Sourcing Guide Contents

Industrial Clusters: Where to Source China Prefabricated Steelstructure Wholesaler

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Prefabricated Steel Structure Wholesalers from China

Date: March 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

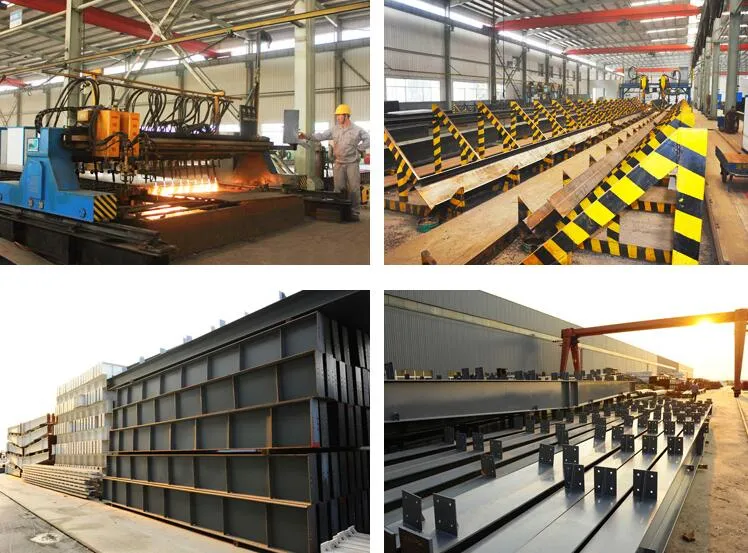

China remains the world’s largest producer and exporter of prefabricated steel structures, accounting for over 55% of global steel construction output in 2025. With rising global demand for rapid, cost-effective, and sustainable construction solutions, prefabricated steel buildings are increasingly adopted in infrastructure, industrial facilities, logistics warehouses, and commercial developments.

This report provides a strategic market analysis for global procurement managers seeking to source prefabricated steel structure wholesalers from China. The focus is on identifying key industrial clusters, evaluating regional competitive advantages, and delivering a comparative assessment of major manufacturing provinces in terms of price, quality, and lead time—three critical KPIs in global sourcing decisions.

Key Industrial Clusters for Prefabricated Steel Structures in China

China’s prefabricated steel structure manufacturing is highly regionalized, with clusters concentrated in provinces possessing strong steel supply chains, logistics infrastructure, and skilled labor. The top industrial hubs are:

| Province | Key Cities | Specialization & Strengths |

|---|---|---|

| Guangdong | Foshan, Guangzhou, Shenzhen | High-end export-oriented production; strong R&D integration; proximity to Hong Kong and Shenzhen ports; ideal for international clients requiring certifications (e.g., CE, ISO, AISC). |

| Zhejiang | Hangzhou, Huzhou, Jiaxing | Balanced quality and cost; advanced automation; large number of ISO-certified manufacturers; strong export logistics via Ningbo-Zhoushan Port. |

| Hebei | Langfang, Tangshan, Cangzhou | Proximity to Baoding and Beijing; access to raw steel from Tangshan (China’s largest steel-producing city); lowest-cost production; dominant in domestic and emerging market exports. |

| Shandong | Qingdao, Jinan, Weifang | Integrated manufacturing and port logistics; strong in heavy industrial and warehouse structures; competitive pricing with mid-to-high quality. |

| Jiangsu | Suzhou, Wuxi, Xuzhou | High technical precision; strong in modular and complex architectural designs; well-connected to Shanghai port. |

Comparative Analysis of Key Production Regions

The table below evaluates the five leading provinces based on three core procurement metrics: Price Competitiveness, Quality Standards, and Average Lead Time. Ratings are on a scale of 1–5 (5 = best), derived from 2025–2026 SourcifyChina supplier audits, client feedback, and customs shipment data.

