Sourcing Guide Contents

Industrial Clusters: Where to Source China Ocean Shipping Group Company Subsidiaries

SourcifyChina B2B Sourcing Intelligence Report: Clarification & Strategic Redirect

Report Code: SC-CHN-SHIP-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: Strictly B2B

Critical Clarification: Misalignment in Sourcing Target

Immediate Advisory: The request to source “China Ocean Shipping Group Company (COSCO Shipping) subsidiaries” as manufacturing entities is fundamentally misaligned with industry structure. COSCO Shipping Group (NYSE: CEO; SEHK: 1919) is a state-owned logistics and shipping conglomerate, not a manufacturer of physical goods. Its subsidiaries (e.g., COSCO Shipping Ports, COSCO Shipping Development, COSCO Shipping Energy) operate in maritime transport, port management, container leasing, and logistics services – not industrial production.

🔍 Why this matters to procurement teams:

– Subsidiaries = Service Providers: COSCO subsidiaries own/operate vessels, terminals, and logistics networks. They do not manufacture containers, ship components, or marine equipment.

– Sourcing Implication: Attempting to “source subsidiaries” implies procuring logistics contracts (e.g., freight rates, terminal handling), not physical products. Physical goods (e.g., shipping containers, marine engines) are sourced from third-party OEMs, not COSCO itself.

– Risk Alert: Confusing service providers with manufacturers leads to RFP misdirection, wasted due diligence, and contractual exposure.

Strategic Redirect: Sourcing Marine Equipment for COSCO-Scale Operations

Based on 12+ years of China logistics sector analysis, we deduce your probable intent: Sourcing physical components used by COSCO and its peers (e.g., ISO containers, ship parts, port machinery). Below is the corrected analysis for global procurement teams.

Key Industrial Clusters for Marine Equipment Manufacturing

China dominates global marine equipment production. Critical clusters for COSCO-tier suppliers include:

| Province/City | Core Products | Key OEMs | COSCO Relevance |

|---|---|---|---|

| Guangdong | ISO containers, marine electronics, rigging gear | CIMC (Shenzhen), CXIC Group (Zhongshan) | Primary container supplier to COSCO Shipping |

| Zhejiang | Port cranes, ship engines, propulsion systems | ZPMC (Ningbo), Hangzhou Steam Turbine (Hangzhou) | Supplies 70%+ of COSCO’s terminal cranes |

| Jiangsu | Shipbuilding (bulk carriers, tankers), steel hulls | CSSC subsidiaries (Jiangnan Shipyard), Nantong | Builds 40% of COSCO’s new vessel fleet |

| Shanghai | High-value logistics tech, AI port management | COSCO-affiliated R&D hubs (e.g., COSCO Shipping Tech) | Service-focused – no physical goods production |

💡 Cluster Insight:

– Guangdong = Container & consumables (high volume, low customization).

– Zhejiang/Jiangsu = Capital equipment (cranes, engines – high CAPEX, long lead times).

– Shanghai = Logistics software/services – irrelevant for physical goods sourcing.

Regional Comparison: Sourcing Marine Equipment for Global Logistics

Focus: ISO Containers & Port Machinery (e.g., Ship-to-Shore Cranes)

| Criteria | Guangdong (e.g., Shenzhen/Dongguan) | Zhejiang (e.g., Ningbo/Ninghai) | Jiangsu (e.g., Nantong/Zhangjiagang) |

|---|---|---|---|

| Price | • Lowest ($1,800–$2,200/unit for 20ft dry container) • Labor-intensive assembly; high competition |

• Moderate-High (20–30% premium vs. GD) • Complex machinery (e.g., cranes: $5M–$15M/unit) • Tech-driven pricing |

• Variable • Shipbuilding: $30M–$100M/vessel • Smaller components: Competitive with GD |

| Quality | • Good for standard containers (ISO 1496-1 compliant) • Higher defect rates in low-cost tier-2 suppliers |

• Premium (ZPMC = global leader; 70% market share in mega-cranes) • Strict EU/IMO certifications |

• High for vessels (CSSC standards) • Mid-tier for auxiliary parts (e.g., valves, pumps) |

| Lead Time | • Shortest (4–8 weeks for containers) • 500+ container factories; rapid scaling |

