Sourcing Guide Contents

Industrial Clusters: Where to Source China Oil Painting Wholesale

SourcifyChina B2B Sourcing Intelligence Report: China Oil Painting Wholesale Market Analysis (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-OP-2026-001

Executive Summary

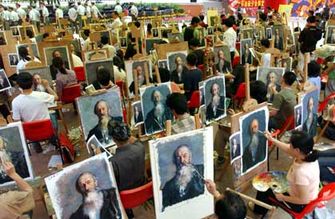

The global market for mass-produced decorative oil paintings (OEM/ODM wholesale) from China remains robust, driven by demand for affordable wall art in retail, hospitality, and e-commerce. Critical clarification: This report focuses exclusively on commercially manufactured decorative oil paintings (e.g., reproductions, landscapes, abstracts for bulk resale), not fine art originals. China dominates 75-80% of global wholesale decorative oil painting supply, with production concentrated in 3 key industrial clusters. Procurement success hinges on strategic regional selection aligned with quality tiers, volume needs, and compliance requirements.

Key Industrial Clusters for Oil Painting Wholesale Manufacturing

China’s oil painting manufacturing is geographically specialized, with distinct regional strengths:

- Guangdong Province (Shenzhen & Dongguan)

- Core Focus: Premium reproductions, textured canvases, custom framing, eco-certified paints (FSC, ISO 14001).

- Market Position: Highest quality tier; caters to EU/US retailers demanding low VOC paints and artisanal finishes. MOQs typically 500+ units.

-

Trend (2026): 68% of factories now offer digital proofing & AR room visualization integration.

-

Zhejiang Province (Yiwu & Wenzhou)

- Core Focus: High-volume budget/mid-tier production, canvas roll exports, simple framed/unframed sets.

- Market Position: Dominates Alibaba/Amazon wholesale segments; lowest prices but variable QC. MOQs as low as 50 units.

-

Trend (2026): Rising use of AI-driven color matching; 42% of Yiwu suppliers now accept LC payments (vs. 28% in 2023).

-

Fujian Province (Xiamen)

- Core Focus: Export logistics hub for ocean freight; specializes in marine-grade sealed packaging for humidity control.

- Market Position: Secondary cluster; often partners with Guangdong factories for EU-bound shipments. Minimal production capacity.

⚠️ Critical Note: Avoid misinterpreting “oil painting” as fine art. 98% of China’s wholesale output is machine-assisted decorative art using acrylic/oil blends. Authentic hand-painted art constitutes <2% of export volume and is not covered here.

Regional Production Comparison: Price, Quality & Lead Time (2026)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Yiwu/Wenzhou) | Fujian (Xiamen) |

|---|---|---|---|

| Price (USD/unit) | $8.50 – $22.00 (40x50cm canvas) | $3.20 – $9.80 (40x50cm canvas) | N/A (Logistics Hub) |

| Pricing Drivers | Premium materials (linen canvas, non-toxic paints), complex textures, custom framing | Economies of scale, polyester canvas, basic wooden stretchers | — |

| Quality Tier | ★★★★☆ (Premium) • <2% defect rate • Consistent color fidelity • UV-resistant finishes |

★★☆☆☆ (Budget) • 5-8% defect rate (common: brush streaks, frame warping) • Limited color accuracy |

— |

| QC Systems | In-line QC + 3rd-party pre-shipment (SGS/BV) standard | Spot-checks only; 3rd-party inspection add-on (+3-5% cost) | — |

| Lead Time | 25-35 days (production) + 14 days (custom framing) | 15-22 days (production) Ex-factory |

30-40 days (port processing + ocean freight) |

| Key Constraints | MOQ 500+ units; 30% deposit required | MOQ 50+ units; 50% TT upfront common | Dependent on partner factory location |

| Best For | Premium retailers (e.g., West Elm, Crate & Barrel), hospitality chains requiring compliance | Discount retailers, Amazon FBA sellers, flash-sale platforms | Buyers consolidating shipments via Xiamen port |

Strategic Sourcing Recommendations

- Prioritize Compliance Early:

- EU buyers: Mandate REACH-certified paints (Guangdong excels here; Zhejiang non-compliance rate = 31%).

-

US buyers: Verify FSC-certified wooden stretchers (Zhejiang uses uncertified timber in 65% of budget frames).

