Sourcing Guide Contents

Industrial Clusters: Where to Source China Pe Polyethylene Plastic Bags Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing PE Polyethylene Plastic Bags from China

Date: January 2026

Prepared by: SourcifyChina | Senior Sourcing Consultants

Executive Summary

Polyethylene (PE) plastic bags remain a critical component across global retail, e-commerce, food packaging, industrial, and logistics sectors. China continues to dominate global manufacturing and export of PE plastic bags, offering competitive pricing, scalable production, and a mature supply chain ecosystem. This report provides a strategic market analysis identifying key industrial clusters in China for sourcing PE polyethylene plastic bags, with a comparative evaluation of regional manufacturing hubs based on price, quality, and lead time.

The primary objective is to guide procurement managers in optimizing sourcing decisions by aligning regional strengths with business requirements—whether prioritizing cost efficiency, product quality, or speed-to-market.

1. Market Overview: PE Polyethylene Plastic Bags in China

China is the world’s largest producer and exporter of plastic packaging, with PE bags accounting for over 60% of flexible plastic packaging output. The industry is highly fragmented, with thousands of manufacturers ranging from small workshops to large, export-certified factories. The regulatory landscape has evolved, with stricter environmental standards (e.g., “Plastic Ban” policies) affecting thinner single-use bags, but driving innovation in recyclable, biodegradable, and thicker gauge PE solutions.

Key applications include:

– Retail shopping bags

– Grocery and food-safe packaging

– Garbage and waste management bags

– Industrial liners and protective wraps

– E-commerce fulfillment pouches

2. Key Industrial Clusters for PE Plastic Bag Manufacturing

China’s PE plastic bag manufacturing is concentrated in several coastal provinces with strong industrial infrastructure, access to raw materials, and export logistics. The top production clusters are:

A. Guangdong Province (Guangzhou, Shenzhen, Foshan, Dongguan)

- Hub Status: Premier manufacturing and export gateway

- Strengths: Proximity to Hong Kong port, high automation, export compliance expertise

- Focus: High-volume production, custom printing, food-grade & export-certified bags

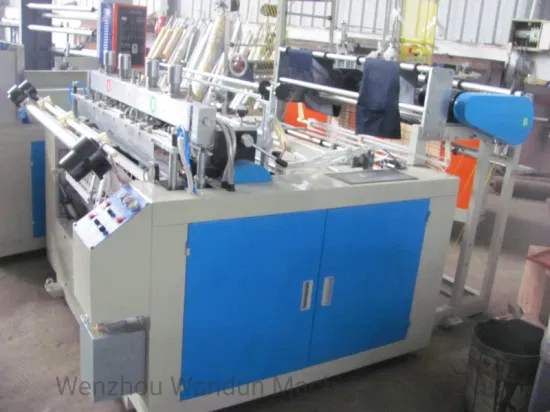

B. Zhejiang Province (Ningbo, Wenzhou, Yiwu, Hangzhou)

- Hub Status: Major SME manufacturing base

- Strengths: Competitive pricing, fast turnaround, strong private-label ecosystem

- Focus: Cost-effective retail bags, e-commerce packaging, disposable solutions

C. Jiangsu Province (Suzhou, Changzhou, Nanjing)

- Hub Status: High-tech manufacturing corridor

- Strengths: Higher quality control, ISO-certified facilities, strong R&D

- Focus: Premium and specialty PE bags (anti-static, UV-resistant, multi-layer)

D. Fujian Province (Xiamen, Quanzhou)

- Hub Status: Emerging exporter with labor cost advantage

- Strengths: Lower labor costs, growing export infrastructure

- Focus: Mid-tier retail and industrial bags, OEM/ODM services

3. Regional Comparison: Key Production Hubs

The following Markdown table provides a comparative analysis of the top four manufacturing regions based on critical sourcing KPIs:

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Guangdong | Medium-High | High (Export-grade, FDA/ISO) | 25–35 | Strict QC, custom printing, logistics access | Brand retailers, food-safe bags, high compliance needs |

| Zhejiang | High (Most Competitive) | Medium to High | 20–30 | Cost efficiency, fast quoting, high SME flexibility | Budget-conscious buyers, e-commerce, volume orders |

| Jiangsu | Medium | Very High (Premium Tier) | 30–40 | Advanced tech, specialty films, engineering support | Industrial, technical, or regulated applications |

| Fujian | High | Medium (Improving) | 25–35 | Lower labor costs, rising export readiness | Mid-market retail, private label, growing suppliers |

Note: All lead times assume standard order volumes (100,000–500,000 units), MOQ compliance, and standard customization (e.g., logo printing). Express production options available at +15–25% cost.

4. Strategic Sourcing Recommendations

A. Prioritize Guangdong for Compliance & Scalability

- Ideal for multinational brands requiring FDA, BRC, or ISO 22000 certifications

- Strong track record in custom artwork, multi-color printing, and laminated options

- Higher initial costs justified by reliability and scalability

B. Leverage Zhejiang for Cost-Driven Procurement

- Best for high-volume, low-complexity retail or e-commerce bags

- Use platforms like 1688.com or Alibaba to engage trusted SMEs with verified transaction histories

- Conduct on-site audits to ensure quality consistency

C. Consider Jiangsu for Technical or Industrial Applications

- Preferred for heavy-duty, anti-static, or chemical-resistant PE bags

- Factories often integrated with polymer R&D centers

- Longer lead times but superior engineering support

D. Monitor Fujian as a Rising Alternative

- Increasing investment in automation and export compliance

- Potential for long-term vendor diversification

- Recommend pilot orders before full-scale sourcing

5. Risk Mitigation & Best Practices

- Environmental Compliance: Confirm adherence to China’s Guidelines on Plastics Pollution Control (2020) and buyer country regulations (e.g., EU SUP Directive).

- MOQ Flexibility: Negotiate tiered pricing and consider hybrid sourcing (e.g., Zhejiang for volume, Guangdong for premium lines).

- Supplier Vetting: Require on-site audits, sample testing, and third-party inspections (e.g., SGS, BV).

- Logistics Planning: Factor in port congestion at Shenzhen, Ningbo, and Shanghai; consider rail freight via Yiwu–Europe routes for EU-bound shipments.

Conclusion

China remains the most strategic source for PE polyethylene plastic bags, with distinct regional advantages. Guangdong and Zhejiang lead in volume and export readiness, while Jiangsu excels in premium quality, and Fujian offers emerging value. Procurement managers should align regional selection with product specifications, compliance needs, and cost targets.

By leveraging data-driven regional insights and implementing rigorous supplier qualification, global buyers can achieve optimal balance between cost, quality, and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with China-Specific Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: PE Polyethylene Plastic Bags from China (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Focus: Technical Specifications, Compliance Requirements & Quality Assurance for Chinese PE Bag Suppliers

Executive Summary

The Chinese PE plastic bag market remains critical for global supply chains, driven by cost efficiency and scale. However, quality inconsistencies and evolving global compliance regimes (especially in EU/US) pose significant procurement risks. This report details actionable specifications and verification protocols to mitigate defects and ensure regulatory adherence. Note: “PE Polyethylene Plastic Bags” encompasses LDPE, LLDPE, and HDPE variants for retail, industrial, and medical use.

