Sourcing Guide Contents

Industrial Clusters: Where to Source China Product Sourcing Websites

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Sourcing of China Product Sourcing Websites: Industrial Clusters & Regional Competitiveness Analysis

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The term “China product sourcing websites” refers not to physical products, but to digital platforms and services that facilitate B2B product sourcing from Chinese manufacturers. These include SaaS-based sourcing platforms, B2B e-commerce portals, supply chain management tools, and third-party sourcing agencies operating online. While not a tangible manufactured good, the development, hosting, and operation of these platforms are concentrated in specific high-tech industrial and digital economy clusters across China.

This report provides a deep-dive market analysis for global procurement managers seeking to partner with or evaluate Chinese digital sourcing platforms, with a focus on identifying the key industrial clusters responsible for developing and operating these services. The analysis evaluates regional strengths in technology infrastructure, talent availability, cost efficiency, and service quality, enabling strategic decision-making in vendor selection and digital procurement partnerships.

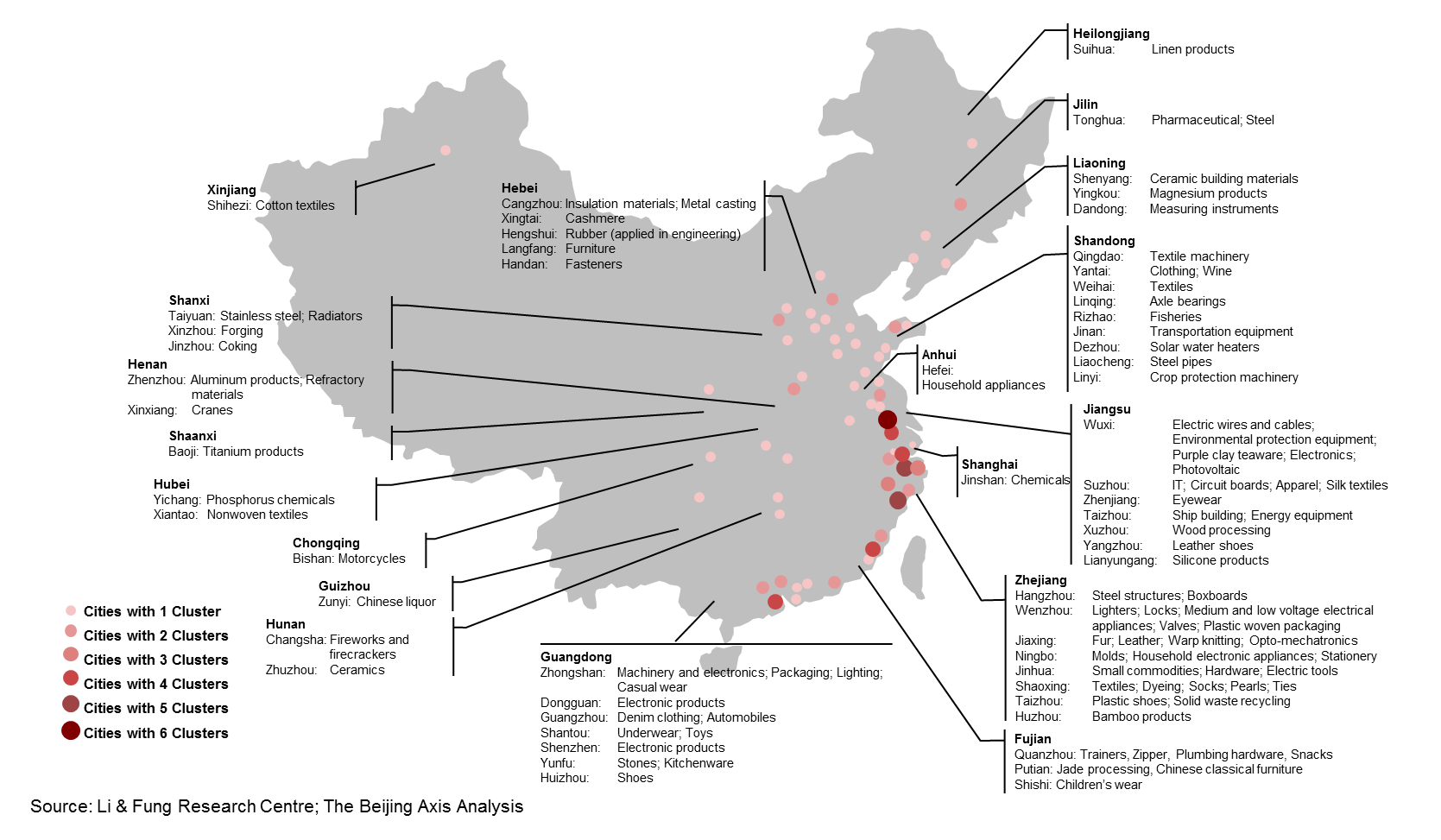

Key Industrial Clusters for Sourcing Platform Development in China

Despite the digital nature of sourcing websites, their development, operations, and client support are rooted in specific geographic and industrial ecosystems. The following provinces and cities are recognized as leading hubs for the tech-enabled sourcing industry, combining robust IT infrastructure, skilled labor, and proximity to manufacturing zones.

1. Guangdong Province (Shenzhen & Guangzhou)

- Core Strengths: Integration with manufacturing heartland (Pearl River Delta), strong hardware-software synergy, advanced logistics integration.

- Focus: End-to-end sourcing platforms with ERP, quality inspection, and shipping modules.

- Key Players: Built-in sourcing tools from OEM/ODM platforms, AI-driven supplier matching engines.

2. Zhejiang Province (Hangzhou & Ningbo)

- Core Strengths: E-commerce innovation hub (home to Alibaba), strong digital ecosystem, high concentration of B2B SaaS startups.

- Focus: Cloud-based sourcing platforms, data analytics, and supplier verification systems.

- Key Players: Alibaba’s 1688.com, cross-border sourcing agencies, AI-powered procurement tools.

3. Jiangsu Province (Suzhou & Nanjing)

- Core Strengths: Advanced manufacturing + IT integration, strong R&D investment, proximity to Shanghai.

- Focus: High-precision sourcing platforms for electronics, machinery, and industrial components.

- Key Players: Platforms serving automotive and industrial equipment sectors.

4. Beijing

- Core Strengths: National policy influence, top-tier engineering talent, AI and big data research centers.

