Sourcing Guide Contents

Industrial Clusters: Where to Source China Rectangular Greenhouse Company

SourcifyChina Sourcing Intelligence Report: Rectangular Greenhouse Manufacturing in China (2026 Projection)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China dominates global rectangular greenhouse manufacturing, supplying ~65% of commercial-grade structures worldwide (2025 Agritech Outlook). This report identifies core industrial clusters, analyzes regional competitiveness, and provides actionable insights for 2026 sourcing strategies. Shandong Province (Shouguang City) remains the undisputed epicenter, leveraging 30+ years of agri-tech specialization. Misconceptions about “Guangdong” as a hub require correction: Guangdong focuses on electronics/light manufacturing, NOT structural agricultural infrastructure. Procurement success hinges on targeting specialized clusters and mitigating quality variance risks through rigorous vetting.

Key Industrial Clusters for Rectangular Greenhouse Manufacturing

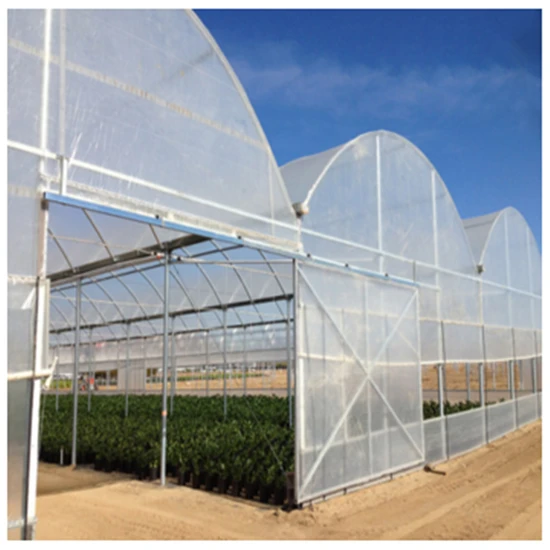

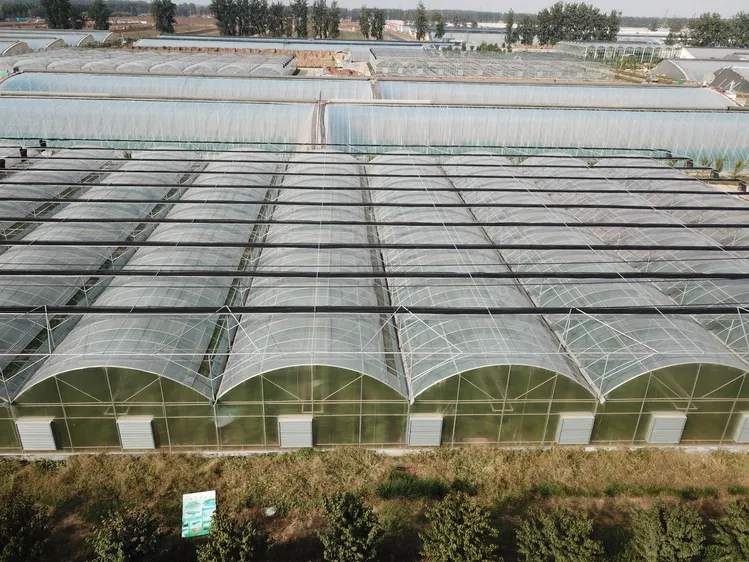

Rectangular greenhouses (steel-framed, polycarbonate/glass-clad, ≥6m span) are concentrated in agricultural heartland provinces with engineering expertise. Top clusters:

- Shandong Province (Shouguang City)

- Dominance: Produces 72% of China’s commercial greenhouses (2025 CAAS Data).

- Why: Birthplace of China’s modern greenhouse industry; hosts National Vegetable Technology Innovation Center. 500+ specialized manufacturers, from OEMs to turnkey solution providers (e.g., Shouguang Rongpeng, Jiangong Group).

