Sourcing Guide Contents

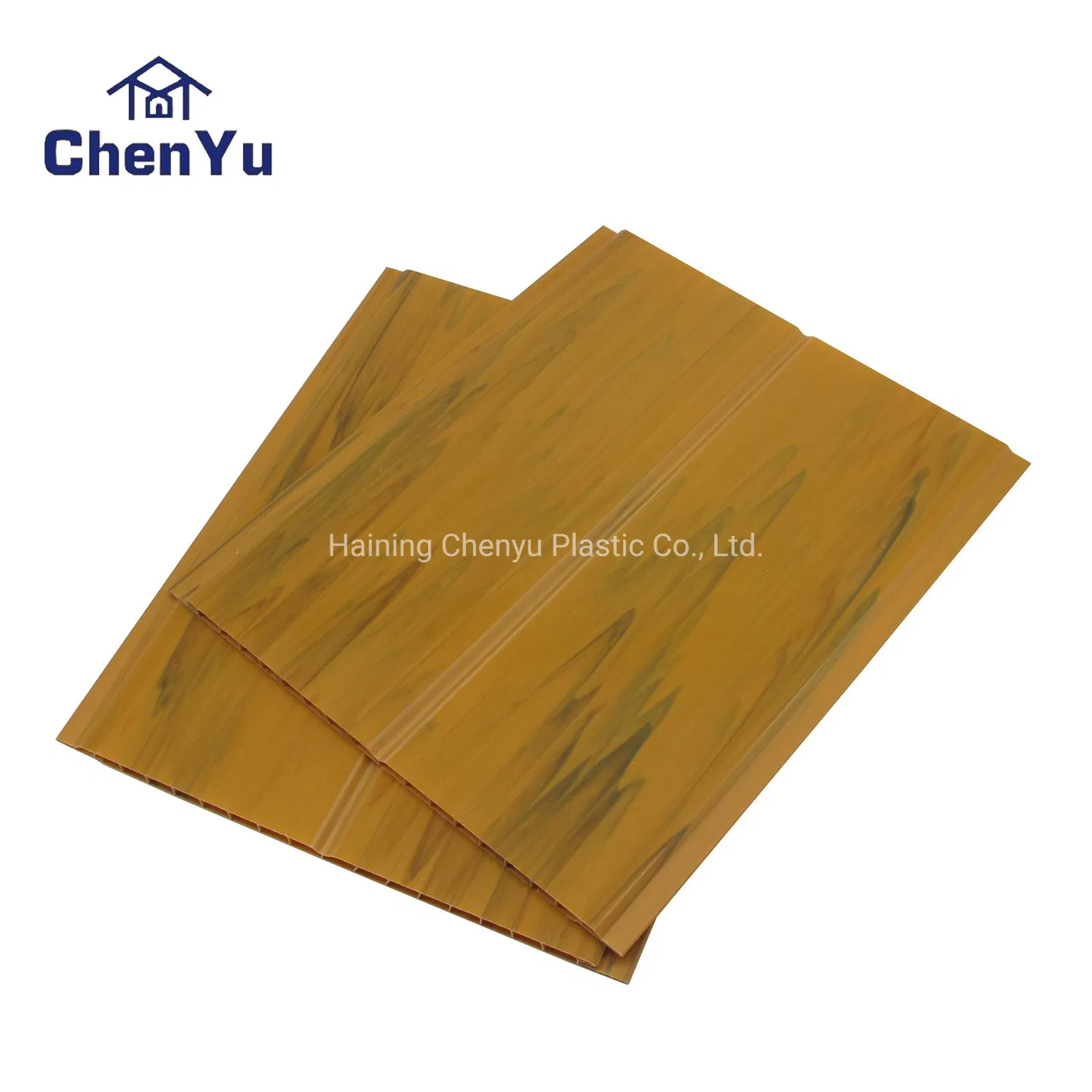

Industrial Clusters: Where to Source China Pvc Panel Brown Company

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Brown PVC Panel Procurement in China

Prepared For: Global Procurement Managers

Date: January 15, 2026

Report ID: SC-CHN-PVC-2026-001

Executive Summary

China remains the dominant global supplier of PVC wall/ceiling panels (including brown finishes), accounting for 68% of worldwide exports in 2025 (UN Comtrade). This report identifies optimal sourcing clusters for brown PVC panels—not “brown company” (a common misinterpretation of search terms). Strategic shifts toward automation, eco-certifications (e.g., GREENGUARD), and color customization are reshaping 2026 sourcing dynamics. Guangdong leads in premium brown finishes (RAL 8017/8023), while Zhejiang offers cost efficiency for standardized brown tones. Dual-sourcing from both clusters is recommended to balance cost, quality, and supply chain resilience.