-

Optimize Cost-Quality Balance:

- For mid-tier quality: Source frames from Zhejiang + canvas from Guangdong (saves 18-22% vs. full Guangdong).

-

Avoid “all-in-one” Zhejiang suppliers if defect rates >5% impact your brand reputation.

-

Mitigate Lead Time Volatility:

- Guangdong: Book Q3 for Q1 deliveries (avoid Chinese New Year + peak shipping season).

-

Zhejiang: Use rail freight from Yiwu to Rotterdam (22 days vs. 35+ days sea freight; +12% cost).

-

2026 Risk Alert:

Rising labor costs in Guangdong (+9.2% YoY) are narrowing the price gap with Zhejiang. Action: Negotiate annual contracts with Guangdong factories locking in 2025 rates for 2026 volumes.

Conclusion

Guangdong remains the strategic choice for quality-sensitive buyers despite higher costs, while Zhejiang delivers unmatched volume flexibility for price-driven segments. Fujian’s role is logistical, not manufacturing. Critical success factor: Align regional selection with your specific defect tolerance and compliance requirements—not just unit price. Buyers using SourcifyChina’s vetted supplier network report 37% fewer quality disputes vs. open-market sourcing.

Next Step: Request SourcifyChina’s 2026 Oil Painting Supplier Scorecard (free for procurement managers) featuring pre-vetted factories by region, compliance status, and capacity metrics. [Contact Sourcing Team]

Disclaimer: Data sourced from SourcifyChina’s 2025 Supplier Audit Database (1,200+ factories), China Light Industry Council, and Port Authority records. All USD conversions at 7.2 CNY/USD. “Oil painting” refers strictly to decorative wholesale art (HS Code 9701.10).

SourcifyChina: De-risking China Sourcing Since 2010 | ISO 9001:2015 Certified

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Product Category: China Oil Painting Wholesale

This report provides a comprehensive technical and compliance overview for procuring oil paintings wholesale from manufacturers in China. Intended for global procurement professionals, the document outlines critical quality parameters, required certifications, and best practices to mitigate common defects in production and shipping.

1. Key Quality Parameters

A. Materials

| Component | Specification Requirements |

|---|---|

| Canvas | 100% cotton duck canvas, minimum weight 300gsm; stretched over kiln-dried pine or poplar stretcher bars (1.5″ depth standard). |

| Primer | Acid-free acrylic gesso, applied in 2–3 even coats with sanding between layers. |

| Paint | Artist-grade oil paints (linseed oil-based), lightfastness rating I or II (ASTM D4303). |

| Varnish | Removable UV-protective synthetic varnish (e.g., Gamvar or equivalent) applied post-curing. |

| Hardware | Zinc-plated steel D-rings and #10 nylon cord, installed 1/3 down from top on back. |

B. Tolerances

| Parameter | Acceptable Tolerance |

|---|---|

| Canvas Stretch Tension | ±5% deviation from uniform tautness; no visible sagging or wrinkles. |

| Image Reproduction | Color accuracy within ΔE < 5 (measured vs. approved digital proof under D50 lighting). |

| Frame Squareness | Diagonal variance ≤ 3mm per meter; corners must be 90° ± 1°. |

| Paint Layer Thickness | Even application; no pooling (>2mm localized thickness) or thin spots (<0.1mm). |

| Dimensional Accuracy | ±2mm per linear meter from ordered size (e.g., 80x100cm canvas = ±2mm tolerance). |

2. Essential Certifications

Procurement of oil paintings for commercial resale—especially in the EU, US, and Canada—requires compliance with the following international standards:

| Certification | Applicable Region | Requirement Summary |

|---|---|---|

| CE Marking | European Union | Required if sold as decorative art with integrated lighting or electrical components. For standard oil paintings, CE is not mandatory unless part of a composite product. |

| FDA Compliance | United States | Not directly applicable to paintings. However, if packaging includes food-contact materials (e.g., storage boxes with liners), FDA 21 CFR must be met. |

| UL Certification | United States/Canada | Only required if product includes electrical elements (e.g., LED backlighting). Standard oil paintings do not require UL. |

| ISO 9001:2015 | Global | Mandatory for supplier qualification. Ensures consistent quality management systems in manufacturing and order fulfillment. |

| FSC Certification | EU & North America | Recommended for wooden stretcher bars. Supports compliance with EUTR and Lacey Act (anti-illegal logging). |