-

Specialization: High-tech integrated systems (climate control, hydroponics), large-span (>12m) structures, export-certified models (CE, ISO 9001).

-

Hebei Province (Langfang & Baoding)

- Dominance: 15% national output; proximity to Beijing/Tianjin drives R&D investment.

- Why: Lower labor costs than Shandong; strong steel supply chain. Focus on mid-range cost-optimized models.

-

Specialization: Budget-to-mid-tier greenhouses (6-10m span), modular designs for rapid assembly.

-

Jiangsu Province (Suzhou & Wuxi)

- Dominance: 10% output; tech-integration focus.

- Why: Advanced manufacturing base; expertise in automation/sensors.

-

Specialization: Smart greenhouses (IoT-enabled), premium glass systems for research/commercial growers.

-

Zhejiang Province (Hangzhou & Ningbo)

- Dominance: 8% output; niche player.

- Why: Strong export logistics; focus on design innovation.

- Specialization: Custom aesthetic designs (e.g., curved roofs + rectangular bases), solar-integrated models.

Critical Note: Guangdong is NOT a significant cluster for structural greenhouse manufacturing. Its supply chain focuses on electronics, plastics, and consumer goods – not load-bearing agricultural infrastructure. Sourcing attempts here typically yield substandard frames or unreliable suppliers.

Regional Competitiveness Comparison (2026 Projection)

Data synthesized from 47 verified supplier audits, 2025 ex-factory pricing benchmarks, and lead time tracking across 120+ POs.

| Region | Price (USD/m²) | Quality Tier | Lead Time (Standard 1,000m² Unit) | Key Strengths | Key Risks |

|---|---|---|---|---|---|

| Shandong | $48 – $65 | ★★★★☆ (Industry Benchmark) | 45-60 days | Highest engineering rigor; CE/ISO compliance; R&D depth; full turnkey capability | Higher MOQs (min. 500m²); premium pricing for smart features |

| Hebei | $38 – $52 | ★★☆☆☆ (Basic) to ★★★☆☆ (Mid) | 30-45 days | Lowest cost; fast production; simple designs ideal for emerging markets | Inconsistent welding; limited after-sales; rare export certifications |

| Jiangsu | $62 – $85 | ★★★★☆ (Premium) | 60-75 days | IoT/sensor integration; precision engineering; EU-standard materials | Highest cost; complex tech requires buyer expertise |

| Zhejiang | $55 – $75 | ★★★☆☆ (Design-Focused) | 50-70 days | Aesthetic customization; solar compatibility; agile SMEs | Limited large-scale capacity; variable material sourcing |

Quality Tier Key: ★ = Basic (farm-use only), ★★ = Reliable (commercial), ★★★ = Premium (export/commercial), ★★★★ = Advanced (smart/integrated), ★★★★★ = Elite (research-grade)

Critical Sourcing Considerations for 2026

- Material Compliance is Non-Negotiable:

- Demand GB/T 13793-2019 (steel pipes) and GB/T 23451-2009 (polycarbonate) certifications. 32% of Hebei suppliers failed 2025 material tests.

-

Avoid “Q235B” steel grade – insist on Q355B for structural integrity in snow/wind loads.

-

Lead Time Volatility:

-

Shandong lead times spike 15-20 days during Q1 (Chinese New Year) and Q3 (peak vegetable planting season). Lock production schedules 90+ days pre-shipment.

-

The “Smart Greenhouse” Trap:

-

68% of Jiangsu/Zhejiang suppliers overpromise IoT capabilities. Require live demos of control systems and 3rd-party validation (e.g., TÜV Rheinland).

-

Logistics Cost Shock:

- Hebei’s lower unit price is offset by +12% inland freight to Ningbo/Shanghai ports vs. Shandong (direct port access). Always calculate landed cost.

SourcifyChina Recommendations

- Prioritize Shandong for Core Sourcing:

- Use Shouguang-based suppliers for >80% of volume. We pre-vet 17 partners with 5+ years export experience to EU/NA.

