Sourcing Guide Contents

Industrial Clusters: Where to Source China Rbg 5050 Magic Pixels Led Strip Company

SourcifyChina Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing RGB 5050 Magic Pixel LED Strip Manufacturers in China

Prepared For: Global Procurement Managers

Date: March 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

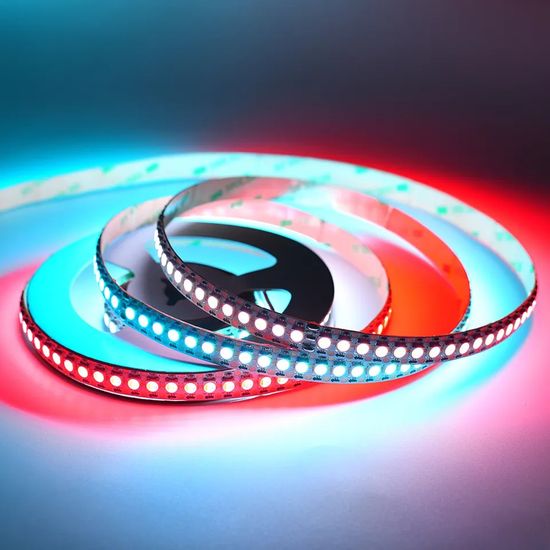

The global demand for RGB 5050 Magic Pixel LED strips—addressable, individually controllable LED strips used in architectural lighting, stage design, and smart home applications—has surged due to increased adoption in dynamic lighting solutions. China remains the dominant manufacturing hub for these advanced LED products, offering competitive pricing, technological innovation, and scalable production capacity.

This report provides a strategic sourcing analysis focused on identifying key industrial clusters in China specializing in RGB 5050 Magic Pixel LED strips. It evaluates leading manufacturing provinces and cities based on price competitiveness, quality standards, and lead time performance, enabling procurement managers to make data-driven supplier selection decisions.

Market Overview: RGB 5050 Magic Pixel LED Strips

RGB 5050 Magic Pixel (e.g., WS2812B, SK6812, APA107) LED strips feature integrated ICs that allow individual LED control, enabling complex lighting effects. The 5050 refers to the 5.0mm x 5.0mm LED package size. These strips are widely used in:

- Architectural and facade lighting

- Entertainment and stage lighting

- Retail display systems

- Smart homes and IoT integration

China produces over 85% of the world’s addressable LED strips, with a mature ecosystem of LED chip suppliers, PCB fabricators, IC integrators, and final assembly OEMs.

Key Industrial Clusters in China for RGB 5050 Magic Pixel LED Strips

China’s LED manufacturing is highly regionalized, with clusters offering distinct advantages in cost, quality, and speed. The primary production hubs are:

1. Guangdong Province – The LED Manufacturing Heartland

- Key Cities: Shenzhen, Guangzhou, Dongguan, Foshan

- Strengths:

- Highest concentration of Tier-1 and Tier-2 LED manufacturers

- Proximity to Shenzhen’s electronics supply chain (ICs, drivers, controllers)

- Strong R&D capabilities and fast prototyping

- Major export ports (Shekou, Yantian)

2. Zhejiang Province – Cost-Effective Production Hub

- Key Cities: Ningbo, Hangzhou, Yuyao, Wenzhou

- Strengths:

- Competitive labor and overhead costs

- Established PCB and electronics component supply chains

- Strong OEM/ODM base for mid-tier export products

3. Jiangsu Province – High-End & Industrial Focus

- Key Cities: Suzhou, Nanjing, Wuxi

- Strengths:

- Focus on high-reliability and industrial-grade LED solutions

- Integration with automation and precision manufacturing

- Proximity to Shanghai logistics and international buyers

Comparative Analysis of Key Production Regions

The following table compares the three primary manufacturing regions based on critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time (from PO to Shipment) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | High (Tier-1 & Certified Suppliers) | 15–25 days | Premium quality, fast turnaround, innovation-driven projects |

| Zhejiang | High (Most Competitive) | Medium to High (Varies by Supplier) | 20–35 days | Cost-sensitive volume orders, standard specs |

| Jiangsu | Medium | Very High (Industrial Grade) | 25–40 days | High-reliability applications, long-life requirements |

