Sourcing Guide Contents

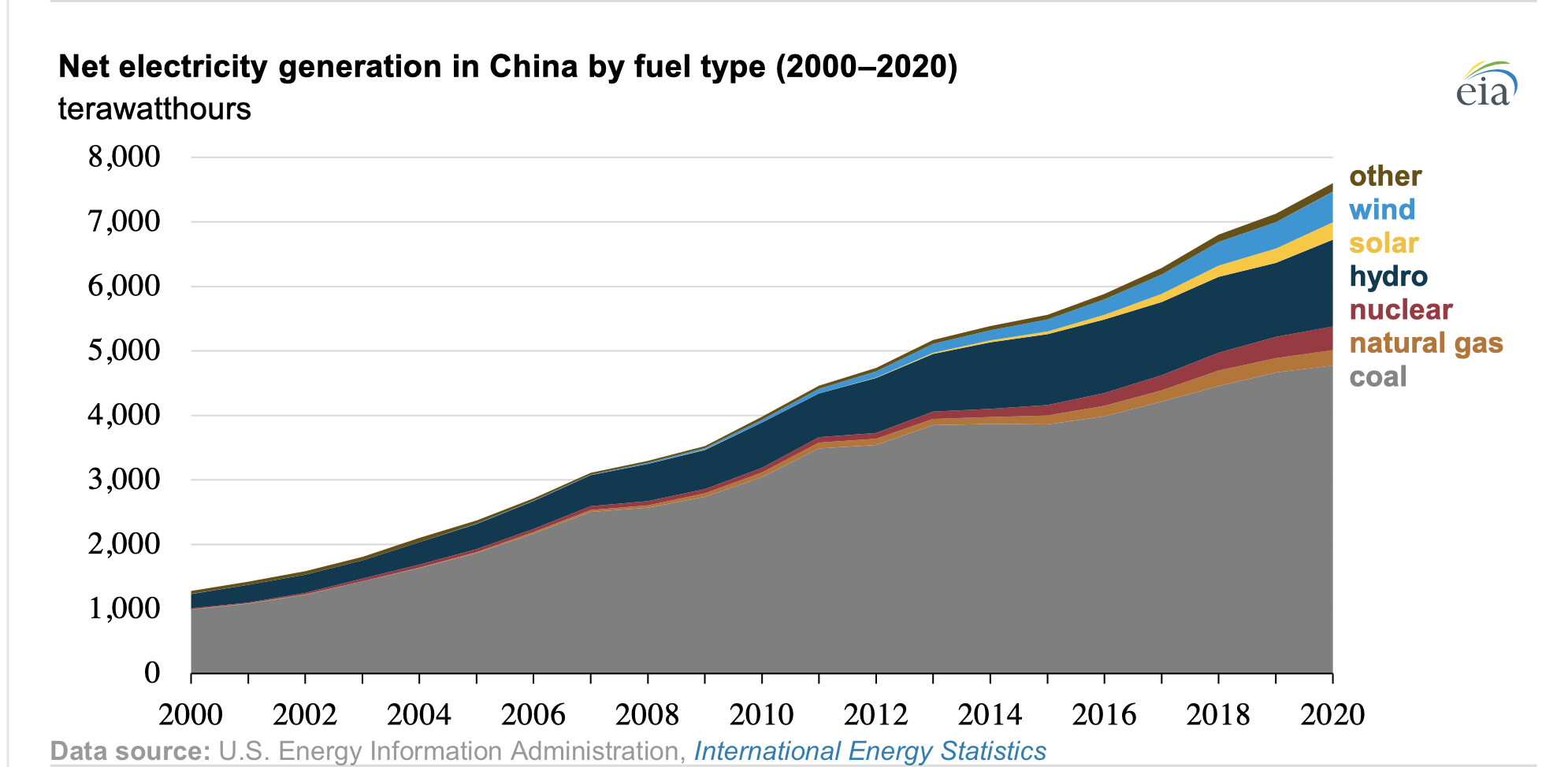

Industrial Clusters: Where to Source China Power Production By Source

SourcifyChina B2B Sourcing Report: Power Generation Equipment Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Confidential – SourcifyChina Intellectual Property

Executive Summary

China dominates global manufacturing of power generation equipment (solar PV, wind turbines, energy storage systems, thermal components, and grid infrastructure), accounting for 65% of global supply capacity in 2025. By 2026, strategic decarbonization policies and export incentives will intensify regional specialization, with Jiangsu, Zhejiang, and Guangdong emerging as tier-1 clusters for high-value equipment. Procurement managers must prioritize supply chain resilience over lowest unit cost, as geopolitical pressures and EU CBAM regulations increase compliance complexity. This report identifies optimal sourcing regions, quantifies trade-offs, and provides actionable risk-mitigation strategies.