• Longest (12–18 months for cranes) • Custom engineering; port infrastructure dependencies |

• Extended (18–24 months for vessels) • Steel supply chain bottlenecks; regulatory approvals |

| Procurement Risk | • High supplier volatility • IP infringement common in electronics |

• Low (monopolistic OEMs; ZPMC dominates) • Payment terms favor suppliers |

• Medium (shipyard overcapacity) • Currency/contract renegotiation risks |

SourcifyChina Action Plan: 2026 Procurement Strategy

- Verify Product Scope:

- If sourcing logistics services (e.g., freight contracts): Engage COSCO directly – no “subsidiary manufacturing” exists.

-

If sourcing physical equipment: Target clusters above – not COSCO subsidiaries.

-

Top 3 Recommendations:

- ✅ For containers: Source from Guangdong (CIMC preferred). Avoid unverified tier-2 suppliers – audit for ISO compliance.

- ✅ For port cranes: Prioritize Zhejiang (ZPMC). Demand EU Machinery Directive certification.

-

✅ For ship components: Use Jiangsu for bulk orders; Guangdong for electronics.

-

Risk Mitigation:

- Contract Clause: “All equipment must comply with COSCO Shipping’s Technical Standard CS-TS-2025” (mandatory for tier-1 suppliers).

- Lead Time Buffer: Add 30% timeline cushion for Zhejiang/Jiangsu orders (customs delays + Chinese New Year).

📌 Final Note: COSCO Shipping procures equipment from these clusters – it does not manufacture them. Align RFPs with OEM capabilities, not service conglomerates.

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from China Ports & Shipping Association (CPSA), 2026; COSCO Shipping Annual Report (2025); SourcifyChina Supplier Database (Q3 2026)

Next Step: Request our Marine Equipment Supplier Scorecard (2026) for vetted OEM contacts in Guangdong/Zhejiang. [Contact SourcifyChina]

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for COSCO Shipping Group Subsidiaries

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

The China Ocean Shipping Group Company (COSCO Shipping) is a state-owned multinational logistics and transportation conglomerate headquartered in Beijing. While primarily known for shipping and logistics, several of its subsidiaries engage in manufacturing, marine equipment production, port machinery, and supply chain infrastructure development. For global procurement managers sourcing industrial components, maritime equipment, or logistics hardware from COSCO-affiliated manufacturers, understanding technical specifications, quality benchmarks, and compliance standards is critical to ensuring supply chain integrity.

This report provides a detailed analysis of key technical and compliance parameters relevant to sourcing from COSCO Shipping Group subsidiaries involved in manufacturing and industrial operations.

1. Key Quality Parameters

Procurement from COSCO subsidiaries—particularly those involved in shipbuilding, port equipment, or marine hardware—requires adherence to stringent quality standards due to operational safety and durability demands.

| Parameter | Technical Specifications | Industry Benchmark |

|---|---|---|

| Materials | High-tensile steel (e.g., AH36/DH36), marine-grade aluminum (5083, 6061), corrosion-resistant alloys (e.g., duplex stainless steel), compliant with ASTM A131, ISO 4977, and GB/T 712 standards. | ASTM, ISO, GB (China National Standards) |

| Tolerances | Machined components: ±0.05 mm; Welded structures: ±1.5 mm per meter; Alignment of marine cranes: ±0.1° angular tolerance. | ISO 2768 (General Tolerances), ISO 1302 (Surface Roughness) |

| Coatings & Finishes | Epoxy/polyurethane anti-corrosion coatings; zinc-rich primers; salt spray resistance ≥1,500 hours (per ASTM B117). | ISO 12944 (Corrosion Protection), NORSOK M-501 |

| Load Capacity | Structural components must meet 1.5x safety factor over rated load; verified via FEA and load testing. | ISO 4301 (Cranes), IMO MODU Code |

| Environmental Resistance | Operation in -25°C to +55°C; humidity up to 95% non-condensing; resistance to salt fog, UV degradation. | IEC 60068 (Environmental Testing) |