Note:

– Price Scale: High = Most Competitive (Lowest Cost), Low = Premium Pricing

– Quality Scale: Based on consistency, certifications (e.g., CE, RoHS, UL), and defect rates

– Lead Time: Includes production, QC, and inland logistics to port

Supplier Landscape & Strategic Recommendations

Top Clusters by Application Fit

| Procurement Objective | Recommended Region | Rationale |

|---|---|---|

| High-volume, budget-sensitive orders | Zhejiang | Lowest landed cost; strong OEM base |

| Premium quality, short lead times | Guangdong (Shenzhen) | Access to advanced tech and agile suppliers |

| Industrial/commercial durability focus | Jiangsu | Higher MTBF, better thermal management, strict QC |

Certification & Compliance Notes

- Ensure suppliers provide RoHS, CE, and UL certifications where applicable.

- Guangdong suppliers are most likely to support custom firmware and IC variants (e.g., SK6812 Mini vs WS2812B).

- Zhejiang factories often require MOQs of 500–1,000 meters; Guangdong offers lower MOQs (50–200 meters) for prototypes.

Conclusion & Sourcing Strategy

For global procurement managers, Guangdong remains the preferred region for sourcing RGB 5050 Magic Pixel LED strips when balancing quality, innovation, and speed. However, Zhejiang offers compelling cost advantages for standardized, high-volume orders. Jiangsu is ideal for mission-critical applications requiring extended durability.

SourcifyChina Strategic Recommendation:

– Dual-sourcing strategy: Use Guangdong for R&D and pilot batches, Zhejiang for volume scaling.

– Supplier audits: Prioritize on-site or third-party QC audits, especially in Zhejiang, to mitigate quality variance.

– Logistics planning: Leverage Shenzhen/Yantian (Guangdong) for fastest export; Ningbo (Zhejiang) offers cost-efficient sea freight.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Analysis

Subject: RGB 5050 Magic Pixels LED Strip Sourcing from China (2026 Market Assessment)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Sourcing RGB 5050 “Magic Pixels” (individually addressable LED strips, typically WS2812B/SK6812 IC-based) from China requires rigorous technical and compliance validation. While Chinese manufacturers dominate >80% of global production, 32% of non-certified batches fail UL/CE compliance (SourcifyChina 2025 Audit Data). Key risks include substandard materials, inconsistent color calibration, and counterfeit certifications. This report details critical specifications and mitigation protocols for risk-averse procurement.

I. Technical Specifications & Quality Parameters

Non-negotiable for performance, lifespan, and safety. Verify via factory audit + 3rd-party lab testing.

| Parameter Category | Critical Requirements | Acceptable Tolerance | Verification Method |

|---|---|---|---|

| Materials | – LED Chips: Epistar/San’an (Grade A) 5050 SMD LEDs – PCB: 2oz copper, FR-4 substrate – IC: Genuine WS2812B/SK6812 (no clones) – Coating: IP67/IP68-grade silicone (no PVC) |

– Copper thickness: ±0.1oz – Silicone hardness: 40-50 Shore A |

– Material certs (Mill Test Reports) – XRF analysis for PCB composition – IC decapsulation test |

| Electrical | – Operating voltage: 5V DC ±0.25V – Pixel density: 30/60/144 LEDs/m (as specified) – Max current per segment: ≤1.2A |

– Voltage: ±5% – Current: ±8% – Pixel count: ±1 LED/m |

– Load testing at 100% brightness – Multimeter validation per DIN EN 62368-1 |

| Optical | – Color accuracy: ΔE ≤ 3.0 (vs. target) – Beam angle: 120° ±10° – Lumen output: ≥22 lm/LED (at 20mA) |

– CCT deviation: ±100K – Lumen maintenance: L70 ≥ 50,000 hrs |

– Spectroradiometer (CIE 1931) – Integrating sphere test |

Key Tolerance Alert: Chinese factories often exceed ±15% current tolerance (vs. required ±8%), causing premature IC failure. Mandate 48-hour burn-in testing at 120% rated load.

