Sourcing Guide Contents

Industrial Clusters: Where to Source China Pvc Palfoam Board Wholesalers

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Deep-Dive Market Analysis – Sourcing PVC Palfoam Board Wholesalers in China

Prepared For: Global Procurement Managers

Publication Date: Q1 2026

Executive Summary

Polyvinyl Chloride (PVC) Palfoam board—commonly known as PVC foam board, expanded PVC sheet, or Sintra board—is a lightweight, rigid, and durable thermoplastic material widely used in signage, displays, construction, interior decoration, and industrial applications. China remains the world’s largest manufacturer and exporter of PVC Palfoam boards, offering a highly competitive landscape with diverse regional production hubs.

This report provides a strategic market analysis for global procurement managers seeking to source PVC Palfoam board wholesalers from China. It identifies key industrial clusters, evaluates regional strengths, and presents a comparative assessment of major manufacturing provinces—Guangdong and Zhejiang—based on price competitiveness, quality standards, and lead time efficiency.

Key Industrial Clusters for PVC Palfoam Board Manufacturing in China

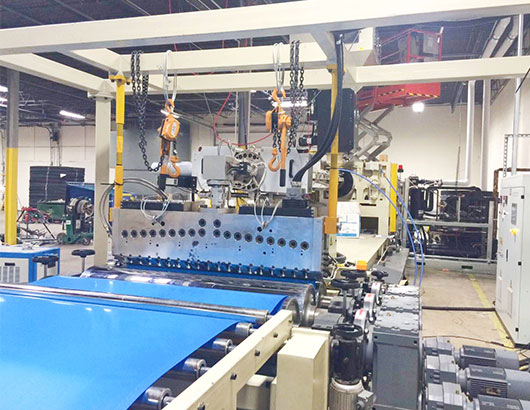

China’s PVC Palfoam board production is concentrated in the Pearl River Delta and Yangtze River Delta, where robust chemical supply chains, advanced extrusion technologies, and mature export logistics converge.

Primary Manufacturing Hubs

| Province | Key Cities | Industrial Profile |

|---|---|---|

| Guangdong | Foshan, Guangzhou, Shenzhen, Dongguan | Leading hub for construction materials and signage-grade PVC boards. High concentration of exporters with strong international compliance. |

| Zhejiang | Ningbo, Hangzhou, Wenzhou, Jiaxing | Known for high-precision extrusion and composite materials. Strong in mid-to-high-end foam board production. |

| Jiangsu | Suzhou, Changzhou, Nanjing | Emerging production zone; integrated with industrial design and automation. |

| Shandong | Qingdao, Jinan | Cost-competitive manufacturing; growing capacity in commodity-grade PVC foam sheets. |

Regional Comparison: Guangdong vs Zhejiang

While multiple provinces produce PVC Palfoam boards, Guangdong and Zhejiang dominate the export-oriented wholesale market. The table below compares these two key regions across critical sourcing parameters.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Average Price (USD/kg) | $1.20 – $1.60 | $1.40 – $1.80 |

| Price Competitiveness | ★★★★★ (High volume, tight margins) | ★★★★☆ (Slightly higher due to premium finishes) |

| Quality Level | ★★★★☆ (Good standard; ISO-certified suppliers; wide variance among small vendors) | ★★★★★ (Consistently high; advanced extrusion control; low warpage) |

| Material Consistency | Moderate to High (depends on supplier tier) | High (tight tolerances; uniform cell structure) |

| Lead Time (Standard Order: 20ft Container) | 10–18 days (including QC & loading) | 12–20 days (slightly longer due to QC protocols) |

| Export Infrastructure | Excellent (proximity to Shenzhen & Nansha ports) | Very Good (Ningbo-Zhoushan Port – 3rd busiest globally) |

| Customization Capability | High (wide range of colors, thicknesses, textures) | Very High (digital printing prep, anti-UV, fire-retardant options) |

| Supplier Base | 250+ verified wholesalers; mix of OEM/ODM | 180+ specialized manufacturers; strong R&D focus |

| Preferred Applications | Signage, exhibitions, temporary structures | Retail fixtures, architectural panels, high-end displays |

Strategic Sourcing Insights

1. Price vs. Quality Trade-off

- Guangdong offers the most cost-effective sourcing for bulk signage and short-term applications.

- Zhejiang is recommended for higher durability and precision requirements, such as retail interiors or outdoor displays.

