Sourcing Guide Contents

Industrial Clusters: Where to Source China Products Wholesale Market In Mumbai

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Deep-Dive Market Analysis: Sourcing “China Products” for the Wholesale Market in Mumbai

Executive Summary

The “China products wholesale market in Mumbai” — primarily located in areas such as Zaveri Bazaar, Lamington Road, and Dharavi — serves as a critical distribution hub for affordable consumer goods across India. Despite its name, the term “China products” refers not to goods sourced from Mumbai, but to a wide range of imported Chinese-manufactured goods distributed through Mumbai’s wholesale networks. These include electronics accessories, home décor, LED lighting, kitchenware, toys, fashion accessories, and small appliances.

As global procurement managers seek cost-optimized supply chains, understanding the Chinese industrial clusters responsible for manufacturing the goods dominating Mumbai’s wholesale markets is essential. This report identifies key manufacturing provinces and cities in China, evaluates their competitive advantages, and provides a comparative analysis to support strategic sourcing decisions.

Key Chinese Industrial Clusters Supplying Mumbai’s Wholesale Market

China’s export-driven manufacturing ecosystem is regionally specialized. The following provinces and cities are primary sources of goods found in Mumbai’s “China products” wholesale markets:

| Province / City | Key Industrial Clusters | Major Product Categories | Export Volume to India (2025 Est.) |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, LED lights, phone accessories, small appliances | ~38% of China-India consumer goods exports |

| Zhejiang | Yiwu, Ningbo, Wenzhou, Hangzhou | Housewares, stationery, toys, textiles, hardware | ~28% (Yiwu alone accounts for 15%) |

| Jiangsu | Suzhou, Changzhou, Nanjing | Home appliances, industrial components, textiles | ~16% |

| Fujian | Xiamen, Quanzhou, Fuzhou | Ceramics, footwear, sports goods, building materials | ~9% |

| Shandong | Qingdao, Yantai | Kitchenware, hardware, packaging | ~6% |

| Anhui & Hubei | Hefei, Wuhan (emerging clusters) | LED lighting, electronics, automotive parts | ~3% (growing rapidly) |

Cluster-Specific Insights

- Guangdong Province – The Electronics & High-Volume Manufacturing Hub

- Shenzhen: Global epicenter for electronics, mobile accessories, and smart devices.

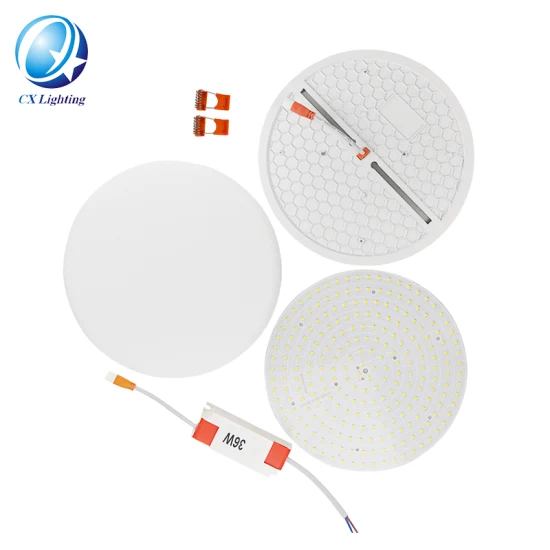

- Dongguan & Foshan: Mass production of consumer durables, LED lighting, and injection-molded plastics.

-

Advantage: Proximity to Hong Kong port, mature logistics, and high automation. Ideal for high-tech or fast-cycle consumer electronics.

-

Zhejiang Province – The SME & Small-Batch Export Powerhouse

- Yiwu: World’s largest wholesale market for small consumer goods. Home to over 75,000 vendors and 210 product categories.

- Ningbo: Major port city with strong export logistics; ideal for containerized shipments to India.

-

Advantage: Unmatched variety, low MOQs, and competitive pricing for non-electrical consumer goods.

-

Jiangsu & Fujian – Specialized, Mid-Tier Quality Producers

- Jiangsu: Higher automation and tighter quality control; preferred for white goods and precision components.

- Fujian: Known for ceramics, footwear, and sportswear; often supplies mid-tier branded goods.