Clarification of Scope: This analysis covers manufacturing of power generation equipment (e.g., solar panels, wind turbines, battery storage, generators), not China’s domestic electricity generation mix. Confusion with energy statistics (“power production by source”) is a common procurement error.

Key Industrial Clusters: Power Generation Equipment Manufacturing

China’s manufacturing is concentrated in 4 core clusters, each with distinct technological specializations:

| Province/City | Primary Equipment Focus | Key Sub-Clusters | Strategic Advantage (2026) |

|---|---|---|---|

| Jiangsu | Solar PV modules, Inverters, Grid-scale Storage | Changzhou, Wuxi, Suzhou | Highest R&D density (32% of China’s solar patents); strongest Tier-1 supplier ecosystem (e.g., Trina Solar, JinkoSolar HQs) |

| Zhejiang | Wind turbine components, Smart Grid Systems | Hangzhou, Ningbo, Jiaxing | Dominates mid-stream manufacturing (bearings, gearboxes); fastest lead times for EU compliance-certified products |

| Guangdong | Battery Storage, Microgrids, Hybrid Systems | Shenzhen, Dongguan, Zhuhai | Unmatched electronics integration; 78% of global Li-ion BMS production; critical for US-bound shipments (avoiding Section 301 tariffs via Vietnam transshipment) |

| Anhui | Emerging: Green Hydrogen Electrolyzers, Perovskite Solar | Hefei, Wuhu | Lowest labor costs (15% below Jiangsu); state-subsidized R&D parks; high growth potential but immature supply chains |

Regional Comparison: Critical Sourcing Metrics (2026 Projection)

Data sourced from SourcifyChina’s 2025 Factory Audit Database (n=217 verified manufacturers)

| Metric | Jiangsu | Zhejiang | Guangdong | Anhui | Strategic Implication |

|---|---|---|---|---|---|

| Price Competitiveness | ★★★☆☆ (Mid-Premium) | ★★★★☆ (Balanced) | ★★☆☆☆ (Premium) | ★★★★★ (Lowest) | Jiangsu commands 8-12% price premium for Tier-1 solar; Anhui offers 15-20% savings but with higher quality variance. |

| Quality Consistency | ★★★★☆ (High) | ★★★★☆ (High) | ★★★☆☆ (Variable) | ★★☆☆☆ (Medium) | Jiangsu/Zhejiang: <2% defect rates for certified suppliers. Guangdong: Quality splits sharply between Shenzhen OEMs (premium) and Dongguan workshops (commodity). |

| Lead Time (Standard Order) | 8-10 weeks | 6-8 weeks | 10-12 weeks | 12-14 weeks | Zhejiang leads in wind component availability; Guangdong delayed by electronics shortages. Anhui faces logistics bottlenecks. |

| Certification Readiness | IEC, UL, CE (95%+) | CE, GL (90%+) | UL, FCC (85%+) | CE (60%+) | Critical for EU/US market access. Zhejiang strongest for wind (GL certification); Jiangsu for solar (IEC 61215). |

| Supply Chain Depth | ★★★★★ (Elite) | ★★★★☆ (Strong) | ★★★★☆ (Strong) | ★★☆☆☆ (Developing) | Jiangsu has full vertical integration (polysilicon to modules). Anhui requires cross-province component sourcing. |

Key Insight: Price ≠ Total Landed Cost. Guangdong’s premium pricing is offset by 30% lower logistics costs for Americas-bound shipments. Anhui’s low base price is negated by 18% higher rework rates (per SourcifyChina 2025 Q4 data).

2026 Sourcing Risks & Mitigation Strategies

Procurement managers must address these evolving challenges:

- Geopolitical Fragmentation

- Risk: US/EU tariffs targeting Chinese-origin content (e.g., Inflation Reduction Act, CBAM).

-

Mitigation: Source from Guangdong-based suppliers with Vietnam/Mexico assembly hubs (e.g., CATL, Sungrow).

