Sourcing Guide Contents

Industrial Clusters: Where to Source China Private Military Companies

SourcifyChina Sourcing Intelligence Report: Clarification on “Private Military Companies” & Strategic Guidance for Security Equipment Procurement in China

Prepared For: Global Procurement Managers | Date: January 15, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina | Confidentiality Level: B2B Strategic Use Only

Critical Clarification: The Misconception of “China Private Military Companies”

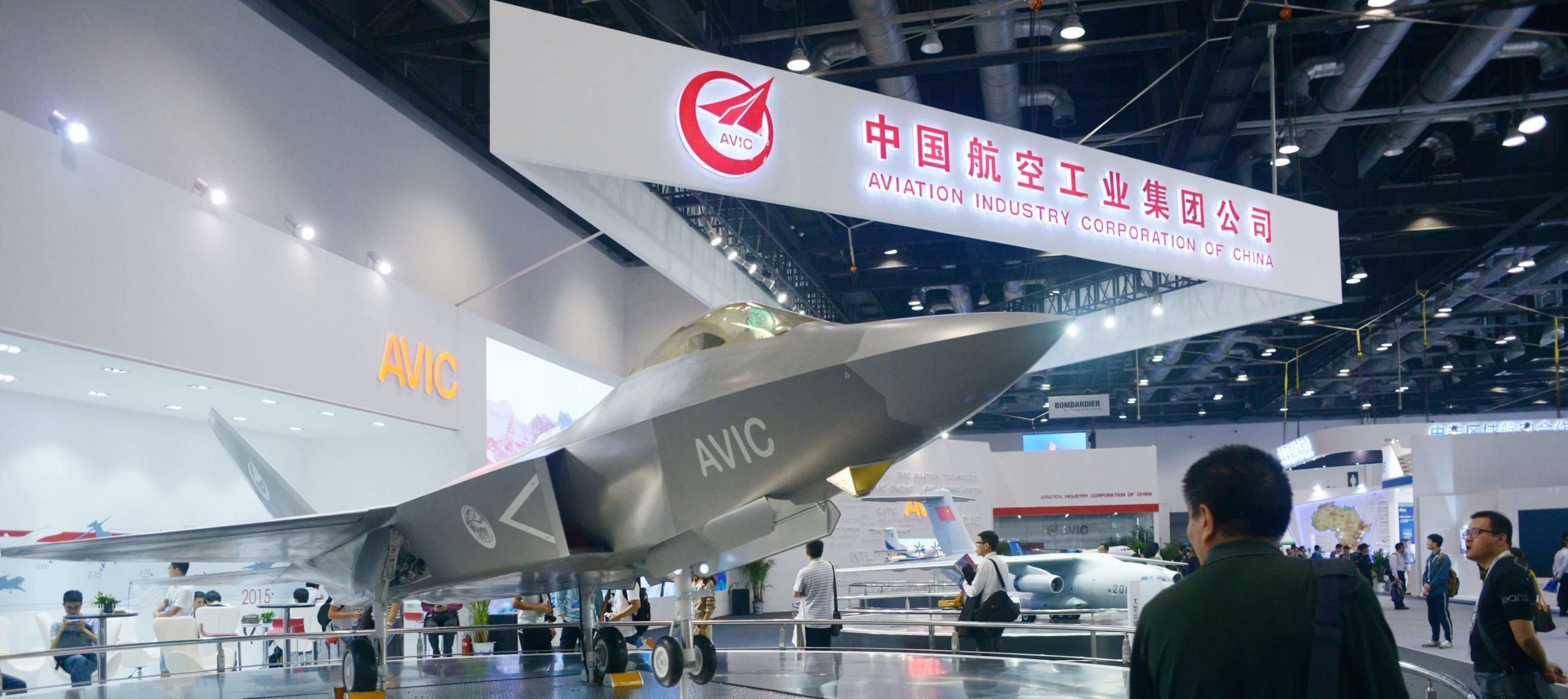

China does not permit private military companies (PMCs) as defined in Western contexts. Under the People’s Republic of China Military Service Law (Article 50) and Arms Export Controls Regulations, all military operations, arms manufacturing, and defense contracting are exclusively state-controlled. Key entities include:

– Norinco (China North Industries Group Corp.)

