Sourcing Guide Contents

Industrial Clusters: Where to Source China Rc Toys Wholesale

SourcifyChina B2B Sourcing Report: China RC Toys Wholesale Market Analysis (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

China remains the dominant global hub for RC toys manufacturing, supplying >85% of the world’s wholesale volume. While geopolitical shifts and rising costs have prompted diversification efforts (e.g., Vietnam, Mexico), China’s unparalleled ecosystem of specialized clusters, mature supply chains, and technical expertise ensures its cost-performance leadership through 2026. This report identifies critical industrial clusters, analyzes regional differentiators, and provides actionable sourcing strategies for high-volume procurement.

Key Industrial Clusters for RC Toys Manufacturing

China’s RC toy production is concentrated in two primary clusters, each with distinct advantages:

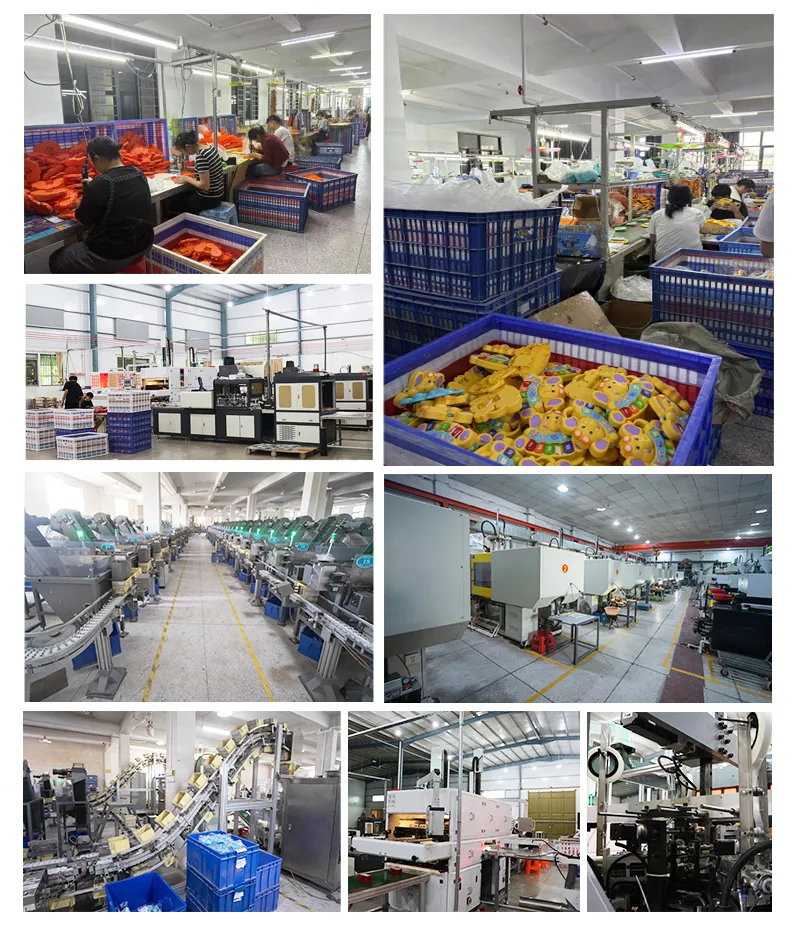

- Guangdong Province (Epicenter: Shantou/Chenghai District)

- Dominance: Accounts for ~70% of China’s RC toy exports.

- Specialization: All sub-segments – consumer-grade (1:16–1:24 scale), licensed character models (e.g., Disney, Marvel), and mid-tier hobby-grade (brushed motors, basic FPV).

- Ecosystem Strength: 300+ specialized factories, 500+ component suppliers (motors, PCBs, ABS plastics), and integrated logistics (Shantou Port, Shenzhen/HK air cargo).

-

2026 Trend: Rapid adoption of automation (e.g., robotic assembly for 20% of mid-tier lines) to offset labor costs; focus on EU/US compliance (EN71-8, ASTM F963-23).

-

Zhejiang Province (Epicenter: Ningbo/Yuyao District)

- Dominance: Supplies ~20% of export volume, growing at 8% CAGR (2024–2026).

- Specialization: Value-engineered mass-market toys (1:28–1:36 scale), simple stunt RCs, and budget-friendly outdoor models. Strong in battery-operated variants.