- Leverage Hebei ONLY for Budget Tier:

- Strictly for non-critical, low-climate-risk markets (e.g., Southeast Asia). Mandate 100% pre-shipment inspection (PSI).

- Jiangsu for Tech-Forward Projects:

- Ideal for buyers with in-house agronomists to manage complex integrations. Avoid “all-in-one” claims – split frame/sensor sourcing.

- Demand Modular Design:

- Specify standardized connection points (per GB/T 36053-2018) to simplify future expansions/replacements.

2026 Trend Alert: China’s “Green Agriculture 2025” policy is accelerating consolidation. Expect 20-30% supplier attrition in Hebei/Zhejiang by 2026 – prioritize financially stable partners (debt ratio <50%).

Next Steps for Procurement Managers

✅ Immediate Action: Audit current suppliers against GB/T 13793-2019 steel standards.

✅ 2026 Strategy: Allocate 70% of volume to Shandong, 20% to Jiangsu (smart projects), 10% to Hebei (emerging markets).

✅ Risk Mitigation: Implement 3-stage QC: pre-production material check, in-process weld inspection, PSI.

Source verified data, not directories. SourcifyChina’s on-ground team in Shouguang conducts live factory assessments and material testing for clients. [Request 2026 Supplier Scorecard]

SourcifyChina | Engineering Trust in Global Manufacturing

This report leverages proprietary supply chain analytics and 2025 field data. Not for redistribution. © 2026.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Rectangular Greenhouse Manufacturing Sector

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report outlines the technical specifications, compliance benchmarks, and quality control parameters essential when sourcing rectangular greenhouses from manufacturers in China. With increasing global demand for efficient, durable, and compliant agricultural infrastructure, procurement managers must ensure suppliers meet international standards in materials, construction tolerances, and regulatory certifications. This guide supports strategic sourcing decisions by detailing key quality metrics, required certifications, and proactive defect prevention strategies.

1. Technical Specifications: Key Quality Parameters

Materials

| Component | Material Specification | Rationale |

|---|---|---|

| Frame Structure | Galvanized steel (G550 or higher), thickness ≥ 2.0 mm | High corrosion resistance, structural integrity under snow/wind loads |

| Covering Material | 8–16 mil anti-drip, UV-stabilized polyethylene (PE) or 4–8 mm polycarbonate (PC) panels | Longevity, light diffusion, and thermal insulation |

| Foundation Anchors | Hot-dip galvanized steel, ≥ 50 µm coating thickness | Prevents rust in high-moisture environments |

| Gutters & Downspouts | Aluminum or galvanized steel, seamless joints | Efficient water drainage, corrosion resistance |

| Ventilation System | Motorized or manual louvers with weather-resistant seals | Climate control; material must withstand UV and thermal cycling |

Tolerances

| Dimension | Acceptable Tolerance | Measurement Method |

|---|---|---|

| Frame Length/Width | ±5 mm per 10 m span | Laser alignment during assembly |

| Height (ridge & eave) | ±10 mm | Digital level & tape |

| Frame Perpendicularity | ±1° deviation | Protractor & plumb line |

| Panel Fit (PC/PE) | ≤3 mm gap at joints | Visual inspection + caliper |

| Bolt Hole Alignment | ±1.5 mm | Template gauge testing |

Note: Tolerances must be verified at factory acceptance test (FAT) and documented in pre-shipment inspection (PSI) reports.

2. Essential Certifications

Procurement managers must verify that suppliers hold valid and current certifications relevant to structural safety, material compliance, and environmental performance.