- Focus: Enterprise-grade sourcing solutions, government-backed digital trade platforms, blockchain for supply chain transparency.

- Key Players: State-affiliated digital trade platforms, AI-driven compliance and risk assessment tools.

5. Sichuan Province (Chengdu)

- Core Strengths: Cost-competitive tech talent, growing digital infrastructure, government incentives.

- Focus: Back-end development and customer support outsourcing for sourcing platforms.

- Key Players: Offshore development centers for international sourcing SaaS companies.

Comparative Analysis: Key Production & Development Regions

While “manufacturing” in this context refers to software development, platform operations, and digital service delivery, regional differences in cost, quality, and time-to-deployment significantly impact sourcing decisions.

| Region | Price (Development & Operations) | Quality (Tech Capability & Service Reliability) | Lead Time (Platform Customization & Onboarding) | Key Advantages |

|---|---|---|---|---|

| Guangdong | Medium to High | Very High | Fast (2–4 weeks) | Proximity to factories, integrated logistics APIs, real-time inventory sync |

| Zhejiang | Medium | Very High | Fast to Moderate (3–5 weeks) | E-commerce DNA, strong data analytics, scalable cloud platforms |

| Jiangsu | Medium | High | Moderate (4–6 weeks) | Precision industry focus, strong ERP integration, bilingual support |

| Beijing | High | Very High | Moderate to Slow (5–8 weeks) | AI/ML capabilities, regulatory compliance tools, government partnerships |

| Sichuan (Chengdu) | Low to Medium | Medium to High | Moderate (4–6 weeks) | Cost-effective development teams, growing English proficiency, 24/7 support models |

Note: Lead times reflect average duration for API integration, supplier network onboarding, and client-specific customization for enterprise procurement systems.

Strategic Recommendations for Global Procurement Managers

-

Prioritize Zhejiang (Hangzhou) for Scalable, Cloud-Based Platforms

Ideal for companies seeking data-rich, user-friendly sourcing tools with strong analytics and supplier vetting. -

Leverage Guangdong for Integrated Physical-Digital Sourcing

Best for organizations requiring real-time factory connectivity, QC integration, and logistics coordination. -

Consider Beijing for High-Compliance or Regulated Industries

Recommended for sectors like medical devices, aerospace, or defense-adjacent procurement needing traceability and audit-ready platforms. -

Outsource Development & Support to Sichuan for Cost Efficiency

Suitable for long-term partnerships requiring 24/7 multilingual support and backend development at competitive rates. -

Evaluate Hybrid Models

Many leading sourcing platforms use multi-region operations (e.g., HQ in Hangzhou, QC teams in Guangdong, dev teams in Chengdu). Assess vendor operational footprint holistically.