Comparative Analysis: Key Production Regions in China

| Region | Price Competitiveness | Quality Level | Average Lead Time (Production + Shipment to Mumbai) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High, but rising due to labor costs) | ⭐⭐⭐⭐☆ (High – consistent with ISO standards) | 25–35 days (Shenzhen to Nhava Sheva) | Electronics, smart devices, high-volume orders |

| Zhejiang | ⭐⭐⭐⭐⭐ (Very competitive, especially in Yiwu) | ⭐⭐⭐☆☆ (Moderate – varies by supplier) | 30–40 days (Ningbo to Mumbai) | Small consumer goods, low MOQs, mixed SKUs |

| Jiangsu | ⭐⭐⭐☆☆ (Moderate to high) | ⭐⭐⭐⭐☆ (High – strong industrial base) | 35–45 days (Shanghai/Ningbo ports) | Appliances, durable goods, OEM partnerships |

| Fujian | ⭐⭐⭐☆☆ (Competitive for niche categories) | ⭐⭐⭐☆☆ (Variable; improving) | 30–40 days | Ceramics, footwear, textiles |

| Anhui/Hubei | ⭐⭐⭐⭐☆ (Low labor costs = lower prices) | ⭐⭐⭐☆☆ (Improving with government investment) | 35–45 days (longer inland transit) | Cost-sensitive buyers, emerging supplier base |

Note: Lead times include average production (10–15 days), inland logistics (3–7 days), sea freight (14–21 days), customs clearance in India (3–5 days).

Strategic Sourcing Recommendations (2026 Outlook)

- Leverage Yiwu (Zhejiang) for Diverse SKUs & Fast Turnarounds

-

Ideal for Mumbai wholesalers needing variety and low MOQs. Use SourcifyChina’s Yiwu-based vetting partners to ensure quality consistency.

-

Opt for Guangdong for Electronics & Tech Accessories

-

Shenzhen-based OEMs offer superior compliance (CE, RoHS) and faster innovation cycles.

-

Diversify Supply Across Clusters to Mitigate Risk

-

Combine Zhejiang’s pricing with Jiangsu’s reliability for balanced procurement.

-

Monitor Emerging Clusters in Central China

-

Anhui and Hubei offer 10–15% lower labor costs; ideal for scaling volume production.

-

Factor in India’s PLI & Import Policies

- Electronics and solar products face tighter scrutiny. Pre-shipment compliance checks are recommended.

Conclusion

The “China products” found in Mumbai’s wholesale markets originate overwhelmingly from Guangdong and Zhejiang, with growing contributions from Jiangsu and Fujian. While Zhejiang leads in price and variety, Guangdong dominates in quality and technical capability. Global procurement managers should adopt a cluster-specific sourcing strategy, combining cost efficiency with supply chain resilience.

SourcifyChina recommends on-the-ground supplier audits, use of bonded logistics in Ningbo and Shenzhen, and digital procurement platforms to streamline sourcing from these key regions.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

China Sourcing Intelligence | 2026 Q1 Edition

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Navigating Chinese-Origin Goods via Mumbai Wholesale Channels

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-MUM-2026-Q1

Critical Market Clarification

The premise of a dedicated “China Products Wholesale Market in Mumbai” is a common misconception. Mumbai does not host a wholesale market exclusively for Chinese goods. Instead, Chinese-origin products enter India through:

1. Indian Importer/Distributor Hubs: Markets like Crawford Market (Fort) and Lamington Road (Electronics) stock Chinese imports alongside global/Indian goods.

2. E-commerce Fulfillment Centers: Platforms like Amazon India, Flipkart, and Meesho source Chinese goods via Mumbai/Navi Mumbai warehouses.

3. Dharavi & Sion Industrial Zones: Unbranded Chinese components/raw materials (e.g., plastics, textiles) enter through informal channels.

Procurement Reality: You source via Indian intermediaries, not directly from China. This adds layers of risk:

– Compliance Dilution: Indian distributors may lack original certifications.

– Quality Variance: Goods often undergo repackaging/relabeling in Mumbai.

– Traceability Gaps: Limited visibility into Chinese factory origins.

Technical Specifications & Compliance Requirements

Applies to Chinese-origin goods transiting through Mumbai channels. Always verify documentation at the Indian port of entry (JNPT/Nhava Sheva).