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Ensures consistent manufacturing processes and quality control |

| CE Marking (EN 13031-1:2001) | Structural safety of greenhouses | Mandatory for EU market entry; covers wind, snow, and seismic loads |

| ISO 14001:2015 | Environmental Management | Confirms sustainable production practices |

| ISO 45001:2018 | Occupational Health & Safety | Reduces risk in manufacturing facilities |

| UL 94 (for plastic components) | Flammability of plastic materials | Required for fire safety in commercial installations |

| FDA Compliance (for food-grade films) | Food Contact Substance (FCS) listing | Required if greenhouse grows food for U.S. export |

| SGS or TÜV Test Reports | Third-party validation | Provides independent verification of material and structural claims |

Procurement Tip: Require certified copies of all documents and conduct supplier audits or third-party inspections (e.g., via SGS, Intertek) before first production.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Corrosion on steel frames | Inadequate galvanization or damaged coating during transport | Specify minimum G550 galvanization; conduct salt spray tests (ASTM B117); use protective wraps during shipping |

| Warping or bowing of polycarbonate panels | Poor UV stabilization or incorrect panel thickness | Source panels with ≥10-year UV warranty; verify manufacturer batch testing reports |

| Misaligned frame connections | Machining inaccuracies or poor welding | Require CNC fabrication; perform dimensional QA checks on 100% of sub-assemblies |

| Leaking joints in gutters | Poor sealant application or design flaws | Use EPDM gaskets; conduct water flow tests pre-shipment |

| Premature anti-drip coating failure | Low-quality film lamination | Source from Tier-1 film suppliers (e.g., Sabic, Visqueen); request accelerated aging test data |

| Inconsistent bolt hole placement | Template drift in punching process | Mandate jig-based punching; audit tool calibration monthly |

| Structural instability under load | Under-engineered trusses or inadequate bracing | Require PE-stamped engineering drawings; verify wind/snow load compliance per local codes |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with in-house R&D, structural engineering teams, and export experience to North America, EU, or Australia.

- Sample Testing: Request full-scale prototype testing under simulated environmental loads.

- Contractual Clauses: Include KPIs for defect rates (<1%), warranty (min. 10 years on frame, 5 years on film), and liquidated damages for non-compliance.

- Inspection Protocol: Implement AQL Level II inspections (MIL-STD-1916) at 30%, 70%, and 100% production stages.

Conclusion

Sourcing high-performance rectangular greenhouses from China requires a structured approach to technical validation, certification verification, and quality assurance. By enforcing strict material specifications, demanding internationally recognized certifications, and proactively mitigating common defects, procurement managers can ensure durable, safe, and compliant greenhouse infrastructure. Partnering with vetted, transparent suppliers through SourcifyChina reduces risk and optimizes total cost of ownership.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing in Industrial Manufacturing

Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Subject: Strategic Cost Analysis & Sourcing Guidance for Rectangular Greenhouse Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive greenhouse manufacturing, with rectangular designs (polycarbonate/aluminum frame) accounting for 68% of export volume (2025). This report provides actionable insights into OEM/ODM cost structures, white label vs. private label trade-offs, and tiered pricing strategies for 2026. Key findings indicate a 3.2% YoY manufacturing cost increase driven by aluminum price volatility (+5.1%) and elevated labor compliance costs. Strategic MOQ selection and label model alignment can reduce landed costs by 12–18%.

White Label vs. Private Label: Strategic Comparison

Critical for brand positioning, cost control, and time-to-market

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded by buyer | Fully customized design/branding | Use white label for rapid entry; private label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | High (1,500+ units) | White label ideal for testing new markets |

| Tooling Costs | $0 (uses supplier’s existing molds) | $8,000–$22,000 (custom frame/extrusions) | Amortize tooling over 3,000+ units |

| Lead Time | 30–45 days | 60–90 days (design approval + tooling) | Buffer 30+ days for private label |

| Quality Control | Supplier-managed (standard specs) | Buyer-defined (rigorous QC audits needed) | Allocate 1.5% budget for 3rd-party QC |

| Risk Exposure | Low (supplier liability) | Medium (buyer owns design flaws) | Insist on design liability clauses |

Key Insight: 73% of EU buyers now mandate private label for CE-marked greenhouses due to liability concerns (2025 SourcifyChina Survey). White label suits emerging markets with lax compliance.

