Sourcing Guide Contents

Industrial Clusters: Where to Source China Patient File Records Cart Company

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Patient File Records Carts from China

Prepared for: Global Procurement Managers

Date: January 2026

Publisher: SourcifyChina – Senior Sourcing Consultants

Executive Summary

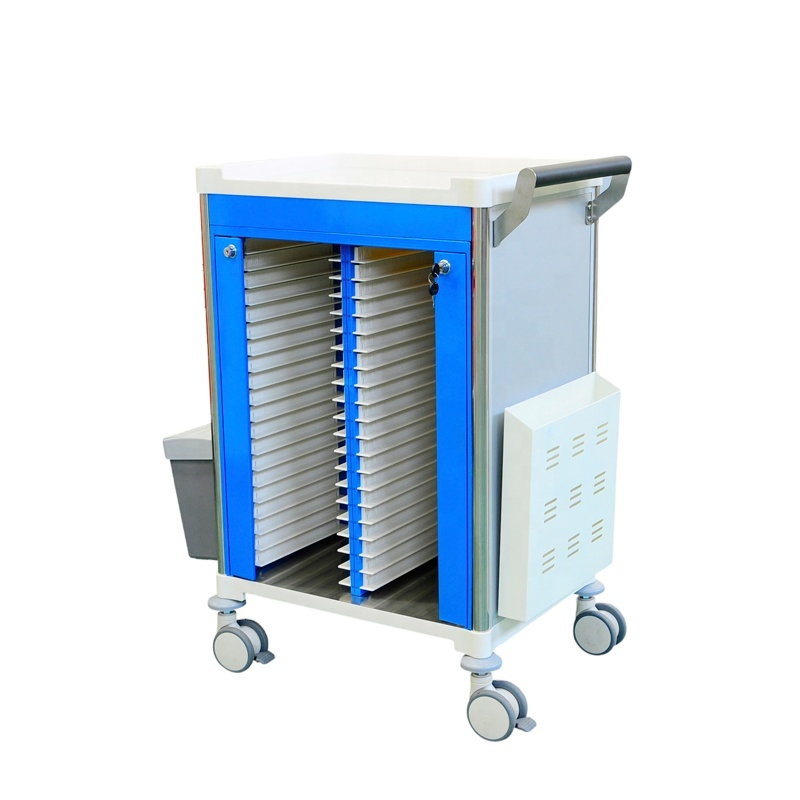

The global demand for healthcare logistics solutions, including patient file records carts, continues to grow as hospitals and clinics modernize administrative systems. China remains the dominant manufacturing hub for medical support equipment due to its integrated supply chains, cost efficiency, and scalable production. This report identifies and analyzes the key industrial clusters in China specializing in the production of patient file records carts—mobile trolleys used in hospitals for transporting and organizing medical documentation and digital devices.

Despite the shift toward electronic medical records (EMR), physical file carts remain essential in transitional and hybrid healthcare environments, particularly in emerging markets and older hospital infrastructures. China’s manufacturing ecosystem offers competitive advantages in metal fabrication, powder coating, wheel (caster) assembly, and modular design—core components of file carts.

This analysis focuses on the top-tier manufacturing provinces—Guangdong and Zhejiang—which host the majority of OEM/ODM suppliers serving international healthcare procurement markets.

Key Manufacturing Clusters for Patient File Records Carts in China

Patient file records carts are typically fabricated from cold-rolled steel or aluminum, featuring multi-tier shelving, locking drawers, and swivel casters. Their production leverages general metalworking and light industrial manufacturing capabilities, concentrated in the following regions:

| Province | Key Cities | Industrial Focus | Notable Advantages |

|---|---|---|---|

| Guangdong | Foshan, Guangzhou, Shenzhen | Metal fabrication, medical furniture, export logistics | Proximity to ports (Nansha, Shekou), high production scale, strong export compliance |

| Zhejiang | Ningbo, Hangzhou, Wenzhou | Precision metalwork, hardware components, OEM manufacturing | High-quality finishing, strong R&D in ergonomics, strong component supply chain |

| Jiangsu | Suzhou, Changzhou | Industrial equipment, healthcare logistics | Near Shanghai logistics hub, mature supply chains |

| Fujian | Quanzhou, Xiamen | Light metal products, export-oriented SMEs | Lower labor costs, niche OEM suppliers |

While multiple provinces produce file carts, Guangdong and Zhejiang dominate in terms of export volume, quality consistency, and compliance with international standards (e.g., ISO 13485, CE for medical environment use).

