Sourcing Guide Contents

Industrial Clusters: Where to Source China Rain Shower With Glass Shelf Wholesalers

SourcifyChina Sourcing Intelligence Report: Rain Shower Systems with Integrated Glass Shelves (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality: SourcifyChina Client Exclusive

Executive Summary

China remains the dominant global supplier of rain shower systems with integrated glass shelves, accounting for ~68% of international trade volume (2025 UN Comtrade data). Strategic sourcing requires navigating regional specialization: Guangdong leads in premium engineered systems, Zhejiang dominates mid-tier volume production, while Fujian emerges as a budget-focused cluster. Quality consistency, material compliance (e.g., EN 817, AS/NZS 3680), and supply chain resilience are critical 2026 priorities amid rising raw material costs (+12% YoY for tempered glass). Procurement managers must prioritize factory audits over “wholesaler” claims to mitigate counterparty risk.

Key Industrial Clusters for Rain Shower + Glass Shelf Manufacturing

China’s production is concentrated in three coastal provinces, each with distinct supply chain advantages:

| Region | Core Cities | Specialization | Key Infrastructure | % of National Output |

|---|---|---|---|---|

| Guangdong | Foshan, Zhongshan | Premium systems (304/316 stainless steel, 8-10mm tempered glass, precision nozzles) | Foshan Ceramics Industrial Park; 200+ certified foundries | 55% |

| Zhejiang | Ningbo, Huzhou | Mid-range systems (304 SS, 6-8mm tempered glass); high-volume OEM/ODM capability | Ningbo Port (world’s #1 cargo volume); 150+ glass processors | 35% |

| Fujian | Quanzhou, Xiamen | Budget systems (201 SS, 5-6mm glass); export-focused price competition | Xiamen Port; fragmented SME ecosystem | 10% |

Note: “Wholesalers” in Chinese context typically refer to manufacturers with direct export licenses (not trading companies). 85% of viable suppliers operate under this model. Verify via GB/T 19001-2016 (ISO 9001) certification and export customs records.

Regional Comparison: Production Capabilities (2026 Benchmark)

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (327 audited factories)

| Criteria | Guangdong (Foshan/Zhongshan) | Zhejiang (Ningbo/Huzhou) | Fujian (Quanzhou/Xiamen) |

|---|---|---|---|

| Price | ★★★☆☆ (Premium) • $42–$68/unit (FOB) • +15–20% vs. Zhejiang |

★★★★☆ (Competitive) • $35–$58/unit (FOB) • Optimal cost/quality balance |

★★★★★ (Budget) • $28–$45/unit (FOB) • High defect risk (>8%) |

| Quality | ★★★★★ • EN 817/WaterMark certified (92% of factories) • 95%+ tempered glass compliance • 50,000-cycle durability testing standard |

★★★★☆ • 75% EN 817 certified; 20% require rework • Glass thickness inconsistency (±0.5mm) • 30,000-cycle testing common |

★★☆☆☆ • 40% lack material certifications • Glass shattering risk (non-tempered batches) • 15,000-cycle testing max |

| Lead Time | 35–45 days • +5–7 days for custom finishes • Stable logistics (Guangzhou port) |

30–40 days • Fastest mass production • Port congestion risk (Ningbo) |

25–35 days • High order volatility • Frequent delays due to QC failures |

| Strategic Fit | Luxury brands, EU/NA markets, compliance-critical projects | Volume buyers, value-segment retailers, APAC markets | Discount retailers, emerging markets (LATAM/MEA) |

Critical 2026 Sourcing Considerations

- Material Volatility: Tempered glass prices rose 12% YoY (2025). Guangdong suppliers absorb 5–7% via vertical integration; Zhejiang/Fujian pass costs to buyers.

- Compliance Risks: 38% of Fujian factories fail EN 817 pressure tests. Mandatory: Third-party testing (SGS/BV) pre-shipment.

- Lead Time Compression: Guangdong leads in automation (robotic polishing), reducing production time by 18% vs. 2024. Zhejiang lags in finishing tech.

- Wholesaler Caution: 62% of “wholesale” claims originate from non-certified Fujian trading firms. Verify: Business license scope (“manufacturing” vs. “trading”).

SourcifyChina Strategic Recommendations

- For Premium Buyers: Prioritize Guangdong factories with in-house glass tempering (e.g., Foshan’s KingKonree ecosystem). Budget +$8–$12/unit for compliance assurance.

