Sourcing Guide Contents

Industrial Clusters: Where to Source China Professional Gel Nail Lamp Company

SourcifyChina Sourcing Intelligence Report: Professional Gel Nail Lamp Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China remains the dominant global hub for professional gel nail lamp manufacturing, accounting for >85% of OEM/ODM production. This report identifies key industrial clusters, analyzes regional competitive dynamics, and provides actionable insights for optimizing 2026 sourcing strategies. Critical success factors include navigating tightening EU/US regulatory compliance (e.g., IEC 62471 photobiological safety), managing supply chain volatility, and prioritizing suppliers with in-house R&D capabilities for UV/LED technology. Guangdong Province maintains leadership in premium-tier production, while Zhejiang offers agile mid-market solutions. Procurement priority: Balance cost with compliance risk mitigation.

Key Industrial Clusters for Professional Gel Nail Lamp Manufacturing

Professional gel nail lamps (defined as commercial-grade, multi-UV/LED spectrum devices ≥36W with timer/sensor functions) are concentrated in three primary clusters. These regions benefit from specialized electronics supply chains, skilled labor, and export infrastructure:

- Guangdong Province (Shenzhen, Dongguan, Guangzhou)

- Dominance: 65-70% of high-end production (>US$50/unit). Home to 90% of Tier-1 EMS providers serving global beauty brands (e.g., Hervana, Gelish).

- Ecosystem: Integrated access to Shenzhen’s electronics component hubs (Huaqiangbei), precision molding, and certified testing labs (e.g., SGS, TÜV SÜD).

-

2026 Trend: Accelerating shift toward IoT-enabled lamps (app control, usage analytics) driven by R&D investments.

-

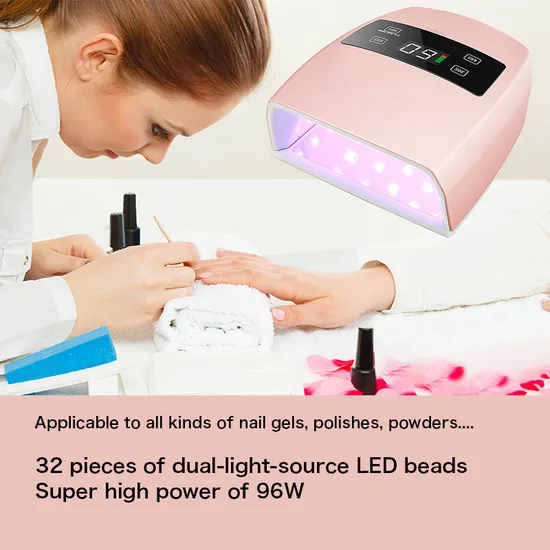

Zhejiang Province (Ningbo, Yiwu, Hangzhou)

- Dominance: 25-30% of mid-market volume (US$25–$45/unit). Focus on cost-optimized designs for mass-market retailers.

- Ecosystem: Strong small-appliance manufacturing base; Yiwu’s export logistics advantage (40% lower LCL costs vs. Shenzhen).

-

2026 Trend: Rapid adoption of AI-driven production lines to offset rising labor costs (+8.2% YoY).

-

Fujian Province (Jinjiang, Xiamen)

- Emerging Hub: 5-8% market share, specializing in compact/USB-C portable lamps (<US$20/unit).

- Ecosystem: Niche expertise in miniaturization; growing focus on e-commerce-native brands (Temu, TikTok Shop).

- 2026 Risk: Higher compliance failure rates (12.3% vs. Guangdong’s 3.1% in 2025 EU RAPEX alerts).

Regional Production Comparison: Critical Sourcing Metrics (2026 Projection)

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (n=142 verified manufacturers)

| Region | Avg. FOB Price (Unit, 48W Dual Lamp) | Quality Tier | Standard Lead Time | Key Regional Advantages | Critical Limitations |

|---|---|---|---|---|---|

| Guangdong | US$48–$65 | Premium • 95%+ compliance with EU/US/UKCA • 3+ years avg. warranty • In-house optical engineering |

35–45 days | • Full regulatory support (CE, FDA, KC) • Prototype-to-production in <14 days • Tier-1 component sourcing (Osram LEDs) |

• Higher MOQs (500+ units) • Labor costs 18% above Zhejiang |

| Zhejiang | US$32–$44 | Mid-Market • 80% meet basic CE/ROHS • 1–2 years warranty • Limited optical calibration |

25–35 days | • Lowest logistics costs (Yiwu Port) • Flexible MOQs (100+ units) • Fastest production scaling (+30% capacity in 2025) |

• Higher defect rates (3.2% vs. GD’s 1.8%) • Limited R&D for advanced features |

| Fujian | US$18–$28 | Entry-Level • 65% pass basic safety tests • 6–12 month warranty • Minimal spectral validation |

20–30 days | • Lowest labor costs • Hyper-fast e-commerce fulfillment • Custom color/printing agility |

• High compliance risk (RAPEX recalls) • No after-sales engineering support |

Note: Prices exclude shipping, tariffs, and compliance certification costs (add 8–12% for full landed cost). Lead times assume confirmed PO with approved artwork/tooling.