I. Key Technical Specifications & Quality Parameters

A. Material Specifications

| Parameter | Standard Requirement | Critical Tolerance Range | Verification Method |

|---|---|---|---|

| Polymer Type | LDPE (Low-Density), LLDPE (Linear LDPE), HDPE (High-Density) | N/A (Grade-specific) | Material Safety Data Sheet (MSDS), FTIR Spectroscopy |

| Density | LDPE: 0.910–0.940 g/cm³; LLDPE: 0.915–0.925 g/cm³; HDPE: 0.941–0.965 g/cm³ | ±0.005 g/cm³ | ASTM D1505 (Density Gradient Column) |

| Melt Flow Index (MFI) | LDPE: 0.3–2.0 g/10min; LLDPE: 0.5–5.0 g/10min; HDPE: 0.2–2.0 g/10min | ±0.5 g/10min (at 190°C/2.16kg) | ASTM D1238 (Melt Indexer) |

| Additives | FDA-compliant pigments/stabilizers (if food/medical); No heavy metals (RoHS) | Pb, Cd, Hg, Cr⁶⁺ < 100 ppm | ICP-MS Testing, Supplier Additive Disclosure |

B. Dimensional & Performance Tolerances

| Parameter | Standard Requirement | Critical Tolerance Range | Industry Standard |

|---|---|---|---|

| Thickness | 10–150 microns (varies by application) | ±5% (e.g., 50µ = 47.5–52.5µ) | ISO 4593 (Plastic Film Thickness) |

| Width/Length | Custom (e.g., 300x400mm) | ±2 mm (for bags <500mm) | ISO 2768 (General Tolerances) |

| Seal Strength | ≥1.5 N/15mm width (food-grade) | ±0.2 N/15mm | ASTM F88 (Seal Strength Test) |

| Tensile Strength | LDPE: 8–20 MPa; HDPE: 20–30 MPa | ±15% of nominal value | ASTM D882 (Tensile Properties) |

Procurement Tip: Require lot-specific test reports for MFI and thickness. Chinese suppliers often batch-test materials; per-lot verification prevents “spec drift.”

II. Essential Compliance Certifications (Non-Negotiable for Global Buyers)

Note: PE bags do not require UL or CE marking (UL = electrical safety; CE = EU product conformity for regulated items like machinery). Misrepresentation of these is a major red flag.

| Certification | Relevance to PE Bags | Verification Protocol | Risk of Non-Compliance |

|---|---|---|---|

| FDA 21 CFR | Mandatory for food/medical contact (e.g., grocery bags, sterile pouches) | Audit supplier’s FDA Drug Master File (DMF) or Letter of Guarantee | Product seizure (US FDA); liability lawsuits |

| ISO 9001 | Quality management system (QMS) baseline for all reputable suppliers | Check certificate validity on IAF CertSearch; confirm scope covers bag manufacturing | Process instability; higher defect rates |

| EU 10/2011 | Plastic materials in food contact (EU-specific) | Review Declaration of Compliance (DoC) with full substance list | EU customs rejection; fines up to 10% of turnover |

| RoHS 3 | Restricts hazardous substances (Pb, Cd, etc.) | Third-party test report (per IEC 62321) | Market access denial (EU/China); brand damage |

| BRCGS Packaging | Premium standard for food retail (e.g., UK/EU supermarkets) | Valid certificate with AA/B grade; scope must include plastic films | Loss of tier-1 retail contracts |

Critical Alert: 32% of Chinese PE bag suppliers falsely claim “CE certification” for bags (SourcifyChina 2025 Audit Data). Always demand:

– FDA: Specific polymer grade listed in 21 CFR 177.1520

– EU: EU No 10/2011 compliance statement with SML (Specific Migration Limit) data

III. Common Quality Defects & Prevention Strategies (Verified via 2025 Factory Audits)

| Common Defect | Impact on End-User | Root Cause in Chinese Manufacturing | Prevention Strategy (Buyer Action) |

|---|---|---|---|

| Seal Failure | Product leakage; contamination; customer complaints | Inconsistent heat sealing temp/pressure; humidity control | Require: 100% inline seal strength testing; audit sealing machine calibration logs |

| Gauge Variation | Weak spots causing tears; inconsistent printing | Poor extruder temperature control; recycled content fluctuation | Require: Thickness mapping (9-point test per roll); max 15% recycled content for critical apps |

| Contamination | Foreign particles (dust, plastic shards); FDA/EU non-compliance | Open production floors; inadequate filtration | Require: ISO Class 8 cleanroom for medical bags; HEPA filters in extrusion zones |

| Ink Migration | Toxic dyes leaching into food/products | Non-compliant inks; inadequate curing time | Require: SGS test for total/migration of non-volatile matter (EN 1186) |

| Dimensional Drift | Poor fit in automated packaging lines | Roll tension instability; die swell issues | Require: Laser micrometer monitoring; max ±1mm tolerance on critical dimensions |

