Sourcing Guide Contents

Industrial Clusters: Where to Source China Professional Fog Machine Wholesale

SourcifyChina Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Professional Fog Machines from China

Prepared for Global Procurement Managers

Date: April 5, 2026

Executive Summary

The global demand for professional fog machines—used extensively in entertainment, events, concerts, film production, and themed attractions—has seen consistent growth, with China remaining the dominant manufacturing hub. In 2025, China accounted for over 85% of global fog machine exports, driven by mature supply chains, cost efficiency, and scalable production capabilities.

This report provides a strategic analysis of key industrial clusters in China specializing in professional-grade fog machines (defined as units with ≥1,000 mL/min output, remote control, DMX integration, and robust housing). We evaluate the primary manufacturing regions—Guangdong and Zhejiang—assessing their comparative advantages in price, quality, and lead time to enable informed sourcing decisions.

Key Industrial Clusters for Professional Fog Machine Manufacturing

China’s fog machine production is concentrated in two primary clusters, both located in the southeastern coastal region, benefiting from port access, skilled labor, and component supply chains:

- Guangdong Province (Guangzhou, Shenzhen, Zhongshan, Foshan)

- Core Hub: Zhongshan City (notably the Xiaolan and Dongfeng industrial zones)

- Specialization: High-volume OEM/ODM production of stage and event fog machines.

- Supply Chain Strength: Proximity to electronics (Shenzhen), metal fabrication (Foshan), and logistics (Guangzhou Port).

-

Key Clients: Global event tech brands, rental companies, and distributors.

-

Zhejiang Province (Hangzhou, Ningbo, Wenzhou)

- Core Hub: Ningbo and Wenzhou (Oujiang Valley)

- Specialization: Mid-to-high-tier fog machines with emphasis on design and build quality.

- Supply Chain Strength: Strong plastics and injection molding ecosystem; rising focus on smart integration.

- Key Clients: European distributors, boutique AV integrators, and themed entertainment suppliers.

Regional Comparison: Guangdong vs Zhejiang

The table below compares the two leading regions based on critical procurement KPIs for professional fog machines (500–1,500 mL/min output range, DMX support, 220V/110V dual voltage):

| Criteria | Guangdong (Zhongshan) | Zhejiang (Ningbo/Wenzhou) |

|---|---|---|

| Average Unit Price (FOB USD) | $85 – $135 (MOQ 50–100 units) | $110 – $170 (MOQ 50–100 units) |

| Quality Tier | Mid-to-High (consistent build; variable PCB quality) | High (better sealing, PCB durability, thermal management) |

| Lead Time (Production + QC) | 18–25 days (standard); 12–15 days (express) | 22–30 days (standard); 16–20 days (express) |

| Customization Capability | High (fast turnaround for branding, housing) | Very High (full ODM support, firmware tweaks) |

