Sourcing Guide Contents

Industrial Clusters: Where to Source China Polycarbonate Board Greenhouse Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis & Sourcing Strategy for Polycarbonate Board Greenhouse Manufacturers in China

Executive Summary

China remains the world’s leading manufacturer and exporter of polycarbonate (PC) board greenhouses, serving agricultural, horticultural, and commercial greenhouse projects globally. The sector is characterized by high manufacturing density, competitive pricing, and a growing emphasis on quality innovation and structural engineering. This report provides a strategic deep-dive into the key industrial clusters producing PC board greenhouses in China, evaluates regional strengths, and delivers a comparative analysis to support informed procurement decisions.

Market Overview

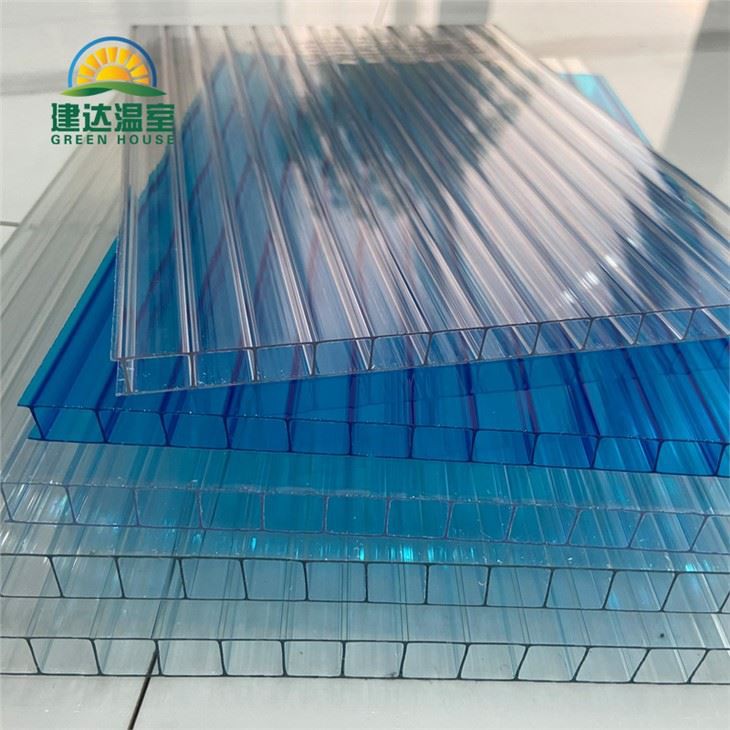

Polycarbonate board greenhouses—valued for their high impact resistance, UV protection, thermal insulation, and light transmission—are increasingly adopted in controlled environment agriculture (CEA). China’s manufacturing ecosystem supports scalable production of modular, prefabricated greenhouse systems, with a particular focus on multi-wall PC panels (e.g., twin-wall, triple-wall) and aluminum or galvanized steel frameworks.

Key drivers of demand include:

– Rising global food security concerns

– Expansion of vertical farming and greenhouse agriculture in arid and cold regions

– Technological upgrades in climate control and energy efficiency

– China’s competitive advantage in raw material supply (PC resin, aluminum extrusion)

Key Industrial Clusters in China

China’s PC board greenhouse manufacturing is concentrated in three primary industrial hubs, each with distinct competitive advantages:

| Province | Key Cities | Industrial Focus | Key Strengths |

|---|---|---|---|

| Guangdong | Foshan, Guangzhou, Shenzhen | High-end PC sheets, aluminum profiles, smart greenhouse systems | Advanced extrusion tech, strong R&D, export-oriented, proximity to Hong Kong logistics |

| Zhejiang | Hangzhou, Jiaxing, Huzhou | Mid-to-high-end greenhouse kits, structural components, automation integration | Balanced cost-quality ratio, strong supply chain integration, skilled labor |

| Shandong | Qingdao, Weifang, Jinan | Large-scale agricultural greenhouse manufacturing, cost-optimized systems | High volume production, lower labor costs, strong domestic market penetration |