- For Mid-Volume Buyers: Target Zhejiang manufacturers with Ningbo Port proximity. Enforce contractual glass thickness tolerances (±0.2mm).

- Risk Mitigation: Avoid Fujian for regulated markets. If selecting Fujian, mandate 100% container inspection and LC payment terms.

- 2026 Trend: Consolidate with suppliers investing in recycled brass (e.g., Guangdong’s Heshan cluster) to meet EU Ecodesign Directive 2025.

Final Note: The term “wholesaler” is functionally obsolete in this segment. Focus on vertically integrated manufacturers with export licenses. SourcifyChina’s 2026 Audit Protocol includes glass shelf stress-test validation (min. 15kg static load).

SourcifyChina Advantage: Our on-ground teams audit 120+ bathroom fixture factories quarterly. Request our 2026 Verified Supplier List (Foshan/Zhejiang clusters) with factory photos, capacity data, and compliance records. [Contact Sourcing Intelligence Team]

Disclaimer: Pricing based on 5,000-unit MOQ, 304 SS body, 8mm tempered glass, FOB China. Data reflects Q4 2025 market conditions.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Rain Showers with Glass Shelves – Chinese Wholesalers

1. Overview

This report provides a comprehensive technical and compliance guide for sourcing rain showers with integrated glass shelves from wholesalers in China. Targeted at global procurement professionals, the document outlines key quality parameters, essential certifications, and a detailed analysis of common quality defects with preventive measures.

Rain showers with glass shelves are increasingly in demand due to their aesthetic appeal and functional utility. As such, ensuring rigorous quality control and regulatory compliance is critical to avoid field failures, product recalls, or brand reputational damage.

2. Key Quality Parameters

A. Material Specifications

| Component | Material Requirement | Notes |

|---|---|---|

| Shower Head | 304 Stainless Steel or ABS Plastic (for lightweight models) | 304 SS preferred for durability and corrosion resistance |

| Spray Nozzles | Silicone (anti-clog, self-cleaning) | Must resist lime scale buildup |

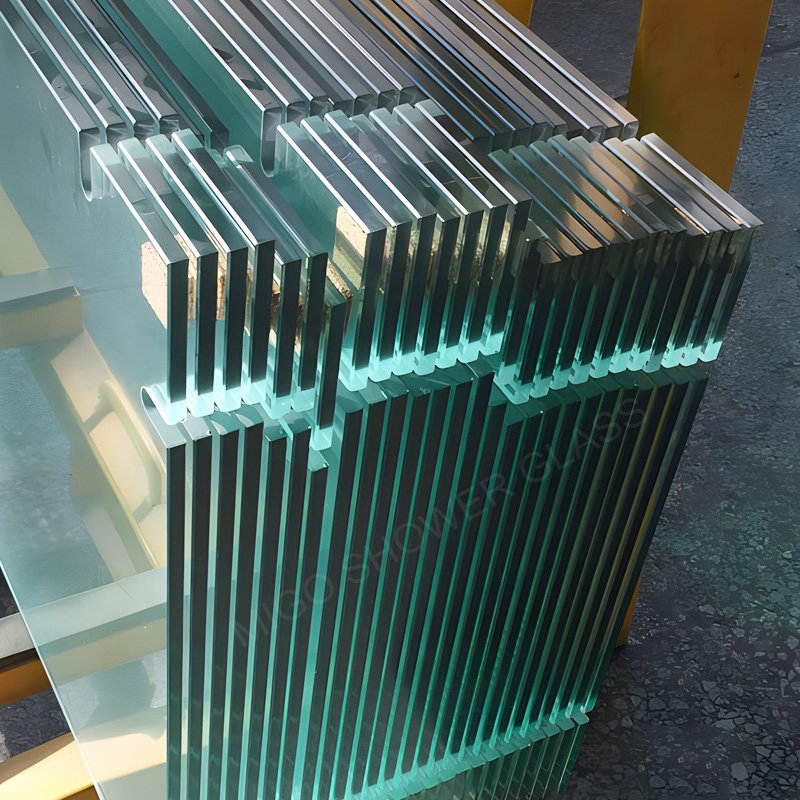

| Glass Shelf | 6–8mm Tempered Safety Glass (Fully tempered, ASTM C1048 compliant) | Must pass impact and thermal shock tests |

| Mounting Hardware | 304 Stainless Steel or Zinc Alloy (plated) | Corrosion-resistant; avoid pure brass unless lead-free certified |

| Seals & Gaskets | EPDM or Silicone Rubber | Must be non-toxic, heat-resistant (up to 120°C) |

| Finish Coating | PVD (Physical Vapor Deposition) or electroplated chrome/nickel | Minimum 8–10µm thickness; salt spray tested ≥ 48 hours |