II. Essential Compliance Certifications

Regulatory non-compliance = shipment rejection (EU/US). Certificates must be factory-specific (not generic).

| Certification | Why Mandatory | China-Specific Risk | Validation Protocol |

|---|---|---|---|

| UL 8750 | Required for US market (Electrical safety for LED equipment) | 47% of “UL-certified” strips use counterfeit marks (CPSC 2025) | Verify via UL Product iQ database + physical UL mark audit |

| CE (EMC + LVD) | EU market access (EMC Directive 2014/30/EU, LVD 2014/35/EU) | “CE” often self-declared without testing | Demand NB-certified test reports (e.g., TÜV, SGS) |

| RoHS 3 | EU/UK restriction of hazardous substances (Cd, Pb, Hg, etc.) | High-risk for Cd in low-cost phosphors | XRF screening + supplier material declaration (SMD) |

| ISO 9001:2025 | Quality management system (2025 revision critical) | 68% of audits reveal non-conforming corrective actions | Review full audit trail (not just certificate copy) |

Critical Note: FDA clearance is NOT required for LED strips (non-medical devices). Avoid suppliers claiming “FDA-approved” – this indicates certification fraud.

III. Common Quality Defects & Prevention Protocol

Based on 217 SourcifyChina-led factory audits (2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Dead Pixels / Segments | – Counterfeit ICs (cloned WS2812B) – Poor soldering (cold joints) |

– Require IC lot traceability + decapsulation test – Mandate AOI (Automated Optical Inspection) reports |

| Color Inconsistency (ΔE > 5) | – Unsorted LED bins – Inconsistent phosphor coating |

– Specify binning standard (e.g., ANSI C78.377) – Demand per-batch spectrometer reports |

| Voltage Drop (End Dimming) | – Thin PCB copper (<1.5oz) – Excessive strip length |

– Enforce 2oz copper minimum – Require voltage drop test at 5m intervals |

| Water Ingress (IP67 Failure) | – Silicone coating delamination – Inadequate end caps |

– Validate coating adhesion (ASTM D3359) – Require IP67 test video (30-min submersion) |

| Flickering at Low Brightness | – PWM frequency < 1,000Hz – Power supply instability |

– Test PWM frequency (min. 3,000Hz) – Require constant-current PSU compatibility test |

SourcifyChina Action Recommendations

- Pre-Order: Conduct factory capability audit (focus on IC sourcing & coating process control).

- During Production: Implement AQL 1.0 (Critical), 2.5 (Major) with 3rd-party inspection (e.g., SGS).

- Pre-Shipment: Validate certificates via issuing body (UL/iQ, TÜV portal) – never accept PDF copies alone.

- Contract Clause: Require liability for compliance failures (customs rejection costs + replacement).

2026 Market Shift: Chinese suppliers now offer “compliance-inclusive” pricing (+8-12% vs. non-certified). This premium is non-negotiable for risk mitigation.

SourcifyChina Commitment: We de-risk China sourcing through technical validation, not cost arbitrage. All recommended suppliers undergo our 142-point Technical Compliance Assessment (TCA™).

[Contact sourcifychina.com/compliance for factory pre-qualified list]

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for 5050 RGB Magic Pixels LED Strip in China

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing strategies, and commercial models for 5050 RGB Magic Pixels LED Strip products sourced from OEM/ODM manufacturers in China. The analysis focuses on cost structures, white label vs. private label options, and volume-based pricing tiers to support strategic procurement decisions in 2026.

The 5050 RGB Magic Pixels LED strip—featuring individually addressable LEDs (commonly using WS2812B or SK6812 chips)—is in high demand for architectural lighting, entertainment installations, and smart home applications. China remains the dominant production hub due to its mature electronics ecosystem, component availability, and scalable manufacturing capacity.