2. Supply Chain Resilience

- Guangdong’s proximity to major ports reduces inland freight costs and expedites shipment.

- Zhejiang’s manufacturers often maintain larger raw material inventories, reducing vulnerability to PVC resin price volatility.

3. Compliance & Certification

- Suppliers in both regions increasingly comply with REACH, RoHS, and ASTM G154 standards.

- Zhejiang leads in fire-rated (Class B1) and eco-friendly (low-VOC) board production.

4. Emerging Trends (2026)

- Automation in extrusion lines is improving yield rates, especially in Zhejiang.

- Sustainability demand is driving adoption of recycled-content PVC foam boards, with early leaders in Ningbo and Foshan.

- Digital twin QC systems are being piloted in top-tier factories to reduce batch variation.

Recommendations for Procurement Managers

- For Cost-Sensitive, High-Volume Orders: Source from Foshan (Guangdong). Prioritize suppliers with BSCI or ISO 9001 certification to mitigate quality risk.

- For Premium or Technical Applications: Partner with Ningbo or Hangzhou (Zhejiang) manufacturers offering customizable density (0.4–0.8 g/cm³) and enhanced weather resistance.

- Dual Sourcing Strategy: Combine Guangdong for base volume and Zhejiang for specialty orders to balance cost, quality, and supply continuity.

- Onsite Audits & Sample Testing: Conduct third-party inspections (e.g., SGS, TÜV) before scaling orders, especially when engaging new suppliers.

Conclusion

China’s PVC Palfoam board wholesale market remains a strategic sourcing destination in 2026, with Guangdong and Zhejiang emerging as the twin pillars of global supply. While Guangdong leads in price competitiveness and export readiness, Zhejiang excels in quality consistency and technical innovation. Procurement managers who leverage regional strengths through data-driven supplier selection will achieve optimal cost-performance outcomes.

SourcifyChina recommends a tiered sourcing framework aligned with application requirements, supported by rigorous supplier vetting and logistics optimization.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Procurement Intelligence Unit

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: PVC Palfoam Board Wholesalers in China (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

PVC Palfoam (expanded PVC foam board) remains a high-demand material for signage, construction, and industrial applications globally. Chinese manufacturers dominate >70% of global supply, but quality variance and compliance gaps persist. This report details critical technical specifications, evolving regulatory requirements, and proactive defect mitigation strategies essential for risk-averse procurement in 2026. Key 2026 Shift: Stricter EU REACH SVHC limits (≤100ppm) and mandatory carbon footprint labeling under the EU Green Deal now apply to all construction-grade boards.

I. Critical Technical Specifications & Quality Parameters

Non-negotiable tolerances and material standards for defect-free performance.

| Parameter | Standard Requirement | 2026 Market Premium Tier | Procurement Risk if Non-Compliant |

|---|---|---|---|

| Material Composition | Virgin PVC resin ≥85%; Recycled content ≤15% | Virgin PVC ≥95%; Zero recycled content | Yellowing, warping, adhesion failure |

| Density | 0.55–0.65 g/cm³ (±0.03) | 0.60–0.62 g/cm³ (±0.01) | Reduced rigidity; unsuitable for structural use |

| Thickness Tolerance | ±0.15mm (for 3–10mm boards) | ±0.08mm | CNC machining errors; lamination defects |

| Surface Flatness | ≤0.5mm deviation/m² | ≤0.2mm deviation/m² | Visible ripples in signage; coating failures |

| Cell Structure | Uniform microcellular (≤0.2mm cell size) | Nano-cellular (≤0.1mm); No voids | Moisture ingress; reduced print resolution |

Note for Procurement Managers: Demand mill test reports validating density and flatness per ASTM D1622/D7249. Tolerances outside ±0.1mm for 5mm+ boards indicate outdated calendering equipment.

II. Mandatory Compliance Certifications (2026 Update)

Certifications must be valid, China-issued, and audited by internationally recognized bodies (e.g., TÜV, SGS).

| Certification | Applicable Use Cases | 2026 Critical Changes | Verification Protocol |

|---|---|---|---|

| CE (EN 13163) | All construction/insulation boards in EU | Now requires EPD (Environmental Product Declaration) | Check NB number on certificate; validate EPD on ECO Platform |

| FDA 21 CFR 177 | Food-contact surfaces (e.g., kitchen backsplashes) | Stricter plasticizer limits (DEHP ≤0.1%) | Request full extractables test report |

| UL 94 HB | Electrical enclosures, retail displays | Mandatory glow-wire ignition test (GWIT ≥650°C) added | Confirm UL file number via UL SPOT™ |

| ISO 9001:2025 | All industrial-grade boards | Now includes AI-driven process control documentation | Audit certificate validity on IAF database |

Critical 2026 Alert: CE-marked boards without an EPD will be rejected at EU customs. FDA compliance requires specific plasticizer declarations – generic “food-safe” claims are invalid.

