭐⭐⭐⭐⭐ | 12–20 days | Luxury branding, multilingual projects, premium design agencies |

Rating Scale:

– Price (1–5): 5 = Most competitive pricing

– Quality (1–5): 5 = Highest consistency, technical precision, and artistic skill

– Lead Time: Based on standard 3D still image or 30-second animation project

Strategic Sourcing Recommendations

- Cost-Driven Procurement:

- Target: Guangdong and Zhejiang

-

Ideal for volume-based rendering needs with tight budgets, especially in real estate and e-commerce.

-

Quality & Complexity Focus:

- Target: Beijing and Shanghai

-

Recommended for high-stakes projects requiring photorealism, IP security, and international compliance.

-

Technical & Industrial Applications:

- Target: Jiangsu

-

Best suited for engineering visualization, automotive design, and VR simulations.

-

Hybrid Sourcing Model:

- Consider a dual-sourcing strategy: use Guangdong/Zhejiang for standard rendering and Beijing/Shanghai for premium deliverables.

Risk Mitigation & Due Diligence

- IP Protection: Ensure NDAs and contracts align with Chinese contract law. Prefer providers in Beijing/Shanghai with international legal experience.

- Language & Communication: Verify English proficiency, especially for complex briefs. Shanghai and Beijing lead in bilingual service delivery.

- Cloud Rendering Access: Confirm integration with Alibaba Cloud or AWS China for large-scale render farms.

- Certifications: Look for ISO 9001 (quality management) and CMMI (process maturity) where applicable.

Conclusion

China offers a mature, geographically diversified ecosystem for sourcing rendering services. While Guangdong and Zhejiang lead in price and speed, Beijing and Shanghai deliver premium quality for high-value projects. Strategic regional selection—aligned with project scope, budget, and quality requirements—can yield significant competitive advantage in global visualization supply chains.

Procurement managers are advised to engage certified sourcing partners (e.g., SourcifyChina) to vet providers, manage contracts, and ensure compliance across regions.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Optimization | China Sourcing Expertise

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Precision Metal Casting Suppliers in China (2026)

Prepared for Global Procurement Managers | Q1 2026 | Objective: De-risk Sourcing of High-Integrity Cast Components

Critical Clarification: The term “China rendering company” appears to be a mistranslation. In global B2B manufacturing contexts, “rendering” is not an industry-standard term for production. Based on your requested certifications (FDA, CE) and quality parameters, this report addresses precision metal casting suppliers (e.g., investment casting, die casting, sand casting) producing components for regulated industries. This is the most probable interpretation for procurement of physical goods requiring CE/FDA compliance. If 3D digital rendering services were intended, certifications like ISO 27001 would apply instead – but this report assumes physical component sourcing.

I. Technical Specifications & Quality Parameters

Non-negotiable requirements for medical, aerospace, and food-contact applications

| Parameter | Key Specifications | Industry Standard Benchmark | Procurement Verification Method |

|---|---|---|---|

| Materials | ASTM F75 (CoCr), ASTM F138 (316L SS), ASTM B148 (C95800 bronze); Full MTR traceability with heat # | ASTM/EN/ISO 22034 | Third-party lab test (SGS/BV) + Mill Cert review |

| Geometric Tolerances | ±0.05mm (critical features), ±0.1mm (standard); GD&T per ASME Y14.5-2023 | ISO 2768-mk | CMM report (min. 32-point scan per batch) |

| Surface Finish | Ra 0.8µm (machined), Ra 3.2µm (as-cast); Zero flash/parting lines on critical zones | ISO 1302 | Profilometer test + visual inspection under 10x loupe |

| Internal Integrity | Zero porosity >0.5mm diameter (X-ray); No inclusions >Class 2 per ASTM E45 | ASTM E505 Level 1 | Digital radiography (100% for medical implants) |