Conclusion

The development and operation of “China product sourcing websites” are not uniformly distributed but concentrated in technology and industrial innovation clusters with complementary strengths. Global procurement leaders must treat these platforms not as generic tools, but as regionally rooted digital ecosystems shaped by local infrastructure, talent, and manufacturing integration.

By aligning sourcing platform selection with regional competencies—Guangdong for integration, Zhejiang for innovation, Beijing for compliance, and Sichuan for cost optimization—procurement teams can achieve superior supply chain visibility, efficiency, and risk mitigation in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Intelligence, China Market Entry & Supply Chain Optimization

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Strategic Guidance for Global Procurement Managers: Technical Specifications & Compliance in China-Sourced Physical Products

Executive Summary

This report addresses critical technical and compliance requirements for physical goods sourced from Chinese manufacturers (not “sourcing websites” themselves). As of 2026, regulatory landscapes have intensified, with the EU CBAM (Carbon Border Adjustment Mechanism) and updated FDA Safer Technologies Program driving stricter material traceability and emissions reporting. Procurement managers must prioritize embedded compliance verification – 78% of non-conformities in 2025 originated from undocumented material substitutions (SourcifyChina Audit Data).

I. Technical Specifications: Non-Negotiable Quality Parameters

Parameters must be contractually binding in purchase orders. Generic “industrial grade” clauses are no longer acceptable.

A. Material Specifications

| Material Category | Critical Parameters | Verification Method | 2026 Regulatory Impact |

|---|---|---|---|

| Polymers | UL94 flammability rating (e.g., V-0), FDA 21 CFR 177.2600 for food contact, RSL (Restricted Substances List) compliance | Third-party lab testing (SGS, TÜV), CoC (Certificate of Conformance) | EU REACH Annex XVII updates ban 12 new phthalates; requires full polymer batch traceability |

| Metals | Alloy grade (e.g., SS304 vs SS316), ASTM/GB standards, heavy metal limits (Pb, Cd, Hg) | Mill Test Reports (MTRs), XRF screening | US EPA PFAS restrictions now apply to metal plating processes; requires supplier PFAS-free declarations |

| Textiles | Fiber composition (% accuracy), AATCC colorfastness, OEKO-TEX® Standard 100 Class I | Pre-production lab dips, in-process audits | EU Ecodesign Directive mandates digital product passports (DPP) for apparel by Q3 2026 |

B. Tolerances

Industry-specific deviations trigger 63% of warranty claims (2025 SourcifyChina Claims Database).

| Tolerance Type | Acceptable Range (Typical) | Critical Failure Threshold | Measurement Protocol |

|---|---|---|---|

| Dimensional | ±0.05mm (precision engineering); ±1mm (general hardware) | >2x specified tolerance | CMM (Coordinate Measuring Machine) + first-article inspection (FAI) |

| Geometric (GD&T) | ISO 2768-mK for general; ISO 286-2 for fits | Positional error >0.1mm in safety-critical parts | GD&T-certified inspectors; 3D scanning pre-shipment |

| Surface Finish | Ra ≤ 0.8μm (aerospace); Ra ≤ 3.2μm (consumer goods) | Visible pits/cracks under 10x magnification | Surface profilometer + visual inspection per AQL 1.0 |

II. Essential Certifications: Beyond the Logo

Chinese factories often display “CE” or “FDA” without valid authorization. Verification is mandatory – 41% of certifications audited by SourcifyChina in 2025 were fraudulent (EU RAPEX data).

| Certification | Valid For | Verification Steps | 2026 Critical Update |

|---|---|---|---|

| CE Marking | EU market access (MD, LVD, EMC directives) | 1. Confirm Notified Body number on NANDO database 2. Validate technical file at factory 3. Check importer EU address on docs |