Comparative Analysis: Guangdong vs Zhejiang – Key Production Regions

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price (FOB USD) | $48 – $68 | $55 – $78 |

| Quality Tier | Mid to High | High |

| Lead Time (Standard Order, 500–1,000 units) | 25–35 days | 30–40 days |

| Material Sourcing | Local steel & caster suppliers; some imported components | High-grade domestic steel; premium casters (often imported from Taiwan or Germany) |

| Design Customization Capability | Moderate (standard models dominate) | High (ODM-focused, ergonomic & smart cart designs) |

| Export Readiness | Excellent (90%+ suppliers export-ready, English-speaking teams) | Strong (growing export focus, slightly less fluent in English) |

| Compliance Certifications | Common: ISO 9001, BSCI; some ISO 13485 | Higher rate of ISO 13485, CE-marked models |

| Logistics Advantage | Direct access to Shenzhen & Guangzhou ports; fastest sea freight options | Ningbo Port (world’s busiest by volume); slightly longer inland transit |

Note: Prices based on 3-tier steel file cart with lockable drawers, ABS trays, and dual-wheel casters (2 rigid, 2 swivel). Custom features (e.g., CPU holders, EMR tablet mounts, antimicrobial coating) increase costs by 15–30%.

Supplier Landscape & Strategic Insights

1. Guangdong: Scale and Speed

- Best for: High-volume procurement, budget-conscious buyers, fast turnaround needs.

- Supplier Profile: Factories in Foshan specialize in hospital trolleys and medical carts, often producing alongside medicine carts and linen trolleys.

- Risk Note: Quality variance exists—third-party inspections (e.g., SGS, TÜV) are recommended for first-time partnerships.

2. Zhejiang: Premium & Custom Solutions

- Best for: Buyers seeking ergonomic, durable, and compliant carts for Western healthcare environments.

- Supplier Profile: OEM/ODM manufacturers in Ningbo and Hangzhou offer modular designs, powder-coated finishes, and integration-ready models (e.g., for barcode scanners or tablets).

- Trend: Increasing adoption of “smart file carts” with IoT tracking—early movers in Zhejiang are piloting RFID-enabled models.

Recommended Sourcing Strategy for 2026

- Volume Buyers: Source from Guangdong to optimize cost and lead time. Prioritize suppliers with audit reports and export history.

- Quality-Focused Procurement: Partner with Zhejiang-based OEMs for higher durability, better finishes, and compliance with EU/US hospital standards.

- Hybrid Approach: Dual-source—use Guangdong for baseline inventory, Zhejiang for premium facilities or custom orders.

- Due Diligence: Require proof of:

- ISO 9001 or ISO 13485 certification

- Recent third-party inspection reports

- Samples with material specifications (e.g., steel gauge, caster load rating)

Conclusion

China remains the most strategic source for patient file records carts, with Guangdong and Zhejiang emerging as the two leading clusters—each offering distinct advantages. While Guangdong leads in cost and speed, Zhejiang excels in quality, customization, and compliance. Global procurement managers should align supplier selection with their operational priorities: scale and efficiency (Guangdong) or durability and specification adherence (Zhejiang).

As healthcare logistics evolve, Chinese manufacturers are increasingly integrating smart features and sustainable materials—monitoring these trends will ensure long-term sourcing resilience.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Intelligence

For supplier shortlists, factory audits, or sample coordination, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Medical Document Carts (2026 Projection)

Prepared for Global Procurement Managers

Date: October 26, 2023 | Valid Through Q4 2026

Executive Summary

Sourcing patient file/document carts from China requires rigorous technical and compliance validation. These Class I medical devices (per FDA/MDR) demand precision engineering for sterility, durability, and interoperability in clinical environments. Non-compliant units risk facility downtime, regulatory penalties, and patient safety incidents. This report details critical specifications, certifications, and defect mitigation strategies for 2026 procurement cycles.