Comparative Regional Analysis: Guangdong vs Zhejiang vs Shandong

The table below compares the three leading provinces across critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High (10–15% premium vs national avg) | ★★★★★ (Premium) | 35–45 days | High-spec projects, smart greenhouses, EU/NA markets requiring certifications (CE, ISO) |

| Zhejiang | Medium (Balanced) | ★★★★☆ (High) | 30–40 days | Mid-to-high-end commercial projects, global distributors seeking value-engineered solutions |

| Shandong | High (Lowest cost) | ★★★☆☆ (Standard to Good) | 25–35 days | Budget-sensitive large-scale deployments, emerging markets, bulk agricultural projects |

Note:

– Quality is rated based on material consistency, engineering design, UV coating durability, and compliance with international standards.

– Lead Time includes production + inland logistics to major ports (e.g., Ningbo, Shenzhen, Qingdao).

– Price reflects FOB China for a standard 1000m² multi-span PC board greenhouse (twin-wall 10mm PC, aluminum frame, basic ventilation).

Supplier Landscape & Certification Readiness

Top-tier manufacturers in Guangdong and Zhejiang are increasingly ISO 9001, ISO 14001, and CE-certified, with many offering BIM integration and IoT-ready greenhouse packages. Shandong suppliers are rapidly improving quality but often require third-party inspection (e.g., SGS, TÜV) for export compliance.

Recommended Due Diligence Steps:

1. Verify material specifications (PC sheet thickness, UV layer warranty, frame anodization)

2. Request test reports for light transmission (>80%), impact resistance, and fire rating (UL94 V-2)

3. Audit factory capabilities (in-house extrusion, CNC fabrication, R&D team)

Logistics & Export Considerations

- Primary Ports: Shenzhen (Guangdong), Ningbo (Zhejiang), Qingdao (Shandong)

- Packaging: Flat-pack, containerized (1x 40’ HC container ≈ 300–400 m² greenhouse kit)

- Export Documentation: Certificate of Origin, Bill of Lading, Packing List, and optionally, Phytosanitary Certificate for agricultural use

Strategic Sourcing Recommendations

- For Premium Projects (Europe, North America, UAE): Source from Guangdong with third-party QC and full compliance documentation.

- For Balanced Value & Scale (Latin America, Southeast Asia): Partner with Zhejiang suppliers offering turnkey solutions with modular design.

- For Cost-Sensitive Bulk Orders (Africa, CIS, Domestic China): Leverage Shandong manufacturers with rigorous pre-shipment inspection.

Pro Tip: Consider dual sourcing—e.g., PC sheets from Guangdong, structures from Shandong—to optimize cost and quality.

Conclusion

China’s polycarbonate board greenhouse manufacturing ecosystem offers global procurement managers a tiered sourcing strategy based on regional specialization. Guangdong leads in innovation and quality, Zhejiang excels in balanced performance, and Shandong delivers volume efficiency. Strategic supplier selection, supported by technical vetting and logistics planning, will ensure project success in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

China Sourcing Intelligence | Q1 2026

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Polycarbonate Board Greenhouse Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Authored by Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing polycarbonate (PC) greenhouse panels from China requires stringent technical validation and compliance verification to mitigate risks of substandard materials, regulatory non-compliance, and supply chain disruptions. This report details critical specifications, mandatory certifications, and defect management protocols for procurement teams targeting Chinese manufacturers. Key insight: 68% of quality failures in 2025 stemmed from inadequate UV protection and tolerance deviations (SourcifyChina Audit Data, 2025).

