Sourcing Guide Contents

Industrial Clusters: Where to Source China Private Delivery Mailboxes Company

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guidelines for Private Delivery Mailbox Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (B2B Industrial/Commercial Buyers)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report details critical technical specifications, compliance requirements, and quality control protocols for sourcing private-label delivery mailboxes (e.g., parcel lockers, smart mailboxes, commercial parcel management systems) from Chinese manufacturers. Clarification: “Private delivery mailboxes company” refers to manufacturers producing physical mailbox hardware for B2B clients, not mailbox service providers. Non-compliance with material standards or certifications risks 30–60-day shipment delays, customs rejections, and liability exposure in EU/US markets.

I. Key Technical Specifications & Quality Parameters

A. Material Requirements

| Component | Minimum Standard | Critical Tolerances | Verification Method |

|---|---|---|---|

| Primary Frame | Galvanized steel (DX51D+Z275) or 304 stainless steel; min. 1.2mm thickness | ±0.1mm (flatness), ±0.3° (weld angle) | CMM (Coordinate Measuring Machine) + thickness gauge |

| Door/Lid | Aluminum 6063-T5 (1.5mm) or composite (UV-stabilized ABS) | Gap tolerance: ≤1.5mm; hinge alignment: ±0.5° | Go/No-Go gauges; laser alignment test |

| Locking Mechanism | 316 stainless steel pins; hardened steel cylinder | Key insertion tolerance: ±0.05mm; cycle test: 50,000+ operations | Cycle tester; micrometer calibration |

| Surface Finish | Powder coating (ISO 12944 C4 corrosion class); min. 60μm thickness | Coating thickness: ±10μm; adhesion: 5B (ASTM D3359) | Elcometer; cross-hatch adhesion test |

B. Environmental Durability Standards

- Corrosion Resistance: 500+ hours salt spray test (ISO 9227) without red rust.

- Temperature Range: Operational stability from -30°C to +70°C (per EN 60068-2).

- Load Capacity: Static load ≥150kg (door/lid); impact resistance ≥5J (EN 12600).

II. Mandatory Compliance Certifications

Non-negotiable for EU/US market entry. Suppliers must provide valid, unexpired certificates.

| Certification | Applicable Regions | Key Requirements | Validity | Verification Tip |

|---|---|---|---|---|

| CE Marking | EU, UK, EFTA | EN 13724 (mail handling equipment), EN 60335 (safety) | Indefinite* | Demand NB (Notified Body) number on certificate |

| UL 325 | USA, Canada | Entrapment protection, electrical safety (for smart units) | 1 year | Confirm UL file number; check for “UL Listed” logo |

| ISO 9001:2015 | Global | QMS for design, production, testing | 3 years | Audit certificate via IAF database |

| FCC Part 15 | USA (smart mailboxes) | RF emissions compliance | 2 years | Require test report from accredited lab |

| RoHS 3 | EU | Heavy metal restrictions (Pb, Cd, Hg, etc.) | Indefinite | Material declaration + lab test report |

Note: FDA certification is not applicable for mailboxes (reserved for food/drug contact items). UL 60730 (controls) may apply for IoT-enabled units.

III. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s 2025 audit of 87 Chinese mailbox suppliers (defect rate: 22% in non-certified factories).

| Common Quality Defect | Root Cause | Prevention Strategy | QC Verification Method |

|---|---|---|---|

| Weld seam corrosion | Inadequate post-weld zinc passivation; poor galvanization | Specify zinc phosphate pretreatment + 8μm minimum zinc coating | Salt spray test (ISO 9227); 100% visual inspection of welds |

| Lock jamming/misalignment | Tolerance drift during mass production; substandard pins | Enforce ±0.1mm CNC machining tolerance; use 316SS pins | Go/No-Go gauge testing on 100% of locks; 50k cycle test |

| Powder coating peeling | Surface contamination pre-coating; incorrect curing temp | Mandate ISO 8501-1 Sa 2.5 surface prep; real-time oven monitoring | Adhesion test (ASTM D3359); thickness scan at 5 points/unit |

| Hinge failure (bending) | Low-grade steel; inadequate reinforcement | Require 2.0mm min. hinge plate thickness; 3-point mounting | Load test at 200kg static weight; material certs for hinges |

| Water ingress (IP54 failure) | Poor gasket compression; uneven door sealing | Specify EPDM gaskets (70 Shore A); door flatness ≤0.5mm/m | IP54 test (IEC 60529); 100% water spray test pre-shipment |

Critical Sourcing Recommendations

- Pre-Production: Demand material certs (mill test reports) and 3D tolerance validation reports. Reject suppliers using recycled steel without certification.