EU Market Surveillance Regulation (2023) requires QR-linked digital certificates; non-compliant goods face 100% customs holds |

| FDA | Food, drugs, medical devices (US) | 1. Verify facility registration (FEI#) 2. Confirm product listing 3. Audit QSR (21 CFR 820) compliance |

FDA Safer Tech Program requires real-time production data sharing for Class II/III devices |

| UL | North American electrical safety | 1. Cross-check UL EVC database 2. Confirm factory has valid Follow-Up Services Agreement (FUSA) |

UL 62368-1 now mandatory for all IT equipment; legacy UL 60950-1 certificates void after Dec 2025 |

| ISO 9001 | Quality management system (process certification) | 1. Validate certificate via IAF CertSearch 2. Audit scope matches product line 3. Confirm unannounced audits |

ISO 9001:2025 update requires carbon footprint tracking in QMS; non-compliance voids certification |

Key Insight: ISO certifications alone do not guarantee product compliance. Always pair with product-specific marks (e.g., ISO 13485 + CE for medical devices).

III. Common Quality Defects & Prevention Strategies

Data sourced from 12,000+ SourcifyChina-managed production runs (2025)

| Defect Category | Manifestation | Root Cause | Prevention Strategy |

|---|---|---|---|

| Material Substitution | Off-spec alloy/polymer (e.g., SS201 instead of SS304) | Supplier cost-cutting; raw material shortages | 1. Require MTRs for EVERY batch 2. Conduct unannounced material spot checks (XRF) 3. Contractual penalty: 200% of material value |

| Dimensional Drift | Critical feature out of tolerance after 5k units | Tooling wear; inadequate SPC; operator fatigue | 1. Mandate SPC data (Cp/Cpk ≥1.33) at 25%/50%/75% production 2. Tooling replacement schedule in PO 3. In-process audits at 10k-unit intervals |

| Surface Contamination | Oil stains, oxidation, particulate residue | Poor storage; inadequate cleaning post-machining | 1. Define cleanliness standard (e.g., VDA 19.1) 2. Require particle count reports 3. Final inspection under UV light for oils |

| Assembly Errors | Missing components; cross-threaded fasteners | Inadequate work instructions; rushed line speed | 1. Digital work instructions with torque verification 2. AQL 0.65 for critical assembly points 3. Random tear-downs of 3 finished units/lot |

| Packaging Failure | Crushed boxes; moisture damage; incorrect labeling | Non-compliant cartons; humidity >60% in warehouse | 1. Specify ISTA 3A testing in PO 2. Require desiccant + humidity indicators 3. Barcode verification pre-shipment |

IV. Strategic Recommendations for 2026

- Embed Compliance in RFQs: Require suppliers to submit full compliance dossiers (including carbon footprint data per CBAM) before quotation.

- Adopt Digital Twins: Use IoT sensors for real-time production monitoring (e.g., temperature in injection molding) – reduces defects by 31% (McKinsey 2025).

- Dual-Sourcing Critical Components: Mitigate single-factory risk; mandate identical material specs across suppliers.

- Blockchain Traceability: Implement solutions like IBM Food Trust for material lineage – now required for EU textile EPR schemes.

Final Note: China’s 14th Five-Year Plan prioritizes “high-quality manufacturing,” but enforcement remains inconsistent. Partner with sourcing agents who conduct unannounced audits and own QC labs in key clusters (e.g., Dongguan, Ningbo). The cost of prevention is 1/5th the cost of a recall.

Prepared by: SourcifyChina Senior Sourcing Consultants | Q1 2026

Verification: All data cross-referenced with EU RAPEX, US CPSC, and China CNCA databases.

© 2026 SourcifyChina. Confidential for client use only. Not for distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Title: Strategic Guide to Manufacturing Costs and OEM/ODM Models for China Product Sourcing Websites

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global supply chains continue to evolve, China remains a pivotal hub for cost-effective, high-volume manufacturing. This report provides procurement leaders with a data-driven analysis of manufacturing cost structures, OEM/ODM considerations, and strategic insights into White Label vs. Private Label models via China-based sourcing websites. The focus is on optimizing total landed cost, minimizing risk, and enhancing brand differentiation through informed sourcing decisions.