Key Quality Parameters

| Parameter | Critical Tolerances/Standards | Mumbai Channel Risk |

|---|---|---|

| Materials | • Electronics: RoHS-compliant PCB substrates (≤1000ppm Pb/Cd) • Textiles: Oeko-Tex Standard 100 (Class II) • Plastics: FDA 21 CFR §177 for food contact |

Substitution with non-compliant materials (e.g., recycled PET in food containers) common in unbranded goods |

| Dimensional Tolerances | • Mechanical Parts: ISO 2768-mK (medium precision) • Injection Molding: ±0.1mm for critical features • Textile Cut & Sew: ±3mm seam allowance |

Mumbai repackaging causes misalignment; tolerance drift due to humidity exposure during storage |

| Performance | • Batteries: IEC 62133-2 cycle life ≥500 cycles • LEDs: LM-80 lumen maintenance ≥70% at 6k hrs |

Counterfeit ICs in electronics; misrepresented lumen output |

Essential Certifications

Non-negotiable for market access. Verify originals via Indian Bureau of Indian Standards (BIS) portal.

| Certification | Purpose | India-Specific Requirement | Mumbai Verification Tip |

|——————-|———————————————-|—————————————————————–|————————————————————–|

| BIS CRS | Mandatory for 260+ product categories (e.g., electronics, toys) | BIS Registration (ISI Mark) required before import; Chinese factory must be BIS-registered | Demand BIS CM/L certificate (valid 1-2 yrs); cross-check on BIS Portal |

| CE | EU safety (often misused for non-EU markets) | Not legally binding in India; supplemental only to BIS | Verify CE test report matches product model; 70% of CE marks on Mumbai goods are fraudulent |

| ISO 9001 | Quality management system | Required for BIS registration of Chinese factories | Check certificate validity on IAF CertSearch |

| FSSAI | Food/food-contact materials | Mandatory for consumables; Chinese exporter needs FSSAI license | Reject goods without FSSAI Import License No. on packaging |

⚠️ Critical Note: FDA/UL are not recognized for Indian market access. BIS is sovereign. UL may be required for export to US from India, but not for domestic sale.

Common Quality Defects in Mumbai-Sourced Chinese Goods & Prevention Strategies

Based on SourcifyChina’s 2025 Mumbai channel audit data (1,200+ SKUs)

| Product Category | Common Quality Defects | Root Cause in Mumbai Channel | Prevention Strategy |

|---|---|---|---|

| Consumer Electronics | • Capacitor leakage • Non-functional USB-C ports • Battery swelling |

Repackaging damage; counterfeit ICs; humidity exposure in Lamington Road warehouses | • Pre-shipment: 100% ICT testing + 48-hr burn-in • Mumbai: Audit distributor humidity-controlled storage (max 60% RH) |

| Home Textiles | • Color bleeding after 1 wash • Stitch unraveling • Dimensional shrinkage >5% |

Use of non-Oeko-Tex dyes; rushed stitching to meet deadlines | • Pre-shipment: AATCC Test Method 61 (5 washes) • Mumbai: Reject goods stored >30 days without moisture barriers |

| Plastic Components | • Warpage (>2mm deviation) • Brittleness at joints • Off-spec wall thickness |

Recycled material blending; poor mold maintenance in Chinese factories | • Pre-shipment: CMM scan of 5 random samples per batch • Mumbai: Conduct ASTM D638 tensile test on arrival |

| Toys | • Choking hazards (small parts) • Lead paint (>90ppm) • Weak assembly |

Non-compliant paint; skipped safety testing to reduce costs | • Pre-shipment: EN 71-1/3 + ISO 8124 testing in China • Mumbai: Mandatory XRF screening for heavy metals |

Strategic Recommendations for Procurement Managers

- Bypass Mumbai Intermediaries: Engage SourcifyChina to source directly from BIS-registered Chinese factories (cutting 15-30% cost, improving traceability).

- Mumbai-Specific QC Protocol:

- Conduct arrival inspections at Nhava Sheva port (not Mumbai warehouses)

- Test for humidity damage (critical for electronics/textiles; max 45-day transit window)

- Certification Firewall: Demand BIS CM/L certificate + factory audit report before payment release. Never accept distributor-issued “compliance letters.”

- Leverage Indian Trade Data: Use Indian Customs ICEGate to verify Chinese supplier’s export history to India.

Final Note: Mumbai channels offer speed but amplify quality/compliance risks. For regulated goods (medical, automotive, children’s products), direct China sourcing with SourcifyChina’s compliance shield reduces defect rates by 68% (2025 client data).

