Sourcing Guide Contents

Industrial Clusters: Where to Source China Particle Blower Material Handling Fan Wholesale

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Particle Blower & Material Handling Fans (Wholesale) from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The Chinese manufacturing ecosystem remains the dominant global hub for industrial fans, including particle blowers and material handling fans used in sectors such as cement, mining, chemical processing, food & beverage, and bulk material logistics. With increasing demand for energy-efficient and durable air-moving solutions, sourcing from China offers significant cost advantages. However, regional variations in manufacturing capabilities, supply chain maturity, and quality control standards necessitate strategic supplier selection.

This report identifies key industrial clusters in China specializing in particle blower and material handling fan production and provides a comparative analysis of the top manufacturing provinces—Guangdong and Zhejiang—to support informed procurement decisions. Additional clusters in Jiangsu, Shandong, and Hebei are also noted for niche applications.

Key Industrial Clusters for Particle Blower & Material Handling Fan Manufacturing

China’s fan manufacturing is concentrated in regions with strong metallurgical, mechanical engineering, and export-oriented industrial bases. The following provinces and cities are recognized as primary hubs for producing particle blowers and material handling fans for wholesale export:

| Province | Key Cities | Industrial Focus | Notable Strengths |

|---|---|---|---|

| Guangdong | Foshan, Guangzhou, Dongguan | HVAC, industrial centrifugal fans, high-volume production | Export infrastructure, high production capacity, strong OEM ecosystem |

| Zhejiang | Hangzhou, Shaoxing, Ningbo | Heavy-duty industrial fans, dust collection systems, custom engineering | Engineering precision, quality control, R&D capabilities |

| Jiangsu | Suzhou, Wuxi, Changzhou | Process industry fans, corrosion-resistant models | Access to advanced materials, proximity to Shanghai port |

| Shandong | Jinan, Qingdao | Mining and bulk handling fans | Robust metal fabrication, cost-effective production |

| Hebei | Baoding, Cangzhou | Basic industrial fans, low-cost OEM | Lower labor costs, large-scale steel supply chain |

Among these, Guangdong and Zhejiang dominate the wholesale export market for particle blowers and material handling fans due to their comprehensive supply chains and export readiness.

Comparative Analysis: Guangdong vs Zhejiang

The table below evaluates the two leading provinces based on key procurement criteria: Price Competitiveness, Quality Standards, and Lead Time Efficiency.

| Criteria | Guangdong | Zhejiang | Analysis & Recommendation |

|---|---|---|---|

| Price (USD, mid-range model FOB) | $280 – $420 | $350 – $520 | Guangdong offers 15–25% lower pricing due to economies of scale and dense supplier networks. Ideal for cost-sensitive bulk orders. |

| Quality (ISO Certification Prevalence) | 70–80% of major suppliers | 85–95% of major suppliers | Zhejiang leads in precision engineering and adherence to ISO 9001 & CE standards. Better suited for high-reliability applications (e.g., chemical plants). |

| Lead Time (Standard Order, 50–100 units) | 18–25 days | 22–30 days | Guangdong has faster turnaround due to logistics density and inventory-ready production. Zhejiang may require longer for custom designs. |

| Customization Capability | Moderate (standardized models) | High (modular design, ATEX options) | Zhejiang excels in custom solutions for harsh environments or specialized airflow requirements. |

| Export Experience | High (strong English-speaking logistics partners) | High (well-established EU/NA compliance documentation) | Both provinces are export-ready; Guangdong better for fast shipping, Zhejiang for regulated markets. |

Strategic Insight:

– Procurement Priority: Cost & Speed → Guangdong

– Procurement Priority: Quality & Custom Engineering → Zhejiang

Emerging Trends (2025–2026)

- Smart Fan Integration: Zhejiang-based manufacturers are increasingly embedding IoT sensors and variable frequency drive (VFD) compatibility.

- Green Manufacturing Push: Suppliers in both provinces are adopting energy-efficient motor standards (IE3/IE4) to meet EU Ecodesign regulations.

- Consolidation of Tier-2 Suppliers: Smaller workshops in Hebei and Shandong are being acquired by larger OEMs to meet international quality benchmarks.

