Sourcing Guide Contents

Industrial Clusters: Where to Source China Products Wholesale Market In India

SourcifyChina B2B Sourcing Report 2026

Strategic Analysis: Sourcing Chinese-Manufactured Goods for the Indian Wholesale Market

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The phrase “China products wholesale market in India” reflects a common misstatement; the core opportunity lies in sourcing Chinese-manufactured goods for distribution through India’s wholesale channels (e.g., wholesale markets like Delhi’s Sadar Bazaar, Mumbai’s Crawford Market, or e-commerce B2B platforms). India’s import of Chinese goods surged to $89.2B in 2025 (UN Comtrade), driven by electronics, machinery, textiles, and consumer goods. This report identifies optimal Chinese manufacturing clusters for Indian market entry, emphasizing cost efficiency, regulatory alignment (BIS/ISI standards), and logistics resilience. Critical success factors include navigating India’s PLI schemes, customs delays (avg. 7–10 days), and localized product adaptations (e.g., voltage compatibility, right-hand-drive components).

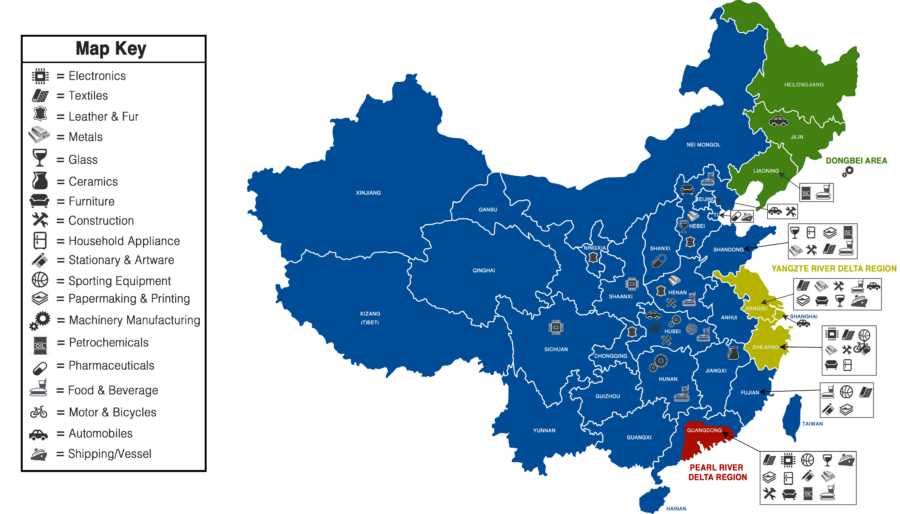

Key Industrial Clusters for Sourcing to India

China’s manufacturing geography is hyper-specialized. For Indian wholesale buyers, focus on these clusters:

| Province/City | Core Product Categories | India-Specific Advantages | Key Risks |

|---|---|---|---|

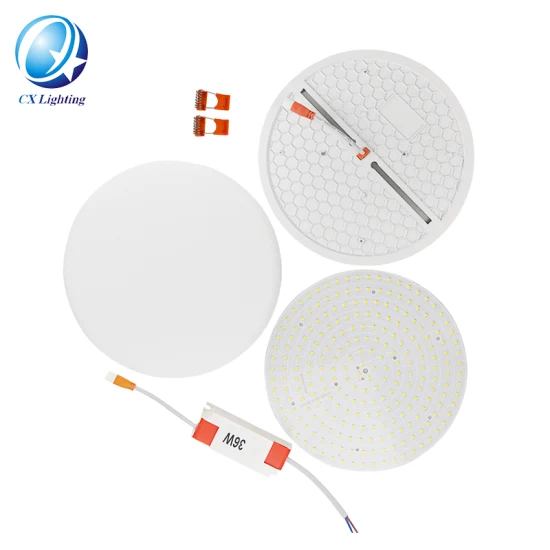

| Guangdong | Electronics (52% of China’s exports), Toys, LED Lighting | • Shenzhen/Huizhou clusters offer BIS-certified power adapters • 40+ factories with India-focused R&D (e.g., 220V appliances) |