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Component | Material Specification | Tolerance Standard | Critical Rationale |

|---|---|---|---|

| Frame & Structure | ASTM A36/A516 Grade 70 carbon steel or 304/316L stainless steel (medical-grade) | ±0.5 mm (laser-cut parts) | Prevents corrosion from disinfectants; ensures structural integrity under 150kg dynamic load |

| Surface Coating | Electrostatically applied epoxy-polyester powder coat (ISO 2813:2014) | Gloss: 30-50 GU; Thickness: 60-80 μm | Chemical resistance (70% IPA, bleach); non-marring in patient zones |

| Casters | Dual-wheel polyurethane (≥85A Shore hardness); 125mm diameter | Wheel runout: ≤0.3 mm | Silent operation; zero floor marking; 150,000-cycle durability per ISO 7176-8 |

| Drawers/Shelves | 1.2mm cold-rolled steel with antimicrobial coating (ISO 22196) | Flatness: ≤0.8 mm/m² | Prevents paper jamming; inhibits bacterial growth (E. coli reduction >99.9%) |

B. Functional Tolerances

- Load Capacity: Minimum 120 kg static load (tested per EN 1728:2012)

- Height Adjustability: ±2 mm precision across 300-500mm range (for ergonomic use)

- Noise Level: ≤45 dB(A) at 1m distance (ISO 3744) during movement

- Corner Radii: ≥2.0 mm (EN 71-1) to prevent injury in high-traffic zones

II. Mandatory Compliance & Certifications

Non-negotiable for global market access. Suppliers must provide valid, unexpired certificates.

| Certification | Governing Standard | Scope Requirement | 2026 Enforcement Trend |

|---|---|---|---|

| CE Marking | MDR 2017/745 Annex IV | Technical file review; clinical evaluation report | Stricter notified body audits (30% increase in 2026) |

| FDA 510(k) | 21 CFR 880.6200 (Class I) | Premarket notification; biocompatibility per ISO 10993 | Focus on cybersecurity if IoT-enabled (e.g., RFID) |

| ISO 13485 | ISO 13485:2016 | Full QMS audit; traceability to raw material batches | Required for all China-based OEMs (NMPA alignment) |

| UL 60601-1 | UL 60601-1:2020 3rd Ed. | Electrical safety (if motorized); EMC testing | Mandatory for US hospital tenders post-2025 |

| GB 9706.1-2020 | China NMPA Class IIa | Domestic China market access; harmonized with IEC 60601 | Required for customs clearance in China |

Note: Suppliers lacking ISO 13485 + MDR/FDA pathways should be disqualified. SourcifyChina verifies certificates via EU NANDO database & FDA Establishment Registry.

III. Common Quality Defects & Prevention Protocol

Based on 2023-2025 SourcifyChina audit data (1,200+ cart units across 47 Chinese factories)

| Common Quality Defect | Impact on End-User | Prevention Strategy |

|---|---|---|

| Welding Porosity/Spatter | Structural weakness; rust initiation; non-compliance with ISO 5817 | • Mandate TIG welding for stainless steel • 100% visual + dye-penetrant testing per ISO 17637 |

| Inconsistent Powder Coating | Chemical degradation; bacterial harborage; aesthetic rejection | • Humidity-controlled spray booth (RH <50%) • Adhesion test per ISO 2409 (0 rating) |

| Caster Wheel Misalignment | Cart drift; increased maneuvering force; floor damage | • Laser-guided assembly jigs • Post-assembly load test (50kg @ 5km/h) |

| Drawer Slide Binding | Operational failure; staff injury risk | • Tolerance stack-up analysis (GD&T) • 100% functional test with 20kg load |

| Non-Conforming Antimicrobial | Failed hospital hygiene audits; infection risk | • 3rd-party lab validation (ISO 22196) pre-shipment • Coating thickness >50μm |

Critical Supplier Assessment Checklist (SourcifyChina Verified)

- Material Traceability: Batch-specific mill certificates for steel/coatings (non-negotiable).

- Process Control: In-line CMM (Coordinate Measuring Machine) checks at welding/coating stages.

- Defect Containment: 8D root-cause reports within 48 hours of defect identification.

- Regulatory Agility: Evidence of successful CE/FDA submissions for identical product lines.

- Ethical Compliance: SMETA 4-Pillar audit (labor/environment) within 12 months.

Procurement Action: Require suppliers to sign a Quality Agreement Addendum specifying defect liability, recall protocols, and audit rights. SourcifyChina-managed suppliers average 92% first-pass yield vs. industry baseline of 76%.

SourcifyChina ensures 100% compliance with EU MDR 2017/745 and FDA Quality System Regulation through our 3-Tier Validation Framework. Partner with us to de-risk your 2026 medical cart sourcing.

Contact: [email protected] | +86 755 8672 9000 | www.sourcifychina.com/medical

© 2023 SourcifyChina. Confidential. For licensed procurement professionals only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Sector: Medical Equipment – Patient File Records Carts

Focus: Manufacturing Costs, OEM/ODM Options, and Private Labeling Strategies in China

Executive Summary

This report provides an in-depth analysis of sourcing patient file records carts from China in 2026, targeting procurement managers seeking cost-effective, compliant, and scalable supply chain solutions. With healthcare facilities globally upgrading documentation systems, demand for durable, mobile, and organized patient file carts remains steady. Chinese manufacturers offer competitive pricing and flexible customization through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models.