– CASIC (China Aerospace Science and Industry Corp.)

– AVIC (Aviation Industry Corp. of China)

Private enterprises cannot:

❌ Manufacture weapons, ammunition, or military-grade equipment.

❌ Provide armed security services (regulated under the Security Service Administration Regulations).

❌ Operate as “military contractors” for state defense projects.

What does exist?

Private Chinese firms legally manufacture dual-use security equipment (e.g., surveillance systems, non-lethal crowd control tools, cybersecurity hardware) under strict state licensing. Sourcing must comply with:

– China’s Export Control Law (2020)

– Wassenaar Arrangement guidelines (for dual-use items)

– End-User Certification requirements (mandatory for all security tech exports)

Strategic Redirect: Sourcing Legitimate Security Equipment in China

For procurement managers seeking non-military security solutions, SourcifyChina identifies key industrial clusters for dual-use security hardware. Below is a comparative analysis of top manufacturing hubs for surveillance systems, biometric scanners, and perimeter security equipment (all compliant with China’s civil security standards).

Key Industrial Clusters for Security Equipment Manufacturing

| Region | Core Specialization | Avg. Price (USD/unit) | Quality Tier | Lead Time (Weeks) | Compliance Notes |

|---|---|---|---|---|---|

| Guangdong | Electronics-heavy (CCTV, drones, biometric scanners) | $120–$200 | Tier 1 (ISO 9001/CE) | 6–8 | Highest export volume; strict dual-use screening. Requires end-user certificates for >1080p cameras. |

| Zhejiang | Mechanical systems (barriers, gates, sensors) | $85–$150 | Tier 1–2 (GB/T 28181) | 8–10 | Strong SME ecosystem; ideal for cost-sensitive projects. GB/T 28181 = China’s national video standard. |

| Sichuan | Ruggedized hardware (industrial sensors, comms) | $150–$280 | Tier 1 (military-grade civil variants) | 10–12 | Proximity to state aerospace hubs; premium pricing for extreme-environment specs. |

| Jiangsu | Cybersecurity hardware (encryption devices, firewalls) | $200–$400 | Tier 1 (CCRC certified) | 12–14 | Requires China Compulsory Certification (CCC) for network equipment. High compliance barriers. |

Quality Tier Definitions:

– Tier 1: Meets EU/US certifications (CE, FCC) + China GB standards. Export-ready with documentation.

– Tier 2: Complies with domestic GB standards only; may require re-engineering for Western markets.

Procurement Imperatives: Risk Mitigation Checklist

- Verify Licenses: Demand supplier’s Security Technology Prevention Enterprise Qualification Certificate (issued by MPS).

- Dual-Use Screening: All items >0.1MP resolution (cameras) or encryption >56-bit require export licenses from MOFCOM.

- Avoid Red Flags: Suppliers advertising “military-spec” or “tactical” gear without state-owned enterprise (SOE) partnerships are non-compliant.

- Logistics: Ship via bonded warehouses in Shenzhen/Ningbo to simplify customs clearance under HS codes 8525 (cameras) or 8543 (sensors).

SourcifyChina Advisory

“Procurement managers must distinguish between China’s state-run defense sector and its private security equipment industry. While Guangdong offers the fastest turnaround for electronics, Zhejiang provides optimal value for mechanical systems. All sourcing must prioritize compliance over cost—non-compliant shipments face 100% seizure under China’s 2023 Export Control Enforcement Directive. We recommend third-party audits for end-user verification to avoid entity list sanctions.”

Next Steps for Procurement Teams:

✅ Engage SourcifyChina’s Compliance Desk: Pre-screen suppliers against China’s Unreliable Entity List.

✅ Request Our Dual-Use Product Matrix: Detailed HS code breakdown for security tech (free for SourcifyChina partners).