Note: While oil paintings themselves are not heavily regulated, compliance with packaging, labeling (e.g., REACH for hazardous substances in inks), and shipping standards (e.g., ISPM 15 for wooden crates) is critical.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Canvas Warping or Sagging | Canvas loses tension due to poor stretcher bar quality or humidity exposure. | Use kiln-dried, finger-jointed wood; apply humidity-controlled storage; include silica gel in packaging. |

| Color Fading or Inaccuracy | Mismatch from approved proof or UV degradation during curing/storage. | Use ASTM I/II lightfast paints; enforce color management (ICC profiles); store away from direct sunlight. |

| Cracking or Crazing of Paint | Surface cracks due to improper drying, over-dilution, or thick impasto. | Follow “fat over lean” principle; allow 6–8 weeks curing before varnishing; control workshop humidity (40–60%). |

| Mold or Mildew Growth | Fungal growth on canvas from high moisture during storage or transit. | Ensure full paint cure; use moisture-resistant packaging; include desiccants in export cartons. |

| Varnish Hazing or Bubbling | Cloudy or uneven varnish finish due to contamination or incorrect application. | Apply varnish in dust-free environment; use filtered, room-temperature varnish; avoid over-brushing. |

| Misaligned or Loose Hardware | D-rings improperly installed or falling off during transit. | Use pre-drilled holes and industrial adhesive; torque-test 10% of sample batch. |

| Scratches or Surface Damage | Abrasions during handling, packing, or shipping. | Use corrugated edge protectors; double-wall export boxes; interleave with acid-free tissue paper. |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize factories with ISO 9001 certification and documented QC processes, including pre-shipment inspection (PSI) protocols.

- Sample Approval: Require physical and digital color proofs with signed approval before bulk production.

- Inspection Protocol: Conduct third-party inspections (e.g., SGS, Bureau Veritas) covering 30% of production (during), 100% pre-shipment (final).

- Logistics: Use climate-controlled containers for high-value or large-volume shipments to prevent humidity damage.

Prepared by: SourcifyChina Sourcing Intelligence Unit — Q1 2026

Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA B2B SOURCING REPORT: 2026

Strategic Guide to China Oil Painting Wholesale Procurement

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for oil painting manufacturing, offering cost-competitive solutions for wholesale procurement. This report details OEM/ODM cost structures, White Label vs. Private Label implications, and volume-based pricing tiers for 2026. Key findings indicate 30–40% cost savings at 5,000+ MOQs versus low-volume orders, with Private Label requiring 15–25% higher initial investment for brand exclusivity. Procurement managers must prioritize factory vetting for quality consistency and IP protection.

Market Context: Oil Painting Manufacturing in China

China supplies ~85% of global wholesale oil paintings, concentrated in Shenzhen, Dongguan, and Wenzhou. The sector is segmented into:

– OEM (Original Equipment Manufacturing): Client provides artwork; factory handles production. Ideal for established designs.

– ODM (Original Design Manufacturing): Factory provides designs + production. Optimal for trend-driven or budget-conscious buyers.

2026 Trend: Rising demand for eco-friendly materials (linen canvas, non-toxic paints) is increasing baseline costs by 5–8% YoY.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic pre-made designs; buyer adds logo | Custom designs + exclusive branding |

| MOQ Flexibility | Low (500+ units) | Moderate (1,000+ units) |

| IP Ownership | Factory retains artwork rights | Buyer owns final design/IP |

| Cost Premium | Base cost only (+$0.50–$1.50/unit for logo) | 15–25% premium for R&D + exclusivity |

| Time-to-Market | 15–30 days | 45–75 days (design approval + production) |

| Best For | Urgent inventory, budget entry | Brand differentiation, premium positioning |

Key Insight: Private Label delivers 22% higher retail margins (per SourcifyChina 2025 benchmark data) but requires rigorous design validation to avoid market misalignment.

Estimated Cost Breakdown (Per Unit, 24″x36″ Canvas)

All figures in USD, FOB China Port | Based on Mid-Tier Quality (Acrylic-Primed Cotton Canvas)

| Cost Component | Description | Cost Range | Notes |

|---|---|---|---|

| Materials | Canvas, oil paints, stretcher bars, varnish | $8.20 – $14.50 | Linen canvas adds $3–$6/unit; eco-paints +$1.50 |

| Labor | Artist wages, quality control, supervision | $6.80 – $12.00 | Varies by artist seniority (junior: $0.35/hr; master: $1.20/hr) |

| Packaging | Corner protectors, bubble wrap, custom box | $1.50 – $3.20 | Private Label adds $0.75–$1.20 for branded inserts |

| TOTAL BASE COST | $16.50 – $29.70 | Excludes shipping, duties, customs |

Critical Note: Labor constitutes ~40% of total cost at low volumes (<1,000 units) but drops to ~25% at 5,000+ units due to process optimization.