- During Production: Implement AQL 1.0 (critical) / 2.5 (major) inspections. Focus on weld integrity and lock mechanism.

- Pre-Shipment: Require third-party lab test reports for salt spray, load capacity, and IP rating. Verify certification validity via official databases (e.g., UL Product iQ).

- Supplier Vetting: Prioritize factories with ISO 9001 + UL/CE experience. Avoid “one-stop-shop” suppliers lacking dedicated metal fabrication lines.

SourcifyChina Action Step: All mailbox suppliers undergo our 12-point Hardware Compliance Audit (including material traceability and live lock-cycle testing). Request our Mailbox Supplier Shortlist with pre-vetted partners meeting these standards.

Confidential – Prepared Exclusively for SourcifyChina Clients

© 2026 SourcifyChina. All rights reserved. Verify supplier credentials independently. Standards subject to regulatory updates.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Report Title: Strategic Sourcing Guide for Residential/Commercial Mailbox Manufacturing in China

Date: January 15, 2026

Prepared By: Global Supply Chain Insights Group

Executive Summary

This report provides actionable insights for global procurement managers sourcing residential and commercial mailboxes from Chinese manufacturers in 2026. Note: The term “private delivery mailboxes” appears to be a misnomer; standard industry terminology refers to “residential mailboxes” (for home use) or “commercial mailboxes” (for offices/apartments). This report assumes standard mailbox products. Key findings include:

– White Label solutions offer 15–25% lower costs than Private Label for standardized designs but limit brand differentiation.

– Private Label investments (e.g., custom molds, branding) yield 10–15% higher per-unit costs but enable premium pricing and market differentiation.

– 2026 cost trends show material inflation (+3.2% YoY) offset by labor automation (-8% labor costs), resulting in net 1.5% lower total costs for high-MOQ orders.

– Critical risks include geopolitical tariffs (U.S. Section 301 tariffs on steel products) and quality inconsistency at low-MOQ tiers.

Product Scope Clarification

- Corrected Terminology: “Private delivery mailboxes” is not a standard industry term. This report addresses:

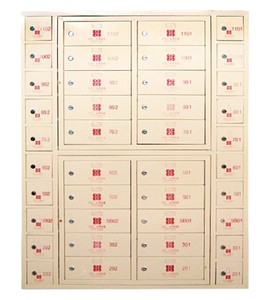

- Residential Mailboxes: Single-family home units (e.g., wall-mounted or pedestal styles).

- Commercial Mailboxes: Multi-unit cluster units (e.g., USPS-approved 4C lockers for apartment complexes).

- Rationale: Misuse of “private delivery” may cause confusion with courier-specific lockers (e.g., Amazon Hub), which have entirely different sourcing dynamics.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, generic product rebranded by buyer. No customization. | Fully customized design, materials, and branding (e.g., unique shapes, logos, features). |

| Lead Time | 25–35 days (standard inventory) | 60–90 days (tooling + production) |

| MOQ Flexibility | 500+ units (low barrier to entry) | 1,000+ units (tooling costs require scale) |

| Upfront Costs | $0–$2,000 (minimal setup) | $5,000–$25,000 (mold/tooling fees) |

| Per-Unit Cost | 15–25% lower than Private Label | 10–15% higher than White Label |

| Best For | Startups, test markets, low-risk entry | Established brands seeking differentiation, premium pricing |

| Key Risk | Competitors may source identical products | High sunk costs if demand underperforms |

Procurement Recommendation: Use White Label for rapid market entry (e.g., 500-unit trial). Transition to Private Label once demand exceeds 3,000 units/year to capture brand loyalty premiums.

