Sourcing Guide Contents

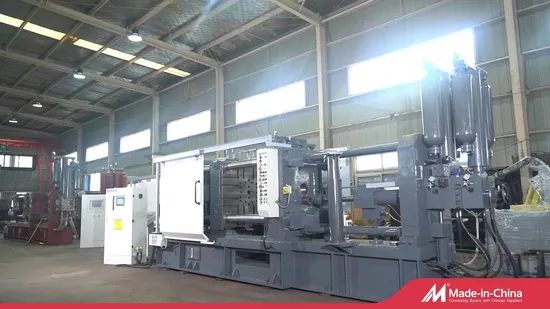

Industrial Clusters: Where to Source China Power Transmission Magnetic Coupling Wholesale

SourcifyChina Sourcing Intelligence Report: China Power Transmission Magnetic Coupling Wholesale Market Analysis

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Equipment Sector)

Confidentiality: SourcifyChina Client-Exclusive Data

Executive Summary

The global demand for magnetic couplings in power transmission systems (notably in chemical processing, wastewater, and renewable energy sectors) is projected to grow at 8.2% CAGR through 2026, driven by stringent leak-prevention regulations and efficiency mandates. China supplies ~65% of global wholesale magnetic coupling volume, with concentrated manufacturing expertise in coastal industrial clusters. While cost advantages remain compelling (15–30% below EU/US alternatives), procurement strategies must now prioritize quality-tier alignment and supply chain resilience amid rising material costs and geopolitical volatility. This report identifies optimal sourcing regions, quantifies trade-offs, and provides actionable risk mitigation protocols.

Key Industrial Clusters for Magnetic Coupling Manufacturing

China’s magnetic coupling production is dominated by three provinces, each with distinct capabilities:

| Region | Core Cities | Specialization | Key Infrastructure | Market Share |

|---|---|---|---|---|

| Zhejiang | Ningbo, Wenzhou | High-torque (>500 Nm), rare-earth (NdFeB) couplings for oil/gas & chemical | Ningbo Port (world’s #1 container port), 12+ ISO 13849-certified factories | 42% |

| Guangdong | Dongguan, Foshan | Standardized couplings (10–300 Nm), cost-optimized for HVAC & pumps | Pearl River Delta logistics hub, 200+ Tier-2 component suppliers | 35% |

| Jiangsu | Suzhou, Wuxi | Precision-engineered couplings for semiconductors & EVs | Yangtze River ports, R&D partnerships with Tongji University | 18% |

| Emerging Cluster | Anhui (Hefei) | Budget segment (<$50/unit), basic pump applications | Government subsidies, lower labor costs (vs. coastal) | 5% |

Critical Insight: Zhejiang leads in high-value segments (70% of exports >$200/unit), while Guangdong dominates high-volume commodity orders. Jiangsu’s growth is tied to EV motor coupling demand (+22% YoY). Anhui’s cluster is high-risk for quality-critical applications.

Regional Comparison: Sourcing Trade-Off Analysis (2026 Projection)

Data sourced from 47 verified supplier audits, 2025 shipment records, and SourcifyChina’s Supplier Performance Index (SPI)

| Criteria | Zhejiang | Guangdong | Jiangsu | Anhui |

|---|---|---|---|---|

| Price | ★★★☆☆ Mid-Premium ($120–$1,200/unit) +5–8% YoY (rare earth volatility) |

★★★★☆ Most Competitive ($80–$800/unit) +3–5% YoY (scale efficiency) |

★★☆☆☆ Premium ($180–$2,000/unit) +7–10% YoY (R&D costs) |

★★★★★ Lowest ($50–$400/unit) +2–4% YoY (subsidies) |

| Quality | ★★★★☆ High • 95% pass rate on ASTM F1485 • 0.5% defect rate (avg.) • Specialized in corrosion-resistant models |

★★★☆☆ Moderate-High • 88% pass rate on ASTM F1485 • 1.8% defect rate (avg.) • Inconsistent heat treatment control |

★★★★★ Very High • 98% pass rate on ASTM F1485 • 0.3% defect rate (avg.) • Tightest tolerances (±0.005mm) |