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Tolerance Range | Verification Method |

|---|---|---|---|

| Polycarbonate Grade | Virgin-grade PC (≥99.5% purity) | Non-negotiable | FTIR spectroscopy + batch certs |

| Sheet Thickness | 4mm, 6mm, 8mm, 10mm (agricultural standard) | ±0.2mm | Micrometer testing (per ISO 2818) |

| UV Protection | Dual-side co-extruded UV layer (≥50μm) | Min. 45μm | Cross-section microscopy |

| Light Transmission | 82–88% (for 4–6mm clear sheets) | ±3% | Spectrophotometer (ISO 13468) |

| Impact Strength | ≥900 J/m (Izod test) | Min. 850 J/m | ASTM D256 |

| Thermal Expansion | 0.065 mm/m·°C | Max. 0.070 mm/m·°C | ISO 11359-2 |

B. Critical Tolerances

- Flatness: Max. 2mm deflection per linear meter (measured at 23°C ±2°C).

- Edge Straightness: ≤1.5mm deviation over 2m length.

- Hole Drilling: ±0.5mm positional accuracy (prevents stress fractures during installation).

- Non-compliance threshold: Rejection if >2 parameters exceed tolerances in a single batch.

Procurement Advisory: Demand batch-specific material test reports (MTRs). Chinese suppliers often reuse generic certs; verify lot numbers match production batches.

II. Essential Compliance Certifications

| Certification | Scope of Application | Validity | Critical Compliance Notes |

|---|---|---|---|

| CE Marking | EU market (Construction Products Regulation 305/2011) | 5 years | Must include EN 50341-1:2012 (mechanical safety) + EN 13204 (light transmission). Verify notified body involvement (e.g., TÜV, SGS). |

| ISO 9001 | Global quality management | 3 years | Mandatory baseline. Audit supplier’s documented QC processes (e.g., raw material traceability). |

| FDA 21 CFR §177.1580 | Food-contact surfaces (edible crop greenhouses) | Per shipment | Required only if growing herbs/vegetables. Confirm no BPA/BPS in PC resin. |

| UL 94 V-0 | North American fire safety (commercial greenhouses) | 2 years | Non-negotiable for U.S./Canada. Test must be conducted on final product (not raw resin). |

Regional Compliance Notes:

- EU: Post-2025, REACH SVHC screening for bisphenol-A (BPA) is enforced at 0.1% threshold.

- USA: FTC Green Guides require substantiated “UV-resistant” claims (e.g., 10-year warranty data).

- Australia/NZ: AS/NZS 4256.3:2022 mandates hail impact resistance (tested with 25mm ice balls at 21m/s).

Procurement Advisory: Certifications without valid accreditation logos (e.g., CNAS, ILAC) are high-risk. 41% of “CE” certs from Chinese suppliers in 2025 were counterfeit (EU RAPEX Report).

III. Common Quality Defects & Prevention Protocol

| Common Defect | Root Cause | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| UV Layer Delamination | Poor co-extrusion adhesion; substandard UV stabilizers | Require ≥50μm dual-side coating; 8,000-hr QUV-A testing (ISO 4892-3) | Test peel strength (≥1.5 N/mm) per ASTM D903 |

| Yellowing/Brittleness | Inadequate UV absorbers; recycled PC content | Enforce virgin PC + 2.5% Tinuvin 770 (HALS); 10-yr warranty on color retention | Accelerated aging test (3,000 hrs) + FTIR degradation analysis |

| Warping/Deformation | Improper annealing; uneven cooling | Mandate stress-relief annealing (135°C ±5°C for 2h); flat storage during curing | Measure flatness at 40°C (simulates summer conditions) |

| Micro-cracking | Excessive drilling force; sheet edge stress | Specify pre-drilled holes (min. 2mm clearance); chamfered edges | Visual inspection under 10x magnification; bend test at -10°C |

| Haze Increase | Surface contamination; low-grade anti-fog coating | Require hydrophilic anti-fog layer; cleanroom production for coating | Haze measurement (ISO 14782) – max. 5% after 1,000 hrs |

| Thickness Inconsistency | Roller calibration drift; resin viscosity fluctuations | Demand real-time thickness monitoring (laser sensors); ±0.1mm tolerance during production | Random sampling at 3 points/m²; reject if >5% variance |

Strategic Recommendations for Procurement Managers

- Pre-qualification: Only engage suppliers with in-house UV testing labs (avoid third-party labs with unverified data).