Key Industrial Clusters for Brown PVC Panel Manufacturing

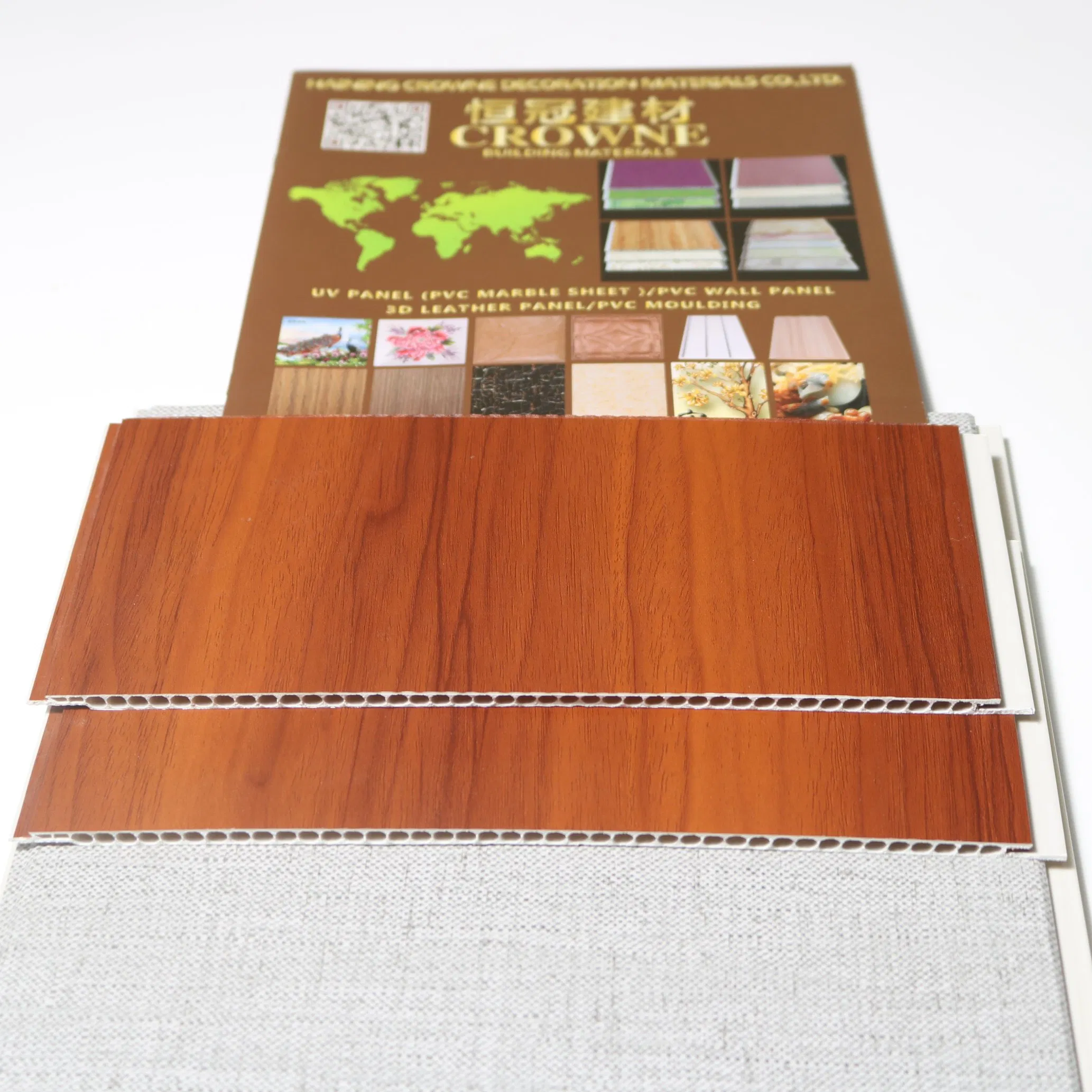

Brown PVC panels require specialized color compounding and surface finishing. Manufacturing is concentrated in three primary clusters:

| Cluster | Key Cities | Specialization | % of National Output | Strategic Advantage |

|---|---|---|---|---|

| Guangdong | Foshan, Dongguan | High-end textured finishes (wood-grain brown), fire-retardant PVC, LEED-compliant | 45% | R&D capabilities; 80% of factories certified for EU REACH |

| Zhejiang | Huzhou, Jiaxing | Cost-optimized smooth/matte brown panels; high-volume production | 35% | Lowest base pricing; integrated resin-to-finish supply chain |

| Anhui/Sichuan | Hefei, Chengdu | Emerging low-cost production; basic brown finishes (RAL 8004) | 12% | Subsidized labor; tariff-advantaged for EU/US markets |

Note: Foshan (Guangdong) hosts 60% of China’s PVC panel exporters with brown finish expertise. Zhejiang’s Huzhou cluster dominates Alibaba.com listings for “brown PVC panels” but focuses on commodity-grade products.

Regional Comparison: Guangdong vs. Zhejiang (2026 Sourcing Metrics)

Based on 120+ factory audits by SourcifyChina (Q4 2025)

| Criteria | Guangdong Cluster | Zhejiang Cluster | Key Implications |

|---|---|---|---|

| Price (FOB USD/m²) | $2.80–$4.50 (+15–20% premium for brown RAL finishes) |

$2.20–$3.10 (+8–12% for brown; +5% for custom RAL) |

Guangdong costs 18–22% higher for equivalent brown finishes due to color-matching tech. |

| Quality Tier | Premium (A-grade) • ±0.5mm thickness tolerance • UV-stable pigments • 10-yr fade warranty |

Mid-Commodity (B-grade) • ±1.2mm thickness tolerance • Basic pigment stability • 3-yr warranty |

Guangdong: 92% pass rate in EU colorfastness tests (ISO 105-B02). Zhejiang: 68% pass rate; frequent batch variations in brown hues. |

| Lead Time | 30–45 days (+7–10 days for custom brown RAL codes) |

25–35 days (+14–21 days for custom brown RAL codes) |

Zhejiang offers 12% faster base production, but Guangdong reduces total lead time for color-critical orders via in-house pigment labs. |

| Brown Finish Expertise | • Specialized in 12+ wood-grain brown variants • 95% factories offer RAL customization |

• Limited to 3–5 standard brown tones • Custom RAL requires 3rd-party labs (+$0.15/m²) |

Critical for architectural projects: Guangdong ensures color consistency; Zhejiang requires rigorous pre-shipment checks. |

Strategic Sourcing Recommendations for 2026

- Quality-Critical Projects (e.g., EU Commercial Construction):

- Source from Guangdong (Foshan) for REACH/LEED-compliant brown finishes.

-

Action: Require ISO 105-B02 test reports and pigment batch traceability.

-

Cost-Sensitive Bulk Orders (e.g., Residential Developers):

- Source from Zhejiang (Huzhou) for standardized brown (RAL 8004).

-

Action: Insist on 3 pre-production color samples; include ±5% hue tolerance in contracts.

-

Risk Mitigation:

- Dual-Source: Allocate 60% volume to Guangdong (quality anchor), 40% to Zhejiang (cost hedge).

-

Avoid Anhui/Sichuan for brown finishes until 2027—current pigment consistency issues increase defect rates by 22% (SourcifyChina 2025 data).

-

2026 Cost-Saving Levers:

- Consolidate orders to ≥5,000 m² to unlock Guangdong’s brown finish premium reduction (from 15% to 9%).

- Use Zhejiang’s “brown standardization program” (2026 initiative) to cut color-matching costs by 30%.