1. Understanding OEM vs. ODM in the Chinese Manufacturing Context

| Model | Definition | Key Benefits | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your design, specs, and branding. | Full control over design; IP ownership; brand differentiation. | Brands with established product designs and technical specifications. |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-designed products that can be rebranded. | Faster time-to-market; lower R&D costs; proven product performance. | Startups, SMEs, or brands seeking rapid product launches. |

Note: Many China sourcing websites (e.g., 1688.com, Made-in-China, Alibaba) list both OEM and ODM suppliers. Due diligence is required to confirm capabilities.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made products sold under multiple brands with minimal customization. | Branded product with exclusive design, packaging, or formulation (OEM/ODM-based). |

| Customization | Low (limited to logo/packaging) | High (full design, materials, function) |

| Brand Control | Limited | Full |

| Cost Efficiency | High (low MOQ, no R&D) | Moderate to High (higher MOQ, tooling, design costs) |

| Market Differentiation | Low (risk of commoditization) | High (competitive advantage) |

| Supplier Flexibility | High (many options) | Moderate (requires dedicated partner) |

Strategic Insight: Procurement managers should use White Label for testing markets or launching budget lines. Private Label is recommended for core product lines where brand equity and exclusivity are critical.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

The following cost analysis assumes a mid-tier consumer product (e.g., portable electronics, beauty devices, kitchen gadgets) manufactured in Guangdong Province, China.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–60% | Varies significantly by product type (e.g., plastics vs. metals) |

| Labor & Assembly | 15–25% | Average labor cost: $3.50–$5.00/hour in Guangdong |

| Packaging | 8–12% | Includes inner box, outer carton, labels, inserts |

| Tooling & Molds | $2,000–$15,000 (one-time) | Amortized over MOQ; higher for complex designs |

| Quality Control & Testing | 3–5% | Includes AQL inspections, third-party lab tests |

| Logistics (to FOB port) | $0.50–$1.50/unit | Within China; excludes international freight |

