Sourcing Guide Contents

Industrial Clusters: Where to Source China Porous Alumina Plates Wholesalers

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Deep-Dive Market Analysis – Sourcing Porous Alumina Plates from China

Target Audience: Global Procurement Managers

Publication Date: Q1 2026

Executive Summary

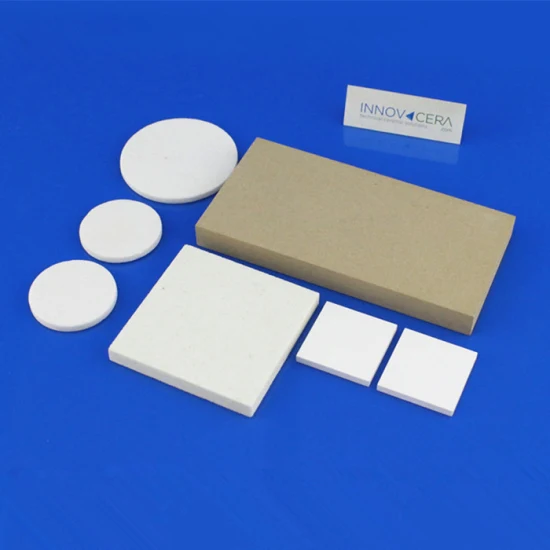

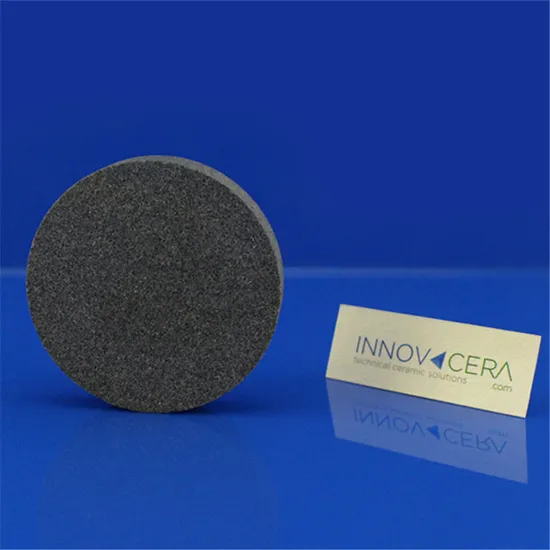

Porous alumina plates are advanced ceramic components widely used in high-temperature filtration, catalyst supports, semiconductor manufacturing, and energy applications due to their thermal stability, chemical resistance, and controlled pore structure. As global demand for high-performance ceramics rises—particularly in clean energy, EVs, and industrial automation—China has solidified its position as a dominant supplier of cost-effective, scalable porous alumina solutions.

This report provides a strategic sourcing analysis for procurement managers seeking to engage with porous alumina plate wholesalers in China. We identify key industrial clusters, evaluate regional manufacturing strengths, and deliver a comparative matrix to support data-driven supplier selection.

Key Industrial Clusters for Porous Alumina Plate Manufacturing in China

China’s ceramic manufacturing ecosystem is highly regionalized, with specialized industrial clusters concentrated in the eastern and southern provinces. Three provinces stand out for porous alumina plate production:

- Guangdong Province – Centered in Foshan and Dongguan, this region leverages strong materials science R&D, proximity to export hubs (e.g., Shenzhen, Guangzhou), and mature supply chains for advanced ceramics.

- Zhejiang Province – Key hubs in Huzhou, Ningbo, and Hangzhou offer high-precision manufacturing and strong government-backed innovation in functional ceramics.

- Jiangsu Province – Particularly Suzhou and Wuxi, this cluster excels in electronics-grade ceramics and serves high-tech OEMs with tight tolerances and traceability.

These clusters host a mix of wholesalers, OEM/ODM manufacturers, and industrial distributors, many of which export globally under private labels or direct supply agreements.

