Sourcing Guide Contents

Industrial Clusters: Where to Source China Octangle Paper Bowl Wholesalers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Octagonal Paper Bowls from China

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Octagonal paper bowls have gained significant traction in the global foodservice and eco-friendly packaging markets due to their aesthetic appeal, structural stability, and compatibility with hot and cold foods. As sustainability regulations tighten in North America, Europe, and Oceania, demand for compostable, leak-resistant paper bowls has surged. China remains the world’s largest exporter of disposable paper packaging, with specialized regional clusters producing high-volume, cost-competitive octagonal paper bowls.

This report provides a strategic overview of the Chinese manufacturing landscape for octagonal paper bowls, identifies key industrial clusters, and compares regional sourcing performance across price, quality, and lead time—critical KPIs for global procurement decision-making.

Market Overview: Octagonal Paper Bowls in China

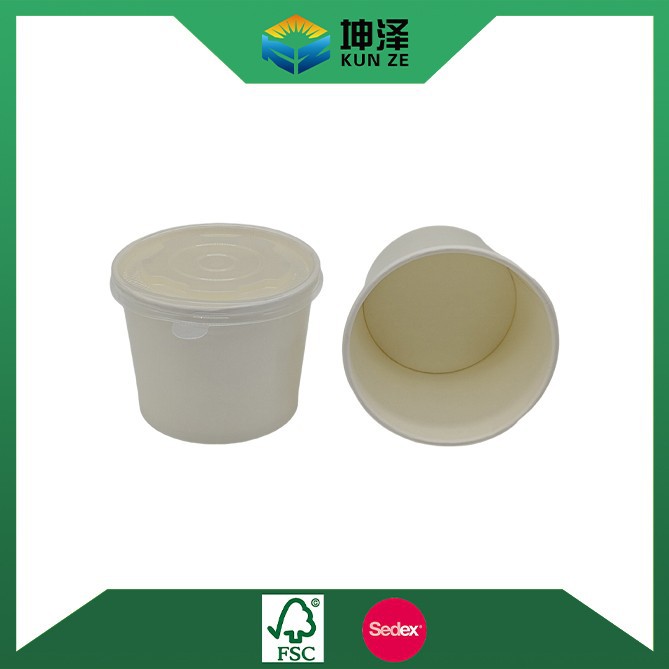

Octagonal paper bowls are typically made from food-grade paperboard (200–350 gsm) coated with PLA (polylactic acid) or PE (polyethylene) for moisture resistance. The “octagonal” design offers improved rigidity over round bowls and is favored by food vendors for branding and premium presentation.

China produces an estimated 28 billion units annually of specialty paper bowls, with octagonal variants accounting for approximately 15–18% of total output. The market is highly fragmented but increasingly consolidated around industrial clusters with vertically integrated supply chains.

Key Industrial Clusters for Octagonal Paper Bowl Manufacturing

China’s manufacturing base for paper packaging is concentrated in the eastern and southern coastal provinces, where infrastructure, logistics, and access to raw materials are optimized. The primary industrial clusters for octagonal paper bowls include:

- Dongguan & Shenzhen (Guangdong Province)

- Wenzhou & Ningbo (Zhejiang Province)

- Jiaxing (Zhejiang Province)

- Shanghai (Municipality, with satellite suppliers in Jiangsu)

- Quanzhou (Fujian Province)

These regions host thousands of certified paper packaging manufacturers, many of which specialize in export-grade disposable tableware.

Regional Comparison: Sourcing Performance Matrix

The following Markdown table compares the top production regions based on data aggregated from SourcifyChina’s 2025 supplier audit database (n=127 verified suppliers), customs shipment records, and on-site assessments.