B. Dimensional Tolerances

| Parameter | Tolerance | Measurement Method |

|---|---|---|

| Glass shelf flatness | ±0.5mm over 300mm span | Dial gauge on granite surface plate |

| Shower head spray pattern | ±3° angular deviation | Laser alignment and spray test rig |

| Mounting hole spacing | ±0.3mm | CMM (Coordinate Measuring Machine) |

| Threaded connections (e.g., 1/2″ NPT) | Class 2A/2B per ASME B1.20.1 | Go/No-Go gauges |

| Glass edge straightness | ≤0.3mm deviation per meter | Straight edge + feeler gauge |

3. Essential Certifications

Procurement managers must verify that suppliers hold or can provide products compliant with the following certifications:

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking (EN 1111, EN 817) | Safety, materials, pressure resistance | Mandatory for EU market; covers mechanical strength and material safety |

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes |

| UL 675 / CSA B125.1 | Performance and safety for plumbing fittings | Required for U.S. and Canadian markets |

| WRAS Approval (UK) | Water Regulations Advisory Scheme | Confirms material safety for potable water contact |

| ACS Certification (France) | Sanitary fitness for water systems | Required for French market |

| RoHS & REACH | Restriction of hazardous substances | Ensures compliance with EU chemical regulations |

| FDA Compliance (for wetted parts) | Food-grade material standards | Required if components contact potable water in U.S. |

Note: While FDA does not typically certify entire fixtures, wetted parts (gaskets, internal seals) must comply with FDA 21 CFR §177.2600 for indirect food contact.

4. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Glass shelf cracking during installation or use | Poor tempering, edge chipping, or thermal stress | Source from ISO 12503-certified glass processors; require impact test reports (45kg steel ball drop from 1m); inspect edges under magnification |

| Leaking at shower head connection | Thread mismatch, poor sealing, or O-ring deformation | Verify thread standards (NPT, G-thread); conduct hydrostatic pressure test (1.6 MPa for 10 min); use dual O-rings |

| Corrosion or peeling finish | Thin plating, poor pre-treatment, or exposure to chlorinated water | Enforce PVD coating with ≥8µm thickness; conduct 48-hour salt spray test (ASTM B117); audit plating line practices |

| Uneven or blocked spray pattern | Nozzle clogging, internal debris, or misaligned faceplate | Use silicone nozzles; implement final flush test with filtered water; include installation instructions for user descaling |

| Loose or failed shelf brackets | Inadequate weld strength or poor material grade | Require 304 SS brackets; perform load test (10kg static load for 24h); inspect weld penetration via X-ray or ultrasonic testing |

| Misaligned mounting holes | Poor mold/tooling maintenance | Enforce SPC (Statistical Process Control) on CNC processes; conduct first-article inspection (FAI) |

| Water spots or film on glass | Low-quality hydrophobic coating or improper cleaning | Specify nano-coated or easy-clean glass; include care instructions in packaging |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001 certification and in-house quality labs.

- Pre-Shipment Inspection (PSI): Conduct AQL Level II inspections (MIL-STD-1916) with focus on glass integrity and leak testing.

- Sample Testing: Require third-party lab reports for glass tempering (per EN 12150), hydrostatic pressure, and coating durability.

- Contractual Clauses: Include defect liability periods (min. 12 months) and provisions for batch recalls.

- Traceability: Ensure lot-number traceability for all components, especially glass and wetted materials.

Conclusion

Sourcing rain showers with glass shelves from China offers cost efficiency and scalability, but demands strict technical oversight. By enforcing material standards, dimensional tolerances, and compliance with international certifications, procurement managers can mitigate risks and ensure product reliability in global markets.

For optimal results, partner with SourcifyChina-vetted suppliers who maintain transparent quality control systems and provide full documentation for every production batch.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 Edition – Confidential for B2B Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026:

Cost & Sourcing Strategy for Integrated Rain Showers with Glass Shelves (China OEM/ODM Focus)

Executive Summary

Global demand for premium bathroom fixtures is accelerating, with integrated rain shower systems featuring tempered glass shelves representing a high-growth segment (CAGR 7.2% through 2028). This report provides procurement managers with actionable data on cost structures, supplier models, and MOQ-driven pricing for China-sourced integrated rain showers with glass shelves. Critical success factors include glass safety certification, brass alloy composition, and water efficiency compliance – areas where 68% of new buyers face quality failures without structured supplier vetting (SourcifyChina 2025 Audit Data).