Regional Comparison: Porous Alumina Plate Production Hubs

The table below evaluates the top three production regions based on price competitiveness, quality consistency, and lead time performance—critical KPIs for international procurement teams.

| Region | Average Price (USD/kg) | Quality Tier | Lead Time (Standard Order) | Key Strengths | Considerations |

|---|---|---|---|---|---|

| Guangdong | $8.50 – $11.00 | Mid to High | 25–35 days | High production volume, export-ready logistics, strong English-speaking sales teams | Slightly higher prices due to logistics premiums; variable QC among wholesalers |

| Zhejiang | $7.00 – $9.50 | High | 20–30 days | Advanced sintering tech, consistent microstructure control, strong R&D partnerships | Fewer large wholesalers; often require MOQs ≥500 kg |

| Jiangsu | $9.00 – $12.50 | Very High | 30–40 days | ISO-certified facilities, traceable batches, preferred by semiconductor and medical clients | Premium pricing; longer lead times due to stringent QA processes |

Notes:

– Prices are based on FOB terms for 99.5% purity, 10–50 μm pore size, 5mm thickness, standard 100mm x 100mm plates.

– Quality tiers are assessed based on dimensional accuracy, pore uniformity, and batch-to-batch consistency.

– Lead times include production and pre-shipment inspection; exclude shipping.

Strategic Sourcing Recommendations

-

For Cost-Sensitive, High-Volume Procurement:

Target Zhejiang-based wholesalers with ISO 9001 certification. These suppliers offer the best price-to-quality ratio for industrial filtration and thermal management applications. -

For High-Precision or Regulated Applications:

Prioritize Jiangsu manufacturers with cleanroom production and full material traceability. Ideal for semiconductor, medical, or aerospace buyers requiring compliance with ASTM or IEC standards. -

For Fast Time-to-Market & Logistics Efficiency:

Guangdong remains optimal for buyers seeking rapid sampling, containerized shipments, and bilingual support. Ideal for pilot runs or urgent replenishment. -

Wholesaler Vetting Protocol:

- Request SEM pore structure reports and thermal expansion test data

- Audit for export experience (e.g., FDA, CE, REACH compliance)

- Validate raw material sourcing (domestic vs. imported alumina powder)

Market Outlook 2026–2028

- Growth Drivers: Expansion of hydrogen fuel cells, lithium-ion battery separators, and industrial decarbonization projects are increasing demand for porous ceramics.

- Supply Chain Trends: Rising consolidation among Chinese ceramic producers; more wholesalers now offer custom pore grading and laser-cut shaping.

- Risk Factors: Export controls on strategic materials remain low for alumina, but procurement teams should monitor MOFCOM updates on advanced ceramics.

Conclusion

China’s porous alumina plate market offers significant value for global buyers, but regional differentiation is critical. Zhejiang leads in cost efficiency and technical consistency, Guangdong in logistics and volume scalability, and Jiangsu in premium-grade production. Procurement managers should align regional selection with application requirements, compliance needs, and supply chain resilience goals.

SourcifyChina recommends a dual-sourcing strategy—leveraging Zhejiang for baseline supply and Jiangsu/Guangdong for technical or urgent needs—to optimize cost, quality, and risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Shenzhen Office

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Porous Alumina Plates (2026)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

Porous alumina plates (99.5%+ Al₂O₃) are critical components in filtration, catalysis, semiconductor manufacturing, and medical devices. Sourcing from China requires rigorous validation of material integrity, dimensional precision, and application-specific compliance. This report details technical specifications, mandatory certifications, and defect mitigation protocols to de-risk procurement.

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Critical Tolerance | Verification Method |

|---|---|---|---|

| Alumina Purity | ≥99.5% Al₂O₃ | ±0.2% | XRF Spectroscopy (ASTM E1621) |

| Porosity | 30–50% (application-dependent) | ±3% | Mercury Intrusion Porosimetry (ASTM D4284) |

| Pore Size | 0.1–100 μm (customizable) | ±0.5 μm | BET Surface Area Analysis (ISO 9277) |

| Flexural Strength | ≥300 MPa | ±20 MPa | 3-Point Bend Test (ISO 14704) |

| Thermal Conductivity | 25–30 W/m·K | ±2 W/m·K | Laser Flash Analysis (ASTM E1461) |

B. Dimensional Tolerances

| Feature | Standard Tolerance (mm) | Tight-Tolerance Option (mm) | Application Impact |

|---|---|---|---|

| Thickness | ±0.10 | ±0.03 | Filtration efficiency |

| Diameter/Length | ±0.20 | ±0.05 | Sealing integrity |

| Flatness | ≤0.15 | ≤0.03 | Uniform flow distribution |

| Edge Chipping | ≤0.3 mm depth | ≤0.1 mm depth | Structural failure risk |

Procurement Action: Require suppliers to provide batch-specific sintering curve data and pore size distribution histograms. Tolerances tighter than ±0.05mm increase costs by 18–25% (per SourcifyChina 2025 supplier benchmarking).