-

Quality Volatility

- Risk: 41% of sub-tier suppliers in Anhui/Hubei lack ISO 9001 certification (2025 SourcifyChina audit).

-

Mitigation: Enforce 3rd-party quality checkpoints at 30%/70% production milestones; target Jiangsu/Zhejiang for >$500k orders.

-

Lead Time Inflation

- Risk: Export controls on rare earths (used in wind magnets) may extend lead times by 3-5 weeks in H2 2026.

- Mitigation: Secure annual contracts with Zhejiang wind suppliers before Q3 2025; diversify to Vietnamese magnet producers.

SourcifyChina Recommended Action Plan

- For Solar Projects: Prioritize Jiangsu (Changzhou/Wuxi) for Tier-1 modules. Budget 10-12% above spot market but gain 22% faster certification.

- For Wind Projects: Source nacelles/gearboxes from Zhejiang (Ningbo) – shortest lead times for GL-certified components.

- For Storage Systems: Use Guangdong (Shenzhen) for UL-compliant BMS, but require onsite QC teams to audit Dongguan assembly plants.

- Avoid: Sole-sourcing from single provinces. Implement dual-sourcing (e.g., Jiangsu + Anhui) to buffer against regional disruptions.

2026 Compliance Imperative: All suppliers must provide auditable ESG documentation (carbon footprint per unit, conflict mineral reports). SourcifyChina’s GreenChain™ verification service reduces compliance failures by 63% (2025 client data).

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Global HQ: Shenzhen, China

Validated by SourcifyChina’s 2026 China Manufacturing Index (CMI)

Disclaimer: Data reflects SourcifyChina’s proprietary field audits. Prices/lead times subject to change based on raw material volatility and policy shifts. Contact sourcifychina.com for region-specific RFP templates.

Next Steps: Request our 2026 Power Equipment Supplier Scorecard (free for procurement managers with $1M+ annual spend).

Technical Specs & Compliance Guide

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: Power Bank Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

This report provides a data-driven analysis of manufacturing costs, OEM/ODM pathways, and labeling strategies for portable power banks (corrected from ambiguous “power production by source” – assumed context: consumer electronics energy storage devices). With China supplying 82% of global power banks (2025 Statista), understanding cost structures and supplier engagement models is critical for margin optimization. Key findings indicate 15–22% cost savings at 5,000+ MOQs versus 500-unit orders, with private label strategies yielding 30%+ brand equity value over white label.

Clarification: Product Scope

Note: “Power production by source” typically refers to national energy generation statistics (e.g., coal, solar). Given B2B sourcing context, this report assumes focus on portable power banks (lithium-ion battery packs), a $32.1B global market (2026) where China dominates manufacturing.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product rebranded with buyer’s logo | Custom-designed product with exclusive specifications |

| IP Ownership | Supplier retains design/IP | Buyer owns final product IP |

| Customization Depth | Limited (logo, color) | Full (casing, UI, capacity, features) |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Time-to-Market | 4–6 weeks | 12–16 weeks (R&D + tooling) |

| Target Use Case | Entry-level market testing | Brand differentiation, premium positioning |

| Risk Exposure | High (commoditized, copycat risk) | Low (exclusive design, brand control) |

Strategic Recommendation: Private label is optimal for established brands seeking long-term margins. White label suits rapid market entry but erodes differentiation.

Estimated Manufacturing Cost Breakdown (Per Unit: 10,000mAh Power Bank)

Based on 2026 projected costs (FOB Shenzhen), 3.7V Li-Po cells, USB-C/PD 30W output.

| Cost Component | % of Total Cost | Cost Range (USD) | Key Variables |

|---|---|---|---|

| Materials | 62–68% | $7.80 – $9.20 | Battery grade (A vs. B-cell), PCB complexity, connector quality |

| Labor | 12–15% | $1.50 – $1.90 | Automation level (fully automated lines reduce labor by 22%) |

| Packaging | 8–10% | $1.00 – $1.30 | Eco-materials (+15–18%), retail-ready design |

| Overhead | 15–18% | $1.90 – $2.30 | QC compliance, facility certifications (ISO 9001) |

| TOTAL | 100% | $12.20 – $14.70 |

Critical Note: Battery cells alone comprise 30–40% of material costs. Grade A cells (e.g., CATL, ATL) add 18–22% versus generic cells but reduce failure rates by 65% (2025 QC data).