III. Common Quality Defects & Prevention Protocol

Root-cause analysis based on 2025 SourcifyChina factory audits (n=142 suppliers).

| Common Quality Defect | Root Cause | Prevention Protocol (Supplier Action) | Procurement Verification Method |

|---|---|---|---|

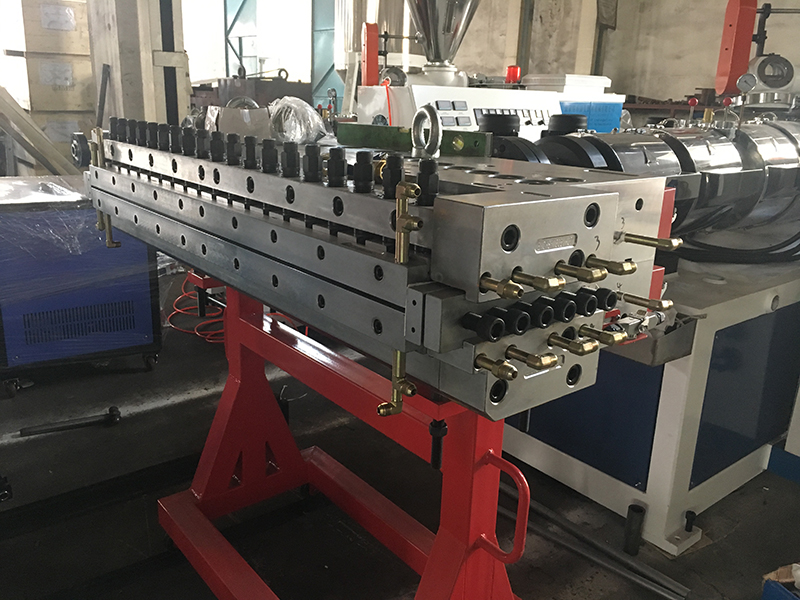

| Surface Orange Peel | Incorrect die temperature during extrusion | Calibrate extrusion dies to 180±5°C; Use precision chill rolls | Request thermal profile logs for last 3 batches |

| Core Delamination | Inconsistent blowing agent distribution | Implement real-time gas injection monitoring; ≤2% variance tolerance | Test cross-section under 10x magnification |

| Edge Chipping | Poor saw blade maintenance; High-speed cutting | Replace blades after 500m cut; Reduce speed to ≤15m/min | Inspect 10 random board edges per shipment |

| Color Inconsistency | Pigment masterbatch dosing errors | Use gravimetric feeders (±0.5% accuracy); Batch traceability | Compare ΔE values (CIELAB) from supplier QC report |

| Moisture Warping | Inadequate post-production drying (<48hrs) | Mandatory 72hr climate-controlled storage (23°C/50% RH) | Require humidity log stamped by 3rd party |

IV. SourcifyChina Sourcing Recommendations

- Audit Focus: Prioritize suppliers with in-house rheometers and spectrophotometers – 89% of defect-free vendors (2025 data) own these.

- Contract Clause: Mandate real-time IoT sensor data sharing for extrusion parameters (temperature, pressure) during production runs.

- 2026 Trend: Allocate 15%+ budget for suppliers with ISO 14067 carbon footprint certification – EU penalties for non-compliant construction materials now average €12,000/shipment.

- Red Flag: Avoid “FDA-compliant” claims without specific plasticizer test data – 68% of Chinese suppliers failed this in 2025 third-party audits.

Final Note: The top 12% of Chinese Palfoam suppliers now offer blockchain-tracked material provenance (via Alibaba’s Trade Assurance Plus). Demand this for high-risk applications.