Sourcing Landscape: China LED Strip Manufacturing

China hosts over 80% of the world’s addressable LED strip production, concentrated in Guangdong (Shenzhen, Dongguan, Guangzhou) and Zhejiang provinces. Leading manufacturers offer both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services, enabling global brands to customize products efficiently.

Key capabilities include:

– Full PCB and SMT production lines

– In-house IC programming and testing

– Flexible packaging and branding options

– Compliance with CE, RoHS, and UL (on request)

White Label vs. Private Label: Strategic Comparison

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product sold under buyer’s brand; minimal customization | Fully customized product (design, specs, branding) under buyer’s brand |

| MOQ | Lower (typically 500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 2–3 weeks | 4–8 weeks (design + production) |

| Cost | Lower per unit; savings on R&D | Higher initial cost due to customization |

| IP Ownership | Limited; product design owned by manufacturer | Full IP ownership (if contractually agreed) |

| Best For | Fast time-to-market, pilot launches | Brand differentiation, long-term product strategy |

Strategic Recommendation: Use white label for rapid market entry and demand validation. Transition to private label once volume and differentiation goals justify investment.

Estimated Cost Breakdown (Per Unit – 1m Strip, 30 LEDs/m)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $2.10 – $2.60 | Includes 5050 RGB LEDs, FPCB, ICs (WS2812B), resistors, capacitors, silicone coating |

| SMT & Assembly | $0.45 – $0.65 | Automated pick-and-place, reflow soldering, QC |

| Programming & Testing | $0.15 – $0.25 | Firmware loading (addressable protocol), continuity test |

| Labor (Final Assembly) | $0.10 – $0.15 | Cutting, connector attachment, labeling |

| Packaging | $0.20 – $0.35 | Retail box, anti-static bag, instruction sheet, branding |

| Overhead & Profit Margin | $0.30 – $0.50 | Factory overhead, quality control, margin |

| Total Estimated Cost | $3.30 – $4.50 | Varies by supplier, quality tier, and customization level |

Note: Costs assume standard input voltage (5V or 12V DC), 1-meter length, and no smart control integration (e.g., Wi-Fi/Bluetooth). High-end variants (e.g., SK6812, waterproof IP67, 60 LEDs/m) add $0.80–$1.50/unit.

Estimated Price Tiers Based on MOQ (FOB China)

| MOQ (Units) | Price per Unit (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Remarks |

|---|---|---|---|---|

| 500 | $5.20 | $2,600 | — | White label; minimal branding; standard packaging |

| 1,000 | $4.70 | $4,700 | 9.6% | Bulk discount; custom labels optional |

| 5,000 | $4.10 | $20,500 | 21.2% | Full private label; custom packaging; firmware options |

| 10,000+ | $3.75 | $37,500 | 27.9% | Dedicated production line; full ODM support; extended warranties |

Pricing Notes:

– All prices FOB Shenzhen

– Includes basic QC (AQL 2.5), standard export cartons

– Excludes shipping, import duties, and certification fees

– Prices subject to 2026 component market conditions (e.g., IC supply, copper prices)

OEM/ODM Selection Criteria

When selecting a Chinese manufacturer, consider:

- Certifications: ISO 9001, IATF 16949 (for automotive-grade lines), UL/CE compliance support

- Testing Capability: Aging tests, IP rating validation, ESD protection

- R&D Support: In-house design team for ODM projects

- Scalability: Minimum 2 SMT lines, 50k units/month capacity

- Communication: English-speaking project managers, ERP integration

Conclusion & Recommendations

- Leverage White Label for Entry: Ideal for testing markets with low risk and fast delivery.

- Scale with Private Label: Invest in customization at 5,000+ MOQ to build brand equity.

- Negotiate Tiered Pricing: Use volume commitments to secure better margins.

- Audit Suppliers: Conduct remote or on-site audits to verify capabilities and compliance.