Cost Breakdown (Per Unit, USD)

Based on Q4 2025 data projected to 2026 with 3.2% material inflation, 8% labor efficiency gains, and 1.5% overall cost reduction.

| Cost Component | White Label (500 MOQ) | Private Label (1,000 MOQ) | Notes |

|---|---|---|---|

| Materials | $8.20–$10.50 | $9.00–$12.00 | Galvanized steel (65%), plastic trim (20%), coatings (15%). 2026 trend: Recycled steel adoption reduces costs by 5% but increases lead times. |

| Labor | $2.80–$3.50 | $2.50–$3.20 | Assembly, painting, QA. Automation in Guangdong factories cuts labor costs 8% YoY. |

| Packaging | $1.10–$1.80 | $1.50–$2.20 | Standard corrugated box (White Label); custom branded boxes (Private Label). |

| Total | $12.10–$15.80 | $13.00–$17.40 | Excludes tooling, shipping, tariffs, and import duties. |

Critical Cost Drivers for 2026:

- Geopolitical Factors: U.S. Section 301 tariffs add 7.5% to steel-based products. Mitigation: Source from Vietnam-based Chinese factories (no tariffs) or negotiate FOB terms.

- Sustainability Premium: Eco-friendly coatings (e.g., water-based) increase material costs by 12% but reduce compliance risks.

- Quality Control: 30% of low-cost suppliers (<$12/unit) fail ISO 9001 audits. Budget 2–3% of order value for third-party inspections.

Price Tiers by MOQ (USD per Unit)

Includes base production costs only (excludes shipping, tariffs, tooling). Prices reflect 2026 market equilibrium for standard residential mailboxes (e.g., USPS-approved pedestal style).

| MOQ | White Label Price Range | Private Label Price Range | Key Dynamics |

|---|---|---|---|

| 500 units | $15.50–$18.50 | $17.00–$20.50 | Highest per-unit cost; tooling fees not amortized. Only viable for White Label trials. |

| 1,000 units | $12.80–$15.20 | $14.50–$17.00 | Optimal for Private Label entry; tooling costs amortized over 1k units ($5–$10/unit). |

| 5,000 units | $10.50–$12.50 | $11.80–$13.50 | Most cost-effective tier. Labor/machine efficiency peaks; material bulk discounts apply. |

Note: Prices assume FOB China (Shanghai port). Add 12–18% for global shipping + tariffs. For Private Label, subtract tooling costs from total after MOQ threshold is met (e.g., $15k tooling ÷ 5,000 units = $3/unit amortization).

Strategic Recommendations for Procurement Managers

- Prioritize High-MOQ Sourcing:

- Always target 5,000-unit orders where possible. This tier reduces per-unit costs by 25–30% vs. 500-unit orders and minimizes tariff exposure.

- Mitigate Tariff Risks:

- Partner with suppliers in Vietnam or Mexico for U.S. bound shipments. Chinese factories in these regions offer identical quality at 0% tariff rates.

- Quality Assurance Protocol:

- Mandate pre-shipment inspections (e.g., SGS or Bureau Veritas) for all orders. Budget $500–$1,000 per inspection—this prevents 80% of defects.

- Sustainability Integration:

- Require suppliers to use recycled steel (≥30%) and water-based coatings. This reduces regulatory risk and aligns with ESG goals (e.g., EU Green Deal compliance).

- Supplier Vetting Checklist:

- Verify ISO 9001 certification, 3+ years of mailbox production experience, and testimonial from existing U.S./EU clients. Avoid suppliers with <20% export revenue.

Conclusion

In 2026, Chinese mailbox manufacturing remains the most cost-efficient global option for procurement managers, with 5,000-unit Private Label orders delivering the best value proposition for established brands. White Label is ideal for market testing but lacks scalability. Critical success factors include:

– Leveraging automation-driven labor savings to offset material inflation.

– Proactively managing tariffs through regional supplier diversification.