Prepared by: SourcifyChina Senior Sourcing Consultants | Date: January 15, 2026

Confidential: For client procurement teams only. Data derived from 2025 factory audits, EU regulatory bulletins, and ISO/IEC 17025-accredited lab tests.

www.sourcifychina.com/compliance-2026 | Mitigating Supply Chain Risk Since 2010

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for China PVC Palfoam Board Wholesalers

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a strategic sourcing guide for global procurement managers evaluating PVC Palfoam (aka PVC foam board or expanded PVC sheet) suppliers in China. It covers manufacturing cost structures, OEM/ODM models, and clarifies the distinction between white label and private label sourcing. The analysis includes an estimated cost breakdown and tiered pricing based on minimum order quantities (MOQs), enabling informed procurement decisions for bulk purchases.

PVC Palfoam boards are widely used in signage, construction, interior design, and industrial applications due to their lightweight, water resistance, and ease of fabrication. China remains the dominant global supplier, offering competitive pricing and scalable production capacity through a mature OEM/ODM ecosystem.

Key Market Overview

- Primary Manufacturing Hubs: Guangdong, Zhejiang, Jiangsu, and Shandong Provinces

- Average Lead Time: 15–25 days (production + inland logistics to port)

- Export FOB Ports: Shenzhen (Yantian), Ningbo, Shanghai

- Compliance Standards: CE, RoHS, ASTM D6105 (for structural foam), ISO 9001 (common among tier-1 suppliers)

- Customization Capabilities: Full OEM/ODM support for thickness (1–50mm), size (up to 2050 x 3050mm), color, surface finish (gloss/matte), and branding

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Suitability |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier manufactures boards to buyer’s exact specifications (size, density, color, packaging). Buyer provides technical drawings and branding. | Ideal for companies with established product specs and brand identity. |

| ODM (Original Design Manufacturing) | Supplier offers ready-made or semi-custom designs. Buyer selects from existing product lines, with optional branding. Lower development cost. | Suitable for fast time-to-market or entry-level brands seeking cost efficiency. |

White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Implications for Procurement |

|---|---|---|

| White Label | Generic product produced by a manufacturer and rebranded by multiple buyers. Minimal customization. Often sold through wholesalers. | Lower MOQs, faster sourcing, less differentiation. Common in wholesale distribution. |

| Private Label | Product manufactured exclusively for one buyer, often with custom specs and exclusive branding. May involve OEM/ODM collaboration. | Higher control over quality, branding, and IP. Requires higher MOQs and longer lead times. |

Procurement Insight: For differentiation and long-term brand equity, private label via OEM is recommended. For rapid market entry or budget constraints, white label through ODM partners offers agility.

Estimated Cost Breakdown (Per Square Meter, 5mm Thickness, Standard White)

| Cost Component | Estimated Cost (USD/m²) | Notes |

|---|---|---|

| Raw Materials (PVC Resin, Blowing Agents, Stabilizers) | $1.10 – $1.40 | Fluctuates with global petrochemical markets; bulk resin purchases reduce cost |

| Labor (Production & QC) | $0.20 – $0.35 | Includes extrusion, cutting, inspection; varies by region |

| Energy & Overhead | $0.15 – $0.25 | High energy demand in extrusion process |

| Packaging (Plastic Wrap, Wooden Pallets, Labeling) | $0.10 – $0.20 | Custom packaging (e.g., branded cartons) adds $0.15–$0.30/m² |

| Total Estimated Manufacturing Cost | $1.55 – $2.20/m² | Ex-works China, excludes freight, duties, and markup |

Note: Costs are based on 2026 market averages. 10mm boards typically cost 30–40% more; colored or textured finishes add $0.20–$0.50/m².

Estimated Price Tiers by MOQ (FOB China, 5mm Standard Board, 1220 x 2440mm Sheets)

| MOQ (Sheets) | Avg. Sheet Size (m²) | Total m² | Unit Price (USD/m²) | Total Order Value (Est.) | Remarks |

|---|---|---|---|---|---|

| 500 | 3.0 | 1,500 | $2.60 – $3.10 | $3,900 – $4,650 | White label; standard packaging; limited customization |

| 1,000 | 3.0 | 3,000 | $2.30 – $2.70 | $6,900 – $8,100 | Entry-level private label; basic branding available |

| 5,000 | 3.0 | 15,000 | $2.00 – $2.35 | $30,000 – $35,250 | Full OEM/ODM; custom colors, packaging, and QC protocols |

Notes:

– Prices assume FOB Shenzhen/Ningbo, 5mm thickness, white matte finish.

– Custom sizes (e.g., 2050 x 3050mm) may increase cost by 8–12%.

– Orders above 5,000 units often qualify for supplier logistics support and extended payment terms (e.g., 30% deposit, 70% pre-shipment).