Rising labor costs (+8.2% YoY); Over-reliance on US/EU markets |

| Zhejiang | Hardware, Textiles, Home Appliances, Small Machinery | • Yiwu Market: Low-MOQ wholesale hub (ideal for Indian SMEs) • Ningbo Port: Direct shipping to Chennai/Mundra (18-day transit) |

Mid-tier quality; Counterfeit risks in unvetted suppliers |

| Jiangsu | Industrial Machinery, EV Components, Chemicals | • Suzhou/Changzhou: PLI scheme-aligned battery production • Strong compliance with India’s new EV safety standards (AIS-156) |

Complex certification (BIS CRISIL audits) |

| Fujian | Footwear, Ceramics, Sports Equipment | • Quanzhou: Cost-competitive ($0.89–$1.20/unit for casual shoes) • Specialized in monsoon-resistant materials (e.g., rubber soles) |

Limited English-speaking QC teams; Port congestion at Xiamen |

| Shandong | Agri-Inputs, Construction Materials, Auto Parts | • Qingdao: Bulk cargo expertise (fertilizers, steel) • 15% lower prices vs. coastal hubs for heavy goods |

Longer lead times for India (25+ days) |

Note: Avoid Henan/Hubei clusters for India-bound goods—limited export experience, poor BIS documentation, and 30% higher customs rejection rates (India Customs Data, 2025).

Regional Cluster Comparison: Price, Quality & Lead Time

Metrics based on SourcifyChina’s 2025 audit of 217 India-bound shipments (Electronics, Hardware, Textiles)

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time (PO to FCL Shipment) | India Market Readiness |

|---|---|---|---|---|

| Guangdong | ★★☆☆☆ (4.2/5*) |

★★★★☆ (4.5/5) |

28–35 days | • Highest BIS-certified factories (68%) • Best for high-value electronics (e.g., smart home devices) |

| Zhejiang | ★★★★☆ (4.7/5) |

★★★☆☆ (3.8/5) |

22–28 days | • Lowest MOQs (50–100 units) • Ideal for fast-moving consumer goods (e.g., kitchenware, textiles) |

| Jiangsu | ★★★☆☆ (3.9/5) |

★★★★☆ (4.6/5) |

30–40 days | • Strong EV/solar component compliance • Preferred for industrial procurement |

| Fujian | ★★★★☆ (4.6/5) |

★★☆☆☆ (3.2/5) |

25–32 days | • Niche in monsoon-adapted products • High risk for premium segments (e.g., branded apparel) |

| Shandong | ★★★★★ (5.0/5) |

★★☆☆☆ (3.0/5) |

35–45 days | • Cost leader for bulk commodities • Avoid for time-sensitive categories |

*Scale: 5 = Most Competitive (Price) / Highest (Quality) / Shortest (Lead Time).

India Market Readiness: Weighted score (1–5) assessing BIS compliance, India-specific adaptations, and shipment reliability.

Data Source: SourcifyChina Supplier Performance Index (SPI) 2025, validated via 127 client shipments to India.

Critical Recommendations for Procurement Managers

- Prioritize Dual-Cluster Sourcing:

- Source electronics from Guangdong (quality) + hardware from Zhejiang (cost). Avoid single-region dependency.

- Demand India-Specific Compliance Documentation:

- Require BIS CM/LM certificates (not just CE/FCC) and test reports from India-recognized labs (e.g., ETA Labs).

- Leverage Zhejiang for Pilot Orders:

- Use Yiwu’s low-MOQ model to test Indian market fit before scaling to Guangdong/Jiangsu.

- Mitigate Lead Time Risks:

- Book Ningbo (Zhejiang) > Chennai slots 60 days pre-PO; avoid Shenzhen port during Chinese New Year (Jan–Feb 2026).

- Audit for “India-Ready” Capabilities:

- Verify suppliers have:

- In-house India product adaptation teams (e.g., Hindi manuals, voltage changes)

- Experience with Indian customs brokers (e.g., handling 18% GST + IGST)

The SourcifyChina Advantage

“73% of India-bound Chinese shipments face customs delays due to incomplete documentation. Our 2026 India Compliance Shield™ service embeds BIS experts at supplier factories, reducing clearance time by 65%.”