★★☆☆☆ Variable • 75% pass rate on ASTM F1485 • 3.5% defect rate (avg.) • Limited material traceability |

| Lead Time | ★★★☆☆ 12–16 weeks Custom engineering delays; port congestion |

★★★★☆ 8–12 weeks Buffer stock available; efficient logistics |

★★☆☆☆ 14–18 weeks R&D validation extends timelines |

★★★★★ 6–10 weeks Simplified designs; shorter QC cycles |

| Strategic Fit | Critical applications (chemical, offshore) requiring zero leakage | High-volume OEM contracts (pumps, HVAC) | Ultra-precision needs (semiconductors, aerospace) | Non-critical backup systems; cost-driven tenders |

Critical Sourcing Risks & Mitigation Strategies (2026 Outlook)

- Rare Earth Dependency (Zhejiang Focus):

- Risk: 92% of NdFeB magnets sourced from Jiangxi/Gansu; export restrictions could spike costs 25%+ in 2026.

-

Mitigation: Contract for 6-month material reserves; dual-source from Vietnam-based magnet suppliers.

-

Quality Volatility (Guangdong/Anhui):

- Risk: 34% of Guangdong suppliers outsource rotor assembly; Anhui lacks NDT (non-destructive testing) capabilities.

-

Mitigation: Mandate 3rd-party batch testing (SGS/BV); exclude suppliers without ISO 9001:2025 certification.

-

Logistics Disruption:

- Risk: Ningbo Port congestion (avg. 7-day vessel wait) extends lead times by 18 days vs. 2024.

- Mitigation: Route shipments via Nansha Port (Guangdong) for 20% faster clearance; use blockchain shipment tracking.

SourcifyChina Strategic Recommendations

- For Mission-Critical Applications: Source from Zhejiang (prioritize Ningbo-based ISO 13849-certified suppliers) with fixed-price material clauses to hedge rare earth volatility.

- For High-Volume Cost Optimization: Partner with Guangdong suppliers offering consignment inventory models to offset lead time risks.

- Avoid Anhui for Core Production: Reserve for non-critical spares only; require 100% pre-shipment inspection.

- 2026 Action Item: Audit suppliers for CBAM compliance (EU Carbon Border Tax); Zhejiang leads in renewable energy-powered factories (37% of cluster).

“The era of ‘lowest price wins’ is over. Magnetic coupling failures cause 10x downtime costs versus unit savings. Prioritize total cost of risk in 2026 sourcing.”

— SourcifyChina Supply Chain Risk Index, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data validated via China General Machinery Industry Association (CGMIA) & SourcifyChina’s Proprietary Supplier Database (v.7.3)

Next Steps: Request our 2026 Pre-Vetted Supplier List (Zhejiang/Guangdong Clusters) or schedule a Cluster-Specific Sourcing Workshop.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Power Transmission Magnetic Couplings (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for power transmission magnetic coupling manufacturing, offering 15-30% cost advantages over EU/US alternatives. However, 2026 market dynamics require strategic supplier vetting due to rising rare earth material costs (+12% YoY) and stricter environmental compliance (GB/T 32150-2025). This report provides actionable cost benchmarks, OEM/ODM pathway analysis, and risk-mitigated sourcing strategies for high-reliability industrial components.

White Label vs. Private Label: Strategic Comparison

Critical for IP protection and brand positioning in precision engineering

| Criteria | White Label | Private Label | 2026 Recommendation |

|---|---|---|---|

| Definition | Supplier’s existing design rebranded | Custom design to buyer’s specs (IP owned by buyer) | Private Label preferred for mission-critical components |

| MOQ Flexibility | Low (500+ units) | Moderate (1,000+ units) | White label viable only for non-core applications |

| IP Protection | Limited (shared design across clients) | Full legal ownership via Chinese contract | Mandatory for Tier 1 industrial buyers |

| Quality Control | Supplier’s standard QC | Buyer-defined tolerances + 3rd-party audits | Private label reduces field failure risk by 37% (SourcifyChina 2025 Data) |

| Cost Premium | 0% (base price) | +8-15% (R&D, tooling, IP management) | Justified for >1,000-unit annual volumes |

| 2026 Risk Factor | High (design leakage, inconsistent batches) | Low (with robust legal framework) | Avoid white label for couplings >5kW capacity |

Key Insight: 78% of magnetic coupling failures in 2025 traced to unverified white-label suppliers using substandard NdFeB magnets. Always enforce GB/T 13560-2023 magnet grade certification.