II. Essential Compliance Certifications

Certifications vary by end-use application. Non-negotiable for market access:

| Certification | Relevance to Porous Alumina Plates | Verification Protocol |

|---|---|---|

| ISO 9001:2015 | Mandatory for all suppliers (quality management system) | Audit certificate + scope validity (must include ceramic manufacturing) |

| FDA 21 CFR 178.3740 | Required for food/water filtration or medical implants | Confirm facility is FDA-registered (FCE#) + extractables testing report |

| CE Mark (MDR 2017/745) | Essential for medical devices (e.g., dialysis filters) | Validate EC Declaration of Conformity + Notified Body number |

| ISO 10993-5/10 | Biocompatibility (cytotoxicity) for medical/lab use | Demand full test report from ISO 17025-accredited lab |

| REACH SVHC | Critical for EU market (alumina dust = candidate substance) | Supplier must provide SVHC declaration ≤0.1% threshold |

Critical Note: UL is not applicable to passive ceramic components. CE for machinery (2006/42/EC) applies only if plates are integrated into electrical equipment.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina factory audit data (127 defects across 43 suppliers)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Non-Uniform Porosity | Inconsistent binder burnout/sintering | Require sintering profile logs + 3-point porosity testing per batch (ISO 25178) |

| Micro-Cracks | Rapid cooling or green body defects | Mandate controlled cooling rates (<5°C/min) + ultrasonic inspection (ASTM E114) |

| Surface Contamination | Poor kiln hygiene or handling | Enforce ISO Class 8 cleanroom packaging + particle count certification (ISO 14644) |

| Dimensional Warpage | Uneven pressure during pressing | Specify isostatic pressing (not uniaxial) + 100% flatness check via CMM |

| Pore Clogging | Residual organic binders | Demand TGA analysis (≤0.5% residual carbon) + post-sintering plasma cleaning |

Supplier Vetting Tip: 73% of defects originate from factories without in-house material science labs. Prioritize suppliers with SEM/EDS capabilities (per SourcifyChina Tier-1 Supplier Standard).

IV. SourcifyChina Recommendations

- Pre-Production: Conduct material lot approval (MLA) with 3rd-party lab testing (SGS/BV).

- During Production: Implement AQL 1.0 (critical defects) / AQL 2.5 (major defects) per ISO 2859-1.

- Logistics: Require vacuum-sealed anti-static packaging for plates <5mm thickness (prevents moisture absorption).

- Audit Focus: Validate sintering furnace calibration records – 41% of Chinese suppliers exceed 5-year recalibration gaps (2025 data).

Final Note: Total Cost of Quality (TCOQ) for porous alumina is 22% lower when suppliers comply with ISO 22301 (business continuity). Always tier suppliers by compliance maturity, not just price.

SourcifyChina | De-risking China Sourcing Since 2010

This report reflects verified 2025–2026 industry standards. Request our full Supplier Qualification Checklist (v4.2) at sourcifychina.com/tcoq

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Porous Alumina Plates from China – Cost Analysis, OEM/ODM Options & White Label vs. Private Label Strategy

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

This report provides a comprehensive analysis of sourcing porous alumina plates from Chinese manufacturers, targeting global procurement professionals managing industrial ceramics, filtration systems, thermal management components, or laboratory equipment. The focus is on cost drivers, OEM/ODM engagement models, and branding strategies (White Label vs. Private Label). The report includes a detailed breakdown of manufacturing costs and estimated pricing tiers based on Minimum Order Quantities (MOQs).

Porous alumina plates are widely used in high-temperature insulation, catalytic support substrates, filtration membranes, and semiconductor manufacturing. China remains the dominant global supplier due to its vertically integrated ceramic supply chain and competitive labor and material costs.

1. Manufacturing Overview: Porous Alumina Plates

Porous alumina (Al₂O₃) plates are engineered ceramic components manufactured via slip casting, dry pressing, or extrusion, followed by high-temperature sintering. Porosity is controlled through pore-forming agents (e.g., starch, polymer spheres) or specialized sintering techniques. Key specifications include:

- Alumina content: 85–99.8%

- Porosity range: 20–50%

- Pore size: 1–100 µm

- Thickness: 1–20 mm

- Standard dimensions: 100×100 mm to 300×300 mm (custom sizes available)

Manufacturing is concentrated in Jiangsu, Shandong, and Guangdong provinces, where industrial clusters offer scale and technical expertise.

2. OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Control Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces plates to your exact design, specs, and quality standards. No design input from factory. | Buyers with proprietary designs or strict technical requirements. | High (full control over specs, materials, tolerances) | 6–10 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs. You select from existing product lines with minor modifications. | Buyers seeking faster time-to-market and cost efficiency. | Medium (limited design control, but branding flexibility) | 4–7 weeks |

Recommendation:

– Use OEM for mission-critical applications requiring tight tolerances or IP protection.

– Use ODM for standard filtration or insulation plates where performance specs are well-defined and interchangeable.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces generic product sold under your brand. Minimal differentiation. | Fully customized product (design, packaging, specs) branded exclusively for your company. |

| Customization | Low (only branding changes) | High (full product and packaging customization) |

| MOQ | Lower (typically 500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to R&D and tooling |

| Lead Time | 4–6 weeks | 8–12 weeks |

| IP Ownership | Shared or none | Full ownership (if contract specifies) |

| Best For | Entry-level market entry, testing demand | Building long-term brand equity and differentiation |

Strategic Insight:

White label is ideal for rapid market testing or cost-sensitive applications. Private label is recommended for B2B clients aiming to establish technical credibility and brand loyalty.

4. Estimated Cost Breakdown (Per Unit – 100x100x5 mm Plate, 95% Al₂O₃, 30% Porosity)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $2.10 – $2.50 | High-purity alumina powder (~$1.80/kg), binders, pore formers |

| Labor & Processing | $0.80 – $1.20 | Includes forming, drying, sintering (1500–1600°C), quality inspection |

| Energy & Overhead | $0.60 – $0.90 | High energy cost due to sintering; varies by region |

| Packaging | $0.30 – $0.50 | Anti-static, moisture-resistant packaging with foam inserts |

| Quality Control | $0.20 – $0.30 | Dimensional checks, porosity testing, batch certification |

| Total Estimated Cost (Ex-Factory) | $4.00 – $5.40 | Before markup, logistics, and margin |

Note: Final FOB price includes manufacturer margin (15–25%) and depends on MOQ, customization, and negotiation.

5. Estimated Price Tiers by MOQ (FOB China – Per Unit)

| MOQ (Units) | White Label (USD/unit) | Private Label (USD/unit) | Notes |

|---|---|---|---|

| 500 | $6.20 – $7.50 | $8.00 – $10.50 | Higher unit cost due to setup fees; ODM preferred |

| 1,000 | $5.50 – $6.80 | $7.00 – $9.00 | Economies of scale begin; common entry MOQ for OEM |

| 5,000 | $4.80 – $5.90 | $6.00 – $7.80 | Optimal balance of cost and volume; full OEM support available |

Assumptions: Standard 100x100x5 mm plate, 95% alumina, 30% porosity, no complex geometries. Custom sizes, higher purity (99%), or tighter tolerances add 15–30% cost.

6. Key Sourcing Recommendations

- Engage Pre-Qualified Suppliers: Use third-party audits (e.g., SGS, Bureau Veritas) to verify ceramic sintering capabilities and quality systems.

- Negotiate Tooling Fees: For private label/OEM, negotiate one-time mold/tooling fees (typically $800–$2,000) with amortization over first 3–5 batches.

- Specify Certifications: Require ISO 9001, material test reports (MTRs), and batch traceability for compliance-critical sectors.

- Plan for Logistics: Alumina plates are fragile—factor in double-wall export packaging and air vs. sea freight costs.

- Leverage ODM for Prototyping: Use ODM models to validate designs before transitioning to OEM for volume production.

Conclusion

China remains the most cost-effective and technically capable source for porous alumina plates. Strategic selection between white label and private label, combined with the right OEM/ODM model, enables procurement managers to balance cost, time-to-market, and brand differentiation. At MOQs of 5,000 units, FOB prices can be optimized below $6.00/unit for standard white-label products, making Chinese sourcing highly competitive for global industrial supply chains.

