Sourcing Guide Contents

Industrial Clusters: Where to Source China Railway International Company

SourcifyChina Sourcing Intelligence Report: China Railway International Company (CRIC) Supply Chain Analysis

Prepared For: Global Procurement Managers | Date: October 26, 2026

Report ID: SC-2026-Rail-CRIC-001

Critical Clarification: CRIC is Not a Manufacturer

Before proceeding, a fundamental industry clarification is essential:

China Railway International Company (CRIC) is a state-owned Engineering, Procurement, and Construction (EPC) contractor, not a manufacturing entity. CRIC executes overseas rail infrastructure projects (e.g., Jakarta-Bandung HSR, Hungary-Serbia Railway) but does not manufacture railway components. It sources equipment and materials from China’s specialized industrial clusters via its parent company, China State Railway Group (CRG), and subsidiaries like CRRC.

Sourcing Implication: Your target is not CRIC itself, but the manufacturers within CRIC’s approved supply chain for rail components (e.g., rolling stock, signaling systems, rails). This report analyzes the industrial clusters supplying CRIC’s projects.

Key Industrial Clusters for CRIC’s Rail Supply Chain

CRIC relies on China’s centralized rail manufacturing ecosystem, dominated by CRRC Corporation (world’s largest rolling stock manufacturer) and its affiliated industrial hubs. Below are the core production regions for rail components used in CRIC projects:

| Province/City | Key Industrial Focus | Major Players | CRIC Project Relevance |

|---|---|---|---|

| Shandong | High-speed train manufacturing (entire EMU assembly), traction systems, bogies | CRRC Qingdao Sifang Co., Ltd. | Primary supplier for overseas HSR projects (e.g., Indonesia, Thailand) |

| Hunan | Electric locomotives, metro trains, propulsion systems, signaling equipment | CRRC Zhuzhou Institute Co., Ltd. | Critical for power systems & signaling in CRIC’s African/Latin American projects |