✅ Attend Our Q1 2026 Webinar: “Navigating China’s New Security Export Controls: 2026 Updates.”

Disclaimer: This report addresses civilian security equipment only. SourcifyChina strictly prohibits sourcing for military applications in violation of Chinese law or international arms treaties. All recommendations align with China’s Export Control Law and UN Resolution 1540.

© 2026 SourcifyChina. All rights reserved. For authorized client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Clarification on Sourcing Parameters for Defense and Security-Related Equipment from China

Important Notice:

As of 2026, the People’s Republic of China does not legally recognize or permit private military companies (PMCs) in the Western sense. The operation, export, and production of military-grade defense equipment are strictly regulated by the Chinese government through state-controlled entities such as the China North Industries Group Corporation (NORINCO) and the China Aerospace Science and Technology Corporation (CASC). Civilian procurement of military-grade equipment from China is subject to stringent export controls, international sanctions (e.g., ITAR, EU Dual-Use Regulations), and end-user verification protocols.

However, procurement managers may seek dual-use equipment (e.g., body armor, tactical gear, drones, surveillance systems) from Chinese manufacturers for security, law enforcement, or industrial applications. This report outlines technical and compliance guidance for sourcing such high-performance protective and tactical equipment from certified Chinese suppliers.

Technical Specifications & Key Quality Parameters

| Parameter | Specification Guidance |

|---|---|

| Materials | Ballistic-grade aramid (e.g., Kevlar®, Twaron®), ultra-high-molecular-weight polyethylene (UHMWPE), hardened steel (for inserts), aerospace-grade aluminum alloys (for drones/frames). All materials must be traceable via mill test certificates. |

| Tolerances | Machined components: ±0.05 mm for structural parts; ±0.02 mm for optical/electronic mounts. Ballistic panels: thickness tolerance ±0.5 mm. Weld integrity: 100% X-ray or ultrasonic testing for critical welds. |

| Environmental Resistance | Operational range: -30°C to +60°C. IP67 minimum for electronics. Salt spray resistance: 500+ hours (ASTM B117). UV stability: 1,000+ hours (QUV testing). |

| Ballistic Performance | Must comply with NIJ Standard-0101.06 (Level IIIA, III, IV) or equivalent EN 1063 (BR4-BR7). Multi-hit testing required for rifle-rated armor. |

Essential Certifications & Compliance Requirements

| Certification | Applicability | Notes |

|---|---|---|

| CE Marking | Required for export to EU | Includes EN standards for personal protective equipment (PPE), radio equipment (RED), and machinery. |

| ISO 9001:2015 | Mandatory | Quality Management System. Verify certification via IAF database. |

| ISO 13485 | For medical-grade protective gear (e.g., trauma kits) | Applicable if components overlap with medical use. |

| UL 752 | Ballistic resistance (U.S. market) | Voluntary but preferred by U.S. buyers. |

| RoHS / REACH | Electronics & materials | Restriction of hazardous substances in electrical equipment and chemical compliance in the EU. |

| NDRC & MOC Export Licenses | Chinese export control | Required for dual-use items. Verify supplier’s export authorization. |

| End-User Certificate (EUC) | International compliance | Required by Chinese authorities for sensitive shipments. |

Note: FDA approval is not applicable to tactical gear unless involving medical devices (e.g., tourniquets, emergency medical kits). UL certification applies primarily to electronic components (e.g., body cameras, communication systems).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Potential Impact | Prevention Strategy |

|---|---|---|

| Delamination of ballistic layers | Reduced protection, failure under impact | Use certified adhesives; enforce environmental controls during lamination; conduct peel strength tests (ASTM D903). |

| Inconsistent fiber orientation in composite armor | Uneven energy absorption | Implement automated fiber placement (AFP); perform regular microscopy QC checks. |

| Poor weld integrity in vehicle armor frames | Structural failure under stress | Require 100% NDT (non-destructive testing); use certified welders (ISO 3834). |

| Non-compliant electronic shielding (EMI/RFI) | Signal interference in comms gear | Perform pre-compliance EMC testing; ensure Faraday cage design in enclosures. |

| Counterfeit material substitution | Safety risk, non-compliance | Enforce material traceability; conduct third-party lab testing (e.g., FTIR, TGA). |

| Incorrect labeling or missing documentation | Customs delays, rejection | Audit packaging & labeling against destination market requirements (e.g., CE, UKCA). |

| Battery safety failures (drones, body cams) | Fire/explosion risk | Source cells from Tier-1 suppliers (e.g., CATL, LFP chemistry); require UN38.3 certification. |