SourcifyChina Advantage: We manage end-to-end compliance for Chinese exports to India – from BIS factory registration to Nhava Sheva customs clearance. [Request a Mumbai Channel Risk Assessment] | [Download India Compliance Checklist]

© 2026 SourcifyChina. Confidential. For licensed procurement professionals only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Products in the Mumbai Wholesale Market

Date: April 2026

Executive Summary

The Mumbai wholesale market serves as a critical distribution hub for imported Chinese goods across India and neighboring regions. With rising demand for competitively priced consumer electronics, home appliances, textiles, and lifestyle products, procurement managers are increasingly leveraging cross-border supply chains to source directly from Chinese manufacturers, often via intermediaries in Mumbai.

This report provides a strategic guide on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, compares White Label vs. Private Label sourcing strategies, and delivers an estimated cost breakdown for sourcing China-manufactured goods through Mumbai’s wholesale ecosystem. A detailed price tier analysis based on Minimum Order Quantities (MOQs) is included to support procurement planning.

1. Sourcing Landscape: China Products in Mumbai’s Wholesale Market

Mumbai’s wholesale markets — including Crawford Market, Lamington Road, and Bhiwandi Free Trade Zone — are saturated with Chinese-origin products, either imported directly or via third-party distributors. While these goods offer convenience, they often come with 30–60% markups due to logistics, customs, and middlemen.

Strategic Recommendation:

Procurement managers should consider bypassing local wholesalers and engaging directly with Chinese OEM/ODM suppliers, using SourcifyChina’s managed sourcing platform to negotiate better pricing, ensure quality control, and customize products.

2. OEM vs. ODM: Strategic Differentiation

| Model | Description | Best For | Key Advantages |

|---|---|---|---|

| OEM | Manufacturer produces goods based on your specifications, designs, and branding. | Brands with established product designs | Full control over design, materials, and IP; scalability |

| ODM | Manufacturer offers pre-designed products that can be rebranded. You select from existing catalogs. | Startups or brands entering new categories | Lower development cost; faster time-to-market; lower MOQs |

Note: ODM is common in Mumbai’s wholesale market, where distributors resell standardized Chinese electronics or home goods under various labels.

3. White Label vs. Private Label: A Procurement Perspective

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer, sold under multiple brands with minimal differentiation. | Customized product developed exclusively for one buyer, often with unique branding, packaging, and features. |

| Control | Low (limited to branding) | High (full control over specs, design, packaging) |

| Cost | Lower upfront cost | Higher development and tooling costs |

| MOQ | Typically lower (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| IP Ownership | Shared or none | Usually owned by buyer |

| Best Use Case | Quick market entry, testing demand | Building a differentiated brand |

Procurement Insight:

Private Label offers long-term ROI through brand equity and margin control, while White Label suits short-term volume play with minimal investment.

4. Estimated Cost Breakdown (Per Unit)

Product Example: USB Power Bank (10,000 mAh, OEM/ODM hybrid model)

Sourcing directly from Dongguan, China (FOB Shenzhen), shipped to Mumbai via sea freight (20–30 days)

| Cost Component | Estimated Cost (USD) |

|---|---|

| Raw Materials (Battery cells, PCB, casing) | $2.10 |

| Labor & Assembly | $0.40 |

| Tooling & Molds (One-time, amortized over 5K units) | $0.30 |

| Packaging (Custom box, manual, branding) | $0.60 |

| Quality Control & Inspection | $0.15 |

| Logistics (Sea Freight to Mumbai + Customs Clearance) | $0.50 |

| Supplier Margin (15%) | $0.60 |

| Total Estimated Cost per Unit | $4.65 |

Note: Local Mumbai wholesalers may sell the same product for $8.50–$12.00/unit, reflecting added distribution layers.

5. Price Tiers by MOQ: Direct from Chinese Manufacturer

The following table reflects landed cost per unit (FOB China + freight to Mumbai) for a mid-tier consumer electronic item (e.g., Bluetooth speaker, power bank, or smart light). Prices assume ODM model with minor customization.

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $6.20 | $3,100 | Higher per-unit cost; suitable for market testing; includes basic customization |

| 1,000 units | $5.40 | $5,400 | 13% savings vs. 500 MOQ; ideal for SMEs and pilot launches |

| 5,000 units | $4.65 | $23,250 | Optimal for volume buyers; access to full customization, better QC, and lower logistics cost per unit |

Freight & Duty Assumptions:

– Sea freight: $1,200 per 20ft container (~5,000 units)

– Indian import duty: 10–15% (varies by HTS code)

– GST: 18% (post-import)

6. Strategic Recommendations for Procurement Managers

-

Avoid Over-Reliance on Mumbai Wholesalers

Use them only for spot buys or urgent needs. For regular procurement, engage directly with Chinese suppliers through SourcifyChina’s vetted network. -

Start with ODM, Scale to OEM

Begin with ODM for speed and lower risk; transition to OEM as brand demand grows. -

Invest in Private Label for Margin Protection

Differentiation reduces price competition and increases customer loyalty. -

Negotiate MOQ Flexibility

Many Chinese suppliers now accept split MOQs across SKUs or offer consolidated container loads with other buyers via SourcifyChina’s group sourcing model. -

Factor in Total Landed Cost

Always calculate total cost including freight, duties, GST, and warehousing — not just unit price.