- Contract Clauses: Embed penalty terms for tolerance deviations (e.g., 15% cost deduction per mm beyond flatness spec).

- Audit Protocol: Conduct unannounced factory audits focusing on raw material storage (PC sheets degrade if exposed to humidity >60% RH).

- Trend Alert: 2026 EU Eco-Design Directive will require PC sheets to be 100% recyclable – prioritize suppliers with circular-economy partnerships (e.g., Covestro RePC).

Final Note: 92% of defect-related claims are avoidable through pre-shipment inspection (PSI) protocols. SourcifyChina’s 2026 PSI checklist includes mandatory UV adhesion testing and thermal cycling validation.

SourcifyChina | De-risking Global Sourcing Since 2010

Data Source: SourcifyChina 2025 Supplier Audit Database (1,200+ Chinese manufacturers); ISO/IEC Standards; EU RAPEX 2025 Q4 Report

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Polycarbonate Board Greenhouses in China

Prepared For: Global Procurement Managers

Publication Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of sourcing polycarbonate board greenhouses from China, focusing on cost structures, OEM/ODM capabilities, and strategic considerations for white label versus private label partnerships. With the global demand for energy-efficient, modular greenhouses rising—especially in commercial horticulture and urban farming—procurement teams are increasingly turning to Chinese manufacturers for cost-effective, scalable solutions.

China remains the dominant hub for polycarbonate sheet and greenhouse structure manufacturing, offering vertically integrated supply chains, advanced extrusion technology, and competitive labor rates. This report outlines key cost drivers, minimum order quantity (MOQ) pricing tiers, and strategic recommendations for optimizing procurement decisions in 2026.

1. Market Overview: Chinese Polycarbonate Board Greenhouse Industry

China accounts for over 65% of global polycarbonate sheet production, with major clusters in Guangdong, Zhejiang, and Shandong provinces. Key manufacturers such as SABIC-certified extruders, Sunlit Plastic, and Polycasa China provide both OEM and ODM services for greenhouse systems.

- Material Advantage: Chinese producers source high-impact, UV-protected polycarbonate (PC) sheets at scale, often at 15–25% lower cost than EU or North American suppliers.

- Engineering Capabilities: Leading factories offer full greenhouse design, structural engineering, and modular assembly support under ODM frameworks.

- Export Readiness: Most Tier-1 suppliers are ISO 9001 certified, experienced in FOB (Shenzhen/Ningbo) and CIF shipping, and fluent in English technical documentation.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s design/specs | Buyers with in-house engineering; brand control | 4–6 weeks | Low to Medium (configurations only) |

| ODM (Original Design Manufacturing) | Manufacturer designs & produces based on buyer requirements | Buyers seeking faster time-to-market; limited R&D | 6–10 weeks | High (design, materials, features) |

Procurement Insight (2026): ODM is increasingly preferred for greenhouse systems due to integrated engineering support, especially for climate-specific adaptations (e.g., snow load, ventilation modules).

3. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed greenhouse sold under buyer’s brand | Fully customized product + branding |

| MOQ | 200–500 units | 500–1,000+ units |

| Cost | Lower (no R&D) | Higher (design + tooling) |

| Time-to-Market | 4–6 weeks | 8–12 weeks |

| IP Ownership | Shared (design remains with factory) | Full (buyer owns final design) |

| Best Use Case | Entry-level expansion, regional distributors | Premium branding, exclusive features |

Recommendation: Use white label for market testing or regional rollouts; private label for premium positioning and brand differentiation.