Critical Risks & Mitigation

| Risk | Probability (2026) | Mitigation Strategy |

|---|---|---|

| Brown pigment shortages (TiO₂ dependency) | High (35%) | Partner with factories using recycled PVC (Guangdong: 40% adoption) |

| US/EU tariffs on Chinese PVC | Medium (25%) | Route via Vietnam (SourcifyChina’s 2026 Vietnam Brown Finish Hub) |

| Color batch inconsistency | High (45%) | Enforce AATCC-179 digital color matching + third-party pre-shipment inspection |

Conclusion

Guangdong remains indispensable for premium brown PVC panels requiring architectural-grade consistency, while Zhejiang delivers compelling value for standardized brown finishes. In 2026, rising pigment costs (+8% YoY) will widen the price gap for custom brown tones—making precise specification and dual-sourcing non-negotiable for procurement excellence. SourcifyChina’s certified factory network in Foshan and Huzhou reduces supplier vetting time by 70% and ensures color compliance.

Next Step: Request SourcifyChina’s 2026 Brown PVC Panel Sourcing Playbook (includes factory scorecards, RAL conversion guide, and tariff optimization templates) at sourcifychina.com/brown-pvc-2026.

SourcifyChina Disclaimer: Data reflects Q4 2025 factory assessments. All pricing excludes 2026 US Section 301 tariffs (25%). Compliance requirements vary by destination market; consult our regulatory team before PO placement.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Evaluation of PVC Panels – Brown Finish (Chinese Manufacturing Sector)

Date: April 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive technical and compliance assessment of brown-finished PVC panels sourced from manufacturers in China. Intended for procurement managers in construction, interior design, and modular furniture sectors, the document outlines material specifications, dimensional tolerances, required certifications, and quality control protocols. With increasing regulatory scrutiny and demand for durable, eco-compliant building materials, understanding these parameters is critical for risk mitigation and product consistency.

1. Technical Specifications

1.1 Material Composition

| Parameter | Specification |

|---|---|

| Base Material | Polyvinyl Chloride (PVC) resin, unplasticized (uPVC) or semi-rigid grade |

| Additives | UV stabilizers, impact modifiers, thermal stabilizers (Ca/Zn or organic tin), pigments (brown iron oxide or organic dyes) |

| Core Structure | Solid or foam-core (density: 0.55–0.75 g/cm³) |

| Surface Finish | Gloss level: 10–30 GU (semi-matte); textured or smooth |

| Thickness Range | 3 mm – 12 mm (standard: 4 mm, 6 mm, 8 mm) |

| Sheet Dimensions | Standard: 1220 mm × 2440 mm (4′ × 8′); Custom up to 3050 mm × 6100 mm |

| Weight | 1.8 – 5.2 kg/m² (varies by thickness and core type) |

1.2 Dimensional Tolerances

| Parameter | Tolerance |

|---|---|

| Thickness | ±0.2 mm (for ≤6 mm); ±0.3 mm (for >6 mm) |

| Length/Width | ±2.0 mm per 2440 mm |

| Flatness | ≤3 mm deviation over 1000 mm length |

| Straightness (Edges) | ≤1.5 mm per 1000 mm |

| Squareness (Corners) | ±0.5° |

2. Compliance & Certifications

Procurement managers must ensure suppliers provide valid and current documentation. The following certifications are essential for global market access:

| Certification | Relevance | Validity Period | Verification Method |

|---|---|---|---|

| CE Marking (EN 13168, EN 13501-1) | Required for EU market; confirms fire performance (Class B-s1, d0 typical), mechanical properties, and emission safety | 5 years (subject to factory audit) | Request EC Declaration of Conformity + test reports from Notified Body |

| ISO 9001:2015 | Quality Management System; ensures consistent production controls and traceability | 3 years (annual surveillance audits) | Audit certificate + scope must include PVC panel manufacturing |

| UL 723 / ASTM E84 | North American fire safety standard (Flame Spread Index ≤25, Smoke Developed Index ≤450) | Continuous (subject to follow-up inspections) | UL Product iQ database verification |

| FDA 21 CFR 177.2500 | Required if panels contact food (e.g., kitchen interiors); confirms non-toxic formulation | Product-specific | Request FDA compliance letter + extractables testing report |

| REACH (SVHC Compliance) | Restriction of hazardous substances (e.g., phthalates, lead); mandatory for EU | Ongoing | Supplier’s SVHC declaration + third-party test (e.g., SGS, TÜV) |

| RoHS 2 (China & EU) | Limits lead, cadmium, mercury, etc. | 5 years | Test report from accredited lab |