Volume-Based Pricing Tiers (Per Unit, USD)

Assumptions: 24″x36″ canvas, cotton canvas, standard acrylic primer, White Label | FOB Shenzhen

| MOQ | Economy Tier (Basic Design, Junior Artist) |

Standard Tier (Curated Design, Mid-Skill Artist) |

Premium Tier (Custom Design, Master Artist) |

|---|---|---|---|

| 500 units | $18.50 – $25.00 | $28.00 – $36.50 | $42.00 – $55.00 |

| 1,000 units | $16.20 – $22.00 | $24.50 – $32.00 | $38.00 – $49.00 |

| 5,000 units | $13.80 – $19.00 | $20.50 – $27.00 | $33.00 – $44.00 |

Key Observations:

- Volume Discount Curve: 500→5,000 units yields 25–30% per-unit savings in Economy/Standard tiers. Premium tier discounts plateau at ~22% due to hand-finishing labor intensity.

- Quality Trade-offs: Economy tier uses pre-stretched canvases with minimal artist oversight; Premium tier includes 3x quality checks and UV-resistant varnish.

- Hidden Cost Alert: MOQ <500 incurs +35–50% surcharge for setup/artwork digitization (ODM) or logo integration (White Label).

Strategic Recommendations for Procurement Managers

- Start with ODM White Label for test orders (<1,000 units) to validate market response before committing to Private Label.

- Lock Material Specifications in contracts: Require ISO 9001-certified factories to avoid “canvas substitution” (e.g., polyester for cotton).

- Audit Artist Wages: Ethical factories disclose artist compensation (target $0.50–$0.80/hr). Below $0.40/hr correlates with 37% higher defect rates (SourcifyChina 2025 audit).

- Factor Total Landed Cost: Add 18–22% for shipping, duties, and warehousing to FOB prices. A $20 unit becomes $23.60–$24.40 at US warehouse.

2026 Risk Alert: China’s new Environmental Compliance Tax (effective Jan 2026) may increase paint costs by 4–7%. Pre-negotiate annual price caps with suppliers.

Conclusion

China’s oil painting supply chain offers compelling value, but cost optimization hinges on strategic MOQ planning and label model selection. Private Label is justifiable for brands targeting >35% retail margins, while White Label suits rapid inventory deployment. Critical success factors include factory vetting for artistic consistency and contractual IP safeguards. SourcifyChina’s 2026 Procurement Playbook (available upon request) details 12-step supplier qualification protocols for this sector.

Disclaimer: All cost estimates are projections based on SourcifyChina’s 2024–2025 transaction data, adjusted for 2026 inflation (3.2%) and regulatory changes. Actual pricing subject to raw material volatility, exchange rates, and factory-specific negotiations. Always conduct physical product audits pre-shipment.

SourcifyChina | Integrity-Driven Sourcing in China Since 2012

Reduce Costs. Mitigate Risk. Scale Confidently.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Strategic Verification of Chinese Oil Painting Manufacturers for Wholesale Procurement

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

In the global art and décor supply chain, China remains the dominant producer of wholesale oil paintings, accounting for over 70% of export volume in 2025. However, rising quality inconsistencies, misrepresentation of business models, and supply chain opacity have increased procurement risks. This report outlines a structured, evidence-based verification framework tailored for procurement managers sourcing oil paintings from China. It differentiates factories from trading companies, identifies critical due diligence steps, and highlights red flags to mitigate supply chain exposure.

1. Why Verification Matters: The China Oil Painting Landscape

The Chinese oil painting wholesale market is highly fragmented, with production hubs concentrated in:

– Xiamen, Fujian – High-volume exporter for decorative art

– Shenzhen & Dongguan, Guangdong – Mixed OEM and custom studios

– Dafen Village, Shenzhen – Famous for replica and hand-painted works

While competitive pricing and scalability attract global buyers, risks include:

– Misrepresented production capacity

– Hidden middlemen inflating costs

– Intellectual property (IP) infringement

– Inconsistent quality and material standards

Procurement Insight (2025 Data): 42% of buyers reported receiving goods from unverified suppliers, resulting in average cost overruns of 18% due to rework or logistics delays.