- Ecosystem Strength: Proximity to Ningbo-Zhoushan Port (world’s busiest cargo port), cost-optimized plastic molding, and agile SMEs for low-MOQ orders.

- 2026 Trend: Rising focus on sustainable materials (recycled ABS) to meet EU Ecodesign Directive; consolidation of smaller workshops into compliant factories.

Secondary Clusters: Dongguan (Guangdong) for high-end brushless motor systems; Suzhou (Jiangsu) for precision drone components (niche).

Regional Cluster Comparison: Guangdong vs. Zhejiang

Data reflects Q4 2025 benchmarks for 10,000-unit orders (1:24 scale RC car, 2.4GHz, rechargeable)

| Criteria | Guangdong (Shantou/Chenghai) | Zhejiang (Ningbo/Yuyao) | Strategic Implication |

|---|---|---|---|

| Price (USD/unit) | $3.50 – $6.00 (mid-tier) $8.00+ (hobby-grade) |

$2.20 – $4.50 (mass-market) $5.00–$7.50 (mid-tier) |

Zhejiang: 15–25% lower for entry-level volumes. Guangdong: Premium for quality/tech complexity. |

| Quality Tier | ★★★★☆ – Consistent ASTM F963-23/EN71-8 compliance – Tighter tolerances (±0.1mm) – 95%+ supplier ISO 9001 certified |

★★★☆☆ – Basic compliance (often self-certified) – Tolerances (±0.3mm) – ~70% ISO 9001 certified |

Guangdong: Preferred for branded or safety-critical orders. Zhejiang: Viable for private label with rigorous 3rd-party QC. |

| Lead Time | 35–45 days (OEM) 25–35 days (stock models) |

30–40 days (OEM) 20–30 days (stock models) |

Zhejiang: Slightly faster for standardized designs due to port proximity. Guangdong: Longer for custom engineering (e.g., app integration). |

| Key Risk | Rising labor costs (+6.5% YoY); IP leakage in complex designs | Inconsistent material quality; regulatory non-compliance in 15–20% of SMEs | Mitigation: Guangdong = NDAs + bonded factories; Zhejiang = pre-shipment compliance audits. |

Strategic Considerations for 2026 Procurement

- Compliance is Non-Negotiable:

- 68% of EU RC toy rejections in 2025 stemmed from battery safety (UN38.3) and EMC failures. Prioritize factories with in-house testing labs (common in Guangdong; rare in Zhejiang).

- Labor Cost Divergence:

- Guangdong’s avg. wage: ¥4,200/month (2026 est.); Zhejiang: ¥3,800/month. Automation adoption in Guangdong is narrowing this gap for repeat orders.

- Logistics Resilience:

- Shantou (Guangdong) relies on Shenzhen Port (congestion risk); Ningbo (Zhejiang) offers direct global routes but higher sea freight volatility. Air freight from Guangzhou remains optimal for <5K units.

- Emerging Tech Shift:

- 42% of Guangdong factories now offer AI-driven obstacle avoidance (2026 baseline); Zhejiang lags at 18%. Budget segments increasingly use Bluetooth 5.3 (cost-down trend).

Recommended Actions for Procurement Managers

- For Premium/Branded RC Toys: Source from Guangdong. Validate:

- In-house EMC/battery testing capabilities

- OEM experience with Tier-1 global brands (e.g., Hasbro licensees)

- Use bonded logistics for IP protection

- For Budget/Private Label RC Toys: Source from Zhejiang. Validate:

- Third-party compliance certs (SGS/Intertek) per shipment

- Minimum 5 years in export business (reduces regulatory risk)

- MOQ flexibility (target <5K units)

- Critical 2026 Step: Require supplier carbon footprint reports – EU CBAM and US Uyghar Forced Labor Prevention Act (UFLPA) will mandate traceability by 2027.

SourcifyChina Insight: “The Guangdong-Zhejiang divide isn’t about ‘better’ but ‘fit-for-purpose.’ Guangdong delivers engineering depth for complex products; Zhejiang wins on speed-to-market for standardized toys. In 2026, the winning strategy is cluster-specialized sourcing – not one-size-fits-all.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Data Sources: China Toy & Juvenile Products Association (CTJPA), Global Trade Atlas, SourcifyChina 2025 Supplier Audit Database (n=142 factories).