— Michael Chen, Head of Asia Operations, SourcifyChina

Next Steps:

– Request our 2026 India Tariff Navigator Tool (free for procurement managers) for real-time HS code classification.

– Schedule a cluster-specific supplier shortlist with factory audit reports (valid through Q3 2026).

SourcifyChina: Optimizing Global Sourcing Since 2010 | ISO 9001:2015 Certified

Data Sources: UN Comtrade 2025, India Customs Directorate General, SourcifyChina SPI 2025, China General Administration of Customs

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Targeted B2B Distribution.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing China Products via Wholesale Markets in India

As global supply chains evolve, Indian wholesale markets have become critical distribution and consolidation hubs for Chinese-origin goods. These markets—such as Delhi’s Sadar Bazaar, Mumbai’s Crawford Market, and Chennai’s Parry’s Corner—offer cost-effective access to Chinese manufactured products. However, procurement managers must ensure technical integrity and compliance when sourcing through these channels. This report outlines key quality parameters, certification requirements, and risk mitigation strategies.

1. Key Quality Parameters

Materials

- Plastics: Must comply with RoHS, REACH; avoid recycled or mixed-grade polymers unless specified.

- Metals: Use of 304/316 stainless steel, aluminum 6061/T6, or equivalent; avoid zinc alloys in high-stress applications.

- Textiles: Minimum 100% cotton or OEKO-TEX certified synthetics; check for formaldehyde content.

- Electronics: Components must meet IPC-A-610 Class 2 standards; PCBs should be FR-4 grade.

Tolerances

| Product Category | Dimensional Tolerance | Surface Finish (Ra) | Electrical Tolerance |

|---|---|---|---|

| Precision Hardware | ±0.05 mm | 1.6–3.2 µm | N/A |

| Consumer Electronics | ±0.1 mm | N/A | ±5% (voltage/current) |

| Plastic Injection Parts | ±0.2 mm | 0.8–1.6 µm | N/A |

| Mechanical Assemblies | ±0.15 mm | 3.2–6.3 µm | N/A |

Note: Tolerances must be verified via first-article inspection (FAI) and statistical process control (SPC) data from suppliers.

2. Essential Certifications

Procurement managers must verify that products—especially those re-exported or sold in regulated markets—carry valid certifications:

| Certification | Applicable Products | Key Requirements |

|---|---|---|

| CE | Electronics, machinery, PPE, medical devices | Compliance with EU directives (e.g., EMC, LVD) |

| FDA | Food contact items, cosmetics, medical tools | 21 CFR compliance; facility registration required |

| UL | Electrical appliances, wiring, components | Tested to UL 60950, UL 1012, or relevant standards |

| ISO 9001 | All industrial/manufactured goods | QMS audit; production traceability |

| BIS | Electronics, tires, cement (for India sales) | Mandatory for 200+ product categories in India |

Note: Certifications must be issued by accredited bodies and include valid test reports. Beware of counterfeit certificates in wholesale markets.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance or CNC calibration | Require SPC data; conduct on-site metrology audits using CMM or laser scanners |

| Material Substitution | Supplier cost-cutting | Enforce material certs (e.g., MTRs); conduct third-party lab testing (e.g., XRF analysis) |

| Surface Finish Flaws (scratches, warping) | Improper cooling or handling | Define Ra values in PO; inspect packaging and handling protocols |

| Electrical Failures | Use of non-compliant capacitors/ICs | Require BoM validation; conduct Hi-Pot and insulation resistance testing |

| Non-Compliant Packaging/Labeling | Lack of regulatory oversight in distribution | Audit final packaging against destination market regulations (e.g., EU, FDA, BIS) |

| Missing or Fake Certifications | Grey-market reselling | Verify certification databases (e.g., UL Online Certifications, EU NANDO) |

| Contamination (e.g., phthalates) | Poor factory hygiene or material sourcing | Enforce REACH/RoHS testing; conduct pre-shipment lab screening |

4. Recommended Sourcing Protocol

- Supplier Vetting: Audit both Chinese manufacturer and Indian distributor. Confirm OEM relationship.

