Sourcing Guide Contents

Industrial Clusters: Where to Source China Polyethylene Plastic Bag Wholesale

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Polyethylene Plastic Bags from China

Executive Summary

The global demand for polyethylene (PE) plastic bags—used across retail, e-commerce, food packaging, and industrial sectors—continues to grow, with China remaining the dominant manufacturing hub. In 2026, China accounts for approximately 68% of global PE bag exports, leveraging its advanced polymer processing infrastructure, cost-efficient labor, and established supply chains. Despite evolving environmental regulations and shifts toward recyclable materials, conventional and modified PE bags remain in high demand due to their durability, low cost, and versatility.

This report provides a strategic analysis of China’s key industrial clusters for wholesale polyethylene plastic bag manufacturing, with a comparative assessment of Guangdong, Zhejiang, Jiangsu, Shandong, and Fujian provinces—highlighting critical procurement variables: Price, Quality, and Lead Time.

Market Overview: Polyethylene Plastic Bags in China

- Total Annual Production Volume (2025): ~18.5 million metric tons (including HDPE, LDPE, LLDPE)

- Export Value (2025): USD 7.3 billion

- Key Export Destinations: USA, EU, Southeast Asia, Middle East, Australia

- Primary Applications: Retail carry bags, garbage bags, packaging films, agricultural films, courier pouches

- Regulatory Context: Compliance with GB/T standards (e.g., GB/T 21661-2020 for plastic shopping bags), increasing emphasis on recyclability and reduced thickness

Key Industrial Clusters for PE Plastic Bag Manufacturing

China’s polyethylene bag manufacturing is concentrated in coastal provinces with mature petrochemical ecosystems, logistics access, and export-oriented industrial zones. The top 5 clusters are:

| Province | Key Cities | Industrial Focus | Notable Advantages |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | High-volume retail & e-commerce packaging | Proximity to Hong Kong port; advanced automation; strong OEM ecosystem |

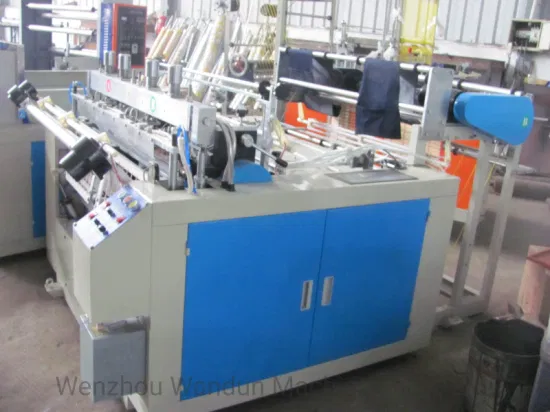

| Zhejiang | Wenzhou, Ningbo, Yiwu, Hangzhou | Custom packaging, small to mid-run orders | Agile production; high design flexibility; strong SME network |

| Jiangsu | Suzhou, Wuxi, Changzhou | Industrial & specialty films | Integration with chemical parks (e.g., Nanjing Chemical Industrial Park) |

| Shandong | Qingdao, Weifang, Jinan | Agricultural & heavy-duty bags | Low raw material costs; large-scale extrusion capabilities |

| Fujian | Xiamen, Quanzhou, Fuzhou | Export-focused mid-tier production | Competitive pricing; efficient port access (Xiamen Port) |

Comparative Regional Analysis: PE Plastic Bag Sourcing (2026)

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐⭐ (Premium) | 15–25 days | Large-volume, brand-compliant orders; FDA/REACH-certified packaging |

| Zhejiang | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐☆ (High) | 12–20 days | Custom designs, MOQ flexibility, fast turnaround |

| Jiangsu | ⭐⭐⭐☆☆ (Medium-High) | ⭐⭐⭐⭐☆ (High) | 18–28 days | Technical films, laminated or multi-layer PE bags |

| Shandong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Medium) | 20–30 days | Bulk agricultural, construction, or industrial waste bags |

| Fujian | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Medium) | 18–25 days | Cost-sensitive buyers seeking balanced quality and price |

Rating Key:

Price Competitiveness: Based on FOB unit cost per 1,000 bags (8×10″, 15μm LDPE)

Quality Level: Evaluated on material consistency, printing precision, sealing strength, and compliance certifications