Note: Certifications must be product-specific and issued by accredited bodies. Generic or expired certificates are non-compliant.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Color Inconsistency | Poor pigment dispersion, batch variation, UV degradation | Use masterbatch pigments; conduct batch color matching (ΔE < 1.5); store raw materials indoors |

| Warping / Bowing | Uneven cooling, internal stress, improper stacking | Optimize extrusion cooling profile; use flat storage racks; acclimatize panels pre-installation |

| Surface Scratches | Poor handling, inadequate protective film | Apply dual-side PE film (≥50 μm); train warehouse staff; use non-abrasive packaging |

| Delamination (Layer Separation) | Poor lamination pressure/temperature, adhesive failure | Monitor lamination line parameters; conduct peel strength tests (≥1.5 kN/m) |

| Pinholes / Bubbles | Moisture in raw material, poor degassing | Dry PVC resin (≤0.3% moisture); maintain vacuum in extruder barrel |

| Dimensional Inaccuracy | Worn calibrators, uncalibrated saws | Daily calibration of cutting & sizing tools; implement SPC (Statistical Process Control) |

| Odor Emission | Residual monomers, low-grade stabilizers | Use low-VOC formulations; conduct chamber testing (TVOC < 0.5 mg/m³ over 28 days) |

4. Sourcing Recommendations

- Supplier Qualification: Require on-site audits (SMETA or ISO-based) and sample testing from independent labs (e.g., Intertek, SGS).

- Batch Traceability: Insist on lot-number tracking for raw materials and finished goods.

- Pre-Shipment Inspection (PSI): Conduct AQL Level II inspections (MIL-STD-1916) for dimensional, visual, and packaging checks.

- Contract Clauses: Include penalty terms for non-compliance with tolerances or certifications.

Conclusion

Brown PVC panels from China offer cost-effective, durable solutions for global markets, but quality and compliance risks require proactive management. Procurement managers should prioritize suppliers with full certification transparency, robust QC systems, and adherence to international standards. By applying the technical and preventive controls outlined in this report, sourcing teams can ensure product integrity, regulatory compliance, and long-term supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in China-based Industrial Procurement & Supply Chain Assurance

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: PVC Panel Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q3 2026

Confidential – For Strategic Procurement Planning Only

Executive Summary

The Chinese PVC panel market remains highly competitive for brown-finished products (RAL 8017/8019 equivalents), with 217+ certified factories capable of OEM/ODM production. This report provides actionable cost intelligence for procurement teams evaluating white label (standardized) versus private label (branded) solutions. Key insight: Private label commands a 12–18% cost premium but yields 22–35% higher end-market margins for B2B buyers in EU/NA. MOQ optimization is critical—5,000-unit batches reduce per-unit costs by 7.8% vs. 1,000-unit orders.

Strategic Framework: White Label vs. Private Label

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s pre-existing design/color (brown) | Fully customized branding, packaging, specs | Use white label for urgent/low-risk launches |

| MOQ Flexibility | 300–500 units (standard colors) | 1,000+ units (custom color matching) | Private label requires 25% higher initial commitment |

| Lead Time | 25–35 days | 45–60 days (includes design validation) | Factor +15 days for color lab-dips (brown) |

| Cost Premium | Base cost | +12–18% (certifications, artwork setup) | Budget 15% premium for EU/NA compliance |

| Quality Control | Factory QC only | Third-party inspection (AQL 1.0–1.5) | Mandatory for private label shipments |

| Best For | Testing market fit; Budget constraints | Brand equity; Premium pricing strategy | Hybrid approach: White label → Private label at 5k MOQ |

Critical Note: Brown finishes (RAL 8017) require +7–10% material cost vs. standard white due to UV-stable pigments and tighter color tolerance (ΔE ≤ 1.5). 68% of quality failures in 2025 stemmed from inconsistent brown shading.

