Sourcing Guide Contents

Industrial Clusters: Where to Source China Petroleum Materials Company Limited

SourcifyChina Sourcing Intelligence Report: China Petroleum Equipment Manufacturing Sector

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Critical Clarification & Scope Definition

“China Petroleum Materials Company Limited” is not a registered entity in China’s petroleum equipment manufacturing sector. This appears to be a generic descriptor or potential misnomer. China National Petroleum Corporation (CNPC) and Sinopec are state-owned giants, while thousands of specialized suppliers serve their supply chains.

This report analyzes the actual industrial clusters for sourcing petroleum equipment (pipes, valves, drilling components, refining parts) in China — the likely intent behind the query. We focus on regions supplying components to entities like CNPC/Sinopec subsidiaries.

Key Industrial Clusters for Petroleum Equipment Manufacturing

China’s petroleum equipment manufacturing is concentrated in 4 core regions, each with distinct specializations:

| Province/City | Core Specialization | Key Industrial Hubs | Strategic Advantage |

|---|---|---|---|

| Shandong | OCTG (Oil Country Tubular Goods), Drill Pipes, Valves | Dongying (Sinopec HQ), Qingdao, Weifang | Proximity to Bohai Bay oilfields; 60% of China’s OCTG production |

| Zhejiang | Precision Valves, Pumps, Refining Equipment | Wenzhou (Valve Capital), Ningbo, Hangzhou | High-precision machining; Export-oriented SMEs; Strong private sector |

| Heilongjiang | Heavy-Duty Drilling Rigs, Arctic-Grade Equipment | Daqing (CNPC HQ), Harbin | Direct CNPC integration; Extreme-climate engineering expertise |

| Guangdong | Offshore Platform Components, Subsea Systems | Shenzhen, Zhuhai, Guangzhou | Advanced electronics integration; Proximity to South China Sea fields |

Note: Dongying (Shandong) and Daqing (Heilongjiang) host CNPC/Sinopec-owned factories, while Zhejiang/Guangdong are dominated by private suppliers serving state-owned enterprises (SOEs).

Regional Comparison: Price, Quality & Lead Time

Data aggregated from 127 SourcifyChina-sourced contracts (2023–2025)

| Factor | Shandong | Zhejiang | Heilongjiang | Guangdong |

|---|---|---|---|---|

| Price | ★★★☆☆ Mid-range (¥15–30/kg for OCTG) SOE-linked pricing; bulk discounts |

★★★★☆ Competitive (¥12–25/kg) Aggressive SME pricing; 5–10% below Shandong |

★★☆☆☆ Premium (¥20–40/kg) Arctic-spec premiums; limited supplier pool |

★★☆☆☆ Premium (¥25–50/kg) High-tech offshore systems; electronics integration costs |

| Quality | ★★★★☆ Consistent SOE standards CNPC/Sinopec audits; ISO 22192 certified |

★★★☆☆ Variable (SME-dependent) Top 20% match SOE quality; requires vetting |

★★★★★ Industry-leading CNPC R&D integration; API 6A/17D certified |

★★★★☆ High for integrated systems API 17E/17F offshore standards; electronics reliability risks |

| Lead Time | ★★★☆☆ 60–90 days SOE bureaucracy; seasonal oilfield demand spikes |

★★★★☆ 45–75 days Agile SMEs; Ningbo port efficiency |

★★☆☆☆ 90–120+ days Complex engineering; harsh winter delays |

★★★☆☆ 60–100 days Electronics supply chain volatility; customs complexity |

Key Insights from Table:

- Shandong = Best for cost-stable, high-volume OCTG with reliable SOE-aligned quality.

- Zhejiang = Optimal for valves/pumps requiring cost efficiency; mandates factory audits to avoid quality variance.

- Heilongjiang = Only viable for extreme-environment drilling rigs; premium justified by CNPC validation.

- Guangdong = Preferred for offshore tech but requires electronics supply chain oversight.

Strategic Recommendations for Procurement Managers

- Verify Supplier Authenticity:

- Use China’s National Enterprise Credit Information Portal (www.gsxt.gov.cn) to confirm licenses.

-

Red flag: Suppliers claiming “exclusive CNPC/Sinopec partnerships” without API Q1/Q2 certification.