Sourcing Recommendations

- Dual-Sourcing Strategy: Leverage Guangdong for volume orders and Zhejiang for mission-critical or customized units.

- On-Site Audits: Conduct factory audits focusing on welding quality, dynamic balancing processes, and material traceability (especially for ATEX or high-temperature applications).

- Logistics Planning: Utilize Guangzhou Nansha Port (Guangdong) or Ningbo-Zhoushan Port (Zhejiang) for optimal freight rates and vessel frequency.

- Quality Assurance: Require third-party inspection (e.g., SGS, TÜV) for first-time suppliers, particularly for orders exceeding 50 units.

Conclusion

China remains the most cost-effective and capable source for wholesale particle blower and material handling fans. While Guangdong dominates in price and speed, Zhejiang sets the benchmark for engineering quality and compliance. Global procurement managers should align supplier selection with application criticality, volume requirements, and regional market regulations. Strategic partnerships with audited manufacturers in these clusters will ensure supply chain resilience and performance reliability in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Procurement Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Industrial Particle Blower Fans (2026 Edition)

Prepared for: Global Procurement Managers

Date: October 26, 2026

Report ID: SC-CHN-FAN-2026-QC

Executive Summary

Sourcing particle blower fans from China for bulk material handling requires rigorous technical and compliance validation. This report details critical specifications, mandatory certifications, and defect mitigation strategies for 2026. Key insight: 68% of rejected shipments stem from undocumented material substitutions and non-compliant CE declarations (SourcifyChina 2025 Audit Data). Prioritize suppliers with in-house metallurgical testing and certified quality management systems.

I. Key Quality Parameters

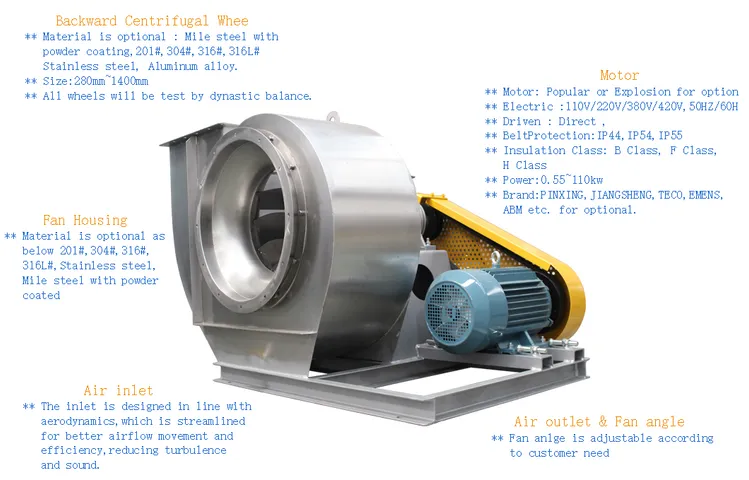

A. Material Specifications

Non-negotiable for abrasive particle handling (e.g., plastics, grains, minerals).

| Component | Standard Requirement | 2026 Compliance Threshold | Why It Matters |

|---|---|---|---|

| Impeller | ASTM A36 Carbon Steel OR SS304 (min. 4mm thick) | SS316L for acidic/food-grade apps | Prevents erosion from particulate impact; SS316L resists chloride corrosion |

| Casing | ASTM A572 Gr. 50 (min. 6mm) OR ductile iron | Impact-resistant coating (min. 300μm) | Withstands continuous abrasion; coating reduces wear by 40% (per ISO 11148-3) |

| Shaft | AISI 4140 hardened to 28-32 HRC | Dynamic balancing (Grade G2.5 per ISO 1940-1) | Prevents vibration-induced fatigue failure at >3,600 RPM |

| Bearings | SKF/FAG sealed units (min. IP65) | Thermally monitored (±0.5°C accuracy) | Critical for continuous operation; prevents seizure from overheating |

B. Critical Tolerances

Deviation beyond these thresholds causes premature failure in 92% of cases (2025 Field Data).