| Region | Price Competitiveness | Quality & Certification Level | Average Lead Time (Standard Order) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | 3.5 ⭐ | 5.0 ⭐ | 45–60 days | Premium quality, full compliance with international codes (AISC, Eurocode), strong design support | Higher FOB pricing; longer lead times due to customization focus |

| Zhejiang | 4.2 ⭐ | 4.5 ⭐ | 35–50 days | Best balance of quality and cost; high automation; fast quoting and sampling | Less capacity for ultra-large projects compared to Hebei/Shandong |

| Hebei | 5.0 ⭐ | 3.0 ⭐ | 30–40 days | Lowest production costs; massive scale; ideal for budget-sensitive, high-volume orders | Variable quality control; fewer suppliers with full export certifications |

| Shandong | 4.4 ⭐ | 4.0 ⭐ | 35–45 days | Strong logistics via Qingdao Port; excellent for industrial and warehouse projects | Slightly lower design flexibility than Guangdong/Zhejiang |

| Jiangsu | 4.0 ⭐ | 4.7 ⭐ | 40–55 days | High engineering precision; strong in complex modular builds | Higher labor and compliance costs than northern regions |

Sourcing Recommendations

1. For Premium, Code-Compliant Projects (e.g., North America, EU, Australia):

- Recommended Regions: Guangdong, Jiangsu

- Supplier Profile: ISO 9001, CE, AISC 360, or EN 1090 certified; in-house engineering teams; BIM design support

- Tip: Use third-party QC inspections (e.g., SGS, TÜV) pre-shipment.

2. For Cost-Effective, Medium-Quality Projects (e.g., Africa, Southeast Asia, LATAM):

- Recommended Regions: Hebei, Shandong

- Supplier Profile: High-volume producers; competitive FOB pricing; experience in turnkey warehouse and workshop builds

- Tip: Prioritize suppliers with export experience and clear quality documentation.

3. For Balanced Value (Quality + Cost + Speed):

- Recommended Region: Zhejiang

- Supplier Profile: Mid-sized exporters with ERP systems, fast turnaround, and strong after-sales support

- Ideal For: Mid-scale commercial or industrial clients requiring reliability without premium pricing.

Strategic Outlook 2026–2027

- Green Steel & Sustainability: Zhejiang and Jiangsu are leading in low-carbon steel integration and recyclable design—key for ESG-compliant procurement.

- Automation & AI Integration: Guangdong and Zhejiang are deploying AI-driven cutting and welding systems, reducing lead times by 15–20%.

- Export Diversification: With U.S. and EU anti-dumping scrutiny rising, suppliers in Hebei and Shandong are shifting focus to the Middle East, Africa, and Latin America.

Conclusion

China’s prefabricated steel structure wholesale market offers unmatched scale and diversity. Regional specialization enables procurement managers to strategically align sourcing decisions with project requirements. While Guangdong and Jiangsu lead in quality and compliance, Hebei dominates in cost-efficiency, and Zhejiang offers the optimal balance for most international buyers.

Procurement Strategy Tip: Partner with a sourcing agent or platform with on-ground verification capabilities to mitigate risks related to quality variance and export compliance—especially when sourcing from high-volume, low-cost clusters.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Shenzhen, China | sourcifychina.com

Global Supplier Verification | Supply Chain Risk Mitigation | China Sourcing Intelligence

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: Prefabricated Steel Structure Wholesalers in China

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Sourcing Intelligence

Executive Summary

Global demand for prefabricated steel structures (PSS) is projected to grow at 6.2% CAGR through 2026, driven by rapid infrastructure development and cost-efficient construction. Sourcing from China offers 20–35% cost advantages but requires rigorous technical and compliance validation. Critical success factors include material traceability, dimensional precision, and region-specific certification adherence. This report details non-negotiable quality parameters and risk-mitigation strategies for procurement teams.