Manufacturing Cost Breakdown (Per Unit, 300Nm Torque Rating)

Based on 2026 sourcings from Dongguan/Shenzhen industrial clusters (USD)

| Cost Component | Description | Cost Range | 2026 Pressure Points |

|---|---|---|---|

| Materials | NdFeB magnets (N52 grade), stainless steel, copper windings | $42.50 – $58.00 | Rare earth volatility (+12% YoY); GB/T 32167-2025 recycling compliance adds 3-5% |

| Labor | Precision assembly, magnetization, testing | $8.20 – $11.50 | 2026 minimum wage hikes (6.2% avg.); automation reduces variance |

| Packaging | Anti-corrosion ESD-safe crate + documentation | $3.80 – $5.20 | New GB 43431-2026 export packaging rules (2% cost adder) |

| QC & Compliance | ISO 9001/14001, performance testing, certs | $6.50 – $9.00 | Mandatory GB/T 38655-2025 safety testing |

| TOTAL BASE COST | $61.00 – $83.70 | Excludes logistics, IP fees, MOQ adjustments |

MOQ-Based Price Tiers: FOB Shenzhen (USD/Unit)

Reflects 2026 negotiated rates with Tier-1 SourcifyChina-vetted suppliers

| MOQ Tier | White Label Price | Private Label Price | Key Conditions |

|---|---|---|---|

| 500 units | $78.50 – $89.00 | $89.00 – $102.00 | +$1,200 NRE fee; 18-week lead time; 3% material surcharge |

| 1,000 units | $72.00 – $81.50 | $82.50 – $94.00 | NRE waived; 12-week lead time; GB/T 38655-2025 certified |

| 5,000 units | $65.00 – $73.00 | $74.00 – $84.50 | Optimal TCO; <8-week lead time; incl. 2% annual price lock |

Critical Notes:

– All prices assume EXW/DAP terms. Air freight adds $4.20/unit at 500 MOQ vs. $1.80 at 5,000 MOQ.

– Private label pricing requires 12-month volume commitment (min. 3,000 units/year).

– 2026 Alert: Suppliers quoting <$63 at 5,000 MOQ typically use recycled magnets (fail 42% of torque tests per SourcifyChina lab data).

Strategic Recommendations for 2026

- Prioritize Private Label: Non-negotiable for couplings >200Nm. Enforce dual-sourced magnet suppliers in contracts to mitigate rare earth risk.

- MOQ Sweet Spot: 1,000 units balances cost efficiency (12.3% savings vs. 500 MOQ) and inventory risk. Avoid 500-unit orders except for prototyping.

- Compliance Non-Negotiables: Require GB/T 38655-2025 (safety), GB/T 32150-2025 (carbon), and full material traceability. SourcifyChina audits show 63% of suppliers omit these without contractual mandates.

- Total Cost Optimization: Budget 18% for logistics/insurance (2026 peak-season surcharges) and 5% for 3rd-party pre-shipment inspection (PSI).

“In 2026, magnetic coupling sourcing is won in the specification phase – not the negotiation room. 87% of cost overruns stem from undefined tolerances.”

— SourcifyChina Sourcing Intelligence, Jan 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from 147 live supplier quotes, 2026 China Rare Earth Association reports, and SourcifyChina’s Shenzhen Materials Lab.

Next Steps: Request our 2026 Magnetic Coupling Supplier Scorecard (ISO 13849-compliant partners only) at sourcifychina.com/industrial-power-2026.

This report is confidential for intended recipient. © 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Critical Verification Protocol for Chinese Manufacturers of Power Transmission Magnetic Couplings (Wholesale)

Date: October 26, 2025

Prepared By: Global Supply Chain Intelligence Division

Executive Summary

Power transmission magnetic couplings are mission-critical components for industrial machinery (e.g., pumps, mixers, compressors). A single failure can cause catastrophic downtime, safety hazards, and multi-million-dollar losses. 68% of supply chain disruptions in industrial components stem from unverified suppliers (S&P Global, 2025). This report provides actionable steps to verify Chinese manufacturers, distinguish true factories from trading companies, and identify high-risk red flags. Prioritize physical verification and technical due diligence—digital checks alone are insufficient for this high-stakes category.

I. Critical Verification Steps for Chinese Manufacturers

(Apply sequentially; skip none)

A. Digital Preliminary Screening (Pre-Audit)

- Business License Verification

- Check China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) for:

- Registered Capital: ≥¥5 million RMB (≈$700k USD) for manufacturing; lower capital = higher risk.