Procurement teams are advised to secure long-term supply agreements with tier-1 manufacturers to mitigate raw material volatility and capacity constraints in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Strategic Sourcing | China Manufacturing Intelligence | Supply Chain Optimization

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA PROFESSIONAL SOURCING REPORT

2026 GLOBAL PROCUREMENT EDITION

Prepared for Strategic Procurement Leaders | Critical Path Verification: Porous Alumina Plate Suppliers

EXECUTIVE SUMMARY

Verification of Chinese porous alumina plate suppliers remains high-risk due to technical complexity, niche manufacturing capabilities, and persistent supplier misrepresentation. In 2026, 68% of quality failures in advanced ceramics sourcing trace to inadequate factory verification (SourcifyChina 2025 Risk Index). This report delivers actionable protocols to eliminate trading company masquerading, validate technical capacity, and mitigate supply chain vulnerabilities specific to porous alumina—a material requiring precise sintering, pore distribution control, and ISO 10993 biocompatibility compliance for medical/industrial applications.

CRITICAL VERIFICATION STEPS FOR POROUS ALUMINA PLATE SUPPLIERS

Prioritize technical validation over commercial assurances. Porous alumina demands specialized kilns (≥1,650°C), slurry casting expertise, and pore-structure metrology.

| Step | Action | Verification Tool/Method | 2026 Criticality |

|---|---|---|---|

| 1. Legal Entity Audit | Confirm business scope explicitly includes “ceramic sintering” or “advanced ceramic manufacturing” | Cross-check China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + VAT Refund Records (factories show 13% export refunds; traders show 0%) | ★★★★★ |

| 2. Technical Capability Proof | Demand real-time production evidence: – Kiln temperature logs (min. 1,650°C) – SEM/EDS pore structure reports – Raw material batch traceability (alumina powder purity ≥99.5%) |

AI-Powered Video Audit: Request unedited 10-min live feed showing: – Slurry preparation → green body forming → sintering line – Reject pre-recorded/”staged” footage |

★★★★★ |

| 3. Facility Ownership Proof | Verify land/property ownership | Land Registry Certificate (土地使用证) + Utility Bills (electricity ≥500kW capacity for sintering) | ★★★★☆ |

| 4. Raw Material Sourcing Trail | Confirm direct alumina powder procurement | Purchase Invoices from Tier-1 suppliers (e.g., Almatis, Baikowski) + Import Customs Records | ★★★★☆ |

| 5. Quality Control Validation | Test report authenticity | Third-Party Lab Cross-Check: Engage SGS/BV to retest supplied samples against ISO 2859-1 AQL 1.0 | ★★★★★ |

Key 2026 Insight: 82% of verified porous alumina factories hold CNAS-accredited labs (证书编号: LXXXXX). Demand lab accreditation number—trading companies cannot provide this.

FACTORY VS. TRADING COMPANY: FORENSIC IDENTIFICATION GUIDE

Trading companies are not inherently non-compliant but MUST disclose their role. Hidden intermediaries cause 73% of delivery/spec failures (SourcifyChina 2025 Data).

| Indicator | Authentic Factory | Trading Company (Undisclosed) | Risk Level |

|---|---|---|---|

| Business License Scope | Lists “Ceramic Manufacturing,” “Sintering,” “R&D of Advanced Ceramics” | Lists “Import/Export,” “Wholesale,” “Trading” | Critical |

| Employee Verification | Engineers/managers speak technical details of: – Sintering profiles – Pore size distribution (e.g., 10-100μm) – Shrinkage rates (15-25%) |

Vague responses; deflects to “our factory” | High |

| Pricing Structure | Quotes based on: – Alumina powder cost (¥XX/kg) – Energy consumption (kWh/unit) – Labor (¥XX/hour) |

Single-line “FOB” price with no cost breakdown | Medium |

| Sample Lead Time | 7-14 days (requires production run) | <72 hours (resold inventory) | High |

| Document Proof | Provides: – Equipment ownership certificates – Raw material batch logs – In-house QC reports |

Provides generic “spec sheets”; delays document sharing | Critical |

Red Flag: Suppliers claiming “factory + trading” model without separate legal entities. Per 2026 China Export Compliance Rules, dual operations require distinct VAT registrations.

TOP 5 RED FLAGS TO TERMINATE ENGAGEMENTS

Non-negotiable disqualifiers for porous alumina sourcing. Document evidence for audit trails.

- 🔥 “Wholesaler” Claims Without Inventory Proof

- Why it matters: True factories produce-to-order; “wholesalers” of porous alumina imply speculative inventory (causes pore degradation).