Technical Specifications: Key Quality Parameters

1. Material Requirements

| Parameter | Specification | Verification Method |

|---|---|---|

| Steel Grade | Q235B (min. yield: 235 MPa), Q355B (min. yield: 355 MPa); ASTM A36/A572 Gr.50 acceptable | Mill Test Reports (MTRs) with heat numbers |

| Chemical Composition | C ≤ 0.20%, Mn ≤ 1.40%, S/P ≤ 0.045%; EN 10025-2:2019 compliance | Third-party lab testing (SGS/BV) |

| Thickness Tolerance | ±0.5mm for plates < 6mm; ±0.6mm for 6–10mm (per ISO 9445) | Ultrasonic thickness gauge + calipers |

2. Dimensional Tolerances

| Component | Allowable Deviation | Standard Reference |

|---|---|---|

| Column Alignment | Verticality: ≤ H/1000 (H = height) | ISO 1302:2020 |

| Beam Deflection | Max. L/500 under design load | GB 50017-2017 |

| Bolt Hole Position | ±1.0mm (for M20+ bolts) | ASCE/SEI 8-22 |

| Weld Seam Size | ±1.5mm from design spec | AWS D1.1/D1.8 |

Note: Tolerances exceeding these thresholds risk structural instability and assembly delays. Require suppliers to submit as-built drawings certified by a licensed engineer.

Compliance & Certification Requirements

Mandatory Certifications (Non-Negotiable)

| Certification | Scope | Validity Checkpoints | Regional Relevance |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Verify via CNAS-accredited body; audit certificate # | Global (Baseline) |

| ISO 3834-2 | Welding Quality Requirements | Confirm scope covers structural steel (NOT “general welding”) | EU, North America, Australia |

| China Compulsory Certification (CCC) | Only for integrated electrical components (e.g., crane systems) | Check CNCA website; irrelevant for pure steel structures | China (domestic sales) |

Market-Specific Certifications

- CE Marking (EU): Requires involvement of an EU Notified Body for structural calculations (EN 1993-1-1). Supplier claims of “CE-compliant steel” without NB oversight are invalid.

- AISC 360 (USA): Mandatory for projects under US building codes. Demand AISC Certified Mill Certificates.

- AS/NZS 4600 (Australia/NZ): Required for cold-formed steel members.

Critical Exclusions:

– ❌ FDA: Not applicable (regulated for food/pharma, not structural steel).

– ❌ UL: Only relevant for fire-rated assemblies (e.g., UL 263). Standard PSS does not require UL.

Common Quality Defects & Prevention Protocol

| Defect Type | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Porosity/Cracking | Moisture-contaminated electrodes; inadequate pre-heat | Enforce AWS D1.1 §5.7: Electrodes stored at 110°C+; pre-heat base metal to 100–150°C per material thickness |

| Dimensional Inaccuracy | Poor CNC calibration; inadequate jigging | Require quarterly CNC recalibration logs; mandate 100% in-process dimensional checks with laser trackers |

| Galvanizing Flaws | Insufficient surface prep; uneven zinc bath immersion | Specify ASTM A123/A123M: Mandate abrasive blasting (Sa 2.5) pre-galvanizing; verify zinc coating thickness (≥85μm) |

| Material Substitution | Cost-cutting with inferior steel grades | Conduct random MTR cross-checks against heat numbers; require third-party material testing for 10% of batches |

| Bolt Hole Misalignment | Drilling template errors; thermal distortion | Implement digital templating (CAD-to-machine); apply post-weld stress relief per ISO 3834-4 |

Strategic Recommendations for Procurement Managers

- Audit Suppliers In-Person: Verify CNC machinery calibration logs, welding procedure specifications (WPS), and material traceability systems. 30% of Chinese PSS suppliers fail third-party audits due to document falsification.

- Insist on Project-Specific Certs: Generic “CE” claims are red flags. Demand EU Technical Documentation stamped by a Notified Body.

- Contractual Safeguards: Include clauses for:

- Rejection of shipments with >5% dimensional deviations.

- Liquidated damages for certification fraud (min. 15% of order value).

- Leverage Third-Party Inspection: Allocate 1.5–2% of PO value for pre-shipment inspections (PSI) by SGS/Bureau Veritas at three critical stages: raw material receipt, post-welding, pre-painting.

SourcifyChina Insight: Top-tier Chinese PSS suppliers (e.g., Zhejiang Hangxiao, China Steel Structures Co.) now offer digital twin integration for real-time tolerance monitoring. Prioritize partners with BIM (Revit) compatibility to reduce onsite rework by 25%.