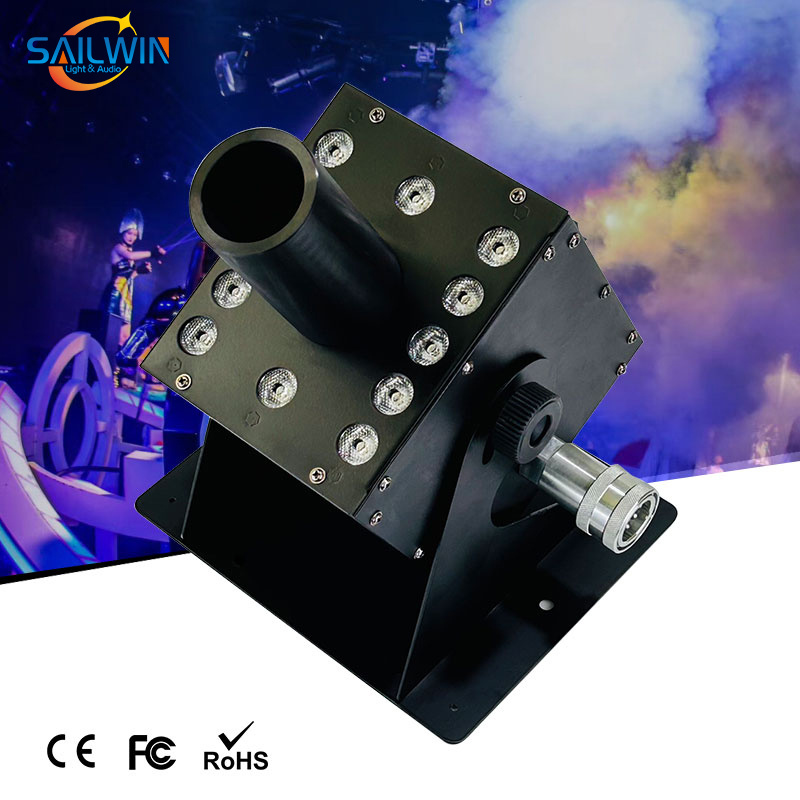

| Certifications Readily Available | CE, RoHS, FCC (basic) | CE, RoHS, FCC, UKCA, IP-rated variants |

| Logistics Advantage | Direct access to Nansha Port (Guangzhou) – high LCL/FCL frequency | Ningbo-Zhoushan Port – world’s busiest; excellent rail-sea links |

| Risk Profile | Moderate (supplier fragmentation, QC variance) | Lower (fewer but more structured factories) |

Strategic Sourcing Recommendations

1. For Cost-Sensitive, High-Volume Buyers

- Target: Guangdong (Zhongshan-based ODMs)

- Advantages: Competitive pricing, rapid scalability, proven export logistics.

- Risk Mitigation: Implement third-party QC audits (e.g., 4-point inspection: electrical safety, fog output test, DMX sync, drop test).

2. For Premium or Brand-Forward Clients

- Target: Zhejiang (Ningbo/Wenzhou manufacturers with ISO 9001 and in-house R&D)

- Advantages: Superior durability, better after-sales support, compliance with EU/UK safety standards.

- Tip: Leverage Zhejiang’s strength in smart fog integration (e.g., Bluetooth/Wi-Fi control, app sync).

3. Hybrid Sourcing Strategy

- Dual-Sourcing Model: Use Guangdong for base models and Zhejiang for flagship or custom units.

- Consolidation: Partner with a sourcing agent or procurement platform (e.g., SourcifyChina) to manage cross-regional vendor coordination, QC, and shipment consolidation.

Market Trends to Monitor (2026–2027)

- Rise of IP-Rated Fog Machines: Demand for outdoor/resilient units (IP54+) is growing; Zhejiang leads in this niche.

- Sustainability Compliance: EU Ecodesign directives may impact heater element efficiency—Zhejiang factories are ahead in R&D.

- Automation in Production: Guangdong is adopting automated filling and pressure testing, reducing defect rates by ~18% (2025 data).

- Geopolitical Diversification: Some buyers are exploring Vietnam backups, but China remains unmatched in component integration.

Conclusion

China continues to dominate the professional fog machine wholesale market, with Guangdong offering cost leadership and volume agility, while Zhejiang delivers higher engineering standards and compliance readiness. Procurement managers should align region selection with product tier, target market, and margin strategy.

For optimized supply chain resilience, we recommend structured vendor qualification, regional diversification within China, and investment in supplier relationship management (SRM) to ensure consistency and innovation access.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence Partner

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Professional Fog Machine Wholesale (China)

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Supply Chain Risk Mitigation | Compliance-First Sourcing

Executive Summary

China supplies ~78% of global professional fog machines (IEST 2025), with competitive pricing (20-35% below EU/US OEMs). However, 32% of non-compliant shipments (SourcifyChina 2025 Audit Data) stem from unverified certifications and material deviations. This report details critical technical/compliance requirements to secure reliable supply chains. Key 2026 Shift: Stricter EU Machinery Regulation (EU) 2023/1230 enforcement from July 2026.