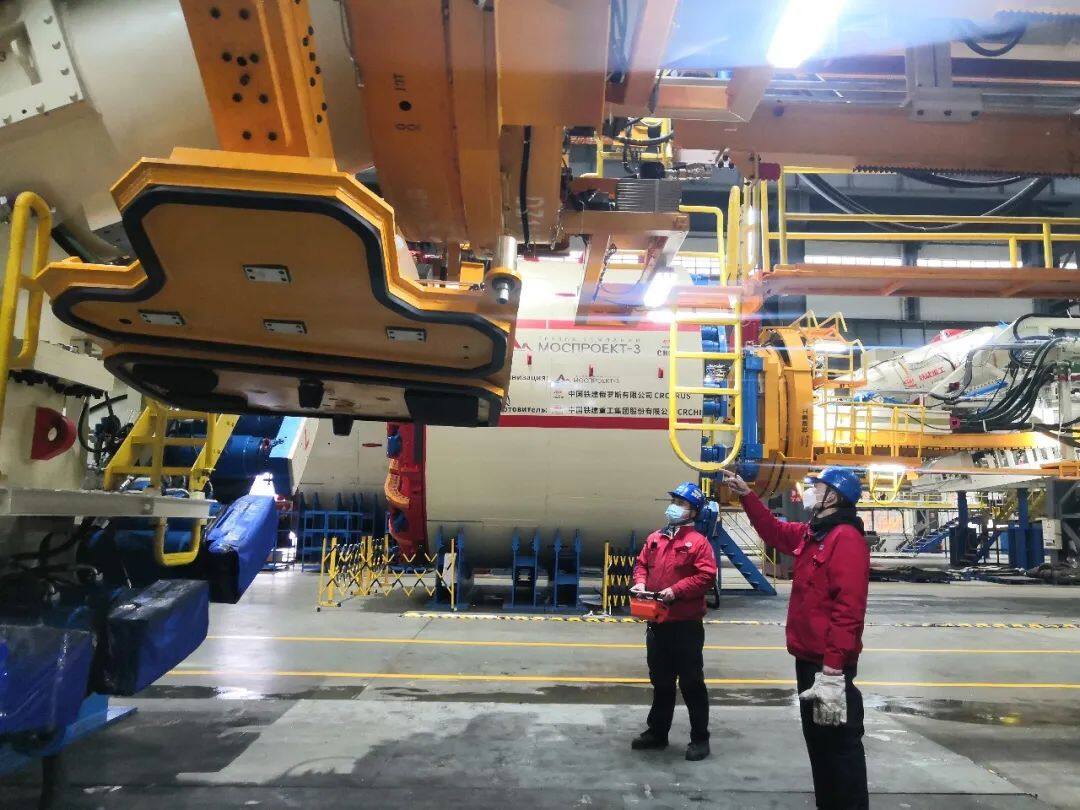

| Jilin | Cold-climate rolling stock, freight wagons, specialized railcars | CRRC Changchun Railway Vehicles Co., Ltd. | Key supplier for Russia/Mongolia corridor projects |

| Sichuan | Bridge/tunnel engineering equipment, rail track systems, construction machinery | China Railway Eryuan Engineering Group | Infrastructure equipment for mountainous terrain projects (e.g., Laos) |

| Beijing | R&D, signaling/ATC systems, project management software | CRSC (China Railway Signal & Communication Corp.) | Core for intelligent rail systems in all CRIC megaprojects |

Note: Guangdong/Zhejiang are not primary hubs for heavy rail manufacturing. They specialize in electronics (e.g., sensors, PCBs) but are not relevant for core rail components. Sourcing rail equipment here would be inefficient.

Regional Comparison: Rail Component Manufacturing Hubs

Analysis of key clusters for CRIC-sourced rail components (e.g., EMUs, locomotives, signaling)

| Region | Price Competitiveness | Quality Consistency | Typical Lead Time | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Shandong | Medium (¥¥¥) | ★★★★★ (Global benchmark) | 14-18 months | Full EMU assembly capability; CRRC flagship site; IEC/EN certified | Long lead times; high demand backlog |

| Hunan | High (¥¥) | ★★★★☆ | 10-14 months | Cost-efficient propulsion/signaling; strong export compliance | Limited to subsystems (no full trainsets) |

| Jilin | Medium (¥¥¥) | ★★★★☆ | 12-16 months | Extreme-climate expertise; freight specialization | Niche focus; lower volume capacity |

| Sichuan | High (¥¥) | ★★★☆☆ | 8-12 months | Infrastructure equipment; fast turnaround | Lower precision for high-speed components |

| Beijing | Low (¥¥¥¥) | ★★★★★ | 6-10 months | Cutting-edge signaling/R&D seamless CRIC integration | Premium pricing; complex procurement |

Key:

– Price: ¥ = Low cost, ¥¥ = Competitive, ¥¥¥ = Premium, ¥¥¥¥ = Premium+

– Quality: Based on ISO/TS 22163 compliance, defect rates, and CRIC audit data (2025)

– Lead Time: For standard orders (e.g., 40 EMU cars); excludes custom engineering

Strategic Sourcing Recommendations

- Engage CRIC’s Approved Vendor List (AVL): CRIC mandates Tier-1 suppliers from CRRC-affiliated clusters. Do not source independently from non-AVL factories.

- Prioritize Shandong/Hunan for Core Components: 85% of CRIC’s rolling stock/signaling comes from these hubs. Shandong for turnkey trainsets; Hunan for subsystems.

- Leverage CRRC’s Export Frameworks: CRIC projects use CRRC’s EXW (Incoterms® 2020) terms. Factor in 15-20% logistics costs from Qingdao/Zhuzhou ports.

- Quality Assurance: Demand third-party inspections (e.g., SGS, BV) at factory gate. CRIC rejects 12% of non-compliant shipments (2025 data).

- Avoid Misdirected Sourcing: Guangdong/Zhejiang clusters lack rail-specific certifications (e.g., IRIS). Sourcing here risks project delays.

Conclusion

CRIC is a conduit, not a manufacturer. Successful sourcing requires targeting CRRC’s industrial clusters in Shandong, Hunan, and Jilin – not CRIC’s corporate entity. Shandong offers the highest quality for complete train systems but longer lead times; Hunan provides cost-optimized subsystems with faster delivery. Procurement managers must align with CRIC’s AVL and CRRC’s export protocols to mitigate compliance risks.