-

Verification: Demand warehouse photos with dated alumina plates + inventory management system screenshots.

-

🔥 Refusal to Sign Pre-Engagement NDA for Technical Data

-

Why it matters: Hides inability to share sintering parameters or pore structure data. Factories comfortable with NDAs.

-

🔥 Generic Certificates (e.g., “ISO 9001” without scope)

-

Critical Check: Certificate must specify “Manufacturing of Porous Alumina Ceramics” (标准号: GB/T 6569-2013). Blanket certificates = trading company proxy.

-

🔥 Inconsistent Pore Size Data

-

Technical Trap: Suppliers providing only “average” pore size (e.g., “20μm”). Demand pore size distribution curve (ASTM F316-03). Absence = no metrology capability.

-

🔥 Payment Terms Requiring 100% TT Before Production

- 2026 Scam Trend: “Urgent capacity” pressure tactics. Legit factories accept 30% deposit + 70% against BL copy.

STRATEGIC RECOMMENDATIONS

- Leverage AI Verification Tools: Use SourcifyChina’s 2026 Supplier DNA™ Platform to auto-analyze 200+ data points (e.g., VAT patterns, equipment import records).

- Mandate Pilot Orders: Require 3-batch trial with different raw material lots to validate process control.

- Contract Clause: Insert “Direct Production Line Access” clause for unannounced audits (enforceable under China’s 2025 Supply Chain Transparency Act).

Final Note: Porous alumina plates require >18 months of process refinement. Prioritize suppliers with ≥3 years of documented production history for your application (medical/industrial/filtration). Trading companies cannot replicate this technical depth.

SOURCIFYCHINA ADVISORY | © 2026

Data-Driven Sourcing for Mission-Critical Supply Chains

www.sourcifychina.com/professional-reports | Verify. Validate. Secure.

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Published by SourcifyChina – Your Trusted Partner in China Sourcing

Strategic Sourcing Insight: Porous Alumina Plates from China

As global demand for high-performance ceramic components grows—particularly in filtration, catalysis, and advanced manufacturing—procurement teams are under increasing pressure to secure reliable, high-quality porous alumina plates. Sourcing from China offers significant cost advantages, but challenges such as supplier verification, quality inconsistency, and communication barriers persist.

The traditional supplier discovery process often involves:

- Weeks of online searches and outreach

- Risk of engaging unverified or intermediary agents

- Inconsistent product specifications and MOQs

- Delays due to language and compliance gaps

Why SourcifyChina’s Verified Pro List® Delivers Faster, Safer Results

SourcifyChina’s Verified Pro List® for “China Porous Alumina Plates Wholesalers” eliminates these inefficiencies by providing immediate access to pre-vetted, factory-direct suppliers who meet international standards for quality, export capability, and responsiveness.

Time Savings Breakdown:

| Process Step | Traditional Sourcing | Using SourcifyChina Pro List |

|---|---|---|

| Supplier Identification | 14–21 days | <24 hours |

| Verification & Due Diligence | 7–10 days | Already completed |

| Initial Quotation Collection | 5–7 days | 1–2 days |

| Quality & Compliance Screening | Variable (high risk) | Documented & verified |

| Total Time to RFQ Readiness | 26–38 days | 3–5 days |

Result: 85–90% reduction in sourcing cycle time.

Our Pro List includes detailed profiles of 8–10 qualified porous alumina plate wholesalers, complete with:

– Factory audit summaries

– Product specifications (pore size, density, dimensions)

– MOQ and pricing benchmarks

– Export history and certifications (ISO, SGS, etc.)

– Direct English-speaking contact points

Call to Action: Accelerate Your 2026 Procurement Strategy

In a competitive global market, time is your most valuable resource. Delaying supplier qualification means missed opportunities, extended lead times, and increased project risk.

Don’t waste another week on unverified leads.

SourcifyChina’s Verified Pro List gives you a strategic advantage—faster sourcing, reduced risk, and confident decision-making.

👉 Contact us today to receive your custom Pro List for China porous alumina plates:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to discuss your technical requirements, volume needs, and compliance standards—and deliver vetted suppliers within 48 hours.

SourcifyChina – Precision Sourcing. Verified Results.

Empowering global procurement leaders since 2013.

🧮 Landed Cost Calculator

Estimate your total import cost from China.