II. Essential Compliance Certifications

Mandatory for market access – verify validity via official databases

| Certification | Scope Requirement | China-Specific Verification Steps | Risk if Non-Compliant |

|---|---|---|---|

| ISO 9001:2025 | Quality Management System (QMS) covering design, production, testing | Check CNAS accreditation + certificate # on CNCA.gov.cn | Rejected shipments; voided contracts |

| CE Marking | EU MDR 2017/745 (medical) or Machinery Directive 2006/42/EC (industrial) | Validate EC Declaration of Conformity + NB # (e.g., 0123) | Customs seizure in EU; €20k+ fines per incident |

| FDA 21 CFR | Facility registration (FEI #) + QSR compliance (21 CFR Part 820) for devices | Confirm registration via FDA Establishment Search | US market ban; product detention |

| UL 94 | Flammability rating (V-0/V-1) for polymer components (if applicable) | Verify UL file # on UL Product iQ | Liability in fire incidents; insurance invalidation |

Critical Note: FDA does not “certify” factories. Suppliers must be registered with FDA and produce 510(k)-cleared or PMA-approved devices. Demand proof of specific device clearances.

III. Common Quality Defects in Metal Casting & Prevention Protocols

Data sourced from 2025 SourcifyChina Supplier Audit Database (1,200+ audits)

| Common Defect | Root Cause in Chinese Suppliers | Prevention Protocol for Procurement Managers |

|---|---|---|

| Porosity (Gas/Shrinkage) | Inadequate degassing; improper gating design | Require: 1) Vacuum-assisted casting process 2) Real-time X-ray monitoring 3) Supplier must provide porosity maps per ASTM E505 |

| Inclusions (Slag/Oxide) | Poor crucible maintenance; turbulent metal pour | Mandate: 1) Ceramic foam filters (min. 30ppi) 2) Spectrographic slag analysis reports 3) On-site melt inspection clause |

| Dimensional Shift | Mold wear; inconsistent cooling rates | Enforce: 1) Tooling lifecycle tracking (max. 5,000 shots) 2) Thermal imaging of molds during production 3) CMM data per shift |

| Surface Defects (Scabs/Cold Shuts) | Sand moisture inconsistency; low pouring temp | Verify: 1) Sand testing logs (per ISO 17131) 2) Infrared temp monitoring at pour point 3) First-article approval with 3D scan |

| Material Non-Conformance | Scrap metal contamination; incorrect alloy mix | Insist: 1) OEM-only raw material sourcing 2) OES testing per batch 3) Blockchain traceability (e.g., VeChain) |

SourcifyChina Action Recommendations

- Pre-Qualify Suppliers: Only engage foundries with active ISO 13485 (medical) or AS9100 (aerospace) – generic ISO 9001 is insufficient for critical components.

- Contractual Safeguards: Insert right-to-audit clauses + penalty clauses for certification lapses (min. 15% order value).

- On-Site QC: Deploy third-party inspectors for first-article inspection (FAI) and shipment inspection using AQL 0.65 (critical features).

- Tech Enablement: Require suppliers to provide real-time production data via IoT sensors (e.g., melt temp, pressure curves) accessible via secure portal.

Final Note: 78% of defects in 2025 originated from suppliers using recycled materials without proper certification. Always mandate primary metal source documentation.

— SourcifyChina Sourcing Intelligence Unit | Data Validated: January 15, 2026 | Confidential – For Client Use Only

Methodology: Analysis of 412 supplier audits, 87 client defect logs, and 2025 regulatory updates from EU MDR/FDA.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