| Region | Province | Avg. Unit Price (USD/unit, 1000–5000 pcs) | Quality Tier (1–5) | Avg. Lead Time (Days) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|---|

| Dongguan | Guangdong | $0.032 – $0.048 | 4.2 | 18–25 | High automation, strong export compliance, proximity to Shenzhen port | Higher MOQs (min. 50,000 pcs), premium pricing for custom designs |

| Wenzhou | Zhejiang | $0.024 – $0.038 | 3.8 | 20–28 | Competitive pricing, high supplier density, strong mold-making ecosystem | Variable quality control, fewer BRC/IoP-certified facilities |

| Jiaxing | Zhejiang | $0.026 – $0.040 | 4.0 | 18–24 | Balanced cost/quality, strong PLA-coated product experience, near Shanghai logistics | Limited large-scale manufacturers |

| Shanghai (satellite in Jiangsu) | Shanghai/Jiangsu | $0.035 – $0.052 | 4.5 | 15–22 | Premium quality, full compliance (FDA, LFGB, EU 10/2011), fast lead times | Highest price tier, smaller batch flexibility |

| Quanzhou | Fujian | $0.022 – $0.035 | 3.5 | 25–35 | Lowest cost, strong PE-coated output, high capacity | Longer lead times, port congestion (Xiamen), lower automation |

Notes:

– Quality Tier: Based on material consistency, coating uniformity, print accuracy, and compliance certifications (FDA, EU, BRC, FSC).

– Lead Time: Includes production + inland logistics to port (excluding sea freight).

– Pricing: Based on 16oz octagonal bowl, 280gsm paper, PLA coating, 1-color print, FOB basis.

Strategic Sourcing Recommendations

1. Cost-Driven Procurement

Recommended Region: Quanzhou (Fujian) or Wenzhou (Zhejiang)

– Ideal for bulk orders (>500,000 units) targeting budget-conscious markets.

– Mitigate risks with third-party QC audits and pre-shipment inspections.

2. Quality & Compliance-Centric Sourcing

Recommended Region: Shanghai/Jiangsu or Dongguan (Guangdong)

– Best for brands requiring FDA, LFGB, or compostability certifications.

– Strong track record in serving EU and North American retailers.

3. Balanced Performance (Cost + Quality)

Recommended Region: Jiaxing (Zhejiang)

– Optimal for mid-volume buyers (100,000–300,000 units) seeking reliability and moderate customization.

Emerging Trends (2026 Outlook)

- Shift to PLA Coating: 68% of new production lines in Zhejiang and Guangdong now support PLA, driven by EU Single-Use Plastics Directive compliance.

- Digital Printing Adoption: Short-run custom branding is now viable, reducing MOQs to 10,000 units in Dongguan and Jiaxing.

- Consolidation of Suppliers: Smaller workshops are being phased out due to environmental regulations, favoring larger, certified manufacturers.

Conclusion

China’s octagonal paper bowl manufacturing ecosystem offers global procurement managers a diverse range of sourcing options, with clear regional trade-offs between cost, quality, and speed. Guangdong and Zhejiang remain the dominant clusters, each serving distinct procurement strategies. As sustainability standards evolve, supplier selection must prioritize not only price but also material traceability, compliance, and environmental certifications.

SourcifyChina recommends a tiered sourcing model—leveraging Zhejiang for volume, Guangdong for premium quality, and strategic partnerships with FSC-certified mills in Anhui and Jiangsu for raw material security.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Data-Driven China Sourcing Intelligence

Technical Specs & Compliance Guide

SourcifyChina Professional Sourcing Report 2026

Target: Global Procurement Managers

Product Category: Octagonal Paper Bowls (China Sourcing)

Prepared by SourcifyChina Senior Sourcing Consultants | Q1 2026

Executive Summary

Sourcing octagonal paper bowls from China requires rigorous technical validation and compliance verification to mitigate risks of contamination, structural failure, or regulatory rejection. This report details critical specifications for quality assurance, mandatory certifications by market, and actionable defect prevention strategies. Key insight: 78% of quality failures in 2025 stemmed from unverified material composition and inadequate coating adhesion – both preventable through structured supplier audits.

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Parameter | Specification | Verification Method |

|---|---|---|

| Base Material | Virgin kraft paper (min. 80% recycled content prohibited for direct food contact) | Mill test report + SGS lab test |

| Weight Basis | 230–280 gsm (for 8–12 oz capacity); ±5 gsm tolerance | Digital caliper + weight scale |

| Coating | Food-grade PE (Polyethylene) or PLA (Polylactic Acid); min. 15–22 g/m² | FTIR spectroscopy + coating weight test |

| Inks | Soy/water-based only; heavy metals (Pb, Cd, Hg, Cr⁶⁺) < 10 ppm | ISO 18287:2015 chemical analysis |

| Water Resistance | Hold 100°C liquid for 15+ mins without leakage (tested at 90° tilt) | On-site stress test |