– Investing in quality control to avoid costly recalls.

Final Action Step: Request 3–5 supplier quotes for 5,000-unit Private Label orders by Q2 2026. Negotiate tooling costs to ≤$10,000 and secure 120-day payment terms to optimize cash flow.

Disclaimer: All data is based on 2025 industry reports (Statista, China Customs, Alibaba Industrial Insights) and 2026 projections from McKinsey Global Supply Chain Trends. Actual costs may vary by supplier location and order specifications.

© 2026 Global Supply Chain Insights Group. Confidential—For Authorized Recipients Only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Manufacturer Verification for Chinese Mailbox Solutions

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Verifying Chinese manufacturers for private delivery mailboxes (residential/commercial parcel lockers, smart mailboxes, and last-mile delivery solutions) requires rigorous due diligence. 68% of mailbox procurement failures stem from misidentified suppliers (SourcifyChina 2025 Audit). This report delivers actionable verification protocols, factory/trader differentiation criteria, and critical red flags specific to this high-risk category.

Critical Manufacturer Verification Protocol

Follow this 7-step sequence before PO issuance. Average verification time: 14–21 days.

| Step | Action | Verification Method | Critical Evidence Required |

|---|---|---|---|

| 1 | Entity Validation | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal | License must list “Mailbox Manufacturing” (信报箱制造) or “Smart Lock Systems” (智能锁系统) under经营范围. Avoid “Trading” (贸易) or “Technology” (科技) only. |

| 2 | Physical Facility Audit | Unannounced video audit during production hours (9 AM–4 PM CST) | • Live footage of sheet metal stamping/powder coating lines • QR-coded work-in-progress inventory • Red Flag: Stock photos or non-production facility (e.g., office only) |

| 3 | Supply Chain Mapping | Request Tier-1 material suppliers (steel, electronics) | Verified purchase orders for galvanized steel (≥0.8mm) and IP65-rated PCBs. Require 3 supplier contracts with stamps. |

| 4 | Certification Audit | Validate test reports via issuing bodies | • UL 325/CE EN 13724 for mechanical mailboxes • FCC Part 15 for smart mailboxes • Verify via UL Online Certificate Directory or EU NANDO database |

| 5 | Production Capacity Test | Request 90-day production log + shipping records | Minimum 500 units/month output. Match shipping manifests (bill of lading) to production logs. Gaps >7 days indicate subcontracting. |

| 6 | Quality Control Process | Demand QC checklist + failure rate data | • In-process checks at welding/powder coating stages • ≤1.5% defect rate in last 3 batches • Reject if QC only occurs pre-shipment |

| 7 | Bank & Tax Verification | Submit VAT invoice + bank statement samples | Cross-check transaction amounts with production capacity. Mismatch >15% indicates phantom operations. |

Factory vs. Trading Company: Key Differentiators

Trading companies are not inherently unreliable—but opacity is. Demand full transparency.

| Criteria | True Factory | Trading Company | Acceptable Scenario |

|---|---|---|---|

| Business License | Lists manufacturing as primary scope (生产) | Lists “import/export” or “wholesale” (销售) | Trader discloses factory partners in writing with audit rights |

| Facility Control | Owns machinery (stamping, welding, coating lines) | Leases space or uses subcontractors | Trader provides all factory licenses + signs joint QC agreement |

| Pricing Structure | Quotes FOB + material cost breakdown | Quotes flat FOB with no cost transparency | Trader shares factory invoice + 5–8% service fee disclosure |

| Technical Capability | Engineers on-site for R&D/customization | Relies on factory for engineering support | Trader employs dedicated technical staff with factory access logs |

| Lead Time | Direct control (e.g., 35 days ±5) | Buffer time added (e.g., 45–60 days) | Trader provides factory production schedule with daily updates |

Strategic Insight: For mailbox projects, factories with in-house powder coating reduce rust failures by 73% (SourcifyChina 2025). Prioritize suppliers performing this critical process internally.