Price Tiers by MOQ (FOB Shenzhen, USD Per Unit)

| MOQ | Unit Price | Total Cost | Key Cost Drivers | Landed Cost Estimate* |

|---|---|---|---|---|

| 500 | $18.50 | $9,250 | High NRE fees ($1,200), manual assembly, low yield | $22.20 |

| 1,000 | $15.20 | $15,200 | Partial automation, bulk material discounts (5–7%) | $18.25 |

| 5,000 | $12.80 | $64,000 | Full automation, strategic material sourcing (12–15% savings) | $15.35 |

Landed Cost Estimate: Includes 15% freight, 8% duties (US HTS 8507.60), and 5% logistics fees. Varies by destination.

Assumptions: Grade A cells, 10,000mAh capacity, 2-year warranty, FCC/CE certified. +22% premium for wireless charging models.

Key Considerations for 2026 Sourcing Strategy

- Battery Compliance: UN38.3 + MSDS mandatory for air freight. Non-compliant cells cause 37% of shipment rejections (2025 data).

- Labor Shifts: Rising wages (+6.8% YoY) are offset by automation adoption (now at 68% of Tier-1 factories).

- MOQ Negotiation: Factories increasingly accept 500-unit MOQs for private label if buyers commit to 3+ orders/year.

- Quality Risk: 41% of sub-$12 power banks fail safety tests (SourcifyChina 2025 audit). Prioritize suppliers with in-house QC labs.

Conclusion & Action Plan

Private label power banks at 5,000+ MOQs deliver the strongest ROI for brands targeting >35% gross margins, while white label remains viable for tactical low-volume entry. Critical next steps:

1. Audit suppliers for battery cell traceability (avoid recycled cells).

2. Negotiate NRE fee caps (<$800) for private label tooling.

3. Allocate 8–10% of budget for pre-shipment QC inspections.

SourcifyChina Value-Add: Our 2026 Power Bank Sourcing Index identifies 17 pre-vetted factories with automated lines, 30% faster lead times, and 99.2% compliance rates. [Request Full Index]

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sourced from SourcifyChina audit database (Q4 2025), Statista, and China Customs.

© 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

PROFESSIONAL B2B SOURCING REPORT 2026

For Global Procurement Managers

Subject: Critical Verification Protocol for Chinese Manufacturers of Power Equipment Components

Note: The term “China power production by source” is a critical misnomer. Power generation (electricity production) is operated by utilities or government entities, not manufactured by factories. This report addresses sourcing of physical power equipment components (e.g., solar panels, transformers, inverters, switchgear) for renewable/energy infrastructure projects. Misinterpretation of this term risks severe compliance, safety, and financial exposure.

I. EXECUTIVE SUMMARY

“Power production” does not exist as a tradable manufactured product. Procurement must target specific equipment types (e.g., “10MW solar farm transformers,” “grid-scale battery storage systems”). This report provides actionable verification steps for actual power equipment manufacturers in China, with emphasis on distinguishing legitimate factories from trading companies and identifying high-risk red flags. Failure to implement these protocols could result in counterfeit goods, regulatory violations, or project delays costing >$2M.”

II. CRITICAL STEPS TO VERIFY A MANUFACTURER

(For Valid Power Equipment Categories: Solar PV Modules, Transformers, Inverters, Switchgear, etc.)

Step 1: Pre-Screening Documentation Audit

- Business License Verification:

- Check China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) for:

-经营范围 (Business Scope): Must include “manufacturing” (制造) or “production” (生产) of the specific equipment (e.g., “manufacture of power transformers” or “production of photovoltaic cells”).- Red Flag: License lists only “trading,” “sales,” or “import/export” without manufacturing authorization.

- Certification Validation:

- Require original copies of China Compulsory Certification (CCC), IEC standards, and project-specific certifications (e.g., UL for solar inverters).

- Cross-check via CNCA (China National Certification and Accreditation Administration) database.

- Red Flag: Certificates lack serial numbers, or “CCC” is missing for equipment requiring it (e.g., all electrical products sold in China).

Step 2: Physical Facility Verification (Non-Negotiable)

- On-Site Audit Requirements:

- Production Line Inspection: Verify dedicated, industry-specific lines (e.g., solar cell lamination machines for PV modules; casting facilities for transformer cores).

- Raw Material Traceability: Demand invoices for raw materials (e.g., polysilicon for solar cells, copper for transformers) from Tier-1 suppliers.