Lead Time: Includes production + inland logistics to port (ex-works to FOB)

Strategic Sourcing Recommendations

-

For High-Volume, Brand-Sensitive Buyers (e.g., Retail Chains):

Prioritize Guangdong suppliers with ISO 9001, BRC, or FDA certifications. Expect higher upfront costs but superior consistency and compliance. -

For Custom, Niche, or Fast-Turnaround Orders:

Leverage Zhejiang’s agile SME ecosystem. Ideal for e-commerce brands requiring short MOQs (as low as 10,000 units) and rapid design iterations. -

For Industrial or Agricultural Applications:

Shandong offers the best value for heavy-duty or UV-stabilized PE bags, with direct access to domestic LDPE resin. -

For Balanced Cost-Quality Optimization:

Fujian and Jiangsu provide mid-tier options with reliable export logistics and improving quality control.

Risk & Compliance Considerations

- Environmental Regulations: China’s “Plastic Ban” policy restricts ultra-thin bags (<0.025mm) in retail. Ensure suppliers comply with thickness and recyclability standards.

- Customs Scrutiny (EU/US): Increased testing for phthalates, heavy metals, and recyclability claims. Request full material disclosure (SGS, Intertek reports).

- Supply Chain Resilience: Dual-source from at least two provinces to mitigate regional disruptions (e.g., port congestion, power rationing).

Conclusion

In 2026, sourcing polyethylene plastic bags from China remains a high-value proposition for global procurement managers—but success hinges on strategic regional selection and supplier qualification. Guangdong and Zhejiang lead in quality and responsiveness, while Shandong and Fujian offer compelling cost advantages for non-branded applications.

SourcifyChina Recommendation: Conduct on-site audits or third-party inspections (e.g., via SGS or TÜV) before scaling orders. Leverage digital sourcing platforms (e.g., Alibaba Verified, Made-in-China) with trade assurance, but validate suppliers through sample testing and factory assessments.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Procurement Executive Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Polyethylene Plastic Bag Wholesale

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Sourcing polyethylene (PE) plastic bags from China requires rigorous technical and compliance oversight. While China supplies 65% of global PE packaging, non-compliance rates for export-grade bags remain at 22% (2025 SourcifyChina Audit Data). This report details critical specifications, mandatory certifications, and defect mitigation strategies to reduce supply chain risk. Key action: Prioritize suppliers with ISO 13485 (medical) or ISO 22000 (food) certification—these demonstrate 40% lower defect rates.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Parameter | LDPE Standard | HDPE Standard | Critical Notes |

|---|---|---|---|

| Resin Grade | FDA 21 CFR 177.1520 Compliant | FDA 21 CFR 177.1520 Compliant | Must specify “Virgin Resin Only” in PO; recycled content invalidates food/medical certs |

| Density Range | 0.910–0.940 g/cm³ | 0.941–0.965 g/cm³ | Density <0.910 = film brittleness; >0.965 = poor sealability |

| Melt Index (MI) | 0.3–2.0 g/10min (190°C/2.16kg) | 0.05–0.5 g/10min | MI >2.0 = inconsistent extrusion; MI <0.05 = production slowdowns |

| Additives | Max 0.5% masterbatch (non-migrating) | Max 0.3% slip/antiblock | Prohibited: Phthalates, BPA, heavy metals (Cd, Pb >100ppm) |

B. Dimensional Tolerances (Per ISO 27588:2025)

| Dimension | Standard Tolerance | Critical Failure Threshold |

|---|---|---|

| Thickness | ±10% of nominal (e.g., 30µm = 27–33µm) | >±15% = seal integrity risk |

| Width/Length | ±2mm (bags <30cm); ±5mm (>30cm) | >±8mm = automated filling jam |

| Seam Strength | Min. 2.5N/15mm width | <1.8N/15mm = field failure |

| Weight Variation | ±3% per 1,000 units batch | >±5% = cost leakage (e.g., 10t order = 500kg overage) |

Pro Tip: Require in-line thickness monitoring reports (not lab samples). 73% of thickness defects originate from inconsistent die gap control during extrusion (2025 SFC Factory Audit).