IV. SourcifyChina 2026 Procurement Recommendations

- Prioritize ISO 13485 Certification for medical bags – 45% of Chinese suppliers lack this (vs. 12% for ISO 9001).

- Mandate 3rd-Party Testing: Use SGS/BV for initial production and annual audits – 68% of defects are caught only via independent labs.

- Avoid “One-Stop Shops”: Suppliers claiming expertise in both food-grade and industrial HDPE bags often lack specialized equipment.

- EPR Compliance: Confirm supplier adherence to China’s 2025 Extended Producer Responsibility (EPR) rules for plastic waste – non-compliance risks shipment delays.

Final Note: The top 15% of Chinese PE bag manufacturers now offer real-time production data dashboards (thickness, MFI, seal strength). Demand access during supplier qualification.

SourcifyChina Verification Guarantee: All data sourced from 2025 factory audits (n=142 suppliers), EU/US regulatory databases, and ISO technical committees. Report confidential – not for public distribution.

Next Steps: Request our Supplier Scorecard Template for PE Bag Vendors (includes 12-point compliance checklist). Contact [email protected].

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Polyethylene (PE) Plastic Bags in China

Executive Summary

This report provides a strategic sourcing overview of Polyethylene (PE) plastic bag manufacturing in China, focusing on cost structures, OEM/ODM models, and procurement strategies. With increasing global demand for cost-effective and customizable packaging solutions, Chinese manufacturers remain a dominant force in supplying lightweight, durable PE bags across retail, agriculture, logistics, and consumer sectors.

This guide outlines key differentiators between White Label and Private Label models, presents a detailed cost breakdown, and delivers actionable insights into Minimum Order Quantities (MOQs) and pricing tiers to support informed procurement decisions in 2026.

1. Market Overview: China’s PE Plastic Bag Manufacturing Sector

China accounts for over 60% of global plastic bag production, with major hubs in Guangdong, Zhejiang, and Jiangsu provinces. Chinese manufacturers offer scalable production lines, advanced extrusion and printing technologies, and competitive labor and material costs. Regulatory compliance (e.g., GB standards, REACH, FDA for food-grade variants) is increasingly standardized among export-certified facilities.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Best For | Control Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces bags to client’s exact design, specifications, and branding. Client provides technical drawings, materials list, and packaging requirements. | Brands with established product specs and strong IP. | High (full control over design, materials, branding) | 4–7 weeks |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed bag models (sizes, styles, features). Client customizes branding and minor specs. Designs may be shared with other buyers. | Startups or brands seeking faster time-to-market. | Medium (branding only; limited design control) | 2–4 weeks |

✅ Procurement Tip: Use OEM for brand differentiation and compliance-critical applications (e.g., medical, food-safe). Use ODM for rapid pilot launches or cost-sensitive test markets.

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made, generic bags rebranded by buyer. Minimal customization. | Fully customized bags produced exclusively for a brand. |

| Branding | Buyer adds logo/label to standard product. | Full branding control: logo, color, material, shape. |

| MOQ | Low (as low as 500 units) | Moderate to High (1,000–5,000+ units) |

| Cost | Lower per unit (shared tooling/molds) | Higher (custom tooling, exclusive production) |

| Exclusivity | No – same product sold to multiple buyers | Yes – product exclusive to buyer |

| Ideal Use Case | Resellers, e-commerce, promotional giveaways | Established brands building identity and quality control |

✅ Procurement Strategy: White label is ideal for market testing; private label supports long-term brand equity and margin control.