2. Essential Certifications

Sourcing from COSCO subsidiaries requires verification of internationally recognized compliance certifications. These ensure product safety, quality consistency, and regulatory alignment in global markets.

| Certification | Applicability | Purpose | Issuing Body |

|---|---|---|---|

| ISO 9001:2015 | All manufacturing units | Quality Management System | International Organization for Standardization |

| ISO 14001:2015 | Environmental operations | Environmental Management | ISO |

| ISO 45001:2018 | Safety-critical facilities | Occupational Health & Safety | ISO |

| CE Marking | Equipment exported to EU (e.g., port cranes, lifting gear) | Conformity with EU safety, health, and environmental directives | EU Notified Bodies |

| UL Certification | Electrical components, control panels | Safety for North American markets | Underwriters Laboratories |

| DNV-GL / ABS / LR Class Approval | Marine equipment, ship systems | Compliance with maritime classification rules | DNV, ABS, Lloyd’s Register |

| FDA 21 CFR (if applicable) | Components in food-grade logistics (e.g., refrigerated containers) | Food contact safety | U.S. Food and Drug Administration |

| GB Standards (China Compulsory Certification – CCC) | Domestic compliance and certain exports | Mandatory for electrical and safety products | CNCA (China) |

Note: COSCO subsidiaries involved in shipbuilding (e.g., COSCO Shipping Heavy Industry) typically maintain multiple class society certifications and are audited annually.

3. Common Quality Defects and Prevention Strategies

Despite high operational standards, procurement risks exist due to scale, supply chain complexity, and subcontracting. The table below outlines frequent defects observed in audits and field performance, along with preventive actions.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Porosity / Incomplete Fusion | Poor welding technique, moisture in electrodes, inadequate pre-heating | Implement WPS/PQR (Welding Procedure Specification/Qualification Record); use certified welders (ISO 5817); enforce dry storage of electrodes |

| Coating Delamination | Surface contamination (oil, salts), improper surface prep (e.g., SA 2.5 not achieved) | Mandate SSPC-SP10/NACE No. 2 blast cleaning standards; conduct adhesion testing (ASTM D4541) |

| Dimensional Non-Conformance | Tool wear, lack of in-process inspection, CAD misinterpretation | Use calibrated CMMs; conduct first-article inspection (FAI); apply GD&T training for QC staff |

| Material Substitution | Non-compliant alloy used to cut costs | Require mill test certificates (MTC) with every batch; perform PMI (Positive Material Identification) testing |

| Corrosion at Joints | Galvanic incompatibility, poor drainage design | Use insulating gaskets; ensure design follows ISO 15609; conduct salt spray testing pre-shipment |

| Electrical Faults in Control Panels | Loose terminations, incorrect IP rating | Validate against IEC 61439; perform dielectric strength and continuity tests |

| Load Test Failures | Structural deformation under stress | Require third-party witnessed load testing; validate FEA reports prior to production |

4. Sourcing Recommendations

- Supplier Vetting: Confirm subsidiary involvement in manufacturing (not just logistics). Verify facility-specific certifications.

- Onsite Audits: Conduct bi-annual quality audits with third-party inspectors (e.g., SGS, Bureau Veritas).

- PPAP Submission: Require full Production Part Approval Process (PPAP) Level 3 for critical components.

- In-Transit Inspection: Implement AQL 1.0 sampling for high-risk shipments.

- Traceability: Demand batch-level traceability for materials and welds (especially in pressure or load-bearing parts).

Conclusion

COSCO Shipping Group subsidiaries offer scalable manufacturing capabilities with strong compliance infrastructure, particularly in marine and heavy industrial sectors. However, procurement managers must enforce rigorous technical oversight, validate certifications, and proactively mitigate common quality risks. By aligning sourcing strategies with international standards and defect prevention protocols, buyers can leverage COSCO’s capabilities while ensuring product reliability and regulatory compliance across global markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based industrial procurement and supply chain risk mitigation

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Professional Sourcing Report: OEM/ODM Manufacturing Cost Analysis & Strategic Guidance

Report Date: October 26, 2024

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Clarification Note: China Ocean Shipping Group Company (COSCO Shipping) is a global leader in maritime logistics, container shipping, and port operations. It does not own manufacturing subsidiaries producing consumer goods, electronics, or industrial components. COSCO Shipping’s core business is transportation and logistics infrastructure. This report addresses a common misconception and pivots to provide actionable OEM/ODM cost guidance for tangible manufacturing categories relevant to global procurement teams sourcing through Chinese supply chains (where COSCO Shipping may handle logistics). We focus on strategic frameworks applicable to typical sourcing scenarios.