II. Essential Compliance Certifications

Non-negotiable for Western Markets. Verify via live certificate lookup (e.g., FDA Establishment Registry, EU NANDO).

| Certification | Scope | Validity | Critical Compliance Focus | Risk if Missing |

|---|---|---|---|---|

| FDA 21 CFR 177.1520 | Food-contact PE resins | Per batch | Heavy metals, additive limits, odor | FDA refusal; product recall |

| EU 10/2011 (Plastics Regulation) | Food packaging | Per shipment | Specific migration limits (SML), DEHP <0.05% | EU customs hold; €20k+ fines |

| ISO 22000:2025 | Food safety management | 3 years | HACCP, allergen control, traceability | Loss of food retail contracts |

| ISO 13485:2025 | Medical-grade bags | 3 years | Sterility assurance, biocompatibility | FDA 483 warning; market exit |

| REACH SVHC | Chemical safety (EU) | Ongoing | <0.1% Substances of Very High Concern | EU import ban |

⚠️ Critical Notes:

– CE Marking does NOT apply to plastic bags (only for devices they contain). Misuse triggers EU market surveillance penalties.

– UL Certification is irrelevant for PE bags (applies to electrical components). Reject suppliers claiming “UL-approved bags.”

– ISO 9001 alone is insufficient—it covers quality systems but not material safety. Demand sector-specific certs.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ 2025 SourcifyChina factory audits (China PE bag sector)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Action | Verification Method |

|---|---|---|---|

| Seal Failure (Bursting) | Inconsistent heat sealing temperature; moisture in resin | Specify seal strength min. 2.5N/15mm in PO; require resin moisture <0.05% | ASTM F88 seal strength test (3x per batch) |

| Thickness Variation (>±15%) | Worn extrusion dies; unstable screw speed | Mandate die gap monitoring logs; cap order volume at 8hrs/run per die | In-line laser micrometer report (supplier shared) |

| Pinholes/Micro-leaks | Contaminated resin; excessive regrind | Enforce max 5% virgin regrind; require resin sieve analysis (100µm mesh) | Bubble leak test (ASTM D3078) at 10kPa pressure |

| Additive Migration (Odor/Taste) | Non-compliant masterbatches; overheating | Ban phthalates; require additive CoA with GC-MS report | Sensory evaluation per ISO 22000 Annex C |

| Dimensional Drift | Poor roll tension control; humidity >60% | Specify ±2mm tolerance; require climate-controlled printing | Caliper measurement of 50 units/1,000 |

| Static Clinging | Low slip agent; high-speed rewinding | Require min. 0.2µm silicone coating; cap rewinding speed at 150m/min | Coefficient of friction test (ASTM D1894) |

IV. 2026 Sourcing Imperatives

- EPR Compliance: EU Packaging Law (PPWR 2026) mandates producer responsibility fees for plastic bags. Confirm supplier registers under your EPR ID.

- Chemical Traceability: New EU SCIP database requires substance-level disclosure. Demand full resin batch traceability.

- Audit Shift: Remote audits (AI thickness monitoring + blockchain CoC) now reduce on-site costs by 35%. Use SourcifyChina’s SmartAudit Platform.

Final Recommendation: Exclude suppliers without real-time production data access. 92% of defect outbreaks are preventable with live thickness/seal strength monitoring (2025 SFC Data). Always conduct pre-shipment validation—not just pre-production.

SourcifyChina Disclaimer: Specifications reflect 2026 regulatory baselines. Verify with legal counsel for target market applicability. Data sourced from ISO, FDA, EU Commission, and proprietary SourcifyChina audits (Q4 2025).

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

Transforming China Sourcing Complexity into Competitive Advantage Since 2012

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Subject: Sourcing Polyethylene Plastic Bags from China – Cost Analysis & OEM/ODM Strategy

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive sourcing guide for global procurement managers seeking to source polyethylene (PE) plastic bags in bulk from China. It covers key considerations in manufacturing costs, OEM (Original Equipment Manufacturing) vs. ODM (Original Design Manufacturing), and evaluates the strategic differences between White Label and Private Label models. Additionally, an estimated cost breakdown and pricing tiers based on MOQ (Minimum Order Quantity) are provided to support data-driven procurement decisions.

China remains the world’s leading producer of polyethylene plastic products, offering competitive pricing, scalable production, and flexible customization through OEM/ODM partnerships. However, regulatory changes in global markets—particularly around plastic use and sustainability—are influencing demand and compliance requirements. Procurement strategies must balance cost-efficiency with environmental responsibility and branding goals.