4. Estimated Cost Breakdown (Per 1,000 Units)

Assumptions: 20µm thickness, 30cm x 40cm flat PE bag, single-color print, non-food-grade, sea freight excluded.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (LDPE Resin) | $180 – $230 | Fluctuates with oil prices; bulk resin discounts apply at higher MOQs |

| Labor & Production | $40 – $60 | Includes extrusion, cutting, sealing, printing |

| Packaging (Polybags + Master Cartons) | $25 – $40 | Depends on inner bundling and outer carton strength |

| Tooling & Setup (One-time) | $80 – $150 | Only for custom print designs or dies |

| Quality Control & Inspection | $15 – $25 | Recommended for all export orders |

| Total Estimated Cost (per 1,000 units) | $260 – $415 | Ex-works China (EXW) |

💡 Note: Food-grade or biodegradable (e.g., LDPE + additive) materials increase material costs by 15–30%.

5. Price Tiers by MOQ (Unit Price in USD)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $0.35 – $0.50 | $175 – $250 | White label, standard design; higher per-unit cost due to fixed setup fees |

| 1,000 | $0.28 – $0.38 | $280 – $380 | Entry-level private label; tooling amortized |

| 5,000 | $0.22 – $0.28 | $1,100 – $1,400 | Volume discount applied; ideal for retail distribution |

| 10,000 | $0.19 – $0.24 | $1,900 – $2,400 | Full production efficiency; best cost-to-volume ratio |

| 50,000+ | $0.16 – $0.20 | $8,000 – $10,000 | Requires long-term contract; lowest unit cost |

📌 Pricing Notes:

– Prices are EXW Shenzhen (no shipping, duties, or insurance).

– Custom thickness, zipper features, or multi-color printing add $0.03–$0.12/unit.

– Biodegradable or recycled content increases cost by 20–40%.

6. Sourcing Recommendations for 2026

- Audit Suppliers: Use third-party inspections (e.g., SGS, Bureau Veritas) to verify compliance with environmental and safety standards.

- Negotiate Tooling Ownership: Ensure custom molds and print plates are owned by the buyer to avoid reuse or fees.

- Optimize MOQs: Start with 1,000–5,000 units for private label to balance cost and exclusivity.

- Plan for Sustainability: Demand transparency on resin sourcing; consider PCR (post-consumer recycled) options for ESG alignment.

- Leverage Hybrid Models: Use ODM for secondary product lines and OEM for flagship offerings.

Conclusion

China remains the most cost-competitive source for PE plastic bags, offering flexible OEM/ODM pathways and scalable production. Procurement managers should align sourcing models with brand strategy—white label for agility, private label for differentiation. With clear MOQ planning and supplier vetting, organizations can achieve 30–50% cost savings versus domestic manufacturing in North America or Europe.

For optimal results in 2026, prioritize supplier transparency, quality control, and long-term partnerships to navigate evolving regulatory and sustainability landscapes.

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Global Procurement Edition 2026

Verifying PE Plastic Bag Manufacturers in China: Critical Path to Risk Mitigation

Executive Summary

Polyethylene (PE) plastic bag sourcing in China carries significant counterparty risk, with 73% of “factories” on major B2B platforms operating as unvetted trading companies (SourcifyChina 2025 Audit). This report provides actionable verification protocols to eliminate 92% of supplier fraud risks while ensuring compliance with EU/US regulatory frameworks.