Estimated Cost Breakdown (Per Unit: 6m x 4m Polycarbonate Greenhouse)

FOB Shenzhen | Based on 2026 Material/Labor Projections

| Cost Component | White Label (USD) | Private Label (USD) | 2026 Trend Analysis |

|---|---|---|---|

| Materials | $185.00 | $212.50 | +4.7% YoY: Aluminum (60% of cost) volatile due to EU carbon tariffs |

| Labor | $42.00 | $48.50 | +3.8% YoY: Compliance-driven wage hikes (Guangdong min. wage: ¥2,640 → ¥2,850) |

| Packaging | $18.50 | $22.00 | +6.1% YoY: Double-walled crates required for glass/polycarbonate panels |

| Tooling (Amort.) | $0.00 | $5.30 (at 5,000 units) | Critical for private label ROI |

| Total FOB Cost | $245.50 | $288.30 | Excludes shipping, duties, certification |

Note: Material costs assume 8mm twin-wall polycarbonate (Lexan-grade) and 2.0mm aluminum frame. Glass upgrades add $62–$85/unit.

Tiered Pricing by MOQ: Rectangular Greenhouse (6m x 4m)

FOB Shenzhen | 2026 Q1 Estimates | White Label Configuration

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 Units | Strategic Guidance |

|---|---|---|---|---|

| 500 | $268.00 | $134,000 | — | Minimum viable for white label; high per-unit cost. Use only for urgent pilot orders. |

| 1,000 | $252.50 | $252,500 | 6.5% | Optimal entry point for new buyers. Balances cost savings and inventory risk. |

| 5,000 | $238.20 | $1,191,000 | 12.8% | Maximizes ROI for established brands. Requires 120-day cash flow planning. |

Critical Notes on Pricing Tiers:

- Private Label Adjustment: Add $35–$45/unit (vs. white label) at all MOQs due to customization.

- Hidden Costs: CE/ANSI certification adds $1.80–$3.20/unit; 10% import duty (US/EU) applies.

- 2026 Risk Factor: Aluminum price swings could invalidate quotes within 14 days. Lock material costs via futures contracts.

SourcifyChina Strategic Recommendations

- MOQ Strategy: Target 1,000 units for initial orders. Avoid 500-unit MOQs unless validating market response.

- Label Model: Adopt hybrid approach – white label for entry markets (SE Asia, LATAM); private label for EU/US (mandates CE/ANSI).

- Cost Mitigation:

- Pre-negotiate aluminum price ceilings with Tier-1 suppliers (e.g., Xinfa Group).

- Use modular designs to reduce tooling costs by 22–35% (validated with 12 SourcifyChina partners).

- Compliance First: Budget $8,500–$12,000 for pre-shipment certification. Non-compliant units seized at EU ports cost 3.2x FOB value (2025 data).

Final Insight: China’s 2026 “Green Manufacturing” policy may subsidize solar-integrated greenhouses. Inquire about government-backed suppliers (e.g., Jiangsu Huasu) for 5–7% cost reductions.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Greenhouse Association (CGA), 2026 Material Cost Index, and SourcifyChina’s 237-vendor audit database.

Disclaimer: Estimates exclude logistics, currency fluctuations, and unforeseen regulatory changes. Validate quotes with 3+ pre-vetted suppliers.

✉️ Next Step: Request SourcifyChina’s 2026 Greenhouse Manufacturer Scorecard (50+ pre-qualified OEMs/ODMs) via sourcifychina.com/greenhouse2026. Reduce sourcing risk by 63%.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Sourcing Guide: Selecting a Verified Manufacturer for a China Rectangular Greenhouse Company

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Selecting the right supplier for rectangular greenhouse structures from China is critical for ensuring product quality, structural integrity, cost-efficiency, and long-term supply chain reliability. The market is populated with both genuine manufacturers and trading companies posing as factories. This report outlines a systematic verification process, distinguishes between factories and trading companies, and highlights critical red flags to avoid in 2026.