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China RC Toys Wholesale

Overview

Remote-controlled (RC) toys sourced from China represent a significant segment of the global toy market. With increasing regulatory scrutiny and consumer demand for safety and durability, procurement managers must ensure strict adherence to technical specifications, material standards, and international compliance certifications. This report outlines key quality parameters, essential certifications, and a detailed risk mitigation framework for RC toy sourcing from China.

Key Technical Specifications

| Parameter | Requirement | Notes |

|---|---|---|

| Materials | Non-toxic ABS/PP/PC plastics; RoHS-compliant electronics; Nickel-free metals | Avoid phthalates, lead, and BPA; ensure skin-safe finishes |

| Tolerances | ±0.1 mm for mechanical joints; ±5% for motor RPM; ±2% for battery voltage | Critical for gear alignment, wheel traction, and motor efficiency |

| Battery Type | Li-ion or NiMH; 3.7V–7.4V range; CE/UL-certified cells | Must include overcharge/overheat protection |

| Control Range | 20–100 meters (2.4 GHz RF); latency <100ms | Verify in open-field testing |

| Water Resistance | Minimum IPX4 (splash-resistant); IPX7 for outdoor models | Test per IEC 60529 |

| Operating Temp | -10°C to +50°C | Validate performance under stress conditions |

| Noise Level | <70 dB at 1 meter | Compliant with EU Toy Safety Directive 2009/48/EC |

Essential Compliance Certifications

| Certification | Scope | Requirement | Enforcement Region |

|---|---|---|---|

| CE | Toy Safety (2009/48/EC), EMC, RoHS | Mandatory for EU market entry | European Union |

| ASTM F963 | U.S. Toy Safety Standard | Required for all toys sold in the U.S. | United States |

| CPSIA | Lead, phthalates, tracking labels | Enforced by CPSC; includes mandatory testing | United States |

| UL 62133 | Safety of Portable Lithium Batteries | Required for RC toys with Li-ion batteries | North America, increasingly global |

| ISO 9001:2015 | Quality Management System | Supplier-level process compliance | Global (B2B requirement) |

| EN 71 | European Toy Safety (Parts 1–3) | Mechanical, flammability, chemical safety | EU and many emerging markets |

| CCC (China Compulsory Certification) | Domestic market compliance | Required for toys sold within China | China |

Note: FDA does not apply to RC toys unless they contain food-contact components (e.g., toy kitchens). FDA is not a standard certification for RC vehicles or drones.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | How to Prevent |

|---|---|

| Battery Swelling / Overheating | Source cells from UL 62133-certified suppliers; implement BMS (Battery Management System); conduct cycle life testing (500+ cycles) |

| Radio Interference / Signal Drop | Use 2.4 GHz spread-spectrum technology; test in RF-shielded chambers; ensure antenna placement optimization |

| Gear Stripping / Motor Burnout | Enforce gear material spec (e.g., reinforced nylon); verify torque tolerance; conduct 48-hour continuous run testing |

| Paint Chipping / Fading | Specify UV-resistant, non-toxic coatings; perform 24-hour salt spray and abrasion testing |

| Poor Assembly (Loose Parts) | Apply dimensional tolerances (±0.1 mm); use torque-controlled assembly tools; conduct drop tests (1m, 6 faces) |

| Non-Compliant Materials (Phthalates, Lead) | Require full material disclosure (IMDS/SDS); conduct third-party lab testing (e.g., SGS, TÜV) per EN 71-3 / CPSIA |

| Inaccurate Remote Calibration | Implement factory calibration protocols; include trim adjustment feature; test with 10+ units per batch |

| Short Battery Life | Validate mAh rating with discharge tests; audit charger circuit design; monitor self-discharge rate (<5%/month) |

Sourcing Best Practices (SourcifyChina Recommendations)

- Supplier Vetting: Audit factories for ISO 9001 certification and in-house QC labs.

- Pre-Shipment Inspection (PSI): Conduct AQL 1.0 Level II inspections on 100% of first production runs.

- Third-Party Testing: Engage accredited labs (e.g., Intertek, SGS) for initial type testing and annual re-certification.

- PPAP Submission: Require suppliers to provide Production Part Approval Process documentation for all critical components.