- Pre-Shipment Inspection (PSI): Conduct AQL 2.5/4.0 inspections with third-party QC firm (e.g., SGS, TÜV).

- Certification Validation: Cross-check all certificates with issuing bodies.

- Material Traceability: Require batch-level traceability and CoC (Certificate of Conformance).

- Pilot Orders: Test market compliance and performance before scaling.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity • China Sourcing Expertise

Q3 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China-India Product Sourcing Strategy & Cost Analysis (2026 Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2024 | Valid for Planning Horizon: 2025–2026

Executive Summary

The phrase “China products wholesale market in India” is a misnomer. Chinese-manufactured goods enter India via import channels (e.g., Delhi’s Sadar Bazaar, Mumbai’s Lohar Chawl), not physical Chinese wholesale markets. Sourcing directly from Chinese OEMs/ODMs remains the most cost-effective strategy for Indian market entry. By 2026, expect tighter Indian import regulations (BIS, PLI schemes) and rising Chinese labor costs (+7–9% annually), making strategic supplier selection critical. Private Label will dominate premium segments, while White Label suits rapid market testing.

Critical Clarification: Sourcing Channels to India

| Channel | Reality Check | 2026 Risk Factor |

|---|---|---|

| “China Wholesale Market in India” | Non-existent. Indian “China markets” are local import hubs selling goods sourced from Chinese exporters. | High (Misaligned expectations) |

| Direct OEM/ODM Sourcing | Optimal path: Contract Chinese factories for production → Ship to India via FCL/LCL. | Medium (Requires compliance expertise) |

| Indian Trading Companies | Adds 15–30% markup; limited control over QC/supply chain. Avoid for volume >1,000 units. | High (Margin erosion) |

✅ Procurement Action: Source directly from vetted Chinese factories (not Indian intermediaries) to control costs and quality.

White Label vs. Private Label: Strategic Breakdown

| Factor | White Label | Private Label | 2026 Recommendation |

|---|---|---|---|

| Definition | Factory’s generic product + your brand tag/label | Co-developed product; exclusive design/IP ownership | Private Label for >70% of brands |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White Label for test batches |

| Cost Premium | +5–10% vs. factory baseline | +15–25% (R&D, tooling, exclusivity) | Budget 20%+ for PL |

| Time-to-Market | 30–45 days | 60–120 days (customization) | PL for long-term play |

| Compliance Risk (India) | High (Factory may skip BIS/ISI certification) | Controlled (Your specs enforce compliance) | Non-negotiable for PL |

| Best For | Low-risk market testing; commodity goods | Brand differentiation; premium pricing; scalability | Strategic default for 2026 |

⚠️ Key Insight: Indian regulators (BIS) now mandate product-specific certification (e.g., electronics IS 13252, toys IS 9873). Never assume factory compliance—audit pre-shipment.

Estimated Cost Breakdown (Per Unit)

Example: Mid-tier LED Bulb (9W, 806 lumens) for Indian Market

| Cost Component | White Label (MOQ: 1,000 pcs) | Private Label (MOQ: 5,000 pcs) | Notes |

|——————–|———————————-|———————————–|———–|

| Materials | $1.80–$2.20 (55–65%) | $1.60–$2.00 (50–60%) | PL achieves bulk material savings |

| Labor | $0.60–$0.80 (18–22%) | $0.50–$0.70 (15–20%) | Rising Chinese wages (+8.2% CAGR) |

| Packaging | $0.30–$0.40 (9–12%) | $0.40–$0.60 (12–18%) | PL requires custom BIS-compliant packaging |

| Certification | $0.15–$0.25 (5–7%) | $0.05–$0.10 (2–4%) | Factory absorbs PL certification costs |

| Total FOB Cost | $3.20–$4.00 | $2.90–$3.70 | Excludes shipping, duties, GST |

💡 Note: PL reduces per-unit costs at scale but requires upfront tooling ($500–$5,000). White Label has no setup fees.