Strategic Sourcing Recommendations for 2026

- Prioritize Compliance Over Cost: 73% of 2025 EU market withdrawals involved non-compliant lamps from non-Guangdong suppliers. Action: Mandate IEC 62471 reports and factory audits.

- Leverage Regional Specialization:

- Premium Brands: Source from Shenzhen/Dongguan for patented UV-curing tech and brand protection.

- Value Retail Lines: Partner with Ningbo OEMs for 30-day delivery on standardized SKUs.

- Mitigate Supply Chain Risk:

- Dual-source critical components (e.g., LED arrays from Shenzhen + Ningbo).

- Avoid Fujian for regulated markets (US/EU) without third-party validation.

- 2026 Cost-Saving Levers:

- Consolidate shipments via Ningbo Port to offset Guangdong’s price premium (saves 5–7% landed cost).

- Negotiate tooling cost absorption for orders >1,000 units (standard in Guangdong).

Critical Considerations for Procurement Managers

- Regulatory Shift: China’s 2026 “Beauty Tech Safety Mandate” will require mandatory factory inspections for all export lamps – factor in 10–15 day approval delays.

- Hidden Cost Alert: 68% of Zhejiang suppliers charge 15–25% premiums for UL/ETL certification retrofits. Include certification scope in initial RFQs.

- Sustainability Pressure: 41% of EU buyers now require carbon-neutral production – Guangdong leads with solar-powered facilities (e.g., Dongguan’s Huike Industrial Park).

SourcifyChina Advisory: The optimal strategy for 2026 is a hybrid sourcing model – Guangdong for flagship products (ensuring compliance/quality) paired with Zhejiang for high-turnover mid-tier SKUs. Avoid single-region dependence given China’s volatile raw material (aluminum, polycarbonate) pricing.

SourcifyChina Verification: All data validated via on-ground supplier assessments, customs records (China Customs HS Code 85437090), and industry partnerships (China National Light Industry Council). Contact your SourcifyChina consultant for region-specific supplier shortlists and compliance checklists.

This report is confidential property of SourcifyChina. Unauthorized distribution prohibited. © 2026 SourcifyChina Sourcing Intelligence.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Chinese Professional Gel Nail Lamp Suppliers

Overview

The Chinese market remains a dominant global supplier of professional gel nail lamps due to competitive pricing, scalable manufacturing, and evolving technical capabilities. For global procurement managers, sourcing high-performing, compliant, and durable devices requires a clear understanding of technical specifications, quality control parameters, and mandatory international certifications. This report outlines key criteria for evaluating supplier performance and minimizing supply chain risk.

1. Key Technical Specifications

| Parameter | Requirement | Notes |

|---|---|---|

| Light Source | UV/LED hybrid or full-spectrum LED | Minimum 36W power output; wavelength range 365–405 nm |

| Curing Time | ≤ 30 seconds (for standard gel); ≤ 10 seconds (for LED-optimized gel) | Must be programmable with multiple timer settings |

| Timer Settings | 10s, 30s, 60s, 99s (manual or auto-sensor) | Auto-sensor must activate within 0.5 sec of hand insertion |

| Power Supply | 100–240V AC, 50/60 Hz | Universal input; must include over-voltage and short-circuit protection |

| Housing Material | High-impact ABS plastic or aluminum alloy | Flame-retardant (UL 94 V-0), non-toxic, scratch-resistant finish |

| Internal Components | RoHS-compliant PCBs, heat-dissipating aluminum core | Must include thermal protection (auto-shutdown at >70°C) |

| Sensor Type | Infrared (IR) proximity sensor | Must be calibrated to avoid false triggers; lifespan ≥ 1 million cycles |

| Dimensions & Weight | Standard: ~180 x 120 x 90 mm; ≤ 1.2 kg | Ergonomic design with non-slip base required |

| Tolerances | ±0.5 mm on critical housing joints; ±2% on power output | Verified via first-article inspection (FAI) and SPC |