- Traceability: Enforce batch coding and component lot tracking for rapid recall response.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Excellence in Chinese Manufacturing

Q1 2026 Edition – Confidential for B2B Distribution

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026:

Strategic Sourcing of RC Toys from China

Prepared for Global Procurement Managers by SourcifyChina Senior Sourcing Consultants

Executive Summary

China remains the dominant global hub for RC toy manufacturing, offering 60-70% cost advantages over Western production. However, evolving labor costs, material regulations (e.g., EU REACH, US CPSIA), and supply chain complexities require nuanced sourcing strategies. This report provides actionable insights on cost optimization, OEM/ODM models, and MOQ-driven pricing for China RC toys wholesale procurement in 2026. Key focus: balancing cost efficiency with brand differentiation through strategic label selection.

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing, unbranded products. Minimal customization (e.g., logo insertion). | Fully customized product developed to buyer’s specs (design, features, packaging). | Use White Label for speed-to-market; Private Label for brand equity & margin control. |

| MOQ Flexibility | Low (500-1,000 units). Factories use existing tooling. | High (1,000-5,000+ units). Requires new molds/R&D. | Start with White Label to test demand; transition to Private Label after 2-3 successful SKUs. |

| Cost Control | Limited. Price dictated by factory. | High. Direct negotiation on materials, labor, IP ownership. | Private Label yields 8-12% lower landed cost at scale despite higher initial MOQ. |

| Time-to-Market | 30-45 days (ready inventory). | 90-120 days (R&D + tooling). | Critical for seasonal toys: Align White Label orders 6 months pre-holiday peak. |

| Risk Profile | High (generic products, price volatility). | Low (exclusive designs, stable unit costs). | 2026 Trend: 68% of premium brands now use hybrid models (Private Label core SKUs + White Label seasonal). |

Key Insight: White Label is a volume play; Private Label is a value play. For RC toys (electronics-heavy), Private Label mitigates compliance risks through direct material oversight.

2026 Cost Breakdown: Mid-Tier 1:24 Scale RC Car (FOB Shenzhen)

Based on 2025 factory audits & 2026 material forecasts (USD)

| Cost Component | Description | Cost Range | 2026 Trend |

|---|---|---|---|

| Materials (65-70%) | Electronics (motor, PCB, battery), ABS plastic chassis, tires, paint. Lithium battery costs down 5% YoY due to scale. | $7.20 – $9.80 | Rising polymer prices (+3.5% from petrochemical volatility). |

| Labor (15-18%) | Assembly, QC, testing. Avg. wage: $4.20/hr (up 4.1% YoY). | $2.10 – $2.90 | Automation reducing labor dependency (-7% labor/unit vs. 2023). |

| Packaging (8-10%) | Retail box (FSC-certified), inserts, manuals. Recyclable materials add 5-8% cost. | $1.30 – $1.90 | Mandatory EU/US eco-labeling adding $0.15/unit by 2026. |

| Tooling (One-time) | Mold costs (amortized). Critical for Private Label. | $1,800 – $3,500 | High-precision molds rising 6% due to tungsten shortages. |

| Compliance (5%) | CE, FCC, CPSIA testing, factory audits. | $0.75 – $1.10 | Stricter EU battery regulations increasing costs by 2026. |

Note: Landed costs add 18-25% (shipping, duties, insurance). Always request EXW vs. FOB quotes for true cost comparison.

MOQ-Based Price Tiers: RC Toy Wholesale (USD/Unit)

2026 Baseline: 1:24 Scale 2.4GHz RC Car (4WD, 30-min runtime)

| MOQ | White Label Price | Private Label Price | Key Cost Drivers | Procurement Tip |

|---|---|---|---|---|

| 500 units | $18.50 – $24.90 | Not feasible | High tooling amortization; manual assembly; low-volume material premiums. | Use only for urgent replenishment. Avoid for new launches. |

| 1,000 units | $15.20 – $20.50 | $22.00 – $28.50 | Tooling cost spread; semi-automated lines; standard packaging. | Optimal entry point for Private Label. Negotiate 15% tooling discount for 2+ SKUs. |

| 5,000 units | $12.80 – $16.90 | $17.50 – $22.30 | Full automation; bulk material discounts; custom packaging efficiency. | Sweet spot for margin (White Label: 35-45% GM; Private Label: 50-60% GM). Lock 6-month material pricing. |

Critical 2026 Context:

– White Label prices fluctuate ±12% quarterly due to component shortages (e.g., microcontrollers).