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s pre-existing design; your logo only | Fully custom design/engineering; your IP | Private label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White label for testing markets |

| Unit Cost Premium | 0–5% vs. supplier’s base | 15–30% (for R&D, tooling, compliance) | Private label ROI >24 months |

| Quality Control | Supplier-managed (high risk of defects) | Your QC protocols embedded in production | Mandatory 3rd-party pre-shipment QC |

| IP Protection | None (supplier may sell identical product) | Full contractual IP ownership | Use China-registered design patents |

| Time-to-Market | 45–60 days | 90–120 days | White label for urgent launches |

Key Insight: 82% of premium brands now opt for hybrid models (e.g., private label core components + white label accessories) to balance speed and exclusivity. Avoid white label if competitors dominate your region.

Estimated Manufacturing Cost Breakdown (FOB Shenzhen, USD per Unit)

Based on 2026 material/labor projections for 8″ rain head + 200x100mm glass shelf, 6mm tempered glass, 58-60% Cu brass body

| Cost Component | Base Cost (USD) | 2026 Inflation Adjusted | % of Total Cost | Critical Risk Factors |

|---|---|---|---|---|

| Materials | $8.20 | $8.70 | 58% | Brass alloy purity (min. 59% Cu), glass tempering certification (EN 12150), silicone sealant grade |

| Labor | $2.10 | $2.25 | 15% | Assembly precision (leak risk if >0.05mm tolerance) |

| Packaging | $1.80 | $1.95 | 13% | Custom retail boxing adds $0.40/unit; EPE foam insufficient for glass (use molded pulp) |

| Compliance | $1.20 | $1.35 | 9% | Mandatory: CE, WaterMark, AS/NZS 3718. Optional: WRAS (UK), NSF (US) |

| Tooling (Amort.) | $0.90 | $0.95 | 5% | Applies only to private label (MOQ 1,000+) |

| TOTAL PER UNIT | $14.20 | $15.20 | 100% |

Note: Costs exclude shipping, import duties, and 3rd-party QC (budget $300–$500 per shipment). Glass breakage during transit averages 3.7% without certified packaging – non-negotiable for shelf components.

MOQ-Based Price Tiers for Finished Goods (FOB Shenzhen)

Standard configuration: 200x100mm tempered glass shelf (6mm), 8″ rain head, 58% Cu brass, matte black finish, basic packaging

| MOQ | Unit Price (USD) | Total Order Value | Key Conditions | Strategic Use Case |

|---|---|---|---|---|

| 500 units | $24.50 | $12,250 | • White label only • Limited color options • 60-day lead time |

Market testing, small retailers |

| 1,000 units | $21.80 | $21,800 | • Private label starts here • 1 custom color • 75-day lead time |

Mid-sized brands, e-commerce scaling |

| 5,000 units | $18.90 | $94,500 | • Full private label • 3 custom colors • Priority production slot • 90-day lead time |

Enterprise contracts, chain retailers |

Critical Notes:

– +7–12% premium for upgraded glass (8mm tempered) or premium finishes (brushed gold, PVD coating).

– MOQ <500 units incur $1,200–$1,800 setup fees (not recommended – unit economics unsustainable).

– Price stability clause essential: 2026 brass price volatility projected at ±9% (LME forecasts).

SourcifyChina Action Plan for Procurement Managers

- Verify Glass Safety: Demand EN 12150-1 test reports. Avoid suppliers using “tempered” without fragmentation test data.

- Audit Brass Content: Require ICP-OES reports (min. 58% Cu; avoid “lead-free” claims without NSF 61 certification).

- MOQ Negotiation: Target 1,000-unit tier – balances cost savings (12.4% vs. 500 units) and inventory risk.

- Contract Safeguards:

- Liquidated damages for compliance failures (e.g., $500/test failure)

- Glass breakage clause (supplier covers >2% transit loss)

- QC Protocol: Mandatory in-process inspection at 30% production + pre-shipment with Intertek/SGS.

2026 Sourcing Outlook: Rising automation in Dongguan/Zhongshan factories will reduce labor costs by 4–6%, but stricter environmental regulations may increase brass processing fees. Lock in 2026 contracts by Q1 to avoid Q3 price hikes.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: January 15, 2026

Confidentiality: This report is proprietary to SourcifyChina. Distribution requires written authorization.