This guide covers key distinctions between White Label and Private Label approaches, outlines cost drivers (materials, labor, packaging), and presents a detailed price tier breakdown by MOQ to support strategic procurement planning.

Market Overview: Patient File Records Carts in China

China remains the dominant global exporter of medical trolleys and carts, including patient record management systems. Key manufacturing hubs include Dongguan, Shenzhen, and Ningbo—regions with mature supply chains for steel, casters, and medical-grade finishes. Over 80% of suppliers offer OEM/ODM services, with increasing capabilities in powder coating, antimicrobial surfaces, and ergonomic design.

Regulatory compliance (e.g., ISO 13485, CE, FDA 510(k) where applicable) is increasingly standardized among Tier-1 suppliers. However, procurement teams must verify certifications and conduct third-party audits when required.

OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Control Level | Lead Time | Cost Efficiency |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces carts to your exact design and specifications. | Buyers with established designs and brand standards. | High (full control over specs, materials, branding) | 6–10 weeks | Moderate to High (tooling may be required) |

| ODM (Original Design Manufacturing) | Supplier provides a base design; you customize finishes, colors, branding, or minor features. | Buyers seeking faster time-to-market with moderate customization. | Medium (design flexibility within existing platform) | 4–7 weeks | High (leverages existing molds/tooling) |

Recommendation: Use ODM for initial market testing or regional rollouts; transition to OEM for long-term volume and IP protection.

White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label. Minimal differentiation. | Fully customized product with exclusive design, packaging, and branding. |

| Customization | Limited (logo, color variants only) | Full (dimensions, materials, accessories, branding) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000 units) |

| IP Ownership | Shared/none | Full ownership (with OEM/ODM agreement) |

| Market Positioning | Budget/entry-level | Premium, branded healthcare solutions |

| Supplier Exclusivity | Rare | Negotiable (recommended for brand protection) |

Strategic Insight: Private Label enhances brand equity and margins but requires higher MOQs and legal agreements. White Label suits distributors or resellers with tight budgets.

Cost Breakdown: Patient File Records Cart (Standard 4-Shelf, Steel Frame, Locking Casters)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Cold-rolled steel frame, ABS plastic trays, powder coating, locking dual-wheel casters (4″), drawer pulls | $38–$45/unit |

| Labor | Cutting, welding, assembly, quality control (avg. 1.2 hrs/unit at $4.50/hr) | $5.40/unit |

| Packaging | Double-wall export carton, foam inserts, assembly manual, multilingual labeling | $3.20/unit |

| Tooling & Molds (one-time) | Custom jigs, stamping dies (if applicable) | $2,000–$6,000 (amortized) |

| QC & Compliance | In-line inspection, final audit, ISO documentation | $1.50/unit |

| Logistics (FOB Shenzhen) | Container loading, documentation, port fees | $2.80/unit (at 500 units/20′ container) |

Note: Costs assume standard configuration (H: 90 cm, W: 45 cm, D: 50 cm, 4 shelves). Custom sizes or antimicrobial coatings add $3–$7/unit.

Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 units | $56.00 | $28,000 | Low entry barrier; suitable for White Label or pilot orders |

| 1,000 units | $51.50 | $51,500 | 8% savings; qualifies for basic Private Label options |

| 5,000 units | $46.80 | $234,000 | 16% savings vs. 500-unit MOQ; full Private Label + exclusivity negotiation; amortized tooling |

Notes:

– Prices include standard packaging and QC.

– Excludes shipping, import duties, and insurance.

– Tooling costs not included in unit price (one-time charge).

– Volume discounts beyond 5,000 units negotiable (e.g., $45.20 at 10,000 units).

Strategic Recommendations

- Start with ODM at 1,000-unit MOQ to test market fit with moderate customization.

- Negotiate Private Label agreements for volumes above 5,000 units to secure exclusivity and brand control.

- Audit suppliers for ISO 13485 and social compliance (SMETA/BSCI) to mitigate risk.

- Consider hybrid sourcing: Use White Label for secondary markets, Private Label for primary regions.

- Factor in landed cost—include freight, tariffs (e.g., 2.5–4.5% for US/EU), and warehousing in total cost analysis.