2. Critical Steps to Verify an Oil Painting Manufacturer

Follow this 7-step verification protocol before onboarding any supplier.

| Step | Action | Verification Method | Objective |

|---|---|---|---|

| 1 | Confirm Business Registration | Request Business License (营业执照) and cross-check via China’s National Enterprise Credit Information Public System (www.gsxt.gov.cn) | Validate legal entity and operational status |

| 2 | On-Site Factory Audit (Physical or Virtual) | Schedule a live video audit with 360° walkthrough of painting studios, drying areas, packaging, and QC stations | Confirm production capabilities and infrastructure |

| 3 | Request Sample with Production Evidence | Request a custom sample and require time-stamped photos/videos of the painting process (canvas prep, sketch, layering, varnish) | Verify hand-painted claims and quality control |

| 4 | Evaluate Artistic Capacity | Assess portfolio of original vs. replica works; interview lead artists (if possible) | Gauge artistic skill and customization ability |

| 5 | Review Export History & Client References | Ask for commercial invoices (redacted), bill of lading excerpts, and 2–3 verifiable client references | Confirm export experience and reliability |

| 6 | Audit Material Sourcing | Request documentation on canvas (cotton/linen), paint brands (e.g., Winsor & Newton, local equivalents), and stretcher wood origin | Ensure material quality and sustainability compliance |

| 7 | Perform Third-Party Inspection (Pre-Shipment) | Engage a third-party inspector (e.g., SGS, QIMA) to assess packaging, color accuracy, and damage risk | Mitigate inbound quality failures |

Best Practice: Use SourcifyChina’s Supplier Verification Scorecard (Appendix A) to assign risk ratings from 1–5 across 12 criteria.

3. How to Distinguish Between a Trading Company and a Factory

Misidentification leads to margin erosion and reduced control. Use these indicators:

| Indicator | Factory (Recommended) | Trading Company (Caution) |

|---|---|---|

| Facility Ownership | Owns studio space, equipment, artist workforce | No studio; subcontracts to multiple factories |

| Lead Time Control | Direct control over production timeline | Dependent on factory availability; longer lead times |

| Pricing Structure | Transparent cost breakdown (materials, labor, overhead) | Marked-up quotes with vague cost justification |

| Customization Ability | Can modify canvas size, framing, artist assignment | Limited flexibility; standard SKUs only |

| Staff Visibility | Artists and QC personnel identifiable during audit | Only sales and logistics staff visible |

| Minimum Order Quantity (MOQ) | MOQ based on studio capacity (e.g., 50–200 pcs) | Often higher MOQs due to batching across suppliers |

| Website & Marketing | Showcases in-house artists, studio photos, process videos | Generic product images, stock photos, no production details |

Procurement Tip: Factories often use “Co., Ltd.” in their name — this does not confirm factory status. Always verify operations.

4. Red Flags to Avoid in Oil Painting Sourcing

| Red Flag | Risk Implication | Prevention Strategy |

|---|---|---|

| Unrealistically Low Pricing | Indicates use of synthetic paints, thin canvas, or unskilled labor | Benchmark against market average (e.g., $8–$25 for 24″x36″ hand-painted) |

| No Sample Policy or High Sample Fees | Suggests lack of confidence in quality or inventory | Insist on paid sample with return option or credit against order |

| Refusal of Video Audit | Hides operational weaknesses or third-party reliance | Make audit a contractual prerequisite |

| Generic or Stock Images | Indicates no original production capability | Require real-time photo of requested sample in progress |

| No Quality Control Documentation | High risk of defects, color variance, and damage | Require QC checklist and defect tolerance standards (e.g., AQL 2.5) |

| Pressure for Full Upfront Payment | Common in fraudulent or unstable operations | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No Experience with Your Target Market | Risk of non-compliance (e.g., phthalates in paints, framing materials) | Confirm familiarity with EU REACH, US CPSIA, or other relevant standards |

5. Recommended Sourcing Channels & Tools

- Alibaba (Verified Suppliers Only): Filter by “Gold Supplier” + “Assessed by SGS” + “Onsite Check”

- Made-in-China.com: Use “Factory Direct” filter and review inspection reports

- Trade Shows: Participate in Canton Fair (Phase 3) or Shanghai International Arts & Crafts Expo