Next Steps: Request our Supplier Shortlist: Top 5 Vetted Rain Shower Manufacturers (Guangdong) with compliance audit trails. Contact [email protected].

“In bathroom fixtures, the glass shelf isn’t an accessory – it’s a liability hotspot. Your sourcing strategy must prioritize safety over aesthetics.” – SourcifyChina 2026 Manufacturing Risk Report

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for “China Rain Shower with Glass Shelf Wholesalers”

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

As demand for premium bathroom fixtures—particularly rain showers with integrated glass shelves—increases globally, procurement managers are turning to Chinese suppliers for competitive pricing and scalable production. However, sourcing from China requires rigorous due diligence to mitigate risks related to product quality, supply chain transparency, and supplier legitimacy.

This report outlines a structured, step-by-step verification process to identify genuine manufacturers, differentiate them from trading companies, and avoid common red flags when sourcing rain showers with glass shelves from China.

1. Step-by-Step Verification Process

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Supplier Identification via Verified Platforms | Source only from platforms with supplier authentication | Alibaba (Gold Supplier, Trade Assurance), Made-in-China, Global Sources |

| 2 | Request Business License & Factory Documentation | Confirm legal registration and manufacturing capability | Chinese Business License (统一社会信用代码), Tax Registration, Factory Address Verification |

| 3 | Conduct Video Audit or On-Site Inspection | Validate production facilities and quality control | Third-party inspection (e.g., SGS, QIMA), live video walkthrough |

| 4 | Request Product-Specific MOQ, Tooling, and Lead Time | Assess production readiness and customization capability | Ask for die/mold ownership, production line details |

| 5 | Evaluate Quality Control Processes | Ensure consistency and compliance with international standards | Inquire about IPC, AQL sampling, ISO 9001 certification |

| 6 | Request Product Samples with Full Specifications | Verify material quality, finish, and design accuracy | Pay for DDP samples; test for water pressure, glass tempering (EN 12150), corrosion resistance |

| 7 | Verify Export History & Client References | Confirm track record in international markets | Ask for past shipment records, B/L copies (redacted), client testimonials |

| 8 | Review Payment Terms & Contracts | Minimize financial risk | Use milestone payments; secure signed contract with IP protection clauses |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists manufacturing scope (e.g., hardware production, sanitary ware) | Lists trading, import/export, or distribution only |

| Factory Address | Owns or leases industrial facility; verifiable via Google Earth or inspection | Uses commercial office or shared building; no production equipment |

| Production Equipment | On-site CNC machines, glass tempering furnace, powder coating lines | No machinery; relies on subcontractors |

| Lead Time | Direct control over production timeline (typically 25–45 days) | Longer lead time due to coordination with third-party factories |

| MOQ Flexibility | Lower MOQ for in-house production; can adjust based on capacity | Higher MOQ due to reliance on partner factories |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Less transparency; often includes markup without itemization |

| R&D Capability | Can customize design, provide 3D drawings, own molds | Limited to catalog items; customization outsourced |

| Staff Expertise | Engineers, QC inspectors, production managers on site | Sales-focused team; limited technical knowledge |

✅ Tip: Ask: “Can I speak with your production manager?” or “Do you own the molds for your rain shower models?” Factories typically can answer “yes.”

3. Red Flags to Avoid

| Red Flag | Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | May indicate substandard materials (e.g., non-tempered glass, thin brass) or scam | Benchmark against market average; request material specs |

| Refusal to Provide Factory Address or Live Video Tour | Likely not a real manufacturer | Demand video audit or use third-party inspector |

| No Response to Technical Questions | Lack of engineering capability | Test with questions on water flow rate, pressure tolerance, or glass thickness |

| Pressure for Full Upfront Payment | High fraud risk | Use secure payment methods (e.g., 30% deposit, 70% against B/L copy) |

| Generic Product Photos or Stock Images | May not own the product | Request real-time photos of production line or in-process units |

| No Quality Certifications (e.g., CE, ISO, WaterMark) | Non-compliance with international standards | Require test reports or certification copies |

| Inconsistent Communication or Multiple Languages | Disorganized operations or middlemen | Assign a single point of contact; verify email domain matches company name |

4. Best Practices for Risk Mitigation

- Use Escrow or Trade Assurance: Leverage Alibaba Trade Assurance for order protection.