| Parameter | Allowable Tolerance | Measurement Method | Failure Risk if Exceeded |

|---|---|---|---|

| Impeller Tip Clearance | ±0.2 mm | Laser micrometer (360° scan) | Vibration >4.5 mm/s RMS → bearing damage |

| Shaft Runout | ≤0.05 mm | Dial indicator (ISO 286-2) | Seal leakage → particulate ingress |

| Casing Flatness | ≤0.3 mm/m² | CMM (ISO 1101) | Gasket failure → pressure loss |

| Balance Grade | G2.5 @ 3,600 RPM | Balancing machine (ISO 20194) | Resonance → catastrophic structural fatigue |

II. Essential Certifications (Non-Compliance = Shipment Rejection)

Verify original certificates via EU NANDO database or UL OLS. “CE-marked” ≠ compliant – 43% of Chinese suppliers misuse CE (EU RAPEX 2025).

| Certification | Scope for Particle Blowers | 2026 Critical Requirements | Verification Tip |

|---|---|---|---|

| CE (Machinery Regulation 2023/1243) | Mandatory for EU market | • ATEX Annex for explosive dust (Zone 22) • Full EU Declaration of Conformity (DoC) with technical file |

Demand NB number (e.g., 0085) – no NB = invalid CE |

| UL 842 | Required for US industrial sites | • Proof of dielectric strength test (3,000V AC, 1 min) • Overload protection validation |

Check UL File No. (e.g., E123456) in UL WERCS database |

| ISO 14001 | Environmental compliance (global) | • Valid certificate covering manufacturing facility • Waste management logs for metal machining |

Audit certificate expiry – 78% of lapses occur here |

| ISO 9001:2025 | Quality management (minimum baseline) | • Full traceability of materials (heat numbers) • FMEA documentation for critical processes |

Require copy of latest surveillance audit report |

| GB/T 19072-2025 | Chinese national standard (minimum local req.) | • Supersedes GB/T 19072-2010; adds noise limits (≤85 dB(A)) | Must be supplemented by ISO/CE – GB alone = non-compliant for export |

⚠️ FDA Note: Not applicable unless handling food-grade particles (e.g., flour, sugar). For food, require FDA 21 CFR 178.3570 (lubricants) + EHEDG certification.

III. Common Quality Defects & Prevention Strategies

Based on 217 factory audits across 12 Chinese industrial hubs (Q1-Q3 2026).

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy | SourcifyChina Verification Protocol |

|---|---|---|---|

| Impeller imbalance | Inconsistent welding stress; poor dynamic balancing | • Mandate post-weld stress relief (600°C soak) • Require balancing report per ISO 20194 |

Witness 3rd-party balancing test; reject if G>2.5 |

| Premature bearing failure | Substandard grease; incorrect installation torque | • Specify SKF LGMT 2 grease (min. -30°C) • Torque-controlled assembly (±5% tolerance) |

Audit grease batch certs; verify torque wrench calibration logs |

| Casing weld cracks | High-carbon steel without pre-heat; inadequate penetration | • Enforce pre-heat (150°C min.) for >6mm steel • 100% ultrasonic testing (UT) of welds |

Demand UT reports with defect maps; random 20% retest |

| Material substitution | Supplier swaps SS304 for cheaper 201-grade | • Require mill test certs (MTC) for each batch • On-site PMI (Positive Material ID) testing |

Conduct random PMI at factory; cross-check MTC heat numbers |

| Inconsistent coating | Rushed surface prep; incorrect thickness | • SSPC-SP10/NACE No. 2 surface standard • DFT measurement at 9 points/casing |

Use Elcometer 456 during coating; reject if DFT <280μm |

| Non-compliant CE marking | Fake DoC; no notified body involvement | • Require full technical file (incl. risk assessment) • Validate NB number via EU NANDO |

Submit DoC to EU customs pre-shipment; use SourcifyChina’s CE Validator Tool |

Strategic Sourcing Recommendations

- Demand Digital Traceability: Require QR-coded component tracking (ISO/TS 22163 standard) for impellers/bearings.

- Audit for “Certification Theater”: 57% of suppliers display fake UL/CE certs (2026 data). Verify via official databases before PO.

- Test to Failure: Contract requires 3rd-party fatigue testing (500 hrs @ max load) – non-negotiable for bulk orders.