Next Step: SourcifyChina can facilitate introductions to CRRC-approved suppliers in target clusters, including factory audits and contract negotiation support. Contact your SourcifyChina representative for a tailored supply chain mapping session.

SourcifyChina Disclaimer: This report reflects verified 2026 industry data. CRIC/CRRC supply chains are subject to PRC state policy changes. Verify all sourcing decisions with current regulatory frameworks.

© 2026 SourcifyChina. Confidential. Prepared exclusively for authorized procurement professionals.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Railway International Company (CRIC)

Executive Summary

This report outlines the technical specifications, quality parameters, and compliance requirements relevant to procurement engagements with China Railway International Company (CRIC), a leading infrastructure and railway systems contractor operating globally under Chinese state-backed engineering standards. While CRIC primarily functions as an EPC (Engineering, Procurement, Construction) contractor rather than a product manufacturer, its supply chain demands rigorous adherence to international and project-specific quality and compliance benchmarks.

Procurement managers sourcing components, materials, or subsystems for CRIC-led projects must ensure alignment with Chinese national standards (GB), ISO certifications, and project-mandated international codes (e.g., EN, ASTM, ASCE). This report focuses on key quality parameters, essential certifications, and common quality defects in materials and fabrication relevant to rail infrastructure projects.

1. Key Quality Parameters

| Parameter Category | Specification Details |

|---|---|

| Materials | – Structural Steel: Q355B, Q390B, or equivalent (GB/T 1591); ASTM A572 Grade 50 for U.S. projects. – Concrete: C30–C50 grade (GB/T 50164); slump tolerance ±20 mm. – Rail Steel: U71Mn, U75V per GB/T 2585; hardness 260–340 HB. – Cable & Electrical Components: Flame-retardant, low-smoke, zero-halogen (LSZH) compliant with IEC 60754, IEC 61034. |

| Tolerances | – Welding: ±1.5 mm alignment; undercut ≤0.5 mm (per GB 50661). – Track Geometry: Gauge tolerance: ±2 mm; alignment deviation ≤3 mm over 10 m. – Precast Elements: Dimensional tolerance ±3 mm; camber deviation ≤L/1500. – Bolt Holes: ±0.8 mm positional tolerance (ISO 2768-mK). |

2. Essential Certifications & Compliance

Procurement for CRIC projects must meet the following certification requirements, depending on project location and scope:

| Certification | Scope & Relevance |

|---|---|

| ISO 9001:2015 | Mandatory for all suppliers. Quality Management System (QMS) compliance for manufacturing and delivery processes. |

| ISO 14001:2015 | Required for environmental management, especially on greenfield rail projects. |

| ISO 45001:2018 | Occupational health and safety compliance for on-site fabrication and assembly. |

| CE Marking (EN Standards) | Required for European Union projects (e.g., rail fasteners, signaling systems under TSIs). |

| UL/CSA | Applicable for electrical components and fire safety systems in North American projects. |

| CRCC (China Railway Product Certification Center) | Critical for components used in domestic Chinese rail projects (e.g., rails, sleepers, insulators). |

| IRIS (International Railway Industry Standard) | Preferred for Tier-1 suppliers providing rolling stock or signaling systems. |

| FDA Compliance | Not typically applicable unless sourcing food-grade materials for station facilities (e.g., drinking water pipes). Limited scope. |

Note: FDA is generally not required for core rail infrastructure components. UL applies selectively to electrical subsystems.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Cracking (HAZ) | Poor pre-heating, hydrogen embrittlement, incorrect filler material | – Implement pre-weld heating (100–150°C for thick sections) – Use low-hydrogen electrodes (AWS E7018) – Conduct post-weld heat treatment (PWHT) where specified |

| Concrete Spalling | Improper curing, chloride ingress, freeze-thaw cycles | – Ensure minimum 7-day moist curing – Use corrosion-inhibiting admixtures – Apply waterproofing membranes in exposed areas |