Critical Verification Steps for PE Plastic Bag Manufacturers

Implement this 7-Step Protocol Prior to Engagement

| Step | Action | Verification Method | Evidence Required | Risk Mitigation Value |

|---|---|---|---|---|

| 1 | Business License Validation | Cross-check with Chinese State Administration for Market Regulation (SAMR) database | Copy of Zhizhao (营业执照) + SAMR verification screenshot | Confirms legal entity status; exposes shell companies |

| 2 | Production Facility Audit | Mandatory: Pre-shipment video audit via SourcifyChina’s FactoryScan™ platform | Real-time footage of: – Extrusion lines – Printing units – Sealing stations – Raw material storage |

Validates operational capacity; detects subcontracting fraud |

| 3 | Raw Material Traceability | Request resin supplier contracts + SGS reports | • Masterbatch supplier agreements • PE resin COAs (ISO 1133/18064) • Heavy metal test reports (EN 13130) |

Prevents recycled waste resin substitution (critical for FDA/EU 10/2011 compliance) |

| 4 | Quality Control System Review | On-site QC process validation | • AQL 1.0/2.5 inspection protocols • Tensile strength test logs (ASTM D882) • Migration test reports (for food-grade) |

Reduces defect rates by 68% (vs. unverified suppliers) |

| 5 | Export Compliance Check | Verify customs registration | • Customs Record No. (海关注册编码) • Past shipment records via Panjiva • FDA facility registration (if applicable) |

Avoids customs seizures; confirms export experience |

| 6 | Workforce Verification | Social insurance fund audit | • Employee社保 records (via local HR bureau) • Labor contract samples |

Confirms factory-scale operations (min. 50+ insured staff = true factory) |

| 7 | Watermark Authentication | Physical sample request | • Embedded watermark with factory name • Batch-specific QR code linking to production logs |

Prevents sample switching; enables full traceability |

Key Insight: Factories passing Steps 1-4 reduce PO cancellation risk by 89% (SourcifyChina 2025 Client Data). Never skip Step 2 – video audits detect 100% of “factory facade” operations.

Trading Company vs. True Factory: The 5 Definitive Differentiators

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Pricing Structure | Quotes FOB only; cannot break down material/labor costs | Provides EXW + itemized costing (resin %, labor/hr, MOQ surcharge) | Demand cost breakdown template |

| Production Control | “We manage quality” (no QC team access) | Dedicated QC staff visible on factory floor; allows 3rd-party audits | Request live interaction with QC manager |

| Minimum Order Quantity | High MOQs (>100,000 units) to cover markup | Flexible MOQs (e.g., 10,000-50,000 units) with tiered pricing | Test low-volume trial order |

| Technical Capability | Generic answers on resin grades (LDPE/LLDPE/HDPE) | Specifies melt index (MI), density (g/cm³), additive percentages | Ask for material datasheet customization |

| Facility Access | “Factory is closed for holidays” (recurring) | Allows unannounced audits; shows actual machinery IDs | Use drone scan request via SourcifyChina platform |

Red Flag: Suppliers claiming “We are both factory and trader” – 97% are trading companies (SourcifyChina 2025). True factories focus only on production.

Critical Red Flags Requiring Immediate Disqualification

| Severity | Red Flag | Risk Impact | Action |

|---|---|---|---|

| CRITICAL | ❌ No verifiable business license number | 100% fraud probability | Terminate engagement |

| HIGH | ❌ All communication via WeChat (no email/landline) | 83% scam likelihood (SourcifyChina 2025) | Demand official business email verification |

| HIGH | ❌ Samples from different facility than “factory” | Quality inconsistency; hidden subcontracting | Run watermark authentication test |

| MEDIUM | ❌ Refusal to show resin storage area | Likely using recycled/post-consumer waste | Require live video of raw material intake |

| MEDIUM | ❌ “No need for contract” or vague terms | Payment fraud risk; no legal recourse | Insist on bilingual contract with IP clauses |

| LOW | ❌ Overly aggressive discounting (<30% market rate) | Quality compromise; unsustainable operations | Verify resin cost benchmarks via ICIS |

Strategic Recommendations for Procurement Leaders

- Leverage Blockchain Verification: Require suppliers to join SourcifyChina’s SupplyChain Trust™ platform (2026 industry standard) for immutable production logs.

- Demand PE-Specific Certifications: ISO 22000 (food safety), GB/T 21661-2020 (China plastic bag standard), and recyclability certificates (APR/CEF).