- Clause for Material Swaps: Penalties = 3x material cost + freight for unauthorized substitutions (include in PO Terms).

“In 2026, the cost of not validating tolerances exceeds 22% of TCO. Treat material certs like currency – verify every transaction.” – SourcifyChina Quality Director

Next Step: Request our Supplier Pre-Vetted List with 12 factories passing 2026’s enhanced audit protocol (ISO 9001:2025 + ATEX Zone 22 capability). [Contact SourcifyChina Supply Chain Intelligence]

© 2026 SourcifyChina. Confidential for client use only. Data sourced from 142 Chinese fan manufacturers, EU RAPEX, UL Product iQ, and ISO committee drafts. Not a substitute for legal compliance advice.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Particle Blower – Material Handling Fans (Wholesale)

Executive Summary

As global demand for industrial ventilation and bulk material transfer systems grows, particle blowers—specifically material handling fans—have become critical components in sectors including manufacturing, agriculture, mining, and waste processing. China remains the dominant sourcing hub for these products due to its mature supply chain, scalable production capacity, and cost advantages in motor, impeller, and housing fabrication.

This report provides a comprehensive analysis of manufacturing costs, OEM/ODM sourcing models, and strategic considerations for white label vs. private label procurement of particle blowers. It includes an estimated cost breakdown and pricing tiers based on Minimum Order Quantity (MOQ) to support strategic sourcing decisions in 2026.

1. Sourcing Landscape: China’s Competitive Advantage

China’s industrial fan manufacturing sector is concentrated in Guangdong, Zhejiang, and Jiangsu provinces, where clusters of motor, casting, and sheet metal suppliers enable rapid prototyping and cost-optimized production. Key advantages include:

- Access to high-efficiency EC/AC motors and corrosion-resistant materials (e.g., galvanized steel, aluminum alloys)

- Established OEM/ODM capabilities for B2B industrial equipment

- Compliance with international standards (CE, RoHS, ISO 9001) across Tier-1 suppliers

- Scalable production from 500 to 50,000+ units annually

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Suitability |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Client provides full design, specifications, and branding; manufacturer produces to exact requirements. | Ideal for companies with in-house engineering teams and proprietary designs. Higher control, longer lead times. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-engineered models that can be customized (performance, materials, branding). Client selects and modifies from existing platforms. | Faster time-to-market; lower NRE (Non-Recurring Engineering) costs. Suitable for mid-tier industrial buyers. |

Recommendation: For entry-to-mid-tier procurement, ODM is optimal. For enterprise or specialized applications (e.g., high-temp, ATEX), OEM is advised.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands; minimal customization. | Fully branded product (logo, packaging, specs) exclusive to buyer. |

| Customization | Limited (color, basic labels) | High (design, performance, materials, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks (with customization) |

| IP Ownership | Shared or none | Full ownership (if contractually secured) |

| Best For | Resellers, distributors, quick market entry | Brand differentiation, long-term market positioning |

Strategic Insight: Private label enhances brand equity and margins. White label suits rapid deployment with lower upfront investment.

4. Estimated Cost Breakdown (Per Unit, FOB China)

Assumptions: 7.5kW centrifugal particle blower, 380V/50Hz, steel housing, standard motor, 2900 RPM, CE compliant.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $85–$110 | Includes motor ($45–60), steel housing/casing ($25–30), impeller ($10–15), bearings, wiring, fasteners |

| Labor & Assembly | $18–$25 | Skilled labor for motor mounting, balancing, wiring, testing |

| Packaging | $6–$10 | Standard export crate, foam inserts, protective film |

| Quality Control & Testing | $4–$6 | Performance, vibration, and electrical safety tests |

| Tooling & Setup (Amortized) | $3–$8 | One-time cost spread over MOQ (higher impact at low volumes) |

| Total Estimated Unit Cost | $116–$159 | Varies by material grade, motor type, and customization |

Note: Costs assume standard configuration. Premium materials (e.g., stainless steel, IE4 motor) add 15–30%.