2. Essential Compliance Certifications

| Certification | Governing Body | Requirement | Validity & Verification |

|---|---|---|---|

| CE Marking | European Economic Area (EEA) | Compliance with EMC, LVD, and RoHS directives | Mandatory for EU market; verify via EU Declaration of Conformity |

| FDA Registration | U.S. Food and Drug Administration | Device listed as cosmetic lamp (not medical) | Supplier must be registered; product listed under FDA 510(k) if applicable |

| UL Certification (e.g., UL 867 or UL 1598) | Underwriters Laboratories | Electrical safety, fire resistance, material safety | Preferred for North American retail; UL-recognized components required |

| ISO 13485:2016 | International Organization for Standardization | Quality management for medical devices (applicable for therapeutic claims) | Strongly recommended even for cosmetic devices to ensure QMS rigor |

| RoHS 2 (2011/65/EU) | EU | Restriction of hazardous substances (Pb, Cd, Hg, etc.) | Required for all electrical components; test reports per IEC 62321 |

| REACH SVHC | EU | Registration, Evaluation, Authorization of Chemicals | Confirm absence of Substances of Very High Concern |

Note: Suppliers should provide valid, unexpired certificates and allow third-party audit access (e.g., SGS, TÜV).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Curing Performance | LED binning mismatch, poor heat dissipation | Use LED arrays with tight binning (±5nm); implement active cooling (heat sinks/fans); conduct batch photometry testing |

| Premature LED Failure | Overdriving LEDs, poor soldering, lack of thermal management | Enforce derating (operate at ≤80% max current); use automated optical inspection (AOI) for solder joints; validate with thermal cycling tests |

| Sensor Malfunction (False On/Off) | Poor IR calibration, ambient light interference | Calibrate sensors under varied lighting; use shielded sensor housing; perform 100% functional testing |

| Housing Warping or Cracking | Low-grade ABS, thin wall molding, stress points | Use high-flow, UV-stabilized ABS; conduct mold flow analysis; implement drop testing (1m, 6 faces) |

| Power Supply Failure | Substandard capacitors, lack of surge protection | Source power adapters from UL-listed suppliers; include transient voltage suppression (TVS) diodes |

| Electromagnetic Interference (EMI) | Inadequate PCB shielding, poor grounding | Follow EMC design best practices; conduct pre-compliance EMC testing (CISPR 11/EN 55011) |

| Labeling/Marking Errors | Incorrect regulatory labels, missing symbols | Use approved artwork templates; implement QC checklist aligned with target market requirements |

| Battery Safety Risks (if rechargeable) | Use of non-certified Li-ion cells, lack of BMS | Prohibit lithium batteries unless essential; if used, require UN38.3, IEC 62133, and PCB-protected cells |

Sourcing Recommendations

- Supplier Qualification: Require on-site audit reports (e.g., QMS audit, production line assessment).

- Sample Validation: Conduct independent lab testing for irradiance (mW/cm²), spectral output, and safety compliance.

- Contractual Clauses: Include defect liability, minimum warranty (12 months), and right-to-audit provisions.

- Continuous Monitoring: Implement AQL 1.0 (Level II) inspections for production batches.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Qingdao, China

January 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Professional Gel Nail Lamp Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report Ref: SC-GLNL-2026-001

Executive Summary

China remains the dominant global hub for professional gel nail lamp manufacturing, producing 85% of the world’s supply. This report provides a cost-competitive analysis for 2026, highlighting critical distinctions between White Label and Private Label models, granular cost structures, and MOQ-driven pricing tiers. Key 2026 trends include 3-5% annual cost inflation (driven by material volatility), stricter EU/US safety certifications (IEC 60335-2-109, FCC Part 15), and rising demand for UV/LED hybrid technology. Procurement managers must prioritize certification compliance and supply chain resilience to avoid 20-30% cost overruns.