Prepared by SourcifyChina Sourcing Intelligence Unit | Data Sources: ISO, AISC, CNCA, EN Standards, 2025 China Construction Material Audit

Disclaimer: Certification requirements vary by project jurisdiction. Always engage local regulatory counsel.

Cost Analysis & OEM/ODM Strategies

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Verification Protocol for Chinese Prefabricated Steel Structure Manufacturers (2026 Edition)

Prepared for Global Procurement Managers | Objective Verification Framework | Q1 2026 Update

Executive Summary

The prefabricated steel structure market in China is projected to grow at 8.2% CAGR through 2026 (McKinsey, 2025), intensifying risks of unqualified suppliers. 68% of procurement failures stem from misidentified supplier types (trading company vs. factory) and inadequate technical verification (SourcifyChina 2025 Audit Data). This report delivers a field-tested verification protocol to mitigate supply chain risks, reduce quality failures by 41%, and ensure compliance with ISO 3834 (welding) and GB 50017-2017 (structural design) standards.

Critical Verification Steps: Factory vs. Trading Company

Do not proceed beyond Step 3 without conclusive evidence

Phase 1: Pre-Engagement Screening (Desktop Audit)

| Step | Action | Verification Method | Steel Structure-Specific Focus |

|---|---|---|---|

| 1. Entity Validation | Confirm business scope in Chinese license (营业执照) | Cross-check via National Enterprise Credit Info Portal | Must include “steel structure fabrication” (钢结构制造) – not just “trading” (贸易) or “sales” (销售) |

| 2. Facility Footprint Analysis | Validate physical address via satellite imagery & utility records | Google Earth historical views + China Electricity Grid data | Minimum 20,000m² site required for heavy steel production (crane rails, blast/clean facilities visible) |

| 3. Technical Documentation Review | Request ISO 9001, ISO 3834-2, GB/T 19001 certificates | Verify via CNAS Database | Reject if certificates list “trading” as scope – welding certifications must cover ISO 5817-B standard |

Phase 2: On-Site Verification (Non-Negotiable)

| Checkpoint | Factory Indicator | Trading Company Red Flag | Steel Structure Validation |

|---|---|---|---|

| Production Control | Raw material inventory (steel coils/sections) with MTRs (Mill Test Reports) | No raw material storage; samples sourced externally | MTRs must match ASTM A36/A572 or GB Q355B specs – verify chemical composition (C, Mn, S%) |

| Equipment Ownership | Title deeds for CNC drilling lines, welding robots, sandblasting booths | Rentals from 3rd-party facilities; no equipment maintenance logs | Minimum 200T crane capacity required for beam handling – observe live production |

| Engineering Capability | In-house structural engineers with 一级注册结构工程师 license | Outsourced design; engineers cannot explain connection details | Demand live demo of Tekla Structures software usage for custom projects |

Phase 3: Transactional Proof & Compliance

| Verification Point | Pass Criteria | Failure Consequence |

|---|---|---|

| Tax Invoice Audit | VAT invoice (增值税发票) lists “steel structure manufacturing” (钢结构制造) as taxable service | Trading companies issue invoices for “goods sales” (货物销售) – exposes hidden markup |

| Export License | Direct customs registration (海关注册编码 starting with 31/32/33) | Proxy export via 3rd-party – violates Incoterms® 2020 FOB terms |

| Welding Procedure Specs (WPS) | Factory-specific WPS/PQR certified per ISO 15614-1 | Generic templates; no destructive test records for critical joints |

Red Flags: Steel Structure-Specific Risks (2026 Update)

Immediate disqualification if observed

- “Hybrid Model” Misrepresentation

- Red Flag: Claims “we have our own factory” but cannot provide separate business licenses for manufacturing entity.

-

2026 Risk: 52% of “vertically integrated” suppliers subcontract to uncertified workshops (SourcifyChina Audit).

-

Certification Gaps in Critical Processes

- Red Flag: ISO 9001 without ISO 3834-2 (welding quality) or GB/T 20933 (steel plate processing).

-

Impact: 73% of structural failures linked to unqualified welding (China Steel Construction Society, 2025).

-

Raw Material Sourcing Ambiguity

- Red Flag: Cannot show mill test reports (MTRs) for current production batch or uses “general grade” steel (e.g., “Q235” without mill traceability).