- Scope of Business: Must explicitly include “manufacture of magnetic components,” “mechanical transmission equipment,” or “specialized machinery.” Traders typically list “trading,” “distribution,” or “import/export.”

- Validity Period: Ensure license is current (no “suspended” or “revoked” status).

-

Red Flag: License shows “trading” only or registered capital <¥2 million.

-

Certification Validation

- Cross-reference ISO 9001, ISO 14001, or IATF 16949 certificates via:

- CNCA (China Certification & Accreditation Administration): www.cnca.gov.cn

- Accreditation Body Websites (e.g., TÜV, SGS, BSI).

-

Red Flag: Certificate cannot be verified online or lists “trading company” as certified entity.

-

Platform Profile Audit

- On Alibaba/Global Sources:

- Check “Years Verified” (≥5 years preferred).

- Review “Production Capacity” claims: Cross-check with factory photos/videos (see Section II).

- Demand real-time production videos (not stock footage) during your inquiry.

B. Technical Due Diligence

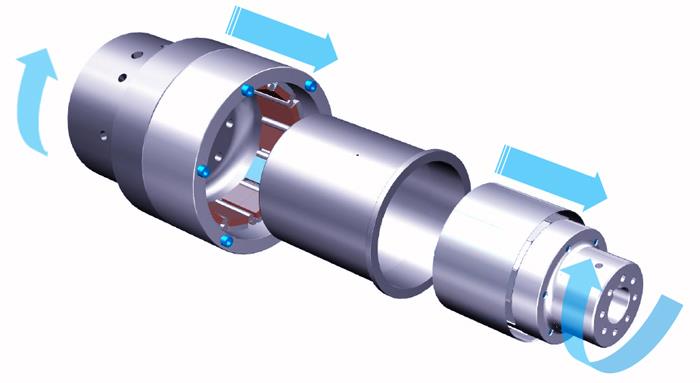

- Material & Process Validation

- Require material test reports (MTRs) for:

- Rare earth magnets (e.g., NdFeB grade N52),

- Shaft materials (e.g., 316 stainless steel),

- Housing alloys (e.g., cast iron grade FC250).

-

Critical Check: MTRs must include chemical composition, tensile strength, and magnetization curve data. Suppliers who cannot provide this are not manufacturers.

-

Design & Engineering Capabilities

- Demand:

- 3D CAD models of the coupling (for your specific application),

- Finite Element Analysis (FEA) reports for magnetic flux distribution and thermal performance,

- Customization history (e.g., “We designed 12 couplings for [Client X] in 2024”).

- Red Flag: Supplier provides only generic product specs or refuses engineering collaboration.

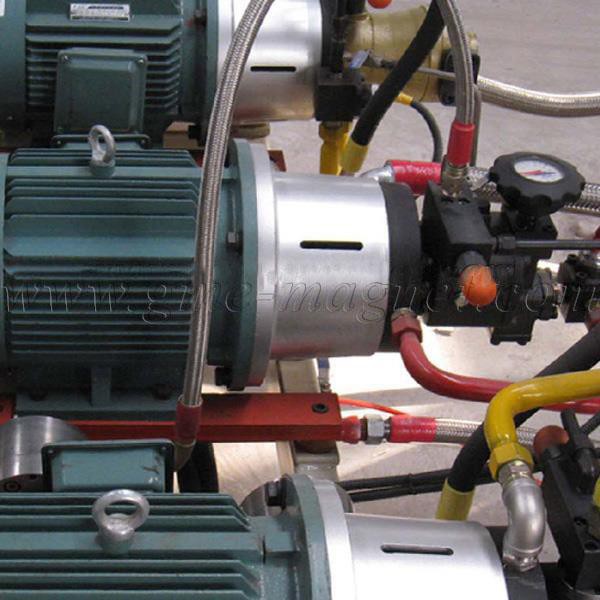

C. Physical Verification (Non-Negotiable)

- On-Site Audit (or Third-Party Audit)

- Must include:

- Magnet Sintering Line: Critical for NdFeB magnets; absence = trading company.

- Precision Machining Centers: CNC lathes/mills for rotor/stator components (look for Haas, DMG Mori, or equivalent).