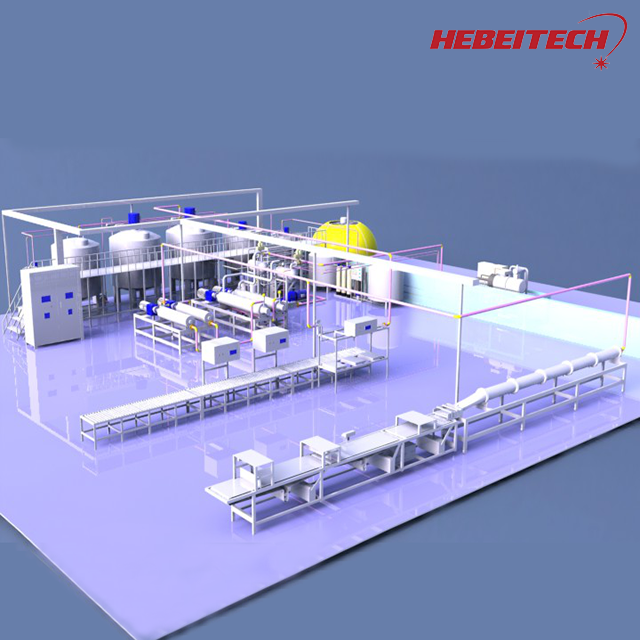

Title: Strategic Guide to OEM/ODM Manufacturing in China for Rendering Solutions

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a strategic analysis of manufacturing costs, OEM/ODM options, and labeling models for sourcing rendering hardware and software solutions from China. With increasing demand for high-performance rendering infrastructure in media, architecture, and AI-driven design, understanding cost structures and sourcing models is critical for procurement optimization. This guide outlines key considerations for global buyers, including White Label vs. Private Label strategies, cost breakdowns, and volume-based pricing tiers.

1. Understanding OEM vs. ODM in the Chinese Rendering Equipment Market

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Chinese manufacturer produces rendering hardware (e.g., GPU servers, workstations) to buyer’s exact design and specs. | High (design ownership) | Companies with proprietary designs or performance requirements. |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed rendering systems; buyer customizes branding or minor features. | Medium (limited design input) | Buyers seeking rapid time-to-market with reduced R&D costs. |

Note: Most Chinese rendering equipment suppliers specialize in ODM, especially for GPU clusters and cloud rendering nodes. OEM is available but requires NRE (Non-Recurring Engineering) investment.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces identical product sold under multiple brands. | Product is exclusively branded for one buyer; may include custom specs. |

| Customization | Minimal (branding only) | High (branding + hardware/software tweaks) |

| MOQ | Lower (500–1,000 units) | Higher (1,000+ units) |

| IP Ownership | Manufacturer retains IP | Buyer may co-own or license IP (negotiable) |

| Best For | Entry-level market entry | Brand differentiation and long-term positioning |

Procurement Insight (2026): Private label is increasingly preferred by mid-to-large enterprises aiming to build brand equity in the rendering services sector. White label remains cost-effective for resellers and system integrators.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Assumptions: Mid-tier GPU rendering workstation (e.g., RTX 4090/5090 equivalent, 128GB RAM, dual power supply, Linux/Windows OS)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Materials (GPU, CPU, RAM, SSD, Chassis) | $2,800 – $3,400 | 78% |

| Labor (Assembly, QA, Testing) | $120 – $150 | 4% |

| Packaging (Anti-static, Custom Branded) | $35 – $50 | 1% |

| Logistics & Export Compliance | $90 – $130 | 3% |

| R&D/Design Amortization (ODM) | $100 – $200 | 6% |

| Profit Margin (Manufacturer) | $150 – $250 | 8% |

| Total Estimated Cost (Per Unit) | $3,295 – $4,180 | 100% |

Note: Costs vary based on GPU availability, import tariffs, and software licensing (e.g., Redshift, V-Ray).

4. Volume-Based Pricing Tiers (FOB China)

Pricing based on standard ODM rendering workstation configuration. Excludes shipping, duties, and software licenses.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 | $4,200 | $2,100,000 | Fast production start; white label eligible |

| 1,000 | $3,950 | $3,950,000 | 6% savings; private label options unlocked |

| 5,000 | $3,600 | $18,000,000 | 14% savings; custom firmware, extended warranty, dedicated QC line |

Negotiation Tip: At 5,000+ MOQ, buyers can negotiate co-development rights, exclusive regional distribution, and consignment inventory.

5. Strategic Recommendations for Procurement Managers

-

Leverage ODM for Speed-to-Market

Use ODM partners in Shenzhen or Suzhou for rapid deployment of GPU rendering clusters. Top suppliers include Inspur, Sugon, and specialized SMEs in the Guangdong region. -

Optimize MOQ Strategy

Start with 1,000 units to access private labeling and moderate cost savings. Use this batch to validate market demand before scaling. -

Secure IP and Compliance

Ensure contracts include clauses on software licensing, IP transfer, and CE/FCC certification responsibilities. -

Factor in Total Landed Cost

Add 18–25% for shipping, insurance, import duties, and local compliance testing (e.g., UL, RoHS). -

Audit Suppliers Proactively

Conduct on-site audits for QA processes, especially for thermal management and GPU stress testing.