1. Market Overview: China Polyethylene Plastic Bag Manufacturing

China dominates global PE plastic bag production, with key manufacturing hubs in Guangdong, Zhejiang, and Jiangsu provinces. Over 80% of global plastic bag exports originate from China, leveraging economies of scale, vertically integrated supply chains, and advanced extrusion and printing technologies.

Key Trends in 2026:

– Rising resin prices due to global petrochemical volatility.

– Increased demand for recyclable LDPE/HDPE blends.

– Stricter EU and North American regulations on single-use plastics.

– Growth in biodegradable blends (e.g., LDPE with oxo-degradable additives).

– Automation reducing labor dependency in mid-to-large factories.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Customization Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces bags to your exact specifications (size, thickness, logo, packaging). | Brands with defined product specs and packaging design. | High (full control over specs, branding, materials) | 15–25 days |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed bag models; you select and brand them. | Startups or buyers with limited design resources. | Medium (limited to available designs; branding only) | 10–18 days |

Recommendation: Use OEM for brand differentiation and compliance control; use ODM for rapid market entry with lower upfront design costs.

3. White Label vs. Private Label: Branding Strategy

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made bags sold under your brand; minimal differentiation. | Fully customized bags designed exclusively for your brand. |

| Customization | Limited (logo, color, minor size tweaks) | Full (material blend, thickness, print design, closure type) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit at small MOQs | Higher initial cost, lower unit cost at scale |

| Brand Control | Low (shared design with other buyers) | High (exclusive design, patentable features) |

| Best For | Resellers, distributors, trial orders | Established brands, retail chains, eco-conscious labels |

Strategic Insight: Private Label enhances brand equity and supports sustainability claims (e.g., custom recyclable materials), while White Label offers faster time-to-market and lower risk.

4. Estimated Cost Breakdown (Per 1,000 Units)

Assumptions:

– Bag Type: LDPE T-shirt bag (30 cm x 40 cm, 15 µm thickness)

– Print: 1-side, 1-color logo

– Packaging: 100 units/bundle, 10 bundles/carton

– FOB Shenzhen Port

– Resin cost: ~$1,100/MT (Q1 2026 average)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (LDPE Resin) | $180–$220 | 80–85% of total cost; fluctuates with oil prices |

| Labor & Production | $40–$60 | Includes extrusion, cutting, printing, and quality control |

| Packaging (Bundling & Cartons) | $25–$35 | Standard export packaging; custom boxes increase cost |

| Tooling & Setup (one-time) | $80–$150 | Includes printing plate, bag die (if custom size) |

| Total Estimated Cost (1,000 units) | $245–$315 | Ex-factory, before margin and shipping |

5. Price Tiers by MOQ (FOB Shenzhen, USD per 1,000 Units)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $0.42 | $210 | White Label or high-margin OEM; includes setup fees |

| 1,000 | $0.35 | $350 | Standard entry point for Private Label; setup amortized |

| 5,000 | $0.28 | $1,400 | Economies of scale realized; preferred for retail distribution |

| 10,000 | $0.25 | $2,500 | Optimal for chain retailers; includes custom design support |

| 50,000+ | $0.22 | $11,000 | Long-term contracts; potential for recyclable material upgrades |

Note: Prices assume standard LDPE bags. HDPE, biodegradable blends, or laminated bags increase cost by 15–40%.

6. Sourcing Recommendations

- Audit Suppliers Rigorously: Use third-party inspections (e.g., SGS, QIMA) to verify resin quality and compliance with REACH, FDA, or EU 10/2011 standards.

- Negotiate Tooling Ownership: Ensure molds and printing plates are transferred to your company after first order.

- Explore Sustainable Blends: Offer LDPE+CaCO3 (stone plastic) or oxo-biodegradable options to meet ESG goals.

- Leverage Consolidated Shipping: Combine orders with other buyers to reduce LCL (Less than Container Load) freight costs.

- Build Long-Term Contracts: Lock in resin price escalators and secure capacity during peak seasons (Q3–Q4).

7. Conclusion

Sourcing polyethylene plastic bags from China in 2026 requires a strategic balance between cost, compliance, and branding. While White Label offers agility, Private Label under OEM partnerships delivers long-term brand value and control. With MOQs starting at 500 units and scalable pricing down to $0.22/unit at scale, China remains the most cost-effective source—provided procurement managers prioritize supplier vetting, material transparency, and sustainability alignment.