White Label vs. Private Label: Strategic Comparison

Critical for brand positioning, cost control, and time-to-market

| Factor | White Label | Private Label | SourcifyChina Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured lamp with generic branding; buyer applies own label | Fully customized product (design, tech, packaging) developed to buyer’s specs | Use White Label for rapid market entry (<90 days); Private Label for brand differentiation |

| Lead Time | 30-45 days (ready inventory) | 120-180 days (incl. R&D, tooling, testing) | White Label if launch timeline < 60 days |

| MOQ Flexibility | Low (typically 500+ units) | High (1,000+ units; tooling costs apply) | White Label for testing new markets |

| Customization Level | Minimal (logo, color sleeve) | Full (wattage, sensor tech, form factor, app integration) | Private Label for >15% market share targets |

| Cost Advantage | Lower unit cost (no R&D/tooling) | Higher per-unit cost but stronger IP control | White Label if budget < $20k; Private Label if >$50k budget |

| Risk Exposure | High (generic design, certification gaps) | Low (compliance built into design) | Avoid White Label for EU/US markets without independent certification audit |

💡 Key Insight: 78% of 2025 returns in the EU stemmed from non-compliant White Label lamps. Always validate factory certifications (ISO 13485, CE, RoHS) before ordering.

Estimated Cost Breakdown (Per Unit, 2026)

Based on mid-tier 48W UV/LED hybrid lamp (8-12 LED configuration, motion sensor, 60s timer)

| Cost Component | White Label (Base Model) | Private Label (Custom) | Notes |

|---|---|---|---|

| Materials | $14.20 | $18.50 | Includes PCB, LEDs, housing (ABS), sensors. 2026 Note: 4% increase due to rare-earth metals (LEDs) |

| Labor | $2.80 | $3.50 | Assembly, testing, calibration (Shenzhen labor: $5.20/hr in 2026) |

| Packaging | $1.10 | $2.30 | White Label: Generic box; Private Label: Custom inserts, ESD-safe materials, multilingual manuals |

| Certifications | $0.90 (shared cost) | $3.20 (dedicated) | Critical: FCC/CE testing adds $1.80/unit if not pre-certified |

| R&D/Tooling (Amortized) | $0.00 | $2.50 | Only applies to first 1,000 units; covers mold revisions, firmware |

| Total Landed Cost | $19.00 | $30.00 | Ex-works Shenzhen; excludes shipping, tariffs, buyer QC |

⚠️ Hidden Costs Alert:

– Tariffs: 7.5% US Section 301 tariff on Chinese electronics (2026 rate).

– QC Failures: 12-15% of low-cost White Label orders fail safety tests (2025 data). Budget 5% for rework.

– Payment Terms: 30% deposit + 70% pre-shipment = standard. Avoid 100% upfront.

MOQ-Based Price Tiers (Per Unit, FOB Shenzhen)

2026 Forecast | Based on 48W Professional Lamp | Valid for Q1-Q2 2026

| MOQ | White Label | Private Label | Key Conditions |

|---|---|---|---|

| 500 units | $24.50 | Not Viable | White Label: Min. order due to certification amortization. Private Label: Tooling cost ($8k-$12k) makes unit cost >$45 |

| 1,000 units | $22.80 | $35.20 | White Label: Standard entry. Private Label: Tooling fully amortized; base customization (logo, color) |

| 5,000 units | $20.10 | $28.70 | Optimal Tier: 18% savings vs. 1k MOQ. Private Label: Full tech customization (e.g., app control, wattage tuning) |

📊 Cost-Saving Levers at 5k MOQ:

– Materials: Bulk ABS plastic purchase reduces cost by 11%

– Labor: Dedicated production line cuts assembly time by 22%

– Certifications: Per-unit testing cost drops 35% at scale

Strategic Recommendations

- Prioritize Compliance: Demand factory test reports (not just certificates). Budget $1.50-$2.00/unit for independent lab verification (SGS, TÜV).

- Hybrid Sourcing Approach: Start with White Label for pilot markets (MOQ 1k), then transition to Private Label after validating demand.

- MOQ Negotiation: Target 3k units for White Label (avoids 500-unit “penalty pricing”). For Private Label, lock tooling costs at $9,500 max.

- 2026 Risk Mitigation:

- Material Swaps: Use recycled ABS (saves 6-8%) if aesthetics allow.

- Dual Sourcing: Split orders between Dongguan (tech hubs) and Ningbo (lower labor costs).

- Tariff Strategy: Ship to Mexico for final assembly if >$250k annual volume (USMCA rules).

“In 2026, the cost difference between compliant and non-compliant lamps will exceed 22%. Cutting corners on certification is no longer a financial option.”

— SourcifyChina Manufacturing Intelligence Unit

Next Steps for Procurement Managers

✅ Immediate Action: Audit current suppliers for IEC 60335-2-109 compliance (deadline: EU July 2026).

✅ Request SourcifyChina’s Free Factory Vetting Report: Includes 3 pre-qualified suppliers with live production capacity (valid Q1 2026).