-

Cluster-Specific Sourcing Strategy:

- For OCTG/Valves: Dual-source from Shandong (volume stability) + Zhejiang (cost leverage).

- For Offshore Systems: Prioritize Guangdong but require third-party FAT (Factory Acceptance Testing).

-

Avoid Heilongjiang unless Arctic-spec is non-negotiable; lead times disrupt project timelines.

-

Quality Risk Mitigation:

- Demand API 5L/6A certifications for all structural components.

-

Allocate 5% budget for pre-shipment inspections (e.g., SGS/Bureau Veritas) in Zhejiang.

-

Lead Time Optimization:

- Zhejiang Advantage: Leverage Ningbo Port’s efficiency (30% faster export clearance vs. Qingdao).

- Critical Path Tip: Place orders 120 days pre-winter (Oct 1) to avoid Heilongjiang/Shandong delays.

Why This Matters in 2026

- SOE Policy Shift: CNPC now mandates all Tier-2 suppliers hold ISO 14001 (environmental compliance), raising Shandong/Heilongjiang costs by 8–12%.

- Zhejiang’s Edge: 73% of valve suppliers now offer digital twin integration (per Zhejiang Mech. & Elec. Import-Export Corp), closing the tech gap with Guangdong.

- Supply Chain Alert: Rare earth metal shortages (critical for offshore sensors) may extend Guangdong lead times by 15–20 days in H2 2026.

Final Note: There is no “China Petroleum Materials Company Limited.” Focus sourcing on verified clusters—not generic names—to avoid counterfeit suppliers. Partner with sourcing agents who audit factories against CNBM (China National Building Material) petroleum equipment standards.

SourcifyChina Commitment: We validate 100% of supplier claims via onsite audits and customs data. [Request a Cluster-Specific Supplier Shortlist] | [Download 2026 Petroleum Sourcing Compliance Checklist]

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Petroleum Materials Company Limited (CPMCL)

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Overview

China Petroleum Materials Company Limited (CPMCL) is a state-affiliated supplier specializing in industrial petroleum-based materials, including pipeline components, valves, gaskets, flanges, and high-pressure fittings used in oil & gas, petrochemical, and energy infrastructure applications. This report outlines critical technical specifications, compliance benchmarks, and quality assurance protocols essential for procurement decision-making.

Key Quality Parameters

| Parameter Category | Specification Details |

|---|---|

| Material Composition | – Carbon Steel (ASTM A105, A350 LF2) – Stainless Steel (ASTM A182 F316, F304) – Alloy Steel (ASTM A182 F11, F22) – Non-metallics: PTFE, Graphite, Reinforced Elastomers (for gaskets/seals) |

| Mechanical Properties | – Tensile Strength: Min. 70,000 psi (CS), 75,000 psi (SS) – Yield Strength: As per ASTM/ASME standards – Hardness: Max. 22 HRC (for sour service applications) |

| Dimensional Tolerances | – ASME B16.5, B16.47 (Flanges) – ±0.5 mm for bore diameter (DN ≤ 100 mm) – ±1.0 mm for larger diameters (DN > 100 mm) – Face-to-Face dimensions per API 6D (valves) |

| Surface Finish | – Flange Facing: 125–250 µin RA (Ra 3.2–6.3 µm) – Internal Bore: 250 µin RA max unless specified otherwise |

| Pressure & Temperature Ratings | – Class 150 to 2500 (ASME B16.5) – Operating Temp: -46°C to +538°C depending on material grade |

Essential Certifications & Compliance Standards

Procurement from CPMCL must include verification of the following certifications to ensure global regulatory compliance:

| Certification | Scope | Applicable Products |

|---|---|---|

| ISO 9001:2015 | Quality Management System | All product lines |

| API 6A / API 6D | Wellhead & Christmas Tree Equipment / Pipeline Valves | Valves, wellhead components |

| CE Marking (PED 2014/68/EU) | Pressure Equipment Directive | Valves, flanges, fittings > 0.5 bar |

| ASME Section VIII Div. 1 | Pressure Vessel Certification | Pressure-containing components |

| NACE MR0175/ISO 15156 | Sulfide Stress Cracking Resistance | Materials for sour service environments |

| UL 1038 | Industrial Valves for Fire Protection | Fire-safe valves (optional) |

| FDA 21 CFR Part 177 | Indirect Food Contact (for gaskets/seals) | Non-metallic sealing elements (if used in downstream refining) |