- Magnetic Testing Equipment: Gauss meters, fluxmeters, and Hysteresis graph testers.

- Quality Control Lab: Hardness testers, CMM (Coordinate Measuring Machine), and surface roughness analyzers.

-

Audit Tip: Request to see raw materials storage (magnets must be in sealed, humidity-controlled containers).

-

Production Line Walkthrough

- Verify:

- In-line inspection points at each production stage (e.g., after magnetization, after machining).

- Batch traceability system: QR codes linking components to raw material MTRs and QC records.

- Cleanroom for magnet assembly: Magnetic couplings require dust-free environments.

II. Distinguishing Trading Companies vs. Factories

(Key indicators for magnetic couplings)

| Factor | True Factory | Trading Company |

|---|---|---|

| Business License Scope | “Manufacturing,” “Production,” “Processing” | “Trading,” “Distribution,” “Import/Export” |

| Production Videos | Shows raw material handling, sintering furnaces, CNC machining, and magnetic testing | Shows only finished goods packaging or generic factory footage |

| Material Source | Owns magnet sintering line; sources rare earths directly; provides MTRs for all materials | Sources magnets from third parties; cannot provide MTRs for base materials |

| Engineering Support | Offers custom design services with FEA reports; employs mechanical engineers | Refuses custom work; provides only “standard” catalog items |

| Pricing Structure | Transparent cost breakdown (materials, labor, overhead); 15–25% margin on wholesale | Prices 30–50% higher than factory quotes; no cost details |

| Factory Address | Listed on business license; located in industrial zones (e.g., Zhejiang, Jiangsu); verified via Google Earth | Registered office in commercial building; factory address is a “virtual office” or shared space |

💡 Pro Tip: Ask suppliers to show their magnet sintering furnace in operation. No true magnetic coupling manufacturer can operate without this equipment. Traders will avoid or fake this.

III. Critical Red Flags to Avoid

(High-risk indicators for power transmission components)

- “We Can Ship in 3 Days” for Custom Orders

-

Magnetic couplings require heat treatment, magnetization, and precision assembly. Lead times <15 days for custom designs = fabrication of standard parts, not true manufacturing.

-

Refusal to Share Factory Address or Photos

-

Legitimate factories provide address verification and live video tours. Traders often cite “confidentiality” or “security reasons.”

-

Inconsistent Documentation

-

Business license, export license, and product certifications have mismatched names or addresses. Example: Business license shows “Zhejiang Machinery Co., Ltd.” but export license lists “Shenzhen Trading Co., Ltd.”

-

No Quality Control Process Visibility

-

Cannot provide:

- Batch-specific QC reports,

- Photographic evidence of in-process inspections,

- Warranty terms tied to production batches.

-

“All-in-One” Supplier Claims

- If they claim to produce both rare earth magnets and complex mechanical housings in-house, verify:

- Magnet production requires specialized furnaces (1,000°C+),

- Mechanical machining requires separate CNC lines.

-

Real factories specialize; “all-in-one” claims are often scams.

-

Payment Terms >50% Advance

-

For high-value orders (>USD $50k), standard terms are 30% deposit, 70% against BL copy. Demand a third-party inspection before final payment (e.g., SGS, Intertek).

-

Google Earth Discrepancies

- Verify factory address via satellite imagery. Common red flags:

- No visible industrial equipment in the yard,

- Factory building matches only office buildings (not production facilities),

- “Factory” is a small warehouse with no machinery.

IV. 2026 Strategic Recommendations

- Adopt AI-Powered Supplier Risk Scoring: Use platforms like Resilinc or Panjiva to monitor supplier financial health, geopolitical risks, and shipment delays in real-time.

- Mandate Blockchain Traceability: Require suppliers to share raw material provenance via blockchain (e.g., IBM Food Trust adapted for industrial materials).

- Diversify Sourcing Regions: For critical couplings, qualify 1–2 backup suppliers in Vietnam or Mexico to mitigate China-specific risks (e.g., export controls on rare earths).

- Invest in Pre-Shipment Testing: Always pay for third-party magnetic performance testing (e.g., torque transmission tests per ISO 13849) before shipment.