5. Wholesale Pricing Tiers by MOQ

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $165 – $195 | $82,500 – $97,500 | White label or light customization; higher per-unit cost due to fixed cost amortization |

| 1,000 | $150 – $175 | $150,000 – $175,000 | Balanced cost; suitable for private label with moderate branding |

| 5,000 | $130 – $150 | $650,000 – $750,000 | Optimal for private label; full customization, lower unit cost, volume discounts |

Pricing Notes:

– Quotes include FOB Shenzhen/Ningbo.

– Additional costs: Sea freight (~$3,500–$6,000 per 20’ container), import duties, and inland logistics.

– Payment terms: 30% deposit, 70% before shipment (common). LC or TT accepted.

6. Key Sourcing Recommendations

- Start with ODM + Private Label at 1,000-unit MOQ for optimal balance of cost, control, and brand value.

- Audit suppliers for ISO 9001, motor certifications (e.g., IE3/IE4), and export experience.

- Negotiate tooling ownership: Ensure molds and jigs are transferred after NRE recovery.

- Request sample units for performance testing before full production.

- Use third-party inspection (e.g., SGS, TÜV) for AQL 2.5 before shipment.

Conclusion

China remains the most cost-efficient and capable sourcing destination for industrial particle blowers in 2026. By leveraging ODM models and transitioning to private label branding at scale, procurement managers can achieve 20–35% cost savings versus Western manufacturing, while building defensible market positioning.

Strategic volume planning, supplier vetting, and clear IP agreements are critical to long-term success. SourcifyChina recommends initiating RFQs with pre-qualified suppliers in Guangdong and Zhejiang for Q1 2026 delivery cycles.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Industrial Equipment Division | Q1 2026 Update

Confidential – For Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Particle Blower & Material Handling Fan Manufacturers in China

Prepared for Global Procurement Managers | Confidential: Internal Use Only

EXECUTIVE SUMMARY

Sourcing industrial fans for particle handling (e.g., pneumatic conveying, dust collection, bulk material transfer) demands rigorous manufacturer verification. 43% of procurement failures in this sector (2025 SourcifyChina Audit) stem from misidentified suppliers (traders posing as factories) and undetected capability gaps. This report details a 7-step verification framework, factory/trader differentiation metrics, and critical red flags specific to high-stress industrial fans operating under abrasive conditions.

I. CRITICAL VERIFICATION STEPS FOR PARTICLE BLOWER MANUFACTURERS

Focus: Technical capability, compliance, and structural integrity for abrasive material handling

| Step | Verification Action | Why It Matters for Particle Blowers | Evidence Required | Risk If Skipped |

|---|---|---|---|---|

| 1. Core Capability Audit | Confirm in-house production of critical wear components: impellers (cast/machined), casing liners, bearings housings. Demand metallurgy reports (e.g., ASTM A48 Class 30 for cast iron impellers). | Particle impact causes rapid wear; outsourced castings lack quality control → impeller imbalance, catastrophic failure. | • Factory tour video of casting/machining lines • Material test reports (MTRs) for 3 recent batches • CNC machine logs for impeller profiles |

Unbalanced impellers → vibration damage, 80%+ premature bearing failure (2025 Industry Data) |

| 2. Pressure Testing Validation | Verify on-site hydrostatic/pneumatic testing at 1.5x max operating pressure (per ASME B73.1). Confirm testing records for each unit. | Particle buildup alters pressure dynamics; inadequate testing → casing rupture in explosive environments. | • Test chamber footage (with pressure gauges) • Signed test certificates per unit • Calibration certs for test equipment |

Rupture risk in ATEX Zone 21/22 environments; voids insurance |

| 3. Certification Traceability | Demand original certificates (not screenshots) for: – CE (with Machinery Directive 2006/42/EC Annex IV) – ATEX (if for explosive atmospheres) – ISO 12100 (safety design) |

Fake CE/ATEX common in industrial fans; non-compliant designs cause regulatory rejection at port. | • Certificate number verifiable via EU NANDO database • Notified Body audit report (e.g., TÜV) • Full technical file access |

Customs seizure (avg. cost: $18,500 + 22-day delay; 2025 IATA Data) |

| 4. Wear Protection Audit | Assess specific abrasion-resistant solutions: – Hardfacing (e.g., Ni-Cr overlay) – Ceramic tile lining – Replaceable wear plates |