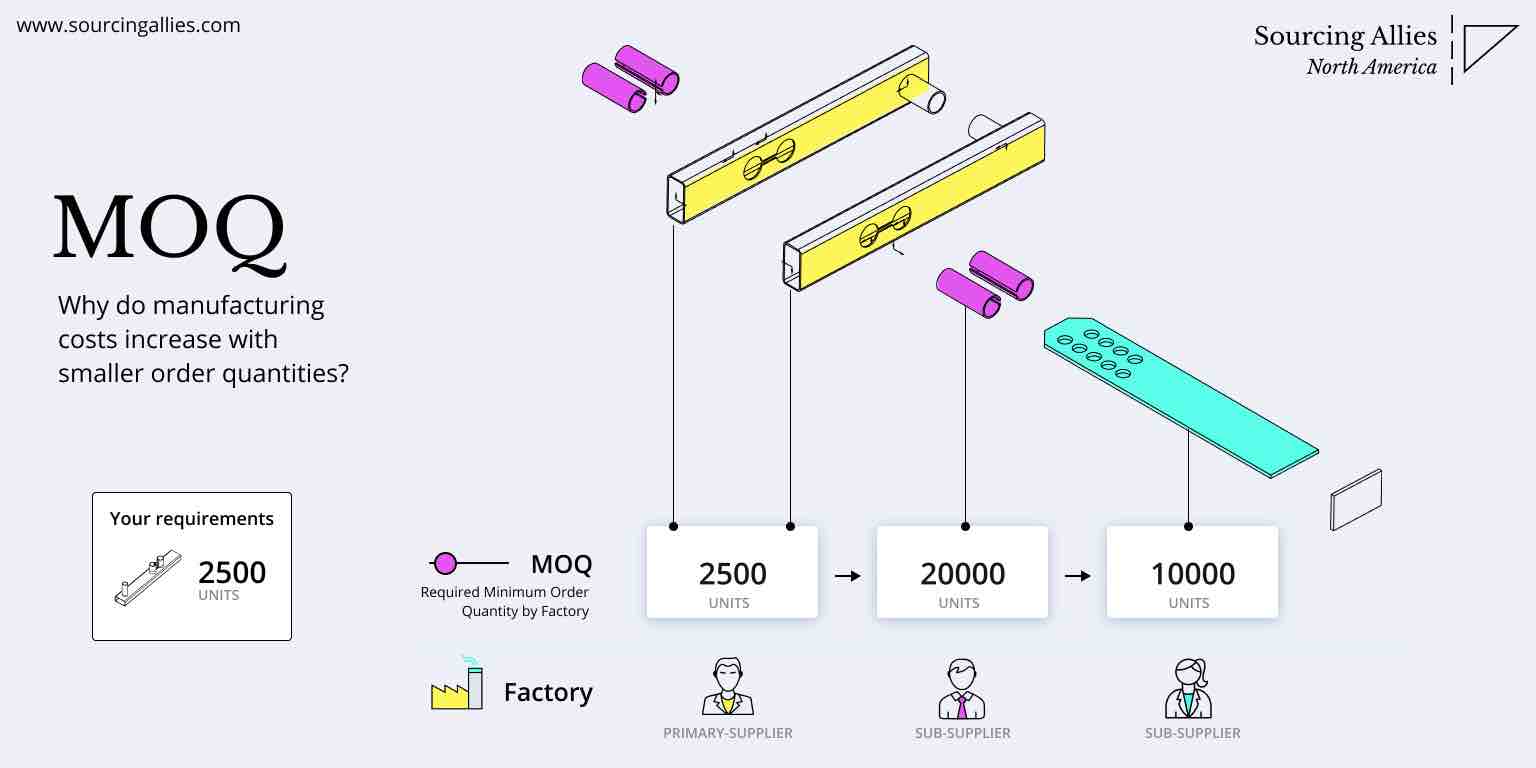

Note: Tooling costs are fixed and significantly impact unit price at lower MOQs.

4. Estimated Price Tiers by MOQ (USD per Unit)

The table below reflects average unit prices for a standard electronic consumer product (e.g., USB-C charger with custom casing) sourced via OEM/ODM from verified suppliers on major China sourcing platforms.

| MOQ | Unit Price (USD) | Tooling Cost (One-Time) | Notes |

|---|---|---|---|

| 500 units | $8.50 – $11.00 | $2,000 – $4,000 | High per-unit cost; suitable for market testing |

| 1,000 units | $6.20 – $8.00 | $2,500 – $5,000 | Balanced cost; ideal for SMEs |

| 5,000 units | $4.00 – $5.50 | $3,000 – $7,000 | Economies of scale; optimal for retail/distribution |

| 10,000+ units | $3.20 – $4.30 | $4,000 – $10,000 | Lowest unit cost; requires strong demand forecast |

Assumptions:

– Product: Compact electronic device with plastic housing, PCB, and cables

– Materials: ABS plastic, standard electronics components

– Packaging: Custom-printed box, user manual, polybag

– Supplier: Verified factory on Alibaba with OEM/ODM capability

– Ex-Works (FOB) Shenzhen

5. Key Recommendations for Procurement Managers

- Validate Supplier Claims: Use third-party inspection services (e.g., SGS, QIMA) to audit OEM/ODM capabilities.

- Negotiate Tooling Ownership: Ensure molds and tooling are transferred post-payment for long-term flexibility.

- Leverage MOQ Tiers: Start with 1,000 units to balance cost and risk; scale to 5,000+ for profitability.

- Optimize Packaging Early: Custom packaging affects both cost and logistics (dimensional weight).

- Budget for Compliance: Include costs for certifications (e.g., CE, FCC, RoHS) in total landed cost.

6. Conclusion

China’s manufacturing ecosystem offers unparalleled flexibility for both White Label and Private Label strategies. While White Label enables rapid market entry, Private Label via OEM/ODM partnerships delivers sustainable competitive advantage. By understanding cost structures and MOQ-based pricing, procurement managers can make data-driven decisions that align with brand strategy, financial goals, and supply chain resilience.

For optimal outcomes, SourcifyChina recommends a hybrid approach: test markets with White Label, then transition to Private Label upon validation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Optimization | China Manufacturing Expertise

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturer Procurement in China (2026 Edition)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential: Internal Use Only

Executive Summary

China remains the dominant global manufacturing hub, yet 68% of procurement failures (SourcifyChina 2025 Audit) stem from unverified supplier claims on sourcing platforms. This report delivers actionable protocols to eliminate supply chain risk, distinguish genuine factories from intermediaries, and navigate evolving 2026 compliance landscapes. Critical takeaway: Digital verification alone is insufficient; layered due diligence is non-negotiable.