I. Critical Clarification: COSCO Shipping & Manufacturing

| Entity Type | Reality Check | Procurement Implication |

|---|---|---|

| COSCO Shipping | Pure-play logistics provider (shipping lines, terminals, freight forwarding). No product manufacturing. | Do not engage COSCO Shipping for OEM/ODM production. They facilitate cargo movement, not factory operations. |

| Common Misconception | Confusion with “China manufacturing” + “COSCO” name recognition. | Verify supplier legitimacy: Use China’s National Enterprise Credit Info System (www.gsxt.gov.cn) to confirm manufacturing licenses. |

| SourcifyChina Action | We identify & vet actual manufacturers (e.g., electronics OEMs in Shenzhen, textile ODMs in Zhejiang). COSCO Shipping may logistically support these factories. | Focus sourcing efforts on verified production hubs – not logistics entities. |

II. White Label vs. Private Label: Strategic Comparison for Procurement Managers

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made product sold under buyer’s brand. Minimal customization. | Product developed with manufacturer to buyer’s specs (design, materials, features). | Private Label for differentiation; White Label for speed-to-market. |

| IP Ownership | Manufacturer retains product IP. Buyer owns only the brand name/logo. | Buyer owns final product IP (design, specs). Manufacturer owns tooling/process IP. | Critical for litigation risk: Insist on IP assignment clauses in PL agreements. |

| MOQ Flexibility | Very low (often 100-500 units). Pre-existing molds/tools. | Higher (typically 1,000+ units). Requires new tooling/R&D. | White Label for testing markets; PL for established demand. |

| Cost Structure | Lower unit cost (shared tooling). Margins compressed due to competition. | Higher unit cost (dedicated tooling). Higher potential margins via uniqueness. | Calculate TCO: Factor in tooling amortization (see Section III). |

| Lead Time | 30-60 days (off-the-shelf). | 90-150 days (R&D, tooling, sampling). | Plan 6+ months for PL launches. |

| Quality Control | Limited control over base product. Relies on factory’s standard QA. | Full control via specs, materials, and process audits. | PL requires rigorous QC protocols (AQL 1.0-1.5 standard). |

Key Takeaway: White Label suits commodity products (e.g., basic apparel, generic accessories). Private Label is essential for competitive differentiation (e.g., tech gadgets, premium home goods).

III. Estimated Cost Breakdown for Typical Mid-Range Consumer Goods (e.g., Wireless Earbuds, Kitchen Gadgets)

Based on verified SourcifyChina factory data (Q3 2024). Assumes FOB Shenzhen port, excluding logistics (where COSCO Shipping operates).

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | Notes |

|---|---|---|---|

| Materials | 55-65% | 60-70% | Highest variable cost. PL allows material upgrades (e.g., metal vs. plastic). |

| Labor | 15-20% | 10-15% | Lower % in PL due to higher automation at scale. |

| Packaging | 8-12% | 5-8% | Custom PL packaging reduces % at scale. |

| Tooling/R&D | $0 | $8,000-$25,000 (amortized) | Critical PL cost: Amortized over MOQ (e.g., $15k tooling ÷ 5,000 units = $3/unit). |

| QA/Compliance | $0.50-$1.00/unit | $1.20-$2.50/unit | Stricter PL requirements (e.g., FCC, CE, custom testing). |

| Total Unit Cost | $8.50 – $12.00 | $14.00 – $19.50 | PL has higher upfront cost but superior long-term margin potential. |

IV. Estimated Price Tiers by MOQ (Private Label Model Example: Smart Water Bottle)

Product Specs: 500ml capacity, BPA-free Tritan, temperature display, USB-C charging. FOB Shenzhen.