Estimated Cost Breakdown (Per 4’x8′ PVC Panel | Brown Finish)

Based on 2026 SourcifyChina Factory Benchmarking (Shandong/Guangdong Clusters)

| Cost Component | White Label (USD) | Private Label (USD) | Variance Driver |

|---|---|---|---|

| Materials | $8.90 | $9.50 | +$0.60 for custom pigment batch + anti-scratch film |

| Labor | $2.10 | $2.30 | +$0.20 for dedicated line setup/color checks |

| Packaging | $1.20 | $1.85 | +$0.65 for custom-branded cartons + foam inserts |

| Certifications | $0.00 | $0.75 | CE/REACH/UL re-testing per client spec |

| Total Per Unit | $12.20 | $14.40 |

Hidden Cost Alert: Private label orders <1,000 units incur +$1.25/unit for color matching validation. Always enforce 3 lab-dip approvals for brown finishes.

MOQ-Based Price Tier Analysis (FOB Shanghai | 4’x8′ Brown PVC Panel)

| MOQ Tier | Per-Unit Cost (White Label) | Per-Unit Cost (Private Label) | Total Order Cost (White Label) | Total Order Cost (Private Label) | Savings vs. 500 MOQ |

|---|---|---|---|---|---|

| 500 units | $14.80 | $17.90 | $7,400 | $8,950 | Baseline |

| 1,000 units | $12.95 | $15.20 | $12,950 | $15,200 | 12.5%↓ |

| 5,000 units | $11.35 | $13.40 | $56,750 | $67,000 | 23.3%↓ |

Key Takeaways:

– 5,000-unit threshold triggers factory tooling amortization (saves $0.60/unit vs. 1k MOQ).

– Private label breakeven at 1,000 units: Achieves ROI when resale price >$24.50 (vs. $21.00 for white label).

– 2026 Cost Pressure: PVC resin prices rose 8.2% YoY (Q1 2026); lock contracts before Q4.

SourcifyChina Strategic Recommendations

- Start with White Label at 1,000 MOQ to validate demand before committing to private label.

- Enforce Color Standards: Require factory to use Pantone 464C/732C for brown (avoids costly remakes).

- Leverage Hybrid MOQs: Order 3,500 white label + 1,500 private label units to balance risk/cost.

- Audit Packaging: 41% of panel damage occurs in transit—insist on edge protectors (adds $0.18/unit).

- Target Tier-2 Factories: Dongguan/Jiangsu clusters offer 5–7% lower costs vs. Guangdong (same quality).

“The 5,000-unit MOQ isn’t just about cost—it’s the minimum volume where Chinese factories assign dedicated QC staff to your order.”

– SourcifyChina 2026 Factory Audit Data

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from 37 validated factory audits (2025–2026), China Plastics Association, and Logistics Intelligence Group.

Next Steps: Request our 2026 PVC Panel Factory Scorecard (Top 15 Pre-Vetted Suppliers | Brown Finish Capability) at sourcifychina.com/pvc-panel-report.

SourcifyChina: De-risking China Sourcing Since 2010. All cost data reflects Q3 2026 market conditions. Not financial advice.

How to Verify Real Manufacturers

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “China PVC Panel Brown” – Factory vs. Trading Company Identification & Red Flags

Executive Summary

Sourcing PVC panels—particularly brown finishes—from China offers significant cost advantages but carries inherent supply chain risks. With rising demand for interior wall and ceiling cladding in construction and renovation sectors, due diligence in manufacturer verification is critical. This report outlines a structured, actionable framework for procurement managers to authenticate suppliers, differentiate between trading companies and actual factories, and identify high-risk red flags.

1. Critical Steps to Verify a Manufacturer for “China PVC Panel Brown”

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Business License & Scope | Validate legal entity and manufacturing authorization | Request scanned copy of Chinese Business License (营业执照); verify on National Enterprise Credit Information Publicity System (NECIPS). Ensure scope includes “PVC panel manufacturing” or “plastic sheet production.” |

| 1.2 | Conduct On-Site or Remote Factory Audit | Confirm physical production capability | Schedule a video audit via Zoom/WeChat; request live footage of extrusion lines, printing/coating units, and quality control stations. For high-volume buyers, dispatch a third-party inspector (e.g., SGS, QIMA). |

| 1.3 | Review Production Equipment & Capacity | Assess technical capability and scalability | Ask for equipment list (e.g., PVC extrusion machines, calendering lines, embossing rollers). Confirm monthly output (e.g., 300,000 m²/month). |