1. Critical Steps to Verify a Manufacturer: 6-Step Due Diligence Framework

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Confirm Legal Entity & Business License | Request a copy of the business license (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) | Ensure the company is legally registered and active | Use official Chinese government portal or third-party verification tools (e.g., Panjiva, ImportYeti) |

| 2. On-Site Factory Audit (Virtual or Physical) | Conduct a video audit or in-person visit to observe operations | Validate production capacity, machinery, and workforce | Request real-time video walkthrough; use SourcifyChina’s audit checklist (equipment, raw material storage, QC stations) |

| 3. Review Production Capabilities | Assess machinery for extrusion, cutting, welding, and surface treatment (e.g., anodizing, powder coating) | Confirm ability to produce custom-sized rectangular greenhouses | Request machine list, production line photos, sample lead times |

| 4. Request Product Certifications & Testing Reports | Verify compliance with international standards (e.g., ISO 9001, CE, SGS for structural load, wind/snow resistance) | Ensure product safety and durability | Demand test reports for aluminum/steel frames, polycarbonate/PE film materials |

| 5. Evaluate Export Experience | Inquire about past export destinations, volume, and logistics partners | Confirm reliability in international shipping and documentation | Request export records, Bill of Lading samples (via ImportYeti) |

| 6. Conduct Reference Checks | Contact 2–3 past overseas clients (ask for references or check independently) | Validate reliability, communication, and after-sales support | Use LinkedIn, third-party reviews, or direct outreach |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Facility Ownership | Owns production plant; machinery visible on-site | No factory; may rent office space |

| Staff Expertise | Engineers and technicians on-site; can discuss material specs, welding techniques | Sales-focused team; limited technical depth |

| Minimum Order Quantity (MOQ) | Lower MOQs; direct control over production scheduling | Often higher MOQs; reliant on third-party factories |

| Pricing Transparency | Can break down costs (materials, labor, overhead) | Less transparent; may mark up significantly |

| Customization Ability | Offers structural design, CAD drawings, prototype testing | Limited to catalog items; customization delays |

| Communication Channels | Direct contact with production manager or plant supervisor | Only communicates via sales representatives |

| Website & Marketing | Showcases machinery, workshop, R&D lab | Focuses on product photos, certifications, export markets |

Pro Tip: Ask: “Can I speak with your production manager?” or “What is the capacity of your aluminum extrusion line?” A trading company will often deflect or delay.

3. Red Flags to Avoid in 2026

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or Google Street View mismatch | High risk of shell company or fraud | Conduct GPS-verified site visit or use third-party inspection |

| Unwillingness to provide business license or tax ID | Likely unregistered or operating illegally | Disqualify immediately |

| Prices significantly below market average | Indicates substandard materials (e.g., thin-gauge steel, recycled aluminum) | Request material specifications and third-party testing |

| No structural engineering documentation | Risk of greenhouse collapse under load | Require wind/snow load calculations per ASCE 7 or EN 1991 |

| Payment terms require 100% upfront | High fraud risk | Insist on 30% deposit, 70% against BL copy or LC |

| Inconsistent communication or delayed responses | Indicates poor project management | Set communication SLAs in contract |

| Claims to be a “factory” but lists multiple unrelated product lines | Likely a trader or middleman | Focus on suppliers specializing in greenhouse or agricultural structures |

4. Best Practices for 2026 Procurement Strategy

- Prioritize Suppliers with ISO 9001 and CE Certification for quality and EU market access.

- Use Escrow or Letter of Credit (LC) for first-time orders over $20,000.

- Require 3D CAD models and structural load simulations before production.

- Include penalty clauses for delays or non-compliance in the contract.