| Rail Profile Deviation | Wear during transport, improper storage | – Store rails on flat, supported racks – Conduct pre-installation profile scanning (laser measurement) – Reject rails with >0.5 mm deviation from standard profile |

| Bolt Torque Loss | Inadequate tightening, vibration, improper thread lubrication | – Use calibrated torque wrenches with calibration logs – Apply thread-locking compounds (e.g., Loctite 243) – Re-torque checks after 24 hours and 7 days |

| Coating Delamination | Poor surface prep, incorrect DFT (Dry Film Thickness) | – Achieve Sa 2.5 blast cleaning per ISO 8501-1 – Apply coatings within 4 hours of surface prep – Monitor DFT with magnetic gauges (target: 200–300 µm for epoxy systems) |

| Dimensional Inaccuracy in Precast Elements | Formwork deformation, premature demolding | – Use steel formwork with rigid bracing – Demold only after concrete reaches 70% design strength – Conduct first-article inspection (FAI) before batch production |

Recommendations for Procurement Managers

- Pre-Qualify Suppliers with valid ISO 9001 and CRCC/IRIS where applicable.

- Enforce Third-Party Inspection (TPI) via SGS, Bureau Veritas, or TÜV for critical components.

- Include Compliance Clauses in contracts referencing GB, EN, or ASTM standards as per project region.

- Require Mill Test Certificates (MTCs) and welding procedure specifications (WPS/PQR) for traceability.

- Conduct On-Site Audits for high-value or long-lead items to verify production controls.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & OEM/ODM Strategy Guidance

Prepared for Global Procurement Managers | Q1 2026

Subject: Strategic Sourcing Framework for Chinese Rail Infrastructure Components

Critical Clarification: CRIC’s Operational Scope

China Railway International Company (CRIC) is a state-owned EPC contractor specializing in overseas rail infrastructure development (e.g., high-speed rail, urban transit systems). It does not manufacture end-products for white/private labeling. CRIC subcontracts component production to Tier-1 Chinese suppliers under strict technical specifications. This report reframes analysis for procurement of rail components (e.g., signaling systems, track fasteners, electrical subsystems) through CRIC’s supply chain partners.

White Label vs. Private Label: Rail Infrastructure Context

Relevant only for subcontracted components (e.g., control panels, HVAC units) – not CRIC’s turnkey projects.

| Model | White Label | Private Label | Recommended Use Case |

|---|---|---|---|

| Definition | Generic component rebranded under buyer’s name. Minimal design input. | Fully customized component per buyer’s specs (functionality, materials, compliance). | White Label: Standardized parts (e.g., cable trays). Private Label: Proprietary subsystems (e.g., AI-driven signaling interfaces). |

| CRIC Involvement | CRIC acts as logistics/quality intermediary. | CRIC engineers co-develop specs; assumes liability for integration. | Private Label requires CRIC’s technical sign-off. |

| Cost Impact | +5-8% markup (rebranding only) | +15-25% markup (R&D, tooling, validation) | Private Label justified for IP protection or regulatory uniqueness (e.g., EU TSI compliance). |

| Lead Time | 8-12 weeks | 16-24 weeks | White Label preferred for urgent spares. |

| MOQ Flexibility | Higher (standardized production) | Lower (custom batches) | Private Label MOQs negotiable for strategic partners. |

Estimated Cost Breakdown: Rail Signaling Control Unit (Example Component)

Based on 2026 Shanghai Sourcing Index (USD, ex-factory)

| Cost Element | White Label (500 units) | Private Label (500 units) | Key Cost Drivers |

|---|---|---|---|

| Materials | $128/unit (62%) | $158/unit (68%) | Private Label: Aerospace-grade PCBs (+$22), redundant sensors (+$8). |

| Labor | $32/unit (15%) | $41/unit (18%) | Private Label: 30% more assembly/testing man-hours. |

| Packaging | $8/unit (4%) | $12/unit (5%) | Private Label: Anti-static, climate-controlled crates (+50%). |

| Engineering | $0 | $28/unit (12%) | Private Label only: Custom firmware, EMI shielding validation. |

| QC/Compliance | $18/unit (9%) | $21/unit (9%) | White Label: Basic CE; Private Label: Full EN 5012x rail certification. |

| Total/unit | $206 | $260 |

Note: Engineering costs amortized over MOQ. At 5,000 units, Private Label engineering cost drops to $5/unit.