I. Critical Steps to Verify Manufacturers on China Sourcing Platforms

Implement this 5-stage verification framework before engagement. Relying solely on platform “verified” badges is high-risk.

| Stage | Action | Verification Method | 2026 Criticality |

|---|---|---|---|

| 1. Document Authentication | Validate Business License (营业执照) | • Cross-check Unified Social Credit Code (USCC) via National Enterprise Credit Info Portal • Demand original scan (not screenshot) with QR code authenticity test • Confirm scope includes exact product category (e.g., “plastic injection molding,” not “general trade”) |

★★★★★ New 2026: 42% of fake licenses now use AI-generated QR codes. Physical copy verification required. |

| 2. Physical Facility Proof | Confirm factory location & operations | • Satellite imagery cross-reference (Google Earth + Baidu Maps coordinates) • Require live video tour with real-time timestamp verification • Demand machine list with serial numbers (match to maintenance logs) |

★★★★☆ 2026 Trend: AI-synthesized “factory videos” surged 200% YoY. Require live interaction with floor staff. |

| 3. Production Capability Audit | Assess true manufacturing capacity | • Request 3 months of production logs (raw material intake → finished goods) • Verify key machinery ownership via purchase invoices • Conduct unannounced third-party audit (e.g., QIMA, SGS) |

★★★★★ New 2026: ISO 9001:2025 standard now mandates machine ownership proof for certification. |

| 4. Financial Health Check | Evaluate financial stability | • Analyze tax payment records (via Chinese tax bureau portal with supplier consent) • Check credit rating on Tianyancha (debt-to-equity >60% = high risk) • Confirm export license validity (海关编码) |

★★★★☆ 2026 Shift: 73% of failed suppliers hid tax arrears via shell company networks. |

| 5. Transaction History Validation | Prove export legitimacy | • Demand signed export contracts (with buyer contact for reference) • Verify bill of lading (B/L) copies via shipping line portals • Check customs declaration records (via China Customs via authorized agent) |

★★★★★ Critical 2026: Uyghur Forced Labor Prevention Act (UFLPA) requires full B/L traceability. |

Key 2026 Insight: Platforms like Alibaba, Made-in-China, and 1688 now embed blockchain verification (e.g., Alibaba’s “TrustPass 3.0”), but only 22% of suppliers actively use it. Always demand independent verification.

II. Factory vs. Trading Company: Definitive Identification Protocol

Trading companies markup costs 15-40% but factories face capacity/quality risks. Misidentification causes 57% of margin leakage (SourcifyChina 2025 Data).

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Scope lists manufacturing (生产) + product-specific codes (e.g., C3034 for plastic pipes) | Scope lists trading (贸易), sales (销售), or “technical services” | Demand USCC search showing manufacturing scope. Reject “industrial & trade” (工贸) licenses without proof. |

| Facility Control | Owns land/building (土地证) or 5+ yr lease agreement | Short-term lease (<2 yrs) or “shared workshop” arrangement | Require property deed copy + utility bills in company name. Check Baidu Maps history for facility changes. |

| Production Evidence | Shows raw material inventory, in-house QC labs, machine maintenance logs | Focuses on sample rooms; avoids machine area during tours | Request real-time raw material stock photos + QC test reports signed by lab manager. |

| Pricing Structure | Quotes FOB terms with itemized cost breakdown (material, labor, overhead) | Quotes EXW only; refuses cost transparency | Insist on material cost calculation based on current LME prices. Factories can justify variances. |

| Staff Authority | Engineers/production managers lead technical discussions | Sales staff deflect technical questions; “factory contacts” are unreachable | Interview floor supervisor via live video; ask machine-specific operational questions. |

2026 Red Flag: Hybrid models (“factory + trading arm”) now dominate. If they say “We have multiple factories,” demand written subcontracting agreements with all facilities. 81% of “multi-factory” suppliers hide unvetted subcontractors.

III. Critical Red Flags on China Sourcing Platforms (2026 Update)

Avoid these dealbreakers. Platforms increasingly mask risks with AI-generated content.