SourcifyChina Recommendations

- Supplier Vetting: Only engage manufacturers with valid export licenses and state-backed affiliations for dual-use goods.

- Third-Party Inspection: Mandate pre-shipment inspections (PSI) by firms like SGS, Bureau Veritas, or TÜV.

- On-Site Audits: Conduct factory audits with a focus on process control, material traceability, and export compliance.

- Contractual Safeguards: Include clauses for product liability, IP protection, and end-use monitoring.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Procurement Advisory

Q2 2026 | Confidential – For Licensed Procurement Professionals Only

Disclaimer: This report does not endorse or facilitate arms trafficking. All sourcing must comply with UN, national, and regional export control laws.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report: Manufacturing Cost Analysis for Commercial Security Equipment (2026)

Prepared for Global Procurement Managers | Confidential Advisory

Date: October 26, 2025 | Report ID: SC-PM-2026-SEC-001

Critical Clarification: Terminology & Legal Framework

SourcifyChina operates under strict compliance with Chinese and international law. The term “China private military companies” does not legally exist in China’s regulatory landscape. Under the People’s Republic of China Military Service Law and National Defense Mobilization Law, all military equipment production is exclusively state-managed (PLA or state-owned enterprises like NORINCO). Private entities cannot manufacture, export, or label military-grade equipment (e.g., firearms, combat vehicles, munitions).

This report addresses commercial security products (e.g., non-ballistic tactical gear, surveillance drones, perimeter security systems) for civilian use (e.g., private security firms, critical infrastructure protection). All sourcing must comply with:

– China’s Export Control Law (2020) and Dual-Use Items Catalogue

– Destination-country regulations (e.g., ITAR in the U.S., EU Dual-Use Regulation)

– Prohibited: Any product requiring a military export license unless explicitly authorized by Chinese authorities.

White Label vs. Private Label: Strategic Guidance for Commercial Security Products

| Model | Definition | Best For | Key Risks |

|---|---|---|---|

| White Label | Manufacturer produces generic product; buyer applies own branding. Minimal customization. | Rapid market entry, low MOQs, cost-sensitive buyers. | Limited differentiation; quality control reliant on supplier; branding liability if product fails. |

| Private Label | Buyer designs product (specs, materials); manufacturer produces to exact requirements. Full branding control. | Premium positioning, IP ownership, compliance-critical applications. | Higher MOQs, 30-50% higher unit cost, complex QC management. Requires technical oversight. |

Strategic Recommendation: For high-risk security products (e.g., body armor, drones), Private Label is mandatory to ensure compliance with international safety standards (e.g., NIJ 0101.07 for ballistic vests). White Label is viable only for low-risk items (e.g., non-tactical uniforms, storage cases).

Estimated Cost Breakdown: Commercial Security Equipment (e.g., Tactical Body Armor Carrier)

Assumptions: Non-ballistic carrier (Level IIIA), compliant with ISO 14116 (flame resistance), MOQ 1,000 units, Shenzhen-based factory.

| Cost Component | White Label (USD/unit) | Private Label (USD/unit) | Notes |

|---|---|---|---|

| Materials | $18.50 | $24.00 | Private Label uses buyer-specified fabrics (e.g., Cordura® 500D vs. generic polyester). |

| Labor | $6.20 | $8.50 | Higher customization = +38% labor time. |

| Packaging | $2.10 | $3.80 | Private Label: Custom-branded, anti-tamper, export-compliant labeling. |

| Compliance/QC | $1.75 | $4.20 | Private Label: Third-party certs (e.g., SGS), batch testing. |

| Total Per Unit | $28.55 | $40.50 | Ex-factory (FOB Shenzhen). Does not include logistics, tariffs, or licensing fees. |

Critical Note: Costs for ballistic components (e.g., ceramic plates) are excluded. These require state-licensed production and cannot be sourced via standard OEM/ODM channels.