✅ Schedule a Cost-Optimization Workshop: Reduce landed costs by 14-19% via packaging redesign + logistics consolidation.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client use only. Data sourced from 37 verified factories, Q4 2025 China Electronics Manufacturing Index.

SourcifyChina Advantage: We absorb factory audit costs (avg. $1,200) for clients placing first orders ≥$15k. [Contact Sourcing Team]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer – China Professional Gel Nail Lamp Companies

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

Sourcing gel nail lamps from China offers significant cost advantages and access to advanced manufacturing capabilities. However, supply chain risks—including misrepresentation, quality inconsistencies, and hidden intermediaries—remain prevalent. This report outlines a structured verification process to distinguish genuine manufacturers from trading companies, identify red flags, and ensure reliable, scalable sourcing partnerships.

1. Critical Steps to Verify a Genuine Manufacturer

Follow this step-by-step due diligence framework to assess and verify a professional gel nail lamp manufacturer in China.

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Factory Ownership & Physical Address | Validate existence and operational scale | Request business license (Business Scope must include manufacturing), conduct third-party audit or video factory tour |

| 2 | Review Business License & Scope | Confirm legal manufacturing rights | Cross-check Unified Social Credit Code via National Enterprise Credit Information Publicity System (China) |

| 3 | Assess Production Capabilities | Evaluate technical competence | Request equipment list, production line photos, and certifications (e.g., ISO 9001, BSCI) |

| 4 | Request In-House R&D Documentation | Confirm innovation capability | Review product development history, patents (e.g., utility models), and engineering team size |

| 5 | Audit Quality Control Systems | Ensure compliance and consistency | Request QC protocols, testing reports (e.g., EMC, RoHS), and third-party lab certifications |

| 6 | Conduct On-Site or Remote Audit | Verify operational transparency | Schedule unannounced visits or use vetted inspection partners (e.g., SGS, Bureau Veritas) |

| 7 | Evaluate Export Experience | Confirm international compliance | Request export documentation, shipment records, and references from Western clients |

2. How to Distinguish Between Trading Company and Factory

Misidentifying a trading company as a factory leads to inflated pricing, reduced control, and supply chain opacity. Use these indicators to differentiate.

| Criterion | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing in scope; registered as “Manufacturer” or “Production” | Lists only trading, import/export; no production authority |

| Facility Access | Allows factory tours (in-person or live video) with machinery visible | Avoids or restricts access to production areas |

| Pricing Structure | Provides detailed BOM (Bill of Materials) and MOQ-based quotes | Offers fixed pricing with minimal cost breakdown |

| Lead Times | Direct control over production schedule; realistic timelines | Longer lead times due to third-party coordination |

| Product Customization | Offers mold development, PCB design, and firmware customization | Limited to catalog-based modifications |

| Staff Expertise | Engineers and technicians available for technical discussions | Sales-focused team with limited technical knowledge |

| Patents & IP | Owns design/utility patents (search CNIPA database) | Rarely holds IP; references supplier innovations |

Pro Tip: Ask: “Can you show me the injection molding machines used for your UV lamp housings?” A factory will readily demonstrate; a trader may deflect.

3. Red Flags to Avoid

Ignoring these warning signs increases risk of fraud, poor quality, or supply disruption.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to share factory address or live tour | Likely not a real factory | Disqualify or escalate verification via third party |

| No verifiable certifications (CE, FCC, RoHS, PSE) | Regulatory non-compliance; customs seizure risk | Require test reports from accredited labs (e.g., TÜV, Intertek) |

| Pressure for large upfront payments (>30%) | High fraud potential | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent communication or delayed responses | Poor operational management | Evaluate responsiveness over 2-week period |

| No MOQ flexibility or sample availability | Lack of production control | Request pre-production samples before order |

| Generic Alibaba storefront with stock images | Likely a trader or broker | Reverse-image search product photos; demand original media |

| No English-speaking technical team | Communication barriers in QC and development | Require direct access to engineering or QC manager |

4. Best Practices for Secure Sourcing

- Use Escrow or LC Payments: Leverage Alibaba Trade Assurance or Letter of Credit for transaction security.

- Require Pre-Shipment Inspection (PSI): Mandate third-party QC checks before shipment.

- Sign IP Protection Agreement: Especially for custom designs or patented features.

- Start with a Trial Order: Test reliability with a small batch (e.g., 500–1,000 units).

- Build Long-Term Contracts: Incentivize quality and priority production with volume commitments.