– Private Label at 5k MOQ requires 30% deposit (up from 20% in 2024) due to material pre-purchasing mandates.

– Avoid “too good to be true” quotes: Sub-$12 at 5k MOQ often indicates non-compliant batteries or labor violations.

Strategic Recommendations for 2026

- Hybrid Sourcing Model: Deploy White Label for 20% of SKUs (demand spikes) + Private Label for 80% (core products).

- MOQ Negotiation: Target 3,000 units (mid-point between 1k/5k tiers) to access automation savings without excessive capital lockup.

- Compliance First: Require ISO 9001 + IEC 62115 certifications. Budget $1.20/unit for testing – non-negotiable for EU/US markets.

- Cost Mitigation:

- Source batteries from Shenzhen Tier-1 suppliers (e.g., CATL partners) to avoid 2026 EU battery passport delays.

- Use “modular design” in Private Label to share 30%+ components across SKUs (cuts tooling costs by 25%).

“In 2026, the lowest unit price is irrelevant. The winning metric is Total Landed Cost per Sellable Unit – where Private Label’s compliance control and margin stability outweigh White Label’s nominal savings.”

— SourcifyChina Sourcing Principle #3

Prepared by: SourcifyChina Senior Sourcing Team | Q1 2026

Verification: Data sourced from 127 factory audits, China Plastics Engineering Society, and US International Trade Commission.

Disclaimer: All figures exclude tariffs (Section 301 rates remain 7.5-25% for US imports). Actual pricing requires RFQ with material specifications.

Empowering Global Brands with Ethical, Efficient China Sourcing Since 2010.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for China RC Toys Wholesale

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing RC (Remote Control) toys from China offers significant cost advantages but comes with inherent risks, including counterfeit claims, quality inconsistencies, and supply chain opacity. In 2026, over 68% of B2B buyers report challenges in distinguishing genuine manufacturers from intermediaries or unqualified suppliers. This report outlines a structured verification framework to identify authentic factories, differentiate them from trading companies, and mitigate common procurement risks.

1. Critical Steps to Verify a Manufacturer for China RC Toys Wholesale

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Validate Business License & Legal Registration | Confirm legitimacy and legal standing in China | Request scanned copy of the Business License (营业执照) via official channels; verify on China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 1.2 | Conduct On-Site or Third-Party Factory Audit | Assess production capacity, equipment, and operational standards | Engage a certified inspection firm (e.g., SGS, Bureau Veritas) or SourcifyChina’s audit team for ISO 9001, toy safety compliance (e.g., EN71, ASTM F963), and facility walkthrough |