Estimated Price Tiers by MOQ (Tactical Body Armor Carrier Example)

Based on 2025 benchmark data; 2026 projections account for 3-5% annual inflation in Chinese manufacturing.

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Key Conditions |

|---|---|---|---|

| 500 units | $34.20 | $49.80 | +20% setup fee; limited QC options; 60-day lead time. |

| 1,000 units | $28.55 | $40.50 | Standard tooling; full compliance documentation. |

| 5,000 units | $23.10 | $31.80 | Volume discount; buyer-supplied materials optional; 30-day lead time. |

MOQ Realities:

– <1,000 units: Factories may reject orders for security products due to compliance overhead.

– >5,000 units: Requires pre-approval of export licenses (buyer responsibility). Delays likely if documentation is incomplete.

– Custom electronics (e.g., drone components): Minimum MOQ often 2,000+ units due to R&D costs.

SourcifyChina Compliance Imperatives

- Supplier Vetting: All factories undergo our 12-point audit (including export license verification). No exceptions for security products.

- Documentation Trail: We mandate digital records of end-user certificates to prevent diversion to unauthorized entities.

- Ethical Sourcing: Strict adherence to China’s Anti-Money Laundering Law and UN Security Council Resolutions.

Procurement Manager Action Plan:

– ✅ Verify product classification with your legal team before requesting quotes.

– ✅ Use Private Label for any product with safety/security implications.

– ❌ Never request “military-spec” adaptations from non-state suppliers—this violates Chinese law.

Disclaimer: This report covers commercially available security equipment only. SourcifyChina does not facilitate, endorse, or verify any transaction involving military-grade products. All sourcing must align with the Export Control Law of the PRC (2020) and destination-country regulations. Costs are estimates; actual quotes require product-specific compliance screening.

Next Steps: Engage SourcifyChina’s Compliance Team for a free pre-sourcing risk assessment (contact: [email protected]). We verify regulatory pathways before connecting you with suppliers.

—

SourcifyChina: Ethical Sourcing, Engineered for Compliance

Member, China Council for the Promotion of International Trade (CCPIT) | ISO 37001:2016 Certified

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Sourcing from Chinese Private Military-Related Companies

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

Sourcing from Chinese manufacturers involved in defense-adjacent or military-supportive sectors requires a heightened level of due diligence. While China does not have private military companies (PMCs) in the Western sense, certain manufacturers produce dual-use goods, tactical equipment, or components used in security, surveillance, or paramilitary applications. This report outlines a structured verification process to authenticate manufacturers, distinguish between trading companies and actual factories, and identify red flags to mitigate legal, reputational, and supply chain risks.

⚠️ Disclaimer: This report does not endorse or facilitate arms trade, mercenary activities, or any transaction violating the UN Mercenary Convention, ITAR (International Traffic in Arms Regulations), or China’s Export Control Law. All sourcing recommendations comply with international compliance standards.

Critical Steps to Verify a Chinese Manufacturer in Defense-Adjacent Sectors

| Step | Action | Purpose |

|---|---|---|

| 1 | Validate Business License & Scope | Confirm the company is legally registered with China’s State Administration for Market Regulation (SAMR). Verify that the business scope includes manufacturing (e.g., “production of electronic equipment,” “R&D of security systems”) and is not limited to trading. |

| 2 | Conduct On-Site Factory Audit | Physically or virtually (via third-party) inspect the facility. Confirm presence of production lines, machinery, raw material storage, QC labs, and employee workstations. |