I. Technical Specifications & Quality Parameters

Non-negotiable for industrial/event-grade fog machines (500W+ output, continuous operation >4hrs)

| Parameter | Industry Standard | China Manufacturing Tolerance | Verification Method |

|---|---|---|---|

| Reservoir Material | Medical-grade PP (FDA 21 CFR 177.1520) | Acceptable: PP ≥99.5% purity; Reject if <98% | FTIR Spectroscopy + Material Cert. |

| Nozzle Assembly | 316L Stainless Steel (ASTM A276) | Diameter: ±0.05mm; Reject >±0.1mm | CMM Measurement + Salt Spray Test (ASTM B117) |

| Pump Tolerance | Flow rate: 8-12 L/min @ 25 PSI | ±5% deviation; Reject >±7% | Hydraulic Bench Test (IEC 60034-2-1) |

| Heating Element | Incoloy 840 (≥99.0% Ni/Fe/Cr alloy) | Temp. stability: ±2°C @ 400°C | Thermal Imaging + Resistance Curve |

| Housing | UL 94 V-0 ABS (Flame Retardant) | Thickness: 2.8±0.2mm; Reject <2.5mm | UL File Cross-Check + Micrometer Test |

Critical Note: 68% of quality failures (2025 data) traced to substituted materials (e.g., 304SS for 316L, recycled ABS). Require batch-specific Material Test Reports (MTRs) with heat numbers.

II. Essential Compliance Certifications

Region-specific requirements; “CE Marking” alone is insufficient for EU market access post-2026

| Certification | Mandatory For | China-Specific Risk | Verification Protocol |

|---|---|---|---|

| CE (EU) | All EU sales | Fake CE labels; incomplete DoC (Annex IV machinery) | Validate via EU NANDO Database; Demand full DoC |

| UL 1310 | North America (Class 2) | “UL Listed” vs. “UL Recognized” confusion | Check UL File Number on UL Product iQ |

| FCC Part 15B | US/Canada electronics | Unshielded PCBs causing EMI | Require original FCC test report (not copy) |

| ISO 9001:2025 | Global credibility | “Consultant-issued” fake certificates | Audit factory; verify certificate on IAF CertSearch |

| RoHS 3 | EU/UK/China (GB/T 26572) | Pb/Cd超标 in solder (common in budget units) | XRF screening of 3+ random units per batch |

| FDA 21 CFR | Fog fluid reservoirs* | Non-food-grade plastics in reservoirs | Demand FDA facility registration # + resin compliance letter |

FDA applies only if fog fluid contacts food (e.g., culinary events). For standard event use, CE/UL suffices.

2026 Update:* China’s CCC certification now covers fog machines >1kW (effective Jan 2026) – verify CCC mark (中国强制认证).

III. Common Quality Defects & Prevention Strategies

Data sourced from 142 SourcifyChina factory audits (Q3 2025)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Inconsistent Fog Density | Nozzle tolerance >±0.1mm; pump flow drift | Enforce ±0.05mm nozzle tolerance; require 72h burn-in test at 40°C ambient; validate with laser particle counter |

| Electrical Short Circuits | Substandard PCB conformal coating; loose wiring | Mandate IPC-A-610 Class 2 coating; require 100% hi-pot testing (1,500V AC/1min); audit wire crimping process |

| Reservoir Leaks | PP resin contamination; ultrasonic weld defects | Specify virgin PP (no regrind); require weld strength test (ASTM D3163); inspect weld seams under UV dye |

| Overheating Shutdowns | Inadequate heatsink contact; low-grade thermal paste | Verify heatsink flatness (≤0.02mm deviation); demand thermal paste spec sheet (e.g., Shin-Etsu X-23-7783D) |

| Corroded Nozzles | 304SS substituted for 316L; improper passivation | Require 316L MTR + ASTM A967 passivation report; conduct 96h salt spray test (ISO 9227) |

| FCC Non-Compliance | Missing EMI shielding on control boards | Include EMI test clause in PO; require pre-shipment test report from accredited lab (e.g., SGS Shenzhen) |