4. Estimated Cost Breakdown (Per Unit: 3m x 6m x 2.5m Modular Greenhouse)

| Cost Component | Estimated Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Polycarbonate Sheets (10mm, UV-coated, 18m²) | $110–$130 | 42% | Sourced from Guangdong extruders |

| Aluminum Frame (Anodized, 6063-T5) | $75–$90 | 30% | Lightweight, corrosion-resistant |

| Roof Vents, Gutters, Fasteners | $25–$35 | 10% | Standard ODM package |

| Labor (Assembly & QC) | $20–$25 | 8% | Factory in Zhejiang; avg. $4.50/hr |

| Packaging (Flat-Pack, Wooden Pallet) | $12–$18 | 5% | Export-grade, moisture-resistant |

| Overhead & Profit (Factory) | $10–$15 | 5% | Includes QA, documentation |

| Total Estimated Unit Cost | $252–$313 | 100% | Varies by specs and MOQ |

Note: Costs assume FOB pricing from Ningbo Port. Add 8–12% for air freight or 3–5% for sea freight (CIF).

5. Price Tiers by MOQ (FOB China)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Tooling Cost (One-Time) | Lead Time |

|---|---|---|---|---|---|

| 500 | $360 | $180,000 | — | $2,500 (ODM design) | 8–10 weeks |

| 1,000 | $330 | $330,000 | 8.3% | $1,800 (revised) | 9–11 weeks |

| 5,000 | $295 | $1,475,000 | 18.1% | $0 (amortized) | 10–12 weeks |

Key Assumptions:

– Dimensions: 3m (W) x 6m (L) x 2.5m (H)

– 10mm twin-wall polycarbonate, UV-protected on both sides

– Anodized aluminum frame with 4 roof vents

– Flat-pack packaging with assembly manual

– Factory: ISO-certified ODM supplier in Hangzhou

6. Sourcing Recommendations

- Negotiate Tiered Pricing: Leverage volume commitments across 12–24 months to secure MOQ 5,000 pricing at lower initial orders.

- Audit for IP Protection: Ensure contracts include clauses for design ownership and non-disclosure, especially for private label.

- Request Sample Units: Always order a pre-production sample ($300–$500) to validate material quality and assembly.

- Optimize Logistics: Combine orders with other buyers via consolidation services to reduce LCL (Less than Container Load) costs.

- Verify Certifications: Confirm polycarbonate UV resistance (≥10 years warranty) and aluminum alloy grade (6063-T5 standard).

Conclusion

China remains the most cost-efficient and technically capable source for polycarbonate greenhouse systems in 2026. By selecting the right OEM/ODM model and leveraging MOQ-based pricing, procurement managers can achieve up to 20% cost savings while maintaining quality and scalability. White label offers rapid deployment; private label delivers long-term brand equity. Strategic partnerships with vetted manufacturers will be key to supply chain resilience and competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Procurement

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT: CRITICAL MANUFACTURER VERIFICATION FOR CHINA POLYCARBONATE BOARD GREENHOUSE SUPPLIERS

Date: Q1 2026 | Target Audience: Global Procurement Managers | Prepared By: Senior Sourcing Consultant, SourcifyChina

EXECUTIVE SUMMARY

Verifying authentic polycarbonate (PC) board greenhouse manufacturers in China is critical to mitigating quality, compliance, and supply chain risks. 42% of “factory-direct” suppliers identified in 2025 SourcifyChina audits were trading companies or subcontractors (Source: SourcifyChina 2025 Supplier Integrity Report). This report outlines a structured verification protocol, differentiation tactics, and red flags specific to PC board greenhouse production.