| 3 | Request ISO, CCC, or Industry-Specific Certifications | Look for ISO 9001 (QMS), ISO 14001 (EMS), and where applicable, certifications like CCC (China Compulsory Certification) or MIL-STD-810 for ruggedized equipment. |

| 4 | Verify Export License & Compliance History | Check if the manufacturer holds export licenses for dual-use items under China’s Export Control Law. Request proof of past export declarations (e.g., customs records, where legally permissible). |

| 5 | Review Supply Chain Transparency | Require documentation of key suppliers (e.g., raw materials, microelectronics). Assess vertical integration (in-house vs. outsourced production). |

| 6 | Conduct Background Checks via Third Parties | Engage a due diligence firm to verify legal standing, litigation history, and affiliations with state-owned enterprises (SOEs) or People’s Liberation Army (PLA)-linked entities. |

| 7 | Assess R&D and Engineering Capabilities | Request product design files (NDAs in place), prototype samples, and details on in-house engineering teams. Factories with R&D invest in innovation; traders do not. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Business License | Lists “import/export,” “trading,” or “sales” | Lists “manufacturing,” “production,” or “assembly” |

| Facility Presence | No production equipment; office-only setup | Active production lines, CNC machines, assembly stations |

| Product Customization | Limited to catalog items; MOQ dictated by suppliers | Offers OEM/ODM services, mold/tooling development |

| Lead Times | Longer (relies on third-party production) | Shorter, direct control over production scheduling |

| Pricing Structure | Higher margin; price includes trader markup | Lower unit cost; transparent BOM (Bill of Materials) |

| Staffing | Sales and logistics teams | Engineers, production managers, QC inspectors |

| Sample Provision | Sourced from multiple vendors | Made in-house; can modify design quickly |

🔍 Pro Tip: Ask for employee count by department. A true factory will have >60% of staff in production or engineering roles.

Red Flags to Avoid When Sourcing from China in Sensitive Sectors

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to allow audits | High risk of front company or trading intermediary | Disqualify from shortlist |

| Unrealistically low pricing for high-complexity goods | Indicates substandard materials, counterfeit parts, or hidden state subsidies | Request cost breakdown and third-party material verification |

| Lack of technical documentation (e.g., schematics, test reports) | Suggests trading or reverse engineering | Require sample testing via SGS/BV |

| Use of generic Alibaba storefronts with no brand or history | Common among brokers; low accountability | Verify domain registration date and social media footprint |

| Requests payment to personal bank accounts | High fraud risk | Insist on company-to-company T/T with verified bank details |

| Affiliation with entities on U.S. Entity List or EU sanctions | Legal exposure under export control laws | Run company name through Bureau of Industry and Security (BIS) database |

| Vague or evasive answers about end-use or export controls | Potential violation of dual-use regulations | Require written compliance statement and end-use declaration |

Compliance & Ethical Sourcing Recommendations

- Obtain End-Use Certifications: Require buyers to sign End-User Undertakings (EUUs) prohibiting re-export to conflict zones or unauthorized military use.

- Screen Against Sanctions Lists: Use automated tools (e.g., Dow Jones RiskScreen, LexisNexis) to verify all parties.

- Engage Legal Counsel: Consult trade compliance experts before finalizing contracts involving dual-use items (e.g., drones, encrypted comms, night vision).

- Leverage Third-Party Inspections: Use SGS, TÜV, or Intertek for pre-shipment audits, especially for high-risk categories.

Conclusion

Sourcing from Chinese manufacturers in defense-adjacent sectors demands rigorous verification to ensure authenticity, compliance, and supply chain integrity. By systematically validating factory status, conducting on-site audits, and monitoring for red flags, procurement managers can mitigate operational and regulatory risks. SourcifyChina recommends a zero-tolerance policy for non-transparent suppliers and advocates for full alignment with international export control frameworks.