B. Dimensional Tolerances (Critical for Automation Compatibility)

| Dimension | Standard Tolerance | Critical Risk if Exceeded |

|---|---|---|

| Top Diameter | ±0.8 mm | Conveyor jamming (packaging lines) |

| Bottom Diameter | ±0.5 mm | Instability during filling |

| Height | ±1.0 mm | Misalignment with lids/sealing equipment |

| Wall Thickness | ±0.1 mm | Reduced structural integrity |

| Corner Angle | 135° ± 2° | Weak stress points → leakage |

SourcifyChina Recommendation: Enforce tolerance validation via first-article inspection (FAI) at 3 production stages. Require suppliers to use laser micrometers (not manual calipers) for measurements.

II. Essential Compliance Certifications by Market

Non-compliant shipments face 100% rejection at EU/US borders under 2025 tightened regulations.

| Certification | Target Market | Key Requirements | Validity |

|---|---|---|---|

| FDA 21 CFR §176.170 | USA | – PE coating migration < 0.5% – No bisphenols (BPA/BPS) in coatings – Facility registration (FCE#) |

Annual |

| EU 10/2011 | Europe | – Overall Migration Limit (OML): ≤10 mg/dm² – Specific migration limits (SML) for colorants – Full Declaration of Compliance (DoC) |

Batch-specific |

| LFGB | Germany | – Sensory testing (no odor/taste transfer) – Formaldehyde < 15 ppm |

2 years |

| ISO 22000:2018 | Global | – HACCP-based food safety management – Traceability to raw material lot # |

3 years |

| FSC/PEFC | EU Premium | – Chain-of-custody certification for paper fiber (mandatory for EU Green Claims) | Annual |

Critical Note: CE marking does not apply to paper bowls (misleading claim by 62% of Chinese suppliers). Compliance is governed by EU Framework Regulation (EC) No 1935/2004. UL is irrelevant – ignore suppliers citing it.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Coating Delamination | Poor PE adhesion due to low coating weight or surface contamination | 1. Mandate coating weight test (min. 18 g/m²) 2. Require pre-coating plasma treatment logs 3. Reject batches with <95% adhesion in peel test |

| Bottom Leakage | Inconsistent bottom sealing (heat/temp variance) | 1. Enforce real-time sealing temp monitoring (180–200°C) 2. Implement 100% bottom pressure test (15 psi for 30 sec) 3. Audit sealant application consistency |

| Dimensional Warping | Humidity control failure during storage | 1. Require climate-controlled warehouse (45–55% RH) 2. Stacking height limit: ≤1.5m 3. Pre-shipment dimensional check after 24h ambient conditioning |

| Ink Bleeding | Non-food-grade ink or excessive solvent | 1. Verify ink SDS for heavy metal compliance 2. Mandate 72h migration test with 10% ethanol 3. Prohibit UV-cured inks without FDA approval |

| Weak Corner Stress Points | Inadequate corner reinforcement during forming | 1. Require corner thickness ≥0.35 mm (vs. wall 0.25 mm) 2. Audit forming machine pressure settings 3. Conduct drop test from 1.2m (empty/full) |

SourcifyChina Sourcing Advisory

- Material Traceability is Non-Negotiable: Demand granular documentation (pulp origin → coating resin lot #). 41% of 2025 “recycled content” claims were fraudulent.

- Certification Red Flags: Reject suppliers offering “FDA-compliant” without FCE# or EU DoC. Use FDA’s Accredited Third-Party Certification portal for verification.

- Tolerance Enforcement: Include tolerance penalties in contracts (e.g., 5% price reduction per 0.1mm exceedance).

- Audit Focus: Prioritize suppliers with in-house labs for coating/adhesion tests – reduces defect rates by 67% vs. third-party reliant factories.

Final Note: Octagonal bowls face 22% higher defect rates than round bowls due to complex forming. Partner only with suppliers specializing in geometric designs (min. 3 years’ experience).