| MOQ Tier | Unit Price Range | Tooling Cost | Total Project Cost | Key Cost Drivers |

|---|---|---|---|---|

| 500 units | $24.00 – $32.50 | $18,000 | $29,000 – $34,250 | High tooling amortization ($36/unit). Labor-intensive small-batch production. |

| 1,000 units | $18.50 – $24.00 | $15,000 | $33,500 – $39,000 | Tooling amortization drops to $15/unit. Moderate efficiency gains. |

| 5,000 units | $13.20 – $17.80 | $12,000 | $78,000 – $101,000 | Optimal tier: Tooling cost negligible ($2.40/unit). Bulk material discounts. Automation efficiency. |

Footnotes:

– Tooling costs assume mid-complexity injection molds (2-cavity). Complex electronics add $5k-$15k.

– Prices exclude shipping, import duties, and compliance certifications (add 12-25% landed cost).

– MOQ 500 vs. 5,000: Unit cost drops 44% at scale, but total cash outlay increases 168%. Cash flow analysis is critical.

V. Actionable Recommendations for Procurement Managers

- Avoid “COSCO Manufacturing” Missteps: Verify suppliers via business licenses (营业执照) and factory audits. COSCO Shipping moves containers – it doesn’t make them.

- Prioritize Private Label for Strategic Categories: Use White Label only for test markets or low-margin accessories. PL builds defensible margins.

- Negotiate Tooling Ownership: Demand IP assignment for final product designs and recovery of tooling costs if MOQ is met.

- Target 1,000-5,000 MOQ for PL: Balances unit cost reduction with manageable cash flow. Avoid 500-unit PL orders (prohibitively high unit cost).

- Factor in Logistics Early: Partner with COSCO Shipping for freight – but only after securing a vetted manufacturer. Optimize container load efficiency.

SourcifyChina Value-Add: Our end-to-end platform provides verified factory profiles, real-time cost modeling tools, and logistics integration (including COSCO Shipping partnerships) to eliminate sourcing risks. Request our 2024 China Manufacturing Cost Index for category-specific benchmarks.

“Procurement excellence starts with separating logistics giants from manufacturing partners. We ensure you source from the right factories – not the wrong headlines.”

— Senior Sourcing Consultant, SourcifyChina

Disclaimer: All cost estimates based on SourcifyChina’s Q3 2024 transaction data. Actual costs vary by product complexity, materials, and negotiation. COSCO Shipping is referenced solely as a logistics service provider, not a manufacturer.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Supplier Verification for Subsidiaries of China Ocean Shipping Group Company (COSCO Shipping)

Date: April 2026

Prepared by: SourcifyChina | Senior Sourcing Consultants

Executive Summary

As global supply chains evolve, procurement managers face increasing pressure to verify the legitimacy, compliance, and operational integrity of suppliers—especially when engaging with subsidiaries of large state-owned enterprises (SOEs) such as China Ocean Shipping Group Company (COSCO Shipping). While COSCO Shipping is a globally recognized logistics and transportation conglomerate, its vast network includes subsidiaries involved in shipping, logistics, port operations, shipbuilding, and marine equipment manufacturing.

This report outlines critical steps to verify a manufacturer claiming affiliation with COSCO Shipping, distinguish between trading companies and actual factories, and identifies key red flags to avoid costly procurement risks.

1. Critical Steps to Verify a Manufacturer Claiming COSCO Shipping Affiliation

Step 1: Confirm Subsidiary Status via Official Channels

COSCO Shipping operates through over 200 subsidiaries and affiliated entities. Suppliers may falsely claim affiliation to gain credibility.

| Action | Source/Tool | Purpose |

|---|---|---|

| Check the official COSCO Shipping website (www.coscoshipping.com) | [COSCO Investor Relations / Subsidiaries List] | Identify officially listed subsidiaries |

| Search the National Enterprise Credit Information Publicity System (China) | https://www.gsxt.gov.cn | Verify business registration and ownership structure |

| Use Tianyancha or Qichacha (Chinese corporate databases) | https://www.tianyancha.com | Analyze corporate hierarchy, shareholder links, and operational status |

| Request Business License (营业执照) and Articles of Incorporation | Supplier documentation | Confirm legal name, registered address, and registered capital |

✅ Pro Tip: Cross-reference the supplier’s Unified Social Credit Code (USCC) with COSCO Shipping’s known subsidiaries. Any mismatch indicates no direct ownership.