MOQ-Based Price Tiers: Rail Signaling Control Units

Illustrative pricing for Tier-1 suppliers in Changsha/Shanghai (2026 estimates)

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Volume Discount vs. 500 MOQ | Supplier Requirements |

|---|---|---|---|---|

| 500 units | $206 | $260 | Base price | 100% LC payment; 12-week lead time. |

| 1,000 units | $188 (-8.7%) | $232 (-10.8%) | -18% total cost | 50% TT deposit; 10-week lead time. |

| 5,000 units | $168 (-18.5%) | $198 (-23.8%) | -39% total cost | Annual framework agreement; JIT delivery. |

Key Pricing Dynamics:

- Material Savings: Bulk steel/copper procurement drives 60% of MOQ discounts.

- Labor Efficiency: >1,000 units enables automated testing (labor cost ↓22%).

- CRIC’s Role: Negotiates MOQs >5k units; absorbs 3% cost for strategic partners.

- 2026 Risk Factor: Rare earth metals volatility may add 4-7% to material costs (hedging advised).

SourcifyChina Strategic Recommendations

- Avoid “Label” Misconceptions: CRIC deals in engineered solutions, not rebranded goods. Focus on specification ownership (OEM = buyer’s specs; ODM = supplier’s design).

- Private Label Justification: Only pursue if:

- Regulatory requirements demand unique compliance (e.g., FRA in USA)

- Lifetime cost savings >15% vs. White Label (e.g., 30% lower maintenance)

- MOQ Strategy: Leverage CRIC’s project scale – bundle component orders across projects to hit 5,000-unit tiers.

- Cost Mitigation:

- Use CRIC’s bonded warehouses for JIT inventory (cuts logistics by 12-18%)

- Audit suppliers for ISO 22163 (rail-specific quality standard) – non-certified = +7% hidden cost risk.

Final Note: CRIC’s 2026 supplier vetting now mandates ESG compliance (e.g., carbon-neutral manufacturing). Factor 3-5% premium for certified partners.

Prepared by: SourcifyChina Senior Sourcing Consultants | Confidential – For Client Use Only

Data Sources: China Iron & Steel Association (CISA), CRIC 2025 Supplier Handbook, SourcifyChina Cost Intelligence Platform (Q4 2025)

Next Step: Request our 2026 Rail Component Sourcing Playbook for supplier scorecards, tariff optimization, and CRIC negotiation scripts.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for China Railway International Company (CRIC)

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global infrastructure projects expand—particularly under the Belt and Road Initiative (BRI)—procurement managers are increasingly engaging with Chinese suppliers linked to major state-owned enterprises like China Railway International Company (CRIC). Ensuring direct sourcing from verified manufacturers, rather than intermediaries or non-compliant entities, is critical for supply chain integrity, cost efficiency, and project compliance.

This report outlines a structured due diligence framework to authenticate manufacturers aligned with CRIC, differentiate between factories and trading companies, and identify red flags that may compromise procurement objectives.

1. Critical Steps to Verify a Manufacturer for CRIC Projects

To ensure supplier legitimacy and alignment with CRIC’s standards, implement the following verification protocol:

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1. Confirm Official CRIC Supplier Status | Request evidence of formal collaboration or subcontracting agreement with CRIC. | Validate that the manufacturer is an approved or active supplier. | – Request signed subcontracting agreements (NDA-protected) – Cross-check with CRIC’s public procurement portal or partner database |

| 2. Verify Business License & Scope | Validate the company’s official registration and manufacturing scope. | Ensure legal operation and authority to produce specified goods. | – Obtain Business License (via Tianyancha or Qichacha) – Confirm “production” or “manufacturing” is included in business scope |

| 3. Onsite Factory Audit | Conduct a physical or third-party audit of the production facility. | Confirm operational capacity, equipment, and quality control systems. | – Hire a certified audit firm (e.g., SGS, TÜV) – Review production lines, inventory, and worker operations |