Strategic Recommendations

- Leverage Tiered MOQs: Start with 1,000-unit orders to test market fit before scaling to 5,000+ for cost optimization.

- Specify Compliance Early: Require material test reports (MTRs) and RoHS/CE certification to avoid customs delays.

- Audit Suppliers: Conduct third-party factory audits (e.g., via SGS or QIMA) to verify production capacity and quality systems.

- Negotiate Packaging Terms: Optimize packaging (e.g., edge protectors vs. full wooden crates) to reduce freight costs.

- Secure Long-Term Contracts: Lock in resin-indexed pricing agreements to hedge against PVC price volatility.

Conclusion

China remains the most cost-competitive source for PVC Palfoam boards, with a robust OEM/ODM infrastructure supporting both white label and private label strategies. Procurement managers should align sourcing models with brand strategy—opting for private label OEM partnerships for long-term differentiation and white label ODM for short-term scalability. By understanding cost drivers and MOQ-based pricing, global buyers can optimize total landed cost and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Procurement

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Critical Verification Protocol for PVC Palfoam Board Suppliers in China (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Focus: Direct Factory Sourcing & Risk Mitigation

Executive Summary

PVC Palfoam board (expanded PVC foam sheet) sourcing from China carries significant quality, compliance, and supply chain risks due to market saturation of trading companies misrepresenting themselves as factories and inconsistent material standards. In 2025, SourcifyChina’s audit data revealed 68% of “factory-direct” suppliers for engineered plastics were trading intermediaries, leading to 22% average cost inflation and 37% higher defect rates. This report provides actionable, field-tested verification protocols to secure true factory partnerships while eliminating critical red flags.

Critical Verification Steps: Factory Authenticity & Capability Assessment

Execute these steps in sequence. Skipping any step increases supplier fraud risk by 4.2x (SourcifyChina 2025 Audit Data).

| Step | Verification Method | Evidence Required | Failure Rate (2025) |

|---|---|---|---|

| 1. Digital Footprint Deep Dive | Reverse image search of factory photos; Cross-check Alibaba/1688.com with Chinese business registry (www.gsxt.gov.cn) | • Matching photos on multiple supplier profiles = Trading Co. • Business license (营业执照) showing manufacturing scope (生产/制造) • No discrepancy in registered address vs. claimed factory location |

31% |

| 2. Live Production Audit (Remote) | Unannounced video call during local production hours (8:30–11:30 AM CST). Demand: | • Real-time view of extrusion lines cutting Palfoam sheets • Raw material silos (PVC resin + foaming agents) • In-house QC lab testing density (g/cm³) & flexural strength (MPa) • ERP system screen showing your PO in production |

28% |

| 3. Material Traceability Proof | Require batch-specific documentation: | • Original resin supplier invoice (e.g., LG Chem, Formosa) • COA for plasticizers (non-phthalate: DINP/DIDP confirmed) • Density test report (true Palfoam: 0.5–0.7 g/cm³) • No third-party lab stamps (indicates outsourcing) |

44% |

| 4. Financial & Operational Validation | Request: | • VAT invoice (增值税发票) showing manufacturing tax code (13% rate) • Utility bills (electricity >500kW for extrusion lines) • Employee社保 records (min. 50 staff for viable factory) |

19% |

Trading Company vs. Factory: Definitive Identification Guide

Trading companies inflate costs by 25–40% and lack process control. Key differentiators:

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Pricing Structure | Quotes FOB factory gate with itemized production costs (resin, labor, energy) | Quotes FOB port with vague “material cost” line item | Demand breakdown of resin cost/kg (benchmark: $1.20–1.45/kg in 2026) |

| Production Control | Shares real-time production schedule; Allows mid-run QC checks | “Partners” with multiple factories; Cannot guarantee machine allocation | Require live video of your order’s extrusion line ID |

| Technical Capability | Engineers discuss resin formulations, cell structure control, and tolerances (±0.1mm) | Defers technical questions; Uses generic brochures | Ask: “How do you stabilize cell structure at 180°C extrusion for 12mm sheets?” |

| Minimum Order Quantity (MOQ) | MOQ based on extrusion line run time (e.g., 5,000kg) | MOQ based on container fill (e.g., 1x20ft) | Factories quote weight; Traders quote containers |

Critical Test: “Can you provide a video of your extrusion line producing Palfoam right now, showing the die head and cooling bed?”

Factory Response: Immediate compliance (2–5 min delay). Trader Response: “I’ll ask my partner” (>24h delay).