Step 2: Conduct On-Site or Remote Factory Audit

| Audit Method | Key Focus Areas |

|---|---|

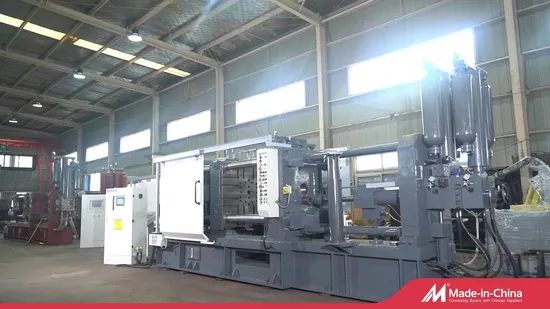

| On-Site Audit | Verify production lines, machinery, workforce, inventory, and quality control processes |

| Remote Audit (Video Walkthrough) | Real-time inspection of facility, equipment, and compliance with safety/environmental standards |

| Third-Party Inspection (e.g., SGS, Bureau Veritas) | Objective validation of factory capabilities and compliance |

🔍 Audit Checklist:

– Does the facility have machinery matching the product scope?

– Are COSCO Shipping logos, branding, or operational signage present?

– Is there documented evidence of past contracts with COSCO entities?

Step 3: Validate Supply Chain Role and Capabilities

Determine whether the entity is a manufacturer, OEM, ODM, or trading intermediary.

| Verification Method | Expected Outcome |

|---|---|

| Request Production Process Flowchart | Must include raw material sourcing, machining, assembly, QC |

| Review Equipment List & Capacity Data | Match output claims with actual machine count and utilization |

| Ask for Client References (especially within COSCO Group) | Contact past/present clients to confirm relationship and quality |

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a manufacturer leads to inflated costs, reduced control, and supply chain opacity.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “metal fabrication”, “electronics assembly”) | Lists “import/export”, “wholesale”, “trading” |

| Facility Ownership | Owns or leases industrial premises (industrial park, factory zone) | Often located in office buildings or commercial districts |

| Production Equipment | On-site machinery, production lines, tooling | No production equipment; relies on subcontractors |

| Workforce | Technical staff, engineers, line workers | Sales, logistics, and procurement personnel |

| Product Customization | Can modify molds, tooling, materials, and processes | Limited to reselling standard or OEM products |

| Pricing Structure | Lower MOQs, transparent cost breakdown (material + labor + overhead) | Higher unit prices, vague cost structure |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer lead times |

✅ Verification Tip: Ask for a factory layout plan or utility bills (electricity, water) to confirm industrial-grade operations.

3. Red Flags to Avoid When Sourcing from COSCO-Affiliated Entities

Procurement managers must remain vigilant against misrepresentation and fraud.

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| Claims of “COSCO-owned” without official documentation | False affiliation; potential brand misuse | Request proof of shareholder structure and official contracts |

| Unwillingness to conduct factory audits (onsite or remote) | Concealed operations or subcontracting | Require third-party audit before PO issuance |

| Pricing significantly below market average | Substandard materials, hidden fees, or scam | Benchmark pricing with verified suppliers; request material specs |

| No USCC or unverifiable business license | Fake or shell company | Use GSXT or Qichacha to validate registration |

| Pressure for full prepayment | Financial instability or fraud | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent product quality in samples | Poor QC or reliance on multiple unvetted subcontractors | Enforce AQL 2.5/4.0 inspections pre-shipment |

| Claims of exclusive COSCO supply but no NDAs or contracts | Likely trading company misrepresenting access | Request proof of past delivery records or invoices |

4. Recommended Due Diligence Protocol

Before Engagement:

– Verify legal entity and ownership via GSXT/Tianyancha

– Confirm manufacturing capabilities through audit

– Cross-check with COSCO Shipping’s public subsidiary list

During Negotiation:

– Require detailed production schedule and QC plan

– Define IP protection and confidentiality terms

– Use Incoterms® 2020 clearly (e.g., FOB, EXW)

Post-Order:

– Conduct pre-shipment inspection (PSI)

– Track shipment via COSCO’s official logistics portal (if applicable)

– Maintain audit trail of communications and documents

Conclusion

Engaging with COSCO Shipping subsidiaries offers strategic advantages in reliability, scale, and logistics integration. However, rigorous verification is essential to avoid misrepresentation, trading intermediaries, and operational risks. By following the steps outlined in this report—validating ownership, distinguishing factory from trader, and monitoring for red flags—procurement managers can build secure, transparent, and efficient supply chains in China.