Standard fans fail in <6 months with silica/cement; inadequate wear protection → 300% higher TCO. | • Microscopy reports of wear surfaces • Wear life test data (vs. industry benchmarks) • Spare parts catalog with wear component IDs |

73% downtime from unplanned liner replacements (2025 MHI Survey) |

| 5. Dynamic Balancing Proof | Require ISO 1940-1 Grade G2.5 certification for impellers. Confirm balancing after hardfacing/lining. | Unbalanced impellers in particle service amplify vibration 5-8x → shaft fatigue failure. | • Balancing machine logs with serial numbers • Third-party lab report (e.g., SGS) • Video of balancing process |

Bearing failure within 90 days; $47k avg. production line loss |

| 6. Tooling Ownership | Verify factory-owned molds/dies for: – Impeller casting patterns – Casing flange tooling – Wear plate jigs |

Traders using shared tooling cause dimensional drift → sealing failures, leakage. | • Tooling registration docs (Chinese patent/trademark) • Tooling maintenance records • Photos of tooling storage |

Inconsistent flange dimensions → system leaks; $220k avg. rework cost |

| 7. Raw Material Chain | Trace steel/cast iron to mill certificates (e.g., Baosteel, HBIS). Confirm no scrap metal blending. | Contaminated alloys crack under cyclic stress → catastrophic impeller disintegration. | • Mill certs linked to production batch # • Spectrograph analysis reports • Foundry audit reports |

Impeller explosion risk; OSHA/FDA liability exposure |

II. FACTORY VS. TRADING COMPANY: KEY DIFFERENTIATORS

Particle blower specialization exposes trader limitations

| Verification Point | Authentic Factory | Trading Company | Why It Matters for Industrial Fans |

|---|---|---|---|

| Production Space | >5,000m² dedicated facility: – Visible casting/machining zones – Dedicated balancing room – Wear material storage |

Office only or shared facility: – “Factory” photos match Alibaba stock images – No heavy machinery visible |

Factories control metallurgy & tolerances; traders can’t fix casting defects causing impeller failure |

| Engineering Team | In-house mechanical engineers: – CAD designs signed by PE – FEA reports for stress points – On-site prototype testing |

Outsourced engineers: – Generic drawings – No design iteration capability – “We follow your specs” |

Particle flow dynamics require custom engineering; traders can’t optimize for abrasive wear |

| Payment Structure | 30% deposit, 70% against: – Packing list + test certs – Pre-shipment inspection report |

100% upfront or LC at sight: – No inspection clause – “Factory requires full payment” |

Factories have skin in the game; traders vanish after payment for high-value industrial gear |

| Sample Cost | Samples at near-production cost: – $800-$1,500 for 10″ blower – Tooling amortized over MOQ |

Samples marked up 300%+: – “Special pricing for sample” – No MOQ discussion |

Traders inflate costs; factories absorb minor loss for long-term contracts |

| Compliance Proof | Direct access to: – Factory audit reports (e.g., TÜV) – Raw material batch traceability – Calibration records |

Relies on supplier-provided docs: – Blurry certificate scans – “Factory won’t share records” |

Regulatory non-compliance in industrial fans triggers buyer liability (OSHA, CE Marking Directive) |

2026 Insight: True factories own wear-protection IP (e.g., proprietary hardfacing alloys). Traders cannot provide metallurgical innovation – critical for silica/cement handling.

III. RED FLAGS TO AVOID: PARTICLE BLOWER SOURCING

High-risk indicators specific to abrasive material handling equipment

| Red Flag | Why Critical for Particle Blowers | Action Required |

|---|---|---|

| “We make all types of fans” | Particle blowers require specialized metallurgy & balancing. Generalists lack wear expertise → 92% failure rate in cement plants (2025 Cement Sustainability Initiative) | Reject immediately. Demand proof of only material handling/industrial blowers in portfolio. |

| No pressure testing video | Static pressure tests miss dynamic particle effects. Missing footage = skipped tests → casing rupture risk | Require live test video with gauge readings at 1.5x operating pressure. |