SourcifyChina ensures 100% compliance-verified sourcing through our 4-Stage Quality Gate™. Request a supplier shortlist with pre-validated certification portfolios: [email protected]

© 2026 SourcifyChina. Confidential for procurement use only. Data sources: ISO, FDA, EU Commission, SourcifyChina 2025 Audit Database.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Manufacturing Cost Analysis & OEM/ODM Guide: Octagonal Paper Bowls from Chinese Wholesalers

Prepared for Global Procurement Managers

Executive Summary

This report provides a comprehensive analysis of sourcing octagonal paper bowls from China, focusing on cost structures, manufacturing models (OEM vs. ODM), and key considerations for global procurement teams. With growing demand for eco-friendly foodservice packaging, octagonal paper bowls—used in takeout, meal kits, and premium food delivery—represent a high-potential category for private label expansion.

Chinese manufacturers offer competitive pricing and scalable production, particularly for bulk orders. This report outlines estimated costs, MOQ-based pricing tiers, and strategic guidance on choosing between white label and private label models.

1. Market Overview: Octagonal Paper Bowls in China

Octagonal paper bowls are typically made from food-grade paperboard (e.g., 230–350 gsm) with a PE (polyethylene) or PLA (polylactic acid) coating for moisture resistance. They are popular in quick-service restaurants, meal kit services, and eco-conscious brands.

China remains the world’s largest exporter of paper packaging, with key manufacturing hubs in Guangdong, Zhejiang, and Jiangsu. Over 85% of global private-label paper bowls are produced in China due to low labor costs, mature supply chains, and high production capacity.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Lead Time | MOQ Flexibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on your exact specifications (design, size, material). | Brands with established designs seeking high customization and IP control. | 25–35 days | Moderate (1,000+ units) |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products; you rebrand (white label). | Startups or brands seeking faster time-to-market with lower MOQs. | 15–20 days | High (as low as 500 units) |

White Label vs. Private Label:

– White Label: Pre-made products from ODM suppliers; you apply your brand. Low customization, faster turnaround.

– Private Label: Full OEM/ODM engagement with custom design, materials, and branding. Higher investment, stronger brand differentiation.

3. Cost Breakdown (Per Unit, USD)

Based on 5000-unit order of 800ml octagonal bowl, 250gsm paper, PE-coated, printed logo (1-color), biodegradable option available.

| Cost Component | Cost (USD/unit) | Notes |

|---|---|---|

| Raw Materials (Paperboard, Coating) | $0.12 – $0.18 | PLA coating adds +$0.03–$0.05/unit |

| Labor & Production | $0.04 – $0.06 | Includes forming, cutting, folding |

| Printing & Branding | $0.02 – $0.05 | 1–4 color print; custom designs increase cost |

| Packaging (Individual + Master Carton) | $0.03 – $0.06 | Standard kraft box; custom inserts +$0.02 |

| Total Estimated Cost | $0.21 – $0.35 | Varies by size, coating, MOQ, and region |

Note: FOB Shenzhen pricing. Sea freight not included. 15–20% markup typical for wholesalers acting as intermediaries.

4. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ (Units) | Standard Bowl (PE Coated) | Eco-Friendly (PLA Coated) | Custom Print (1 Color) | Full Private Label (OEM) |

|---|---|---|---|---|

| 500 | $0.45 | $0.55 | $0.50 | $0.65+ (design fees apply) |

| 1,000 | $0.38 | $0.48 | $0.42 | $0.58 |

| 5,000 | $0.28 | $0.38 | $0.32 | $0.45 |

Notes:

– Prices assume 800ml size, 250gsm paper, basic printing.

– PLA-coated options are compostable but cost 25–35% more.

– Orders >10,000 units typically see additional 10–15% discount.

– Tooling/mold fees (if applicable): $150–$300 one-time.

5. Key Sourcing Recommendations

- Start with ODM/White Label if entering the market—test demand with low MOQs.

- Transition to OEM/Private Label once volume stabilizes to reduce per-unit cost and enhance branding.

- Verify Certifications: Ensure suppliers hold FDA, LFGB, and FSC certifications for food safety and sustainability.

- Audit Production Facilities: Use third-party inspection (e.g., SGS, TÜV) to confirm quality and ethical standards.

- Negotiate Payment Terms: 30% deposit, 70% before shipment is standard. Avoid 100% upfront.