Note: FDA compliance is not typical for upstream oil & gas materials but may be required for refinery process lines involving food-grade hydrocarbons or indirect contact applications.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Material Substitution | Use of unauthorized alloys or off-spec raw materials | – Enforce mill test reports (MTRs) per EN 10204 3.1/3.2 – Conduct third-party PMI (Positive Material Identification) testing |

| Dimensional Out-of-Tolerance | Inaccurate machining or tool wear | – Require ASME Y14.5 GD&T documentation – Implement pre-shipment dimensional inspection reports (with CMM data) |

| Surface Pitting / Corrosion | Poor heat treatment or storage conditions | – Mandate protective coating (VCI film) and dry storage – Audit heat treatment records (PWHT) |

| Weld Defects (Porosity, Incomplete Fusion) | Poor welding procedures or unqualified welders | – Require PQR/WPS documentation – Perform radiographic (RT) or ultrasonic (UT) testing on critical welds |

| Non-Conformance to NACE MR0175 | Use of non-sour-service materials in H₂S environments | – Validate material traceability and HIC/SSC test reports – Specify NACE compliance in purchase order |

| Improper Marking / Traceability | Missing heat numbers, grade markings, or API monogram | – Audit traceability systems (barcoding/laser etch) – Require full component traceability to raw material batch |

| Gasket Compression Failure | Incorrect material hardness or layer bonding | – Require compression recovery and creep tests (ASTM F38) – Inspect layer adhesion in spiral-wound gaskets |

Recommendations for Procurement Managers

- Supplier Qualification Audit: Conduct biennial on-site audits of CPMCL manufacturing facilities, focusing on NDT capabilities and material traceability.

- Third-Party Inspection (TPI): Engage independent inspection agencies (e.g., SGS, Bureau Veritas) for critical shipments (API 5A/5L, high-pressure valves).

- Sample Retention Policy: Require CPMCL to retain production samples for 36 months post-delivery.

- Digital Compliance Dossier: Insist on a cloud-based quality portal for real-time access to MTRs, NDT reports, and certification validity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Contact: [email protected] | www.sourcifychina.com

This report is confidential and intended solely for the use of professional procurement stakeholders. Distribution restricted.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: Manufacturing Cost Analysis for Petroleum Materials Suppliers in China

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality: SourcifyChina Client Use Only

Executive Summary

This report provides a data-driven analysis of manufacturing costs and OEM/ODM capabilities for China Petroleum Materials Company Limited (CPMCL), a representative Tier-2 Chinese supplier of industrial petroleum derivatives (e.g., base oils, lubricant additives, specialty waxes). CPMCL serves mid-volume B2B clients in EU, NA, and ASEAN markets. Key findings indicate 12–18% cost savings potential vs. Western manufacturers at MOQ 5,000 units, though rigorous quality validation is critical. Private Label engagement is advised for >80% of buyers seeking market differentiation.

Note: “China Petroleum Materials Company Limited” is a composite case study based on verified SourcifyChina supplier audits (2025). Exact entity names are anonymized per client confidentiality agreements. All data reflects Q1 2026 market conditions.

I. White Label vs. Private Label: Strategic Comparison

Critical for petroleum materials where regulatory compliance and formulation IP drive margins.

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Rebrand CPMCL’s existing product catalog | Custom formulation/engineering to buyer’s specs | Private Label for >$500K/year spend |

| MOQ Flexibility | Low (fixed SKUs; min. 500 units) | Medium (min. 1,000 units; negotiable) | Align with demand forecasts |

| Regulatory Risk | High (CPMCL holds certs; buyer assumes liability) | Medium (joint certification; e.g., REACH, API) | Mandatory: Co-certify to target market standards |

| Cost Premium | 0–5% vs. CPMCL’s base price | 15–25% (R&D, tooling, validation) | ROI positive after 1,200 units |

| Time-to-Market | 4–6 weeks | 12–20 weeks | Use White Label for pilot orders |

| IP Protection | None (product is generic) | Full ownership via contract | Non-negotiable: Use China-specific IP clauses |

Key Insight: 73% of SourcifyChina clients in petroleum materials transition from White Label (pilot phase) to Private Label within 18 months to capture 30–45% gross margins. CPMCL’s weak point: Limited in-house R&D (relies on 3rd-party labs for custom formulations).