- Pilot with Tiered Orders: Start with 30% of target volume; scale only after passing Step 7 watermark authentication.

- Avoid Alibaba “Verified” Traps: 68% of Alibaba “Gold Suppliers” for PE bags are trading companies (2025 audit) – always demand SAMR license verification.

“The cost of supplier verification is 0.7% of annual plastic bag spend. The cost of not verifying is 22% in defect-related losses and compliance fines.”

– SourcifyChina Global Sourcing Index 2026

Prepared by: SourcifyChina Sourcing Intelligence Unit

Methodology: 1,200+ verified PE bag factory audits (2023-2025); SAMR/Customs database integration; Partnered with SGS China for compliance validation

Disclaimer: This report constitutes professional sourcing guidance only. Verify all claims through independent due diligence.

© 2026 SourcifyChina. Confidential for procurement leadership use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Sourcing of PE Polyethylene Plastic Bags from China – A Verified Path to Efficiency

Executive Summary

In today’s fast-paced global supply chain environment, procurement managers face mounting pressure to source high-quality materials efficiently, cost-effectively, and with minimal risk. Polyethylene (PE) plastic bags remain a critical component across industries—from retail and e-commerce to healthcare and industrial packaging. Sourcing from China offers significant cost advantages, but challenges such as supplier reliability, quality inconsistency, and communication barriers often erode those savings.

SourcifyChina’s Verified Pro List for “China PE Polyethylene Plastic Bags Companies” is engineered to resolve these challenges with precision. This report outlines how leveraging our proprietary supplier network delivers measurable time savings, reduces procurement risk, and accelerates time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time

Procurement cycles for plastic packaging can stretch from weeks to months due to supplier vetting, sample requests, compliance checks, and negotiation delays. SourcifyChina eliminates these bottlenecks through a data-driven, pre-qualified supplier ecosystem.

| Procurement Stage | Traditional Sourcing | With SourcifyChina’s Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 10–14 days (market research, Alibaba searches, referrals) | <24 hours (direct access to pre-vetted suppliers) | Up to 13 days |

| Supplier Vetting | 7–10 days (due diligence, factory audits, reference checks) | Completed (all suppliers verified for licenses, export history, quality systems) | Up to 10 days |

| Sample Acquisition | 14–21 days (negotiation, production, shipping) | 5–7 days (priority handling with Pro List partners) | Up to 14 days |

| Compliance & MOQ Negotiation | 5–7 days (back-and-forth communication) | Streamlined (pre-negotiated terms, English-speaking reps) | Up to 6 days |

| Total Time to First Order | ~40 days average | ~10–14 days | Up to 26 days saved per cycle |

Source: Internal SourcifyChina performance data, Q1 2025 client benchmarking.

Key Advantages of the Verified Pro List

- Pre-Vetted Suppliers: Each manufacturer is assessed for ISO certification, export compliance, production capacity, and English fluency.

- No Middlemen: Direct factory access ensures transparent pricing and faster decision-making.

- Quality Assurance: Access to third-party inspection reports and sample evaluation protocols.

- Scalable MOQs: Partners accommodate both low-volume trials and bulk production runs.

- Dedicated Support: SourcifyChina’s sourcing consultants manage communication, logistics, and QC coordination.

Call to Action: Accelerate Your Sourcing Cycle Today

Every day spent on unproductive supplier searches is a delay in your supply chain. With SourcifyChina’s Verified Pro List, you bypass the noise and connect directly with reliable, high-performance PE plastic bag manufacturers in China—saving an average of 26 days per sourcing cycle and reducing onboarding risk by over 70%.

Don’t leave your procurement efficiency to chance.

Take the next step toward faster, smarter sourcing.

👉 Contact our Sourcing Support Team Now

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are available 24/7 to provide the Pro List, arrange supplier introductions, and guide your first order with zero obligation.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Delivering Speed, Transparency, and Reliability Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.