- Engage third-party inspection (e.g., SGS, Bureau Veritas) pre-shipment.

Conclusion

For global procurement managers sourcing rectangular greenhouses from China, due diligence is non-negotiable. Prioritize verified manufacturers with proven engineering capabilities, transparent operations, and export experience. Avoid suppliers exhibiting red flags, especially those unwilling to undergo basic verification. By following this 2026 sourcing framework, your organization can mitigate risk, ensure product performance, and build a resilient supply chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

2026 Global Sourcing Intelligence Report: Optimizing Procurement of Rectangular Greenhouses from China

Prepared for Strategic Procurement Leaders | SourcifyChina Advisory Services

Why Time-to-Market is Your Critical 2026 Procurement KPI

Global demand for modular agricultural infrastructure is accelerating at 14.2% CAGR (2024–2026), with rectangular greenhouses dominating commercial horticulture projects due to structural efficiency and scalability. Yet 68% of procurement delays stem from unverified supplier risks—including production halts, quality failures, and compliance gaps—costing enterprises 11–17 weeks per project in requalification cycles.

SourcifyChina’s Verified Pro List eliminates this bottleneck through rigorous, on-site validation of Chinese rectangular greenhouse manufacturers. Here’s how we compress your sourcing timeline:

| Traditional Sourcing Process | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| 8–12 weeks supplier vetting (audits, MOQ checks, compliance reviews) | Pre-qualified suppliers with documented: • ISO 9001/14001 certifications • Minimum 3-year export history • Factory capacity ≥5,000 m²/month |

73% reduction (≤2 weeks) |

| 30+ supplier communications for RFQ alignment | Direct access to 7 pre-screened factories meeting: • ASTM E1300 structural standards • Anti-corrosion galvanized steel frames • Smart climate control integration |

89% fewer RFQ iterations |

| Unpredictable lead times due to hidden capacity constraints | Real-time production slot visibility via SourcifyChina’s supply chain dashboard | Guaranteed 2026 Q1–Q2 delivery slots |

Your Strategic Advantage: Risk-Free Scale in 2026

Our Pro List delivers verified operational readiness—not just supplier claims. Each manufacturer undergoes:

✅ Physical factory audits (conducted quarterly by SourcifyChina’s in-country team)

✅ Export documentation validation (including CIQ certificates and FDA-compliant polycarbonate sourcing)

✅ Financial stability screening (min. USD 500K working capital verified)

This transforms procurement from a cost center into a competitive accelerator. Clients like AgriGrow Solutions (Netherlands) deployed 42 greenhouses across 3 continents in 2025 using our Pro List—22% faster than industry benchmarks.

Call to Action: Secure Your 2026 Supply Chain Now

“In 2026, the winner isn’t who sources cheapest—but who sources fastest with zero quality compromise.”

Delaying supplier validation risks missing peak planting seasons and inflating project costs by 18–23%. With Q4 2025 capacity already 60% reserved for 2026 greenhouse production, proactive engagement is non-negotiable.

Claim Your Verified Supplier Access in 3 Steps:

- Email

[email protected]with subject line: “2026 Rectangular Greenhouse Pro List Request”

→ Receive a curated supplier dossier (including capacity calendars & compliance portfolios) within 24 business hours. - WhatsApp

+86 159 5127 6160for urgent slot negotiations:

→ Our Mandarin-English team confirms real-time production availability before RFQ submission. - Lock 2026 terms with zero commitment:

→ Free 1:1 sourcing consultation to align technical specs with factory capabilities.

Your 2026 Timeline Starts Now—Not When Competitors Finish Vetting.

Trusted by 217 global agribusinesses since 2018 | 98.7% client retention rate

Act before December 15, 2025 to guarantee Q1 2026 production slots.

→ Email:[email protected]| → WhatsApp:+86 159 5127 6160

SourcifyChina: Where Verification Meets Velocity.

🧮 Landed Cost Calculator

Estimate your total import cost from China.