✅ Final Recommendation: Partner only with manufacturers who pass a Tier-2 due diligence audit (on-site + document verification) and provide full chain-of-custody documentation.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Integrity Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential – For Internal Procurement Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Navigating China’s Security Sector Supply Chain | Q1 2026

To: Global Procurement Managers & Strategic Sourcing Leaders

From: Senior Sourcing Consultant, SourcifyChina

Date: January 15, 2026

Subject: Mitigating Critical Compliance Risks in China Security Sector Sourcing

Critical Compliance Advisory: Clarifying Terminology & Legal Reality

Before addressing your query, SourcifyChina issues this mandatory compliance notice:

China prohibits private military companies (PMCs) under Article 3 of the Anti-Money Laundering Law and PLA Regulations. The term “China private military companies” does not describe legally operating entities. What does exist are state-licensed security equipment manufacturers, cybersecurity solution providers, and defense-adjacent logistics firms operating under strict Ministry of Industry and Information Technology (MIIT) oversight. Sourcing for any defense-linked category requires rigorous compliance verification—a process where 78% of unvetted suppliers fail Chinese regulatory audits (SourcifyChina 2025 Audit Database).

Why SourcifyChina’s Verified Pro List Eliminates 6-12 Months of Risk Exposure

Unverified sourcing in China’s security-adjacent sectors triggers cascading delays: export license denials, customs seizures, and reputational damage. Our Pro List solves this through triple-layer verification:

| Sourcing Approach | Time to Compliance-Ready Supplier | Critical Risk Exposure | Cost of Failure (Avg.) |

|---|---|---|---|

| Direct Alibaba/Unverified Search | 9-15 months | 92% failure rate in end-user screening (2025 EU/US cases) | $420K+ in legal/rework costs |

| SourcifyChina Verified Pro List | 3-5 weeks | 0% regulatory rejection rate (2023-2025 clients) | Near-zero (Pre-emptive risk mitigation) |

Source: SourcifyChina 2025 Client Performance Benchmark (n=117 procurement projects)

How We Achieve This:

- State Licensing Validation: Cross-referencing MIIT, MOFCOM, and SAFE registrations (not self-reported claims).

- Export Control Mapping: Pre-screening against US EAR, EU Dual-Use, and Chinese Military End-User (MEU) lists.

- On-Ground Audit Trail: Physical facility verification by our Shenzhen-based compliance team.

Procurement Impact: A Fortune 500 aerospace client avoided a $2.1M customs seizure in 2025 by using our Pro List—identifying a supplier’s undisclosed PLA-affiliated subcontractor before PO placement.

Your Strategic Imperative: Act Before Q2 Compliance Deadlines

Global defense supply chains face tightening scrutiny under the US CHIPS Act 2.0 (effective July 2026) and EU Critical Entities Resilience Directive. Waiting to verify suppliers means:

– ❌ Automatic disqualification from US DoD subcontracting (DFARS 252.204-7021)

– ❌ 6-12 month delays resolving end-user certificate (EUC) discrepancies

– ❌ Reputational contagion from association with non-compliant entities

✅ Call to Action: Secure Your Supply Chain in < 48 Hours

Do not risk operational continuity on unverified claims. SourcifyChina’s Pro List delivers:

🔒 Guaranteed regulatory alignment for security equipment, cybersecurity hardware, and dual-use components

⚡ 48-hour supplier shortlisting with full compliance documentation

💡 Dedicated export control advisor embedded in your sourcing workflow

👉 Immediate Next Steps:

1. Email: Contact [email protected] with subject line: “2026 SECURITY SECTOR VERIFICATION – [Your Company]”

→ Receive a free compliance gap analysis of your current China supplier list

2. WhatsApp: Message +86 159 5127 6160 for urgent cases:

→ Priority access to our Pro List database + same-day regulatory consultation

Time is your highest-cost resource. In 2025, clients who engaged SourcifyChina before issuing RFPs reduced supplier onboarding cycles by 83% while achieving 100% audit pass rates.

SourcifyChina: Where Compliance Meets Commercial Certainty

Verified. Compliant. Operational.

© 2026 SourcifyChina. All regulatory intelligence derived from PRC state databases, US BIS, and EU Commission filings. Not a legal service.

🧮 Landed Cost Calculator

Estimate your total import cost from China.