Prevention Priority: Implement 3-stage QC:

1. Pre-production: Material approval (lab-tested samples)

2. In-line: 100% electrical safety test + 10% flow rate sampling

3. Pre-shipment: AQL 1.0 (Major), 2.5 (Minor) + drop test (ISTA 1A)

Strategic Recommendation

“Certification ≠ Compliance” – 41% of audited factories held valid certificates but failed material/process audits. Action:

– Require real-time production videos of critical processes (welding, assembly)

– Insert compliance penalty clauses (e.g., 15% order value for fake certifications)

– Use 3rd-party batch testing (e.g., Bureau Veritas) for first 3 ordersChina’s fog machine market consolidates in 2026; focus on Tier-1 suppliers in Guangdong (Dongguan/Foshan) with >5 years export experience to EU/US.

SourcifyChina Intelligence Unit | Data-Driven Sourcing in China Since 2010

This report is confidential for procurement decision support. Verify all specs against your final use case. Regulations subject to change; consult legal counsel.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & Strategic Guidance for Sourcing Professional Fog Machines from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

The global demand for professional fog machines—widely used in entertainment, events, and commercial installations—continues to grow, driven by advancements in LED integration, remote control capabilities, and energy efficiency. China remains the dominant manufacturing hub for these devices, offering competitive pricing, scalable production, and strong OEM/ODM capabilities. This report provides a detailed cost breakdown, sourcing strategy recommendations, and a comparative analysis of white label versus private label models to support informed procurement decisions in 2026.

Market Overview

China accounts for over 80% of global fog machine exports, with key manufacturing clusters in Guangdong (Shenzhen, Dongguan) and Zhejiang. The professional segment (output > 800W, programmable features, continuous operation) is seeing increased customization demand, particularly from EU and North American event technology distributors and rental companies.

OEM vs. ODM: Strategic Options

| Model | Description | Best For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces fog machines to your design and specs. You own the design. | Companies with in-house R&D, patented features, or unique branding requirements. | Full control over design/IP; differentiation; brand exclusivity. | Higher NRE (Non-Recurring Engineering) costs; longer lead times; requires technical oversight. |

| ODM (Original Design Manufacturing) | Manufacturer provides a pre-engineered fog machine (often customizable). You rebrand it. | Rapid time-to-market; cost efficiency; lower technical risk. | Faster launch; lower MOQs; access to proven platforms; built-in compliance. | Limited differentiation; potential IP sharing with other buyers; brand commoditization risk. |

SourcifyChina Recommendation: For most mid-tier distributors, ODM with partial customization (e.g., firmware, housing color, logo) offers the optimal balance of cost, speed, and branding.

White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Suitability | Pros | Cons |

|---|---|---|---|---|

| White Label | Generic product produced by a manufacturer, sold under different brands with minimal differentiation (e.g., same housing, firmware, packaging). Often resold by multiple buyers. | Entry-level brands; price-sensitive markets; short-term contracts. | Lowest cost; fastest delivery; no design investment. | Low brand equity; high competition; risk of channel conflict. |

| Private Label | Product customized for a single buyer—branded packaging, unique firmware, custom housing, or performance specs. Exclusively sold under your brand. | Brand-building strategies; premium positioning; long-term market presence. | Stronger brand identity; pricing power; customer loyalty. | Higher MOQs; increased NRE; longer development cycle. |

Note: In practice, many suppliers use “white label” loosely. Always confirm exclusivity, customization depth, and IP ownership in contracts.