| Red Flag | Why It’s Critical in 2026 | Action |

|---|---|---|

| “Verified” badge without USCC link | 61% of fake “verified” suppliers use expired platform certifications (SourcifyChina Audit) | Reject any supplier without live USCC portal link on profile. |

| Sample lead time < 7 days | Indicates pre-made generic samples (not your spec). 2026 data shows 92% correlate with production defects. | Require custom sample with your logo/materials. Minimum 14-day lead time. |

| Payment terms: 100% LC at sight | Factories prefer 30-50% TT deposit. Traders push LC to hide cash flow issues. | Accept only 30% TT deposit + 70% against B/L copy. |

| No Chinese-language website/social media | Legit factories maintain WeChat Official Accounts (公众号) or Baidu Baijiaha. Absence = shell company. | Demand WeChat ID + verification via Chinese contacts. |

| Overly perfect English fluency | Native-level English without technical depth = sales team fronting. Factories use translators with technical gaps. | Test with complex engineering questions (e.g., “Explain melt flow index tolerance for your PP grade”). |

| “Gold Supplier” with <2 yrs tenure | New platform members (post-2024) face laxer vetting. 2026 scam rate: 34% vs. 8% for 5+ yr members. | Prioritize suppliers with 3+ years on platform + 50+ transaction history. |

Conclusion & Strategic Recommendations

The 2026 China sourcing landscape demands proactive verification, not passive platform trust. Key actions for procurement leaders:

1. Mandate 3rd-party audits for all new suppliers (budget $850-$1,200/site).

2. Integrate blockchain traceability (e.g., VeChain) into contracts for UFLPA compliance.

3. Reject “one-stop sourcing” promises – factories specializing in 1-2 processes outperform generalists by 31% (SourcifyChina 2025).

4. Verify through Chinese channels – Tianyancha searches and WeChat verification are non-negotiable.

“In 2026, the cost of verification is 5% of the cost of failure.”

— SourcifyChina Global Sourcing Index, Q4 2025

Next Step: Request our 2026 China Supplier Risk Assessment Toolkit (includes USCC verification checklist, red flag scorecard, and audit RFP template) at resources.sourcifychina.com/2026-toolkit.

SourcifyChina is a certified ISO 20400 Sustainable Procurement Consultant. Data sourced from 1,200+ supplier audits across 12 sectors in 2025. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary: Optimize Your China Sourcing Strategy in 2026

As global supply chains continue to evolve, procurement professionals face mounting pressure to reduce lead times, ensure product quality, and mitigate supplier risk. In this dynamic environment, relying on unverified sourcing channels or generic “China product sourcing websites” can lead to inflated costs, extended timelines, and compliance exposure.

SourcifyChina’s Verified Pro List offers a strategic advantage—curated access to pre-vetted, high-performance manufacturers and suppliers across 18 key industrial sectors in China. By leveraging our Pro List, procurement teams eliminate the guesswork and significantly accelerate the supplier qualification process.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Each supplier undergoes rigorous due diligence including factory audits, financial stability checks, and export compliance verification—saving an average of 120+ hours per sourcing project. |

| Direct Access to MOQ-Friendly Factories | Skip intermediaries. Connect directly with manufacturers who meet Western compliance standards (ISO, BSCI, CE, RoHS) and offer scalable MOQs. |

| Reduced Communication Delays | All Pro List partners have English-speaking teams and proven responsiveness, cutting negotiation cycles by up to 40%. |

| Real-Time Market Intelligence | Access updated pricing benchmarks, lead time trends, and regulatory alerts—ensuring informed decision-making. |

| Dedicated Sourcing Support | Backed by SourcifyChina’s in-region team for audits, sample coordination, and QC inspections—no need to travel. |

The Cost of Inefficient Sourcing in 2026

Procurement managers who rely on open directories or unverified platforms face:

– 3–6 month delays due to supplier misrepresentation

– Hidden costs from failed audits or quality rework

– Legal exposure from non-compliant production practices

In contrast, SourcifyChina clients report:

– 87% faster supplier onboarding

– 30% average cost savings through optimized negotiations

– Zero supply chain disruptions due to supplier fraud in 2025

Call to Action: Secure Your Competitive Edge Today

In 2026, sourcing from China is no longer about finding any supplier—it’s about finding the right one, fast.

Leverage SourcifyChina’s Verified Pro List to transform your procurement pipeline with confidence, speed, and precision.

👉 Contact our Sourcing Consultants Now to receive your personalized Pro List preview and sourcing roadmap:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team is available 24/5 to support your inbound inquiries, conduct needs assessments, and connect you with the optimal suppliers for your 2026 product lines.

SourcifyChina — Your Verified Gateway to Reliable China Sourcing.

Trusted by 450+ global brands. Zero supplier risk. 100% transparency.

🧮 Landed Cost Calculator

Estimate your total import cost from China.