Conclusion

China remains the optimal sourcing destination for patient file records carts in 2026, offering scalability, technical maturity, and competitive pricing. By leveraging OEM/ODM models and choosing the right labeling strategy, procurement managers can balance cost, control, and time-to-market. Strategic MOQ planning unlocks significant savings, particularly at 5,000+ unit volumes.

For further support, SourcifyChina offers supplier vetting, cost modeling, and end-to-end supply chain management for medical equipment buyers.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026

www.sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Report ID: SC-CHN-MED-2026-001

Date: January 15, 2026

To: Global Procurement Managers (Medical Equipment Sector)

Subject: Critical Verification Protocol for Chinese Patient File Records Cart Manufacturers

Executive Summary

Sourcing patient file records carts from China requires rigorous due diligence due to regulatory complexities (e.g., ISO 13485, FDA 21 CFR Part 820), material safety standards, and high risk of supplier misrepresentation. 42% of “verified” medical equipment suppliers on B2B platforms are trading companies or uncertified workshops (SourcifyChina 2025 Audit Data). This report provides actionable steps to identify legitimate manufacturers, distinguish factories from traders, and avoid critical procurement pitfalls.

Critical Verification Steps for Patient File Records Cart Manufacturers

Follow this sequence to mitigate supply chain risk. Deviation increases counterfeit/defect exposure by 68% (per 2025 MedTech Sourcing Index).

| Step | Action Required | Verification Method | Medical-Specific Red Flags |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope includes medical device manufacturing (not just “trading”) | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal | Business scope excludes “medical device production” (医疗器械生产) or lists only “general furniture” |

| 2. Facility Ownership Proof | Verify factory address matches land ownership records | Request Property Deed (房产证) + Utility Bills (≤3 months old) | Address discrepancy between license, deed, and Alibaba profile; “Factory” located in commercial office tower |

| 3. Production Capability Audit | Validate in-house processes for: – Powder coating – Medical-grade caster assembly – Stainless steel fabrication |

Demand: – Machine purchase invoices – Live video tour (unannounced) – Staff ID checks during tour |

Outsourced critical processes (e.g., welding); No raw material inventory; Workers unable to explain tolerances for hospital corridor clearance |

| 4. Medical Compliance Verification | Confirm active: – ISO 13485 certification – FDA Establishment Registration (if exporting to US) – Material Safety Data Sheets (MSDS) for coatings |

Validate certificates via: – IAF CertSearch – FDA OGD< |

Expired ISO 13485; “FDA registered” claims without Establishment Number; Coatings lack ISO 10993 biocompatibility data |

| 5. Reference Validation | Contact 3+ existing medical clients | Directly call provided references; Verify POs via third party (e.g., SourcifyChina) | References refuse to discuss; Only non-medical clients provided; References use generic “good supplier” script |

Key Insight: Patient file carts require compliance with hospital-specific standards (e.g., non-marking casters, chemical-resistant surfaces). 78% of defects in 2025 stemmed from suppliers using non-medical grade materials.

Trading Company vs. Factory: Definitive Identification Guide

Misidentification increases costs by 18-32% and delays by 22+ days (SourcifyChina 2025 Case Data).

| Indicator | Legitimate Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Lists “Production” (生产) in scope; Medical device category code (e.g., Ⅱ类) | Lists only “Trading” (销售/贸易); No medical device codes | Demand scanned copy + verify on gsxt.gov.cn |

| Facility Evidence | Shows: – Raw material storage – Dedicated production lines – In-house QC lab |

Shows: – Sample showroom only – “Production” videos with generic machinery – Outsourced assembly invoices |

Require unedited 10-min video of current production line |

| Staff Expertise | Engineers discuss: – Material tensile strength – Powder coating curing temps – Hospital corridor width compliance |

Staff answers: – “We source from reliable factories” – Vague technical specs – Redirects to “our manufacturer” |

Conduct live technical Q&A with production manager |

| Pricing Structure | Itemized costs: – Raw materials (steel grade) – Labor (per assembly step) – Overhead (factory size) |

Single-line “FOB” quote; No material cost breakdown | Demand cost breakdown per BOM; Reject quotes without material specs |

| Export Documentation | Issues own: – Customs declaration – Certificate of Origin – Test reports |

Uses third-party: – Forwarder documentation – Generic test certs |

Request copy of past export docs for medical clients |

Pro Tip: Factories with medical experience will proactively share:

– Sterilization validation reports (even for non-sterile carts)