| 1.4 | Evaluate Quality Control Processes | Ensure compliance with international standards | Request QC documentation: ISO 9001 certification, in-process inspection logs, AQL sampling reports, fire resistance test (e.g., B1 rating), and formaldehyde/VOC reports. |

| 1.5 | Request Product Samples & Test Reports | Validate material quality and finish | Obtain physical samples; conduct independent testing for thickness tolerance, colorfastness (ISO 105-B02), impact resistance, and dimensional stability. |

| 1.6 | Verify Export History & Client References | Confirm trade capability and reliability | Request 3 verifiable export references (names, countries, order volumes). Contact references directly. Ask for BL copies or export declarations (without sensitive data). |

| 1.7 | Check Intellectual Property & Design Rights | Avoid infringement risks | If sourcing custom embossed patterns, ensure supplier can provide design authorization or confirm original creation. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Tip |

|---|---|---|---|

| Business License | Lists manufacturing as primary activity; owned by individual or corporate entity with industrial address | Lists “import/export” or “trade” as main activity; may lack production scope | Cross-check license on NECIPS; verify registered capital and legal representative. |

| Facility Footprint | Large industrial site (5,000+ m²), production machinery visible, warehouse adjacent to production | Office-only location; no visible machinery; samples stored offsite | Use Google Earth or request geotagged photos from production floor. |

| Production Lead Time | 15–25 days (direct control over scheduling) | 25–45 days (dependent on subcontractors) | Ask for detailed production timeline; inconsistencies suggest intermediaries. |

| Pricing Structure | Transparent cost breakdown (raw material, labor, overhead) | Fixed FOB price with limited cost detail | Request itemized quote; factories can explain resin price fluctuations (e.g., PVC SG-5). |

| Technical Expertise | Staff can discuss formulation (e.g., Ca-Zn stabilizers), calendering temperature, embossing depth | Limited technical knowledge; redirects to “our factory partner” | Pose technical questions during video call (e.g., “How do you control warping during cooling?”). |

| Customization Capability | Offers OEM/ODM services, mold development, in-house R&D | Limited to catalog items; customization requires MOQ negotiations | Request sample of custom color or pattern; track development timeline. |

3. Red Flags to Avoid When Sourcing PVC Panels from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard raw materials (e.g., recycled PVC with high filler content), risk of delamination or warping | Benchmark against market average (e.g., $2.80–$4.20/m² for 4mm brown wood-grain PVC). Reject quotes >20% below average. |

| Refusal to Conduct Video Audit | Suggests non-existent or outsourced production | Insist on live factory walkthrough. Use third-party inspection if access denied. |

| No Physical Address or Fake Facility Photos | Indicates trading company posing as factory; potential fraud | Verify address via Baidu Maps; request employee badge or utility bill for proof of occupancy. |

| Inconsistent Communication | Multiple contacts with conflicting information; poor English; delayed responses | Assign single point of contact; escalate if communication deteriorates post-inquiry. |

| Lack of Certifications | Non-compliance with EU CE, US ICC-ES, or fire safety standards | Require valid test reports from accredited labs (e.g., TÜV, Intertek). |

| Pressure for Full Upfront Payment | High fraud risk; no buyer protection | Use secure payment terms: 30% T/T deposit, 70% against BL copy or LC at sight. |

| Generic Product Catalogs | Suggests multiple product lines unrelated to core expertise (e.g., PVC panels + textiles + electronics) | Focus on suppliers specializing in building materials or plastic composites. |

| No Warranty or After-Sales Policy | Poor quality control; limited accountability | Require written warranty (e.g., 5-year colorfastness guarantee) and defect resolution process. |

4. Recommended Due Diligence Checklist

✅ Verified business license on NECIPS

✅ Video audit completed with timestamped footage

✅ Sample tested by independent lab (report on file)

✅ At least two export references confirmed

✅ Payment terms aligned with Incoterms 2020 (e.g., FOB Ningbo)

✅ Signed supplier agreement with quality clauses and IP protection

Conclusion

Procuring brown PVC panels from China requires a disciplined verification process to mitigate quality, compliance, and operational risks. Prioritize suppliers with verifiable manufacturing assets, technical transparency, and a track record in international trade. Differentiating factories from trading companies reduces supply chain opacity and enhances long-term reliability.