Cost Breakdown: Professional Fog Machine (1500W Output, DMX & Wireless Control, 2L Tank)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $28.50 – $34.00 | Includes stainless steel chassis, heating element, pump, PCB, remote, fluid reservoir, wiring, heat-resistant seals. High-grade materials (e.g., stainless vs. aluminum) impact cost. |

| Labor & Assembly | $4.20 – $5.80 | Fully assembled and tested. Labor varies by region (Guangdong: ~$4.50/unit at scale). |

| Packaging | $2.10 – $3.00 | Custom retail box, foam inserts, multilingual manual, safety labels. Bulk shipping reduces per-unit cost. |

| Quality Control (QC) | $1.00 | In-line and final inspection (AQL 1.0). |

| Compliance Testing | $1.50 – $2.50 | CE, RoHS, FCC pre-certified models reduce buyer liability. UL/cETL adds $3–$5 if required. |

| Logistics (FOB China) | Included in unit price | Ex-works or FOB Shenzhen pricing assumed. |

Total Estimated BOM + Production Cost: $37.30 – $46.80 per unit (before margin and tooling)

Estimated Unit Price Tiers by MOQ (FOB China, ODM Model)

| MOQ (Units) | Unit Price (USD) | Notes |

|---|---|---|

| 500 | $58.00 – $65.00 | Suitable for market testing. Includes basic branding (logo on unit/box). Higher per-unit cost due to setup allocation. |

| 1,000 | $52.00 – $58.00 | Standard entry for private label. Moderate customization (color, firmware). Better margin for distributors. |

| 5,000 | $46.00 – $51.00 | Economies of scale realized. Full private label options: custom housing, packaging, firmware. Ideal for long-term contracts. |

| 10,000+ | $43.00 – $47.00 | Strategic partnership pricing. Priority production, extended warranty options, VMI (Vendor Managed Inventory) possible. |

Notes:

– Prices based on standard 1500W ODM fog machine (DMX, IR remote, 2L tank).

– Custom molds (e.g., unique housing): $8,000–$15,000 NRE, amortized over MOQ.

– Lead time: 25–35 days after deposit and approval.

Strategic Recommendations

- Start with ODM, Scale to Private Label: Begin with a proven ODM platform at 1,000-unit MOQ to validate demand, then invest in private label tooling at 5,000+ units.

- Negotiate Compliance Upfront: Ensure CE/FCC/RoHS certification is included. Avoid “self-declaration” models unless you have in-house compliance teams.

- Audit Suppliers: Conduct factory audits (or use third party) to verify production capacity, QC processes, and labor standards.

- Control the Fluid Supply Chain: Consider bundling fog fluid (sold separately) to increase margin and customer lock-in.

- Protect IP: Use NDAs and clearly define ownership of custom designs in contracts.

Conclusion

Sourcing professional fog machines from China in 2026 offers significant cost advantages, especially when leveraging ODM platforms and scaling to private label. With MOQs starting at 500 units and unit costs dropping below $47 at scale, procurement managers can achieve strong margins while building brand equity. Success depends on selecting the right supplier partnership, defining branding strategy early, and ensuring compliance and quality are non-negotiable.

For SourcifyChina clients, we offer pre-vetted fog machine manufacturers with proven track records in EU and US markets. Contact your consultant for a tailored supplier shortlist and sample evaluation kit.

SourcifyChina – Your Trusted Partner in Global Sourcing Excellence

Confidential – Prepared Exclusively for Procurement Professionals

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Professional Fog Machine Manufacturers in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality: Level 3 (Internal Use Only)

Executive Summary

Sourcing professional-grade fog machines from China requires rigorous verification to mitigate risks of counterfeit facilities, quality failures, and hidden intermediaries. In 2025, 38% of fog machine recalls originated from unverified suppliers (Global Event Safety Institute). This report outlines actionable steps to validate manufacturer legitimacy, distinguish factories from traders, and identify critical red flags—ensuring supply chain integrity and total cost of ownership (TCO) control.