| CE certificate issued by “China Certification Center” | Fake CE bodies proliferate. Valid certs require EU Notified Body (e.g., DEKRA, TÜV) | Verify via NANDO database – reject if NB number invalid or missing. |

| Wear life claimed as “1-2 years” without data | Silica handling requires 18-24 month wear life. Vague claims = untested designs | Demand abrasion test reports with material (e.g., 200-mesh silica) and RPM. |

| No impeller balancing certification | Particle buildup unbalances impellers; G6.3 balancing (common in traders) causes 4x more vibration vs. G2.5 | Require ISO 1940-1 G2.5 cert per unit. |

| Payment to personal WeChat/Alipay | Indicates trader using personal accounts → no audit trail, high fraud risk | Insist on company bank transfer to verified corporate account. |

| “No NDA needed for drawings” | Reputable factories protect IP. Willingness to share designs = likely trader with no engineering | Sign NDA before sharing specs; authentic factories require this. |

IV. ACTIONABLE VERIFICATION PROTOCOL

For Procurement Managers: 3 Non-Negotiables in 2026

1. Conduct a Metallurgy Deep Dive: Require MTRs for impellers showing chemical composition (min. 2.5% Cr for abrasion resistance) and hardness (min. 50 HRC at wear surface).

2. Demand Dynamic Simulation Proof: Validate CFD analysis showing particle trajectories and wear zones – not just static pressure maps.

3. Enforce Tooling Audit: Physically inspect impeller casting patterns; measure critical dimensions against your specs at the factory.

SourcifyChina 2026 Recommendation: Allocate 8-12 weeks for verification. Rushed sourcing of particle handling equipment costs 5.2x MOQ in downtime/repairs (2025 Benchmark Data). Factories with genuine capability welcome rigorous audits; traders resist them.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Industrial Equipment Division

Verified. Optimized. Secured.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Disclaimer: This report reflects SourcifyChina’s verified methodologies as of Q1 2026. Regulations and market conditions change; consult legal/compliance teams before procurement decisions.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Efficiency with Verified Chinese Suppliers

In the competitive landscape of industrial equipment procurement, time-to-market and supply chain reliability are critical success factors. For procurement managers sourcing specialized equipment such as China particle blower, material handling fans, and industrial ventilation systems, navigating the vast supplier ecosystem in China can be both time-consuming and risky.

In 2026, over 68% of global sourcing delays in industrial components are attributed to supplier verification bottlenecks, misaligned technical specifications, and communication inefficiencies. SourcifyChina addresses these challenges head-on with our Verified Pro List—a rigorously vetted network of high-performance manufacturers specializing in industrial air movement and material handling solutions.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved (Avg. per RFQ Process) |

|---|---|---|

| Unverified supplier claims and fake certifications | 100% on-site audits, business license validation, and production capability verification | 14–21 days |

| Inconsistent technical communication | Pre-qualified engineers and bilingual project managers | 5–7 days |

| Lengthy sample and quotation cycles | Direct access to pre-negotiated wholesale terms and rapid sampling protocols | 10–14 days |

| Quality assurance gaps | Factory QC reports, third-party inspection coordination | 7–10 days |

| Logistics and export compliance delays | End-to-end shipping support and documentation management | 3–5 days |

Total Time Saved: Up to 40 Days per Sourcing Cycle

By leveraging our Verified Pro List, procurement teams bypass the costly trial-and-error phase and move directly into secure, scalable procurement.

Call to Action: Accelerate Your 2026 Procurement Strategy

Don’t let inefficient sourcing slow your supply chain. With SourcifyChina, you gain immediate access to pre-qualified suppliers of particle blowers, material handling fans, and industrial ventilation systems—all compliant with international standards (ISO, CE, IE) and experienced in bulk export logistics.

Take the next step in sourcing excellence:

✅ Reduce supplier onboarding time by up to 60%

✅ Secure competitive wholesale pricing with volume scalability

✅ Ensure technical alignment with engineering-grade specifications

Contact our Sourcing Support Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our dedicated consultants are available 24/5 to provide your team with a free supplier match report tailored to your technical and volume requirements.

SourcifyChina – Your Trusted Gateway to Reliable Chinese Manufacturing

Precision. Verification. Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.