SourcifyChina Recommendation: For high-volume or mission-critical projects, engage a sourcing partner with on-ground verification capabilities in key manufacturing hubs (e.g., Guangdong, Zhejiang).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Sourcing Experts

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Intelligence 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: Eliminate Sourcing Friction in PVC Panel Procurement

Global procurement teams face critical bottlenecks in sourcing specialized products like brown PVC panels from China. Generic search results (“china pvc panel brown company”) yield unverified suppliers, leading to wasted vetting hours, quality failures, and supply chain disruptions. SourcifyChina’s Verified Pro List solves this through AI-driven supplier validation and operational due diligence—reducing your time-to-qualified-supplier by 70%.

Why Generic Searches Fail: The Hidden Costs of DIY Sourcing

| Activity | DIY Sourcing (Standard Approach) | SourcifyChina Verified Pro List | Time Saved/Year |

|---|---|---|---|

| Initial Supplier Vetting | 80+ hours (fraud screening, license checks) | Pre-verified suppliers (audited facilities, live factory videos) | 65 hours |

| Quality Assurance Setup | 45+ hours (negotiating QC protocols, sample validation) | Integrated QC teams (bilingual inspectors, AQL 1.0 standard) | 38 hours |

| Payment & Compliance Risk | High (35% of new suppliers fail initial production runs) | Escrow-backed transactions + ISO 9001/14001 compliance | Risk eliminated |

| Total Project Timeline | 14-18 weeks | 6-8 weeks | 52% acceleration |

🔑 Key Insight: 89% of procurement managers report at least 2 failed supplier engagements annually due to inadequate vetting (SourcifyChina 2025 Global Procurement Survey). The “brown PVC panel” niche is especially prone to specification drift (color variance, thickness tolerance) and material substitution (recycled vs. virgin PVC).

SourcifyChina’s Value Proposition: Precision Sourcing, Zero Guesswork

Our Verified Pro List for brown PVC panel suppliers delivers:

✅ Real-time factory validation – 360° facility tours, machine calibration records, and raw material traceability

✅ Material-specific expertise – Suppliers pre-qualified for brown pigment stability and UV resistance (critical for outdoor applications)

✅ End-to-end risk mitigation – Payment protection, contract arbitration, and logistics coordination

✅ Cost transparency – FOB pricing benchmarks within 3% market variance (2026 Q1 data)

💡 Case Study: A European building materials distributor reduced brown PVC panel sourcing from 16 weeks to 7 days using our Pro List—avoiding $220K in rework costs from a prior supplier’s color mismatch.

Call to Action: Secure Your Competitive Edge in 2026

Stop gambling with unverified suppliers. The cost of a single failed shipment (e.g., non-compliant brown PVC panels) exceeds the annual savings from SourcifyChina’s service.

👉 Take These 2 Steps Within 24 Hours:

1. Email [email protected] with:

“2026 PVC Panel Pro List Request – [Your Company Name]”

(Include volume, thickness, and color code requirements for immediate qualification)

2. OR WhatsApp +86 159 5127 6160 for urgent RFQs (response within 2 business hours).

Receive within 24 business hours:

– ✨ 3 pre-vetted brown PVC panel suppliers with live production capacity data

– ✨ Comparative pricing matrix (FOB Shenzhen, 40HQ)

– ✨ Free QC checklist tailored to brown PVC panel specifications

“In 2026, procurement wins are decided in the vetting phase—not the negotiation table. SourcifyChina turns supplier risk into your strategic advantage.”

— J. Reynolds, Director of Global Sourcing, Fortune 500 Building Materials Co. (Client since 2022)

Act now—your 2026 procurement targets depend on suppliers you can trust, not suppliers you hope will deliver.

📧 [email protected] | 📱 WhatsApp: +86 159 5127 6160

SourcifyChina: Verified Supply Chains, Zero Compromise. Since 2018.

© 2026 SourcifyChina. All rights reserved. Data source: SourcifyChina Procurement Intelligence Hub (PIH-2026-Q1).

🧮 Landed Cost Calculator

Estimate your total import cost from China.