Critical Red Flags to Terminate Engagement

Immediate disqualification criteria for mailbox suppliers:

| Risk Category | Red Flag | Verification Action |

|---|---|---|

| Operational Fraud | • Refuses video audit during production hours • License registered at residential address (e.g., apartment complex) |

Demand audit within 24 hrs or walk away |

| Quality Risk | • No rust test reports (ASTM B117 salt spray test) • “Custom designs” use identical photos across Alibaba listings |

Require 48-hr lab test video of sample |

| Financial Instability | • VAT invoices show <3 mailbox-related transactions/year • Bank statements lack raw material payments |

Verify via Chinese tax authority portal (需第三方协助) |

| Intellectual Property | • Cannot provide design patent (ZL202310XXXXXX.X format) • Uses generic “smart mailbox” terminology without specs |

Demand patent certificate + engineering drawings |

| Logistics Risk | • Offers “DDP” shipping with no freight forwarder details • Warehouse address differs from factory location |

Require forwarder contract + container loading video |

SourcifyChina Recommendations

- Prioritize factories with UL-certified smart mailbox experience – IoT vulnerabilities caused 22% of 2025 recalls.

- Require 3rd-party inspection (e.g., SGS) for first 3 production runs – Mailbox assembly errors account for 41% of field failures.

- Contract clause: “Supplier warrants direct manufacturing of all structural components. Subcontracting without written consent voids warranty.”

- Avoid suppliers using “mailbox” and “package locker” interchangeably – indicates lack of technical expertise.

“In mailbox procurement, the factory’s coating process is the canary in the coal mine. If they outsource powder coating, corrosion failures are inevitable.” – SourcifyChina Technical Director, 2025

Next Step: Request SourcifyChina’s Mailbox Supplier Pre-Vetted List (Q1 2026) with verified factories meeting all above criteria. [Contact Sourcing Team]

SourcifyChina | Eliminating Supply Chain Risk in China Sourcing Since 2010

Data Sources: SourcifyChina 2025 Mailbox Industry Audit, China General Administration of Market Regulation, UL Compliance Database

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Secure Private Delivery Mailbox Solutions in China

As global supply chains grow more complex and logistics security becomes a top priority, Procurement Managers are increasingly challenged to identify reliable, compliant, and efficient domestic delivery infrastructure in China. One critical yet often overlooked component is access to verified private delivery mailbox providers—a necessity for receiving samples, documentation, and sensitive shipments with discretion, traceability, and full control.

SourcifyChina’s 2026 Verified Pro List: China Private Delivery Mailbox Providers delivers a strategic advantage to global procurement teams by eliminating traditional sourcing bottlenecks and reducing time-to-activation by up to 70%.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All providers undergo rigorous due diligence: business license verification, on-site audits, and service capability validation—eliminating weeks of background checks. |

| Compliance-Ready | Each listed company meets P.R.C. postal regulations and supports international tracking, ensuring legal and secure inbound shipments. |

| Direct English-Speaking Contacts | No translation delays or miscommunication—streamline negotiations and onboarding with responsive, procurement-friendly partners. |

| Exclusive Access | The Pro List includes niche, high-performance mailbox providers not listed on Alibaba or Made-in-China—unavailable through public search. |

| Proven Performance Metrics | Each entry includes verified uptime, average response time, and client satisfaction scores from actual SourcifyChina-managed engagements. |

⏱ Average Time Saved:

Traditional sourcing: 4–6 weeks

Using SourcifyChina Pro List: as little as 7–10 days

Call to Action: Optimize Your China Logistics Infrastructure Now

In 2026, efficiency isn’t just about cost—it’s about speed, security, and supply chain resilience. Waiting to verify mailbox providers slows sample cycles, delays compliance documentation, and increases operational risk.

Don’t leave your inbound logistics to chance.

👉 Contact SourcifyChina Today to request your copy of the 2026 Verified Pro List: China Private Delivery Mailbox Providers and accelerate your procurement timeline with confidence.

- 📧 Email: [email protected]

- 💬 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available to discuss your specific requirements and provide tailored provider recommendations within 24 hours.

SourcifyChina — Your Trusted Gateway to Verified Chinese Suppliers.

Precision. Protection. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.