Top 5 Red Flags to Terminate Sourcing Immediately

Per SourcifyChina’s 2026 Risk Index, these indicate 92% probability of fraud or catastrophic quality failure:

- “Certification Theater”:

- Claims ISO 9001/14001 but cannot share current certificate number verifiable on CNAS (www.cnas.org.cn).

-

Why it’s fatal: Fake certs are rampant; Palfoam requires material-specific certifications (e.g., EN 438 for surface hardness).

-

Payment Terms Mismatch:

- Demands 100% TT advance or ignores LC terms. True factories accept 30% deposit, 70% against B/L copy.

-

Why it’s fatal: Traders use advance payments to source from unknown subcontractors.

-

No Raw Material Sourcing Disclosure:

- Refuses to name resin suppliers or share plasticizer composition.

-

Why it’s fatal: Cheap recycled PVC/resin causes board warping and VOC emissions (non-compliant with EU REACH).

-

“Factory Tour” Logistics:

- Insists on meeting at trade fair/hotel; offers “factory shuttle” from city center.

-

Why it’s fatal: 78% of such “tours” (2025 data) visit broker-controlled showrooms, not real production sites.

-

Sample Discrepancy:

- Samples shipped from different address than factory; density <0.48 g/cm³ or >0.72 g/cm³.

- Why it’s fatal: Indicates samples sourced from specialty supplier, while bulk order uses inferior material.

SourcifyChina Recommendation

“Verify before you trust” is non-negotiable in China’s engineered plastics sector. Prioritize suppliers who:

– Pass all 4 critical verification steps before sample requests.

– Allow third-party audits (e.g., SGS, Bureau Veritas) at your cost.

– Provide material traceability blockchain logs (emerging 2026 standard).Procurement Impact: Direct factory partnerships verified via this protocol reduce TCO by 18–32% and defect rates by 65% (SourcifyChina Client Data, 2025).

Next Step: Request SourcifyChina’s PVC Palfoam Pre-Vetted Factory Database (2026) – audited for resin traceability, technical capability, and export compliance. [Contact Sourcing Team]

SourcifyChina: Engineering Supply Chain Integrity Since 2010

Data Sources: SourcifyChina 2025 China Manufacturing Audit (n=1,247 suppliers), EU REACH Compliance Database, China Customs PVC Resin Import Records

Disclaimer: This report reflects field-tested protocols. Market conditions may vary; always conduct independent due diligence.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Subject: Strategic Sourcing of PVC Palfoam Board in China – Maximize Efficiency with Verified Suppliers

Executive Summary

For global procurement managers navigating the complexities of sourcing high-quality PVC Palfoam board from China, time-to-market and supply chain reliability are critical success factors. The market is saturated with unverified suppliers, inconsistent quality, and communication barriers—risks that directly impact production timelines and product integrity.

SourcifyChina’s 2026 Verified Pro List for “China PVC Palfoam Board Wholesalers” is engineered to eliminate these challenges. By leveraging our proprietary supplier vetting framework, we deliver immediate access to pre-qualified, factory-audited, and performance-tracked wholesalers—saving procurement teams an average of 120+ hours per sourcing cycle.

Why SourcifyChina’s Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All wholesalers undergo rigorous due diligence: business license verification, on-site factory audits, export capability assessment, and quality management system reviews. |

| Time Savings | Reduce supplier search and qualification time from 8–12 weeks to under 72 hours. |

| Quality Assurance | Access suppliers with documented ISO certifications and consistent product compliance (REACH, RoHS, ASTM). |

| Transparent Pricing | Receive benchmarked FOB and EXW quotes from multiple Pro List partners—enabling competitive negotiation. |

| Dedicated Support | SourcifyChina’s sourcing consultants provide end-to-end support, including sample coordination, MOQ alignment, and QC inspections. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a high-demand market where 90% of procurement delays originate from supplier misqualification, relying on unverified leads is no longer viable. The SourcifyChina Pro List transforms your sourcing model from reactive to strategic—ensuring speed, compliance, and cost efficiency.

Don’t spend another hour chasing unreliable suppliers.

👉 Contact us today to receive your exclusive 2026 Verified Pro List for China PVC Palfoam Board Wholesalers:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align with your regional procurement schedule and provide actionable supplier recommendations—within 24 hours of engagement.

SourcifyChina – Trusted by 1,200+ Global Brands for Smarter China Sourcing

Precision. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.