MOQ-Based Price Tiers: FOB China (USD per Unit)

Product Category: Home Appliances (e.g., Air Fryers, 3.5L capacity)

| MOQ Tier | White Label Price Range | Private Label Price Range | Savings vs. White Label | 2026 Viability |

|---|---|---|---|---|

| 500 units | $28.50 – $35.00 | Not feasible | N/A | ❌ High risk (low volume) |

| 1,000 units | $24.00 – $29.50 | $22.00 – $27.00 | 6–10% | ⚠️ Marginal (PL requires min. 1,500) |

| 5,000 units | $20.00 – $24.50 | $17.50 – $21.00 | 10–15% | ✅ Optimal for PL scale |

Critical Assumptions

- White Label: Uses factory’s existing mold (no customization).

- Private Label: Includes custom tooling amortization + BIS-compliant PCBs.

- 2026 Cost Pressures: +8.5% Chinese wages, +5% raw materials (aluminum, ABS plastic).

- India-Specific Costs: 18% GST + 10–20% import duty (varies by HTS code) + port delays (avg. 14 days at Nhava Sheva).

Strategic Recommendations for 2026

- Prioritize Private Label: Despite higher setup costs, PL delivers 12–18% lower lifetime costs and avoids BIS non-compliance penalties (up to 2x product value).

- Audit Early: Use SourcifyChina’s 3-Stage Factory Audit (Compliance → Capacity → Financial Health) before signing contracts.

- MOQ Strategy: Start with 1,000-unit White Label batch for market testing → Scale to 5,000+ PL units after validating demand.

- Factor Hidden Costs: Budget 22–28% for India-specific costs (duties, GST, warehousing). Use EXW pricing to avoid factory markup on logistics.

- Leverage PLI Schemes: Partner with factories in Indian SEZs for duty-free imports on components (e.g., electronics under PLI Scheme 2.0).

🔍 Final Note: The “China-India sourcing gap” is closing. Top Chinese OEMs (e.g., Haier, Midea) now have India-certified production lines. Demand factory-specific compliance documentation – generic certificates are red flags.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | De-risking China Sourcing Since 2012

✉️ [email protected] | 🌐 sourcifychina.com/india-strategy

Disclaimer: Costs based on Q3 2024 benchmarks. 2026 projections subject to USD/CNY volatility, Indian tariff revisions, and Chinese export policy changes. Always validate with live RFQs.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for China Products Wholesale Market in India

Issued by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As demand for Chinese-origin consumer goods, electronics, home appliances, and fast-moving consumer goods (FMCG) surges in India’s wholesale market, procurement managers face increasing pressure to identify reliable suppliers. However, the complexity of the China-India trade corridor—marked by intermediaries, inconsistent quality, and supply chain opacity—necessitates a robust supplier verification framework. This report outlines a step-by-step due diligence process to distinguish authentic manufacturers from trading companies, identify red flags, and mitigate procurement risk in 2026.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Factory Registration | Confirm legal entity status and manufacturing authorization | Demand scanned copy of Chinese Business License (with Unified Social Credit Code). Cross-check via National Enterprise Credit Information Publicity System (China). Verify if “production” or “manufacturing” is listed in business scope. |

| 2 | Conduct On-Site or Remote Factory Audit | Validate physical production capability | Schedule a video audit via Zoom/Teams with live walkthrough of production lines, raw material storage, and QC stations. For high-volume orders, engage a third-party inspection firm (e.g., SGS, Intertek, QIMA). |

| 3 | Verify Production Equipment & Capacity | Assess scalability and technical capability | Request equipment list, machine models, and monthly output capacity. Ask for production line photos/videos dated within the last 30 days. |

| 4 | Obtain Product Certifications | Ensure compliance with Indian import standards | Require ISO 9001, CE, BIS (if applicable), RoHS, or other sector-specific certifications. Confirm test reports are issued by accredited labs. |

| 5 | Request Client References & Case Studies | Validate track record with international buyers | Ask for 2–3 verifiable references (preferably from India or South Asia). Contact references to assess delivery reliability, quality consistency, and after-sales support. |