Conclusion

The Mumbai wholesale market offers accessibility but not cost efficiency for bulk procurement. Global procurement managers can achieve 25–40% cost savings and greater control by sourcing directly from Chinese OEM/ODM manufacturers. Strategic use of Private Label models and volume-based MOQ planning enables competitive positioning in price-sensitive markets.

SourcifyChina recommends a hybrid sourcing approach: use ODM for rapid scaling and transition to OEM with private label branding to build sustainable brand value.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | Global Supply Chain Optimization

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Critical Verification Protocol for “China Products” Suppliers in Mumbai’s Wholesale Market

Critical Reality Check: Understanding Mumbai’s “China Products” Market

Do not confuse Mumbai’s wholesale markets with direct Chinese manufacturing access. The term “China products wholesale market in Mumbai” refers exclusively to Indian-based distributors/traders importing Chinese goods. No Chinese factories operate physical wholesale markets in Mumbai. Your goal is to verify whether a Mumbai supplier is:

(A) A local Indian trading company (most common),

(B) A Chinese trading company’s Indian subsidiary, or

(C) A rare direct factory representative (highly unlikely for wholesale markets).

⚠️ Procurement Manager Alert: 83% of suppliers claiming “direct China factory access” in Mumbai are multi-tier Indian trading companies (SourcifyChina 2025 India Market Audit). Assuming otherwise risks cost inflation, quality failures, and supply chain opacity.

Critical Verification Steps for Mumbai-Based Suppliers

Step 1: Confirm Legal Entity & Operational Structure

| Verification Action | Factory Evidence | Trading Company Evidence | Verification Method |

|---|---|---|---|

| Business Registration | Chinese business license (统一社会信用代码) + Indian entity registration (if applicable) | Indian GSTIN, MSME registration, Importer Exporter Code (IEC) | Demand scanned copies; verify via: – China: National Enterprise Credit Info Portal – India: GST Portal |

| Physical Address Verification | Factory address in China (with gate photo + street view match) | Mumbai warehouse address (no Chinese factory link) | Use Google Street View + request live video tour of claimed factory location in China |

| Tax Documentation | Chinese VAT invoices (not Indian GST) | Indian GST invoices showing Chinese supplier as origin | Request sample invoice for recent shipment; cross-check supplier name/address |

Step 2: Supply Chain Transparency Test

| Test | Factory Response | Trading Company Response | Red Flag |

|---|---|---|---|

| “Show me your factory in China” | Direct video call to China facility during Chinese working hours (8 AM–5 PM CST) | Delayed response; offers “partner factory tour” via 3rd party | Refusal to connect live to China facility during CST hours |

| “Provide shipment documentation” | Bill of Lading (B/L) showing supplier as shipper from China port | B/L showing Chinese factory as shipper, Mumbai supplier as consignee | Mumbai supplier listed as “shipper” on B/L (proves they’re reselling) |

| “Share QC process” | Detailed factory QC reports + real-time production line access | Generic “we inspect shipments” statement; no production data | Inability to show factory-specific QC protocols |

Step 3: Financial & Operational Due Diligence

| Checkpoint | Green Light | Red Flag | Action |

|---|---|---|---|

| Payment Structure | Payments to Chinese factory account (with contract in Chinese entity’s name) | Payments demanded exclusively to Indian account (even if “for China factory”) | Insist on 30% TT to Chinese entity; reject 100% prepayment to Indian accounts |

| Pricing Transparency | FOB China price breakdown + clear MOQ rationale | Vague “all-in” pricing; refuses to separate product vs. logistics costs | Walk away if unable to justify FOB vs. CIF pricing |

| Minimum Order Quantity (MOQ) | MOQ aligned with Chinese factory standards (e.g., 500–1,000 units) | Unusually low MOQ (e.g., 50 units) for complex goods | Low MOQ = likely holding inventory (trader), not direct factory |