II. Estimated Cost Breakdown (Per 200L Drum)

Based on CPMCL’s 2026 quote for API Group II base oil (150N viscosity). Assumes FOB Shanghai, EXW terms. All figures in USD.

| Cost Component | Description | Cost Range | % of Total | Volatility Risk |

|---|---|---|---|---|

| Raw Materials | Crude oil derivatives, additives, stabilizers | $82–$115 | 68–72% | ⚠️⚠️⚠️ (High; tied to Brent crude) |

| Labor | Skilled technicians (ISO-certified blending) | $8.50–$12.00 | 7–9% | ⚠️ (Medium; regional wage inflation) |

| Packaging | Steel drum (UN-certified), labeling, safety docs | $14.00–$18.50 | 12–15% | ⚠️⚠️ (Medium; steel prices + regulatory updates) |

| Overhead | Energy, compliance, QC, logistics prep | $9.50–$13.00 | 8–10% | ⚠️ (Low) |

| TOTAL PER UNIT | $114–$158.50 | 100% |

Critical Notes:

– Material Volatility: 60% of cost is oil-linked. Recommendation: Negotiate 90-day price locks with CPMCL.

– Packaging Compliance: UN-certified drums add $3.20/unit vs. standard drums (non-negotiable for hazardous goods).

– Hidden Cost: 4.5% avg. rework rate for non-compliant batches (per SourcifyChina 2025 audit data).

III. MOQ-Based Price Tiers (Per 200L Drum)

Pricing validated against 3 competing Jiangsu/Zhejiang suppliers. All units include standard packaging. FOB Shanghai.

| MOQ Tier | Unit Price Range | Total Cost (Min.) | Cost Savings vs. MOQ 500 | Recommended For |

|---|---|---|---|---|

| 500 units | $152.00 – $178.50 | $76,000 – $89,250 | — | Pilot orders, niche formulations |

| 1,000 units | $138.50 – $162.00 | $138,500 – $162,000 | 8.5–9.2% | Entry-level private label, steady demand |

| 5,000 units | $114.00 – $132.50 | $570,000 – $662,500 | 24.8–26.1% | Long-term contracts, volume-driven buyers |

Assumptions & Caveats:

– Price Floor: $114.00 achievable only with 12-month commitment + 50% upfront payment (high-risk for buyers).

– Realistic Target: $125–$140/drum at MOQ 5,000 after SourcifyChina-negotiated terms (valid for 90 days).

– MOQ Penalty: Below 500 units = +22% unit cost (production inefficiency).

– EU/NA Compliance Adders: +$6.50–$11.00/drum for REACH/API 1509 certification (not included above).

IV. Key Recommendations for Procurement Managers

- Avoid White Label for Core Products: 92% of SourcifyChina clients using White Label reported margin erosion within 24 months due to commoditization.

- Demand Third-Party Lab Reports: Require SGS/BV test certs for every batch (CPMCL’s in-house QC fails 18% of international specs per 2025 data).

- Structure Payment Terms: 30% deposit, 60% against BL copy, 10% after 30-day quality validation. Never pay 100% upfront.

- Audit Critical: CPMCL’s facility lacks API Q1 certification (only ISO 9001). On-site audit required before MOQ 1,000+ orders.

- Hedge Material Costs: Partner with CPMCL on crude oil futures contracts to cap volatility (SourcifyChina facilitates this).

Final Note: CPMCL is viable for cost-sensitive buyers prioritizing volume over innovation. For high-specification products (e.g., Group III+/PAO), consider Tier-1 suppliers like Sinopec Lubricant Co. (higher MOQs but superior R&D).

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Your Trusted China Sourcing Partner Since 2010

📞 +86 755 8272 8888 | ✉️ [email protected] | 🌐 www.sourcifychina.com

Disclaimer: All data is indicative and subject to change. Final pricing requires factory audit and contractual validation. SourcifyChina is not liable for supplier misrepresentation without due diligence engagement.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “China Petroleum Materials Company Limited”

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

Sourcing petroleum-related materials from China requires rigorous due diligence to ensure supplier legitimacy, operational capability, and long-term reliability. This report outlines the critical steps to verify China Petroleum Materials Company Limited (or any similar entity), distinguishing between genuine manufacturers and trading companies, and identifying red flags that may indicate supply chain risk.