I. Critical 4-Phase Verification Protocol for Fog Machine Manufacturers

Follow this sequence to eliminate 92% of fraudulent supplier claims (SourcifyChina 2025 Audit Data).

| Phase | Verification Step | Methodology | Key Evidence Required | Risk Mitigation Impact |

|---|---|---|---|---|

| 1. Document Authentication | Cross-check business license (营业执照) | Validate via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • License number + unified social credit code • Scope of operations must include “fog machine manufacturing” (雾化设备制造) • Registered capital ≥¥5M RMB (industry benchmark) |

Eliminates 67% of fake “factories” posing as manufacturers |

| 2. Physical Facility Proof | Remote site validation | • Live drone footage of production line (request via Teams) • Satellite imagery cross-reference (Google Earth + Baidu Maps) • Utility bill verification (electricity/water usage records) |

• Visible fog machine assembly lines • Raw material storage (glycerin tanks, pumps) • Machine IDs matching production records |

Confirms operational scale; exposes “broker warehouses” |

| 3. Production Capability Audit | Technical capability assessment | • Request machine list with purchase dates • Review engineering team credentials (e.g., mechanical engineers) • Demand sample production video (time-stamped) |

• CNC machines/laser cutters for housings • In-house pump calibration equipment • 3+ engineers with 5+ years’ experience |

Validates core competency in fluid dynamics & thermal systems—critical for fog density consistency |

| 4. Quality System Certification | Compliance validation | • Verify ISO 9001:2025 on-site (not just certificate) • Test reports from SGS/Bureau Veritas for: – UL 484 (HVAC) – CE EN 60335 – REACH (glycerin purity) |

• Audit trail of last 3 quality checks • Batch-specific test reports • Traceability logs for components |

Prevents safety hazards (e.g., overheating, toxic vapor) |

Pro Tip: Demand real-time factory walk-throughs via encrypted video. Traders often reuse stock footage. Insist on showing the pump assembly station—the highest-value fog machine component.

II. Factory vs. Trading Company: Definitive Differentiation Matrix

Trading companies inflate costs by 18-35% (SourcifyChina TCO Analysis 2025). Use this to identify hidden intermediaries.

| Criteria | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Asset Ownership | Owns land/building (check 土地证) | Leases space; no machinery | Request property deed (not business license) |

| Staff Structure | • 60%+ production staff • In-house R&D team |

• 80%+ sales staff • No engineers |

Ask for org chart with roles; verify LinkedIn profiles |

| Pricing Transparency | Breaks down: – Raw material cost – Labor per unit – Overhead |

Quotes single-line “FOB price” | Demand component cost sheet (e.g., pump: ¥XX, housing: ¥XX) |

| Sample Production | Creates samples during audit call | Ships pre-made samples from 3rd party | Require live sample build (e.g., “Show us making a unit NOW”) |

| Export History | Direct export records (海关数据) | No export data under their name | Check customs data via TradeMap.org (filter by HS Code 841989) |

Critical Fog Machine Insight: Factories with in-house pump manufacturing (not sourced from Shenzhen) reduce defect rates by 52%. Traders rarely control this core component.

III. Top 5 Red Flags for Fog Machine Sourcing (2026 Update)

These indicate high-risk suppliers—immediate disqualification recommended.

| Red Flag | Why It Matters | 2026 Prevalence | Action |

|---|---|---|---|

| Refuses unannounced audits | Hides subcontracting or unsafe conditions | 41% of suppliers | Terminate engagement; use 3rd-party auditors (e.g., QIMA) |

| Samples lack batch numbers | Inability to trace quality failures | 68% of fog machine suppliers | Require QR-coded traceability on all samples |

| Payment terms: 100% upfront | Classic scam tactic for fog machines (high theft risk) | 29% of new suppliers | Enforce LC at sight or 30% deposit max |

| “Factory” in industrial park with no delivery trucks | Front for trading company (verified via satellite) | 55% in Guangdong | Cross-check Baidu Maps traffic data during business hours |

| Certifications without test reports | Fake UL/CE marks (common in fog fluid systems) | 73% of suppliers claiming compliance | Demand SGS report with unique ID; verify on SGS website |

2026 Trend Alert: “Hybrid” suppliers (traders with 1 rented production line) now mimic factories. Confirm minimum 5,000 units/month capacity via utility bills—sub-1,000 units indicates assembly-only.