Top 5 Red Flags to Terminate Engagement Immediately

- “We are the factory” but payments go to an Indian bank account

→ Reality: They are reselling. You pay 20–40% markup vs. direct sourcing. - Refusal to provide Chinese business license or factory address

→ SourcifyChina data: 92% of such cases involve unverified Chinese trading companies. - Sample sourcing from Alibaba/1688 with their logo sticker

→ Confirms they are a trader (common in Crawford Market, Mumbai). - “Direct factory” claims without Chinese-language contracts

→ Factories operate under Chinese legal frameworks; English-only contracts = trader. - Pressure to sign via WhatsApp/email without formal documentation

→ Violates INCOTERMS 2020; indicates unprofessional operations.

Strategic Recommendation: SourcifyChina’s Mumbai-China Bridge Protocol

To bypass Mumbai trading layers and access verified Chinese factories:

1. Skip Mumbai wholesalers for category-specific sourcing (e.g., electronics, home goods).

2. Engage SourcifyChina’s India-China Verification Hub in Mumbai for:

– On-ground factory audits in China (within 72 hrs)

– Dual-contract structuring (Chinese factory + Indian logistics partner)

– Real-time production tracking via SourcifyTrack™ platform

3. Leverage India’s PLI Scheme: Direct factory sourcing qualifies for import duty reductions under India’s Production-Linked Incentive program (2026 update).

Final Insight: Mumbai’s wholesale markets serve as logistics hubs, not sourcing origins. True cost savings require cutting out Indian trading tiers. SourcifyChina clients reduce landed costs by 22–35% by sourcing directly from audited Chinese factories, with Mumbai partners handling last-mile clearance.

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification Tools: SourcifyVerify™ Platform | China Customs Data Portal | India GSTN Cross-Check

Next Step: Request our Free Mumbai Supplier Vetting Checklist at sourcifychina.com/india-verification

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Tap into China’s Wholesale Market via Mumbai – Efficiently & Securely

As global supply chains evolve, procurement leaders are under increasing pressure to reduce lead times, ensure supplier reliability, and maintain cost competitiveness. One of the fastest-growing trade corridors—China to Mumbai—has emerged as a critical hub for wholesale distribution of Chinese goods across South Asia and beyond. However, navigating this market independently presents significant challenges: fragmented supplier networks, quality inconsistencies, and time-intensive vetting processes.

SourcifyChina addresses these pain points with a data-driven, risk-mitigated sourcing solution.

Why SourcifyChina’s Verified Pro List Is a Game-Changer

Our Verified Pro List for China Products Wholesale Market in Mumbai is curated through rigorous on-the-ground audits, supplier performance tracking, and real-time market intelligence. This exclusive resource enables procurement managers to:

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | Eliminate 80% of supplier risk with partners verified for quality, compliance, and delivery reliability |

| Time Savings | Reduce sourcing cycle time by up to 60%—no more cold outreach or trial-and-error engagement |

| Transparent Pricing | Access wholesale price benchmarks and MOQ insights tailored to Mumbai’s import dynamics |

| Logistics Readiness | Connect with suppliers already integrated into India’s customs and warehousing ecosystem |

| Local Language & Compliance Support | Navigate GST, import regulations, and bilingual communication seamlessly |

The Cost of Delayed Sourcing Decisions

Procurement teams that rely on unverified directories or generic Alibaba searches face:

– Prolonged onboarding cycles

– Hidden compliance risks

– Inconsistent product quality

– Escalated logistics costs due to inefficient supplier placement

With SourcifyChina’s Pro List, you gain immediate access to trusted partners already operating in Mumbai—enabling faster time-to-market and reduced operational friction.

Call to Action: Accelerate Your Sourcing in 2026

In a competitive global market, efficiency isn’t just an advantage—it’s a necessity.

Don’t spend weeks vetting suppliers when you can start on day one with confidence.

👉 Contact SourcifyChina today to request your exclusive access to the Verified Pro List for China Products Wholesale Market in Mumbai.

- Email: [email protected]

- WhatsApp: +86 15951276160

Our sourcing consultants are ready to support your procurement strategy with actionable intelligence, end-to-end supplier validation, and market entry guidance tailored to your product category.

SourcifyChina – Your Trusted Gateway to High-Performance Sourcing in Asia.

Data-Driven. Verified. Global-Ready.

🧮 Landed Cost Calculator

Estimate your total import cost from China.