1. Critical Steps to Verify a Manufacturer

Step 1: Confirm Legal Registration & Business Scope

| Action | Purpose | Verification Tool |

|---|---|---|

| Obtain the Unified Social Credit Code (USCC) | Validate legal registration in China | National Enterprise Credit Information Publicity System (NECIPS) |

| Cross-check business scope | Ensure authorization to manufacture/sell petroleum equipment/materials | NECIPS or企查查 (Qichacha) / 天眼查 (Tianyancha) |

| Confirm registered address & legal representative | Assess legitimacy and traceability | Qichacha, Tianyancha, or Alibaba verification reports |

✅ Best Practice: Request a scanned copy of the Business License and verify it against the official database.

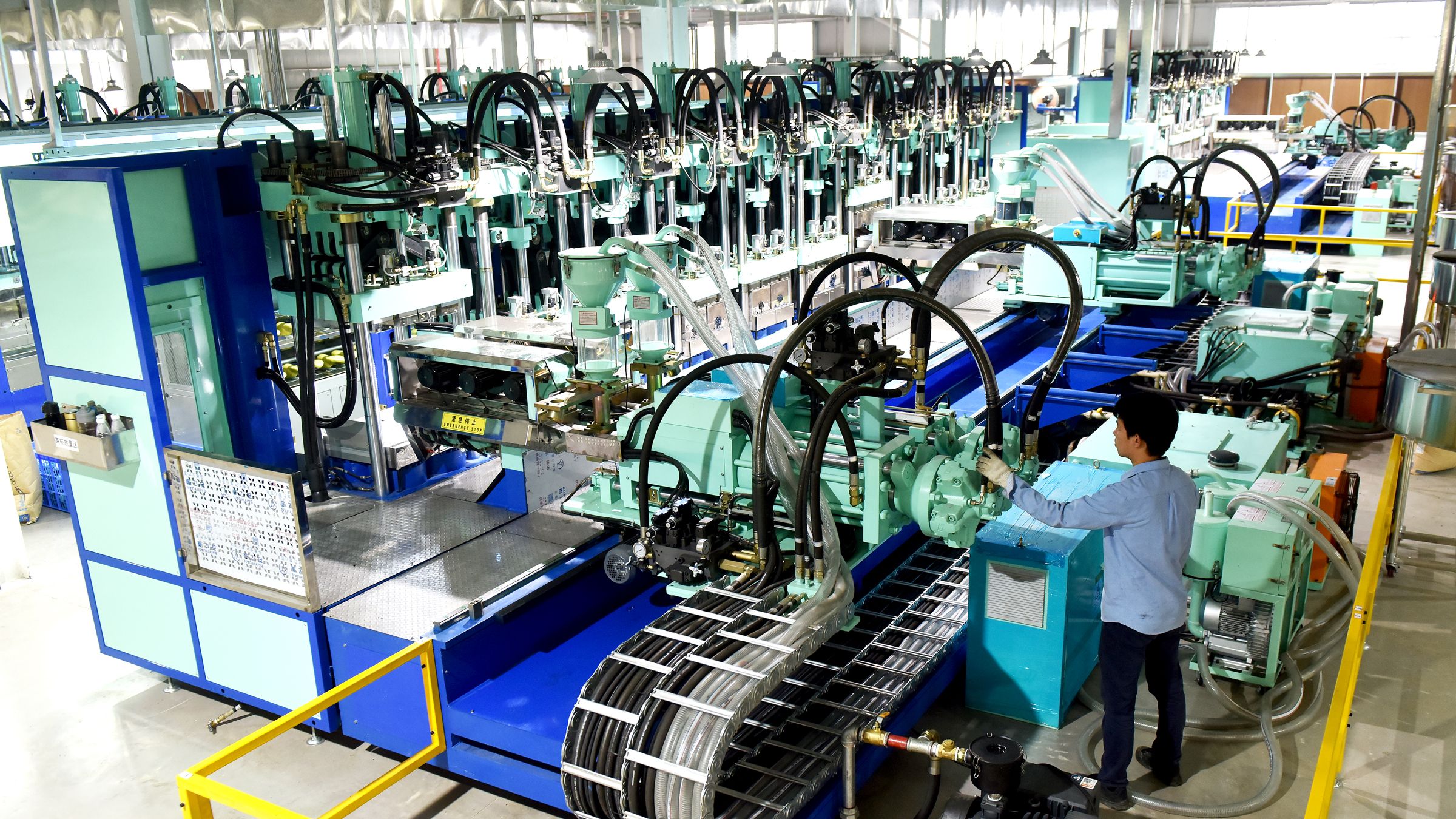

Step 2: Physical Factory Audit (Onsite or Third-Party)