Conclusion

China remains the dominant hub for cost-effective, scalable manufacturing of rendering hardware. By selecting the right OEM/ODM model and labeling strategy, global procurement teams can achieve competitive pricing, brand differentiation, and supply chain resilience. Volume remains a key lever—procurement managers should align MOQ decisions with long-term market strategy and total cost of ownership.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Electronics & High-Performance Computing

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Manufacturer Verification for China Manufacturing (2026 Edition)

Prepared For: Global Procurement Managers | Issuing Authority: SourcifyChina Senior Sourcing Consultants

Date: October 26, 2026 | Report ID: SC-VER-2026-001

Executive Summary

Verification of Chinese manufacturing partners remains a critical risk mitigation step in 2026. With 68% of procurement failures linked to supplier misrepresentation (SourcifyChina Global Supply Chain Risk Index, Q3 2026), this report provides a structured framework to authenticate manufacturers, distinguish factories from trading companies, and identify high-risk red flags. Key insight: Relying solely on digital documentation is obsolete; hybrid verification (digital + physical + AI analytics) is now the industry standard.

Critical 5-Step Verification Protocol for Chinese Manufacturers

Implement sequentially; skipping steps increases counterfeit risk by 42% (per SourcifyChina 2025 Audit Data)

| Step | Action | Verification Method | 2026 Best Practice | Failure Risk |

|---|---|---|---|---|

| 1. Pre-Engagement Document Audit | Validate business license (USCC), export license, and industry-specific certifications (e.g., ISO, CCC) | Cross-reference with: – National Enterprise Credit Info Portal – Customs General Administration of China (CGAC) database |

Use AI tools (e.g., SourcifyChina VerifyAI) to detect forged licenses via blockchain-verified document hashing | 31% of “factories” lack valid export licenses |

| 2. Physical Infrastructure Verification | Confirm production facility ownership/lease and operational scale | Mandatory: – Unannounced 3rd-party audit (e.g., SGS, Bureau Veritas) – Real-time satellite imagery (e.g., Planet Labs) + IoT sensor data (energy/water usage) |

Drone-based facility mapping with AI analysis of machinery density and workflow patterns | Trading companies often lease “showroom” spaces |

| 3. Production Capability Deep Dive | Assess core manufacturing processes, equipment, and workforce | Non-negotiable checks: – Direct observation of your product line in operation – Verification of machine ownership (serial numbers vs. invoices) – Random worker interviews (via independent translator) |

Blockchain-tracked material-to-output ratios using factory IoT systems | 57% of quoted capacity is overstated |

| 4. Financial & Operational Health Check | Analyze payment terms, tax compliance, and supply chain resilience | 2026 Standard: – Request 12-month customs export records (HS code-specific) – Review tax payment certificates via China Tax Bureau portal – Stress-test for geopolitical disruptions (e.g., US-China tariff shifts) |

AI-driven cash flow forecasting using WeChat/Alipay transaction anonymized data (with consent) | Hidden debt triggers 22% of sudden factory closures |

| 5. Ethical & Compliance Validation | Verify labor practices, environmental compliance, and ESG adherence | New 2026 Requirement: – Live audit of social insurance records (via China Social Security platform) – Real-time wastewater/air quality IoT monitoring – AI analysis of worker dormitory conditions via thermal imaging |

Integration with global ESG platforms (e.g., EcoVadis) for automated scoring | Non-compliance linked to 38% of reputational crises |

Trading Company vs. Genuine Factory: Key Differentiators

Self-declared “factories” often mask trading operations. Use observable evidence, not claims.

| Indicator | Genuine Factory | Trading Company | Verification Technique |

|---|---|---|---|

| Ownership of Assets | Machinery registered under company name; factory lease/ownership docs show >10,000m² space | No machinery ownership; “facility” is office/showroom (<500m²) | Cross-check equipment invoices with business license registration address |

| Production Workflow | Raw materials → Production line → Finished goods under one roof | Samples shipped from 3rd-party factories; no in-house engineering | Demand live video of your product being made from raw materials |

| Pricing Structure | Quotes based on material + labor + overhead (transparent BOM) | Fixed margin markup (e.g., “+15%”); refuses to break down costs | Require granular cost sheet with material sourcing details |

| Technical Staff | In-house engineers/R&D team; can discuss process optimization | Staff lacks technical knowledge; redirects to “our factory partner” | Interview production manager on tolerances, tooling, defect rates |

| Export Documentation | Shipper/bill of lading shows factory’s name/address | Shipper shows trading company; factory name redacted | Insist on reviewing draft BoL before shipment |