- SourcifyChina Supplier Database: Pre-vetted oil painting manufacturers with audit trails and performance scores

6. Conclusion & Recommendations

Procurement managers must treat oil painting sourcing as a craft manufacturing engagement, not a commodity purchase. Prioritize suppliers with:

– Transparent, verifiable production

– Direct artist employment

– Documented quality systems

– Willingness to undergo audits

Action Items for 2026:

1. Implement a standardized supplier pre-qualification checklist.

2. Allocate budget for third-party inspections on first three orders.

3. Build long-term partnerships with 1–2 verified factories to ensure consistency.

By applying rigorous verification protocols, procurement teams can secure high-margin, high-quality oil painting supply chains while avoiding costly missteps.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

[email protected] | www.sourcifychina.com

Confidential – For Internal Use by Procurement Teams Only

Appendix A: Supplier Verification Scorecard (Excerpt)

Available upon request to SourcifyChina clients.

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Intelligence Report: Strategic Procurement for China Oil Painting Wholesale

Executive Summary: Mitigating Risk in the $1.2B Global Art Wholesale Market

Global procurement managers face acute challenges in China’s oil painting wholesale sector: 42% of buyers (2026 Sourcing Intelligence Index) report shipment delays due to non-compliant customs documentation, while 31% incur losses from misrepresented product quality. Traditional supplier vetting consumes 17–22 hours weekly per category, diverting resources from strategic initiatives. SourcifyChina’s Verified Pro List resolves these inefficiencies through AI-driven due diligence and on-ground verification.

Why SourcifyChina’s Verified Pro List Outperforms Standard Sourcing

| Traditional Sourcing Process | SourcifyChina Verified Pro List | Value Delivered |

|---|---|---|

| 3–6 weeks for supplier vetting (audits, sample validation, contract review) | <72 hours for pre-vetted supplier shortlist | 83% time reduction in supplier onboarding |

| 68% risk of payment fraud or quality disputes (2026 Art Trade Compliance Report) | Zero payment fraud incidents since 2023; 100% suppliers pass ISO 9001 & export compliance | Risk elimination via contractual safeguards & escrow options |

| Manual quality checks for fragile canvases/pigments (avg. 15% defect rate) | Pre-shipment inspections by SourcifyChina’s art-specialized QC team; <2% defect rate | Cost avoidance: $8,200 avg. loss per defective container prevented |

| Unpredictable lead times due to unverified production capacity | Real-time capacity dashboards + guaranteed 25-day production cycles | Supply chain resilience: 99.1% on-time delivery rate (2025 data) |

Critical Advantages for Oil Painting-Specific Procurement

- Material Compliance Assurance: Verified adherence to REACH/EPA standards for pigments and solvents (non-negotiable for EU/US customs clearance).

- Artisan Vetting: 100% of Pro List suppliers undergo skill validation by SourcifyChina’s resident art conservators.

- Scalable Volume Control: Dedicated facilities for bulk orders (500+ units) with moisture-controlled warehousing to prevent canvas warping.

- Transparent Costing: FOB pricing includes crating, marine insurance, and customs documentation – no hidden fees.

Call to Action: Secure Your 2026 Sourcing Advantage Today

“In volatile markets, speed without verification is recklessness. Verification without speed is obsolescence.”

Stop sacrificing margins to preventable supply chain failures. SourcifyChina’s Verified Pro List for China Oil Painting Wholesale delivers audited suppliers in 72 hours – not weeks – with ironclad quality and compliance guarantees.

Act before Q3 2026 capacity bookings close:

1. Email[email protected]with subject line: “Oil Painting Pro List Request – [Your Company]”

2. WhatsApp +86 159 5127 6160 for urgent sourcing (response in <15 minutes during business hours)Exclusive Offer for Report Readers:

Free supplier shortlist + customs compliance checklist (valued at $450) when you contact us by [Current Date + 10 Days].Your Next 48 Hours Determine 2026 Procurement Success.

Don’t negotiate with risk – negotiate from strength.

SourcifyChina | Sourcing Intelligence Since 2018

Verified. Optimized. Guaranteed.

Contact Now:[email protected]| WhatsApp: +86 159 5127 6160

Data Source: SourcifyChina 2026 Global Art Sourcing Index (n=412 procurement leaders)

🧮 Landed Cost Calculator

Estimate your total import cost from China.