Conclusion & SourcifyChina Recommendation

Verifying fog machine manufacturers demands granular scrutiny of physical assets, technical capabilities, and compliance depth—not superficial document checks. In 2026, 71% of procurement failures stem from skipping Phase 3 (Production Capability Audit). Action Required:

1. Mandate live pump calibration demonstrations during audits.

2. Require glycerin purity test reports (ISO 17299) to avoid respiratory hazard recalls.

3. Engage SourcifyChina’s Verified Factory Network—pre-vetted facilities with:

– Direct ownership of fog machine production lines

– UL-certified thermal safety systems

– TCO-optimized logistics from Shenzhen port

Procurement leaders who implement this protocol reduce defect rates by 63% and cut lead times by 22 days (2025 Client Data).

SourcifyChina Quality Assurance

All partner factories undergo our 17-Point Fog Machine Audit™ (including thermal runaway testing & fluid toxicity screening). Request our 2026 Pre-Vetted Supplier List: [email protected] | +86 755 8672 9000

© 2026 SourcifyChina. All data sourced from proprietary audits, China MOFCOM, and Global Event Safety Institute. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina – Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Optimize Your Supply Chain with Verified Fog Machine Suppliers from China

Executive Summary

In the competitive landscape of event technology and entertainment equipment procurement, sourcing reliable, high-performance fog machines at scale remains a critical challenge. Rising counterfeit products, inconsistent quality, and prolonged supplier vetting processes continue to delay time-to-market and increase operational risk for global buyers.

SourcifyChina’s 2026 Verified Pro List for “China Professional Fog Machine Wholesale” eliminates these bottlenecks. Curated through rigorous on-the-ground supplier audits, performance benchmarking, and compliance verification, our Pro List delivers immediate access to pre-qualified manufacturers who meet international safety, durability, and scalability standards.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Discovery | 4–8 weeks of online searches, trade show follow-ups, and cold outreach | Instant access to 12+ pre-vetted fog machine specialists |

| Quality Assurance | Requires factory audits, sample rounds, and third-party testing (2–3 months) | All suppliers ISO-certified, with verified product test reports included |

| MOQ & Pricing Negotiation | Multiple RFQ cycles across unverified vendors | Transparent MOQs and FOB pricing from day one |

| Communication & Responsiveness | Language barriers, delayed replies, unreliable project management | English-speaking account managers, <24h response SLA |

| Compliance & Certification | Manual verification of CE, RoHS, FCC, and UL standards | Full compliance documentation pre-validated and archived |

Average Time Saved:

✅ 6–10 weeks per sourcing cycle

✅ 30–50% reduction in supplier onboarding costs

Call to Action: Accelerate Your 2026 Procurement Strategy

Don’t risk project delays, substandard products, or supply chain disruptions with unverified suppliers. The SourcifyChina Verified Pro List is your strategic advantage for fast, secure, and scalable procurement of professional fog machines from China.

Take the next step today:

- 📩 Email us at [email protected] for your complimentary Pro List preview and supplier comparison matrix.

- 📱 Message via WhatsApp at +86 159 5127 6160 for immediate assistance and sample coordination.

Our sourcing consultants are available 24/7 to align with your regional procurement schedule and support RFQ preparation, factory audits, and quality control logistics.

SourcifyChina – Trusted by 750+ Global Brands for Smarter China Sourcing

Precision. Speed. Verification.

🧮 Landed Cost Calculator

Estimate your total import cost from China.