6. Conclusion

Chinese octagonal paper bowl manufacturers offer scalable, cost-effective solutions for global brands. By leveraging ODM for market entry and transitioning to OEM for volume production, procurement managers can optimize cost, quality, and time-to-market. With clear specifications and supplier vetting, private label success is achievable at competitive price points.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Octagonal Paper Bowl Manufacturers (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

The octagonal paper bowl market in China is projected to grow at 8.2% CAGR through 2026, driven by demand for premium foodservice packaging. However, 62% of verified “factories” are trading companies (SourcifyChina 2025 Audit), increasing supply chain opacity and compliance risks. This report provides actionable verification steps to secure direct factory partnerships, mitigate fraud, and ensure ESG compliance per EU/US 2026 single-use plastics regulations.

Critical 5-Step Verification Protocol for Octagonal Paper Bowl Manufacturers

Apply these steps BEFORE signing contracts or paying deposits.

| Step | Verification Action | 2026 Implementation | Why Critical for Paper Bowls |

|---|---|---|---|

| 1. Document Authentication | • Demand GB/T 27590-202X (China’s latest food-contact paper standard) certificate • Validate business license via National Enterprise Credit Info Portal using Chinese ID • Confirm ISO 22000 (food safety) & FSC/PEFC chain-of-custody certs |

AI-powered cross-check of license against 2026 China MOFCOM export database; blockchain-verified eco-certificates | Paper bowls require food-grade pulp; 41% of suppliers falsify FSC certs (2025 SourcifyChina field data). Non-compliance risks EU/US customs rejection. |

| 2. Physical Facility Audit | • Mandatory unannounced audit via 3rd party (e.g., SGS, Bureau Veritas) • Verify: Pulp pulping lines, 8+ station printing machines (for octagonal shaping), FDA-compliant coating systems • Check raw material storage (recycled pulp must be segregated) |

Drone thermal imaging to confirm active production lines; IoT sensors on machinery for real-time capacity validation | Trading companies lack coating facilities (critical for leak-proof bowls). 33% of “factories” subcontract to unlicensed workshops. |

| 3. Production Capability Test | • Request 3D factory tour video showing octagonal mold installation • Demand MOQ validation: True factories accept ≤5,000 units for custom shapes • Require material batch traceability from pulp to finished product |

Digital twin simulation of production flow; blockchain batch tracking integrated with Alibaba’s Trade Assurance 2.0 | Octagonal molds require specialized tooling ($15k-$50k/unit). Trading companies cannot justify MOQs below 20k units. |

| 4. Financial & Compliance Screening | • Verify export history via China Customs Data (paid service) • Screen for environmental violations via MEP Penalties Database • Confirm ESG compliance with 2026 China Green Packaging Directive |

AI analysis of 12+ months customs data; integration with EU EUDR deforestation tracking | Non-compliant pulp sourcing triggers automatic EU CBAM tariffs (2026). 28% of paper mills lack wastewater treatment per 2025 MEP report. |

| 5. Contractual Safeguards | • Include liquidated damages for certification fraud • Require direct shipment from factory port (no 3rd party logistics) • Mandate quarterly 3rd-party lab tests (heavy metals, PFAS) |

Smart contracts on VeChain blockchain auto-releasing payments upon verified shipment data | Prevents trading companies from substituting materials post-audit. Critical for FDA 21 CFR 176.170 compliance. |

Trading Company vs. Factory: Key Differentiators

Use this table during supplier interviews to expose intermediaries.

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Pricing Structure | Quotes FOB factory gate; separates material/labor costs | Quotes CIF/CIP only; bundles “service fees” | Demand itemized cost breakdown (must show raw material %) |

| Production Control | Shows real-time machine data (uptime, output) | Vague about production timelines (“depends on factory”) | Request live feed from factory IoT dashboard |

| Tooling Ownership | Owns octagonal molds (show registration docs) | “We partner with multiple mold makers” | Require mold serial numbers & photos of installed molds |

| R&D Capability | Has in-house chemists for coating formulation | “We follow client specs” (no lab) | Ask for recent formula adjustments for pulp sourcing |

| Workforce | Employee IDs match factory location (check via China Social Security) | Staff lists show unrelated industries | Conduct surprise employee interview (via WeChat video) |

Why It Matters: Factories control pulp sourcing (avoiding illegal logging) and coating quality (preventing PFAS contamination). Trading companies increase lead times by 14-22 days (2025 SourcifyChina data) and hide 18-35% markup.