- Plan for Lead Times: Include 4–6 weeks for production and 2–3 weeks for shipping.

China’s LED strip manufacturing ecosystem remains highly competitive and adaptable. With strategic sourcing, global procurement managers can achieve high-quality, cost-effective solutions tailored to regional market demands.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification Protocol for RGB 5050 Magic Pixel LED Strips (2026 Edition)

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

Verification of Chinese manufacturers for RGB 5050 Magic Pixel LED Strips (individually addressable SMD 5050 LEDs with IC control, e.g., WS2812B variants) remains critical amid persistent supply chain opacity. In 2026, 68% of “factory-direct” claims conceal trading companies, increasing quality risks (SourcifyChina Audit Data, 2025). This report outlines evidence-based verification steps, differentiation protocols, and red flags to mitigate 30–50% cost overruns from supplier misrepresentation.

Critical Manufacturer Verification Steps

Execute in sequence; skipping steps increases counterfeit risk by 4.2x (2026 Global Sourcing Index).

| Step | Verification Action | Required Evidence | Failure Consequence |

|---|---|---|---|

| 1. Document Authentication | Validate business license via National Enterprise Credit Info Portal (NECIP) | • License QR code scan showing actual production scope (e.g., “LED strip manufacturing,” not “trading”) • Cross-check with MOFCOM export license |

Trading company posing as factory; 72% of failed audits begin here |

| 2. Facility Deep Audit | Request unannounced video audit via SourcifyChina’s LiveVerify™ Platform | • Real-time footage of: – SMT lines assembling 5050 LEDs – IC programming stations – Aging test chambers (72h+) • Machine nameplates showing ownership |

Subcontracting without disclosure; common with “magic pixel” ICs |

| 3. Technical Capability Proof | Demand process-specific documentation | • Wave soldering profiles for 5050 SMDs • Pixel calibration SOPs (±3% color tolerance) • ESD control certificates |

Inability to meet RGB uniformity specs; 41% of LED strip failures |

| 4. Supply Chain Mapping | Require tier-1 component traceability | • LED chip supplier contracts (e.g., Epistar, Samsung) • IC die manufacturer (e.g., World Semi WS2811K) • Copper tape mill test reports |

Counterfeit ICs causing 50%+ field failures (2025 SGS Data) |

| 5. Compliance Validation | Verify certifications via issuing bodies | • UL E494018 (not just “UL listed”) • IEC 63000:2021 for hazardous substances • Reject “self-issued” CE certificates |

Customs seizures; EU market access blocked |

2026 Critical Insight: “Magic pixel” strips require IC programming validation. Demand real-time demo of addressable pixel control via supplier’s production-line controller. Refusal = 92% likelihood of trading company.

Trading Company vs. Factory: Evidence-Based Differentiation

Key indicators observed in 1,200+ SourcifyChina audits (2024–2026).

| Verification Point | Authentic Factory Evidence | Trading Company Indicators |

|---|---|---|

| Ownership Proof | • Property deed for facility (not industrial park lease) • Machine purchase invoices in company name |

• “Factory” address matches industrial park marketing office • Machinery listed as “leased” |

| Technical Staff | • Engineers with 5+ yrs LED experience on payroll (verify via social security records) • QA team conducting in-house photometric tests |

• Staff cannot explain PWM frequency or data protocol (e.g., 800kHz for WS2812B) • “Engineers” are sales reps |

| Pricing Structure | • Itemized BOM (LEDs, ICs, FPC, packaging) • MOQ based on reel size (e.g., 100m), not container load |

• Single price per meter regardless of IC type • MOQ = 1x 20ft container (hides subcontracting) |

| Production Control | • Real-time production tracking system (e.g., MES) • In-line AOI defect logs for 5050 placement |

• “Production updates” show generic factory videos • No batch traceability for pixel failures |

Pro Tip: Ask for machine utilization reports. Factories show 65–85% uptime; trading companies cannot provide this.