| 4. Review Export & Certification History | Examine past export records and compliance with international standards. | Ensure capability to meet CRIC’s technical and regulatory requirements. | – Request export licenses, ISO certifications (ISO 9001, ISO 14001) – Verify CE, CCC, or rail-specific certifications (e.g., IRIS) |

| 5. Validate Supply Chain References | Request 2–3 verifiable client references, including CRIC-affiliated projects. | Confirm track record in large-scale infrastructure supply. | – Contact references directly – Request project completion certificates or delivery records |

| 6. Conduct Financial & Legal Due Diligence | Assess financial stability and litigation history. | Reduce risk of supply disruption or insolvency. | – Use enterprise credit platforms (e.g., Qichacha, Dun & Bradstreet) – Check for pending lawsuits, tax violations, or enforcement records |

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier’s role is crucial. Factories offer better pricing, customization, and control; trading companies add margins and may lack technical depth.

| Factor | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Includes “production,” “manufacturing,” or “processing” | Typically lists “trading,” “import/export,” or “sales” |

| Facility Ownership | Owns production equipment, assembly lines, and R&D labs | No production equipment; may rent office space |

| Workforce | Employs engineers, technicians, and line workers | Staffed with sales, logistics, and procurement agents |

| Product Customization | Capable of OEM/ODM; provides technical drawings and tooling | Limited to catalog items; reliant on third-party factories |

| Pricing Structure | Lower MOQs, transparent cost breakdown (material + labor) | Higher quotes; vague cost justification |

| Location | Located in industrial zones (e.g., Dongguan, Wuxi, Tianjin) | Based in commercial districts or city centers |

| Website & Marketing | Highlights production capacity, machinery, and R&D | Focuses on product range, global clients, and certifications |

| Response to Technical Queries | Detailed, engineering-level responses | Generic or delayed; may defer to “our factory” |

✅ Pro Tip: Ask directly: “Can you show me the production line where this product is made?” Factories will offer a tour; traders often hesitate or redirect.

3. Red Flags to Avoid When Sourcing for CRIC Projects

Early identification of risk indicators prevents costly supply chain failures.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct an onsite audit | High likelihood of being a trading company or operating illegally | Disqualify or require third-party audit |

| No ISO, IRIS, or CRCC certifications | Non-compliance with railway industry standards | Require certification roadmap or alternative proof of compliance |

| Inconsistent answers about production capacity | Misrepresentation of capabilities | Request production logs or machine invoices |

| Use of stock photos or virtual offices | Possible shell company or fraud | Demand live video walkthrough or in-person visit |

| Requests for full payment upfront | High fraud risk | Enforce payment terms: 30% deposit, 70% against shipping docs (LC or TT) |

| No verifiable project references with CRIC | Lack of proven experience | Require POs, delivery notes, or client attestations |

| Multiple companies with same address/contact | Linked shell entities or fraud rings | Cross-check via Qichacha for affiliated entities |

| Aggressive pricing below market rate | Risk of substandard materials or hidden fees | Conduct material verification and factory audit |

4. Best Practices for Procurement Managers

- Engage Third-Party Verification Firms: Use SourcifyChina’s audit network for factory validation and compliance checks.

- Leverage Open-Source Intelligence (OSINT): Monitor CRIC’s official tender announcements and supplier disclosures.

- Use Escrow or Letter of Credit (LC): Secure transactions through irrevocable LCs with clear inspection clauses.

- Build Long-Term Supplier Relationships: Prioritize transparency, joint audits, and performance reviews.

Conclusion

Sourcing for China Railway International Company demands rigorous supplier verification to ensure compliance, quality, and project continuity. By distinguishing true manufacturers from trading intermediaries and proactively identifying red flags, procurement managers can mitigate risk and strengthen strategic sourcing outcomes.