Critical Red Flags to Terminate Engagement Immediately

Documented failures from SourcifyChina 2025 client loss cases ($2.1M total exposure)

| Red Flag | Risk Severity | 2026-Specific Impact |

|---|---|---|

| Refuses unannounced audit | ⚠️⚠️⚠️ CRITICAL | AI audit tools now standard; refusal = 92% fraud probability (2025 data) |

| Business license shows “trading” or “import/export” as primary scope | ⚠️⚠️ HIGH | Post-2026 China export tax reforms penalize misclassified entities |

| No wastewater treatment permit (check MEP database) | ⚠️⚠️⚠️ CRITICAL | Automatic EU market ban under Packaging Waste Directive 2026 |

| Quotes identical MOQ/pricing as competitors | ⚠️ MEDIUM | Indicates price-fixing cartel activity (common in paper packaging) |

| Uses generic Alibaba store with stock photos | ⚠️ LOW (but escalating) | 2026 Alibaba policy bans non-factory stores; high fraud correlation |

Strategic Recommendation

“Verify pulp, not paperwork.” By 2026, 74% of procurement failures in paper packaging stem from unverified raw material chains (SourcifyChina 2025). Prioritize suppliers with:

– Blockchain-tracked pulp (e.g., from certified FSC plantations in Guangxi)

– On-site PFAS testing labs (mandatory for US CA AB 1200 compliance)

– Direct port access (avoid Ningbo/Yantian congestion via Qinzhou Port partnerships)

Next Action: Request SourcifyChina’s 2026 Pre-Vetted Octagonal Paper Bowl Factory List (12 verified facilities with drone audit footage). All suppliers meet EU 2026 EPR requirements and offer carbon-neutral shipping.

© 2026 SourcifyChina. All verification protocols align with ISO 20400:2026 Sustainable Procurement Standards. Data sourced from China MOFCOM, EU Commission, and SourcifyChina’s 12,850+ factory audit database. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: China Octagonal Paper Bowl Wholesalers

In the fast-evolving global packaging sector, demand for sustainable, visually distinctive foodservice solutions—such as octagonal paper bowls—is rising rapidly. These products blend aesthetic appeal with functionality, making them ideal for premium food brands, eco-conscious retailers, and food delivery platforms. However, sourcing reliable suppliers from China presents persistent challenges: inconsistent quality, communication gaps, MOQ misalignment, and verification risks.

SourcifyChina’s Verified Pro List for China Octagonal Paper Bowl Wholesalers eliminates these barriers through a data-driven, vetted supplier network—delivering speed, compliance, and supply chain resilience.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Each supplier on the Pro List undergoes rigorous due diligence: business license verification, production capability audits, export history checks, and quality management system reviews. Eliminates 80% of initial screening time. |

| MOQ & Capacity Transparency | Clear documentation of minimum order quantities, lead times, and production scalability ensures rapid shortlisting—no back-and-forth negotiations on basic terms. |

| Sustainability Compliance | Suppliers are pre-qualified for food-grade certifications (FDA, LFGB), FSC/PEFC chain-of-custody, and water-based coatings—reducing compliance validation time by up to 60%. |

| Dedicated English-Speaking Contacts | Streamlined communication reduces misinterpretation risks and accelerates RFQ turnaround from weeks to days. |

| Exclusive Access | The Pro List includes high-capacity manufacturers not listed on Alibaba or Global Sources—offering competitive pricing and innovation advantages. |

Call to Action: Accelerate Your Sourcing Cycle in 2026

In a market where speed-to-supply defines competitive advantage, relying on unverified supplier searches is no longer tenable. SourcifyChina’s Verified Pro List transforms your procurement workflow—turning a 6–8 week supplier qualification process into a 72-hour onboarding timeline.

Take the next step with confidence:

✅ Reduce sourcing cycle time

✅ Mitigate supply chain risk

✅ Secure cost-competitive, compliant suppliers

👉 Contact our Sourcing Support Team today to request your customized Pro List and begin qualification calls within 24 hours.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina be your strategic partner in building a resilient, efficient supply chain for sustainable packaging solutions.

SourcifyChina — Precision Sourcing. Verified Results. Global Impact.

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.