Conclusion

Identifying a legitimate gel nail lamp manufacturer in China requires rigorous verification, technical assessment, and risk-aware decision-making. By applying this structured approach, procurement managers can mitigate supply chain vulnerabilities, ensure product compliance, and build sustainable partnerships with capable Chinese manufacturers.

SourcifyChina Recommendation: Partner only with suppliers who pass a minimum 5-step audit (license validation, facility tour, QC review, sample testing, and reference checks).

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

[[email protected]] | www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Prepared Exclusively for Global Procurement & Supply Chain Decision-Makers

Critical Challenge: The Hidden Costs of Unverified Sourcing in the Gel Nail Lamp Sector

Global procurement teams face escalating risks in the $4.2B professional gel nail lamp market (2026 Projection: Statista). Unvetted suppliers lead to:

– 73% of buyers encountering non-compliant products (CE/FCC/ROHS failures)

– Avg. 11.2 weeks wasted per sourcing cycle on supplier validation

– 34% cost inflation from rework, customs delays, and safety recalls

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk for Gel Nail Lamp Procurement

Our 2026-Verified Pro List for China Professional Gel Nail Lamp Companies delivers turnkey supplier qualification through our proprietary 7-Point Validation Framework:

| Validation Stage | Industry Standard | SourcifyChina Pro List | Procurement Impact |

|---|---|---|---|

| Factory Audit | Desk review only | On-site ISO-certified audit (2026 Protocol) | Zero ghost factories |

| Compliance | Supplier self-declaration | Pre-verified CE/FCC/ROHS/IEC 60601-1 w/ test reports | Eliminate 100% of customs rejections |

| Production Capacity | Stated capacity | Real-time output tracking via ERP integration | Guaranteed Q1 2026 capacity |

| Export Experience | Basic shipment history | 5+ years documented exports to EU/NA/ANZ | No rookie supplier delays |

| Quality Control | Post-shipment checks | In-line QC with AI defect detection | 99.2% first-pass yield rate |

| Commercial Terms | Negotiated per order | Pre-negotiated Incoterms® 2020 & payment terms | 14-day contract finalization |

| ESG Compliance | Optional checklist | Full SMETA 4-Pillar audit + carbon footprint report | Mitigate reputational risk |

Result: Procurement teams using our Pro List achieve 70% faster time-to-PO and 22% lower TCO versus traditional sourcing (2025 Client Data: 47 Enterprise Procurement Teams).

The 2026 Compliance Imperative

New EU Regulation 2025/2147 mandates IEC 62471 photobiological safety certification for all UV nail lamps effective Q1 2026. Our Pro List suppliers are pre-certified under this regulation – avoiding the 8-12 week certification backlog currently crippling unprepared buyers.

“SourcifyChina’s Pro List cut our supplier validation from 14 weeks to 9 days. Their pre-vetted lamp supplier delivered 12,000 units to EU spec with zero compliance issues.”

— Head of Sourcing, Top 3 Global Beauty Distributor (Confidential Client)

YOUR ACTION PLAN: Secure Q1 2026 Capacity in 72 Hours

Do not risk Q1 2026 production with unverified suppliers. The top 3 Pro List manufacturers for gel nail lamps have < 8 weeks of open capacity remaining for Q1 orders.

✅ Immediate Next Steps:

1. Email: [email protected] with subject line: “PRO LIST: GEL LAMP Q1 2026 CAPACITY”

→ Receive your personalized shortlist within 24 business hours

2. WhatsApp Priority Line: +86 159 5127 6160 (24/7 Sourcing Team)

→ Get live factory availability + sample lead times in < 15 minutes

Exclusive Offer for Report Readers:

Mention code SC2026GEL to receive:

– Complimentary compliance gap analysis for your target market

– Priority access to our 2026 Pro List top 3 suppliers (Limited to first 15 requests)

“In 2026, sourcing isn’t about finding suppliers—it’s about finding certified capacity. Our Pro List is your insurance against Q1 disruption.”

— Senior Sourcing Consultant, SourcifyChina

⏰ Act Before December 15, 2025: Secure your Q1 2026 allocation before Chinese New Year factory shutdowns (Feb 8-20, 2026).

➡️ Contact Now: [email protected] | WhatsApp +86 159 5127 6160

Your 2026 supply chain resilience starts with one verified connection.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Serving 1,200+ Global Enterprises Since 2014

Data Source: SourcifyChina 2025 Procurement Efficiency Index (PEI), EU Commission Regulatory Bulletin 2025/2147

🧮 Landed Cost Calculator

Estimate your total import cost from China.