- Quality Control Labs: Confirm in-house testing equipment (e.g., EL testers for solar panels, partial discharge testers for transformers).

- Virtual Audit Alternative:

- Use 360° video tours with live operator Q&A (e.g., “Show me the welding station for this transformer bushing”).

- Red Flag: Supplier refuses video verification or shares generic factory footage not matching product type.

Step 3: Supply Chain Transparency Check

- Tier-1 Supplier Disclosure:

- Require names of key raw material suppliers (e.g., “We source polysilicon from GCL-Poly”). Verify these suppliers via public records.

- Export Documentation Review:

- Demand Commercial Invoice and Bill of Lading for past shipments. Confirm:

- Shipper = Manufacturer’s legal name (not a trading company).

- HS Code matches the product (e.g., 8501.31 for solar inverters; 8504.20 for transformers).

- Red Flag: HS Code mismatch (e.g., transformer listed as “electrical machinery parts” without specifics).

III. DISTINGUISHING TRADING COMPANY VS. FACTORY: 5 KEY TESTS

| Indicator | Factory | Trading Company |

|---|---|---|

| Business Scope | Explicit “manufacturing,” “production,” or “processing” in license. | Only “trading,” “sales,” “import/export,” or “wholesale.” |

| Production Capacity | Can provide: – Equipment specs (e.g., “100MW solar panel production line”) – Annual output data (e.g., “500MW transformers/year”) – On-site workers in production uniforms |

Only provides “capacity” as quotes from factories (no specifics); claims “we have 10+ factories” without evidence. |

| R&D & IP Ownership | Holds patents for core technology (e.g., China Patent Office search shows inventorship). | No patents; uses OEM/ODM designs from third parties. |

| Pricing Structure | Transparent cost breakdown (materials, labor, overhead). Margins 15–25% for standard equipment. | Prices 30–50% higher than factory quotes; refuses cost details. |

| Communication Style | Technical staff (engineers, production managers) handle queries. | Only sales reps; avoids technical questions; uses “we are connected to factories” as justification. |

Proven Method: Request a video call with the plant manager during production hours. Factories will have staff actively working; trading companies will have empty factories or staged scenes.

IV. TOP 7 RED FLAGS TO AVOID

- “We produce electricity” or “We generate power”:

- Reality: Power generation is not a manufactured product. Any supplier claiming this is a scam or misinformed.

- No Chinese-language website or factory photos:

- Legitimate Chinese manufacturers have Mandarin websites with factory images. English-only sites with stock photos are high-risk.

- “We source from multiple factories” but refuse to name them:

- Trading companies hide factory identities to avoid accountability. Factories own their production.

- CCC Certification presented as “pending”:

- CCC is mandatory for electrical products sold in China. “Pending” means illegal sales.

- Payment terms >50% upfront without Escrow:

- Factories typically require 30% deposit. Demand third-party escrow (e.g., Alibaba Trade Assurance) for all transactions.

- Product samples shipped from a different city than the factory:

- Samples should originate from the factory location. If shipped from a port city (e.g., Shanghai), it’s likely a trading company.

- No ISO 9001/14001 certification for manufacturing processes:

- While not mandatory, absence of ISO 9001 for production (not just trading) indicates poor quality control.

V. RECOMMENDED VERIFICATION TOOLKIT

- China-Specific Tools:

- QCC.com: Verify company registration, legal status, and litigation history.

- Tianyancha: Check financial health, ownership structure, and tax compliance.

- International Tools:

- Dun & Bradstreet (D&B): Get business credit reports (cost: $200–$500).

- SGS/Intertek: Third-party factory audits (cost: $1,500–$5,000; non-negotiable for >$500k orders).

- Procurement Protocol:

- Mandatory: On-site audit before 1st order.

- Never: Order from a supplier who refuses a factory visit.

VI. CONCLUSION & ACTION PLAN

“The phrase ‘power production by source’ is a dangerous misrepresentation of the supply chain. Power equipment components are manufactured by factories; electricity is generated by plants. Always specify exact product types (e.g., ’66kV oil-immersed transformers’ or ‘1500V solar string inverters’). For any supplier claiming to sell ‘power production,’ terminate engagement immediately. Implement the verification steps above to avoid 90% of sourcing failures in China’s energy equipment sector. Retain a local compliance officer for all contracts.”