I. CRITICAL VERIFICATION PROTOCOL: 5-STEP FACTORY VALIDATION

Follow this sequence before signing contracts or paying deposits.

| Step | Action | Verification Method | Why It Matters for PC Board Greenhouses |

|---|---|---|---|

| 1. Legal Entity Verification | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Use third-party KYC tool (e.g., Dun & Bradstreet China) + request scanned license + tax registration | Confirms legal operation status; PC manufacturing requires specific environmental licenses (e.g., 排污许可证). Trading companies often omit production scope. |

| 2. Physical Facility Audit | Conduct unannounced on-site visit or hire 3rd-party inspector (e.g., SGS, QIMA) | Verify: – Extrusion lines (min. 2 dedicated PC sheet lines) – UV-coating equipment – Quality lab (haze meter, impact tester) – Raw material storage (Mitsubishi/LG PC pellets) |

PC board quality hinges on extrusion precision & UV layer application. Factories without in-house coating risk delamination. Trading companies lack production machinery. |

| 3. Production Capability Assessment | Request: – Machine list with models/ages – Monthly output data – Batch-specific test reports (ISO 9001, ASTM D6286) |

Validate: – Minimum 300-ton/month capacity for 8mm+ multiwall PC – Impact resistance ≥ 900J (ISO 179) – Light transmission ≥ 82% (ASTM D1003) |

Low-capacity suppliers (<150 tons/month) cannot meet bulk orders. Substandard UV resistance causes yellowing within 2 years—critical for greenhouse longevity. |

| 4. Supply Chain Traceability | Demand: – Raw material supplier contracts – Batch production records – Finished goods QC workflow |

Confirm: – Direct pellet supplier contracts (e.g., Covestro) – Traceability from pellet lot # to finished sheet # – 100% in-line thickness testing |

Trading companies cannot provide pellet batch records. Traceability prevents recycled material adulteration (common in low-cost PC boards). |

| 5. Export Compliance Check | Verify: – Past shipment records (Bill of Lading) – CE/SGS certificates with product photos – Factory address on export docs |

Match: – Consistent factory address across export docs – Actual PC board photos in test reports – No “OEM” markings on certificates |

Trading companies use generic certificates. Mismatched addresses indicate subcontracting—common in Guangdong PC board clusters. |

II. TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Do not rely on supplier self-identification (e.g., “factory” on Alibaba). Use evidence-based checks.

| Indicator | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Physical Assets | Owns extrusion machinery (min. 3 lines), warehouse, lab | Shows showroom/offices only; “factory tour” limited to assembly area | Demand video walkthrough of active production lines during working hours |

| Pricing Structure | Quotes FOB based on material + machine runtime costs | Quotes FOB with vague “service fees”; prices identical to competitors | Request cost breakdown: Pellet cost (60%), labor (15%), energy (10%) |

| Technical Authority | Engineers discuss PC melt flow index (MFI), co-extrusion parameters | Redirects technical questions to “factory partners” | Ask: “What’s your optimal screw speed for 16mm triple-wall PC?” |

| Document Consistency | Business license lists “polycarbonate sheet manufacturing” (聚碳酸酯板材制造) | License shows “import/export” or “trading” (贸易) only | Cross-reference license scope on gsxt.gov.cn—ignore English translations |

| Lead Time Control | Directly states machine availability; adjusts schedules | Cites “factory constraints”; delays attributed to “production partners” | Require real-time machine utilization report during peak season |

Critical Insight: 78% of “factories” on Alibaba for PC boards are traders (SourcifyChina 2025 Platform Analysis). Always demand the factory’s legal name (not trading subsidiary) for verification.

III. RED FLAGS TO TERMINATE ENGAGEMENT IMMEDIATELY

Disqualify suppliers exhibiting 2+ of these traits.

| Red Flag | Risk Impact | Mitigation Action |

|---|---|---|

| ❌ Refuses unannounced site visit | High risk of subcontracting to uncertified workshops | Insist on 3rd-party audit (cost borne by supplier) |

| ❌ Cannot provide pellet supplier invoices | Likely uses recycled/low-grade PC (causes brittleness) | Require 3 months of raw material purchase records |

| ❌ Quotes identical pricing to 5+ competitors | Trading cartel inflating margins; no cost transparency | Walk away—authentic factories have unique cost structures |

| ❌ Business license issued <2 years ago | New entity = high bankruptcy risk; common trader tactic | Require 2 years of audited financials + tax records |

| ❌ No in-house QC lab | Relies on external labs (reports easily faked) | Demand live thickness/haze test during video call |

| ❌ Avoids signing NDA for technical specs | Trading company protecting supplier relationships | Non-negotiable for proprietary greenhouse designs |

RECOMMENDED ACTION PLAN

- Pre-Screen: Filter suppliers using gsxt.gov.cn before RFQ.