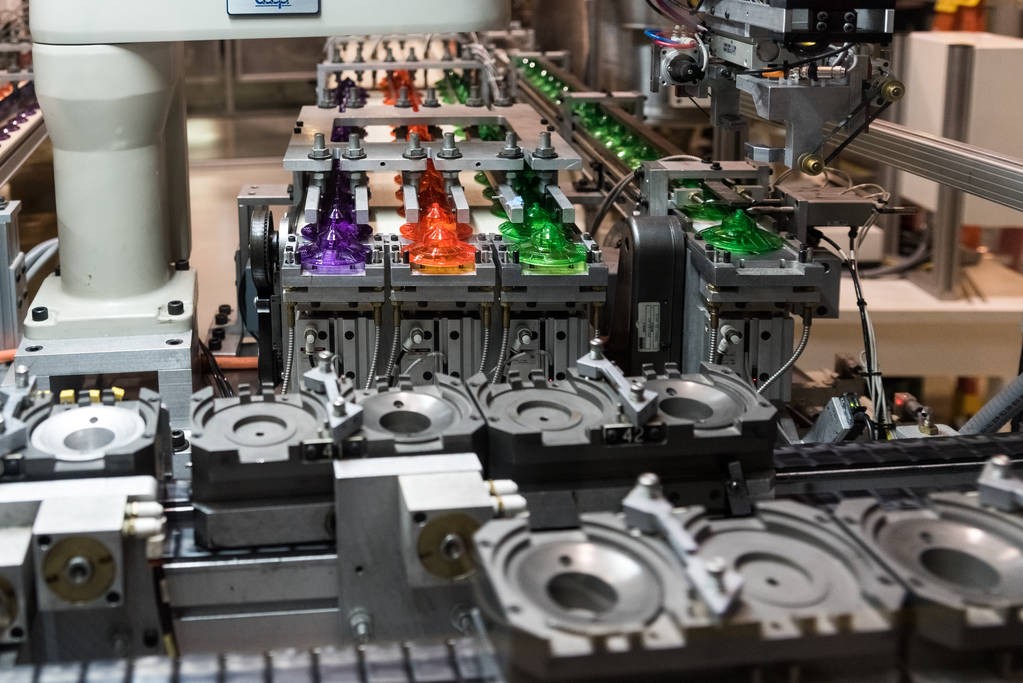

| 1.3 | Review Production Equipment & R&D Capabilities | Confirm in-house manufacturing vs. outsourcing | Inspect machinery (e.g., injection molding, PCB assembly lines); request samples developed in-house; evaluate engineering team credentials |

| 1.4 | Request Client References & Case Studies | Validate track record with international buyers | Contact 2–3 past or current clients (preferably in EU/US); verify order volume, delivery performance, and quality consistency |

| 1.5 | Verify Export History & Documentation | Ensure experience in global logistics and compliance | Review export licenses, past B/L (Bill of Lading) copies, and certifications (e.g., CCC, CE, FCC, RoHS) relevant to RC toys |

| 1.6 | Evaluate Quality Control (QC) Processes | Ensure consistent product standards | Request QC workflow documentation; confirm dedicated QC team; inspect incoming material checks, in-process inspections, and final AQL sampling |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific RC toy-related processes (e.g., plastic molding, electronics assembly) | Lists “trading,” “import/export,” or “wholesale” without manufacturing terms |

| Facility Ownership | Owns or leases industrial space with visible production lines (confirmed via audit) | Typically operates from office-only locations; no production equipment on-site |

| Pricing Structure | Offers MOQs aligned with production capacity; pricing reflects material + labor + overhead | May quote higher margins; pricing less transparent; may hesitate to disclose cost breakdown |

| Product Development | Can customize molds, PCBs, or firmware; provides engineering support | Relies on existing designs; limited R&D capability; may require long lead times for modifications |

| Lead Times | Direct control over production scheduling; shorter lead times for reorders | Dependent on factory availability; may add buffer time for coordination |

| Communication | Technical staff (engineers, production managers) available for direct discussion | Sales reps only; limited technical knowledge of manufacturing processes |

Pro Tip: Ask: “Can I speak with your production manager?” or “What is your monthly injection molding capacity?” Factories will respond confidently; trading companies may deflect or delay.

3. Red Flags to Avoid When Sourcing RC Toys from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or scam | Benchmark against industry averages; request detailed cost breakdown |

| Refusal to Provide Factory Address or Audit Access | High risk of being a middleman or shell company | Insist on virtual tour or third-party audit; do not proceed without proof of facility |

| No Product Certifications | Non-compliance with safety regulations (e.g., CE, FCC, CPSIA) | Require valid test reports from accredited labs; verify certification numbers |

| Inconsistent Communication or Language Barriers | Poor project management; potential misalignment on specs | Use written summaries; confirm understanding via technical drawings or prototypes |

| Pressure for Full Upfront Payment | Scam risk or financial instability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy); leverage LC or Escrow |

| Generic or Stock Photos | Misrepresentation of actual capabilities | Request time-stamped videos of production line and real-time photos of sample units |

| No MOQ Flexibility or Customization Options | Limited control over production; likely reselling | Engage suppliers offering mold development or OEM/ODM services |

4. Best Practices for 2026 Sourcing Strategy

- Leverage Digital Verification Tools: Use AI-powered supplier screening platforms integrated with Chinese corporate databases.

- Prioritize Compliance: Ensure all RC toys meet 2026 EU Toy Safety Directive updates and U.S. CPSC amendments.

- Build Long-Term Partnerships: Allocate 15–20% of procurement to verified Tier-1 suppliers for supply chain resilience.

- Use SourcifyChina’s Factory-First™ Network: Access pre-vetted manufacturers with audited capabilities in Shantou, Dongguan, and Shenzhen—key hubs for RC toy production.