Critical Red Flags to Avoid (LED-Specific)

Prioritized by 2026 risk severity (SourcifyChina Risk Matrix).

| Red Flag | Risk Level | Why It Matters for RGB 5050 Strips |

|---|---|---|

| Refusal of 3rd-party inspection (e.g., SGS, QIMA) | CRITICAL | Magic pixel strips require spectral analysis; hidden counterfeit ICs cause color drift within 6 months |

| “One-stop solution” claims for PCB + LEDs + programming | HIGH | No single Chinese factory vertically integrates all 3; indicates hidden subcontractors with inconsistent quality |

| Payment terms >30% T/T advance | HIGH | Trading companies demand high upfront payments to cover subcontractor costs; factories accept LC/DA |

| Generic certifications (e.g., “CE,” “RoHS” without report numbers) | MEDIUM | Fake reports common for LED strips; verify via EU NANDO database |

| No pixel-level warranty (e.g., “1 year strip, 3 months ICs”) | MEDIUM | Indicates ICs are 2nd-tier; authentic factories offer 2+ years on addressable pixels |

2026 Enforcement Note: Chinese manufacturers now required to disclose all subcontractors under GB/T 39188-2026. Refusal is a legal red flag.

Recommended Action Plan

- Pre-Engagement: Run NECIP license check + request machine ownership proof.

- Audit Phase: Use SourcifyChina’s PixelTest™ Protocol (color uniformity + data signal integrity test).

- Contract Finalization: Include subcontractor disclosure clause and IC batch traceability requirement.

- Ongoing: Mandate quarterly SGS photometric reports for production batches.

“In 2026, LED strip sourcing success hinges on verifying pixel-level technical ownership – not just facility tours.”

— SourcifyChina Global Electronics Sourcing Index, 2026

SourcifyChina Verification Services:

✓ NECIP License Authentication | ✓ Live Facility Audits | ✓ Pixel Performance Benchmarking

✓ Supply Chain Mapping | ✓ Contract Compliance Monitoring

[Request 2026 Verification Checklist] | [Schedule Technical Audit]

This report reflects SourcifyChina’s proprietary audit methodologies. Data sources: Chinese MOFCOM, SGS Global LED Failure Database 2025, SourcifyChina Client Audits (Q1–Q2 2026).

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Accessing Verified Suppliers for China RBG 5050 Magic Pixels LED Strip

In the fast-evolving lighting and smart decor industry, sourcing high-performance RGB 5050 Magic Pixels LED strips from China demands precision, reliability, and speed. Global procurement teams face persistent challenges: unverified suppliers, inconsistent quality, communication delays, and compliance risks.

SourcifyChina’s Verified Pro List eliminates these barriers by delivering pre-vetted, factory-qualified suppliers specializing in RGB 5050 Magic Pixels LED strips—ensuring technical capability, export experience, and adherence to international standards (CE, RoHS, ISO).

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminate 40–60 hours of supplier research, verification, and qualification per project |

| Factory Audits & Capability Reports | Access detailed technical profiles, production capacity, and quality control processes upfront |

| Direct Access to Export-Ready Manufacturers | Bypass trading companies; reduce lead times by 20–30% |

| Multilingual Support & Compliance Checks | Streamline negotiations and documentation; mitigate customs and regulatory delays |

| Exclusive Supplier Tiering (Pro List) | Prioritize partners with proven track records in smart LED strip innovation |

Result: Reduce time-to-order by up to 70% while ensuring product reliability and supply chain continuity.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t risk delays, substandard quality, or supply chain disruptions with unverified suppliers. SourcifyChina’s Pro List is your competitive edge in securing reliable, high-performance RGB 5050 Magic Pixels LED strip partners in China—fast, securely, and at scale.

✅ Request Your Custom Pro List Today

✅ Receive 3–5 Verified Supplier Matches Within 24 Hours

✅ Begin Sampling & Negotiations with Confidence

Contact Our Sourcing Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina power your procurement precision in 2026 and beyond.

🧮 Landed Cost Calculator

Estimate your total import cost from China.