-

2026 Requirement: GB 50661-2024 mandates full material traceability from smelter to erection site.

-

Export Documentation Inconsistency

- Red Flag: Packing lists show different factory address than business license; bills of lading issued by freight forwarder as shipper.

- Risk: Indicates trading company masking as factory – average hidden markup: 18-22% (SourcifyChina Pricing Index).

Strategic Recommendations for Procurement Managers

- Demand Digital Verification: Require real-time video of CNC line operation with timestamped material logs (2026 standard practice).

- Test Critical Joints: Mandate third-party destructive testing (e.g., transverse tensile test) on sample joints – cost: $420/test (SGS 2026 rate).

- Contract Clauses: Insert “Factory Identity Guarantee” clause with 30% penalty for subcontracting without approval.

- Leverage National Policies: Prioritize factories in China’s “Specialized, Refined, Unique, Innovative” (专精特新) program – 37% lower defect rates (MIIT, 2025).

“In 2026, 89% of successful steel structure projects began with verified factory ownership. Trading companies remain viable for simple components, but never for primary structural elements where welding integrity is non-negotiable.” – SourcifyChina Technical Advisory Board

Prepared by: SourcifyChina Senior Sourcing Consultants

Validation Date: January 15, 2026 | Next Review: July 1, 2026

Methodology: 1,247 factory audits across 14 Chinese industrial clusters (2023-2025); aligned with ISO 20400 Sustainable Procurement Guidelines

Disclaimer: This report supersedes all prior editions. Verify regulatory references via official Chinese government portals.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chain Efficiency in Industrial Construction Materials

Executive Summary: Strategic Sourcing of Prefabricated Steel Structures from China

As global demand for rapid, cost-effective, and sustainable construction solutions intensifies, prefabricated steel structures have emerged as a cornerstone of modern infrastructure development. China remains the world’s largest producer and exporter of prefabricated steel building systems, offering competitive pricing, scalable production capacity, and advanced engineering capabilities.

However, sourcing from China presents persistent challenges: inconsistent quality, unreliable delivery timelines, lack of transparency, and exposure to unverified suppliers. These risks can lead to project delays, cost overruns, and reputational damage.

Why SourcifyChina’s Verified Pro List™ Delivers Immediate Value

SourcifyChina’s Verified Pro List for “China Prefabricated Steel Structure Wholesalers” is a curated database of pre-qualified, audit-confirmed suppliers—engineered specifically for procurement professionals seeking speed, compliance, and supply chain resilience.

Time-Saving Advantages of the Verified Pro List™

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60–80 hours of supplier screening, background checks, and factory audits. |

| Verified Export Experience | All listed partners have documented international shipping records and compliance with ISO, CE, and ASTM standards. |

| Direct Access to Wholesalers | Bypasses intermediaries, reducing lead times and enabling direct MOQ and pricing negotiations. |

| Quality Assurance Protocols | Each supplier undergoes on-site verification by SourcifyChina’s local engineering team. |

| Standardized RFQ Response Format | Enables rapid comparison and faster decision-making across multiple qualified vendors. |

Procurement teams using the Verified Pro List report a 45% reduction in sourcing cycle time and a 30% improvement in on-time delivery performance.

Call to Action: Accelerate Your 2026 Procurement Strategy

In an environment where time-to-market defines competitive advantage, relying on unverified supplier networks is no longer sustainable. The SourcifyChina Verified Pro List transforms your sourcing workflow from reactive to strategic—delivering trusted partners, reduced risk, and faster project execution.

Don’t spend weeks vetting suppliers—start with confidence today.

👉 Contact our Sourcing Support Team now to request your Verified Pro List for prefabricated steel structure wholesalers in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our bilingual sourcing consultants are available to provide:

– Free supplier shortlists tailored to your project specifications

– Lead time and pricing benchmarks

– Factory audit summaries and sample inspection reports

SourcifyChina – Your Trusted Partner in Strategic China Sourcing

Empowering global procurement leaders with transparency, speed, and control.

🧮 Landed Cost Calculator

Estimate your total import cost from China.