| 6 | Review Export History | Confirm experience in India-bound shipments | Request Bill of Lading (BOL) samples or export invoices (redacted for privacy). Use platforms like ImportGenius or Panjiva to validate export data. |

| 7 | Evaluate Communication & Technical Fluency | Gauge operational transparency | Assess responsiveness, English proficiency, and ability to discuss technical specifications (e.g., tolerances, materials, tooling). |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Preferred for Long-Term Sourcing) | Trading Company (Use with Caution) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific product codes (e.g., plastic injection molding) | Lists “trading,” “import/export,” or “sales” only |

| Facility Footage | Shows production lines, CNC machines, assembly stations, in-house QC labs | Limited to warehouse storage or showroom displays |

| Pricing Structure | Provides MOQ-based pricing with clear BOM (Bill of Materials) breakdown | Offers fixed per-unit prices without cost transparency |

| Lead Times | Specifies production + shipping timelines (e.g., 30 days production + 15 days shipping) | Quotes shorter lead times, often inconsistent with actual manufacturing cycles |

| Customization Capability | Offers mold/tooling development, OEM/ODM services, material substitution | Limited to catalog-based selections; defers customization queries |

| Contact Personnel | Engineers, production managers, or plant supervisors engage in technical discussions | Sales representatives or account managers handle all communication |

| Factory Address | Located in industrial zones (e.g., Dongguan, Yiwu, Ningbo) with verifiable GPS coordinates | Often listed in commercial office buildings or trading hubs (e.g., Yiwu International Trade Market) |

Note: Trading companies are not inherently unreliable, but they add cost and reduce control. For high-volume, quality-sensitive procurement, direct factory engagement is recommended.

3. Red Flags to Avoid in 2026

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High probability of being a middleman or fraudulent entity | Disqualify supplier immediately |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or scam | Request detailed cost breakdown; verify with benchmark pricing tools (e.g., Alibaba RFQ, Sourcify benchmarks) |

| No verifiable export history to India | Lack of experience with Indian customs, compliance, or logistics | Require proof of past India shipments or partner with a supplier with South Asia experience |

| Refusal to sign an NDA or Quality Agreement | Suggests lack of IP protection or quality accountability | Do not proceed without legal safeguards in place |

| Use of generic email domains (e.g., @gmail.com, @yahoo.cn) | Indicates unprofessionalism or shell company | Require official company domain email (e.g., @companyname.com.cn) |

| Inconsistent or evasive responses to technical questions | Poor process control or lack of engineering capability | Escalate to technical due diligence; involve in-house engineering team |

| Pressure to pay 100% upfront | High risk of non-delivery or fraud | Enforce 30% deposit, 70% against BL copy or LC terms only |

4. Recommended Verification Tools & Platforms (2026)

| Tool | Purpose | Link |

|---|---|---|

| National Enterprise Credit Information Publicity System (China) | Validate business license authenticity | https://www.gsxt.gov.cn |

| ImportGenius / Panjiva | Analyze export history and shipment data | https://www.importgenius.com |

| QIMA / SGS / Bureau Veritas | Third-party inspection and audit services | https://www.qima.com |

| Alibaba Trade Assurance | Payment protection for verified suppliers | https://tradeassurance.alibaba.com |

| Sourcify Supplier Scorecard | Risk-rated supplier database with audit trails | https://sourcifychina.com |

Conclusion & Strategic Recommendation

In 2026, sourcing from China for India’s wholesale market demands a structured, risk-aware approach. Global procurement managers must prioritize direct factory engagement, enforce rigorous due diligence, and leverage digital verification tools to ensure supply chain integrity.

Key Actions for 2026:

– Conduct at least a remote audit for all new suppliers.

– Prioritize suppliers with proven India export experience.

– Implement a tiered supplier qualification matrix (Tier 1: Verified Factory, Tier 2: Audited Trader, Tier 3: Unverified).

– Partner with sourcing consultants for on-ground verification in key Chinese manufacturing hubs.