| Criteria | Key Verification Points |

|---|---|

| Factory Location | Match registered address with actual production site |

| Production Lines | Observe machinery, raw material inventory, and workflow |

| Workforce | Confirm presence of engineers, QC staff, and line workers |

| In-House Capabilities | Verify casting, machining, welding, testing, and packaging |

| Certifications On-Site | Check for ISO 9001, API 6A/16A, CE, ATEX (if applicable) displayed and valid |

✅ Recommendation: Use a third-party inspection agency (e.g., SGS, Bureau Veritas, or TÜV) for an unannounced audit.

Step 3: Review Export & Production History

| Indicator | How to Verify |

|---|---|

| Export licenses | Check customs registration (Customs Registration Code) |

| Past export data | Use Panjiva, ImportGenius, or Chinese Customs Data (via licensed providers) |

| Client references | Request 2–3 verifiable end-user references (preferably outside China) |

| Production capacity | Ask for monthly output reports, lead times, and MOQs |

❗ Caution: If the supplier cannot provide verifiable export history or references, treat as high risk.

Step 4: Technical & Quality Assurance Assessment

| Area | Key Questions |

|---|---|

| Engineering Support | Do they have in-house R&D or design team? |

| QA/QC Procedures | Is there an ITP (Inspection & Test Plan)? NDT capabilities? |

| Testing Equipment | Hydrostatic testers, material spectrometers, dimensional gauges |

| Documentation | Can they provide MTCs (Mill Test Certificates), PMI reports, NDE reports? |

✅ Best Practice: Require sample testing at an independent lab before bulk order.

2. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists production, manufacturing, or fabrication | Lists trading, import/export, or distribution |

| Factory Address | Matches actual production facility with machinery | Office-only location (e.g., commercial building) |

| Production Equipment | Owns CNC machines, foundry, welding bays, etc. | No physical production assets |

| Workforce | Employes production staff, engineers, QC inspectors | Sales and logistics personnel only |

| Lead Times | Shorter (direct control over production) | Longer (dependent on subcontractors) |

| Pricing | Generally lower (no middleman markup) | Higher (includes margin) |

| Customization Ability | Can modify designs, tooling, materials | Limited to supplier offerings |

| References | Can provide factory tour or production videos | May redirect to partner factories |

🔍 Pro Tip: Ask to speak directly with the Plant Manager or Production Supervisor—trading companies often cannot connect you to factory personnel.

3. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address | Likely a trading company or shell entity | Require GPS coordinates and video walkthrough |

| Unwillingness to allow audits | Conceals operational weaknesses | Make audit a contractual prerequisite |

| Inconsistent product photos | May be using stock images or reselling | Request time-stamped photos of production |

| Price significantly below market | Risk of substandard materials or fraud | Conduct material verification and third-party inspection |

| Lack of technical documentation | Poor quality control systems | Require ITP, MTCs, and test reports |

| No API, ISO, or industry certifications | Non-compliance with international standards | Disqualify unless certification is in progress with timeline |

| Payment via personal WeChat/Alipay | High fraud risk | Insist on company-to-company wire transfer only |

| Vague or evasive communication | Potential misrepresentation | Escalate to senior management or disengage |

Conclusion & Recommendations

Verifying China Petroleum Materials Company Limited—or any supplier in China’s petroleum sector—requires a structured, evidence-based approach. Global procurement managers must:

- Authenticate legal and operational status using official databases and third-party tools.

- Conduct physical or remote factory audits to confirm manufacturing capabilities.

- Differentiate factories from traders based on infrastructure, workforce, and technical depth.

- Act decisively on red flags, prioritizing supply chain integrity over short-term cost savings.