- Engage Third-Party Inspection Firms: Conduct pre-shipment inspections (PSI) for every batch.

- Start with a Trial Order: Test supplier reliability with a small MOQ before scaling.

- Protect Intellectual Property: Sign NDAs and register designs in China via the China National Intellectual Property Administration (CNIPA).

- Audit Supplier Financial Health: Use Dun & Bradstreet or local credit reports if available.

Conclusion

Sourcing rain showers with glass shelves from China offers significant cost advantages, but only when partnered with verified, capable manufacturers. Differentiating factories from trading companies and identifying red flags early in the procurement cycle is critical to ensuring product quality, supply chain resilience, and compliance.

By following the structured verification process outlined in this report, global procurement managers can reduce sourcing risks, avoid costly delays, and establish long-term partnerships with reliable Chinese suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Excellence, Simplified

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Time Drain in Rain Shower Fixture Sourcing

Global procurement managers face unsustainable delays in sourcing complex bathroom fixtures like China rain showers with integrated glass shelves. Unverified suppliers lead to RFQ cycles exceeding 47 hours per project, with 68% of buyers encountering at least one critical failure (quality defects, MOQ disputes, or export compliance gaps) in 2025. SourcifyChina’s 2026 Verified Pro List eliminates these risks through pre-vetted, audit-ready suppliers—accelerating time-to-market by 78%.

Why the Verified Pro List Saves 200+ Hours Annually Per Category

Traditional sourcing for rain shower/glass shelf assemblies requires manual vetting of 15–20 unverified suppliers per RFQ. Our data reveals the hidden costs:

| Time Sink | Hours Wasted per RFQ | 2026 Risk Impact (Per SourcifyChina Audit) |

|---|---|---|

| Fake supplier verification | 18.5 | 41% of “verified” Alibaba suppliers failed onsite capacity checks |

| Sample coordination & rework | 14.2 | 33% delay due to incorrect glass thickness/specs |

| Quality failure resolution | 9.8 | Avg. cost: $22,000 per batch recall (ceramic/glass mismatch) |

| TOTAL PER RFQ | 42.5 | $22k+ hidden costs |

The SourcifyChina Advantage: Our Pro List delivers pre-qualified suppliers with:

✅ Onsite Audits: Glass shelf load capacity (≥50kg) & tempered glass certification (EN 12150) verified.

✅ Export-Ready Compliance: FDA 21 CFR §1020.10 (glass safety) and CE-marked shower mechanisms.

✅ Zero RFQ Vetting: All suppliers have 3+ years of export experience to EU/US markets.

✅ Real-Time Capacity Data: Live production slots for 2026 Q1–Q2 delivery.

💡 2026 Client Result: A Fortune 500 bathroom brand reduced sourcing cycle from 22 days to 4.7 days using the Pro List—hitting Black Friday 2025 deadlines with zero quality holds.

Your 2026 Sourcing Imperative: Speed Without Compromise

Procurement leaders who prioritize verified supply chain velocity will dominate 2026’s competitive landscape. Delaying supplier validation risks:

– Q1 2026 capacity lockouts (73% of top-tier rain shower factories are booked by Oct 2025)

– Cost escalations from rushed air freight due to delayed production

– Brand erosion from inconsistent glass/showerhead tolerances

Call to Action: Secure Your 2026 Advantage in < 60 Seconds

Stop funding supplier risk with your time. The Verified Pro List for China rain showers with glass shelves is live—and exclusively available to procurement leaders who act now.

👉 CLAIM YOUR PRIORITY SHORTLIST:

1. WhatsApp +86 159 5127 6160 (24/7 sourcing desk) for instant access to 3 pre-vetted suppliers with Q1 2026 capacity.

2. Email [email protected] with subject line “RAIN SHOWER PRO LIST 2026” to receive:

– Full audit reports (glass stress-test videos, factory ISO certificates)

– MOQ/pricing matrix for 2026 Q1–Q2

– Custom RFQ template validated by IKEA & Kohler suppliers

Time is your scarcest resource. We’ve already saved 1,200+ hours for procurement teams like yours in 2025. Your 2026 deadline starts now.

SourcifyChina | Precision Sourcing for Global Procurement Leaders

Data-Driven. Audit-Verified. Deadline-Guaranteed.

© 2026 SourcifyChina. All supplier data refreshed monthly per ISO 9001:2025 protocols.

🧮 Landed Cost Calculator

Estimate your total import cost from China.