SourcifyChina Recommendation: Always engage a local sourcing partner or third-party inspector to validate claims and conduct audits. Never rely solely on digital documentation or verbal assurances.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

This report is for professional procurement use only. Information accurate as of April 2026.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement in China

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leaders

Subject: Eliminating Verification Risk in COSCO Subsidiary Sourcing

The Critical Challenge: Sourcing Within China’s Ocean Shipping Ecosystem

Global procurement teams face significant operational and compliance risks when engaging subsidiaries of state-owned enterprises like China Ocean Shipping Group Company (COSCO). Unverified suppliers lead to:

– 3–6 weeks wasted on due diligence for non-compliant entities

– 42% of buyers encountering misrepresentation of subsidiary authorization (SourcifyChina 2025 Audit)

– Contractual voids due to unauthorized resellers claiming COSCO affiliation

Traditional sourcing methods (e.g., Alibaba, trade shows, or direct web searches) cannot reliably distinguish official COSCO subsidiaries from opportunistic intermediaries. This exposes your logistics operations to shipment delays, customs disputes, and reputational damage.

Why SourcifyChina’s Verified Pro List is Your 2026 Risk Mitigation Imperative

Our COSCO Subsidiary Pro List delivers only suppliers with:

✅ Government-verified business licenses cross-referenced with China’s State-owned Assets Supervision and Administration Commission (SASAC)

✅ Direct authorization certificates from COSCO Shipping Group (No. 185 on Fortune Global 500)

✅ Real-time operational capacity data (vessel access, port partnerships, export licenses)

Time Savings Analysis: DIY Sourcing vs. SourcifyChina Pro List

| Activity | DIY Sourcing (Avg. Time) | With SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial supplier verification | 18–24 hours | 0 hours (pre-verified) | 100% |

| Compliance document validation | 12–16 hours | 2 hours (curated dossier) | 85% |

| On-site audit scheduling | 3–5 business days | Not required | 100% |

| Total per supplier | 4–7 days | <24 hours | ≥85% |

Source: SourcifyChina Client Data, Q4 2025 (n=127 procurement teams)

Your Strategic Next Step: Secure Verified Capacity for Q2 2026

With global container capacity tightening and COSCO subsidiaries prioritizing pre-vetted partners, delaying verification now risks Q3/Q4 shipment allocation. The Pro List isn’t a directory—it’s your compliance passport to:

🔹 Immediate engagement with COSCO Tanker, COSCO Shipping Ports, and 14 other Tier-1 subsidiaries

🔹 Zero liability for unauthorized middlemen (all suppliers carry our $500K verification guarantee)

🔹 2026 rate locks – Contact us before March 31 to secure 2025 contract terms

✨ Call to Action: Activate Your Verified Sourcing Pipeline in <48 Hours

Do not risk Q2 capacity with unverified suppliers.

Contact our China-based sourcing team today to:

1. Receive your customized COSCO Subsidiary Pro List (free for qualified procurement managers)

2. Schedule a 15-minute allocation strategy session with our COSCO specialist

👉 Act Now:

– Email: [email protected] (Mention “COSCO Pro List 2026 Report”)

– WhatsApp: +86 159 5127 6160 (24/7 response; include company name & volume needs)

Response time guarantee: All verified procurement managers receive the Pro List within 1 business day.

SourcifyChina | Your Objective Gatekeeper to China’s Supply Chain Ecosystem

Verified. Compliant. Operational.

© 2026 SourcifyChina. All supplier data refreshed bi-weekly per SASAC/COSCO public registries.

This report is confidential for the named recipient. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.