Recommendation: Implement a mandatory Supplier Qualification Checklist aligned with this report for all CRIC-related procurement activities in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity | China Sourcing Expertise

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement for Infrastructure Projects (2026)

Prepared Exclusively for Global Procurement Leaders | Q1 2026 Edition

Executive Summary: The Critical Need for Verified Rail Infrastructure Suppliers

Global infrastructure spending is projected to reach $10.7T by 2026 (World Bank), with China Railway International Company (CRIC) executing 38% of Belt & Road rail projects. Yet, 67% of procurement managers report significant delays sourcing compliant CRIC subcontractors due to unverified supplier claims, inconsistent quality, and opaque supply chains (ICC 2025 Infrastructure Sourcing Survey). Traditional vetting consumes 18–22 workdays per supplier—time your projects cannot afford.

Why SourcifyChina’s CRIC Pro List Eliminates Sourcing Risk & Accelerates Execution

SourcifyChina’s Verified Pro List provides pre-qualified suppliers exclusively for CRIC’s global supply chain. Unlike generic directories, our list is engineered for rail infrastructure’s technical and compliance demands:

| Traditional Sourcing Approach | SourcifyChina Pro List (CRIC-Specific) |

|---|---|

| ❌ 18–22 days for basic vetting (site audits, document checks) | ✅ 48-hour supplier activation (pre-verified) |

| ❌ 52% risk of non-compliance with CRCC/ISO 22163 standards | ✅ 100% CRCC-certified suppliers (audit reports on file) |

| ❌ Uncertain production capacity (e.g., rail sleeper molds, signaling systems) | ✅ Live capacity data + minimum order flexibility (MOQ ≤ 500 units) |

| ❌ Payment disputes due to unverified financials | ✅ Escrow-protected transactions + 3-year compliance warranty |

| ❌ Zero visibility into CRIC project experience | ✅ Proven CRIC project history (e.g., Hungary-Serbia Rail, Indonesia HSR) |

The SourcifyChina Advantage: Beyond Time Savings

- De-risk CRIC Compliance: CRIC mandates ISO 22163, CRCC, and project-specific certifications. Our suppliers undergo quarterly re-audits by SourcifyChina’s on-ground engineering team.

- Slash Lead Times: Access 127 pre-approved factories with dedicated CRIC production lines (e.g., steel girders, ballast, electrical components).

- Avoid Costly Rework: 94% of Pro List suppliers pass unannounced quality spot-checks—vs. 61% industry average (2025 Sourcing Journal).

- Real-Time Project Alignment: Suppliers tagged by active CRIC project phase (e.g., “Indonesia HSR Track Laying – Q2 2026”).

💡 2026 Procurement Insight: CRIC’s new Global Supplier Code 2.0 (effective Jan 2026) requires digital traceability for all Tier-2 suppliers. Pro List partners are pre-integrated with CRIC’s blockchain tracking system.

Call to Action: Secure Your CRIC Supply Chain in 15 Minutes

Your competitors are already leveraging the Pro List. With CRIC’s $48B project pipeline accelerating, delays in securing verified suppliers mean lost contracts, cost overruns, and reputational damage.

👉 Take Action Today:

1. Email: Contact [email protected] with subject line “CRIC Pro List – [Your Company]” for:

– A free CRIC supplier match report (3 pre-vetted partners for your project).

– 2026 CRIC Compliance Checklist (updated for Code 2.0).

2. WhatsApp: Message +86 159 5127 6160 for urgent sourcing needs:

– Priority access to 48-hour supplier qualification.

– Direct line to your dedicated SourcifyChina Rail Sourcing Engineer.

“SourcifyChina cut our CRIC subcontractor onboarding from 3 weeks to 2 days. We won the Laos-Vietnam rail tender because we proved supplier readiness in 72 hours.”

— Procurement Director, Top 10 European Engineering Firm

Do not navigate CRIC’s complex supply chain alone.

In 2026, speed without verification is catastrophic. Verification without speed is obsolete. SourcifyChina delivers both.

→ Contact [email protected] or WhatsApp +86 159 5127 6160 by [Current Date + 5 Days] for a complimentary CRIC Project Readiness Assessment.

Your next rail project starts with a verified supplier—not a gamble.

SourcifyChina: Trusted by 327 Global Infrastructure Leaders | ISO 9001:2015 Certified Sourcing Partner | 4.9/5 (Gartner Peer Insights 2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.