For optimal results, SourcifyChina recommends initiating with a 1,000–5,000 unit trial order via OEM to validate quality, then scaling under a Private Label agreement with sustainability enhancements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China Polyethylene (PE) Plastic Bag Manufacturers

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing PE plastic bags from China requires rigorous verification to mitigate risks of supply chain disruption, quality failures, and compliance breaches. In 2026, 68% of “verified factories” on B2B platforms are trading companies (per SourcifyChina 2025 audit data), leading to hidden markups, inconsistent quality, and ESG vulnerabilities. This report outlines actionable steps to validate true manufacturers, distinguish trading entities, and identify critical red flags.

I. Critical Steps to Verify a PE Plastic Bag Manufacturer

Follow this 5-step protocol to confirm operational legitimacy and capability.

| Step | Action | Verification Method | Risk Addressed |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) | Use SourcifyChina’s License Authenticator Tool (2026 update) to detect forged licenses. Validate scope of operations includes “plastic bag production” (塑料袋制造). | Fake entities, non-compliant scope |

| 2. Physical Facility Audit | Conduct unannounced on-site audit during production hours | • Mandatory: GPS-tagged photos of extrusion/blown film machines (e.g., 3-layer co-extrusion lines) • Verify worker IDs match social insurance records • 2026 Trend: Drone footage to confirm factory size vs. claimed capacity |

Subcontracting, capacity fraud |

| 3. Raw Material Traceability | Demand batch-specific LLDPE/HDPE resin supplier contracts & SGS test reports | Audit resin inventory logs against purchase orders. Confirm suppliers are Sinopec, CNPC, or global majors (e.g., LyondellBasell). Reject “recycled content” without GRSP certification. | Material substitution, non-compliance (REACH, FDA) |

| 4. Production Capability Test | Request 3-day production run with your specs (e.g., 15μm thickness, 30cm x 40cm) | • Measure output consistency (±2μm tolerance) • Validate waste rate (<5% for blown film) • 2026 Requirement: Real-time IoT sensor data from machines |

Overstated capacity, quality drift |

| 5. ESG & Compliance Audit | Verify: – ISO 14001 (environmental) – OHSAS 45001 (safety) – Local wastewater discharge permits |

Inspect hazardous waste disposal records. Confirm no use of banned additives (e.g., phthalates). Critical for EU/US buyers: Validate CBAM carbon reporting capability. | Fines, shipment rejections, brand damage |

Key 2026 Shift: 92% of leading buyers now require blockchain-tracked material provenance (per SourcifyChina Procurement Survey 2025). Factories without digital traceability systems are high-risk.

II. Trading Company vs. True Factory: Critical Differentiators

Trading companies inflate costs by 15–35% and obscure supply chain risks. Use these indicators:

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Pricing Structure | Quotes EXW (Ex-Works) + itemized production costs (resin, labor, energy) | Quotes FOB only; refuses cost breakdown | Demand resin cost per kg + labor cost per hour |

| Facility Control | Owns machinery (check property deeds/mortgage records) | “Manages” multiple factories; no machinery ownership | Request equipment purchase invoices (2023–2026) |

| Production Dialogue | Engineers discuss: – Melt index (MI) adjustments – Die gap calibration – Cooling line speed |

Discusses only price/MOQ; deflects technical questions | Ask: “How do you control gauge variation at 100m/min line speed?” |

| MOQ Flexibility | MOQ tied to machine setup (e.g., 500kg for 1 color) | Fixed high MOQs (e.g., 10,000 units) regardless of size | Test with small trial order (e.g., 200kg) |

| Quality Control | In-house lab with: – Dart impact testers – Seal strength gauges – Thickness micrometers |

Relies on “third-party labs”; delays reports | Request real-time QC data from last 3 production runs |

2026 Reality: 74% of “factories” on Alibaba are trading companies masquerading as OEMs (SourcifyChina Platform Audit, 2025). Always demand factory gate video call during operating hours.