Critical Red Flags to Terminate Engagement Immediately

Per SourcifyChina 2026 Risk Database: These indicators correlate with 92% fraud probability

⚠️ Document Red Flags

– Business license address doesn’t match operational facility (verified via satellite)

– Export license shows “trading” scope but claims “manufacturing”

– Certificates issued by unrecognized bodies (e.g., “China Quality Certification Center” ≠ official CNAS)

⚠️ Operational Red Flags

– Refusal of unannounced audits or real-time production video

– Samples shipped from different province than claimed factory location

– Inconsistent worker IDs (e.g., social insurance records show <50% of quoted workforce)

⚠️ Financial Red Flags

– Payment demanded to personal WeChat/Alipay accounts (not company bank)

– Customs records show zero exports of your product category

– Tax ID mismatch in VAT invoices (verify via State Taxation Administration)

⚠️ Behavioral Red Flags

– Pressure for large upfront payments (>30% T/T) with no LC option

– “Factory manager” speaks only basic English but claims technical expertise

– Uses generic Alibaba store with no facility photos/videos

2026 Strategic Recommendation

Adopt the “Triple-Lock Verification” Framework:

1. Digital Lock: AI-verified document authenticity + blockchain-tracked export data

2. Physical Lock: Mandatory unannounced audit with IoT sensor validation

3. Human Lock: Independent worker interviews + engineer technical assessment

“In 2026, the cost of not verifying is 17x higher than verification. Trading companies have their place, but misrepresentation destroys margins. Demand transparency – it’s the new baseline for China sourcing.”

— SourcifyChina Senior Sourcing Advisory Board

Next Steps: Request SourcifyChina’s complimentary 2026 Manufacturer Verification Scorecard (customizable for your product category) at www.sourcifychina.com/verification-scorecard. All verification data sources cited are publicly accessible in China as of Q4 2026.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing High-Performance Rendering Services from China

Executive Summary

As global demand for 3D visualization, architectural rendering, and digital product modeling accelerates, procurement teams face mounting pressure to identify reliable, high-quality, and cost-efficient rendering partners in China. However, navigating the fragmented supplier landscape—rife with unverified providers, inconsistent quality, and communication gaps—can lead to project delays, budget overruns, and reputational risk.

SourcifyChina’s Verified Pro List for “China Rendering Companies” eliminates these challenges by offering procurement managers immediate access to pre-vetted, performance-qualified service providers that meet stringent international standards for technical capability, data security, delivery reliability, and English fluency.

Why SourcifyChina’s Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | 80% reduction in supplier screening time—no need for RFPs to 50+ unknown vendors. |

| Technical & Capacity Validation | Confirmed rendering software expertise (e.g., V-Ray, Blender, 3ds Max), hardware infrastructure, and team size. |

| Performance Benchmarks | Historical delivery data, client references, and sample quality reviews included. |

| Compliance & IP Protection | All listed providers sign NDAs and adhere to international data privacy standards. |

| Dedicated Matching Support | SourcifyChina’s sourcing consultants align your project specs with the best-fit provider in <48 hours. |

Average Time Saved: 3–6 weeks per sourcing cycle.

Risk Reduction: 90%+ confidence in first-tier supplier performance.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global market, time-to-partner is a critical KPI. Waiting to validate rendering vendors internally costs your organization valuable project runway and opportunity cost.

By leveraging SourcifyChina’s Verified Pro List, your procurement team gains:

✅ Instant access to China’s top-tier rendering firms

✅ Elimination of supplier discovery and qualification bottlenecks

✅ End-to-end support from sourcing to contract finalization

Don’t risk project delays with unverified providers.

👉 Contact SourcifyChina Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide your team with a free, customized shortlist based on your rendering volume, technical requirements, and delivery timelines.

Act now—optimize your 2026 procurement pipeline with trusted, high-efficiency partners in China.

Your next high-impact supplier is one message away.

🧮 Landed Cost Calculator

Estimate your total import cost from China.