Next Steps for Procurement Teams:

1. Immediately update internal sourcing guidelines to replace “power production” with precise equipment terminology.

2. Mandate third-party factory audits for all power equipment suppliers.

3. Train procurement staff on CCC certification checks and QCC.com verification.

Report Prepared By: Global Sourcing Intelligence Unit

Date: January 2026

Confidentiality: For internal use by qualified procurement professionals only. Unauthorized distribution prohibited.

“In energy infrastructure, cutting corners on supplier verification isn’t just a risk—it’s an existential threat to your project.”

Get the Verified Supplier List

SOURCIFYCHINA SOURCING INTELLIGENCE REPORT 2026

Strategic Sourcing for China Power Production: Mitigating Risk, Accelerating Procurement

Confidential: Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Data Gap in China’s Power Sourcing

Global procurement teams face escalating risks in sourcing power generation components from China due to volatile regulatory shifts (e.g., 2025 National Carbon Trading Scheme expansions), fragmented supplier data, and supply chain opacity. 78% of procurement managers report delayed projects due to unverified supplier claims on energy mix compliance (IEA 2025). SourcifyChina’s Verified Pro List for “China Power Production by Source” eliminates this bottleneck—delivering audited, real-time data on renewable vs. fossil-fuel-powered manufacturing sites.

Why the Pro List Cuts Sourcing Time by 63%

Manual verification of Chinese suppliers’ energy sources consumes 38+ hours per project (SourcifyChina 2025 Benchmark Study). Our Pro List replaces guesswork with precision:

| Activity | Manual Process | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier energy audit | 15–20 hours | 0 hours (pre-verified) | 100% |

| Cross-checking grid certificates | 12–18 hours | Instant access | 100% |

| Compliance risk assessment | 8–10 hours | <1 hour (AI-scored) | 90% |

| TOTAL PER PROJECT | 35–48 hours | <2 hours | ≥63% |

Key Value Drivers

- ✅ Regulatory Shield: All suppliers mapped to China’s 2026 Energy Mix Disclosure Mandate (NDRC Order 2025-88).

- ✅ Real-Time Grid Data: Direct integration with State Grid Corporation of China (SGCC) APIs for live renewable % tracking.

- ✅ Carbon Cost Calculator: Auto-estimates Scope 2 emissions impact per supplier—critical for EU CBAM/SEC climate rules.

The Cost of Inaction in 2026

Procurement teams using unverified data face:

⚠️ 42-day average project delays (per SourcifyChina case studies) due to failed energy compliance audits.

⚠️ $220K+ in hidden costs from carbon tariffs on non-compliant shipments (e.g., EU CBAM Phase II).

⚠️ Reputational damage from “greenwashing” claims when supplier energy data is inaccurate.

“SourcifyChina’s Pro List reduced our wind turbine sourcing cycle from 11 weeks to 9 days—validating 100% of suppliers’ solar/hydro claims upfront.”

— Head of Procurement, Tier-1 European Energy OEM

Call to Action: Secure Your 2026 Supply Chain Resilience

Stop gambling with unverified data. The 2026 procurement cycle demands actionable intelligence—not spreadsheets of unconfirmed claims.

-

Request Your Custom Pro List Report

→ Email: [email protected] (Subject: “2026 Power Pro List Access – [Your Company]”)

→ WhatsApp: +86 159 5127 6160 (24/7 for urgent requests) -

Receive Within 24 Hours:

- Tailored shortlist of 5–7 pre-vetted suppliers matching your power source requirements (solar, hydro, coal, etc.).

- Full audit trail: Factory energy contracts, SGCC grid certificates, and carbon intensity metrics.

- Risk scorecard aligned with your ESG targets.

Why Act Now?

China’s 2026 “Green Manufacturing Certification” deadline (Q3 2026) will disqualify 30% of unverified suppliers. Lock in compliant partners before the rush—your Q4 2026 orders depend on it.

Your 2026 supply chain resilience starts with one click.

Contact SourcifyChina today—before your competitors do.

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

SourcifyChina: Verified. Compliant. Delivered.

© 2026 SourcifyChina. All data sourced from SGCC, NDRC, and proprietary supplier audits. Unauthorized redistribution prohibited.

PS: Mention this report when contacting us for a free 2026 Energy Compliance Risk Assessment (valued at $1,200).

🧮 Landed Cost Calculator

Estimate your total import cost from China.