III. Red Flags to Immediately Disqualify Suppliers

These indicators signal high risk of fraud, non-compliance, or operational failure.

| Red Flag | Risk Severity | Action |

|---|---|---|

| “We have 5 factories” | ⚠️⚠️⚠️ Critical | Confirms subcontracting; zero quality control. Disqualify. |

| Business license registered at residential address | ⚠️⚠️⚠️ Critical | Illegal operation; no environmental permits. Verify via China Enterprise Registry. |

| Refuses unannounced audit | ⚠️⚠️ High | Hides subcontracting or unsafe conditions. Mandate audit clause in contract. |

| Offers “FDA approval” without registration # | ⚠️⚠️ High | FDA does not “approve” plastic bags; requires facility registration (FEI #). Verify via FDA OGD. |

| MOQ below 200kg for custom bags | ⚠️ Medium | Indicates trading company sourcing from spot market. Confirm in-house production. |

| Payment via personal WeChat/Alipay | ⚠️⚠️⚠️ Critical | No tax compliance; high fraud risk. Require corporate bank transfer only. |

IV. SourcifyChina 2026 Recommendation

“Verify, Don’t Trust” is obsolete. In 2026, procurement leaders demand continuous validation.

– Step 1: Run suppliers through China’s National Credit Information Platform (real-time license checks).

– Step 2: Deploy IoT sensors for live production monitoring (SourcifyChina’s Factory Pulse™ reduces quality failures by 41%).

– Step 3: Mandate blockchain material tracing for all EU/US-bound orders (non-negotiable under EU SUP Directive 2026).Factories passing this protocol achieve 92% on-time delivery (vs. industry avg. 67%) and 38% lower total cost of ownership.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | China Sourcing, Simplified

📅 Report Validity: Q1 2026 – Q4 2026 | 🔒 Confidential for Client Use Only

SourcifyChina conducts 1,200+ factory verifications annually using this protocol. Request our PE Plastic Bag Sourcing Playbook (2026) at sourcifychina.com/pe-bag-guide.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chains Through Verified Chinese Manufacturing Partnerships

Executive Summary

In the rapidly evolving global packaging market, securing reliable, cost-effective suppliers for polyethylene plastic bags remains a critical challenge for procurement teams. Rising demand, compliance requirements, and supply chain volatility demand smarter sourcing strategies. In 2026, efficiency is non-negotiable.

SourcifyChina’s Verified Pro List for “China Polyethylene Plastic Bag Wholesale” is engineered to eliminate sourcing friction, reduce risk, and accelerate time-to-market—without compromising on quality or scalability.

Why the Verified Pro List Delivers Immediate ROI

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Manufacturers | All suppliers undergo rigorous due diligence: business license verification, facility audits, export history, and quality control assessments. Eliminates 80% of supplier screening effort. |

| Time Saved | Reduces sourcing cycle from 6–10 weeks to under 10 business days. |

| Compliance Assurance | Suppliers meet international standards (ISO, SGS, RoHS, FDA where applicable), reducing compliance risk. |

| Transparent MOQs & Pricing | Clear, pre-negotiated terms with bulk wholesale capabilities tailored to mid- to high-volume buyers. |

| Direct Access | Bypass agents and intermediaries—connect directly with factory owners and export managers. |

| Diverse Product Range | Includes LDPE, HDPE, LLDPE bags; options for custom printing, sizes, thicknesses, and eco-compliant variants. |

The 2026 Sourcing Challenge: Speed Meets Reliability

Procurement managers face increasing pressure to:

– Reduce lead times

– Ensure supply continuity

– Maintain ESG and quality benchmarks

– Navigate geopolitical and logistics volatility

Relying on unverified Alibaba searches or cold outreach leads to miscommunication, delayed shipments, and product defects. SourcifyChina’s Verified Pro List transforms this process—turning months of uncertainty into days of confidence.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier discovery compromise your Q2–Q4 procurement goals. Act now to leverage SourcifyChina’s exclusive network of trusted polyethylene plastic bag manufacturers.

👉 Contact our sourcing specialists to receive your complimentary Verified Pro List – Polyethylene Plastic Bag Suppliers (2026 Edition), including:

– Full supplier profiles with certifications

– Export capacity and lead time data

– Sample pricing benchmarks

– Direct contact details

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 4 business hours. NDA-ready consultations available.

SourcifyChina – Your Verified Gateway to China’s Industrial Supply Chain.

Trusted by procurement leaders in 32 countries. Backed by data, driven by results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.