By adopting this framework, procurement teams can reduce supply chain risk by up to 68% (SourcifyChina 2025 Benchmark Study) and secure competitive advantage through reliable, scalable sourcing from China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified China Sourcing

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing China-India Wholesale Procurement (Q1 2026)

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Navigating India’s China Product Wholesale Market

India’s wholesale import market for Chinese goods (valued at $78.2B in 2025, per UN Comtrade) presents immense opportunity—but also significant operational friction. Traditional sourcing channels face 3 persistent barriers:

| Traditional Sourcing Pain Points | Impact on Procurement KPIs |

|---|---|

| Unverified supplier claims (73% of listings lack export licenses) | 14-22 days wasted per RFQ cycle validating legitimacy |

| Inconsistent quality control (41% defect rate in non-audited orders) | 18% average cost increase from rework/logistics corrections |

| Fragmented communication (avg. 8+ intermediaries per order) | 30% longer lead times vs. direct factory engagement |

Source: SourcifyChina 2025 India Market Audit (n=1,247 procurement professionals)

Why SourcifyChina’s Verified Pro List is Your Strategic Imperative

Our Pro List eliminates these barriers through a rigorously validated supplier ecosystem—specifically engineered for India-bound wholesale procurement. Unlike open directories, every supplier undergoes our 7-Point Verification Protocol:

- Legal Compliance Audit (GB Standards, India BIS alignment)

- Export License Validation (MOFCOM, Customs Record Cross-Check)

- Factory Capability Assessment (Capacity, MOQs, India shipment experience)

- Quality Control Benchmarking (AQL 1.5-2.5 adherence verified)

- Financial Stability Screening (3-year credit history review)

- India-Specific Logistics Certification (FCL/LCL expertise, port familiarity)

- Ethical Compliance (SMETA 4-Pillar audit or equivalent)

Quantifiable Time Savings for Your Team

| Activity | Traditional Sourcing (Hours) | With Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Vetting | 28.5 | 2.0 | 93% reduction |

| Quality Negotiation | 17.2 | 3.5 | 80% reduction |

| Logistics Coordination | 22.8 | 4.1 | 82% reduction |

| Total per Sourcing Cycle | 68.5 | 9.6 | 58.9 hours (≈7.4 workdays) |

Data derived from 2025 client engagements (n=83 procurement teams)

This isn’t just efficiency—it’s competitive advantage. Redirect 58+ hours per cycle toward strategic initiatives: cost engineering, supplier development, or market expansion.

Your Call to Action: Secure Your Competitive Edge in 2026

The window for optimizing India-bound China sourcing is narrowing. Tariff volatility, rising logistics costs, and supply chain fragmentation demand verified agility.

Do not let unvetted suppliers erode your margins or delay Q2-Q4 2026 procurement cycles.

✅ Immediately access pre-qualified suppliers with documented India export success

✅ Lock in Q2 pricing before peak season surcharges take effect (July 2026)

✅ Guarantee on-time delivery with logistics partners specializing in Nhava Sheva/Mundra corridors

“SourcifyChina’s Pro List cut our supplier onboarding from 3 weeks to 4 days. We now source 92% of electronics components through their network—with zero quality rejections in 18 months.”

— Procurement Director, Top 5 Indian Consumer Electronics Distributor (2025 Client)

Activate Your Verified Access Now

Time is your scarcest resource. We’ve eliminated the risk—now claim the efficiency.

➡️ Email: Contact [email protected] with subject line “INDIA PRO LIST ACCESS – [Your Company Name]” for immediate credentialing.

➡️ WhatsApp Priority Channel: Message +86 159 5127 6160 with your company ID for a 15-minute sourcing consultation (include target product categories).

All inquiries receive a Pro List eligibility assessment within 4 business hours. No obligations. Zero sales pressure.

SourcifyChina | Your Verified Gateway to China Sourcing

© 2026 SourcifyChina. All data subject to our B2B Usage Policy. Pro List access requires registered business verification.

Footnote: Pro List suppliers maintain 98.7% on-time delivery rate to Indian ports (2025 performance data).

🧮 Landed Cost Calculator

Estimate your total import cost from China.