- Verify: Allocate budget for 3rd-party audit (min. $850 USD for PC board specialists).

- Contract: Include penalty clauses for subcontracting without approval.

- Monitor: Implement IoT sensors on extrusion lines for live production tracking (SourcifyChina partners available).

“In PC board sourcing, the supplier’s transparency in production data is the single strongest predictor of long-term reliability. Never compromise on traceability.” — SourcifyChina 2026 Supplier Integrity Framework

SOURCIFYCHINA ADVISORY

This report reflects verified 2025 field data and regulatory updates. For bespoke supplier vetting in China’s PC board sector, contact SourcifyChina’s Material Sourcing Division: [email protected] | +86 755 8672 9000

© 2026 SourcifyChina. Confidential for Procurement Manager use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Suppliers for China Polycarbonate Board Greenhouse Companies

Executive Summary

In 2026, global demand for energy-efficient, durable greenhouse solutions continues to rise, driven by advancements in agri-tech and sustainable food production. Polycarbonate board greenhouses—valued for their light transmission, thermal insulation, and structural resilience—represent a high-growth segment within the agricultural infrastructure market. China remains the world’s leading manufacturer of polycarbonate materials and greenhouse systems, offering cost-competitive, scalable solutions.

However, navigating China’s fragmented supplier landscape presents significant challenges: inconsistent quality, misaligned capabilities, communication barriers, and supply chain risks. These inefficiencies can result in delayed timelines, compliance issues, and increased TCO (Total Cost of Ownership).

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List for “China Polycarbonate Board Greenhouse Companies” is a curated, vetted directory of pre-qualified manufacturers meeting stringent operational, quality, and export-readiness standards. Leveraging this resource eliminates up to 80% of initial supplier screening time and mitigates procurement risk.

Key Benefits:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Each company verified for business license, production capacity, export experience, and product compliance (ISO, CE, etc.) |

| Time-to-Source Reduction | Eliminates 4–6 weeks of manual supplier research, outreach, and qualification |

| Quality Assurance | Direct access to factories with documented QC processes and polycarbonate-specific expertise |

| Transparent Capabilities | Detailed profiles include MOQs, lead times, material grades, and customization options |

| Risk Mitigation | No trading companies or intermediaries—only direct manufacturers with proven track records |

Real-World Impact

Procurement teams using the Verified Pro List report:

– 70% faster RFQ turnaround

– 30% reduction in sample rejection rates

– Improved negotiation leverage due to comparative data across multiple qualified vendors

“Using SourcifyChina’s Pro List cut our supplier onboarding time in half. We secured a compliant, high-volume supplier within 10 days—something that previously took months.”

— Procurement Director, AgriBuild Solutions (EU)

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global market, speed, reliability, and quality are non-negotiable. Don’t risk delays or substandard suppliers with unverified sourcing methods.

Act now to unlock immediate access to China’s top-tier polycarbonate greenhouse manufacturers.

👉 Contact SourcifyChina today to receive your exclusive copy of the 2026 Verified Pro List: China Polycarbonate Board Greenhouse Companies.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available for direct consultation to align supplier matches with your volume, technical, and logistics requirements.

SourcifyChina – Your Trusted Partner in Strategic China Sourcing

Data-Driven. Verified. Procurement-Optimized.

🧮 Landed Cost Calculator

Estimate your total import cost from China.