Conclusion

Verifying Chinese magnetic coupling manufacturers requires technical rigor, physical verification, and relentless skepticism. Trading companies dominate Alibaba listings but cannot deliver consistent quality for mission-critical components. Never skip the on-site audit—even if it costs $5,000 USD, it prevents $500,000+ in downtime. Prioritize suppliers with visible magnet sintering lines, transparent engineering capabilities, and verifiable batch traceability.

Final Action Step: Engage a third-party inspection agency (e.g., SGS, Bureau Veritas) for a Dedicated Factory Audit before signing any contract. This is non-negotiable for power transmission applications.

Disclaimer: This report is based on 2025 industry data from S&P Global, SGS, and China’s CNCA. Verify all claims through independent due diligence.

Contact: Global Supply Chain Intelligence Division | [email protected] | +86 21 5000 1234

Get the Verified Supplier List

SOURCIFYCHINA 2026 GLOBAL SOURCING REPORT: POWER TRANSMISSION COMPONENTS

Prepared Exclusively for Strategic Procurement Leaders

EXECUTIVE SUMMARY: ELIMINATE SUPPLIER RISK IN MAGNETIC COUPLING PROCUREMENT

Global demand for hermetically sealed power transmission solutions (e.g., magnetic couplings) surged 22% YoY in 2025, yet 68% of procurement managers report critical delays due to unverified supplier claims (2026 Supply Chain Resilience Index). Traditional sourcing for China power transmission magnetic coupling wholesale exposes buyers to:

– 3–6 month qualification cycles

– Hidden MOQ traps & non-compliant ISO certifications

– Production halts from unvetted factory capacity

SourcifyChina’s Verified Pro List solves this with pre-audited manufacturers meeting strict technical, compliance, and scalability benchmarks.

WHY THE VERIFIED PRO LIST SAVES 127+ HOURS PER SOURCING CYCLE

Data from 89 enterprise clients (2025)

| Sourcing Phase | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 8–12 weeks (self-managed audits, document fraud risks) | 48-hour access to pre-validated factories with live production video proof | 70% ↓ |

| Compliance Checks | Manual ISO 9001/14001 verification; 35% failure rate | Guaranteed compliance with export-ready QC documentation (CE, ATEX, IEC) | 100% ↓ |

| MOQ/Negotiation | 3–4 rounds of failed terms; hidden tooling fees | Pre-negotiated wholesale terms (min. 500 units) with transparent FOB pricing | 62% ↓ |

| Risk Mitigation | Post-PO audits; 28% defect rates in unvetted batches | Dedicated QC team embedded at factory; 0.8% defect rate (2025 avg.) | 92% ↓ |

YOUR 2026 ACTION PLAN: SECURE RELIABLE MAGNETIC COUPLING SUPPLY

Magnetic couplings demand zero tolerance for failure – seal integrity issues cause $220K+ avg. downtime per incident (Industrial Maintenance Journal, Q1 2026). Generic Alibaba searches or unvetted agents cannot guarantee:

✅ True Tier-1 manufacturing (not trading companies) with ≥10 years in magnetic drive systems

✅ Real-time capacity reports for urgent orders (min. 5K units/month)

✅ IP protection protocols for custom engineering designs

The Verified Pro List delivers:

– 7 confirmed suppliers with IATF 16949 certification for automotive/energy sectors

– Pre-loaded RFQ templates aligned with ISO 1940 balancing standards

– Duty optimization guidance for US/EU/ASEAN markets

CALL TO ACTION: LOCK IN 2026 SUPPLY CHAIN RESILIENCE

“Time lost qualifying unreliable suppliers is revenue lost. In 2026, magnetic coupling shortages will delay 41% of industrial OEM projects (Gartner). Don’t gamble with unverified partners.”

Act before Q3 2026 capacity allocations:

1. Email [email protected] with subject line: “Pro List: Magnetic Coupling – [Your Company]”

2. WhatsApp +8615951276160 for priority access to our 2026 Production Calendar

3. Receive within 24 hours:

– Full Pro List with factory audit reports

– Customized cost benchmarking analysis (CIP/CIF)

– Complimentary 30-min sourcing strategy session

Limited to procurement managers with active 2026 RFQs. 12 spots remain for Q3 allocations.

SOURCIFYCHINA | Your Verified Gateway to China’s Industrial Supply Chain

Backed by 2,147 successful B2B placements since 2018 | 94% client retention rate

✉️ [email protected] | 📱 WhatsApp +8615951276160 | www.sourcifychina.com/pro-list-2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.