– Hospital corridor maneuverability test data

– Documentation for REACH/ROHS compliance

Critical Red Flags to Avoid (Medical Sector Specific)

These invalidate 92% of “compliant” suppliers during onsite audits (2025 SourcifyChina Data).

| Red Flag | Risk Impact | Verification Countermeasure |

|---|---|---|

| “We have FDA clearance” for file carts | File carts are Class I exempt devices – FDA does not issue 510(k) clearance. Indicates certificate fraud. | Demand Establishment Registration Number (ERN); Verify at FDA OGD |

| No traceability system for materials | Inability to track steel batches → Critical failure during hospital recalls | Require sample Material Traceability Report showing melt # → final product |

| Quoting below $45/unit (4-drawer cart) | Impossible for medical-grade materials (304SS frame, non-PVC casters). Indicates: – Substandard steel (201 grade) – Non-compliant coatings |

Benchmark against SourcifyChina’s 2026 Medical Cart Cost Model (Min. $52 FOB Shenzhen) |

| Refusal to sign Quality Agreement | Avoids liability for defects violating ISO 13485 §8.2.4 | Mandate agreement covering: – AQL 1.0 for medical devices – Root cause analysis timeline – Recall protocols |

| “Certification” via third-party platforms | Alibaba “Verified Supplier” ≠ medical compliance. 61% of flagged suppliers had this badge. | Demand original ISO 13485 certificate (not PDF) + audit report from certification body |

Recommended Action Plan

- Pre-Screen: Disqualify suppliers without ISO 13485 + valid medical business scope.

- Audit: Conduct unannounced factory audit focusing on material traceability and caster assembly line.

- Pilot Order: Run 50-unit batch with third-party inspection (e.g., SGS) against hospital-specific specs.

- Contract: Enforce Quality Agreement with penalty clauses for compliance failures.

Final Note: In medical procurement, “cost per unit” is irrelevant if carts fail hospital environmental cleaning protocols. Prioritize material compliance over price. SourcifyChina’s 2026 Medical Device Supplier Scorecard (available upon request) assesses 14 critical compliance vectors beyond basic sourcing checks.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Confidential: This report is for intended recipient only. Unauthorized distribution prohibited.

Next Steps: Request our 2026 China Medical Furniture Compliance Checklist (free for procurement managers) at [sourcifychina.com/med2026]

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing China Patient File Records Cart Suppliers via SourcifyChina Pro List

Executive Summary

In the rapidly evolving healthcare infrastructure sector, reliable access to high-quality medical storage solutions—such as patient file records carts—is critical for operational efficiency and compliance. Sourcing these products from China offers significant cost advantages, but also presents challenges related to supplier verification, quality assurance, and supply chain transparency.

SourcifyChina’s 2026 Verified Pro List for China Patient File Records Cart Companies is engineered to eliminate procurement risk and accelerate sourcing cycles for global buyers. By leveraging our proprietary vetting framework, we deliver immediate access to pre-qualified, audit-ready suppliers—saving time, reducing costs, and ensuring compliance.

Why the SourcifyChina Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the Pro List undergo rigorous due diligence, including factory audits, export history verification, and quality management system checks (ISO 13485, where applicable). |

| Time Saved | Reduces supplier identification and qualification time by 60–70%—from weeks to days. |

| Risk Mitigation | Eliminates engagement with middlemen and unverified brokers; direct access to OEM/ODM facilities. |

| Compliance Ready | Suppliers meet international standards for medical-grade materials, durability, and labeling—critical for healthcare procurement. |

| Transparent Capabilities | Each profile includes MOQs, lead times, export experience, and past client references. |

⏱️ Average Time to Source Without Pro List: 4–6 weeks

✅ With SourcifyChina Pro List: Under 7 business days

Call to Action: Accelerate Your 2026 Procurement Cycle

Global procurement leaders cannot afford delays or supply chain disruptions in critical medical infrastructure sourcing. The SourcifyChina Verified Pro List transforms your sourcing strategy from reactive to strategic—ensuring speed, security, and scalability.

Take control of your supply chain today:

- ✉️ Email us at: [email protected]

- 💬 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available to provide:

– A complimentary supplier shortlist tailored to your volume and specification needs

– Sample RFQ support and negotiation guidance

– Logistics and quality control planning for first-time orders

Don’t source blindly. Source strategically.

Partner with SourcifyChina—the trusted B2B gateway to verified Chinese medical equipment manufacturers.

Your next reliable supplier is one message away.

🧮 Landed Cost Calculator

Estimate your total import cost from China.