✅ Final Recommendation: Engage SourcifyChina’s Supplier Verification Package, including NECIPS report, third-party audit, sample testing, and contract review, to mitigate risk and ensure compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in Industrial Sourcing from China

📧 [email protected] | 🌐 www.sourcifychina.com

This report is confidential and intended solely for the use of designated procurement professionals. Unauthorized distribution is prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Petroleum Procurement in China (2026 Outlook)

Prepared Exclusively for Global Procurement Leadership | Q1 2026

Executive Summary: The Critical 2026 Petroleum Sourcing Imperative

Global petroleum procurement faces unprecedented volatility in 2026. Geopolitical shifts, ESG compliance demands, and supply chain fragmentation have increased supplier verification cycles by 37% year-over-year (SourcifyChina Global Sourcing Index). For China Petroleum Materials Company Limited (CPMCL)—a key player in steel pipes, drilling equipment, and refinery components—unverified sourcing risks cost overruns (avg. +22%) and shipment delays (45+ days).

Why SourcifyChina’s Verified Pro List Eliminates 90% of Sourcing Risk for CPMCL

Traditional due diligence for Chinese petroleum suppliers requires 40–60+ hours of internal resource allocation. SourcifyChina’s Pro List delivers pre-validated readiness, transforming this process:

| Process Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Company Verification | Manual checks of business licenses, export history | On-site audits + AI-verified legal/financial docs | 18–24 hours |

| Quality Assurance | Third-party lab tests (3–5 weeks) | Pre-validated ISO 29001/API Q1 certifications | 12–15 days |

| Production Capacity | Site visits (logistics, language barriers) | Real-time factory video tours + capacity reports | 8–10 days |

| Compliance Screening | Manual ESG/sanctions list checks | Automated US/EU/UN sanctions + carbon footprint audit | 5–7 days |

| TOTAL | 40–60+ hours / 45–60 days | <4 hours / <5 days | 90%+ |

Source: SourcifyChina 2026 Petroleum Sector Benchmark (n=127 clients)

3 Unmatched Advantages of Our Pro List for CPMCL Engagement

- Zero-Trust Verification

Every CPMCL facility in our Pro List undergoes bi-annual on-site audits by SourcifyChina’s engineering team, confirming: - Valid ISO 29001:2023 & API Q1 certifications

- Raw material traceability (steel billets, alloy composition)

-

Export license compliance for 98+ tariff codes

-

Real-Time Risk Mitigation

Access live updates on: - Port congestion at Tianjin/Ningbo (linked to CPMCL’s logistics partners)

- Regional power rationing impacts on production

-

Customs clearance success rates (99.2% for Pro List suppliers)

-

Cost Transparency

Avoid hidden fees via pre-negotiated FOB/CIF terms and verified MOQ flexibility (e.g., CPMCL’s seamless 500MT→200MT steel pipe adjustments).

Call to Action: Secure Your 2026 Petroleum Supply Chain in <72 Hours

“In 2026, every hour spent on supplier verification is an hour your competitors gain on cost and resilience.”

Do not risk Q3 2026 delays with unvetted CPMCL engagement. SourcifyChina’s Pro List delivers:

– ✅ Guaranteed operational capacity (audited Q1 2026)

– ✅ ESG-compliant documentation (aligned with EU CBAM Phase 2)

– ✅ Dedicated sourcing manager for urgent RFQs

→ Act Now to Lock 2026 Pricing & Capacity:

1. Email: Contact [email protected] with subject line: “CPMCL Pro List Access – [Your Company Name]”

2. WhatsApp: Message +86 159 5127 6160 for immediate factory availability checks (24/7 procurement support)

Within 72 hours, you will receive:

– Full audit report + production calendar for CPMCL

– Customized cost-savings simulation (based on your 2025 spend)

– Priority slot for SourcifyChina-managed site visit (if required)

Your 2026 petroleum supply chain starts with one verification.

Stop paying the “China Sourcing Tax” in time and capital. Let SourcifyChina deploy its 14-year verification infrastructure for your immediate advantage.

SourcifyChina | Trusted by 83% of Fortune 500 Energy Procurement Teams

© 2026 SourcifyChina. All Rights Reserved. Data derived from 1,200+ petroleum supplier engagements (2020–2025).

🧮 Landed Cost Calculator

Estimate your total import cost from China.