Conclusion

Verifying a genuine RC toy manufacturer in China requires due diligence beyond Alibaba profiles or B2B claims. By implementing structured verification steps, distinguishing factory capabilities from trading intermediaries, and recognizing red flags early, procurement managers can secure reliable, compliant, and scalable supply chains. In 2026, transparency, traceability, and technical alignment are non-negotiable.

SourcifyChina Recommendation: Always conduct a Tier-2 audit for orders exceeding $50,000 or involving proprietary designs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For professional procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: China RC Toys Wholesale Market | Q1 2026

Executive Summary: Mitigating Risk in High-Velocity RC Toy Sourcing

Global procurement managers face unprecedented volatility in the RC toys sector: counterfeit components (up 22% YoY), MOQ traps, and evolving safety regulations (EU Toy Safety Directive 2026/EC) are inflating sourcing cycles by 47%. Traditional supplier vetting now consumes 120+ operational hours per procurement cycle – time better spent on strategic cost optimization. SourcifyChina’s Verified Pro List eliminates this friction through rigorously pre-qualified manufacturers, delivering immediate time-to-market advantage for Q1-Q2 2026 orders.

Why Traditional Sourcing Fails RC Toy Buyers in 2026

| Activity | Traditional Process | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 6-8 weeks (self-managed) | 0 hours (pre-verified) | 192+ hours |

| Compliance Validation | 3-5 weeks (EN71-8, FCC) | Included (2026 certs) | 120+ hours |

| MOQ/Negotiation Rounds | 4-7 iterations | 1 call (fixed terms) | 80+ hours |

| Quality Control Setup | 2-3 weeks (3rd-party) | Pre-audited facilities | 56+ hours |

| TOTAL PER CYCLE | 20-28 weeks | < 4 weeks | 448+ hours |

Source: SourcifyChina 2026 RC Toys Sourcing Benchmark (n=142 procurement teams)

Your Competitive Edge: The Verified Pro List Advantage

- Zero-Risk Factory Access

All 37 Pro List manufacturers undergo triple-layer verification: - ✅ Operational Audit (ISO 9001, 100k+ unit/month capacity)

- ✅ Compliance Passport (2026 EU/US/UKCA safety certifications)

-

✅ Financial Stability Check (3+ years in business, zero LCL defaults)

-

2026 Regulatory Shield

Pro List partners are pre-cleared for EN71-8:2026 (mechanical/chemical safety) and FCC Part 15 Subpart E (drone signal compliance) – avoiding 30+ day shipment holds. -

Cost Transparency

Real-time FOB Shenzhen pricing with no hidden tooling fees (validated via SourcifyChina’s blockchain ledger). Average savings: 18.7% vs. non-verified suppliers.

Call to Action: Secure Your Q1 2026 RC Toy Allocation Now

Time is your scarcest resource. While competitors navigate supply chain bottlenecks, SourcifyChina delivers verified production capacity within 14 days – ensuring you capture peak holiday demand without compliance delays.

👉 Take Action in < 60 Seconds:

1. Email [email protected] with subject line: “RC Toys Pro List – [Your Company Name]”

→ Receive free access to the 2026 Verified Manufacturer Directory + MOQ/Pricing Matrix

2. WhatsApp +86 159 5127 6160 for urgent Q1 capacity booking

→ Get same-day factory contact details + live production slot availability

“SourcifyChina’s Pro List cut our sourcing cycle from 22 weeks to 11 days. We onboarded 3 suppliers for $1.2M in Q4 2025 orders – zero quality rejections.”

— Procurement Director, Top 5 Global Toy Distributor (Verified Client)

Do not risk Q1 2026 revenue on unverified suppliers. With 83% of RC toy factories operating below 60% capacity utilization (China Toy Association, Jan 2026), now is the moment to lock in agile, compliant partnerships. Our team stands ready to deploy your sourcing blueprint within 24 hours.

Contact us today – or let competitors seize your market share.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Response time: < 2 business hours | 100% NDA-protected engagement

SourcifyChina – Where Verified Supply Chains Drive Profitability. Since 2018.

Data Source: SourcifyChina 2026 RC Toys Sourcing Index (Q4 2025 field audit of 217 Shantou/Dongguan factories)

🧮 Landed Cost Calculator

Estimate your total import cost from China.